Professional Documents

Culture Documents

First Appeal To TEP RTI To PR - Chief Commissioner Kolkata-Part-9

Uploaded by

Arjun Ghose0 ratings0% found this document useful (0 votes)

12 views1 pageFirst Appeal to TEP RTI To Pr.Chief Commissioner Kolkata-Part-9

Original Title

First Appeal to TEP RTI To Pr.Chief Commissioner Kolkata-Part-9

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFirst Appeal to TEP RTI To Pr.Chief Commissioner Kolkata-Part-9

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageFirst Appeal To TEP RTI To PR - Chief Commissioner Kolkata-Part-9

Uploaded by

Arjun GhoseFirst Appeal to TEP RTI To Pr.Chief Commissioner Kolkata-Part-9

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

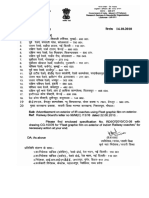

‘Now at the end | may reasonably expect that honorable CPIO & Addl. Commissioner of Income Tax will

honor the numerous decisions of CIC and Honorable High court as stated above while making decision

on this appeal so that at least the wastage of time for honorable CIT / CIC could be avoided in second,

appeal while discussing the same matter.

Please Note:

1, Please read the sec 19(7) of RTI act which clearly mandates that the order of

Information commissioner is final and binding. If any PIO violates the above CIC

orders then it counts to disrespect of the order of the Information

commissioner and contempt’s the RTI ACT.

2. No clubbing of points even if information is repeated.

3. Kindly make sure all the pages of your reply are certified/attested.

4. If you feel that the requested information doesn’t pertain to your department, then please

follow the provisions of section 6 (3) of RTI Act 2005 and transfer the application to the Relevant

Public Information Officer within the stipulated time as per the RTI Act 2005.

5. Any effort to provide false, incomplete, irrelevant or misleading

information will be complained to CENTRAL INFORMATION

COMMISSION for disciplinary action U/s 20 of RTI Act 2005 read

with section 166, 166 A and 167 IPC. As also action will be

initiated through the Central Bureau of Investigation, Central

Vigilance Commission and the Anti-Corruption Branch West

Bengal.

6. Any effort to harass the RTI petitioner directly or indirectly will be

duly complained to the CENTRAL INFORMATION

COMMISSION, Finance Minister -Shri Arun Jaitley.

“Yada yada hi dharmasya glanirbhavati bharata

Abhythanamadharmasya tadatmanam srijamyaham

Paritranaya sadhunang vinashay cha dushkritam

Dharmasangsthapanarthay sambhabami yuge yuge””

“Bhagavad Gita

You might also like

- Indranil Pakrashi-Profile 2019 NovDocument8 pagesIndranil Pakrashi-Profile 2019 NovArjun GhoseNo ratings yet

- Present Organization: Fortune Speculator LTD, Seychelles, Mahe 1 December 2019 - PresentDocument3 pagesPresent Organization: Fortune Speculator LTD, Seychelles, Mahe 1 December 2019 - PresentArjun GhoseNo ratings yet

- Professional Summary: Bijetri BoseDocument9 pagesProfessional Summary: Bijetri BoseArjun GhoseNo ratings yet

- SAP PI Training CurriculumDocument5 pagesSAP PI Training CurriculumArjun GhoseNo ratings yet

- Complaint To Ministry of Finance To Be Sent To Arun JaitleyDocument7 pagesComplaint To Ministry of Finance To Be Sent To Arun JaitleyArjun GhoseNo ratings yet

- Complain To Ministry of Finance For Expediting Investigation On TEP and Action Against ITO's-Part-1Document1 pageComplain To Ministry of Finance For Expediting Investigation On TEP and Action Against ITO's-Part-1Arjun GhoseNo ratings yet

- 50 Ways To Find Funding For Your BusinessDocument120 pages50 Ways To Find Funding For Your BusinessArjun GhoseNo ratings yet

- TEP First AppealDocument5 pagesTEP First AppealArjun GhoseNo ratings yet

- TEP To CCITDocument3 pagesTEP To CCITArjun GhoseNo ratings yet

- What After 498a Chargesheet Is FiledDocument2 pagesWhat After 498a Chargesheet Is FiledArjun GhoseNo ratings yet

- RTI For Marksheet (SPIO)Document5 pagesRTI For Marksheet (SPIO)Arjun GhoseNo ratings yet

- TEP RTI Complaint Us 19 (1) To FM Against SMT 498a FamilyDocument5 pagesTEP RTI Complaint Us 19 (1) To FM Against SMT 498a FamilyArjun GhoseNo ratings yet

- RTI After 498a Charge Sheet To DGP To Be SentDocument4 pagesRTI After 498a Charge Sheet To DGP To Be SentArjun GhoseNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Integrated Marketing Communication Study GuideDocument87 pagesIntegrated Marketing Communication Study GuideSao Nguyễn ToànNo ratings yet

- Integrated Marketing Communications Plan For Neal's Year RemediesDocument35 pagesIntegrated Marketing Communications Plan For Neal's Year RemediesChristina See-Kei Wong0% (1)

- GCC Works IR 2018Document14 pagesGCC Works IR 2018LRC ER-LLHNo ratings yet

- FCE - READING - The Perfect WorldDocument3 pagesFCE - READING - The Perfect WorldPablo SalcedoNo ratings yet

- Advertising ExecutionDocument17 pagesAdvertising ExecutionPrincess VillaruelNo ratings yet

- Ôn TACN 2Document6 pagesÔn TACN 2Vi NguyễnNo ratings yet

- Karan Bhatia: Copywriter Ad Guy - I Do Ads+Ideas+Writing+Design+VideosDocument3 pagesKaran Bhatia: Copywriter Ad Guy - I Do Ads+Ideas+Writing+Design+VideosKaran BhatiaNo ratings yet

- Google - Chrome - User Data - DefaultDocument107 pagesGoogle - Chrome - User Data - DefaultAndrew Shevchenko100% (2)

- 2022 Creative Art Booklet Form 2 Term 2Document22 pages2022 Creative Art Booklet Form 2 Term 2Tirelo LekomaNo ratings yet

- Search Engine OptimizationDocument16 pagesSearch Engine OptimizationAishwaryaNo ratings yet

- Language Style in AdvertisementDocument12 pagesLanguage Style in AdvertisementSheila Garcia NorthNo ratings yet

- Assignment 1 - Integrated Marketing Communications: Nescafe'Document6 pagesAssignment 1 - Integrated Marketing Communications: Nescafe'Suman BandyopadhyayNo ratings yet

- Local Literature in Recent Years, Google and Social Media Sites Have Become An ImportantDocument2 pagesLocal Literature in Recent Years, Google and Social Media Sites Have Become An ImportantJohn Cedrick ManlangitNo ratings yet

- Herrold Consulting Incorporated On February 1 2011 The Company EngagedDocument1 pageHerrold Consulting Incorporated On February 1 2011 The Company Engagedtrilocksp SinghNo ratings yet

- Pepsi Refresh Project CaseDocument2 pagesPepsi Refresh Project CaseTanuj Gulati83% (6)

- Rhetorical AnalysisDocument2 pagesRhetorical AnalysisMichelleLondoñoNo ratings yet

- Nescafe Ad ReportDocument19 pagesNescafe Ad Reportpriyanka ahmedNo ratings yet

- Zenni Optical Creative BriefDocument1 pageZenni Optical Creative Briefapi-532855472No ratings yet

- Umani - John Rei M. - Lesson 3Document6 pagesUmani - John Rei M. - Lesson 3John Rei UmaniNo ratings yet

- Consumer Behaviour: Part 3: Learning and Memory (Chapter 4)Document36 pagesConsumer Behaviour: Part 3: Learning and Memory (Chapter 4)Erik CarlströmNo ratings yet

- The Freelancer Designers Marketing Playbook PDFDocument34 pagesThe Freelancer Designers Marketing Playbook PDFEdu-gomesNo ratings yet

- Sticky Wisdom2Document56 pagesSticky Wisdom2liduschka777No ratings yet

- Xavier University Bhubaneswar: Course Name - Product and Brand ManagementDocument4 pagesXavier University Bhubaneswar: Course Name - Product and Brand ManagementAkash KumarNo ratings yet

- Media and Advertising - Topic Vocabulary - NgocbachDocument4 pagesMedia and Advertising - Topic Vocabulary - NgocbachHuỳnh ThưNo ratings yet

- Narrative Charter StatementDocument2 pagesNarrative Charter StatementKaren Johana Parada MolinaNo ratings yet

- Advertising Management NotesDocument32 pagesAdvertising Management NotesAjit GolchhaNo ratings yet

- INS1032-HK1 2022-2023-TestDocument7 pagesINS1032-HK1 2022-2023-TestLinh KhánhNo ratings yet

- Gay Times - January 2015 PDFDocument152 pagesGay Times - January 2015 PDFChristopher Torres42% (66)

- PTE Essay FormatDocument9 pagesPTE Essay Formatramji013No ratings yet

- Farhan Kurniadi Digital Marketing PortfolioDocument25 pagesFarhan Kurniadi Digital Marketing PortfolioLily UrsulaNo ratings yet