Professional Documents

Culture Documents

P1 923

Uploaded by

Ashley Levy San Pedro0 ratings0% found this document useful (0 votes)

10 views7 pagesp1

Original Title

P1-923

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentp1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views7 pagesP1 923

Uploaded by

Ashley Levy San Pedrop1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

PRACTICAL

UC EspenillaG, Macariola

INTANGIBLE

LON OF THE ACCOUNTING SESNDARDS

ion An intangible iy recognized it, and only if

8. Is probable that future economic benefits attributable to the asset will flow to the enterprise

b. The cost of the asset can be measured reliably

Identifiable Intangibles - can be identified a part from other assets of the enterprise and can be sold

Separately. Example ~ patents, copyrights, customer lists, trademarks or trade names and franchises.

Unidentifiable intangibles ~ assets that cannot be sold, transferred, licensed, rented or exchange

separately. Example ~ goodwill

2. Measurement of intangibles - Initial Recognition: The intangible asst is initially recognized at historical

cost, The historical cost of an intangible is its fair value which is equal to its cash price equivalents. The

cash price equivalent is determined by the following ways of acquiting an intangible asset

By purchase ~ the purchase price and any import duties and non-refundable purchase taves and any

directly attributable expenditure on preparing the asset for its intended use such as professional fees for

legal services,

By a deferred plan beyond n normal credit terms ~ the eash price equivatents (the cash price or the

present or discounted value for a non-interest long term liability). "The difference of the cash prive

equivalents and the total amount of payments is interest and recognized as expenise over the term of the

credit period,

By the issuance of equity instruments ~ the fair market value of the instruments, which is equal to the fair

‘market value of the intangible.

By part of a business combination ~ the fair market value on the date of acquisition. The fait market

Value is equal to the following.

‘© i'there is an active market ~ quoted market price which is usually the current bid price.

‘© there is no active market ~ the amount, which would have been paid by the company in an

arm's length transaetion between knowledgeable and willing parties (by discounting

estimated cash flows from the intangible asset).

If the fair market value of the intangible asset in a business combination cannot be measured reliably,

the asset is mot recognized as a separate intangible but is included within the over-all cost of purchase

goodwill,

By goverament grant

it is recorded at the fair value or nominal value of the asset. The allemative course

that is sometimes followed is to record both asset and grant at nominal valve. Note that the standard

does not prescribe a preference. Accordingly. reporting entities with such grants are given

recording the grant at fair value or at nominal value,

hoice of

By exchange ~ the cost of the intangible asset is measured at the fait market value unless the transaction

facks commercial substance. If the exchange lacks the necessary commercial substance, the intangible

asset is not measured at fair market value but the carrying value of the asset given up.

Internally generated intangible are the cost that can be directly attributed or allocated on a reasonable

and consistent basis to creating, producing and preparing the asset for its intended use. The

includes the follow ing:

© cost of materials und services used or consumed in genera

iz the intangible asset.

* Salaries and wages and other employment related cost of personne! directly engaged in generating

the asset.

© Expenditure that is directly attributable to generating the

and amortization of patents and licenses that are used to generate the asset

such as fees to register a legal right

‘+ Overhead that are necessary to generate the asset and that can be allocated on a reasonable and

consistent basis to the asset.

3. Measurement subsequent to acquisition:

Cost model — after initial recognition, the intangible shall be carried at its cost less accumulated

amortization and accumulated impairment losses.

SAY PRACTICAL ACCOUNTING I- Intangible

4

beste RE

(on, an Tnlangible Asser shall be carried al A Fevalued amount,

he date of revaluation less uny subsequent accumulated amortization and any

Amortization period —the amortizable/depreciable amount of an intangible asset should be allocated an @

systematic basis over the best estimate of its useful life. The intangible assets with a limited life are

amortized over their uselul fife. The intangible assets with indefinite Ife are not amortized but are tested

fir impairment at feast annually. The method of amortization shall reflect the pattern in which the future

‘economic benefits from the asset are expected to be consumed by the entity, I the pattern eannot be

detemmine rehably, the straight line method is used The residual value of an intangible usset shull be

presumed to be zero, unless a third purty is committed to buy the intangible asset atte end of ts useful life

(oF unless here Ws an active market, Any change in the methud of amorticalion oF Wife of ar imansible

should be treated us a change in estimate,

‘Speeific guidelines on specific intangibles:

Patent an exclusive right granted by the government to an inventor enabling him to control the

manufacture, sale or other use of his invention fora specitied period of time.

‘The cost of a purchased patent should be amortized over its legal life (20 years) or useful tie

whichever is shorter

‘The cost of a developed patent (the cost should include only the Ticensing and other related legal fees

in securing the patent rights) should be amortized the shorter of the legal life or useful I

If a competitive patent was acquired 1 protect the old patent, the competitive pa

amortized over the remaining life of the old patent,

Legal fees and other costs of successfully prosecuting or defending a patent should be charged

successful litigation on patent should also be charged

as an expense including the unamortized cost of the patent

Fa new patent negates the old patent's value, the cost of the new patent can be made for adding the

unamontized cost of the old patent, however. most business enterprises rely on the conservatism

constraint and immediately write-off the unamortized cost of the old patent.

should be

Copyright — exclusive right granted by the government to the author. composer or artist enabling to

publish, sell or otherwise benefit from his literacy, musical and artistic work. .

‘The costs (the expenses incurred in the production of the work including those required to establish or

‘obtain the right) should be amortized over the period itis expected to provide a revenue of legal lite

whichever is shorter However, if revenues are expected to be received for an indefinite period oF time

land renewal and registration can be done with minimal effort and eost, it should not be amortized but

should however be reviewed for impairment at each reporting date

Franchise - an exclusive right granted by the franchisor (government or private companies) fo @ franchisee

to use the property or the rights (trademark, patent and process of the franchisor).

‘The cost ofthe franchise should be should be amortized or should be reviewed at each ceporting period

for impairment

a. If the franchise has a definite period — it should be amortized over the definite period (not

exceeding 20 years) of usefl life whichever is shorter.

b. Ifthe franchise has an indefinite life ~ it is not amortize but should however be reviewed for

impairment at each reporting date.

‘Trademark/trade name/brand name is a symbol, sign, slogan or name use to mark a product to

distinguish it from other products. The cost of te intangible should include

‘a, When purchased -the purchase price or the eash price equivalents,

b, When developed -the expenditures required to establish including filing fees, registry fees and

other expenses incurred in securing the trademark, ee ee oe

The legal life of a trademark or trade name or brand name is 10 years and maybe renewed for

perio of lyn cork” KA. Na 320). Toe onl ofa rodeumnk aeons ne

test of impairment atleast annually as a result ofthe almost antomaiic renewal Trademark may

be priv clooiid x anisoogite see witha indent if: omcoor ita lpk re tone,

considered iidfnite, should be amortized wver its remaining usid life

Goodwill:

‘Only a purchased goodwill (external) should be recognized as an asset, Gi

joodwill generated internally

Cnherent goodwill ) should be charged outright as an expense. Subsequent aoa reed a ke coil

should be charged immediatly against income, The cost of purchased yoodlll terme

following computations: 7 ye bye

ion con less the fir market value of et asset acquired

b. Purchase of average excess earinas average earnings ~ normal earnings x numberof yeara

SAL PRICTICAL ACCOUNTING 1: Imunglbles

6. Captalization of averaye exes earnings averag

hee Pane Sob

wnings 198 F eapitalization rate

Chpitalization of average earnings: average earnings + capitalization rate net unset

The cost of yoodwill s not amortized because its useful fife is indefinite, However, goodwill shall be

tested for impairment af least annually or mute frequently sf events or changes in circumstances indicate

4 possible impairinent

‘The amount of goodwill impairment is det

generating unit (CGU) to which

10 hich the woodwill belangs,

# If the recoverable amount of the CGU exceeds the carrying value of the CGU, the CGU and the

woodwill allocated to tua unit shall be reyarded as not impuired.

© IF the carrying, amount of the CL exeeeds the recoverable amount of the uni

recognize an 1 lon

ined by comparing the recoverable amount for the cash-

We yowxtwill belongs against the carrying value of the cash-yenerat

the company must

Research an activity undertaken fo discover new knowledge that will be useful in developing new product

‘or that will result in sipnificant impravement of existing. product, Examples of these are: laboratory

tor discovering new knowledye, semiching for application of research Findings

and other knowledge; conceptual formulation and design of possible product or process alternative and;

testing in search for product oF process alternative,

Development is the application of rewatch Findings oF other knowledge to a plan or design for the

production of new or substantially improved material, device, product, process, system, and prior to the

‘commencement of commertsal production. Examples of these are: a) design, construction and testing of

pre-production prototype and inode; b) design of tools, jigs. molds and dies involving new technology,

€) design, construction and operation of a pilot plant that is not of a scale economically feasible to the

prise for commercial production, and d) desigh, construction and testing of 4 chosen alternative for

new oF improved product or process

The standard allows recognition of an intangible asset during the development phase, provided the

enterprise carn demonstrate al the following:

44. Technical feasibility of completing the intangible asset so that it will be available for use or sale

b. Its intention 1 complete the intangible asset and ether use it or sell it

Its ability to use or sell the intangible aset

d.The mechanisin by which the intangible will generate probable future economic benefits

fe. The availability of adequate (echnical, financial and usher resources to complete the development

and to use or sell the intangible ase, and

f. The entity's ability o reliably measure the expenditure attributable to the intangible asset during its

development.

Uthe company cannoy distinguish the research phase from the development phase, the company treats

the expunditure asi. was ncurred inthe research phase only.

Internally Developed Computer Software: the cost incurred on the research stage in creating the software

should be charged outright to expense when incurred until a technological feasibility has been established

for the product, Technological feasibifity is established when a company has produced either a detailed

program design of the software or a working model. After establishing technological feasibility, the cost

of software 19 be capitalized should Include the cows of coding and testing and the cost to produce the

product masters.

‘The cost of the computer software should be allocated base on the pattern in which the asset’s future

economic benefits are expected to be consumed by the entity. If such patter canni mit

reliably, the straight-line method is used, = ee

Purchased Software:

a. If itis for sale ~ should be treated as an inventory

b. IF itis held for licensing or rental to others - recognized as an intangible asset

© Ith efor ned and integra pt w the hardware weed ve ae ee

frivar pte’ een [ition beet

7. Impairment of intangible Assets Other Than Goodwill:

a. Subject to amortization

b. Not subject to amortization

Ifthe recoverable amount of an intangible asset is less than its c

ptangible asset should be reduced to ity recoverable a et ane

int, the reduction is an impairment loss.

BeSA/ PRACTICA UNTING I- Intangibles 4

Ifthere is an impairment loss on a non-revalued intangible asset. tis recognized in profit or loss.

If there is an impairment loss on a revalued intangible asset, the carrying value based on the revalued

amount less the fair value of the intangible less the existing revaluation surplus is the measure of

impairment loss.

& Compute the recoverable value (higher of the fair value less cost to sell and value in use) of each

reporting unit to which goodwill has been assigned.

b. If recoverable amount of the reporting unit exceeds the net carrying value of the assets (including

goodwill) and liabilities of the reporting unit, the goodwill is assumed not to be impaired and no

impairment loss is recognized

©. If the recoverable amount of the reporting unit is less than the net carrying amount of the assets and

liabilities of the reporting unit, then a new fair value of the goodwill is computed.

9. Reversal of impairment loss for an Individual Asset:

‘The increased carrying amount of an asset other than goodwill attributable to a reversal of an impairment

loss shall not exceed the carrying amount that would have been determined (net of amortization or

depreciation) had no impairment loss been recognized for the asset in prior years.

A reversal of an impairment loss for an asset other than goodwill shall be recognized immediately in profit

(oF loss, unless the asset is carried at revalued amount. A reversal of impairment loss on a revalued asset

credited directly to equity under the heading revaluation surplus. However, to the extent that an

mpairment Joss on the same revalued asset was previously recognized in profit or loss, a reversal of that

impairment loss is also recognized in profit or loss.

10, Leasehold Improvements are alteration or modifications on the leased property made by the lessee, such

as buildings, walkways, pavements, landscaping, driveways, lightning installations, major repairs or

replacements, partitions, cabinets, shelves, ventilating system and etc, made on leased assets.

Leaschold improvements are generally classified as property plant and equipment. ‘The cost of leasehold

improvements should be depreciated over the shorter of the life of the improvements or the life of the

leased asset. 7

If the lease contract contains a provision for an option to renew and the likelihood of the renewal option is

highly probable, the cost of the leaschold improvements should be depreciated the shorter of the life of the

improvement and the remaining extended tease term. But when the renewal option is uncertain, the cost of

the leasehold improvements should be depreciated the shorter between the life of the improvements and the

remaining lease term, as if there was no renewal option.;

Differences between IFRS for SMEs and FULL IFRS

IFRS for SMEs FRS

Tntangible assets acquired in a business combi wible assets acquired in a

are only recognized if the fair value can be measured | business combination is presumed.

ably ea eet Ls ee om

Re-assessment is only applicable when there is an | Annual te-assessment of

indicator of a change in the residual value, tion method or useful life of an intangibl

amortization method, or useful life of an intangible | asset is required. ‘of an intangible

are a —_|

‘All internally generated intangibles are expensed;

development costs may not be capitalized,

The cost of intangible asset acquired in a government

‘pant is its fair value.

There is a choice between accounting for the cost of

an intangible asset acquired in a government yran a

wus eH fair value oF nominal val

[AIT intangible assets are regarded as having a finite | tn . ‘t i

in in Nangible assets may hi in

Useful if and must be amorizd, The useful lie | No year ecumed tno et

presumed to be ten years if @ reliable estimate cannot

| be made. Zi aaati bs

COUNTING 1_ C. Uberita/C, Espenitlu/G. Macariola

foutre hineht

When pve Kg

Intangibles <— ¢ yy,

(On January 1, 2014. M Company acquired an intangible asset from a foreign company. The invoice price ofthe

intangible was P10,000,000 subject to a 10% discount if aequired on a cash basis, M Company patil P2,000,000

import dates and professional fees of P100.000 in relation to its acquisition, “At what amount should the

imangible asset be initially recorded inthe books of M Company? woran 725

9.000.000 «. Pi ,000,000 Se

b, 9,100,000 & PI,100,000 ye

icket Company acquired an intangible asset from Trinket Company on May 1, 2014 by issuing 5,000,000 of

‘ordinary shares with a par value of P2.00 per share but currently selling in the stock exchange for P3.00 per

share and an additional amount of P2,000,000, Cricket Company also pays P100,000 legal cost in relation to

the acquisition of the intangible asset. At what amount should the intangible asset be initially recorded by

Cricket Company? Bars Sie?

a. P10,100,000 . P17,000,000 ae

b. 15,100,000 . PI7,100,000 Tne

Michelle Company exchanges the rights to distribute a product in Brisbane which have a carrying amount of

2.000.000, for cash of PSO0,000 and the righis to distribute the same product in Canberra. The fair market

value Of the rights received is P1,700,000. The exchange is considered haying the necessary-connercigk

balance, AX the time of exchange, the intangible ase should be intially recorded by Michelle Company aug

a. PI,500,000 «. P2,000,000 ty Sieg = 400 10

b. 1.700.000 4 2200000 Pia

Justified Company purchases a trademark from an overseas company to manufacture items under the trademark,

Justice Company incurs the following costs in purchasing the trademark: Amount paid for the trademark,

'P8,000.000. Import duties, P80.400; Legal fees (negotiating the deat and ensuring the terms of the trademark

are fair). P100-000; Training costs (required by overseas company before the trademark can be usedO, P20,000;

Advertising new product, P30,001) and cost of registering the trademark (required in terms of the agreement

with supplier). P90.000. What amount should the trademark be initially recorded?

a. P8.180,000 c. P8,290,000

be P8.270,000 dd. P8.320,000

On July, 2009-Flat Co. signed af aetcement to operate asa franchise of Tire Co. for an initial franchise fee of

P1.200,000. On the same date, Flat paid P400,000 and agreed to pay the balance in four equal payments of

200,000 beginning July 1, 2010. The down payment is not refundable and no future services are required of

the franchisor. Flat can borrow ai 14% fora loan of this type. What isthe earryine ve ofthe franchise to be

reported on the December 31, 2011 statement of fi ranchise has» definite tte oF

I position assuming i

20 years? Lie 6 Wp PEI) Boy,

a 859.950 vis oe €. 1.140.000 pahes vey

982,800 » 4 2

Pirate Company purchased a patent on January 1, 2006 for P428,400, ‘The patent was being amortized over its

remaining legal life of 1S"years expiring on January |, 2021. On January 1, 2009, Pirate determined that the

economic benefits of the patent would not last longer than 10 years from the date of acquisition, What amount

shouldbe reported inthe balance sheet as patent net of accumulated amortization at December 3], 201

a M6880 ¥0 8 Sie Wat 1. 244,800

b, 195,8407 HO 8 sear 4. 302,400

On January 2, 2012, Proton Company paid P500,000 to acquire a patent with a remaining economic useful life

‘of 15 years. Proton Company expects fo use the patent for S.ycars and intends to sell it after S years, Newton

‘Company has committed to buy the patent far 40% of the cost to Proton Company. In its December 31, 2012,

What amount of patent amortization should Proton Company report in its profit or loss?

a. PA0.000 ‘© P100.000 2

. 60,000 4 P200000 OY! “28

istine Company has a broadcasting license that expires in S years. As of January 1, 2012 the license has a

carrying amount of P1.800,000" “The license is renewable and has already heen renewed twice in the past

During the current year 2012 the broadcasting authority has decided that in the future it will auction the licenses

when they came up for renewal. As a result ofthis development the company's renewal eption is no longer

assured. “The license has a remaining life of three years as of January 1, 2012, In the December 31, 2012

Statement of financial positon, how much should be reported asthe carping valu of the Frvedkenctnsfnecuse™

none €. P1.600,000 -

be 1.200.000 4. P2,000,000 sar 1 07. aeye 923

$ OUNTING 1 GIES gllare pot __fntangibles

© Morgan Corporation incurred P298 130 of revearch and developm wvelop a product for which a

patent was granted on January 2, 2006. Leval fees and other costs associated with registration of the patent

foraled P109,200. On January 2, 2012, Morgan Company paid 90,000 for legal fees for the litigation put up.

Azur the patent ‘The patent has aust life of 20 yes. The fin vert was known oly on July 1.2012

in favor of Morgan Conan. Wha ft amount of expense Morgan Conary shld rapon its 2012 profi

oN pon

or loss related tothe patent? mea ah eo,

a 5460 «95.460 © ier

90,000 a. 166840 cyfor-ef)) ‘t y

iif ides Mh loge

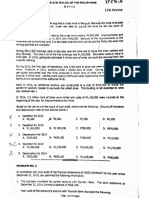

{i 10. The R & D division of Biotech Company undertakes both research and development scivitie tthe combate

ts current development projet on aproiype fener completo. The cox Menied i hi projec ons of

he Tullow ng

Cost of materials used -P5,000,000

Salaries of consultants for the projects

Fees to register trade design

Amortization of patent used in the project

‘Selling and adnunistrative overheads allocated

Initial operating losses

Training costs to operate the asset

Total

‘The other costs that related to this project are the salaries of scientists and technicians (1.200.000) and

depreciation of equipment used in the research and development activities (P900,004)). Management estimates

that about one third of these costs relate to the development project. What amount of development costs that

should be capitalized” IDs We

a. 7.150.000 4, 8,250,000 wb = we.

b. 7,850,000 d. 8,750,000 ~»

Advance Technology Company has two projects under development, and the amounts capitalized as assets as at

the end of the prior financial year are as follows:

Project A Project

Deferred development costs P1o,000,000 P1S,000,000

For the current financial year ended December 31, 2011, development costs of P3,000,000 and P4,000,000 were

incurred for Project A and Project respectively. At the end of the current financial year. the directors

assessed and concluded that the market for the products under Project) is unlikely to exist and therefore not

feasible to continue with its development. For Project B. the eriteia for capitalization continue to be met.

Estimates made for this project are as follows: Revenue from sale of products, P38.000,000: Further

development costs to complete project, P6,000,000; Related production costs of products, P12,000,000 and

diresly atributable selling and administrative cos, PA,000,000, What total ampunt of impairment loss on

project B should the company recognized? Ae > 43 «full 7 ~

See Nane ‘4,000,000 4 a

7,000.0 yi

b. 3,000,000 4. 7,000,000 CF itt gh =

1 12, Stack Company ineured P1,S00.000 (P400,000 in 2009 and P1.160,000 in 2010) to develop a computer

software product. P500,000 of this amount was expended belore technological feasibility was established in

early 2010. The product will eam foure revenues of P8,000,000 over its S-year life, a6 follows: 2010. ~

1,000,000; 2011 ~ P1,000,000; 2012 ~ PR00,000; 2013 -P800,000; and 2014

1,500,000 computer software costs should be expensed in 2010?

7250.00.94, Gane nat . e P 350,000

. 4. P1,100,000

15. Jing Company has recognized two intangible assets at their revalued amount. As of December 31, 2014, their

cary ing amounts ae as falows: i" ees

sset A Asset B Bas \e8

At valuati 20,000,000 P13.000,000 4 2 Z

era 6000000 mone D1 's

Revaluation decrease recogized as an expense mone (5,000,006)

As of January 1. 2015, the assets were revalued by reference to their current market prices. The market values

fof Asset A and Asset B on this date were P12,000,000 and P24,000,000. As at this date both assets have a

remaining useful life of ten years. The assets are being amortized on the straight-line method.

‘Question 1: What amount of gain or loss that Jing Company recognize in relation to Asset A on January #,

2015?

b Pesmv0.900 = romeo 923

>

ARMA / PRACTICAL ACCOUNTING L ________________intonibin

Onesion 2 Wh {Tos Soul Ting Company Focogie i relaion Yo Asser Bron danary Ty

wis

> Nowe &, P5000.000

5. F2,000.000 4. P5.000,000

14. Service Company markets prod stale agents and to new homeowners, purchased a customers list for

£, -* Po00.000 on January 2, 2010, Because of turnover among real-estate agents and bevause new homeowners

‘gradually become established homeowners, the lis is expected to have economic valve for only four years, Ihe

Company uses the sirayhiline method of amortization. On January 2011, the customer list was tested for

ial til-estate market in the area. It is estimated that the

ist will generate futire cash Hows of P40,000, P120,000 and P80,000.in 2011. 2012 and 2013

value (ess ess tefl) ofthe cusiomer list P240.000. The marke rae of

Pea tye

inerest on this dle Yo Ce a oo ty

rea ee 4)

‘What amount of impairment loss on customer lists should Service Company recognize? fh

a. none HHO Us. 244ON7 ce. 192300 519s

b. 153,983 RG d. 450,000 ite

(1) 15. An imangie asset costs P300,000 on anuary 1 2011. On January 1,2012, the asset was evaluated 0

‘determine if w was impaired, As of January 1, 2012, the asset was expected to generate future cash flows of a

25.000 per year (at the end ofeach year). "The appropriate discount rate is 57% we

w= ay

‘What total amount should be charged against income in 2012, assuming that the asset had a total useful THe Of 2 sg

10 years from date of acquisition? develo gy 04,

a P30,000 ©. PII2048 Map |

b Po.308 @. Pr22308 -

(116. Manin Company seyured Jenny Company on January 12008. The acquisition cost exceeds the market value

C1 Brine net uses of Jenny Co. by 200,800 The exces as abated wo a unidentifiable intangible ase tha

sive sseredto Jean's separate repotng nit Daring he coment Sear. 2008. the separate reporting. i

Teponed revenes of P600:000, Publicly trade companies wth operations similar wo those of the separate

Ferny uo ey hrf even i verge 2). The fa valve and bok vals ofthe at

YQ He

dang liabities of the unit are ws follows: j,7< 6a I, BG me

Book Values Fair Values(o™? - (Gd

Identifiable assets 1,950,000 1,900,000 “7d "WO “ig

Goodall ‘300:000° >

Liabilives 650,000 650,000

a>

‘What js the amount of goodwill impairment should Jenny recognize baved on the abuye information?

4. none «. 390.000

b. 380.000 4. 500,000

(J. 1% Gere Pradt Company bout Special Prous Divison n 2010 and appopritely recoded S00 000 of

goodwill related (o the purchase On December 31. 2014, the fair value of Special Products Division iy

'P4.(n0,000 and it is carried on General Product's books for a otal of P 3,400,000, including the goodwill. An

analyuis of Special Products Division's assets indicates that goodwill of P400,000 exists on December 31, 2014,

Sot gon impirmsn should be eure by General Prods 20147 py I fh pea

e , P200,000 Gtk kigthh ood tas

vb P50,000. d. P300,000 "

bg Ary. wt 4 ie

(On January 1. 2009, Japan Compan; signed a f-year leae for warchouse space, ‘he lease contract contains a

renewal option for an additional ® year period on January 1, 2012. On January. 2, 2011, Japan completed

substantial improvements to the waychouse. ‘The cost of these improvements was P450,000 with an estimated

useful life of 15 years.. dW som thin SS

{Question I: \f the likelihood of renewal is highly probable, what is the 7

. what isthe carrying. value of the improvement on

Duvet 34,2053 statement of financial positon’ “tO aba

A380 ©, 360.000

340.000) d. 364,000

A eesti 2: IF the Uietihod of renewal is ancera

Hevember 31, 2013 statement of financial position?

® 210.00 nee

b. 330,000 4

what is the carrying value of the improvement on

©. 360,000

S33

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Audit ExamDocument29 pagesAudit Exam101bus85% (13)

- ATDocument12 pagesATAshley Levy San PedroNo ratings yet

- ConceptualDocument2 pagesConceptualAshley Levy San PedroNo ratings yet

- Ar MCQDocument4 pagesAr MCQAshley Levy San PedroNo ratings yet

- At MCQDocument6 pagesAt MCQAshley Levy San PedroNo ratings yet

- ReceivablesDocument5 pagesReceivablesAshley Levy San PedroNo ratings yet

- TEST BANK - LAW 1-DiazDocument14 pagesTEST BANK - LAW 1-DiazChristian Blanza Lleva100% (3)

- Franchise QDocument6 pagesFranchise QAshley Levy San PedroNo ratings yet

- Fraud and Noncompliance PDFDocument6 pagesFraud and Noncompliance PDFAshley Levy San PedroNo ratings yet

- LTCC QDocument15 pagesLTCC QAshley Levy San PedroNo ratings yet

- Consignment Q PDFDocument5 pagesConsignment Q PDFAshley Levy San PedroNo ratings yet

- Franchise Q PDFDocument6 pagesFranchise Q PDFAshley Levy San PedroNo ratings yet

- Chapter06.Activity-Based Management and Cost Management ToolsDocument16 pagesChapter06.Activity-Based Management and Cost Management ToolsAshley Levy San PedroNo ratings yet

- Quality Control Practice SetDocument6 pagesQuality Control Practice SetAshley Levy San PedroNo ratings yet

- Corporate QDocument6 pagesCorporate QAshley Levy San PedroNo ratings yet

- Test Bank - PNC CPARDocument6 pagesTest Bank - PNC CPARChristian Blanza LlevaNo ratings yet

- Fraud and Noncompliance PDFDocument6 pagesFraud and Noncompliance PDFAshley Levy San PedroNo ratings yet

- Consignment Q PDFDocument5 pagesConsignment Q PDFAshley Levy San PedroNo ratings yet

- Comprehensive Summary For ContractsDocument13 pagesComprehensive Summary For ContractsAshley Levy San PedroNo ratings yet

- TOA Test BankDocument15 pagesTOA Test BankRod100% (2)

- Risk AssessmentDocument9 pagesRisk AssessmentAshley Levy San PedroNo ratings yet

- P1 923 PDFDocument7 pagesP1 923 PDFAshley Levy San PedroNo ratings yet

- Arens Auditing and Assurance Services 13eDocument9 pagesArens Auditing and Assurance Services 13eintanfidztiraNo ratings yet

- Tax 101 PDFDocument11 pagesTax 101 PDFAshley Levy San PedroNo ratings yet

- Cpar Pw-ApDocument14 pagesCpar Pw-ApAshley Levy San PedroNo ratings yet

- Activity-Based Costing: Assignment Classification TableDocument26 pagesActivity-Based Costing: Assignment Classification TableAshley Levy San PedroNo ratings yet

- Garrison ABCDocument18 pagesGarrison ABCAshley Levy San PedroNo ratings yet

- T02 - Installment Sales & Consignment Sales PDFDocument7 pagesT02 - Installment Sales & Consignment Sales PDFAshley Levy San PedroNo ratings yet

- Hilton ABCABCMngtDocument22 pagesHilton ABCABCMngtAshley Levy San PedroNo ratings yet