Professional Documents

Culture Documents

Monograph Supervision of Financial Market Infrastructures in Singapore

Uploaded by

Let's Save MyanmarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monograph Supervision of Financial Market Infrastructures in Singapore

Uploaded by

Let's Save MyanmarCopyright:

Available Formats

SUPERVISION OF FINANCIAL MARKET

INFRASTRUCTURES IN SINGAPORE

Monetary Authority of Singapore

January 2013

(revised in January 2015)

SUPERVISION OF FINANCIAL MARKET

INFRASTRUCTURES IN SINGAPORE

Contents Page

1 Introduction 1

2 Supervisory Objectives 3

3 Regulatory Framework 4

4 Supervisory Approach 8

5 FMIs Subject to Cooperative Oversight 11

Annex A:

Financial Market Infrastructures Supervised by MAS 12

Annex B:

Financial Market Infrastructures Subject to Cooperative 15

Oversight

MONETARY AUTHORITY OF SINGAPORE

JANUARY 2013 (revised on 8 January 2015)

Supervision of Financial Market Infrastructures in Singapore

1 Introduction

1.1 Financial market infrastructures (“FMI”) that facilitate the clearing, settling, or

recording of payments, securities, derivatives or other financial transactions are key

components of the financial system, and play a critical role in fostering financial

stability. FMIs that are not properly managed can pose significant risks to the

financial system and be a potential source of contagion. This monograph describes

the approach of the Monetary Authority of Singapore (“MAS”) in its supervision1 of

FMIs in Singapore.

International Standards

1.2 MAS adopts the Principles for Financial Market Infrastructures (“PFMI”) when

carrying out its supervision of FMIs. The PFMI was issued by the Committee on

Payments and Market Infrastructures2 (“CPMI”) and the International Organization of

Securities Commissions (“IOSCO”) in April 2012, following a comprehensive review of

three pre-existing sets of standards for FMIs – the Core Principles for Systemically

Important Payment Systems (“CPSIPS”), the Recommendations for Securities

Settlement Systems (“RSSS”), and the Recommendations for Central Counterparties

(“RCCP”). The PFMI, which sets the benchmark for the supervision of FMIs, are

expressed as broad principles, in recognition of the differences amongst FMIs, and

provide guidance to FMIs and authorities on the identification, monitoring,

mitigation and management of the full range of risks that arise in or are transmitted

by FMIs.

1.3 The PFMI defines an FMI as a multilateral system among participating

institutions, including the operator of the system, used for the purposes of clearing,

settling, or recording payments, securities, derivatives or other financial transactions.

There are five key types of FMIs:

(a) Payment systems: A payment system is a set of instruments, procedures, and

rules for the transfer of funds between or among participants; the system

1

Regulation refers to the establishment of specific rules of behaviour to which FMIs are required to

adhere while supervision refers to the monitoring of the behaviour of FMIs, including compliance

with rules and regulations. When the term “supervision” is used in isolation, we intend it to mean

the broad oversight of the FMIs, including both regulation and supervision.

2

Formerly known as the Committee on Payment and Settlement Systems (“CPSS”). The renaming

became effective as of 1 September 2014.

Monetary Authority of Singapore 1

Supervision of Financial Market Infrastructures in Singapore

includes the participants and the entity operating the arrangement. Payment

systems are commonly categorised into large-value payment systems (“LVPS”)

and retail payment systems. An LVPS is a funds transfer system that settles

large-value transactions between financial institutions. Retail payment

systems are mostly large-volume low-value payments by and between

individuals and corporations through instruments such as cheques, credit

transfers, debit transfers, or payment cards.

(b) Central Securities Depositories (“CSD”): A central securities depository

provides securities accounts, central safekeeping services, and asset services,

which may include the administration of corporate actions and redemptions.

A CSD can hold securities either in physical form (but immobilised) or in

dematerialised form (that is, they exist only as electronic records).

(c) Securities Settlement Systems (“SSS”): A securities settlement system enables

securities to be transferred and settled by book entry according to a set of

predetermined multilateral rules.

(d) Central Counterparties (“CCP”): A central counterparty interposes itself

between counterparties to contracts traded in one or more financial markets,

becoming the buyer to every seller and the seller to every buyer and thereby

ensuring the performance of open contracts.

(e) Trade Repositories (“TR”): A trade repository is an entity that maintains a

centralised electronic record/database of transaction data.

1.4 Prior to the issuance of the PFMI, MAS had applied CPSIPS, RSSS and RCCP in

its supervision of relevant FMIs. In line with international developments, MAS now

adopts the standards set out in the PFMI. All systemically important payment

systems (“SIPS”), CSDs, SSSs, CCPs, and TRs in Singapore are expected to comply with

the PFMI. In addition, MAS may impose higher or more specific requirements on

FMIs, as appropriate, in the context of specific risks, or in the context of wider

financial sector stability.

Monetary Authority of Singapore 2

Supervision of Financial Market Infrastructures in Singapore

2 Supervisory Objectives

2.1 The Monograph on Objectives and Principles of Financial Sector Oversight

issued in 2004 sets out six distinct objectives of MAS’ functions:

a stable financial system;

safe and sound financial intermediaries;

safe and efficient FMIs;

fair, efficient and transparent organised markets;

transparent and fair-dealing intermediaries and offerors; and

well-informed and empowered consumers.

2.2 The objectives of ensuring safe and efficient FMIs, and fair, efficient and

transparent organised markets, directly pertain to the supervision of FMIs. In

particular, FMIs provide the services and facilities underpinning financial market

activities, and are important nodes in the financial system. They thus play a critical

role in the safety and efficiency of the financial system. MAS monitors and assesses

relevant FMIs to ensure that they have proper structures, processes and rules in

place to achieve the following objectives:

(a) Safety: FMIs play a key role in fostering financial stability. The failure of FMIs

may contribute to and exacerbate systemic crises, and threaten the stability of

domestic and international financial markets, and the broader economy. A

safe FMI identifies, assesses, and manages risks that arise within the FMI or

through interdependencies with other participants. These risks include, but

are not limited to, legal, credit, liquidity, general business, custody,

investment and operational risks. MAS seeks to ensure that FMIs are

designed and operated in a safe manner, so that they do not compromise

financial stability.

(b) Efficiency: MAS also seeks to ensure that FMIs operate in an efficient manner.

Inefficient FMIs may distort financial activity and the market structure,

affecting not only its participants, but participants’ customers as well. These

distortions may in turn lead to increased risks within the broader financial

system. An efficient FMI makes effective use of resources in performing its

duties, thereby keeping costs reasonable while maximising economic benefits.

Monetary Authority of Singapore 3

Supervision of Financial Market Infrastructures in Singapore

3 Regulatory Framework

3.1 MAS’ powers for the supervision of FMIs are derived from the Payment

Systems (Oversight) Act (“PS(O)A”) and the Securities and Futures Act (“SFA”). The

PS(O)A and SFA set out the regulatory framework for FMIs, in line with the PFMI.

MAS has primary responsibility for the supervision of SIPS, CSDs3, SSSs, CCPs and TRs

in Singapore. A list of FMIs which MAS supervises is in Annex A.

Payment Systems

3.2 The PS(O)A empowers MAS to collect information from all payment systems in

Singapore. Specifically, MAS has powers to require the provision of payment system-

related information by the operators, settlement institutions or participants of any

payment system in Singapore. The purpose of this requirement is to allow MAS

access to comprehensive and reliable information. This enables MAS to monitor the

development of the payment system industry in Singapore and make informed policy

decisions.

3.3 In addition, the PS(O)A provides MAS with powers to regulate designated

payment systems (“DPS”). MAS can designate a payment system if it is considered a

SIPS or a system-wide important payment system (“SWIPS”), or where it is otherwise

in the public interest to do so.

(a) SIPS are systems whose disruption could trigger, cause or transmit further

disruption to participants or cause systemic disruption to the financial system

of Singapore. The MAS Electronic Payment System (“MEPS+”) is a SIPS in

Singapore. All SIPS are subject to the PFMI.

(b) SWIPS are systems whose disruption could affect public confidence in

payment systems or the financial system of Singapore. Although a disruption

or failure in these systems may have system-wide implications and may affect

3

There is currently only one commercial CSD in Singapore, operated by The Central Depository (Pte)

Limited (“CDP”), which is also a CCP and SSS, the functions of which are regulated under the

Securities and Futures Act. MAS administers the regulation of CDP as a CSD in accordance with the

Companies Act.

Monetary Authority of Singapore 4

Supervision of Financial Market Infrastructures in Singapore

many users, there is negligible risk of systemic impact to financial stability.

The Singapore Dollar Cheque Clearing System (“SGDCCS”), US Dollar Cheque

Clearing System (“USDCCS”), Interbank GIRO System (“IBG system”) and NETS

Electronic Fund Transfers at Point of Sale (“EFTPOS”) are considered SWIPS

and have been designated under the PS(O)A. MAS does not subject SWIPS to

the PFMI.

3.4 The criteria used to determine the need for designating payment systems for

supervision include number and value of transactions processed, number and type of

participants, markets served, market share, interconnectedness with other payment

systems and other financial institutions, and available alternatives to using the

payment system at short notice.

3.5 DPSs in Singapore are brought under MAS’ regulatory and supervisory ambit

due to their impact on public confidence and the broader financial system of

Singapore. MAS’ regulatory powers over DPSs include the ability to regulate access

rules for participation, impose restrictions and conditions, establish standards, make

regulations, approve and remove chief executive officers and directors, approve

substantial shareholders and other controllers, issue directions and inspect DPSs’

operations.

3.6 Unlike other DPSs, MEPS+ is owned and operated by MAS. As the PS(O)A is

designed for commercial DPSs, MAS is exempted from the PS(O)A4 as an operator,

settlement institution and participant of MEPS+. To supervise MEPS+ effectively,

internal arrangements and controls have been established within MAS to ensure

adherence to the PFMI. These are elaborated under Section 4 of this monograph.

Capital Markets FMIs

3.7 As the statutory capital markets regulator, MAS is responsible for the

supervision of capital markets FMIs (“CMFMI”) which comprise CSDs, SSSs, CCPs and

TRs in Singapore. CMFMIs in Singapore have the potential to trigger or transmit

systemic disruptions due to their critical functions in the Singapore capital markets

and are therefore deemed to be systemically important.

4

The amendments to the PS(O)A to exempt MAS were passed in Parliament on 14 January 2013.

Monetary Authority of Singapore 5

Supervision of Financial Market Infrastructures in Singapore

3.8 MAS’ supervision of CMFMIs is guided by the SFA and its accompanying

regulations. Any SSS, CCP or TR that seeks to offer its services in Singapore must be

authorised5 by MAS before it can commence operations.

3.9 Pursuant to Part III of the SFA, clearing facilities are defined to include SSSs

and CCPs. Corporations operating clearing facilities are regulated as approved

clearing houses (“ACH”) or recognised clearing houses (“RCH”). TRs are regulated as

either licensed trade repositories (“LTR”) or licensed foreign trade repositories

(“LFTR”) under Part IIA of the SFA.6

3.10 Generally, ACHs and LTRs are locally-incorporated FMIs subject to a higher

degree of supervision in Singapore on account of their greater systemic importance.

They are required to comply with a set of ongoing obligations in line with the PFMI,

including obligations to operate safe and efficient facilities, manage business and

operational risks prudently, and maintain sufficient financial, human and system

resources. In addition, specific risk management frameworks are subject to MAS’

direct supervision and review, for example, changes to business rules or, for ACHs,

changes to financial resources that are available to support a member’s default. In

general, MAS’ regulatory powers over ACH and LTRs include powers to impose

restrictions (including access restrictions) conditions and directions, approve and

remove chief executive officers and directors, approve substantial shareholders and

other controllers, and conduct inspections of the operations.

3.11 RCHs include locally-incorporated clearing facilities which are not FMIs, i.e. do

not carry out CSD, SSS or CCP functions, as well as overseas-incorporated clearing

facilities which offer FMI functions in Singapore. LFTRs are overseas-incorporated

FMIs which offer trade repository functions in Singapore. An overseas-incorporated

FMI is regulated as RCH or LFTR, in recognition that MAS has been satisfied of the

following:

5

“Authorised” means an admission process, which may be referred to as “approved”, “recognised”,

“licensed” or words of such effect, in the legislation.

6

MAS issued a legislative consultation on 23 May 2012, to expand the scope of the Securities and

Futures Act by introducing (i) a new licensing regime for trade repositories to be regulated as

licensed trade repositories or licensed foreign trade repositories; and (ii) a new authorisation regime

for all persons operating clearing facilities to be regulated as approved clearing houses or recognised

clearing houses. The Securities and Futures (Amendment) Bill 2012, containing these legislative

amendments, was passed in Parliament on 15 November 2012.

Monetary Authority of Singapore 6

Supervision of Financial Market Infrastructures in Singapore

(a) The regulatory regime in the home jurisdiction of the FMI is comparable, in

the degree to which MAS’ objectives of regulation are achieved, to the

requirements and supervision to which a locally-incorporated FMI in

Singapore is subject under the SFA. The home jurisdiction should be one

which applies the PFMI in its supervision of the overseas-incorporated FMI;

and

(b) Adequate arrangements have been made for cooperation with the home

regulator of the FMI, generally through a memorandum of understanding, or

similar formal documentation, on information exchange and mutual

assistance between MAS and the home regulator of the FMI.

3.12 RCHs and LFTRs are subject to a baseline level of general obligations in line

with the PFMI. These include obligations to operate safe and efficient facilities,

manage business and operational risks prudently, and maintain sufficient financial,

human and system resources. However, in view that they are subject to supervision

by their home regulators, MAS exercises a less intrusive approach towards

supervision of such entities.

3.13 Similar to the PS(O)A, the SFA empowers MAS to collect information from

ACHs, RCHs as well as LTRs and LFTRs. This allows MAS to monitor the activities of

the FMIs, in order to assess the impact of their activities to the capital markets in

Singapore.

3.14 Both the PS(O)A and the SFA are regularly reviewed and updated to ensure

their continued effectiveness in supporting MAS’ supervisory objectives with respect

to FMIs.

Monetary Authority of Singapore 7

Supervision of Financial Market Infrastructures in Singapore

4 Supervisory Approach

SIPS

4.1 MEPS+ is the only SIPS in Singapore and is owned and operated by MAS.

Notwithstanding that MAS is exempted from the PS(O)A, MAS holds itself to similar

standards as those expected of an operator and settlement institution of a DPS

under the PS(O)A. To maintain effective oversight of MEPS+, MAS has established a

formalised internal arrangement where the supervisory and operational functions

are separate, with distinct reporting lines to different management fora. The

supervision of MEPS+ is aimed at ensuring its safety and efficiency through

adherence to the PFMI.

4.2 The Information Technology Department (“ITD”) in MAS is responsible for the

operations of MEPS+. An independent risk management unit resides in the Risk

Management Department (“RiMD”) to oversee the risk management of MEPS+. The

Specialist Risk Department (“SRD”) in MAS is responsible for the supervision of

MEPS+. SRD uses a combination of supervisory tools to oversee MEPS+. These tools

include:

(a) Information gathering and analysis: SRD collects a variety of reports and data

to facilitate on-going monitoring and analysis of MEPS+ operations,

developments and risks. On a quarterly basis, ITD submits a report on key

MEPS+ payment statistics and events, such as industry testing and decisions

made by management committees. The quarterly report allows SRD to

maintain a good understanding of MEPS+, and to assess potential areas where

risks may materialise. In addition, SRD collects and analyses transaction

information on MEPS+ periodically to understand payment trends and to

identify payment flow anomaly and any risk that may arise in the system. On

an ad-hoc basis, ITD reports material incidents and notifies SRD prior to

material changes to its operations. These ad-hoc submissions provide SRD

with more timely information on significant developments and risks to MEPS+.

(b) On-site inspection: In addition to desk top reviews and analyses, SRD carries

out periodic inspections of MEPS+ operations and participants. Such

inspections facilitate a more in-depth review of whether risks are

Monetary Authority of Singapore 8

Supervision of Financial Market Infrastructures in Singapore

appropriately managed, and whether relevant MAS notices and guidelines are

adhered to.

(c) Assessment against PFMI: ITD and RiMD conduct self-assessments of MEPS+

adherence to the PFMI, and are committed to publish information required

under the PFMI Disclosure Framework (“DF”) biennially. SRD reviews the DF.

SRD also performs ongoing risk assessment of MEPS+, using information

gathered from both off-site and on-site reviews, to determine if supervisory

action is needed to improve the safety or efficiency of MEPS+.

(d) Stakeholder engagement: SRD will regularly engage ITD and RiMD to highlight

for their timely action, any issues of supervisory concern. Where significant,

issues will be escalated to the relevant management fora to ensure

appropriate oversight and timely remediation. Internal audit is also kept

apprised of such issues to facilitate their audit and risk assessment. Escalation

to the MAS Board or relevant Board Committees may also take place where

appropriate.

SWIPS

4.3 MAS’ supervisory framework for SWIPS similarly includes activities such as

regular monitoring, meetings with senior management, inspection and assessment.

Regular monitoring entails gathering information relating to the design and

operation of DPS from the operator and settlement institution. Apart from the

ongoing communications at staff level, MAS conducts regular meetings with senior

management of the operator and settlement institution to discuss and understand

the strategic plans of the DPS. Inspections and targeted examinations are carried out

on a periodic basis. These supervisory activities focus on topics identified through

monitoring as well as from previous inspections that either present higher risk or

where control processes warrant validation. To facilitate the supervision of SWIPS, a

risk assessment framework has been developed to assess the level of risks, and

adequacy of controls of these payment systems. 7 In addition, MAS collects

7

Please refer to the monograph on MAS’ Framework for Impact and Risk Assessment of Financial

Institutions, issued in April 2007, available on the MAS website. This monograph covers how MAS’

supervisory objectives and principles shape our supervisory framework, and the supervisory

processes that underpin the framework including how MAS assesses the impact of financial

institutions and the use of the Common Risk Assessment Framework and Techniques (CRAFT) to

assess their risks.

Monetary Authority of Singapore 9

Supervision of Financial Market Infrastructures in Singapore

information and data from these payment systems to analyse payment trends and to

improve its understanding of the way these systems operate.

4.4 In addition, MAS engages the industry to monitor current issues and

developments. Such surveillance and engagement with industry could form the basis

for our payment systems policy formulation and regulations which MAS reviews from

time to time.

CMFMIs

4.5 MAS supervises CMFMIs on an ongoing basis to ensure that they comply with

their statutory obligations under the SFA. Similar to our supervision of DPS, MAS’

supervisory framework for CMFMIs includes activities such as regular monitoring,

meetings with senior management, self-assessments and inspection.

4.6 Regular monitoring entails the review of CMFMIs in various key areas such as

financial and regulatory capital compliance, incidences of systems disruptions, and

changes to business rules of CMFMIs, which govern the relationships between the

CMFMIs and their respective participants. MAS also engages the CMFMIs in regular

dialogue both at staff and senior management level. Self-assessments involve

CMFMIs conducting and submitting a self-assessment report to describe how they

have discharged their statutory responsibilities. As with DPS, a risk assessment

framework has been developed to assess the level of risks, and adequacy of controls

of these CMFMIs. Based on the risk assessment framework, on-site inspections are

carried out on a periodic basis, focusing on areas identified through monitoring as

well as from previous inspections.

Monetary Authority of Singapore 10

Supervision of Financial Market Infrastructures in Singapore

5 FMIs Subject to Cooperative Oversight

5.1 Where relevant and practical, MAS seeks to participate in the cooperative

oversight of cross-border or multi-currency FMIs which may affect the stability of the

financial system of Singapore. Cooperation may take a variety of forms, including

formal arrangements that are organised under memoranda of understanding,

protocols, informal ad hoc arrangements and regular communications. MAS

recognises that cooperative oversight between authorities helps to foster consistent

and transparent communications between authorities and the cross-border or multi-

currency FMI, enhance transparency among the participating authorities and avoid

subjecting the FMI to conflicting regulation. This approach is reflected in the design

and administration of the PS(O)A and SFA. Please refer to Annex B for details of FMIs

that are subject to cooperative oversight by MAS.

Monetary Authority of Singapore 11

Supervision of Financial Market Infrastructures in Singapore

Annex A

Financial Market Infrastructures Supervised by MAS8

1 Systemically Important Payment System

1.1 MEPS+9 is a real time gross settlement system for large-value SGD interbank

funds transfers. It is the payment system used for financial market transactions, such

as foreign exchange and securities transactions. It is also used to effect interbank

payments arising from other financial market infrastructures (e.g. cheque and GIRO

clearing, and Central Securities Depository). MEPS+ also processes the settlement

and holding of scripless Singapore Government Securities10 (“SGS”) and MAS Bills11.

MEPS+ is designated under the Payment and Settlement Systems (Finality and

Netting) Act (“FNA”) which provides the legal certainty that all transactions settled by

MEPS+ are final and irrevocable.

2 System-Wide Important Payment Systems

Systems operated by the Singapore Automated Clearing House (“SACH

Systems”)

2.1 The SGDCCS, USDCCS and IBG system, collectively called the SACH systems,

are provided by the Singapore Automated Clearing House. These systems are

operated by the Banking Computer Services Pte Ltd (“BCS”).

2.2 The SACH systems process mainly interbank retail payments. These retail

transactions are lower in value compared to MEPS+ payments, but form a large

volume of important business and retail transactions such as salary and bill

payments. Obligations from financial transactions such as those arising from stock

8

As at January 2015.

9

As explained in paragraph 3.6 of this monograph, MAS is exempted from the PS(O)A as an

operator, settlement institution and participant of MEPS+.

10

SGS are issued by MAS, in its capacity as the Singapore Government’s fiscal agent. SGS issuance is governed

by the Government Securities Act and Local Treasury Bills Act.

11

MAS Bills are issued by MAS pursuant to the MAS Act.

Monetary Authority of Singapore 12

Supervision of Financial Market Infrastructures in Singapore

trading may also be settled through SACH systems. SACH clears transactions on a

multilateral deferred net settlement basis. Actual funds settlement for IBG and SGD

cheques take place in MEPS+ while for USD cheques, settlement occurs in the

Cheque Settlement System operated by Citibank N.A., the appointed settlement

bank for USDCCS. These systems are designated under the FNA to provide for the

enforceability of netting arrangements under certain scenarios and to give certainty

to the default arrangements of these systems in the event of the insolvency of a

participant.

NETS Electronic Fund Transfers at Point of Sale (“EFTPOS”)

2.3 Debit cards are an important means of payment at points-of-sale (“POS”) for

Singapore residents. NETS EFTPOS, a debit card system, is operated by Network for

Electronic Transfers (Singapore) Pte Ltd. It has key linkages to customer deposits and

the merchant base. Interbank settlement occurs on a deferred net basis.

3 Capital Markets FMIs

The Central Depository (Pte) Limited (“CDP”)

3.1 CDP is a CSD, SSS and CCP in respect of trades executed on the market

operated by the Singapore Exchange Securities Trading Limited. This includes trades

on shares, warrants and other securities12. CDP is also a CSD and SSS in respect of

the settlement of transactions in over-the-counter (“OTC”) bonds.

Singapore Exchange Derivatives Clearing Limited (“SGX-DC”)

3.2 SGX-DC is a CCP which provides clearing and settlement for futures and

options contracts on interest rates, stock indices, dividend indices and commodities

traded on the Singapore Exchange Derivatives Trading Ltd. SGX-DC also offers

clearing of OTC commodity and financial derivatives, such as oil, coal swaps, freight

forward agreements, interest rate swaps and non-deliverable foreign exchange

forward contracts.

12

These include real estate investment trusts (REITs), exchange-traded funds (ETFs), exchange-

traded notes (ETNs), business trusts, American depository receipts (ADRs), global depository receipts

(GDRs) as well as bonds.

Monetary Authority of Singapore 13

Supervision of Financial Market Infrastructures in Singapore

ICE Clear Singapore Pte Ltd (“ICSG”)

3.3 ICSG provides clearing and settlement for futures listed on ICE Futures

Singapore Pte Ltd (“IFSG”). Intercontinental Exchange, Inc. acquired Singapore

Mercantile Exchange Pte Ltd and Singapore Mercantile Exchange Clearing

Corporation Pte Ltd in February 2014, and renamed these entities as IFSG and ICSG,

respectively.

DTCC Data Repository (Singapore) Pte. Ltd. (“DDRS”)

3.4 DDRS, a subsidiary of Depository Trust and Clearing Company in the US,

operates a TR in Singapore. DDRS enables market participants’ reporting of OTC

derivative transactions (e.g. credit default swaps, interest rate swaps). Information

reported to DDRS provides regulators with enhanced transparency in the OTC

market.

Monetary Authority of Singapore 14

Supervision of Financial Market Infrastructures in Singapore

Annex B

Financial Market Infrastructures Subject to Cooperative Oversight13

1 Continuous Linked Settlement

1.1 The Continuous Linked Settlement (“CLS”) is a global payment system that

MAS oversees via a cooperative oversight arrangement. CLS is a cross-border

payment system that settles foreign exchange transactions for the major currencies

on a payment-vs-payment (“PVP”) basis. The settlement service is provided by CLS

Bank in New York. It provides PVP settlement service across 17 currencies (including

the Singapore Dollar), and non-PvP settlement of certain credit derivative and non-

deliverable foreign exchange forward trades.

1.2 MAS participates in the cooperative oversight of CLS. CLS Bank is regulated

and supervised by the Federal Reserve in the U.S. as an Edge corporation. The U.S.

Federal Reserve also chairs the CLS Oversight Committee (“OC”), in which MAS

participates along with other central banks. The CLS OC provides a mechanism for

central banks whose currencies are settled in CLS Bank to carry out their individual

oversight responsibilities. The U.S. Federal Reserve organises and administers the

CLS OC, which operates in accordance with the Protocol for Cooperative Oversight of

CLS (“Protocol”). The Protocol was adopted by the CLS OC to avoid duplication of

effort by the central banks, foster consistent, transparent communications between

the central banks and CLS Bank, and enhance transparency among the participating

central banks regarding the development and implication of international and

domestic policies applicable to CLS Bank. As a SIPS, CLS is required to comply with

the PFMI by the CLS OC.

13

As at January 2015.

Monetary Authority of Singapore 15

You might also like

- 2018 Article Iv Consultation-MyanmarDocument91 pages2018 Article Iv Consultation-MyanmarLet's Save MyanmarNo ratings yet

- Code Standard For Rice 198-1995Document6 pagesCode Standard For Rice 198-1995Let's Save MyanmarNo ratings yet

- Lemon Law in Singapore:Consumer Protection (Fair Trading) ActDocument55 pagesLemon Law in Singapore:Consumer Protection (Fair Trading) ActLet's Save MyanmarNo ratings yet

- The Regime S Cronies List June 27 2011 FinalDocument14 pagesThe Regime S Cronies List June 27 2011 FinalLet's Save Myanmar100% (1)

- Yangon Circular Railway Line Upgrading Project !Document274 pagesYangon Circular Railway Line Upgrading Project !THAN HAN100% (1)

- MYANMAR SELECTED ISSUES (International Monetary Fund)Document34 pagesMYANMAR SELECTED ISSUES (International Monetary Fund)Let's Save MyanmarNo ratings yet

- Strategic Environmental Assessment of The Myanmar Hydropower Sector IFCDocument152 pagesStrategic Environmental Assessment of The Myanmar Hydropower Sector IFCBhamotharNo ratings yet

- Recent Developments of The Myanmar Economy - Nov 6,2018Document9 pagesRecent Developments of The Myanmar Economy - Nov 6,2018Let's Save MyanmarNo ratings yet

- Six Billion Dollar Timber Corruption Black Hole Revealed by Official Data - EIA Data CorruptionDocument6 pagesSix Billion Dollar Timber Corruption Black Hole Revealed by Official Data - EIA Data CorruptionLet's Save MyanmarNo ratings yet

- Singapore CPFDocument1 pageSingapore CPFLet's Save MyanmarNo ratings yet

- Myanmar Tourism Statistics 2016 1Document2 pagesMyanmar Tourism Statistics 2016 1Let's Save MyanmarNo ratings yet

- Myanmar Travel & Tourism Economic Impact 2017Document24 pagesMyanmar Travel & Tourism Economic Impact 2017Let's Save MyanmarNo ratings yet

- The Study of SME's Contribution To Myanmar's Economic DevelopmentDocument8 pagesThe Study of SME's Contribution To Myanmar's Economic DevelopmentTHAN HANNo ratings yet

- UNDP MM Perception Survey EnglishDocument47 pagesUNDP MM Perception Survey EnglishLet's Save MyanmarNo ratings yet

- 2016 Pwint Thit Sa enDocument48 pages2016 Pwint Thit Sa enYe PhoneNo ratings yet

- Myanmar Investment Law Official Translation 3-1-2017Document32 pagesMyanmar Investment Law Official Translation 3-1-2017THAN HANNo ratings yet

- 2018-PTS enDocument2 pages2018-PTS enLet's Save MyanmarNo ratings yet

- Press Release For Tea Briefing Paper in English VersionDocument1 pagePress Release For Tea Briefing Paper in English VersionLet's Save MyanmarNo ratings yet

- Myanmar Finincal Report 2102Document114 pagesMyanmar Finincal Report 2102Let's Save MyanmarNo ratings yet

- SMEs Situation Myanamr 2016Document12 pagesSMEs Situation Myanamr 2016Let's Save MyanmarNo ratings yet

- Myanmar Companies Law 2017Document188 pagesMyanmar Companies Law 2017Let's Save Myanmar100% (1)

- Tea Briefing Paper by Burmese VersionDocument13 pagesTea Briefing Paper by Burmese VersionAung Myo TheinNo ratings yet

- Articles CompanyDocument45 pagesArticles CompanyLet's Save MyanmarNo ratings yet

- RaportiDocument245 pagesRaportiFlorenc StafaNo ratings yet

- SME Financing in Myanmar (8 September 2013)Document19 pagesSME Financing in Myanmar (8 September 2013)THAN HANNo ratings yet

- Set Myanmar Final 170404Document83 pagesSet Myanmar Final 170404THAN HANNo ratings yet

- Quarterly Financial Statistics Bulletin (Volume I 2017)Document98 pagesQuarterly Financial Statistics Bulletin (Volume I 2017)Let's Save MyanmarNo ratings yet

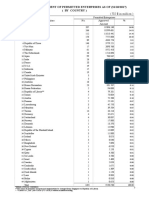

- Myanamr Yearly Approved Amount of Foreign Investment (By Country)Document1 pageMyanamr Yearly Approved Amount of Foreign Investment (By Country)Let's Save MyanmarNo ratings yet

- Myanmar Foreign Investment of Permitted Enterprises As of (31/10/2017) (By Country)Document4 pagesMyanmar Foreign Investment of Permitted Enterprises As of (31/10/2017) (By Country)Let's Save MyanmarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Spring 2009 Mgt201 3 VuabidDocument5 pagesSpring 2009 Mgt201 3 Vuabidsaeedsjaan100% (3)

- Dynamic Risk ParityDocument18 pagesDynamic Risk ParityRohit ChandraNo ratings yet

- Delta Marketing TrendsDocument7 pagesDelta Marketing TrendsCandy SaberNo ratings yet

- ACC702 International Corporate ReportingDocument16 pagesACC702 International Corporate ReportingShazana KhanNo ratings yet

- Case 52 Sanofi-Aventis's - Analysis GuidanceDocument2 pagesCase 52 Sanofi-Aventis's - Analysis Guidancebaworanan46No ratings yet

- Nirmal Bang Securities Pvt. LTD Company ProfileDocument7 pagesNirmal Bang Securities Pvt. LTD Company ProfileTeja Choudhary Medarametla100% (2)

- FF Full Eng PDFDocument146 pagesFF Full Eng PDFAnonymous YgBIdKxvNo ratings yet

- SAFE PrimerDocument8 pagesSAFE PrimerJaap FrölichNo ratings yet

- Deepak Nitrite by Edelweiss (From BIGBULLS)Document5 pagesDeepak Nitrite by Edelweiss (From BIGBULLS)Ranjan BeheraNo ratings yet

- Forex 1 PDFDocument3 pagesForex 1 PDFgatNo ratings yet

- Unpaid Sheet 2014Document234 pagesUnpaid Sheet 2014Jagadamba RealtorNo ratings yet

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- Qoul Quo Srai Sek 7 2603201401Document6 pagesQoul Quo Srai Sek 7 2603201401hafiz091201No ratings yet

- This Study Resource Was: Logo HereDocument5 pagesThis Study Resource Was: Logo HereMarcus MonocayNo ratings yet

- 02 - Price Action StrategiesDocument82 pages02 - Price Action Strategiesvvpvarun94% (63)

- Five Day Trading Programme Amplify Trading 2014Document7 pagesFive Day Trading Programme Amplify Trading 2014RahulNo ratings yet

- Larry Steffen Case StudyDocument4 pagesLarry Steffen Case StudyRicky ZhaiNo ratings yet

- Foreign Exchange Markets and TransactionsDocument9 pagesForeign Exchange Markets and TransactionsAli khanNo ratings yet

- Nippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Document29 pagesNippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Saif MansooriNo ratings yet

- Multi Time Frame Structure Breakdown for Identifying High Probability Trade SetupsDocument6 pagesMulti Time Frame Structure Breakdown for Identifying High Probability Trade SetupsFX IINo ratings yet

- Equity Linked Notes (ELNs) DBS TreasuresDocument1 pageEquity Linked Notes (ELNs) DBS Treasuresspecul8tor10No ratings yet

- Financial Market Risks & ManagementDocument73 pagesFinancial Market Risks & Managementakhilyerawar7013No ratings yet

- Day 1Document28 pagesDay 1CHENAB WEST100% (1)

- Goal Assure BrochureDocument20 pagesGoal Assure BrochureBharat19No ratings yet

- Gemini Electronics: US LCD TV Giant's Growth & Financial AnalysisDocument1 pageGemini Electronics: US LCD TV Giant's Growth & Financial AnalysisSreeda PerikamanaNo ratings yet

- Bloomberg - Performance Attribution ModelDocument17 pagesBloomberg - Performance Attribution Modelde deNo ratings yet

- Exchange Rate MechanismDocument42 pagesExchange Rate Mechanismpriya nNo ratings yet

- Hedge Funds Presentation Apr 08Document31 pagesHedge Funds Presentation Apr 08Marina BoldinaNo ratings yet

- Good-bye original sin, hello risk on-off, financial fragility, and crises? Analysis of EM sovereign bond issuanceDocument14 pagesGood-bye original sin, hello risk on-off, financial fragility, and crises? Analysis of EM sovereign bond issuanceNadia Cenat CenutNo ratings yet

- Modul Lab. Akuntansi Menengah 2 - P 20.21Document54 pagesModul Lab. Akuntansi Menengah 2 - P 20.21Ivonie NursalimNo ratings yet