Professional Documents

Culture Documents

Tax Card 2018

Uploaded by

Umer BhuttaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Card 2018

Uploaded by

Umer BhuttaCopyright:

Available Formats

r_I m

TAX RATES FOR THE TAX YEAR 2O1B -

\

RATES FoR BUSTNESS rNprvrpuAL & Aop MIN|MUM TAX

MINIMUM TAx fll

Nature of Payment Section

lN

Filer Non-F ler

,,, --"- ,-- - =

1. Upto Rs.400,000

lndividuals &AOPS [having annual turnover Rs.10

anduomoanres

l\4illion or-morel

ililii:1ilfli:'l'.?[:,tiI;'!:"1]n"ii#"''"'"""'*'''

morel and Companies - ,,'113

-

s\v,

, a:. -:- __- =-

1

2-

c.

Rs.400,000 to Rs.500,000

Rs.500,000 to Rs.750,000

7ak at lhe amount exceeding Rs.400,000

Rs.7,000 + 1 0% of the amount

Oil Marketing Companies, Reflneries, SSGCL. SNGPL,

ill3ffIflilfi;.Xil:iii?"r,::o"::,i'..";.i,-,

PlA, Dealer or Distributors of Fertillzers & Poultry lndustry I ',, ,,,', ,'---,

ltJ .. t)l

4. Rs.750,000 to Rs.1 ,500,000

Rs.32,000 + 1 5% of the amount

exceeding Rs.750,000

orsoiPnarma.Fas[l\lov,ngConsJTe'gooos.,

Distributors of Pharma, Fast Moving Consumer goods.

Ciqarettes, Petroleum Agent, Rice Mills & Flour N4ills

1I?

113 n,-,:

,r/

Ul

Motorcvcles Dealers 113

Rs.144,500 + 20% ofthe amount

Rs.1,500,000 to Rs.2,500,000 exceeding Rs. 1,500,000 &p""kingr"t"nut

lmports of edible oil &

"dibtuoit

tcffi

packinq material (Companies) 1 48(8) 5.5.. : --' . a

6c. 3 :'.

a Rs.344,500 + 25% of the amount lmports of edible oil & packing material (others) 1 48(8)

Rs.2,500,000 to Rs.4,000,000 -

,lV

6. exceeding Rs.2,500,000 lmports of Plastic Raw Material by lndustrial undertakin( 148(8) 1.75.. a:,,

Rs.719,500 + 30% ofthe amount Services (Companies) 1 53(1 )(b)

7. Rs.4,000,000 to Rs.6,000,000 exceeding Rs.4,000,000

Services, (oth.,

(Other th"n corp"ni"=)

than Companies) 1 53( 1 )(b) - L-:., '- :',

=':

B- Exceeding Rs.6,000,000 Rs.'1,319,500 + 35% of the amount Transport Seruices '153(i)tb, 2i': 2:',

exceeding Rs.6,000,000

TAX RATES FOR SALARIED INDIVIDUALS s""rJ:*--"*-r****M

Seruices provided to Textile, Carpets, Leather, Surgical

& Sports goods

-Iii3illoi'-

'153(1)1lr '.::: ' _.,

2

1 Upto Rs.400,000 0% FINAL DISCHARGE OF TAX

t"t*Jotpay."nt

@ a

Rs,400,000 to Rs.500,000 2% of the amount exceeding Rs.400,000

D

2. lmports of Remeltable Steel, Potassic Fertilizer, Urea LNG

J. Rs.500,000 to Rs.750,000

Rs.2,000 + 5% of the amount l'"[Ti,l'"1i,j?,lli,"J;i3l?i"?"r'*?lii!!,ij5,"-"',''u'"'"

Cotton, Gold & Manufacturers undet SRO.1125(l)/2011

exceedinq Rs.500.000 a".r"r",r, covered undet SRA.1 1 25(l)/241

4. Rs.750,000 to Rs.1 ,400,000

Rs.'14,500 + 10% of the amount

lmports Commercial

"""",

lmports Commercial of Plastic Raw l\,4ateria

1

I

exceeding Rs.750,000

Rs.79,500 + 12.5% of the amount

Rs.1,400,000 to Rs.1,500,000 Imports (Other than above)

6 Rs.1 ,500,000 to Rs.'1 ,800,000

exceeding Rs. 1,400,000

Rs.92,000 + 15% of the amount

exceeding Rs. 1,500,000 Profit on debt upto Rs.500,000 (Other than Companies)

N

7 Rs.1,800,000 to Rs.2,500,000

Rs.1 37,000 + 1 7.5% of the amount

exceeding Rs. 1,800,000 non-residents 1 ': - 'i ^ N

Ja

I

ts bv '521'A

8.

o

Rs.2,500,000 to Rs.3,000,000

Rs.3,000,000 to Rs.3,500,000

Rs.259,500 + 20% of lhe amount

exceeding Rs.2,500,000

Rs.359,500 + 22.5% ofthe amount

exceeding Rs.3,000,000 Sale of Rice, Cotton Seed Oil & Edible Oils

7

I

Rs.472,000 + 25% ofthe amount Sale bv Distributor of Fast Movinq Consumer Goods

10 Rs.3,500,000 to Rs.4,000,000 exceeding Rs.3,500,000 Sale by Distributor of Fast Moving Consumer Goods

Rs.597,000 + 27.5% of the amount Local Sales & Supplies provided to Textile, Carpets,

11 Rs.4,000,000 to Rs.7,000,000 exceedinq Rs.4,000,000 Leather, Surgical & Sports goods, Cigarettes and Pharma

1 53(1 )(a)

Rs.1 ,422,000 + 30% of the amount (Companies)

.ts |

'153r1',c' 7ir: '. :', ll

12 Exceeding Rs.7,000,000 exceeding Rs.7,000,000 .ts(OtherthanCompanies) 115311)(c, 75c- --::. l[,

Banking Company | 35./"

=l:lt*^y,r-'

Services of Stitching, Dyeing, Printing, Embroidery,

g. Sizing & Weaving to Exporters '--'- " tI

il

Company

Public & Private I 30%

Small Company | 25ok

DEDUCTION ON CAPITAL GAIN ON DISPOSAL OF IMMOVABLE PROPERW

Products 112.C'o 17.a',

lsion on Petroleum | 1564 f

lrrespective of Holding Psriod allotment covered u/s 236C(4) 0.0%

iing Commission I 233f ') r0 O0'-r 1a -r- -/^

Holding period is upto one year acquired on or after 01-07-2016

Holding period is upto two years acquired on or after 01-07-2016

Holding period is upto three years acquired on or after 0'l-07-2016

10.0%

7.5o/o

5.0%

Life lnsuranceAqent Commission upto Rs.500,000

CNG Stations on Gas bills

a

Holdinq period is more than three years acquired on or after 01-07-2016 0.0%

I

ll Part lv of First sche

Holding period is upto three years acquired before 01-07-2016 5.0% Wio!

Nature of Payment Section Filer I

Holding period is more than three years acquired before 01-07-2016 0.0%

Cash withdrawal from bank 2314 0.3%

Sale bv auclion 236A 10%

Where profit on debt does not exceed Rs.5,000,000

Where proflt on debt exceeds Rs.5,000,000 but not exceed Rs.25,000,00c

10o/o

12.5%

Sale or transfer of lmmovable property

gatherings

1s and gatherings

Functions

236C

236D i 5"0

| 236D 5% 5',

N

la

Where profit on debt exceeds Rs.25,000,000 15%

Sale to distributors, dealers or wholesalers - Fertilizer 236G 0.7% 1.4

(A) Karachi, Lahore and

lslamabad

TAX ON

lB) Hyderabad, Sukkur, Multan, Faisalabad

Rawalpindi, Gujranwala, Sahiwal,

Peshawar, l\,4ardan, Abbottabad, Quetta

(C) Urban Areas

not specifled in

Aand B

Sale to distributors, dealers or wholesalers - Other

Sale to retailers - Electronics

Sale to retailers - Others

236G

236H

236H

0.1%

0.5%

a.?%

1L

1o/'c

d

For commercial buildinqs On dealers, commission aqents and arhatis, etc 23AJ

Rs.210l Sq Ft I Rs.210l Sq Ft Rs.21 0/ Sq Ft

A

For residential buildings

croup or Class I Rs. t o.ooo ll oroup or Class B Rs.7,500

\rea in Sq.Ft Rate/ Sq.Ft Area in Sq.Ft Rate/ Sq.Ft Area in Sq.Fl Rate/ Sq.Ft croup or Class C I Rs.s,ooo ll Any other category Rs.5,000

up to 750 Purchase of immovable property upto Rs. 4(M) 236K

I

up to 750 Rs.20 up to 750 Rs.15 Rs.10 0o/o

751 to 1500 Rs.40 751 to '1500 Rs.35 751 to 1500 Rs.25 Purchase of immovable property exceeding Rs. 4(M) 236K 4%

1501 & more Rs.70 501 & more Rs.55 150'1 & more Rs.35 Banking transaction otherwise than through cash 236P 0.6%-

I

1

Payment to resident for right to use machinery and equip 236Q 10%

(A) Karachi, Lahore and B) Hyderabad, Sukkur, Multan, Faisalabad (C) Urban Areas

not specified in

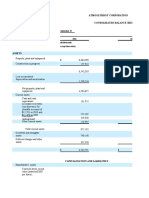

pEpucTroN oN rNcoME FRoM PROPERTY U/S 155 FOR lNp. & AOP I

lslamabad Rawalpindi, Gujranwala, Sahiwal,

Peshawar, Mardan, Abbottabad, Quetta Aand B

I

For commercial buildings

Rs.210/ Sq Yd

IR".200.000toRs.6oo.ooo I 5.0"/"ofthegrossamountExceeqingRs.2oolo0q--_-_ | |

Rs.21 0/ Sq Yd Rs.210/ Sq Yd

For residential buildings

ffi.2o,ooo * to.o% oith" gros" arount E""""ding R".Goo,ooo I t

\rea in Sq.Y Rate/ Sq.Yd Area in Sq.Yd Rate/ Sq.Yd Area in Sq.Yr Rate/ Sq.Yd

ffioo.ooo* ts.o"r"ofth"gro."rrountEIJfiilE.t,ooo..o.o.o.l

I

@10,000 * 2o.o% of th" gro"" Er"""di.g R=.2,ooo,ooo I

to 120

up Rs.20 upto120 Rs.1 upto120 Rs.1 0 "rount 1

121 lo 2O0 Rs.40 121 lo 2OO Rs.35 121 to 2OO Rs.25 DEDUCTION ON INCOME FROM PROPERTY U/S 1ss FOR COMPANIES II

201 & more Rs.70 201 & more Rs.55 201 & more Rs.35 tfe *t" ot t", to Ue CeOucted under section 55, in case of company shall be 1 5% of gross amount oi rent. !

1

I

*A word of caution: Due care and caution has been taken to print this paper and if any error, mistake or mission is found to have crept in, the informatlon

would be accepted and efforts would be made to remove the same in next time. for further detail please consult the relevant Law

t//

You might also like

- Auditing McqsDocument27 pagesAuditing McqsGhulam Abbas100% (5)

- Accounting Principles and Procedures m001 PDFDocument2 pagesAccounting Principles and Procedures m001 PDFUmer BhuttaNo ratings yet

- 12 Basic Accounting PrinciplesDocument5 pages12 Basic Accounting PrinciplesUmer BhuttaNo ratings yet

- Audit ObjectionsDocument10 pagesAudit Objectionsburhan_qureshiNo ratings yet

- 12 Basic Accounting PrinciplesDocument5 pages12 Basic Accounting PrinciplesUmer BhuttaNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementUmer BhuttaNo ratings yet

- Job Application FormDocument1 pageJob Application Formupstar_mughalNo ratings yet

- Pension Rules SummaryDocument70 pagesPension Rules SummarySehrish MemonNo ratings yet

- 12 Basic Accounting PrinciplesDocument5 pages12 Basic Accounting PrinciplesUmer BhuttaNo ratings yet

- Re-Appropriation of FUndsDocument2 pagesRe-Appropriation of FUndsUmer BhuttaNo ratings yet

- Accounting Principles and Procedures m001 PDFDocument2 pagesAccounting Principles and Procedures m001 PDFUmer BhuttaNo ratings yet

- Audit ObjectionsDocument10 pagesAudit Objectionsburhan_qureshiNo ratings yet

- Pakistan National Transmission and Despatch CompanyDocument50 pagesPakistan National Transmission and Despatch CompanyUmer BhuttaNo ratings yet

- Pension Rules SummaryDocument70 pagesPension Rules SummarySehrish MemonNo ratings yet

- Job Application FormDocument1 pageJob Application Formupstar_mughalNo ratings yet

- Chapter#7 Cost Theory and Analysis Solution (Economics)Document8 pagesChapter#7 Cost Theory and Analysis Solution (Economics)Umer BhuttaNo ratings yet

- Noting & DraftingDocument1 pageNoting & DraftingUmer BhuttaNo ratings yet

- Noting & DraftingDocument1 pageNoting & DraftingUmer BhuttaNo ratings yet

- E-Commerce Ethical and Legal IssuesDocument6 pagesE-Commerce Ethical and Legal IssuesUmer BhuttaNo ratings yet

- Symantec Ghost Boot CDDocument8 pagesSymantec Ghost Boot CDZlatko KuzeNo ratings yet

- Statistics: For Higher Secondary To First Year CollegeDocument267 pagesStatistics: For Higher Secondary To First Year CollegeJireh Grace100% (1)

- The Scope of MarketingDocument2 pagesThe Scope of MarketingUmer BhuttaNo ratings yet

- The Impact of e CommerceDocument5 pagesThe Impact of e CommerceUmer BhuttaNo ratings yet

- The Four Components of Time Series AreDocument1 pageThe Four Components of Time Series AreUmer Bhutta100% (1)

- Chapter 5Document23 pagesChapter 5Kenya HunterNo ratings yet

- Diet Plan For Diabetes Patients in UrduDocument1 pageDiet Plan For Diabetes Patients in UrduUmer BhuttaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Financial ReportingDocument22 pagesFinancial Reportingmhel cabigonNo ratings yet

- Reyes V San Pablo CityDocument3 pagesReyes V San Pablo CityVic FrondaNo ratings yet

- One Dividend Policy by An Organization - Team 2Document15 pagesOne Dividend Policy by An Organization - Team 2Aishwarya KulkarniNo ratings yet

- TB Raiborn - Activity-Based Management and Activity-Based CostingDocument31 pagesTB Raiborn - Activity-Based Management and Activity-Based Costingjayrjoshuavillapando100% (1)

- HR To FI Posting Configuration in SAPDocument12 pagesHR To FI Posting Configuration in SAPmansursk100% (1)

- Chapter 9: Cash Flow Statement: Solutions To Problems and Cases Try It YourselfDocument7 pagesChapter 9: Cash Flow Statement: Solutions To Problems and Cases Try It YourselfSaurabh KhuranaNo ratings yet

- Practice Questions Cost AcoountingDocument6 pagesPractice Questions Cost AcoountingNabeel Khaliq0% (1)

- Bataan P2Document9 pagesBataan P2Yaj CruzadaNo ratings yet

- Business Plan of Energy DrinkDocument20 pagesBusiness Plan of Energy DrinkUsmanNo ratings yet

- Absorbing Overhead CostsDocument9 pagesAbsorbing Overhead CostssikshaNo ratings yet

- O Level Business Studies NotesDocument14 pagesO Level Business Studies NotesFarhan Arshad60% (5)

- Net Income Calculation for Multiple ProblemsDocument3 pagesNet Income Calculation for Multiple ProblemsChris Tian FlorendoNo ratings yet

- Fine Print Pay Stub 1Document3 pagesFine Print Pay Stub 1api-585050784100% (1)

- Capital Budgeting Idea For Netflix Inc.Document26 pagesCapital Budgeting Idea For Netflix Inc.PraNo ratings yet

- FABM 2 Module 2 SCI SCOE PDFDocument10 pagesFABM 2 Module 2 SCI SCOE PDFJOHN PAUL LAGAO100% (4)

- Atmos Energy Corporation Balance Sheet AnalysisDocument7 pagesAtmos Energy Corporation Balance Sheet AnalysisBetty M. VargasNo ratings yet

- Reji - Accountant 5 Year ExpDocument3 pagesReji - Accountant 5 Year ExpNoushad N HamsaNo ratings yet

- Business Plan For The LAUSD's Aviation Branch of The North Valley Service Area of SchoolsDocument2 pagesBusiness Plan For The LAUSD's Aviation Branch of The North Valley Service Area of SchoolsLos Angeles Daily NewsNo ratings yet

- Inter Process ProfitsDocument10 pagesInter Process ProfitsKella Pradeep100% (1)

- Samplepractice Exam 18 April 2017 Questions and AnswersDocument21 pagesSamplepractice Exam 18 April 2017 Questions and AnswersMAG MAGNo ratings yet

- Consolidation of Peanut and SnoopyDocument2 pagesConsolidation of Peanut and SnoopyFarrell P. NakegaNo ratings yet

- John Case WorksheetDocument10 pagesJohn Case Worksheetzeeshan33% (3)

- Cbi Myanmar Garment Sector Value Chain AnalysisDocument43 pagesCbi Myanmar Garment Sector Value Chain AnalysisWint Wah HlaingNo ratings yet

- BPLO AF - 002 Business Renewal FormDocument1 pageBPLO AF - 002 Business Renewal FormAdrian Joseph GarciaNo ratings yet

- Fix PPH 22 Dan PPH 23 (ENGLISH)Document19 pagesFix PPH 22 Dan PPH 23 (ENGLISH)Muhammad NunoNo ratings yet

- Unit 5 (A) - Financing DecisionDocument28 pagesUnit 5 (A) - Financing Decision2154 taibakhatunNo ratings yet

- Week 6Document8 pagesWeek 6Richelle GraceNo ratings yet

- Calculate solvability ratio formulaDocument2 pagesCalculate solvability ratio formulaanjanichrns100% (2)