Professional Documents

Culture Documents

Calculation 8

Uploaded by

Abank Fahri0 ratings0% found this document useful (0 votes)

11 views2 pagesCal 8

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCal 8

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesCalculation 8

Uploaded by

Abank FahriCal 8

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

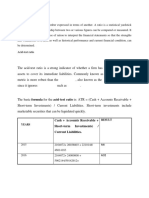

No. Ratios 2016 2015 Diff.

TESTS OF FINANCIAL CONDITION

20 Financial Leverage Ratio (x) 1,91 1,96 -0,05

Financial leverage ratios, sometimes called equity or debt ratios, measure the value

of equity in a company by analyzing its overall debt picture. These ratios either

compare debt or equity to assets as well as shares outstanding to measure the true

value of the equity in a business. In other words, the financial leverage ratios

measure the overall debt load of a company and compare it with the assets or

equity. This shows how much of the company assets belong to the shareholders

rather than creditors. When shareholders own a majority of the assets, the company

is said to be less leveraged. When creditors own a majority of the assets, the

company is considered highly leveraged. All of these measurements are important

for investors to understand how risky the capital structure of a company and if it is

worth investing in. This indicates that the company is still considered risky for the

investor because the company is using debt and other liabilities to finance its assets.

So, the company should work better for upcoming years to lower the leverage, until

the ratio is between 1-2 which means the low risk for the company. It means that

additional equity was converted proportionally into Indofood assets.

21 DER (%) 90,79 95,85 -5,06

The debt to equity ratio (DER) is a financial, liquidity ratio that compares a

company's total debt to total equity. The debt to equity ratio shows the percentage of

company financing that comes from creditors and investors. A higher debt to equity

ratio indicates that more creditor financing (bank loans) is used than investor

financing (shareholders). Lower the ratio means less risk on its financial or funding

the Samudera Indonesia business compare to year 2015. The table above showed

that the DER of Samudera Indonesia decreasing from previous year. This could be

considered good performance for Samudera Indonesia, because a lower debt to

equity ratio usually implies a more financially stable business. Companies with a

higher debt to equity ratio are considered more risky to creditors and investors than

companies with a lower ratio. Creditors view a higher debt to equity ratio as risky

because it shows that the investors have not funded the operations as much as

creditors have. In other words, investors do not have as much skin in the game as

the creditors do. This could mean that investors do not want to fund the business

operations because the company is not performing well. Lack of performance might

also be the reason why the company is seeking out extra debt financing. So, for next

years, Samudera Indonesia should maintain and improve their good performance in

order to prevent the need of funding from creditors and gain the trust from the

regular and new investors to fund the operations.

No. Ratios 2016 2015 Diff.

22 DCR (%) 66,60 67,24 -0,64

The debt-to-capital ratio is a measurement of a company's financial everage,

calculated as the company's debt divided by its total capital. The debt-to-capital ratio

of Samudera Indonesia is decreasing from the previous year, which decreases from

67,24 in 2015 to 66,60 in 2016. This indicates that the company is tend to use equity

financing rather than debt financing, because the higher the debt-to-capital ratio, the

more debt the company has compared to its equity. A company with high debt-to-

capital ratios, compared to a general or industry average, may show weak financial

strength because the cost of these debts may weigh on the company and increase

its default risk. We can also conclude from those 3 ratios (DER, DCR and FLR) that

Samudera Indonesia is more solvent in 2016 than 2015.

23 Times Interest Earned (x) 11,65 16,09 -4,44

Times interest earned ratio is a coverage ratio that measures the proportionate

amount of income that can be used to cover interest expenses in the future. In year

2016 means that one of interest guaranteed by 11,65 of profits. This amount is lower

than previous year which is 16,09 . Eventhough there is a decreasing in 2016,

company still have capability to cover its interest.

24 Cash Flow / Debt (%) 16,86 14,80 2,06

The cash flow-to-debt ratio is a ratio of a company‖s cash flow from operations to its

total debt. The cash flow-to-debt ratio is a type of debt coverage ratio, and is an

estimate of the amount of time it would take a company to repay its debt if it devoted

all of its cash flow to debt repayment. Cash flow is used to evaluate a company's

funds rather than earnings because it provides a better insight into a company's

ability to pay its obligations. With a significant reduction of the ratio of cash flow-to-

debt Samudera Indonesia from 14,80 percent in 2015 to 16,86 percent in 2016, it is

considered good for the company because the higher the percentage ratios, its

better the company's ability to bring its total debt. This shows that Samudera

Indonesia was a good performance in 2016.

You might also like

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Aqsa Iram FA13 BAF 002Document13 pagesAqsa Iram FA13 BAF 002Aqsa ChNo ratings yet

- QUESTION 1 - Evaluate US Tire's Financial Health. How Well Is The Company Performing?Document3 pagesQUESTION 1 - Evaluate US Tire's Financial Health. How Well Is The Company Performing?Anna KravcukaNo ratings yet

- Financial Analysis of Tvs Motor Co. Ltd.Document21 pagesFinancial Analysis of Tvs Motor Co. Ltd.Piyush_jain004100% (3)

- Fsa Assignment Report On Financial Health of Companies by Group 3 Industry - It Companies - Wipro, TCS, Infosys. Ratio AnalysisDocument20 pagesFsa Assignment Report On Financial Health of Companies by Group 3 Industry - It Companies - Wipro, TCS, Infosys. Ratio AnalysissanhithNo ratings yet

- Q 2Document2 pagesQ 2mohd reiNo ratings yet

- Liquidity Ratios: Current RatioDocument3 pagesLiquidity Ratios: Current RatiojatinNo ratings yet

- Solvency Ratios: Solvency Ratios Come in A Variety of FormsDocument3 pagesSolvency Ratios: Solvency Ratios Come in A Variety of FormssanskritiNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisikramNo ratings yet

- 0036 - Accounting For Business - EditedDocument4 pages0036 - Accounting For Business - EditedAwais AhmedNo ratings yet

- FSA Chapter 7Document3 pagesFSA Chapter 7Nadia ZahraNo ratings yet

- Current RatioDocument22 pagesCurrent RatioAsawarNo ratings yet

- RatiosDocument4 pagesRatiosAerielle SkyNo ratings yet

- Strategic Audit NotesDocument6 pagesStrategic Audit NotesMaeve AguerroNo ratings yet

- BUS 104, Introduction To Finance Group AssignmentDocument12 pagesBUS 104, Introduction To Finance Group AssignmentJannatul FerdausNo ratings yet

- Sadafco PartDocument6 pagesSadafco PartQusai BassamNo ratings yet

- 2021 Finance ReportDocument25 pages2021 Finance ReportSanjana SinghNo ratings yet

- Assignment On: Financial Statement Analysis FIN 4218Document28 pagesAssignment On: Financial Statement Analysis FIN 4218নাফিস ইকবাল আকিলNo ratings yet

- Financial Analysis Shell PakistanDocument17 pagesFinancial Analysis Shell PakistanYasir Bhatti100% (1)

- Report On Liquidity Ratios-1Document38 pagesReport On Liquidity Ratios-1Dalia's TechNo ratings yet

- Theoretical PerspectiveDocument12 pagesTheoretical PerspectivepopliyogeshanilNo ratings yet

- Debt To Equity Ratio InterpretationDocument2 pagesDebt To Equity Ratio Interpretationarav0607No ratings yet

- FRA Report: GMR Infrastructure: Submitted To: Submitted byDocument12 pagesFRA Report: GMR Infrastructure: Submitted To: Submitted bySunil KumarNo ratings yet

- Financial Statement Analysis-IIDocument45 pagesFinancial Statement Analysis-IINeelisetty Satya SaiNo ratings yet

- What Is A Debt RatioDocument11 pagesWhat Is A Debt RatioshreyaNo ratings yet

- Debt ManagementDocument9 pagesDebt ManagementIsha Shehzad Khan (Class of 2021)No ratings yet

- Financial LeverageDocument7 pagesFinancial LeverageGeanelleRicanorEsperonNo ratings yet

- Interest Coverage Ratio 2017 2016 2015Document1 pageInterest Coverage Ratio 2017 2016 2015Daphne RodriguezNo ratings yet

- Fuad, 7,8,9Document6 pagesFuad, 7,8,9Muhd FiekrieNo ratings yet

- Fin201 Final Assignment ReportDocument13 pagesFin201 Final Assignment ReportAasif26No ratings yet

- AssignmentDocument5 pagesAssignmentpankajjaiswal60No ratings yet

- Topical Ratio Analysis For PradaDocument4 pagesTopical Ratio Analysis For PradaRadNo ratings yet

- What Is The Solvency RatioDocument2 pagesWhat Is The Solvency RatioDarlene SarcinoNo ratings yet

- Financial Analysis Tools - HandoutsDocument2 pagesFinancial Analysis Tools - HandoutsJohna Mae Dolar EtangNo ratings yet

- Sedano, Crea Final RequirementDocument6 pagesSedano, Crea Final RequirementCrea Madula SedanoNo ratings yet

- Integrated Case 4-26Document6 pagesIntegrated Case 4-26Cayden BrookeNo ratings yet

- Asia Metroolitan University Taman Kemachaya, Batu 9, 43200 CHERAS SelangorDocument7 pagesAsia Metroolitan University Taman Kemachaya, Batu 9, 43200 CHERAS SelangorMehedi TanvirNo ratings yet

- Net Debt As A Percentage of Total CapitalizationDocument1 pageNet Debt As A Percentage of Total CapitalizationjoeydanzaNo ratings yet

- Anees Ahmad (0964) - Ratio AnalysisDocument9 pagesAnees Ahmad (0964) - Ratio AnalysisMR ANo ratings yet

- Certain Period, or That They Are Not Getting Payments For Invoices in Fast Enough. A SharpDocument6 pagesCertain Period, or That They Are Not Getting Payments For Invoices in Fast Enough. A Sharpmalik waseemNo ratings yet

- Tata Motors.: Liquidity RatiosDocument11 pagesTata Motors.: Liquidity RatiosAamir ShadNo ratings yet

- Lecture 5 Financial Statement AnalysisDocument42 pagesLecture 5 Financial Statement Analysismainul04029No ratings yet

- Shoiab Finance AssignmentDocument6 pagesShoiab Finance AssignmentAbhishek GokhaleNo ratings yet

- Ratio Formula RemarksDocument7 pagesRatio Formula RemarksmgajenNo ratings yet

- Capital StructureDocument17 pagesCapital StructureVinit Mathur100% (1)

- What Is Ratio AnalysisDocument19 pagesWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- A. Liquidity Ratios: Vi. Accounting and FinanceDocument9 pagesA. Liquidity Ratios: Vi. Accounting and FinanceJasonHrvyNo ratings yet

- BF Nishant Rana (1875405) Buisiness Finance AssignmentDocument16 pagesBF Nishant Rana (1875405) Buisiness Finance AssignmentNishant RanaNo ratings yet

- What Is A Coverage RatioDocument2 pagesWhat Is A Coverage RatioDarlene SarcinoNo ratings yet

- FM Cia 3Document6 pagesFM Cia 3Priyanshu ChhabariaNo ratings yet

- Financial AccountingDocument11 pagesFinancial AccountingSHIKHA DWIVEDINo ratings yet

- Ratio Analysis of Life Insurance - IBADocument116 pagesRatio Analysis of Life Insurance - IBANusrat Saragin NovaNo ratings yet

- Interpretations Current RatioDocument3 pagesInterpretations Current RatiorituNo ratings yet

- Fin420 Ratio FinanceDocument27 pagesFin420 Ratio FinanceHulababoo KeChikNo ratings yet

- Liquidity Ratio: What Are Liquidity Ratios?Document11 pagesLiquidity Ratio: What Are Liquidity Ratios?Ritesh KumarNo ratings yet

- Financial Ratios Are Mathematical Comparisons of Financial Statement Accounts or CategoriesDocument5 pagesFinancial Ratios Are Mathematical Comparisons of Financial Statement Accounts or Categoriesalfred benedict bayanNo ratings yet

- Solvency Ratio - Overview, How To Compute, LimitationsDocument6 pagesSolvency Ratio - Overview, How To Compute, Limitationssunnyleoni.440No ratings yet

- Two Financial RatiosDocument9 pagesTwo Financial RatiosWONG ZI QINGNo ratings yet

- Solvency AnalysisDocument4 pagesSolvency Analysissonam agrawalNo ratings yet

- WEB: Salvatore's Managerial Economics in A Global Economy, 8 Ed. Chapter 2: Changes in Supply and Demand Cause Large Swings in Copper PricesDocument1 pageWEB: Salvatore's Managerial Economics in A Global Economy, 8 Ed. Chapter 2: Changes in Supply and Demand Cause Large Swings in Copper PricesAbank FahriNo ratings yet

- The Role of Shared Services PDFDocument5 pagesThe Role of Shared Services PDFAbank FahriNo ratings yet

- Chapter 3Document6 pagesChapter 3Abank FahriNo ratings yet

- Pengumunan CPNS Kab. CirebonDocument3 pagesPengumunan CPNS Kab. CirebonAbank FahriNo ratings yet

- Katie Wales, University of Leeds, UKDocument20 pagesKatie Wales, University of Leeds, UKAbank FahriNo ratings yet

- Current Ratio, Quick Ratio, Debt To Equity RatioDocument20 pagesCurrent Ratio, Quick Ratio, Debt To Equity RatioAbank FahriNo ratings yet

- STTP Annual Report 2015Document33 pagesSTTP Annual Report 2015Abank FahriNo ratings yet

- MM5002 AccountingDocument7 pagesMM5002 AccountingAbank FahriNo ratings yet

- No. Ratios 2016 2015 Diff.: Tests of Dividend PolicyDocument1 pageNo. Ratios 2016 2015 Diff.: Tests of Dividend PolicyAbank FahriNo ratings yet

- Financial Ratio CalculationDocument2 pagesFinancial Ratio CalculationAbank FahriNo ratings yet

- B. Syllabus: NO Skills Competency Topic Source of Materials 1 at The AirportDocument1 pageB. Syllabus: NO Skills Competency Topic Source of Materials 1 at The AirportAbank FahriNo ratings yet

- Accounting Text and Cases 12 Ed.Document14 pagesAccounting Text and Cases 12 Ed.Abank FahriNo ratings yet

- Application Form Unilever General 2014v1Document9 pagesApplication Form Unilever General 2014v1Abank FahriNo ratings yet

- Accounting Text and Cases 12 Ed. Chapter 4 PDFDocument22 pagesAccounting Text and Cases 12 Ed. Chapter 4 PDFAbank Fahri100% (2)

- Accounting Text and Cases 12 Ed. Chapter 11 PDFDocument13 pagesAccounting Text and Cases 12 Ed. Chapter 11 PDFAbank FahriNo ratings yet

- Accounting Text and Cases 12 Ed.Document13 pagesAccounting Text and Cases 12 Ed.Abank FahriNo ratings yet

- Accounting Text and Cases 12 Ed.Document11 pagesAccounting Text and Cases 12 Ed.Abank FahriNo ratings yet

- Accounting Text and Cases 12 Ed.Document19 pagesAccounting Text and Cases 12 Ed.Abank Fahri100% (1)

- Reading Assignment Nuclear ChemistryDocument2 pagesReading Assignment Nuclear Chemistryapi-249441006No ratings yet

- Select Event Venue and SiteDocument11 pagesSelect Event Venue and SiteLloyd Arnold Catabona100% (1)

- English Language Paper 1 - Answer KeyDocument5 pagesEnglish Language Paper 1 - Answer Keybangtansone1997No ratings yet

- API 614-Chapter 4 DATA SHEET Dry Gas Seal Module Si Units: System Responsibility: (2.1.2)Document10 pagesAPI 614-Chapter 4 DATA SHEET Dry Gas Seal Module Si Units: System Responsibility: (2.1.2)tutuionutNo ratings yet

- 10.0 Ms For Scaffolding WorksDocument7 pages10.0 Ms For Scaffolding WorksilliasuddinNo ratings yet

- 2023 VGP Checklist Rev 0 - 23 - 1 - 2023 - 9 - 36 - 20Document10 pages2023 VGP Checklist Rev 0 - 23 - 1 - 2023 - 9 - 36 - 20mgalphamrn100% (1)

- Ammonium Chloride: Product InformationDocument2 pagesAmmonium Chloride: Product InformationusamaNo ratings yet

- Cranial Electrotherapy Stimulator (C.E.S.) Earlobe Stimulator, Pocket-Transportable, 9VDocument1 pageCranial Electrotherapy Stimulator (C.E.S.) Earlobe Stimulator, Pocket-Transportable, 9VemiroNo ratings yet

- Private Standard: Shahram GhanbarichelaresiDocument2 pagesPrivate Standard: Shahram Ghanbarichelaresiarian tejaratNo ratings yet

- Post Traumatic Stress DisorderDocument2 pagesPost Traumatic Stress Disorderapi-188978784100% (1)

- Edgie A. Tenerife BSHM 1108: Page 1 of 4Document4 pagesEdgie A. Tenerife BSHM 1108: Page 1 of 4Edgie TenerifeNo ratings yet

- Understanding Senior Citizens Outlook of Death Sample FormatDocument14 pagesUnderstanding Senior Citizens Outlook of Death Sample FormatThea QuibuyenNo ratings yet

- RestraintsDocument48 pagesRestraintsLeena Pravil100% (1)

- DELIGHT Official e BookDocument418 pagesDELIGHT Official e BookIsis Jade100% (3)

- Brachiocephalic TrunkDocument3 pagesBrachiocephalic TrunkstephNo ratings yet

- APPSC Calender Year Final-2017Document3 pagesAPPSC Calender Year Final-2017Krishna MurthyNo ratings yet

- 感應馬達安裝、保養使用說明書31057H402E (英)Document17 pages感應馬達安裝、保養使用說明書31057H402E (英)Rosyad Broe CaporegimeNo ratings yet

- Recommendation On The Acquisation of VitasoyDocument8 pagesRecommendation On The Acquisation of Vitasoyapi-237162505No ratings yet

- OA Standard 050505Document75 pagesOA Standard 050505fido_dagemNo ratings yet

- Multilevel Full Mock Test 5: Telegramdagi KanalDocument20 pagesMultilevel Full Mock Test 5: Telegramdagi KanalShaxzod AxmadjonovNo ratings yet

- UIP ResumeDocument1 pageUIP ResumeannabellauwinezaNo ratings yet

- DIAC Experienced Associate HealthcareDocument3 pagesDIAC Experienced Associate HealthcarecompangelNo ratings yet

- WT Chapter 5Document34 pagesWT Chapter 5Wariyo GalgaloNo ratings yet

- Hippocrates OathDocument6 pagesHippocrates OathSundary FlhorenzaNo ratings yet

- 2017 LT4 Wiring DiagramDocument10 pages2017 LT4 Wiring DiagramThomasNo ratings yet

- Senographe Crystal: The Choice Is Crystal ClearDocument7 pagesSenographe Crystal: The Choice Is Crystal ClearmuhammadyassirNo ratings yet

- SSN Melaka SMK Seri Kota 2021 Annual Training Plan: Athletes Name Training ObjectivesDocument2 pagesSSN Melaka SMK Seri Kota 2021 Annual Training Plan: Athletes Name Training Objectivessiapa kahNo ratings yet

- Citizen's 8651 Manual PDFDocument16 pagesCitizen's 8651 Manual PDFtfriebusNo ratings yet

- Fomula Spreadsheet (WACC and NPV)Document7 pagesFomula Spreadsheet (WACC and NPV)vaishusonu90No ratings yet

- Gmail - RedBus Ticket - TN7R20093672Document2 pagesGmail - RedBus Ticket - TN7R20093672Bappa RoyNo ratings yet