Professional Documents

Culture Documents

IDirect Graphite SectorUpdate Jan18

Uploaded by

vkagarwaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDirect Graphite SectorUpdate Jan18

Uploaded by

vkagarwaCopyright:

Available Formats

Sector Update

January 3, 2018

Rating Matrix

Graphite Electrodes

Company Target Price CMP Upside Rating

Graphite India 1,000 840 19% Buy Good times to continue...

HEG 3200 2650 21% Buy

Both HEG and Graphite India, domestic graphite electrode stocks, have

Target period is 15-18 months

seen a sharp run up on the bourses in the last few months. A sustained

positive outlook on the global graphite electrode segment coupled with

Price performance (%) healthy realisations of both global and domestic manufacturers has driven

Return % 1M 3M 6M 12M the strong rally. Key triggers have been: 1) consolidation of graphite

HEG 49.7 173.7 589.0 1,590.2 electrode market globally, 2) ~20% of the global graphite electrode

Graphite India 35.5 112.0 380.1 980.3 capacity (ex-China) shutting down in the last three years, 3) increase in

Source: ICICIdirect.com Research steel production through EAF route (outside China) coupled with an

increase in global steel prices, 4) closure of steel capacity in China leading

to a decline in exports of steel and graphite electrodes from the region.

Chinese crackdown on polluting industries has augured well...

In the last few years, China was a major exporter of lower grade graphite

electrodes. In China, many small facilities are present, which perform one

or two among all six processes required to manufacture graphite

electrodes. During CY17, many such facilities were closed on account of

environmental reasons thereby breaking the total chain of graphite

electrode production. According to industry sources, the environmental

crackdown has led to closure of ~30-50% of graphite electrode capacity

in the region, auguring well for graphite electrodes prices.

Upcoming EAF capacity in China to create incremental demand...

As per industry sources, China has chalked out plans to set up a new EAF

capacity of 30-50 million tonnes (MT) in the near future. As ~1.8-2 kg of

graphite electrode is needed to produce a tonne of steel, the proposed

EAF capacity may create incremental demand for graphite electrodes.

Over a longer term horizon, rising production through EAF route

(especially in China) bodes well for global graphite electrodes demand.

Introduction of electrode surcharge by steel/stainless steelmakers...

The sharp increase in graphite electrode prices has increased the cost

dynamics for steel makers through the EAF route. A majority of steel and

stainless steel makers have, thus, introduced electrode surcharge to

offset the cost impact. The electrode surcharge essentially passes on the

cost increase to its customers, thereby limiting the impact on margins.

Global players like Outokumpu, AK Steel, Carpenter Technology

Corporation have indicated the imposition of surcharge on electrodes.

Key risk

A slowdown in steel production primarily through EAF route

Volatility in raw material prices exerting pressure on margins

Any decline in graphite electrode prices

New contracts at higher prices to boost performance; maintain BUY…

Traditionally, a large part of the order book of HEG and Graphite India is

negotiated in January, February every year. Thus, benefits of increased

electrodes prices have been limited in H1FY18 as the contracts were

negotiated at old prices. However, going forward, the topline, EBITDA of

these domestic players is likely to get a boost with the new contracts

Research Analyst

likely to be negotiated at higher prices. Thus, we believe there is more leg

Dewang.Sanghavi

room in the stock price appreciation. On the back of an improved financial

dewang.sanghavi@icicisecurities.com performance, we expect ROCE of both graphite electrodes players to

improve substantially to ~44-50% by FY20E. We maintain our positive

Akshay Kadam stance on both Graphite India and HEG. We have a BUY recommendation

akshay.kadam@icicisecurities.com

on both stocks.

ICICI Securities Ltd | Retail Equity Research

Rating matrix

Rating : Buy Graphite India (CAREVE) | 840

Target : | 1000

Target Period : 15-18 months

Potential Upside : 19%

Capacity utilisation levels to remain healthy...

Graphite India (GIL) reported healthy utilisation levels of 95% and 89% for

What’s Changed? Q1FY18 and Q2FY18, respectively. On the back of healthy demand

Target Changed from | 725 to | 1000 prospects, we expect GIL’s consolidated capacity utilisation levels to

EPS FY18E Changed from | 23.4 to | 30.2 improve from ~74% in FY17 to ~84% in FY18E. Going forward, for the

EPS FY19E Changed from | 46.0 to | 52.7 consolidated operations, we model capacity utilisation of ~79% for both

EPS FY20E Introduced at | 68.7 FY19E & FY20E. For standalone operations, the capacity utilisation is likely

Rating Unchanged to improve from 79% in FY17 to 91% in FY18E. Going forward, for the

standalone operations, we model capacity utilisation of 85% for both

Key financials FY19E and FY20E. We tone down the capacity utilisation levels for FY19-

(| Crore) FY17 FY18E FY19E FY20E 20E factoring in the current scarce availability of needle coke (a key raw

Total Operating Income 1467.8 2792.8 4328.2 5049.8 material). Any increase in availability of needle coke presents an upside

EBITDA 39.6 804.4 1397.2 1762.2 risk in terms of capacity utilisation.

Net Profit 70.5 590.2 1030.1 1342.1

EPS 3.6 30.2 52.7 68.7

Higher price contracts to augment operating margins…

Healthy capacity utilisation coupled with benefits of higher price contracts

Valuation summary are expected to fructify from H2FY18E. We expect Graphite

FY17 FY18E FY19E FY20E India’s consolidated EBITDA margins to increase to 28.8% in FY18E,

PE (x) 232.9 27.8 15.9 12.2 32.3% in FY19E and further to 34.9% in FY20E (FY17 EBITDA margin of

Target PE (x) 277.3 33.1 19.0 14.6 2.7%).

EV/EBITDA (x) 404.3 19.4 10.7 8.2 Exhibit 1: What's Changed?

P/BV (x) 8.8 7.6 5.9 4.7 FY18E FY19E FY20E

(| Crore) New Old % Change New Old % Change Introduced

RoNW (%) 3.8 27.3 37.3 38.6

Standalone Cap Utilisation 91.0 91.0 0 bps 85.0 80.0 500 bps 85.0

RoCE (%) -0.3 31.6 48.0 49.9

Consol Cap Utilisation 84.0 84.0 0 bps 79.0 75.0 400 bps 79.0

Revenue 2,793 2,524 10.6 4,328 3,812 13.6 5,049.8

Stock data

EBITDA 804.4 631.4 27.4 1,397 1,249 11.9 1,762.2

Particular Amount

PAT 590.2 457.8 28.9 1,030 899 14.6 1,342.1

Market Capitalisation (| crore) | 15583

EPS (|) 30.2 23.4 29.1 52.7 46.0 14.6 68.7

Debt (FY17) (| crore) | 259

Source: Company, ICICIdirect.com Research

Cash & Cash Equivalent (FY17) (| crore) | 683

EV (| crore) | 15159

Exhibit 2: Capacity & utilisation rates (consolidated basis)

52 week H/L 798 / 73

Equity capital (| crore) | 39.1 100000 100

90

Face value |2 80000 84 80

79 79

74 70

tonne

Stock Price Movement 60000 62 60

98000

98000

98000

98000

98000

50

82700

%

77900

77900

72520

40000 40

60760

30

12,000 1,000 20000 20

10,000 800 10

8,000 600 0 0

6,000 FY2016 FY2017 FY2018E FY2019E FY2020E

4,000 400

2,000 200 Capacity (LHS) Production (LHS) Utilization rate (RHS)

0 0

Aug-14

Aug-15

Aug-16

Aug-17

Apr-17

Apr-15

Apr-16

Dec-16

Dec-14

Dec-15

Dec-17

Source: Company, ICICIdirect.com Research

Nifty (L.H.S) Price (R.H.S) Performance to improve notably; maintain BUY…

Graphite India reported a strong H1FY18 performance driven by better

capacity utilisation and increase in realisation. Going forward, we expect

the company to capitalise on the favourable demand-supply scenario and

further report robust earnings led higher realisations. We value the

company at 10x FY20E EV/EBITDA thereby arriving at a target price of

| 1000. A robust balance sheet, net cash status and healthy cash-flow

generation reiterate our positive stance on the company. We maintain our

BUY recommendation on the stock.

ICICI Securities Ltd | Retail Equity Research Page 2

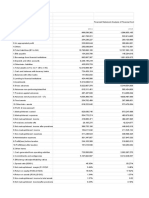

Financials (Consolidated)

Profit and loss statement (| crore) Cash flow statement (| crore)

(Year-end March) FY17 FY18E FY19E FY20E (Year-end March) FY17 FY18E FY19E FY20E

Total Operating Income 1467.8 2792.8 4328.2 5049.8 Profit after Tax 70.5 590.2 1,030.1 1,342.1

Growth (%) -4.2 90.3 55.0 16.7 Add: Depreciation 46.4 54.6 55.8 28.1

Raw Material Expenses 585.1 835.2 1,500.2 1,754.1 (Inc)/dec in Current Asset 204.0 -84.0 -82.5 -898.5

Employee Expenses 222.5 294.0 387.3 412.0 Inc/(dec) in CL & Provision 11.6 151.0 35.2 679.9

Other expenses 620.6 859.2 1,043.6 1,121.5 Others 9.3 2.9 0.0 0.0

Total Operating Expenditure 1,428.2 1,988.4 2,931.0 3,287.5 CF from operating activities 341.7 714.8 1,038.6 1,151.6

EBITDA 39.6 804.4 1397.2 1762.2 (Inc)/dec in Investments -215.1 -50.0 -400.0 -400.0

Growth (%) -70.6 1,933.8 73.7 26.1 (Inc)/dec in Fixed Assets -89.1 -15.0 -25.0 -25.0

Depreciation 46.4 54.6 55.8 28.1 Others 0.0 0.0 0.0 0.0

Interest 7.9 7.0 3.5 0.5 CF from investing activities -304.2 -65.0 -425.0 -425.0

Other Income 86.5 138.2 199.7 269.5 Issue/(Buy back) of Equity 0.0 0.0 0.0 0.0

PBT 71.8 880.9 1,537.5 2,003.2 Inc/(dec) in loan funds -43.1 -54.0 -175.0 -30.2

Exceptional Item 0.0 0.0 0.0 0.0 Dividend paid & div. tax -47.0 -177.3 -433.2 -628.9

Total Tax 1.3 290.7 507.4 661.1 Inc/(dec) in Share Cap 83.0 -106.4 1.7 -1.7

PAT 70.5 590.2 1030.1 1342.1 Others 0.0 0.0 0.0 0.0

Growth (%) -14.9 737.7 74.5 30.3 CF from financing activities -7.1 -337.7 -606.5 -660.9

EPS (|) 3.6 30.2 52.7 68.7 Net Cash flow 30.4 312.1 7.1 65.7

Source: Company, ICICIdirect.com Research Opening Cash 21.0 51.5 363.6 370.8

Closing Cash 51.5 363.6 370.8 436.5

Source: Company, ICICIdirect.com Research

Balance sheet (| crore) Key ratios

(Year-end March) FY17 FY18E FY19E FY20E (Year-end March) FY17 FY18E FY19E FY20E

Liabilities Per share data (|)

Equity Capital 39.1 39.1 39.1 39.1 EPS 3.6 30.2 52.7 68.7

Reserve and Surplus 1,818.5 2,125.1 2,723.7 3,435.2 Cash EPS 6.0 33.0 55.6 70.1

Total Shareholders funds 1,857.6 2,164.1 2,762.8 3,474.3 BV 95.1 110.8 141.4 177.8

Total Debt 259.2 205.2 30.2 0.0 DPS 2.0 7.6 18.5 26.8

Deferred Tax Liability 85.0 85.0 85.0 85.0 Cash Per Share 2.6 18.6 19.0 22.3

Minority Interest / Others 0.0 0.0 0.0 0.0 Operating Ratios (%)

Total Liabilities 2,201.8 2,454.4 2,878.0 3,559.3 EBITDA Margin 2.7 28.8 32.3 34.9

PBT / Total Operating income 4.9 31.5 35.5 39.7

Assets PAT Margin 4.8 21.1 23.8 26.6

Gross Block 1,539.1 1,583.1 1,608.1 1,633.1 Inventory days 149.7 135.0 120.0 75.0

Less: Acc Depreciation 871.7 926.3 982.2 1,010.3 Debtor days 109.8 100.0 125.0 80.0

Net Block 667.4 656.8 625.9 622.8 Creditor days 78.6 90.0 80.0 50.0

Capital WIP 32.1 3.1 3.1 3.1 Return Ratios (%)

Total Fixed Assets 699.5 659.8 629.0 625.8 RoE 3.8 27.3 37.3 38.6

Investments 631.0 681.0 1,081.0 1,481.0 RoCE -0.3 31.6 48.0 49.9

Inventory 602.1 613.7 598.0 1,037.6 RoIC -0.3 37.4 55.4 57.1

Debtors 441.5 454.6 622.9 1,106.8 Valuation Ratios (x)

Loans and Advances 11.7 95.8 50.8 50.8 P/E 232.9 27.8 15.9 12.2

Other Current Assets 103.5 78.5 53.5 28.5 EV / EBITDA 404.3 19.4 10.7 8.2

Cash 51.5 363.6 370.8 436.5 EV / Net Sales 10.9 5.6 3.5 2.9

Total Current Assets 1,210.1 1,606.2 1,695.9 2,660.2 Market Cap / Sales 11.2 5.9 3.8 3.3

Current Liabilities 316.0 409.1 398.7 691.7 Price to Book Value 8.8 7.6 5.9 4.7

Provisions 25.7 83.5 129.2 516.0 Solvency Ratios

Current Liabilities & Prov 341.7 492.7 527.9 1,207.7 Debt/EBITDA 6.6 0.3 0.0 0.0

Net Current Assets 868.4 1,113.5 1,168.1 1,452.5 Debt / Equity 0.1 0.1 0.0 0.0

Others Assets 2.9 0.0 0.0 0.0 Current Ratio 3.5 3.3 3.2 2.2

Application of Funds 2,201.8 2,454.4 2,878.0 3,559.3 Quick Ratio 1.8 2.0 2.1 1.3

Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 3

Rating matrix

Rating : Buy HEG Ltd (HEG) | 2650

Target : | 3200

Target Period : 15- 18 months Operating margins to increase with better utilisation levels…

Potential Upside : 21%

For H1FY18E, HEG reported a strong EBITDA margin of 34.7%. The

What’s changed? management has guided for capacity utilisation of ~80-85% for FY18E. In

Target : Changed from | 2250 to | 3200

line with management guidance, we model capacity utilisation of ~83%

EPS FY18E : Changed from | 76.9 to | 116.0 for FY18E and FY19E. For FY20E, we model capacity utilisation of 85%.

EPS FY19E : Changed from | 152.4 to | 196.1 Going forward, increased volumes coupled with higher priced contracts

EPS FY20E : Introduced at | 206.4 are likely to boost the company’s earnings. A higher operating leverage is

Rating : Unchanged expected to accentuate operating margins sharply from current levels.

We expect HEG to clock EBITDA margins of ~34-38% in FY18-20E (9.4%

Key financials in FY17).

FY17 FY18E FY19E FY20E

Net Sales 860.0 2,027.4 3,468.0 4,051.7 Exhibit 3: What's Changed?

EBITDA 80.6 779.4 1,265.4 1,382.8 FY18E FY19E FY20E

( | Crore) FY17

Adjusted PAT (50.1) 463.7 783.5 824.8 New Old % Change New Old % Change New

Adjusted EPS (|) (12.5) 116.0 196.1 206.4 Revenue 860.0 2,027.4 1,691.3 19.9 3,468.0 2,914.6 19.0 4,051.7

Valuation summary EBITDA 80.6 779.4 555.9 40.2 1,265.4 1,004.7 25.9 1,382.8

FY17 FY18E FY19E FY20E EBITDA Margin (%) 9.4 38.4 32.9 558 bps 36.5 34.5 202 bps 34.1

PE (x) NA 22.8 13.5 12.8 PAT -50.1 463.7 307.2 50.9 783.5 608.8 28.7 824.8

Target PE (x) NA 27.6 16.3 15.5 EPS (|) -12.5 116.0 76.9 309.1 196.1 152.4 28.7 206.4

EV/EBITDA (x) 139.7 14.2 8.6 7.5 Source: Company, ICICIdirect.com Research

P/BV (x) 12.1 7.9 5.0 3.6

RoE (%) (5.7) 34.7 37.0 28.0 Exhibit 4: Graphite electrode production and capacity utilisation rates

RoCE (%) 0.9 37.9 48.7 43.8 83 83 85

75000 68 100

Stock data 60000 75

Particulars Amount

45000

Market Capitalisation | 10589 crore 50

tonne

%

Debt (FY17) | 684 crore 30000

54000

66000

66000

68000

Cash (FY17) | 8 crore 15000 25

EV | 11265 crore 0 0

52 Week H / L (|) 2554 / 147 FY2017 FY2018E FY2019E FY2020E

Equity Capital 40.0

Face Value | 10 Production Capacity utilisation

Stock Price Performance Source: Company, ICICIdirect.com Research

12,000 3,000

Expansion plan in the wings...

10,000 2,500 The HEG management indicated that the company can expand the

8,000 2,000

6,000 1,500 current capacity of 80,000 tonnes to 100,000 tonnes. As and when

4,000 1,000 undertaken, the expansion would happen in ~20-24 months entailing an

2,000 500

0 0 investment of ~| 200+ crore. However, the management iterated that the

current priority of the company is to increase capacity utilisation to the

Aug-14

Aug-15

Aug-16

Aug-17

Apr-17

Apr-15

Apr-16

Dec-16

Dec-14

Dec-15

Dec-17

level of 90-95% before talking up any expansion. Furthermore, adequate

availability of needle coke remains crucial for capacity expansion.

Nifty (L.H.S) Price (R.H.S) Higher price contracts to boost performance; maintain BUY…

We expect higher price contracts to fructify from H2FY18E leading to

robust earnings growth from the company in FY18-20E. We value the

core business at 9x FY20E EV/EBITDA, assign a 50% discount to HEG’s

stake in BEL and arrive at a target price of | 3200. We maintain our BUY

recommendation on the stock.

ICICI Securities Ltd | Retail Equity Research Page 4

Financials

Profit and loss statement (| crore) Cash flow statement (| crore)

(Year-end March) FY17 FY18E FY19E FY20E (Year-end March) FY17 FY18E FY19E FY20E

Total Operating Income 860.0 2,027.4 3,468.0 4,051.7 Profit/(Loss) after taxation (50.1) 463.7 783.5 824.8

Growth (%) 3.9 135.7 71.1 16.8 Add: Depreciation & Amortization 73.9 73.9 77.3 78.6

Raw Material Expenses 443.9 537.1 1,340.6 1,695.7 Net Increase in Current Assets 38.0 (376.8) (767.5) (331.9)

Employee Expenses 58.9 115.7 138.7 141.8 Net Increase in Current Liabilities (75.8) 61.0 228.2 117.7

Other expenses 276.6 595.1 723.2 831.3 CF from operating activities (14.0) 221.8 321.5 689.2

Total Operating Expenditure 779.4 1,248.0 2,202.6 2,668.8 (Inc)/dec in Investments (0.3) - - -

EBITDA 80.6 779.4 1,265.4 1,382.8 (Inc)/dec in Fixed Assets 2.0 (30.1) (80.1) (180.1)

Growth (%) (35.2) 866.6 62.4 9.3 Others - - - -

Depreciation 73.9 73.9 77.3 78.6 CF from investing activities 1.7 (30.1) (80.1) (180.1)

Interest 54.7 47.7 31.4 13.3 Inc / (Dec) in Equity Capital - - - -

Other Income 7.1 9.6 12.7 - Inc / (Dec) in Loan 53.7 (135.0) (200.0) (317.2)

PBT (40.9) 667.4 1,169.4 1,290.9 Dividend & Dividend Tax - (135.6) (229.2) (241.2)

Exceptional Item - - - - Others (38.2) 141.1 227.2 239.2

Total Tax 9.2 203.8 385.9 466.1 CF from financing activities 15.4 (129.5) (202.0) (319.2)

Reported PAT (50.1) 463.7 783.5 824.8 Net Cash flow 3.2 62.2 39.4 189.9

Adjusted PAT (50.1) 463.7 783.5 824.8 Opening Cash 5.1 8.3 70.5 109.9

Growth (%) 230.7 LP 69.0 5.3 Closing Cash 8.3 70.5 109.9 299.9

EPS (|) (12.5) 116.0 196.1 206.4 Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

Balance sheet (| crore) Key ratios

(Year-end March) FY17 FY18E FY19E FY20E (Year-end March) FY17 FY18E FY19E FY20E

Liabilities Per share data (|)

Equity Capital 40.0 40.0 40.0 40.0 EPS -12.5 116.0 196.1 206.4

Reserve and Surplus 831.8 1,295.5 2,079.0 2,903.8 Cash EPS -3.5 55.5 80.5 172.5

Total Shareholders funds 871.8 1,335.5 2,119.0 2,943.7 BV 218.2 334.2 530.3 736.7

Total Debt 684.0 549.0 349.0 31.8 DPS 0.0 29.0 49.0 51.6

Deferred Tax Liability 60.9 65.9 63.4 60.9 Cash Per Share 2.1 17.6 27.5 75.0

Non Current Liabilities 4.7 5.2 5.7 6.2 Operating Ratios (%)

Total Liabilities 1,621.3 1,955.5 2,537.0 3,042.6 EBITDA margins 9.4 38.4 36.5 34.1

PBT margins -4.8 32.9 33.7 31.9

Assets Net Profit margins -5.8 22.9 22.6 20.4

Gross Block 1,672.5 1,702.5 1,732.5 1,762.5 Inventory days 121 110 110 110

Less: Acc Depreciation 787.5 861.4 938.7 1,017.3 Debtor days 153 125 125 125

Net Block 885.0 841.1 793.8 745.2 Creditor days 71 90 90 90

Capital WIP 1.2 1.3 51.3 201.4 Return Ratios (%)

Total Fixed Assets 886.2 842.3 845.1 946.5 RoE -5.7 34.7 37.0 28.0

Investments 149.8 149.8 149.8 149.8 RoCE 0.9 37.9 48.7 43.8

Inventory 257.8 376.1 663.8 804.3 RoIC 0.4 38.9 50.4 48.7

Debtors 360.8 694.3 1,187.7 1,387.6 Valuation Ratios (x)

Loans and Advances 31.9 11.9 5.4 3.9 P/E NA 22.8 13.5 12.8

Other Current Assets 76.9 21.9 14.9 7.9 EV / EBITDA 139.7 14.2 8.6 7.5

Cash 8.3 70.5 109.9 299.9 EV / Revenues 13.1 5.5 3.1 2.5

Total Current Assets 735.7 1,174.8 1,981.7 2,503.6 Market Cap / Revenues 12.3 5.2 3.1 2.6

Creditors 86.5 132.4 330.6 418.1 Price to Book Value 12.1 7.9 5.0 3.6

Other Current Liabilities (incl Provisions)63.9 79.0 109.1 139.2 Solvency Ratios

Current Liabilities & Prov 150.4 211.4 439.6 557.3 Debt / Equity 0.8 0.4 0.2 0.0

Net Current Assets 585.3 963.3 1,542.1 1,946.3 Debt/EBITDA 8.5 0.7 0.3 0.0

Others - - - - Current Ratio 4.9 5.6 4.5 4.5

Application of Funds 1,621.3 1,955.5 2,537.0 3,042.6 Quick Ratio 3.2 3.8 3.0 3.0

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 5

ICICIdirect.com coverage universe (Graphite steel electrodes)

CMP M Cap EPS (|) P/E (x) EV/EBITDA (x) ROCE(%) ROE(%)

Company

(|) TP (|) Rating (| Cr) FY17 FY18E FY19E FY20E FY17 FY18E FY19E FY20E FY17 FY18E FY19E FY20E FY17 FY18E FY19E FY20E FY17 FY18E FY19E FY20E

Graphite India 840 1,000 Buy 16,414 3.6 30.2 54.0 69.4 232.9 27.8 15.6 12.1 404.3 19.4 10.4 8.1 -0.3 31.6 45.7 43.8 3.8 27.3 36.3 36.0

HEG 2657 3200 Buy 10,628 -12.5 116.0 196.1 206.4 NA 22.1 13.1 12.4 135.2 13.7 8.3 7.2 0.9 37.9 48.7 43.8 -5.7 34.7 37.0 28.0

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 6

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises them

as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional

target price is defined as the analysts' valuation for a stock.

Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;

Buy: >10%/15% for large caps/midcaps, respectively;

Hold: Up to +/-10%;

Sell: -10% or more;

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities Ltd | Retail Equity Research Page 7

Disclaimer

ANALYST CERTIFICATION

We /I, Dewang Sanghavi MBA (FIN) and Akshay Kadam MBA (FIN), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report

accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or

view(s) in this report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities

Limited is a Sebi registered Research Analyst with Sebi Registration Number – INH000000990. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has

its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which

are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking

and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts

and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current.

Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended

temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this

company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment

in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in

respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned

in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any

compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts

and their relatives have any material conflict of interest at the time of publication of this report.

It is confirmed that Dewang Sanghavi MBA (FIN) and Akshay Kadam MBA (FIN), Research Analysts of this report have not received any compensation from the companies mentioned in the report in the

preceding twelve months.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month

preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

It is confirmed that Dewang Sanghavi MBA (FIN) and Akshay Kadam MBA (FIN), Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

ICICI Securities Ltd | Retail Equity Research Page 8

You might also like

- Tata Steel Stock AnalysisDocument50 pagesTata Steel Stock AnalysisAmitabh VatsyaNo ratings yet

- Costing Ispat Part ADocument5 pagesCosting Ispat Part AJeet ShahNo ratings yet

- Indian Graphite SectorDocument45 pagesIndian Graphite SectorMSHYDERABAD4334No ratings yet

- Graphite Electrode Market Gathers Momentum - Part 1Document2 pagesGraphite Electrode Market Gathers Momentum - Part 1Anish ShahNo ratings yet

- Graphite India LimitedDocument28 pagesGraphite India LimitedRicha SinghNo ratings yet

- App. Material WF Import + BrosurDocument38 pagesApp. Material WF Import + BrosurArieNo ratings yet

- Fbe Coated TMTDocument19 pagesFbe Coated TMTParam SaxenaNo ratings yet

- Review of Innovative Energy Savings Technology For The Electric Arc FurnaceDocument14 pagesReview of Innovative Energy Savings Technology For The Electric Arc FurnaceDavi Silva AlvesNo ratings yet

- Silicon Carbide Carborundum MarketDocument9 pagesSilicon Carbide Carborundum MarketEugênia PheganNo ratings yet

- Getting Graphite Prices RightDocument5 pagesGetting Graphite Prices RightMochammad AdamNo ratings yet

- Metalmorphosis: How Decarbonisation Is Transforming The Iron and Steel IndustryDocument14 pagesMetalmorphosis: How Decarbonisation Is Transforming The Iron and Steel IndustryComunicarSe-Archivo100% (1)

- Recent Development of Ductile Cast PDFDocument10 pagesRecent Development of Ductile Cast PDFMoHammadNashatSabbah100% (1)

- Comparative Life Cycle Assessment and Technoeconomic Analysis of Electric Arc Furnace Steelmaking Processes Integrated With Solar Energy SystemDocument14 pagesComparative Life Cycle Assessment and Technoeconomic Analysis of Electric Arc Furnace Steelmaking Processes Integrated With Solar Energy SystemdanielsmattosNo ratings yet

- Cost Minimization of Liquid Steel Production in Libyan Iron and Steel CompanyDocument8 pagesCost Minimization of Liquid Steel Production in Libyan Iron and Steel CompanyAli MahamedNo ratings yet

- Power TodayDocument12 pagesPower Todaydiptenb4No ratings yet

- Heg Q3fy24 NoteDocument2 pagesHeg Q3fy24 Notevipraw srivastavaNo ratings yet

- Thermal Management On IGBT Power Electronic Devices and ModulesDocument17 pagesThermal Management On IGBT Power Electronic Devices and ModulessudheerkumarpiratiNo ratings yet

- JFE Steel Hydrogen - 11Document8 pagesJFE Steel Hydrogen - 11ANAND SANGWANNo ratings yet

- Transition Asia Low Carbon Steel Development in Japan 1701593311Document34 pagesTransition Asia Low Carbon Steel Development in Japan 1701593311winder-surf0mNo ratings yet

- Industry and Company AnalysisDocument76 pagesIndustry and Company AnalysisAnsu MishraNo ratings yet

- Steel Decarbonisation in India - September 2023Document47 pagesSteel Decarbonisation in India - September 2023AVINASH YADAVNo ratings yet

- Copper Current Market Demand Condition DetailsDocument10 pagesCopper Current Market Demand Condition Detailsmidtown bakerNo ratings yet

- Steel Industry PitchDocument17 pagesSteel Industry Pitchnavinmba2010No ratings yet

- Article 1. The Future of CoalDocument4 pagesArticle 1. The Future of Coalwisnu fitraddyNo ratings yet

- Global EV Batteries - Nomura (1) - 220626 - 193037Document124 pagesGlobal EV Batteries - Nomura (1) - 220626 - 193037naman makkar100% (2)

- Evolution of Green Steel Market Dynamics in Europe 1680545075Document4 pagesEvolution of Green Steel Market Dynamics in Europe 1680545075PRASANJIT MISHRANo ratings yet

- Optimization of Steelmaking Using Fastmet Direct Reduced Iron in The Blast FurnaceDocument9 pagesOptimization of Steelmaking Using Fastmet Direct Reduced Iron in The Blast FurnaceLiz FrancoNo ratings yet

- Result Update - Metals & Mining - 09 August 2010Document6 pagesResult Update - Metals & Mining - 09 August 2010lutfiali205No ratings yet

- Iron & Steel FinalDocument67 pagesIron & Steel FinalKartik Ravichander0% (1)

- Script of The Day: Tata Iron and Steel Company LTDDocument8 pagesScript of The Day: Tata Iron and Steel Company LTDAnonymous Mw6J6ShNo ratings yet

- Welding ElectrodeDocument27 pagesWelding ElectrodeRobel KefelewNo ratings yet

- Steel Sector Motilal OswalDocument30 pagesSteel Sector Motilal OswalBinod Kumar PadhiNo ratings yet

- Facts About Graphite As A Strategic MineralDocument3 pagesFacts About Graphite As A Strategic MineralRichard J MowatNo ratings yet

- Management Discussion and Analysis ReportDocument6 pagesManagement Discussion and Analysis ReportVictor RoyNo ratings yet

- M. Kuramoto (2012) Low-Temperature and Pressureless Ag-Ag Direct Bonding For Light Emitting Diode Die-AttachmentDocument5 pagesM. Kuramoto (2012) Low-Temperature and Pressureless Ag-Ag Direct Bonding For Light Emitting Diode Die-Attachment许甜No ratings yet

- Indian Galvanised & Colour Coated Steel IndustryDocument7 pagesIndian Galvanised & Colour Coated Steel Industrytejindersingh001No ratings yet

- Graphite High Tech Supply Sharpens Up Nov 00Document12 pagesGraphite High Tech Supply Sharpens Up Nov 00Familoni LayoNo ratings yet

- Company Overview: Apollo Tricoat Tubes LTD Investment Thesis 8th June 2020Document3 pagesCompany Overview: Apollo Tricoat Tubes LTD Investment Thesis 8th June 2020Saurabh KumarNo ratings yet

- IP METALS - 09 Mar 2021Document42 pagesIP METALS - 09 Mar 2021klshfyusbdfkNo ratings yet

- An Introduction To Geopolymer Concrete: Indian Concrete Journal November 2011Document5 pagesAn Introduction To Geopolymer Concrete: Indian Concrete Journal November 2011m g vidyashree CivilNo ratings yet

- GeopolymerDocument5 pagesGeopolymerjahremade jahremadeNo ratings yet

- Pipes and Tubes SectorDocument19 pagesPipes and Tubes Sectornidhim2010No ratings yet

- FOAMINGOFSLAGSINEAFDocument10 pagesFOAMINGOFSLAGSINEAFDiego mena contrerasNo ratings yet

- Metal Pipes Sector Final ReportDocument69 pagesMetal Pipes Sector Final Reportvajiravel407No ratings yet

- Decarbonize SteelDocument9 pagesDecarbonize SteelkeshoooNo ratings yet

- EOF: The Reliable Choice For Indian "Start-Up" Steel PlantsDocument8 pagesEOF: The Reliable Choice For Indian "Start-Up" Steel PlantsRitesh KumarNo ratings yet

- Weld Repair of GTD 111 SuperalloyDocument10 pagesWeld Repair of GTD 111 SuperalloyJJNo ratings yet

- Minimal Business Case Study and Report Business PresentationDocument7 pagesMinimal Business Case Study and Report Business Presentationnamansingh.hrdcsrccNo ratings yet

- Decarbonizing US Steel IndustryDocument22 pagesDecarbonizing US Steel Industryropi.saraNo ratings yet

- 1 s2.0 S0959652621018837 Main PDFDocument16 pages1 s2.0 S0959652621018837 Main PDFSafalsha BabuNo ratings yet

- The Electroplating MarketDocument2 pagesThe Electroplating MarketmanishbhingareNo ratings yet

- FOAMINGOFSLAGSINEAFDocument10 pagesFOAMINGOFSLAGSINEAFJose LaraNo ratings yet

- Steel TypeDocument15 pagesSteel TypeYadav KrishnaNo ratings yet

- Teck Steelmaking Coal Fact SheetDocument3 pagesTeck Steelmaking Coal Fact Sheetkkd kdkqNo ratings yet

- Steel Sector - Aug 2022Document36 pagesSteel Sector - Aug 2022Nitish KhatanaNo ratings yet

- MMRW06 12 2021Document20 pagesMMRW06 12 2021shrinath bhatNo ratings yet

- Byron Capital Research ReportDocument16 pagesByron Capital Research ReportMuhammad Saad HussainNo ratings yet

- Steel Industry Research PaperDocument4 pagesSteel Industry Research Papers0l1nawymym3100% (1)

- Gallium Nitride-enabled High Frequency and High Efficiency Power ConversionFrom EverandGallium Nitride-enabled High Frequency and High Efficiency Power ConversionGaudenzio MeneghessoNo ratings yet

- No. Athlete Nation Sport Years Games Gender Gold 1 2 3 4 5 6Document2 pagesNo. Athlete Nation Sport Years Games Gender Gold 1 2 3 4 5 6vkagarwaNo ratings yet

- Composite DeckDocument5 pagesComposite DeckvkagarwaNo ratings yet

- Reinforcement Detailing of RCC StructureDocument8 pagesReinforcement Detailing of RCC StructurevkagarwaNo ratings yet

- 000-English 001 PDFDocument22 pages000-English 001 PDFvkagarwaNo ratings yet

- Momentum PicksDocument27 pagesMomentum PicksvkagarwaNo ratings yet

- 3M India Limited - Annual Report 2015-16 PDFDocument144 pages3M India Limited - Annual Report 2015-16 PDFvkagarwaNo ratings yet

- Offshore Structural IIT MadrasDocument2 pagesOffshore Structural IIT MadrasvkagarwaNo ratings yet

- Structural Dynamics Prof. P. Banerji Department of Civil Engineering Indian Institute of Technology, Bombay Lecture - 1Document19 pagesStructural Dynamics Prof. P. Banerji Department of Civil Engineering Indian Institute of Technology, Bombay Lecture - 1vkagarwaNo ratings yet

- Lec1 3Document29 pagesLec1 3vkagarwaNo ratings yet

- Index Cooking Dish RecipeDocument5 pagesIndex Cooking Dish RecipevkagarwaNo ratings yet

- Surveying TOCDocument26 pagesSurveying TOCvkagarwa0% (2)

- CardosoDocument3 pagesCardosovkagarwaNo ratings yet

- Bagatsing V Committee On Privatization 246 - SCRA - 334Document17 pagesBagatsing V Committee On Privatization 246 - SCRA - 334mmagsilaNo ratings yet

- Project Study (Sweety Kurup Bba019314)Document79 pagesProject Study (Sweety Kurup Bba019314)Hrithik BokdeNo ratings yet

- Current Personal Financial StatementDocument2 pagesCurrent Personal Financial Statementrajiverma50% (2)

- NothingDocument65 pagesNothingBonson DevasykuttyNo ratings yet

- FM - CA InterDocument255 pagesFM - CA Interarun100% (1)

- IT Income From Other Sources Pt-1Document25 pagesIT Income From Other Sources Pt-1syedfareed596No ratings yet

- Financial Statement AnalysisDocument1,179 pagesFinancial Statement AnalysisSYEDWASIQABBAS RIZVINo ratings yet

- Woolworths Annual Report 2017Document132 pagesWoolworths Annual Report 2017Adrienne HoNo ratings yet

- Advanced Accounting - 2 Mark's QuestionsDocument5 pagesAdvanced Accounting - 2 Mark's Questionshima artNo ratings yet

- Financial Analysis of Ogdcl and SSGCLDocument24 pagesFinancial Analysis of Ogdcl and SSGCLShahid MehmoodNo ratings yet

- Kenya Legal Framework AnalysisDocument19 pagesKenya Legal Framework AnalysisBenedict AnicetNo ratings yet

- FM - 5. Stock Valuation MBADocument21 pagesFM - 5. Stock Valuation MBAsarasNo ratings yet

- Raj Lanka Power CompanyDocument3 pagesRaj Lanka Power Companysaifmuiz1369No ratings yet

- Afar 10Document8 pagesAfar 10RENZEL MAGBITANGNo ratings yet

- Where Vision Gets BuiltDocument100 pagesWhere Vision Gets BuiltxaveoneNo ratings yet

- Analysis of Earnings and Dividend LevelDocument6 pagesAnalysis of Earnings and Dividend Leveldeveshr25No ratings yet

- Consolidated Techniques and ProceduresDocument50 pagesConsolidated Techniques and ProceduresApri ZdenkNo ratings yet

- Fundamental Accounting Principles Canadian Vol 2 Canadian 14th Edition Larson Solutions ManualDocument46 pagesFundamental Accounting Principles Canadian Vol 2 Canadian 14th Edition Larson Solutions Manualstarlikeharrowerexwp5100% (28)

- Prohibition of Benami Property Transactions ACT, 1988: After Reading This Chapter, You Will Be Able To UnderstandDocument43 pagesProhibition of Benami Property Transactions ACT, 1988: After Reading This Chapter, You Will Be Able To UnderstandBimal KumarNo ratings yet

- Reg Section 1.937-2Document11 pagesReg Section 1.937-2EDC AdminNo ratings yet

- 74689bos60485 Inter p1 cp4 U2Document24 pages74689bos60485 Inter p1 cp4 U2Ankita DebtaNo ratings yet

- 34 80 1 SMDocument14 pages34 80 1 SMoctaNo ratings yet

- Important Definitions: The Income-Tax Act, 1961Document17 pagesImportant Definitions: The Income-Tax Act, 1961namastastNo ratings yet

- ITC Consolidated FinancialsDocument49 pagesITC Consolidated FinancialsVishal JaiswalNo ratings yet

- Nature and Scope of Financial Management Role of Finance Function Finance Decisions For The FirmDocument22 pagesNature and Scope of Financial Management Role of Finance Function Finance Decisions For The FirmRAHUL KUMARNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Tax4861 2022 TL 103 0 BDocument99 pagesTax4861 2022 TL 103 0 BFlorence ApleniNo ratings yet

- Itad Bir Ruling No. 168-12Document7 pagesItad Bir Ruling No. 168-12Karla TigaronitaNo ratings yet

- Cash Flow NotesDocument4 pagesCash Flow NotesSana GulNo ratings yet

- S&P 500 Intrinsic Value EstimatorDocument24 pagesS&P 500 Intrinsic Value EstimatorAleja JiménezNo ratings yet