Professional Documents

Culture Documents

Corpus Yield & Maturity Expenses & Loads

Uploaded by

aadhil1992Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corpus Yield & Maturity Expenses & Loads

Uploaded by

aadhil1992Copyright:

Available Formats

HDFC Mutual Fund ‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐ Debt,

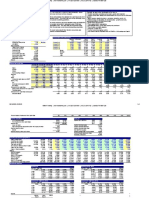

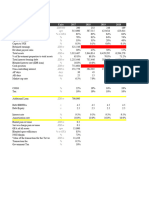

Yield & Maturity Corpus Portfolio Concentration Expenses & Loads

Hybrid & Balanced Reckoner

By Ratings

By Asset Class

Equity /

AA+ & G‐Sec / T‐ CD/CP/ Credit Exp.

Scheme Name YTM APM MD AUM (Rs.cr) AAA* Unrated Cash* Exit Load Load period (m) Div Options*

Below Bills/SDL BRDS Exposure Ratio

Debt

Cash Management Call Plan 5.90% 4 d 4 d 86 ‐ ‐ ‐ 100% ‐ ‐ ‐ 0.25% ‐ ‐ D

Liquid Fund 6.33% 35 d 29 d 25,548 96.6% 0.49% ‐ ‐9.6% 12.48% 90.8% 6.4% 0.20% ‐ ‐ DWM

Cash Management Savings Plan 6.33% 46 d 40 d 6,623 90.1% 2.1% ‐ ‐3.4% 11.3% 81.2% 11.0% 0.30% ‐ ‐ DW

CMF Treasury Advantage Plan 7.23% 1.18 361 d 13,304 49.4% 34.9% 0.0% 4.0% 11.8% 11.9% 72.4% 0.97% ‐ ‐ DWM

Floating Rate Income ‐ STP 7.02% 350 d 296 d 17,924 68.6% 16.8% ‐ 4.0% 10.6% 11.0% 74.4% 0.35% ‐ ‐ DWM

Banking & PSU Debt Fund 7.92% 3.96 3.02 4,729 59.7% 35.1% ‐ 5.1% ‐ 3.3% 91.6% 0.71% ‐ ‐ W

High Interest Fund STP 7.66% 2.92 2.24 1,871 46.8% 37.6% ‐ 5.0% 10.6% 2.6% 81.8% 1.22% ‐ ‐ F

Floating Rate Income ‐ LTP 7.30% 2.94 2.20 1,874 77.0% ‐ ‐ 4.0% 19.1% 1.1% 75.9% 0.26% ‐ ‐ W

Medium Term Opportunities 7.36% 2.85 2.37 14,041 73.4% ‐ ‐ 3.8% 22.9% ‐ 73.4% 0.36% ‐ ‐ Q

Short Term Opportunities 7.24% 1.52 1.33 11,301 79.0% 9.4% ‐ 3.8% 7.9% 2.6% 85.8% 0.37% ‐ ‐ F

Regular Savings Fund 8.11% 1.89 1.60 5,531 24.7% 67.3% 0.4% 6.3% 1.4% 3.8% 88.5% 1.89% 0.75% 6 M

Corporate Debt Opportunities 8.47% 3.85 2.90 13,674 25.9% 66.5% 1.0% 5.8% 0.8% 1.3% 92.0% 1.98% 1% / 0.5% 18./12 H

Income Fund 7.42% 11.07 6.40 1,525 14.9% 14.4% ‐ 11.5% 59.2% ‐ 29.3% 1.89% ‐ ‐ Q

HIF Dynamic Plan 7.61% 9.10 5.55 1,825 9.8% 20.7% ‐ 9.7% 59.8% ‐ 30.5% 1.86% 0.50% 6 QHA

Gilt STP 6.89% 4.82 3.83 376 ‐ ‐ ‐ 5.4% 94.6% ‐ ‐ 0.40% ‐ ‐ Q

Gilt LTP 7.17% 12.56 6.84 2,237 ‐ ‐ ‐ 11.8% 88.2% ‐ ‐ 0.84% ‐ ‐ Q

Multiple Yield Fund ‐ Plan 2005 6.54% 106 d 84 d 171 47.5% 8.9% 18.7% 25.0% ‐ 56.3% 1.84% 1.00% 15 A

MIP STP 7.55% 6.92 4.74 307 10.8% 17.8% 24.3% 3.8% 43.3% ‐ 28.6% 2.46% 1.00% 12 MQ

MIP LTP 7.80% 8.41 5.28 3,827 11.6% 21.0% 24.3% 6.1% 36.9% 32.6% 1.81% 1.00% 12 MQ

Childrens Gift Fund ‐ Investments 7.29% 6.24 3.80 2,021 2.1% 8.1% 69.9% 6.8% 13.2% ‐ 10.1% 2.33% 3% / 2% / 1% 12 / 24 / 36 ‐

Balanced Fund 7.30% 6.06 3.84 18,027 10.9% 4.1% 67.5% 5.5% 12.1% 1.2% 13.9% 1.96% 1.00% 12 Q

Prudence Fund 8.09% 5.71 3.74 36,395 5.8% 14.9% 72.3% 4.1% 3.0% ‐ 20.7% 2.26% 1.00% 12 M

Arbitrage Fund ‐ ‐ ‐ 6,025 5.3% 13.3% 66.3% 15.2% ‐ 3.2% 15.3% 0.75% 0.25% 1 M

Equity Savings Fund 7.53% 2.53 2.01 4,812 2.4% 13.3% 66.5% 15.6% 2.3% ‐ 15.6% 2.28% 1.00% 12 Q

30‐Nov‐17 30‐Nov‐2017 30‐Nov‐2017 As on Dec 6, 2017 10:34:10 AM IST

Source: www.hdfcfund.com, Internal, CCIL, RBI MIP STP, MIP LTP, Prudence, Balanced,STP,CDOF & Equity Savings Exit Load: 15% of the units (“the limit”) may be redeemed without any exit load from the date of allotment

Month End Weighted Average Expense Ratios used for all schemes. Check website for Current Expense Ratios

YTM: Yield to Maturity, MD: Modified Duration, APM: Average Portfolio Maturity CRR 4.00%

CD/CP: Certificate of Deposit/ Commercial Paper Repo Rate 6.00%

Dividend Options: Daily (D), Weekly (W), Monthly (M), Quarterly (Q), Annually (A); Dividend distribution is subject to distributable surplus Reverse Repo Rate 5.75%

*AAA / AAA(SO) / A1+ / A1+(SO); Cash and Cash Equivalents & Net Current Assets ; *AA+ for Liquid and Savings plan contain Bill Rediscounting (BRDS) SLR Rate 19.50%

CGF Savings Lock‐in Period If opted: Until the Unit Holder (being the beneficiary child) attains the age of 18 years or until completion of 3 years from date of allotment , whichever is later 06.79 GS 2027 7.0669

You might also like

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- WACCDocument7 pagesWACCUjalaNo ratings yet

- Evercore Partners 8.6.13 PDFDocument6 pagesEvercore Partners 8.6.13 PDFChad Thayer VNo ratings yet

- PG One PagerDocument2 pagesPG One PagerAlexandra Denise PeraltaNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- DCF ModellDocument7 pagesDCF ModellVishal BhanushaliNo ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- DCF ModellDocument7 pagesDCF Modellsandeep0604No ratings yet

- 04.30.20 Gs DeckDocument22 pages04.30.20 Gs DeckV SNo ratings yet

- Measuring Banks Performance 1606494463Document3 pagesMeasuring Banks Performance 1606494463Syed Tanvir AhmedSHUVI ShuvoNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- 2 Financial Statements of Bank - For StudentDocument75 pages2 Financial Statements of Bank - For StudenttusedoNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Implememntation Polaroid - Corporation - TemplateDocument11 pagesImplememntation Polaroid - Corporation - TemplateShirazeeNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Derivatives and Risk ManagementDocument136 pagesDerivatives and Risk Managementabbas ali100% (3)

- V F Corporation NYSE VFC FinancialsDocument9 pagesV F Corporation NYSE VFC FinancialsAmalia MegaNo ratings yet

- AMH Co AnswerDocument3 pagesAMH Co AnswerOlivier MNo ratings yet

- MF COMPARISON - Small CapDocument3 pagesMF COMPARISON - Small CapRajkumar GNo ratings yet

- Mercury Athletic Footwear: Ashutosh DashDocument49 pagesMercury Athletic Footwear: Ashutosh DashSaurabh ChhabraNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- Sustainable Growth Analysis of Under Armour Inc. 2009 - 2013Document9 pagesSustainable Growth Analysis of Under Armour Inc. 2009 - 2013Maria Camila CadavidNo ratings yet

- Syndicate 3 - Nike-Case 7 - YP64ADocument7 pagesSyndicate 3 - Nike-Case 7 - YP64ADimas Kusuma AndanuNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- KMX Write Up RedditDocument4 pagesKMX Write Up Redditapi-404463664No ratings yet

- GAR39 14 11 2022 Performance Update 3Q2022Document5 pagesGAR39 14 11 2022 Performance Update 3Q2022Devina Ratna DewiNo ratings yet

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocument3 pagesCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaNo ratings yet

- Analyzing Bank Performance: Using The UbprDocument70 pagesAnalyzing Bank Performance: Using The UbpraliNo ratings yet

- Steve Eisman - A Long and A ShortDocument34 pagesSteve Eisman - A Long and A Shortpgold12100% (1)

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Duffphelps RF Erp CRSP 5-21-2019Document1 pageDuffphelps RF Erp CRSP 5-21-2019G ChaddiNo ratings yet

- DuffphelpsDocument1 pageDuffphelpsG ChaddiNo ratings yet

- Krakatau Steel A CaseDocument9 pagesKrakatau Steel A CaseFarhan SoepraptoNo ratings yet

- Byjus Base ModelDocument8 pagesByjus Base Modelsharma.kunal70No ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- GridExport December 8 2022 19 20 38Document4 pagesGridExport December 8 2022 19 20 38FBusinessNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh VanNo ratings yet

- Top 50 World BanksDocument1 pageTop 50 World BanksKicki AnderssonNo ratings yet

- Branch FormatDocument1 pageBranch FormatShweta YaragattiNo ratings yet

- JS Income FundDocument9 pagesJS Income Fundcoolbouy85No ratings yet

- Reporte Copeme Imf Mar2023Document52 pagesReporte Copeme Imf Mar2023Jesús Del Prado MattosNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- Manzana Insurance: The Business ProblemDocument8 pagesManzana Insurance: The Business Problemdhirendra katiyarNo ratings yet

- Ratio Analysis-Overview Ratios:: CaveatsDocument14 pagesRatio Analysis-Overview Ratios:: CaveatsEng abdifatah saidNo ratings yet

- MF COMPARISON - Large & MidDocument3 pagesMF COMPARISON - Large & MidRajkumar GNo ratings yet

- Book 1Document3 pagesBook 1nishantNo ratings yet

- Fundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Document3 pagesFundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Isra MachicadoNo ratings yet

- Informe SBS Asset ManagementDocument32 pagesInforme SBS Asset ManagementyaninaNo ratings yet

- ValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03Document4 pagesValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03fukkatNo ratings yet

- Pag BankDocument24 pagesPag Bankandre.torresNo ratings yet

- Analyse Bus 28-02-2018Document75 pagesAnalyse Bus 28-02-2018n.02thierryNo ratings yet

- Capitec Bank - Valuation Looks Steep But Growth Outlook Is The Differentiating Factor - FinalDocument54 pagesCapitec Bank - Valuation Looks Steep But Growth Outlook Is The Differentiating Factor - FinalMukarangaNo ratings yet

- Report 2022Document338 pagesReport 2022Yerrolla MadhuravaniNo ratings yet

- Step Up - Debt & Equity Funds - Themes, Schemes & UtilityDocument27 pagesStep Up - Debt & Equity Funds - Themes, Schemes & Utilityaadhil1992No ratings yet

- Step Up - Understanding Lump Sum, Sip, STP, SWPDocument12 pagesStep Up - Understanding Lump Sum, Sip, STP, SWPaadhil1992No ratings yet

- Step Up - Financial Markets Ancillary JargonsDocument8 pagesStep Up - Financial Markets Ancillary Jargonsaadhil1992No ratings yet

- Step Up - High Nav, Low Nav DynamicsDocument5 pagesStep Up - High Nav, Low Nav Dynamicsaadhil1992No ratings yet

- HDFC Mid-Cap Opportunities Fund - July 2015 PDFDocument16 pagesHDFC Mid-Cap Opportunities Fund - July 2015 PDFaadhil1992No ratings yet

- The Velveteen Rabbit 001 The Velveteen Rabbitt or How Toys Become Real PDFDocument13 pagesThe Velveteen Rabbit 001 The Velveteen Rabbitt or How Toys Become Real PDFBence PéteriNo ratings yet

- HDFC Growth Fund - September 2015 PDFDocument15 pagesHDFC Growth Fund - September 2015 PDFaadhil1992No ratings yet

- HDFC Large Cap Equity Fund PDFDocument25 pagesHDFC Large Cap Equity Fund PDFaadhil1992No ratings yet

- Assistant Manager - Chennai SalesDocument1 pageAssistant Manager - Chennai Salesaadhil1992No ratings yet

- HDFC ETF Product Suite - February 2016 PDFDocument23 pagesHDFC ETF Product Suite - February 2016 PDFaadhil1992No ratings yet

- HDFC Equity Savings Fund PDFDocument18 pagesHDFC Equity Savings Fund PDFaadhil1992No ratings yet

- ReportDocument62 pagesReportaadhil1992No ratings yet

- HDFC ETF Product Suite PDFDocument23 pagesHDFC ETF Product Suite PDFaadhil1992No ratings yet

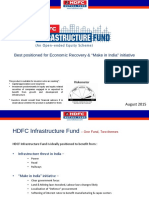

- HDFC Infrastructure Fund - August 2015Document20 pagesHDFC Infrastructure Fund - August 2015aadhil1992No ratings yet

- Fast Data Collection in Tree-Based Wireless Sensor NetworksDocument15 pagesFast Data Collection in Tree-Based Wireless Sensor NetworksChetan PatilNo ratings yet

- HDFC Small & Midcap Fund - December 2015 PDFDocument17 pagesHDFC Small & Midcap Fund - December 2015 PDFaadhil1992No ratings yet

- HDFC GILT Fund LTP Jan 2015 PDFDocument22 pagesHDFC GILT Fund LTP Jan 2015 PDFaadhil1992No ratings yet

- HDFC Prudence Fund PDFDocument21 pagesHDFC Prudence Fund PDFaadhil1992No ratings yet

- Veeramanikandan - J2EE - 3+ (Recent)Document8 pagesVeeramanikandan - J2EE - 3+ (Recent)aadhil1992No ratings yet

- HDFC Equity Fund PDFDocument24 pagesHDFC Equity Fund PDFaadhil1992No ratings yet

- Thabu Sankar-Devadhaikalin DevadhaiDocument47 pagesThabu Sankar-Devadhaikalin Devadhaikarthik93% (27)

- AadDocument61 pagesAadaadhil1992No ratings yet

- Swot MerckDocument3 pagesSwot Mercktomassetya0% (1)

- Pol Parties PDFDocument67 pagesPol Parties PDFlearnmorNo ratings yet

- Ground Floor Plan Second Floor Plan: Bedroom 1 T & B Service Area Closet T & BDocument1 pageGround Floor Plan Second Floor Plan: Bedroom 1 T & B Service Area Closet T & BAbegail Dela CruzNo ratings yet

- Creative Writing PieceDocument3 pagesCreative Writing Pieceapi-608098440No ratings yet

- To The Lighthouse To The SelfDocument36 pagesTo The Lighthouse To The SelfSubham GuptaNo ratings yet

- Romantic Criticism of Shakespearen DramaDocument202 pagesRomantic Criticism of Shakespearen DramaRafael EscobarNo ratings yet

- Lec 15. National Income Accounting V3 REVISEDDocument33 pagesLec 15. National Income Accounting V3 REVISEDAbhijeet SinghNo ratings yet

- Macpherson - Advanced Written EnglishDocument102 pagesMacpherson - Advanced Written Englishmarsza23100% (1)

- KPMG Our Impact PlanDocument44 pagesKPMG Our Impact Planmuun yayo100% (1)

- Alexei NavalnyDocument6 pagesAlexei NavalnyMuhammad M HakimiNo ratings yet

- Webinar2021 Curriculum Alena Frid OECDDocument30 pagesWebinar2021 Curriculum Alena Frid OECDreaderjalvarezNo ratings yet

- Appointment Letter 17may2022Document6 pagesAppointment Letter 17may2022Gaurav ChoudharyNo ratings yet

- Returns To Scale in Beer and Wine: A P P L I C A T I O N 6 - 4Document1 pageReturns To Scale in Beer and Wine: A P P L I C A T I O N 6 - 4PaulaNo ratings yet

- Strategic Management A Competitive Advantage Approach Concepts and Cases 17Th 17Th Edition Fred R David All ChapterDocument67 pagesStrategic Management A Competitive Advantage Approach Concepts and Cases 17Th 17Th Edition Fred R David All Chaptertabitha.turner568100% (3)

- Listening Practice9 GGBFDocument10 pagesListening Practice9 GGBFDtn NgaNo ratings yet

- Certified Data Centre Professional CDCPDocument1 pageCertified Data Centre Professional CDCPxxxxxxxxxxxxxxxxxxxxNo ratings yet

- Module 2. Lesson 2. OverexploitationDocument11 pagesModule 2. Lesson 2. OverexploitationJephthah Faith Adorable-PalicNo ratings yet

- Mock Act 1 - Student - 2023Document8 pagesMock Act 1 - Student - 2023Big bundahNo ratings yet

- C.W.stoneking Lyric BookDocument7 pagesC.W.stoneking Lyric Bookbackch9011No ratings yet

- Sales ProcessDocument4 pagesSales ProcessIsaac MorokoNo ratings yet

- People vs. Tampus DigestDocument2 pagesPeople vs. Tampus Digestcmv mendozaNo ratings yet

- RPA Solutions - Step Into The FutureDocument13 pagesRPA Solutions - Step Into The FutureThe Poet Inside youNo ratings yet

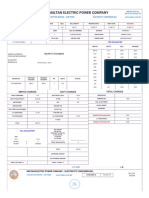

- Multan Electric Power Company: Say No To CorruptionDocument2 pagesMultan Electric Power Company: Say No To CorruptionLearnig TechniquesNo ratings yet

- IGNOU Vs MCI High Court JudgementDocument46 pagesIGNOU Vs MCI High Court Judgementom vermaNo ratings yet

- Supermarkets - UK - November 2015 - Executive SummaryDocument8 pagesSupermarkets - UK - November 2015 - Executive Summarymaxime78540No ratings yet

- Chapter 06 v0Document43 pagesChapter 06 v0Diệp Diệu ĐồngNo ratings yet

- Wrongful ForeclosureDocument8 pagesWrongful Foreclosurefaceoneoneoneone100% (2)

- 45-TQM in Indian Service Sector PDFDocument16 pages45-TQM in Indian Service Sector PDFsharan chakravarthyNo ratings yet

- StarbucksDocument19 pagesStarbucksPraveen KumarNo ratings yet

- Sculi EMT enDocument1 pageSculi EMT enAndrei Bleoju100% (1)