Professional Documents

Culture Documents

Company: JK Tyre & Industries LTD: Common Size Balance Sheet (Rs in CRS)

Uploaded by

Sowmya Namburu0 ratings0% found this document useful (0 votes)

100 views33 pagesthis is comparitive analysis of jk tyres and ceat tyres with financial ratios

Original Title

both1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentthis is comparitive analysis of jk tyres and ceat tyres with financial ratios

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

100 views33 pagesCompany: JK Tyre & Industries LTD: Common Size Balance Sheet (Rs in CRS)

Uploaded by

Sowmya Namburuthis is comparitive analysis of jk tyres and ceat tyres with financial ratios

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 33

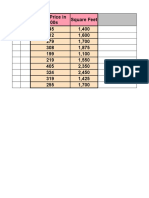

Company : JK Tyre & Industries Ltd

Industry : Tyres - Large

Common Size Balance Sheet (Rs in Crs)

Year Mar 13 Mar 14 Mar 15

SOURCES OF FUNDS :

Share Capital + 410.6 1.020% 410.6 0.97% 453.6

Reserves Total + 8,653.90 21.507% 10,436.90 24.64% 13,556.50

Equity Share Warrants 0 0.000% 123.7 0.29% 0

Equity Application Money 0 0.000% 0 0.00% 0

Total Shareholders Funds 9,064.50 22.527% 10,971.20 25.90% 14,010.10

Minority Interest 0 0.000% 0 0.00% 0

Secured Loans + 22,570.40 56.093% 24,267.90 57.28% 27,047.90

Unsecured Loans + 4,463.10 11.092% 2,779.00 6.56% 2,699.90

Total Debt 27,033.50 67.185% 27,046.90 63.84% 29,747.80

Policy Holders Fund 0 0.000% 0 0.00% 0

Other Liabilities+ 4,139.70 10.288% 4,345.60 10.26% 4,106.80

Total Liabilities 40,237.70 100.000% 42,363.70 100.00% 47,864.70

APPLICATION OF FUNDS :

Gross Block + 44,752.20 111.220% 46,756.20 110.37% 48,278.10

Less: Accumulated Depreciation+ 17,607.90 43.760% 19,852.90 46.86% 21,265.10

Less: Impairment of Assets 0 0.000% 0 0.00% 0

Net Block+ 27,144.30 67.460% 26,903.30 63.51% 27,013.00

Lease Adjustment 0 0.000% 0 0.00% 0

Capital Work in Progress+ 762 1.894% 1,771.00 4.18% 8,303.20

Producing Properties 0 0.000% 0 0.00% 0

Investments + 1,038.70 2.581% 1,154.40 2.72% 1,402.60

Current Assets, Loans & Advances

Inventories + 9,337.50 23.206% 9,367.90 22.11% 8,750.30

Sundry Debtors + 10,499.40 26.093% 13,350.80 31.51% 14,345.80

Cash and Bank+ 1,401.00 3.482% 2,362.50 5.58% 1,905.80

Loans and Advances + 3,577.00 8.890% 3,217.20 7.59% 4,603.70

Total Current Assets 24,814.90 61.671% 28,298.40 66.80% 29,605.60

Less : Current Liabilities and Provisions

Current Liabilities + 11,627.70 28.898% 13,862.50 32.72% 15,407.00

Provisions + 1,839.60 4.572% 1,675.70 3.96% 2,568.30

Total Current Liabilities 13,467.30 33.469% 15,538.20 36.68% 17,975.30

Net Current Assets 11,347.60 28.201% 12,760.20 30.12% 11,630.30

Miscellaneous Expenses not written off + 0 0.000% 0 0.00% 0

Deferred Tax Assets 463.3 1.151% 443.4 1.05% 326.3

Deferred Tax Liability 2,383.80 5.924% 2,967.60 7.01% 3,524.50

Net Deferred Tax -1,920.50 -4.773% -2,524.20 -5.96% -3,198.20

Other Assets+ 1,865.60 4.636% 2,299.00 5.43% 2,713.80

Total Assets 40,237.70 100.000% 42,363.70 100.00% 47,864.70

Contingent Liabilities+ 1,413.40 469.2 964.8

Company : JK Tyre & Industries Ltd

Industry : Tyres - Large

Common Size Income Sheet (Rs in Crs)

Mar 13 Mar 14 Mar 15

Year (12) (12) (12)

INCOME :

Sales Turnover + 6,002.16 100.00% 6,560.29 100.00% 6,784.37

Excise Duty 571.33 9.52% 609.21 9.29% 659.14

Net Sales 5,430.83 90.48% 5,951.08 90.71% 6,125.23

Other Income + 13.05 0.22% 17.44 0.27% 14.75

Stock Adjustments + 54.93 0.92% -24.14 -0.37% -47.4

Total Income 5,498.81 91.61% 5,944.38 90.61% 6,092.58

EXPENDITURE :

Raw Materials + 3,917.26 65.26% 4,012.40 61.16% 3,902.24

Power & Fuel Cost+ 215.5 3.59% 233.46 3.56% 243.59

Employee Cost + 333.72 5.56% 404.47 6.17% 459.48

Other Manufacturing Expenses + 113.66 1.89% 131.96 2.01% 146.89

Selling and Administration Expenses + 319.14 5.32% 396.16 6.04% 449.27

Miscellaneous Expenses + 130.04 2.17% 170.11 2.59% 134.06

Less: Pre-operative Expenses Capitalised+ 0 0.00% 0 0.00% 0

Total Expenditure 5,029.32 83.79% 5,348.56 81.53% 5,335.53

Operating Profit 469.49 7.82% 595.82 9.08% 757.05

Interest + 206.53 3.44% 248.3 3.78% 240.8

Gross Profit 262.96 4.38% 347.52 5.30% 516.25

Depreciation+ 112.65 1.88% 152.47 2.32% 139.14

Profit Before Tax 150.31 2.50% 195.05 2.97% 377.11

Tax+ 0.28 0.00% 0 0.00% 53.03

Fringe Benefit tax+ 0 0.00% 0 0.00% 0

Deferred Tax+ 44.49 0.74% 60.37 0.92% 70.78

Reported Net Profit 105.54 1.76% 134.68 2.05% 253.3

Extraordinary Items + -15.52 -0.26% -36.58 -0.56% -5.64

Adjusted Net Profit 121.06 2.02% 171.26 2.61% 258.94

Adjst. below Net Profit + 0 0.00% 0 0.00% 0

P & L Balance brought forward 38.52 0.64% 67.25 1.03% 102.91

Statutory Appropriations 0 0.00% 0 0.00% 0

Appropriations + 76.81 1.28% 99.02 1.51% 190.95

P & L Balance carried down 67.25 1.12% 102.91 1.57% 165.26

Dividend 14.37 0.24% 20.53 0.31% 34.02

Preference Dividend 0 0.00% 0 0.00% 0

Equity Dividend % 35 0.58% 50 0.76% 75

Dividend Per Share(Rs) 3.5 0.06% 5 0.08% 1.5

Earnings Per Share-Unit Curr 25.11 0.42% 31.95 0.49% 10.86

Earnings Per Share(Adj)-Unit Curr 5.02 0.08% 6.39 0.10% 10.86

Book Value-Unit Curr 175.32 2.92% 202.27 3.08% 48.13

Book Value(Adj)-Unit Curr 35.06 0.58% 40.45 0.62% 48.13

es Ltd

Mar 16 Mar 17

0.95% 453.6 0.90% 453.6 0.55%

28.32% 17,060.70 33.85% 19,194.20 23.25%

0.00% 0 0.00% 0 0.00%

0.00% 0 0.00% 0 0.00%

29.27% 17,514.30 34.75% 19,647.80 23.80%

0.00% 0 0.00% 1,450.10 1.76% ROA

56.51% 27,145.40 53.86% 49,566.30 60.04%

5.64% 1,852.70 3.68% 6,980.20 8.45% TAT

62.15% 28,998.10 57.54% 56,546.50 68.49%

0.00% 0 0.00% 0 0.00%

8.58% 3,886.90 7.71% 4,913.00 5.95%

100.00% 50,399.30 100.00% 82,557.40 100.00%

100.86% 60,566.90 120.17% 82,288.90 99.67%

44.43% 23,098.80 45.83% 24,405.90 29.56%

0.00% 0 0.00% 0 0.00% Total Asset

56.44% 37,468.10 74.34% 57,883.00 70.11%

0.00% 0 0.00% 0 0.00%

17.35% 1,057.20 2.10% 3,255.20 3.94%

0.00% 0 0.00% 0 0.00%

2.93% 1,603.10 3.18% 792.9 0.96%

18.28% 8,725.20 17.31% 13,204.20 15.99%

29.97% 14,027.10 27.83% 17,946.40 21.74%

3.98% 1,394.30 2.77% 2,953.00 3.58%

9.62% 3,364.00 6.67% 6,499.70 7.87%

61.85% 27,510.60 54.59% 40,603.30 49.18%

32.19% 14,644.40 29.06% 17,465.00 21.15%

5.37% 401 0.80% 357.3 0.43%

37.55% 15,045.40 29.85% 17,822.30 21.59%

24.30% 12,465.20 24.73% 22,781.00 27.59%

0.00% 0 0.00% 0 0.00%

0.68% 856.7 1.70% 2,152.30 2.61%

7.36% 5,932.50 11.77% 8,016.60 9.71%

-6.68% -5,075.80 -10.07% -5,864.30 -7.10%

5.67% 2,881.50 5.72% 3,709.60 4.49%

100.00% 50,399.30 100.00% 82,557.40 100.00%

619.6 595.7

es Ltd

Mar 16 Mar 17

(12) (12)

100.00% 6,510.03 100.00% 6,607.51 100.00%

9.72% 684.49 10.51% 628.39 9.51%

90.28% 5,825.54 89.49% 5,979.12 90.49%

0.22% 22.6 0.35% 167.71 2.54%

-0.70% -14.06 -0.22% 68.74 1.04%

89.80% 5,834.08 89.62% 6,215.57 94.07%

57.52% 3,344.62 51.38% 3,765.70 56.99%

3.59% 239.01 3.67% 231.58 3.50%

6.77% 536.34 8.24% 537.71 8.14%

2.17% 55.91 0.86% 57.2 0.87%

6.62% 353.13 5.42% 389.89 5.90% 4,580.14

1.98% 295.88 4.54% 322.63 4.88% 9,337.50

0.00% 0 0.00% 0 0.00% 0.4905103079

78.64% 4,824.89 74.11% 5,304.71 80.28%

11.16% 1,009.19 15.50% 910.86 13.79%

3.55% 236.09 3.63% 267.58 4.05%

7.61% 773.1 11.88% 643.28 9.74%

2.05% 172.3 2.65% 183.58 2.78%

5.56% 600.8 9.23% 459.7 6.96%

0.78% 80.66 1.24% 36.88 0.56%

0.00% 0 0.00% 0 0.00%

1.04% 95.65 1.47% 90.69 1.37%

3.73% 424.49 6.52% 332.13 5.03%

-0.08% -6.79 -0.10% 81.52 1.23%

3.82% 431.28 6.62% 250.61 3.79%

0.00% -6.93 -0.11% -11.55 -0.17%

1.52% 124.29 1.91% 357.83 5.42%

0.00% 0 0.00% 0 0.00%

2.81% 184.02 2.83% 206.7 3.13%

2.44% 357.83 5.50% 471.71 7.14%

0.50% 0 0.00% 0 0.00%

0.00% 0 0.00% 0 0.00%

1.11% 125 1.92% 125 1.89%

0.02% 2.5 0.04% 2.5 0.04%

0.16% 18.72 0.29% 14.64 0.22%

0.16% 18.72 0.29% 14.64 0.22%

0.71% 62.59 0.96% 73.81 1.12%

0.71% 62.59 0.96% 73.81 1.12%

0.0021583632

0.1070117385

0

0.0133553974

47,024.30

0.8383901955

56,088.80

9,064.50

6.1877433946

2013 2014 2015 2016 2017

9337.5 9,352.70 9,151.90 9,045.23 9877.02

2013 2014 2015 2016 2017

dividend pay out ratio 0.697211 0.782473 0.138122 0.133547 0.170765

operating cycle 1382.607 1532.679 1557.786 1669.483 1880.605

payable turnover 0.393899 0.375226 0.348596 0.300739 0.314505

accounts payable period 926.6334 972.7477 1047.057 1213.677 1160.553

cash cycle 455.9733 559.931 510.7288 455.806 720.0514

JK TYRES

Ratios Types 2013

current ratio 1.843

Liquidity quick ratio 1.149

cash ratio 0.104

total debt ratio 0.838

debt-equity ratio 5.188

Financial Leverage equity multiplier 6.188

times interest earned ratio 1.728

cash coverage ratio 2.273

inventory turnover 0.491

days sales in inventory 744.123

receivables turnover 0.572

Turnover

days sales in receivables 638.484

total asset turnover 0.107

capital intensity 9.345

profit margin 0.020

Profitability return on assets 0.002

return on equity 0.013

price-earning ratio 3.751

Market value

market to book ratio 400.136

JK TYRES

2014 2015 2016 2017

1.821 1.647 1.829 2.278

1.218 1.160 1.249 1.537

0.152 0.106 0.093 0.166

0.820 0.798 0.755 0.819

4.548 3.951 3.075 4.517

5.548 4.951 4.075 5.517

1.786 2.566 3.545 2.718

2.400 3.144 4.275 3.404

0.511 0.519 0.462 0.465

713.829 702.926 790.614 785.053

0.446 0.427 0.415 0.333

818.850 854.860 878.870 1095.552

0.108 0.098 0.091 0.061

9.278 10.224 10.964 16.405

0.026 0.038 0.066 0.038

0.003 0.004 0.006 0.002

0.016 0.018 0.025 0.013

5.518 8.987 4.503 8.900

10044.257 30011.974 6305.786 11103.639

JK Tyre & Industries Ltd

Industry : Tyres - Large

Year Mar 13 Mar 14 Mar 15 Mar 16 Mar 17

Cash Flow Summary

Cash and Cash Equivalents at Beginning of th 77.84 94.08 177.13 72.45 55.18

Net Cash from Operating Activities -101.18 562.51 586.8 815.08 163.87

Net Cash Used in Investing Activities -179.33 -218.5 -673.46 -474.2 -663.09

Net Cash Used in Financing Activities 296.75 -260.96 -18.02 -358.15 499.75

Net Inc/(Dec) in Cash and Cash Equivalent 16.24 83.05 -104.68 -17.27 0.53

Cash and Cash Equivalents at End of the year 94.08 177.13 72.45 55.18 55.71

Company : CEAT Ltd

Industry : Tyres - Large

Common Size Balance Sheet (Rs in Crs.)

Year Mar 13 Mar 14 Mar 15

SOURCES OF FUNDS :

Share Capital + 343.2 1.87% 359.6 1.59% 404.5

Reserves Total + 7,475.80 40.65% 9,926.50 43.83% 16,418.00

Equity Share Warrants 36.4 0.20% 0 0.00% 0

Equity Application Money 0 0.00% 0 0.00% 0

Total Shareholders Funds 7,855.40 42.72% 10,286.10 45.42% 16,822.50

Minority Interest 0 0.00% 362.9 1.60% 326.7

Secured Loans + 8,541.40 46.45% 9,467.80 41.81% 6,377.10

Unsecured Loans + 1,835.40 9.98% 2,270.10 10.02% 1,373.40

Total Debt 10,376.80 56.43% 11,737.90 51.83% 7,750.50

Policy Holders Fund 0 0.00% 0 0.00% 0

Other Liabilities+ 156.5 0.85% 260 1.15% 338

Total Liabilities 18,388.70 100.00% 22,646.90 100.00% 25,237.70

APPLICATION OF FUNDS :

Gross Block + 22,446.90 122.07% 23,267.60 102.74% 24,397.80

Less: Accumulated Depreciation+ 6,719.10 36.54% 7,617.00 33.63% 8,589.80

Less: Impairment of Assets 0 0.00% 0 0.00% 0

Net Block+ 15,727.80 85.53% 15,650.60 69.11% 15,808.00

Lease Adjustment 0 0.00% 0 0.00% 0

Capital Work in Progress+ 273.7 1.49% 823.1 3.63% 2,290.20

Producing Properties 0 0.00% 0 0.00% 0

Investments + 5.9 0.03% 0 0.00% 3,124.40

Current Assets, Loans & Advances

Inventories + 5,648.60 30.72% 7,535.80 33.28% 6,801.50

Sundry Debtors + 6,628.50 36.05% 7,545.30 33.32% 7,049.50

Cash and Bank+ 1,120.80 6.10% 1,678.70 7.41% 1,236.30

Loans and Advances + 1,212.80 6.60% 1,196.10 5.28% 989.4

Total Current Assets 14,610.60 79.45% 17,956.00 79.29% 16,076.60

Less : Current Liabilities and Provisions

Current Liabilities + 11,609.50 63.13% 10,823.00 47.79% 10,627.40

Provisions + 745.8 4.06% 782.2 3.45% 1,109.70

Total Current Liabilities 12,355.30 67.19% 11,605.30 51.24% 11,737.00

Net Current Assets 2,255.30 12.26% 6,350.70 28.04% 4,339.60

Miscellaneous Expenses not written off + 0 0.00% 0 0.00% 0

Deferred Tax Assets 579.3 3.15% 332.4 1.47% 384.9

Deferred Tax Liability 1,365.60 7.43% 1,480.80 6.54% 1,634.40

Net Deferred Tax -786.3 -4.28% -1,148.40 -5.07% -1,249.50

Other Assets+ 912.3 4.96% 970.8 4.29% 925

Total Assets 18,388.70 100.00% 22,646.90 100.00% 25,237.80

Contingent Liabilities+ 3,573.50 4,690.00 3,249.00

Company : CEAT Ltd

Industry : Tyres - Large

Common Size Income Statement (Rs in Crs.)

Mar 13 Mar 14 Mar 15

Year (12) (12) (12)

INCOME :

Sales Turnover + 5,349.77 100.00% 5,896.80 100.00% 6,132.92

Excise Duty 468.33 8.75% 541.99 9.19% 591.5

Net Sales 4,881.44 91.25% 5,354.81 90.81% 5,541.42

Other Income + 21.48 0.40% 20.54 0.35% 28.87

Stock Adjustments + 34.19 0.64% 105.86 1.80% -56.27

Total Income 4,937.11 92.29% 5,481.21 92.95% 5,514.02

EXPENDITURE :

Raw Materials + 3,411.97 63.78% 3,573.09 60.59% 3,378.75

Power & Fuel Cost+ 166.77 3.12% 172.67 2.93% 161.37

Employee Cost + 269.1 5.03% 289.07 4.90% 355.98

Other Manufacturing Expenses + 221.9 4.15% 297.29 5.04% 405.88

Selling and Administration Expenses + 359.7 6.72% 424.98 7.21% 455.47

Miscellaneous Expenses + 90.98 1.70% 80.58 1.37% 85.33

Less: Pre-operative Expenses Capitalised+ 0 0.00% 0 0.00% 0

Total Expenditure 4,520.42 84.50% 4,837.67 82.04% 4,842.79

Operating Profit 416.69 7.79% 643.53 10.91% 671.23

Interest + 192.79 3.60% 183.76 3.12% 140.52

Gross Profit 223.9 4.19% 459.77 7.80% 530.71

Depreciation+ 78.16 1.46% 82.63 1.40% 87.85

Profit Before Tax 145.74 2.72% 377.14 6.40% 442.86

Tax+ -1.71 -0.03% 88.78 1.51% 132.49

Fringe Benefit tax+ 0 0.00% 0 0.00% 0

Deferred Tax+ 41.09 0.77% 34.57 0.59% 11.4

Reported Net Profit 106.35 1.99% 253.78 4.30% 298.97

Extraordinary Items + -12.62 -0.24% -6.61 -0.11% -4.7

Adjusted Net Profit 118.97 2.22% 260.39 4.42% 303.67

Adjst. below Net Profit + 0 0.00% 0 0.00% 0

P & L Balance brought forward 253.55 4.74% 332.87 5.64% 519.37

Statutory Appropriations 0 0.00% 0 0.00% 0

Appropriations + 27.03 0.51% 67.28 1.14% 45.33

P & L Balance carried down 332.87 6.22% 519.37 8.81% 773.02

Dividend 13.7 0.26% 36.64 0.62% 40.45

Preference Dividend 0 0.00% 0 0.00% 0

Equity Dividend % 40 0.75% 100 1.70% 100

Dividend Per Share(Rs) 4 0.07% 10 0.17% 10

Earnings Per Share-Unit Curr 30.38 0.57% 69.12 1.17% 72.71

Earnings Per Share(Adj)-Unit Curr 30.38 0.57% 69.12 1.17% 72.71

Book Value-Unit Curr 216.98 4.06% 268.97 4.56% 395.19

Book Value(Adj)-Unit Curr 216.98 4.06% 268.97 4.56% 395.19

Mar 16 Mar 17

1.60% 404.5 1.45% 404.5 1.18%

65.05% 20,142.90 72.10% 23,745.00 69.11%

0.00% 0 0.00% 0 0.00%

0.00% 0 0.00% 0 0.00%

66.66% 20,547.40 73.55% 24,149.50 70.29%

1.29% 322.4 1.15% 291.5 0.85%

25.27% 5,847.30 20.93% 8,653.00 25.19%

5.44% 784.5 2.81% 587 1.71%

30.71% 6,631.80 23.74% 9,240.00 26.89%

0.00% 0 0.00% 0 0.00%

1.34% 434.1 1.55% 676.4 1.97%

100.00% 27,935.70 100.00% 34,357.40 100.00%

96.67% 21,393.80 76.58% 27,017.00 78.63%

34.04% 1,073.10 3.84% 2,491.70 7.25%

0.00% 0 0.00% 0 0.00%

62.64% 20,320.70 72.74% 24,525.30 71.38%

0.00% 0 0.00% 0 0.00%

9.07% 2,990.80 10.71% 3,262.60 9.50%

0.00% 0 0.00% 0 0.00%

12.38% 1,954.90 7.00% 2,316.00 6.74%

26.95% 6,397.10 22.90% 9,434.80 27.46%

27.93% 5,935.10 21.25% 6,138.00 17.87%

4.90% 630.3 2.26% 359.2 1.05%

3.92% 1,567.40 5.61% 1,845.00 5.37%

63.70% 14,529.90 52.01% 17,777.00 51.74%

42.11% 10,723.20 38.39% 12,598.40 36.67%

4.40% 838.7 3.00% 764.3 2.22%

46.51% 11,561.80 41.39% 13,362.80 38.89%

17.19% 2,968.10 10.62% 4,414.30 12.85%

0.00% 0 0.00% 0 0.00%

1.53% 0 0.00% 0 0.00%

6.48% 1,582.00 5.66% 2,133.50 6.21%

-4.95% -1,582.00 -5.66% -2,133.50 -6.21%

3.67% 1,283.10 4.59% 1,972.80 5.74%

100.00% 27,935.60 100.00% 34,357.50 100.00%

3,026.90 3,132.70

Mar 16 Mar 17

(12) (12)

100.00% 6,118.73 100.00% 6,376.52 100.00%

9.64% 663.68 10.85% 674.79 10.58%

90.36% 5,455.05 89.15% 5,701.73 89.42%

0.47% 46.09 0.75% 41.46 0.65%

-0.92% 2.32 0.04% 76.15 1.19%

89.91% 5,503.46 89.94% 5,819.34 91.26%

55.09% 3,091.95 50.53% 3,451.43 54.13%

2.63% 155.88 2.55% 177.9 2.79%

5.80% 380.45 6.22% 397.18 6.23%

6.62% 474.99 7.76% 485.1 7.61%

7.43% 469.99 7.68% 499.14 7.83%

1.39% 96.09 1.57% 113.19 1.78%

0.00% 0 0.00% 0 0.00%

78.96% 4,669.37 76.31% 5,123.94 80.36%

10.94% 834.1 13.63% 695.39 10.91%

2.29% 99.46 1.63% 86.73 1.36%

8.65% 734.64 12.01% 608.66 9.55%

1.43% 106.84 1.75% 142.01 2.23%

7.22% 627.8 10.26% 466.65 7.32%

2.16% 150.58 2.46% 46.03 0.72%

0.00% 0 0.00% 0 0.00%

0.19% 32.04 0.52% 57.9 0.91%

4.87% 445.18 7.28% 362.73 5.69%

-0.08% -4.4 -0.07% -10.12 -0.16%

4.95% 449.58 7.35% 372.85 5.85%

0.00% -96.92 -1.58% -3.16 -0.05%

8.47% 775.84 12.68% 1,107.43 17.37%

0.00% 0 0.00% 0 0.00%

0.74% 16.67 0.27% 16.67 0.26%

12.60% 1,107.43 18.10% 1,450.32 22.74%

0.66% 0 0.00% 0 0.00%

0.00% 0 0.00% 0 0.00%

1.63% 115 1.88% 115 1.80%

0.16% 11.5 0.19% 11.5 0.18%

1.19% 110.06 1.80% 89.67 1.41%

1.19% 110.06 1.80% 89.67 1.41%

6.44% 481.84 7.87% 570.12 8.94%

6.44% 481.84 7.87% 570.12 8.94%

2013 2014 2015 2016 2017

avg inventory 6592.2 6,661.97 5,276.60 7,163.56

CEAT TYRES

Ratios Types 2013

current ratio 1.183

Liquidity quick ratio 0.725

cash ratio 0.091

total debt ratio 0.755

debt-equity ratio 3.088

Financial Leverage equity multiplier 4.088

times intrest earned ratio 1.756

cash coverage ratio 2.161

inventory turnover 0.720

days sales in inventory 506.602

receivables turnover 0.807

Turnover

days sales in receivables 452.244

total asset turnover 0.167

capital intensity 6.002

profit margin 0.022

Profitability return on assets 0.004

return on equity 0.015

price-earning ratio 2.936

Market value

market to book ratio 1304.025

CEAT TYRES

2014 2015 2016 2017

1.547 1.370 1.257 1.330

0.898 0.790 0.703 0.624

0.145 0.105 0.055 0.027

0.712 0.564 0.500 0.516

2.474 1.295 0.999 1.064

3.474 2.295 1.999 2.064

3.052 4.152 7.312 6.380

3.502 4.777 8.386 8.018

0.657 0.646 0.778 0.630

555.422 565.232 469.372 579.549

0.782 0.870 1.031 1.039

467.039 419.550 354.046 351.347

0.165 0.159 0.149 0.128

6.060 6.295 6.714 7.818

0.044 0.050 0.073 0.058

0.007 0.008 0.011 0.007

0.025 0.018 0.022 0.015

6.409 10.673 9.642 14.720

26438.307 22908.341 26110.570 29920.047

2013 2014 2015 2016 2017

dividend ratio 0.131666 0.144676 0.137533 0.104488 0.128248

operating cycle 958.8464 1022.46 984.7824 823.4177 930.8959

payable turnover 0.350553 0.386236 0.39038 0.374872 0.400097

accounts payable period 1041.213 945.018 934.9852 973.6644 912.2795

cash cycle -82.367 77.44244 49.79715 -150.247 18.61635

CEAT Ltd

Industry : Tyres - Large

Year Mar 13 Mar 14 Mar 15 Mar 16 Mar 17

Cash Flow Summary

Cash and Cash Equivalents at Beginning of th 28.59 67.63 93.26 44.46 11.42

Net Cash from Operating Activities 556.98 155.24 705.21 718.5 344.08

Net Cash Used in Investing Activities -64.21 -98.02 -258.73 -412.04 -419.04

Net Cash Used in Financing Activities -453.74 -31.59 -177.21 -339.5 77.8

Net Inc/(Dec) in Cash and Cash Equivalent 39.03 25.63 269.27 -33.04 2.83

Cash and Cash Equivalents at End of the year 67.62 93.26 362.53 11.42 14.25

You might also like

- Colibri - DEMSU P01 PDFDocument15 pagesColibri - DEMSU P01 PDFRahul Solanki100% (4)

- Swot & Vrio Tata Steel 2Document9 pagesSwot & Vrio Tata Steel 2Sowmya NamburuNo ratings yet

- Swot & Vrio Tata Steel 2Document9 pagesSwot & Vrio Tata Steel 2Sowmya NamburuNo ratings yet

- 4thsession - RIL Bonds CaseDocument6 pages4thsession - RIL Bonds CaseVignesh_230% (2)

- Midterm Exam StatconDocument4 pagesMidterm Exam Statconlhemnaval100% (4)

- Company Finance Balance Sheet (Rs in CRS.)Document18 pagesCompany Finance Balance Sheet (Rs in CRS.)Tanya MansiNo ratings yet

- Group 7-Ratio AnalysisDocument439 pagesGroup 7-Ratio AnalysisKritika JalanNo ratings yet

- HDFC ValuationDocument112 pagesHDFC ValuationAmit Kumar PaswanNo ratings yet

- Company Finance Profit & Loss (Rs in CRS.) : Company: ACC LTD Industry: Cement - Major - North IndiaDocument26 pagesCompany Finance Profit & Loss (Rs in CRS.) : Company: ACC LTD Industry: Cement - Major - North IndiaAbhinavSagarNo ratings yet

- Company Finance Balance Sheet (Rs in CRS.)Document13 pagesCompany Finance Balance Sheet (Rs in CRS.)Dinesh SharmaNo ratings yet

- Company Finance Balance Sheet Consolidated (Rs in CRS.)Document11 pagesCompany Finance Balance Sheet Consolidated (Rs in CRS.)Chirag GugnaniNo ratings yet

- Capital + Reserves Total +: Company Finance Balance Sheet (Rs in CRS.)Document58 pagesCapital + Reserves Total +: Company Finance Balance Sheet (Rs in CRS.)Lovish SoienNo ratings yet

- Calculation For Shahdad Textiles LTDDocument12 pagesCalculation For Shahdad Textiles LTDSaeed Ahmed (Father Name:Jamal Ud Din)No ratings yet

- Company Finance Balance Sheet Consolidated (Rs in CRS.)Document3 pagesCompany Finance Balance Sheet Consolidated (Rs in CRS.)rohanNo ratings yet

- Year Latest 2017 2016 2015 2014 2013 2012 2011 2010 2009 Key RatiosDocument11 pagesYear Latest 2017 2016 2015 2014 2013 2012 2011 2010 2009 Key Ratiospriyanshu14No ratings yet

- Company Finance Profit & Loss (Rs in CRS.) : Company: ITC LTD Industry: CigarettesDocument16 pagesCompany Finance Profit & Loss (Rs in CRS.) : Company: ITC LTD Industry: CigarettesAnimesh GuptaNo ratings yet

- Income Statement 2018-2019 %: Sources of FundsDocument8 pagesIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeNo ratings yet

- Oil and Natural Gas CorporationDocument43 pagesOil and Natural Gas CorporationNishant SharmaNo ratings yet

- Company Finance Balance Sheet (Rs in CRS.)Document2 pagesCompany Finance Balance Sheet (Rs in CRS.)akshathaNo ratings yet

- Company Finance Balance Sheet (Rs in CRS.) : Company: ITC LTD Industry: CigarettesDocument9 pagesCompany Finance Balance Sheet (Rs in CRS.) : Company: ITC LTD Industry: CigarettesAnimesh GuptaNo ratings yet

- Term Paper Sandeep Anurag GautamDocument13 pagesTerm Paper Sandeep Anurag GautamRohit JainNo ratings yet

- Bank ValuationDocument88 pagesBank Valuationsnithisha chandranNo ratings yet

- Titan Company TemplateDocument18 pagesTitan Company Templatesejal aroraNo ratings yet

- Illustration Acc FMDocument22 pagesIllustration Acc FMHEMACNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- Hindustan Unilever LTD Industry:Personal Care - MultinationalDocument17 pagesHindustan Unilever LTD Industry:Personal Care - MultinationalZia AhmadNo ratings yet

- Dabur ValuationDocument41 pagesDabur Valuationashwini patilNo ratings yet

- Group 1 Adani PortsDocument12 pagesGroup 1 Adani PortsshreechaNo ratings yet

- Bank of BarodaDocument22 pagesBank of BarodaShivane SivakumarNo ratings yet

- Assignment of Accounting For ManagersDocument17 pagesAssignment of Accounting For ManagersGurneet KaurNo ratings yet

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNo ratings yet

- Powergrid: Yash Bhuthada SAP ID - 74011919001Document32 pagesPowergrid: Yash Bhuthada SAP ID - 74011919001YASH BHUTADANo ratings yet

- CV Assignment - Agneesh DuttaDocument9 pagesCV Assignment - Agneesh DuttaAgneesh DuttaNo ratings yet

- CV Assignment - Agneesh DuttaDocument14 pagesCV Assignment - Agneesh DuttaAgneesh DuttaNo ratings yet

- KPR MillsDocument32 pagesKPR MillsSatyam1771No ratings yet

- 17pgp216 ApolloDocument5 pages17pgp216 ApolloVamsi GunturuNo ratings yet

- WiproDocument9 pagesWiprorastehertaNo ratings yet

- MKT Ca1Document96 pagesMKT Ca1Nainpreet KaurNo ratings yet

- Relaxo Footwear - Updated BSDocument54 pagesRelaxo Footwear - Updated BSRonakk MoondraNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- Khushboo Tomar Altman Zscore FinalDocument9 pagesKhushboo Tomar Altman Zscore FinalKHUSHBOO TOMARNo ratings yet

- Hexaware Valuation - Group 3 - Sec-ADocument50 pagesHexaware Valuation - Group 3 - Sec-ARahulTiwariNo ratings yet

- Answer To The Question No 1 (I) ACI Group of Company Balance Sheet (Vertical Analysis) For The Years Ended June 30, 2019Document4 pagesAnswer To The Question No 1 (I) ACI Group of Company Balance Sheet (Vertical Analysis) For The Years Ended June 30, 2019Estiyak JahanNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- Fsa B-32Document24 pagesFsa B-32Pihu MouryaNo ratings yet

- Revenue 3. Net Revenue 5. Gross ProfitDocument3 pagesRevenue 3. Net Revenue 5. Gross ProfitPhuong Anh NguyenNo ratings yet

- Balance Sheet - in Rs. Cr.Document72 pagesBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- NilkamalDocument14 pagesNilkamalNandish KothariNo ratings yet

- Accounts Cia: Submitted By: RISHIKESH DHIR (1923649) PARKHI GUPTA (1923643)Document12 pagesAccounts Cia: Submitted By: RISHIKESH DHIR (1923649) PARKHI GUPTA (1923643)RISHIKESH DHIR 1923649No ratings yet

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument4 pagesApollo Hospitals Enterprise Limitedpaigesh1No ratings yet

- Institute Program Year Subject Project Name Company Competitor CompanyDocument37 pagesInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiNo ratings yet

- ICICI Bank Is IndiaDocument6 pagesICICI Bank Is IndiaHarinder PalNo ratings yet

- Rs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37Document6 pagesRs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37priyanshu14No ratings yet

- Fsa GroupDocument25 pagesFsa Groupakarshika raiNo ratings yet

- Company Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Document14 pagesCompany Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Sujay SinghviNo ratings yet

- Finance Using Excel RJDocument27 pagesFinance Using Excel RJVishal NigamNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Working Capital Management - docx.PDF 20231102 130330 0000Document3 pagesWorking Capital Management - docx.PDF 20231102 130330 0000Aarti SharmaNo ratings yet

- JL22PG002 NMDCDocument35 pagesJL22PG002 NMDCHemendra GuptaNo ratings yet

- CHAPTER - 4 Data Analysis and InterpretationDocument12 pagesCHAPTER - 4 Data Analysis and InterpretationSarva ShivaNo ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- KPR Phase - 1Document23 pagesKPR Phase - 1Satyam1771No ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Interim ReportDocument22 pagesInterim ReportSowmya NamburuNo ratings yet

- CandlestickDocument24 pagesCandlestickSowmya NamburuNo ratings yet

- Discriminant AnalysisDocument16 pagesDiscriminant Analysisazam49100% (1)

- Project Report On "ANALYTICAL STUDY OF IMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIS) ON EXCHANGE RATE AND VALUE OF INDIAN NATIONAL RUPEE (INR) IN TERMS OF VOLATILITY"Document93 pagesProject Report On "ANALYTICAL STUDY OF IMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIS) ON EXCHANGE RATE AND VALUE OF INDIAN NATIONAL RUPEE (INR) IN TERMS OF VOLATILITY"Jayantkumar Kumbhare92% (12)

- Capacity ManagementDocument27 pagesCapacity ManagementSowmya NamburuNo ratings yet

- $6400, Which Is Less Than Competitor's 4 Zink Servers' Price-$6800Document1 page$6400, Which Is Less Than Competitor's 4 Zink Servers' Price-$6800Sowmya NamburuNo ratings yet

- Technical Kit FinalDocument71 pagesTechnical Kit FinalSowmya NamburuNo ratings yet

- Simple Regression - ProblemsDocument3 pagesSimple Regression - ProblemsSowmya NamburuNo ratings yet

- Operations & Supply Planning: Demand ForecastingDocument9 pagesOperations & Supply Planning: Demand ForecastingSowmya NamburuNo ratings yet

- TacticalDocument3 pagesTacticalSowmya NamburuNo ratings yet

- RegressionDocument17 pagesRegressionSowmya NamburuNo ratings yet

- RegressionDocument17 pagesRegressionSowmya NamburuNo ratings yet

- Atlantic Computers: Pricing For Atlantic Bundle Student # S01180176 Mailbox # 2052Document6 pagesAtlantic Computers: Pricing For Atlantic Bundle Student # S01180176 Mailbox # 2052Sowmya NamburuNo ratings yet

- RegressionDocument17 pagesRegressionSowmya NamburuNo ratings yet

- Chapter 4 AnswersDocument5 pagesChapter 4 AnswersSowmya NamburuNo ratings yet

- Course Handout - Marketing Management - IIDocument7 pagesCourse Handout - Marketing Management - IISowmya NamburuNo ratings yet

- AtlanticDocument6 pagesAtlanticSowmya NamburuNo ratings yet

- Case 5 Answer 5Document1 pageCase 5 Answer 5Sowmya NamburuNo ratings yet

- Mobile Smart Card ReaderDocument14 pagesMobile Smart Card ReaderSowmya NamburuNo ratings yet

- Sewing Machins Operations ManualDocument243 pagesSewing Machins Operations ManualjemalNo ratings yet

- Ting Vs Heirs of Lirio - Case DigestDocument2 pagesTing Vs Heirs of Lirio - Case DigestJalieca Lumbria GadongNo ratings yet

- Auto Report LogDocument3 pagesAuto Report LogDaniel LermaNo ratings yet

- Revenue Management Session 1: Introduction To Pricing OptimizationDocument55 pagesRevenue Management Session 1: Introduction To Pricing OptimizationDuc NguyenNo ratings yet

- Central Banking and Monetary PolicyDocument13 pagesCentral Banking and Monetary PolicyLuisaNo ratings yet

- Failure of A Gasket During A Hydrostatic TestDocument7 pagesFailure of A Gasket During A Hydrostatic TesthazopmanNo ratings yet

- T&B Detailed Plan: Ceiling LineDocument1 pageT&B Detailed Plan: Ceiling LineKuthbert NoceteNo ratings yet

- Expected MCQs CompressedDocument31 pagesExpected MCQs CompressedAdithya kesavNo ratings yet

- WPGPipingIndex Form 167 PDFDocument201 pagesWPGPipingIndex Form 167 PDFRaj AryanNo ratings yet

- A.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdDocument6 pagesA.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdCharisse SarateNo ratings yet

- Oasis 360 Overview 0710Document21 pagesOasis 360 Overview 0710mychar600% (1)

- List of Light Commercial LED CodesDocument8 pagesList of Light Commercial LED CodesRenan GonzalezNo ratings yet

- Contemp World Module 2 Topics 1 4Document95 pagesContemp World Module 2 Topics 1 4Miguel EderNo ratings yet

- IIBA Academic Membership Info-Sheet 2013Document1 pageIIBA Academic Membership Info-Sheet 2013civanusNo ratings yet

- BS As On 23-09-2023Document28 pagesBS As On 23-09-2023Farooq MaqboolNo ratings yet

- Mix Cases UploadDocument4 pagesMix Cases UploadLu CasNo ratings yet

- 11 TR DSU - CarrierDocument1 page11 TR DSU - Carriercalvin.bloodaxe4478100% (1)

- Adjectives With Cork English TeacherDocument19 pagesAdjectives With Cork English TeacherAlisa PichkoNo ratings yet

- Learner Guide HDB Resale Procedure and Financial Plan - V2Document0 pagesLearner Guide HDB Resale Procedure and Financial Plan - V2wangks1980No ratings yet

- Options Trading For Beginners Aug15 v1Document187 pagesOptions Trading For Beginners Aug15 v1Glo BerriNo ratings yet

- Criminal Law I Green Notes PDFDocument105 pagesCriminal Law I Green Notes PDFNewCovenantChurchNo ratings yet

- Tech Mahindra Sample Verbal Ability Placement Paper Level1Document11 pagesTech Mahindra Sample Verbal Ability Placement Paper Level1Madhav MaddyNo ratings yet

- Simplified Concrete Modeling: Mat - Concrete - Damage - Rel3Document14 pagesSimplified Concrete Modeling: Mat - Concrete - Damage - Rel3amarNo ratings yet

- Computer System Sevicing NC Ii: SectorDocument44 pagesComputer System Sevicing NC Ii: SectorJess QuizzaganNo ratings yet

- A Case On Product/brand Failure:: Kellogg's in IndiaDocument6 pagesA Case On Product/brand Failure:: Kellogg's in IndiaVicky AkhilNo ratings yet

- MPPWD 2014 SOR CH 1 To 5 in ExcelDocument66 pagesMPPWD 2014 SOR CH 1 To 5 in ExcelElvis GrayNo ratings yet

- DFUN Battery Monitoring Solution Project Reference 2022 V5.0Document50 pagesDFUN Battery Monitoring Solution Project Reference 2022 V5.0A Leon RNo ratings yet

- Karmex 80df Diuron MsdsDocument9 pagesKarmex 80df Diuron MsdsSouth Santee Aquaculture100% (1)