Professional Documents

Culture Documents

CCME GH Research

Uploaded by

wctbillsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CCME GH Research

Uploaded by

wctbillsCopyright:

Available Formats

Global Hunter Securities, LLC August 16, 2010

Fort Worth Houston Los Angeles New York Company Update

Newport Beach New Orleans San Francisco China

Institutional Sales & Trading: (949) 274-8050

Research: (949) 274-8052 Senior Analyst: Ping Luo, CFA

www.ghsecurities.com pluo@ghsecurities.com

Direct: (212) 644-8913

Associate Analyst: Jodi Dai

jdai@ghsecurities.com

Direct: (212) 644-8913

Rating: Buy

Price Target: $21.00

China MediaExpress Holdings, Inc.

(Nasdaq: CCME)

Price Target M etrics: 9x P/E (2010)

Event: Strong Q2 results. Raising estimates and price target; Reiterate Buy.

Current Price: $10.68

Diluted Shares: 35.8MM Summary: China MediaExpress (CCME) reported strong Q2 results which highlighted an

Float: 27% impressive gross margin improvement due to greater contribution from higher-margin airport

Short Interest: 1.9MM express buses. The company continued to expand its network by adding new buses and

Average Daily Volume: 340k operators into its system. The company also generated strong operating cash flow of $25MM in

52-w eek Range: $7.51-$14.82 the quarter and further strengthened its balance sheet. With $139MM in net cash, management

Market Cap: $383MM expressed the consideration of various options to improve shareholder’s value. We expect

Cash & Investments: $139MM continued growth as the company further expands its inter-city and airport bus network and

Debt: $0MM explores value-added services. Despite a strong 1H, CCME reiterated its prior FY10 net income

Enterprise Value: $243MM guidance, which we view as conservative. We are raising our ’10 and ’11 EPS estimates. We

Net Cash/Sh: $3.89 believe shares are considerably undervalued, trading at just 4.5x our ’10 EPS estimate. Thus,

Tangible Book Value/Sh: $4.21 we reiterate our Buy rating and raise our 12-month price target from $18 to $21, representing

PR IC E C HA R T 9x our new ’10 EPS estimate.

$16 4,000

$14 3,500

Highlights

$12 3,000

$10 2,500

Strong Q2 results. Q2 revenue of $53.5MM was roughly in line with our $55.1MM estimate and represented

$8 2,000

over 180% YoY growth and 20% QoQ growth, driven mainly by expansion in network coverage. Net income

$6 1,500 of $28.5MM or $0.80 per share (based on 35.8MM diluted shares) was far ahead of our estimate of

$4 1,000 $21.5MM or $0.53 per share (based on 40.5MM diluted shares). In Q2, the company continued to expand its

$2 500

network. It increased the number of bus operators and number of buses from 46 and 20,422 at the end of Q1

$0 0

09/

01

09/

11

09/

21

0

1

/

1

0

1

/

2

0

1

/

3

0

1

/

4

0

1

/

5

0

1

/

6

0

1

/

7

to 59 and 22,775 at the end of Q2, respectively. At present, the company has its programs running on over

23,200 express buses with 61 bus operators. Airport express buses that CCME just started reporting in Q1

EST IM A T ES - U S $ ( M M s excep t mult ip les & EPS) contributed $13.1MM or 24% to total revenue, representing an 87% QoQ growth. CCME currently covers the

FY 0 9 F Y 10 F Y 10 F Y 11 F Y 11 airports in Guangzhou, Fuzhou, Beijing, and Qingdao.

Pr io r N ew Pr io r N ew

R evenues

Gross margin shines. The EPS outperformance in Q2 was largely due to an impressive gross margin of

Q1 M ar $ 18.8 A $ 44.5 $ 44.5 A $ 59.0 $ 60.1 E 79%, representing a significant improvement from 62% in 2Q09 and 60% in Q1, and compared to our

Q2 Jun $ 19.1 A $ 55.1 $ 53.5 A $ 67.0 $ 67.6 E estimate of 64%. We believe the higher than expected gross margin was primarily attributed to increased

Q3 Sep $ 26.1 A $ 55.6 $ 55.7 E $ 78.0 $ 77.7 E weight of airport express buses (24% of Q2 revenue versus 16% in Q1) which carries much higher margins

Q4 Dec $ 32.0 A $ 56.3 $ 57.3 E $ 84.0 $ 82.7 E

(over 80% versus ~60% for inter-city express buses). Management expects gross margin to stay at

FY $ 95.9 A $ 211.5 $ 211.0 E $ 288.0 $ 288.1 E

approximately 70% in 2H.

EV / Sales 2 .5x 1.2 x 0 .8 x

Strong balance sheet and cash flow. The company generated strong operating cash flow of $25MM for Q2

EPS, D ilut ed and $38MM for 1H. As of the end of Q2, CCME had $139MM in cash and no debt, up from $114MM net

Q1 M ar $ 0.36 A $ 0.54 $ 0.54 A $ 0.49 $ 0.55 E cash at the end of Q1. In regards to the use of cash, management plans to deploy $10MM for equipment

Q2 Jun $ 0.40 A $ 0.53 $ 0.80 A $ 0.55 $ 0.62 E

upgrades and repairment, $10MM-$20MM to acquire operating rights from other media companies, and

Q3 Sep $ 0.56 A $ 0.51 $ 0.59 E $ 0.65 $ 0.71 E

Q4 Dec $ 0.49 A $ 0.46 $ 0.48 E $ 0.61 $ 0.66 E $10MM-$20MM to implement a new value-added service project (on-bus brochures). With plenty of cash on

FY $ 1.81 A $ 2.03 $ 2.38 E $ 2.30 $ 2.55 E its balance sheet, management mentioned that the board is considering various options to maximize

P/ E 5.9 x 4 .5x 4 .2 x shareholder’s value, weighing alternatives such as a share buyback, dividend distribution, and investment

into future expansion.

EB IT D A ( A d just ed ; see mo d el)

Q1 M ar $ 11.3 A $ 25.2 $ 25.3 A $ 31.9 $ 35.7 E

FY10 guidance appears conservative. Management expressed confidence in continuing to expand its

Q2 Jun $ 11.9 A $ 29.5 $ 39.2 A $ 36.1 $ 40.2 E network while keeping concession fees stable. However, management also cited uncertainty in China’s

Q3 Sep $ 16.3 A $ 29.8 $ 30.8 E $ 41.9 $ 46.1 E economic outlook in 2H and potential increases in costs of new projects as a basis for prudence. Therefore,

Q4 Dec $ 20.4 A $ 30.2 $ 31.5 E $ 45.0 $ 49.0 E

despite an impressive Q2, the company reaffirmed its prior FY10 guidance of $82MM-$85MM in adjusted net

FY $ 59.9 A $ 114.7 $ 126.9 E $ 154.9 $ 171.0 E

income (excluding acquisitions and non-cash charges), which we view as conservative.

EV / EB IT D A 4 .1x 1.9 x 1.4 x

Raising estimates. We maintained our ’10 and ’11 revenue projection at $211MM (120% YoY) and

$288MM (36% YoY), respectively. We increased our gross margin assumption from 59% to approximately

64%-65% for the next six quarters, on increased revenue from higher margin airport buses. This is below the

roughly 70% gross margin management is projecting. We remain conservative considering potential cost

increases associated with new concession rights contracts with new bus operators, lump sum payments for

acquisitions, and renewal of existing contracts when they start to expire in ’11. Our ‘10 net income estimate

was increased from $83MM to $92MM based on the upside in Q2 and a higher gross margin, and our ’10

EPS estimate was raised from $2.03 to $2.38. We also increased our ’11 net income estimate from $113MM

to $126MM, and our ’11 EPS estimate from $2.30 to $2.55.

Reiterate Buy rating and increasing price target to $21. We expect CCME’s impressive growth

momentum to continue in 2H10 and 2011, as the company expands its network and explores value added

services and new strategic initiatives. Shares are trading at just 4.5x our updated ‘10 EPS estimate, which

we believe is considerably undervalued given an average forward P/E of 20x and median P/E of 10x in the

peer group. We reiterate our Buy rating and raise our price target from $18 to $21, which reflects a 9x P/E

multiple based on our updated ‘10 EPS estimate of $2.38.

Company Description: China MediaExpress provides TV advertising network on inter-city express buses

and airport buses in China.

SEE ANALYST CERTIFICATION AND OTHER IMPORTANT DISCLOSURES AT THE END OF THIS REPORT

China MediaExpress Holdings, Inc. (Nasdaq:CCME) Financial Model

Global Hunter Securities, LLC

China MediaExpress Holdings, Inc. (CCME)

Global Hunter Securities, LLC

Research Department: 949-274-8052

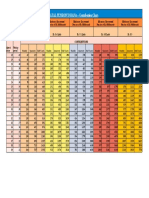

Fiscal period FY'06 (A) FY'07(A) FY '08(A) Q1 '09(A) Q2 '09(A) Q3 '09(A) Q4 '09(A) FY '09(A) Q1 '10(A) Q2 '10(A) Q3 '10(E) Q4 '10(E) FY '10(E) Q1 '11(E) Q2 '11(E) Q3 '11(E) Q4 '11(E) FY '11(E)

Period ends Dec '06 Dec '07 Dec '08 Mar '09 Jun '09 Sep '09 Dec '09 Dec '09 Mar '10 Jun '10 Sep '10 Dec '10 Dec '10 Mar '11 Jun '11 Sep '11 Dec '11 Dec '11

Income Statement (U.S.$000s)

Total revenue from inter-city buses 4,035 25,837 62,999 18,769 19,092 26,122 31,951 95,934 37,525 40,411 42,200 43,600 163,736 45,900 54,700 61,220 65,200 227,020

Revenue from airport buses - - - - - - - - 7,000 13,100 13,500 13,700 47,300 14,200 15,200 16,500 17,500 63,400

Total revenue 44,525 53511 55,700 57,300 211,036 60,100 67,600 77,720 82,700 288,120

Revenue 4,035 25,837 62,999 18,769 19,092 26,122 31,951 95,934 44,525 53,511 55,700 57,300 211,036 60,100 67,600 77,720 82,700 288,120

Cost Of Goods Sold 1,446 12,427 23,002 7,133 7,229 8,630 6,736 29,728 17,931 11,398 20,331 20,628 70,288 21,035 23,660 27,202 28,945 100,842

Gross Profit 2,589 13,410 39,997 11,636 11,863 17,492 25,215 66,206 26,594 42,113 35,370 36,672 140,749 39,065 43,940 50,518 53,755 187,278

Selling General & Admin Exp. 916 1,657 2,813 1,101 778 1,959 2,516 6,354 2,353 3,815 5,500 6,100 17,768 4,300 4,732 5,440 5,789 20,261

Other Operating Expense/(Income) 87 737 2,063 - - - 3,209 3,209 - - - - - - - - - -

Operating Expenses 1,003 2,394 4,876 1,101 778 1,959 5,725 9,563 2,353 3,815 5,500 6,100 17,768 4,300 4,732 5,440 5,789 20,261

Operating Income 1,586 11,016 35,121 10,535 11,085 15,533 19,490 56,643 24,241 38,298 29,870 30,572 122,981 34,765 39,208 45,078 47,966 167,017

Interest Expense - - - - - - - - - - - - - - - - -

Interest and Invest. Income 8 24 100 22 21 27 43 113 61 84 90 90 325 100 100 100 100 400

Net Interest Income (Exp) 8 24 100 22 21 27 43 113 61 100 100 100 361 100 100 100 100 400

EBT 1,594 11,040 35,221 10,557 11,106 15,560 19,533 56,756 24,302 38,398 29,970 30,672 123,342 34,865 39,308 45,178 48,066 167,417

Income Tax Expense 689 4,073 8,854 3,102 2,825 3,896 5,222 15,045 6,160 9,878 7,492 7,668 31,198 8,716 9,827 11,294 12,017 41,854

Net Income 905 6,967 26,367 7,455 8,281 11,664 14,311 41,711 18,142 28,520 22,477 23,004 92,143 26,149 29,481 33,883 36,050 125,562

Tax rate 43.2% 36.9% 25.1% 29.4% 25.4% 25.0% 26.7% 26.5% 25.3% 25.7% 25.0% 25.0% 25.3% 25.0% 25.0% 25.0% 25.0% 25.0%

Basic EPS NA 0.33 1.26 0.36 0.40 0.56 0.61 1.93 0.58 0.86 0.64 0.48 2.50 0.55 0.62 0.71 0.66 2.55

Diluted EPS NA 0.33 1.26 0.36 0.40 0.56 0.49 1.81 0.54 0.80 0.59 0.48 2.38 0.55 0.62 0.71 0.66 2.55

Weighted Avg. Basic Shares Out. NA 20,915 20,915 20,915 20,915 20,915 23,542 21,588 31,275 33,290 35,288 47,545 36,850 47,600 47,600 47,600 54,545 49,336

Weighted Avg. Diluted Shares Out. NA 20,915 20,915 20,915 20,915 20,915 29,137 22,998 33,500 35,831 37,828 47,545 38,676 47,600 47,600 47,600 54,545 49,336

Equity Research

Company Update

Margins

GAAP gross margin 64.2% 51.9% 63.5% 62.0% 62.1% 67.0% 78.9% 69.0% 59.7% 78.7% 63.5% 64.0% 66.7% 65.0% 65.0% 65.0% 65.0% 65.0%

Sales, General and Administrative 22.7% 6.4% 4.5% 5.9% 4.1% 7.5% 7.9% 6.6% 5.3% 7.1% 9.9% 10.6% 8.4% 7.2% 7.0% 7.0% 7.0% 7.0%

GAAP operating margin 39.3% 42.6% 55.7% 56.1% 58.1% 59.5% 61.0% 59.0% 54.4% 71.6% 53.6% 53.4% 58.3% 57.8% 58.0% 58.0% 58.0% 58.0%

Net income margin 22.4% 27.0% 41.9% 39.7% 43.4% 44.7% 44.8% 43.5% 40.7% 53.3% 40.4% 40.1% 43.7% 43.5% 43.6% 43.6% 43.6% 43.6%

Adjusted EBITDA margin 42.6% 46.9% 60.3% 60.2% 62.2% 62.6% 63.7% 62.4% 56.9% 73.3% 55.3% 55.0% 60.1% 59.5% 59.4% 59.3% 59.2% 59.3%

Growth Y/Y

Revenue N/A 540.3% 143.8% 24.3% 24.3% 65.5% 90.6% 52.3% 137.2% 180.3% 113.2% 79.3% 120.0% 35.0% 26.3% 39.5% 44.3% 36.5%

Gross profit N/A 418.0% 198.3% 25.8% 27.6% 87.6% 108.0% 65.5% 128.5% 255.0% 102.2% 45.4% 112.6% 46.9% 4.3% 42.8% 46.6% 33.1%

Operating income N/A 594.6% 218.8% 23.3% 29.4% 83.0% 104.7% 61.3% 130.1% 245.5% 92.3% 56.9% 117.1% 43.4% 2.4% 50.9% 56.9% 35.8%

Net income N/A 669.8% 278.5% 15.9% 29.4% 83.3% 99.6% 58.2% 143.4% 244.4% 92.7% 60.7% 120.9% 44.1% 3.4% 50.7% 56.7% 36.3%

Adjusted EBITDA N/A 547.7% 200.7% N/A N/A 76.7% 102.2% 57.6% 124.1% 230.6% 88.6% 54.8% 112.0% 41.2% 2.4% 49.5% 55.3% 34.7%

EPS N/A N/A 278.5% N/A N/A N/A 43.3% 43.9% 51.9% 100.9% 6.5% -1.5% 31.3% 1.4% -22.1% 19.9% 36.7% 6.9%

Growth Q/Q (sequential)

Revenue 11.9% 1.7% 36.8% 22.3% 39.4% 20.2% 4.1% 2.9% 4.9% 12.5% 15.0% 6.4%

Gross profit -4.0% 2.0% 47.5% 44.2% 5.5% 58.4% -16.0% 3.7% 6.5% 12.5% 15.0% 6.4%

Operating income 10.6% 5.2% 40.1% 25.5% 24.4% 58.0% -22.0% 2.4% 13.7% 12.8% 15.0% 6.4%

Net income 4.0% 11.1% 40.9% 22.7% 26.8% 57.2% -21.2% 2.3% 13.7% 12.7% 14.9% 6.4%

Adjusted EBITDA 12.1% 5.1% 37.7% 24.6% 24.3% 55.0% -21.5% 2.3% 13.3% 12.5% 14.6% 6.3%

EPS 4.0% N/A N/A N/A 10.3% 46.9% -25.3% -18.6% 13.6% 12.7% 14.9% -7.2%

August 16, 2010

Page 2

Global Hunter Securities, LLC China MediaExpress Holdings, Inc. (Nasdaq:CCME) Financial Model

China MediaExpress Holdings, Inc. (CCME)

Global Hunter Securities, LLC

Research Department: 949-274-8052

Fiscal period FY'06 (A) FY'07(A) FY '08(A) Q1 '09(A) Q2 '09(A) Q3 '09(A) Q4 '09(A) FY '09(A) Q1 '10(A) Q2 '10(A) Q3 '10(E) Q4 '10(E) FY '10(E) Q1 '11(E) Q2 '11(E) Q3 '11(E) Q4 '11(E) FY '11(E)

Period ends Dec '06 Dec '07 Dec '08 Mar '09 Jun '09 Sep '09 Dec '09 Dec '09 Mar '10 Jun '10 Sep '10 Dec '10 Dec '10 Mar '11 Jun '11 Sep '11 Dec '11 Dec '11

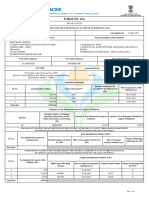

Selected Cash Flow Items

EBIT (GAAP) 1,586 11,016 35,121 10,535 11,085 15,533 19,490 56,643 24,241 38,298 29,870 30,572 122,981 34,765 39,208 45,078 47,966 167,017

Depreciation and amortization 365 1,621 2,875 760 783 808 875 3,226 1,072 940 950 960 3,922 970 980 990 1,000 3,940

Adjusted EBITDA 1,951 12,637 37,996 11,295 11,868 16,341 20,365 59,869 25,313 39,238 30,820 31,532 126,903 35,735 40,188 46,068 48,966 170,957

Cash flow from operation (CFFO) 1,717 12,105 27,396 8,495 9,197 12,172 16,380 46,244 12,946 25,264 19,077 19,654 76,941 22,829 26,181 30,633 32,850 112,492

Capital expenditures (800) (6,600) (4,200) (500) (200) (800) (500) (1,900) (1,875) (645) (5,000) (5,000) (12,520) (3,750) (3,750) (3,750) (3,750) (15,000)

FCF (CFFO - capital expenditure) 917 5,505 23,196 7,995 8,997 11,372 15,880 44,344 11,071 24,619 14,077 14,654 64,421 19,079 22,431 26,883 29,100 97,492

Selected Balance Sheet Items

Cash and equivalent 1,485 6,364 29,997 20,416 29,437 40,855 57,151 57,151 114,396 139,321 155,560 173,012 173,012 194,321 216,378 242,810 272,261 272,261

Accounts receivable 186 2,716 6,065 7,288 7,412 11,293 12,569 12,569 18,805 20,664 24,484 25,187 25,187 26,418 29,714 34,163 36,352 36,352

Restricted cash 3 13 59 35 36 26 251 251 1,929 3,372 3,541 3,718 3,718 3,904 4,099 4,304 4,519 4,519

Total current assets 1,674 9,093 36,121 27,739 36,885 52,174 69,971 69,971 135,130 163,357 183,584 201,916 201,916 224,642 250,191 281,276 313,131 313,131

Property plant and equipement (Net) 3,269 8,848 11,417 10,910 10,137 10,864 11,065 11,065 11,525 12,018 15,233 19,273 19,273 22,053 25,793 28,563 32,293 32,293

Total assets 4,943 18,707 49,116 40,309 48,775 64,948 82,979 82,979 157,311 188,655 212,761 235,830 235,830 262,068 292,126 326,788 363,221 363,221

Accounts payables 87 769 1,565 1,782 1,800 2,030 2,179 2,179 2,571 2,839 4,468 4,534 4,534 4,623 5,200 5,978 6,362 6,362

Accrued expenses 248 714 1,230 1,380 1,378 2,672 4,573 4,573 6,801 6,505 6,505 6,505 6,505 6,505 6,505 6,505 6,505 6,505

Short term borrowings - - - - - - 10,000 10,000 - - - - - - - - - -

Tax payables 341 1,854 3,072 3,700 3,426 4,567 5,765 5,765 8,333 9,980 9,980 9,980 9,980 9,980 9,980 9,980 9,980 9,980

Other current liabilities 2,654 4,690 1,941 1,974 2,043 3,336 6,091 6,091 4,943 7,989 7,989 7,989 7,989 7,989 7,989 7,989 7,989 7,989

Total current liabilities 3,330 8,027 7,808 8,836 8,647 12,605 28,608 28,608 22,648 27,313 28,942 29,008 29,008 29,097 29,674 30,452 30,836 30,836

Convertible perferred stock - - - - - - - - 22,095 22,095 22,095 22,095 22,095 22,095 22,095 22,095 22,095 22,095

Total common equity 1,613 7,617 34,996 24,831 33,115 44,805 47,732 47,732 99,958 128,855 151,332 174,336 174,336 200,484 229,965 263,849 299,898 299,898

Total Equity 1,613 7,617 34,996 24,831 33,115 44,805 47,732 47,732 122,053 150,950 173,427 196,431 196,431 222,579 252,060 285,944 321,993 321,993

Total Liabilities And Equity 4,943 18,707 49,116 40,309 48,775 64,948 82,979 82,979 157,311 188,655 212,761 235,830 235,830 262,068 292,126 326,788 363,221 363,221

Equity Research

Valuation & Other Financial Information

Company Update

DSOs 17 38 35 35 35 39 36 48 38 35 40 40 40 40 40 40 40 40

Days payables outstanding 22 23 25 23 23 21 29 27 13 23 20 20 20 20 20 20 20 20

Net cash per share N/A N/A N/A N/A N/A N/A 1.6 2.1 3.4 3.9 4.1 3.6 4.5 4.1 4.5 5.1 5.0 5.5

Tangible book value per share N/A 0.3 1.6 1.1 N/A N/A 1.6 2.1 3.6 4.2 4.6 4.1 5.1 4.7 5.3 6.0 5.9 6.5

Price/Tangible book N/A 32.6 6.7 9.6 N/A N/A 6.5 5.1 2.9 2.5 2.3 2.6 2.1 2.3 2.0 1.8 1.8 1.6

EV/sales (LTM) N/A N/A N/A N/A N/A N/A 2.8 2.1 2.0 1.6 1.3 1.6 1.1 1.4 1.2 1.0 1.1 0.9

EV/EBITDA (LTM adjusted) N/A N/A N/A N/A N/A N/A 4.4 3.3 3.3 2.4 2.1 2.6 1.9 2.3 2.1 1.7 1.8 1.5

EV/unlevered earnings (LTM) N/A N/A N/A N/A N/A N/A N/A 4.8 N/A N/A 2.7 2.9 2.6 2.7 2.7 2.4 2.2 2.0

Price/earnings (LTM) N/A N/A 8.5 N/A 0.0 6.5 5.9 5.9 5.4 4.5 4.4 4.4 4.5 4.4 4.8 4.5 4.2 4.2

August 16, 2010

Page 3

China MediaExpress Holdings, Inc. (CCME) Company Update August 16, 2010

China MediaExpress Holdings, Inc. (CCME) Disclosures

Analyst Certification

I, Ping Luo, certify that the views expressed in this report accurately reflect my personal beliefs about this company and that I have

not and will not receive compensation directly or indirectly in connection with my specific recommendations or views contained in this

report.

I, Jodi Dai, certify that the views expressed in this report accurately reflect my personal beliefs about this company and that I have

not and will not receive compensation directly or indirectly in connection with my specific recommendations or views contained in this

report.

Important Disclosures

GHS does and seeks to do business with the company covered in this research report.

As with all employees of GHS, a portion of this analyst’s compensation is based on investment banking revenues.

Risks & Considerations

Increase in concession fees. CCME’s core strategy is expanding its network within inter-city express buses. Successful execution relies to

a large extent on its partnership with bus operators. The company signed concession rights contracts with bus operators to display

advertising programs on its buses. These contracts usually have a term of 5-8 years and allow concession fees to increase 10%-30% every

year. CCME’s future growth is dependent upon its ability to renew these contracts with existing partners or to obtain new contracts with new

operator partners. Although a majority of the contracts expire after 2015, some of these contracts start to expire at the end of 2011. The

company may not be able to renew the contracts with the bus operators or they may encounter significant increases in concession fees,

which will have a severe negative impact on the operation and profitability of the company’s business. The bus operators may set up a

bidding system which invites competition and results in significant increases in costs for CCME.

Increase in entertainment content fees. The company currently receives free entertainment content mainly from Fujian Southeastern TV

and Hunan Satellite TV. The agreement with Hunan Satellite TV expires in August 2010, and the agreement with Fujian Southeastern TV

expires in 2015. If CCME could not renew the agreements or the two TV stations decide to charge CCME for the content, the profitability of

the company could be negatively impacted or the company may have to look for alternative ways to obtain entertainment content.

Increased competition. CCME does not currently have significant competition for inter-city express buses, however, as mentioned, if bus

operators open up a bidding system, it could attract domestic and foreign media companies with strong financial resources and better

technologies to compete. Cost controls and technology improvement are essential to CCME’s business. CCME also faces indirect

competition from more traditional advertising channels, such as TV and newspaper advertising, and other out-of-home advertising platforms

such as airports and public mass transit systems. CCME’s clients typically advertise through many different platforms in order to reach a

broad range of consumers. The company competes for its clients’ advertising dollars with other media platforms.

Technology obsolete. The company currently operates its advertising program with digital TV screens and hard disk drives and changes

the programs manually once or twice a month. Continued technology improvement is important to retaining current advertisers and bus

operator relationships. If a competitor presents more sophisticated technologies which increase the effectiveness of advertising and better

enhance passengers’ travel experience, advertisers and bus operators may opt to work with that competitor.

Execution risks. The company plans to expand to new geographic regions and introduce new services to its advertiser clients such as

publishing on-bus magazines to promote its clients’ products and services and setting up call centers to take orders on behalf of advertisers.

The company may incur unexpected challenges in these new regions as well as new business initiatives.

Regulatory risks. CCME is subject to a series of advertising regulations to ensure that the content of the advertisements is fair, accurate

and in full compliance with applicable laws. Violation of these regulations may result in penalties including fines and orders to cease

business. In addition, China has been deregulating its advertising market, allowing foreign companies to operate in China’s advertising

industry. Continued deregulation may expose CCME to competition with more multi-national advertising companies with significantly greater

resources.

A VIE structure. CCME does not have equity ownership but relies on contractual arrangements to control its key operating subsidiary

Fujian Fenzhong Media, which operates as a variable interest entity (VIE). Though the possibility is remote, if Chinese government changes

its policies on VIE structures, CCME may lose control of its key operating entity.

See the Company’s most recent SEC filings, including 10-Ks, 10-Qs, 8-Ks and proxy filings, for additional risks and

considerations.

Other Companies Mentioned In This Report

None

Global Hunter Securities, LLC Equity Research Page 4

China MediaExpress Holdings, Inc. (CCME) Company Update August 16, 2010

China MediaExpress Holdings, Inc. (CCME) Disclosures (Continued)

Historical Recommendations

$16.00

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

$0.00

10/15/09

10/22/09

10/29/09

11/5/09

11/12/09

11/19/09

11/26/09

12/3/09

12/10/09

12/17/09

12/24/09

12/31/09

1/7/10

1/14/10

1/21/10

1/28/10

2/4/10

2/11/10

2/18/10

2/25/10

3/4/10

3/11/10

3/18/10

3/25/10

4/1/10

4/8/10

4/15/10

4/22/10

4/29/10

5/6/10

5/13/10

5/20/10

5/27/10

6/3/10

6/10/10

6/17/10

6/24/10

Initiated coverage on 7/1/2010 with a Buy rating and price target of $18

Date Rating Price Target Closing Price

1. 7/1/2010 Buy $18.00 $8.77

2. 8/15/2010 Buy $21.00 $10.68

Explanation of Ratings

Buy: We expect the stock to outperform the average total return of the stocks in the analyst’s industry (or industry team’s) coverage

universe over the next six to twelve months.

Neutral: We expect the stock to perform in line with the average total return of the stocks in the analyst’s industry (or industry

team’s) coverage universe over the next six to twelve months.

Sell: We expect the stock to underperform the average total return of the stocks in the analyst’s industry (or industry team’s)

coverage universe over the next six to twelve months.

Ratings Distribution

Research Coverage Investment Banking Clients*

Rating Count % of Total Count % of Total % of Rating Category

Buy 75 66.4% 8 80.0% 10.7%

Neutral 31 27.4% 2 20.0% 6.5%

Sell 7 6.2% 0 0.0% 0.0%

Total 113 100.0% 10 100.0% 8.8%

*Investment banking clients are companies from whom GHS or an affiliate received compensation from investment banking services provided in the

last 12 months.

Note: Ratings Distribution as of June 30, 2010

Disclaimer & Other Disclosures

This material has been prepared by Global Hunter Securities, LLC ("Global Hunter") a registered broker-dealer, employing

appropriate expertise, and in the belief that it is fair and not misleading. Information, opinions or recommendations contained in the

reports and updates are submitted solely for advisory and information purposes. The information upon which this material is based

was obtained from sources believed to be reliable, but has not been independently verified. Therefore except for any obligations

under law, we do not guarantee its accuracy. Additional and supporting information is available upon request. This is not an offer or

solicitation of an offer to buy or sell any security or investment. Any opinion or estimates constitute our best judgment as of this date,

and is subject to change without notice. Global Hunter and our affiliates and their respective directors, officers and employees may

buy or sell securities mentioned herein as agent or principal for their own account. Not all products and services are available

outside of the US or in all US states. Copyright 2010.

Global Hunter Securities, LLC Equity Research Page 5

You might also like

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- CCME - GH Research 2Document5 pagesCCME - GH Research 2wctbillsNo ratings yet

- LIWA Global Hunter Jan 31 2011 ReportDocument32 pagesLIWA Global Hunter Jan 31 2011 ReportbullriderpenNo ratings yet

- RBC - ARCC - Revision - 3Q20 Review - 13 PagesDocument13 pagesRBC - ARCC - Revision - 3Q20 Review - 13 PagesSagar PatelNo ratings yet

- Sea Ltd. (SE) - Earnings Review - Upbeat Guidance, Strong Growth Buy (On CL)Document12 pagesSea Ltd. (SE) - Earnings Review - Upbeat Guidance, Strong Growth Buy (On CL)Poen, Chris ChouNo ratings yet

- JMP Securities - ORCC - Initiation - Initiating Coverage of Industry - 50 PagesDocument50 pagesJMP Securities - ORCC - Initiation - Initiating Coverage of Industry - 50 PagesSagar PatelNo ratings yet

- Marathon Partners Recommends e.l.f. Beauty Pursue Sale to Unlock ValueDocument5 pagesMarathon Partners Recommends e.l.f. Beauty Pursue Sale to Unlock ValueKan ZhouNo ratings yet

- Top Glove Corporation Berhad: Expect Yet Another Strong Set of Results - 16/03/2010Document2 pagesTop Glove Corporation Berhad: Expect Yet Another Strong Set of Results - 16/03/2010Rhb InvestNo ratings yet

- OTB - 170623 - Still A Nice Cup of Coffee - ADBSDocument10 pagesOTB - 170623 - Still A Nice Cup of Coffee - ADBSNishanth K SNo ratings yet

- Chruch Ill DownsDocument17 pagesChruch Ill DownsMichael OzanianNo ratings yet

- Media Chinese Int'l: Corporate HighlightsDocument4 pagesMedia Chinese Int'l: Corporate HighlightsRhb InvestNo ratings yet

- JMP Securities - ORCC - Initiation - 2Q20 Preliminary Balance Sheet - 6 PagesDocument6 pagesJMP Securities - ORCC - Initiation - 2Q20 Preliminary Balance Sheet - 6 PagesSagar PatelNo ratings yet

- Equidam Valuation Report SampleDocument25 pagesEquidam Valuation Report SampleRelin Ganda SaputraNo ratings yet

- HEC - Dow Jones - PE Fitness Rankings - FAQ - FinalDocument11 pagesHEC - Dow Jones - PE Fitness Rankings - FAQ - FinalDan PrimackNo ratings yet

- Bank Neo Commerce: Quickly Scaling UpDocument23 pagesBank Neo Commerce: Quickly Scaling UpAgus SuwarnoNo ratings yet

- Hang Seng Bank 2020 Annual Report SummaryDocument257 pagesHang Seng Bank 2020 Annual Report SummarySaxon ChanNo ratings yet

- PFRM - Final PPT - Group 3Document21 pagesPFRM - Final PPT - Group 3RAHUL DASNo ratings yet

- MBI Supp UpdateDocument18 pagesMBI Supp UpdateResearchWorks360No ratings yet

- Corteva Company FinalizedDocument27 pagesCorteva Company FinalizedKim FloresNo ratings yet

- Mergent Online As Reported - Tesla IncDocument2 pagesMergent Online As Reported - Tesla IncLyca MaeNo ratings yet

- CB Insights Global Fintech Report Q1 2017Document64 pagesCB Insights Global Fintech Report Q1 2017prsntNo ratings yet

- Greater China: Territory ReviewDocument21 pagesGreater China: Territory ReviewGeoffrey ChengNo ratings yet

- MBM Resources Berhad: An Even Better 2Q - 18/08/2010Document3 pagesMBM Resources Berhad: An Even Better 2Q - 18/08/2010Rhb InvestNo ratings yet

- Vietnam Startup Investment Insight:: 2017 in SnapshotDocument8 pagesVietnam Startup Investment Insight:: 2017 in Snapshothungnguyen2332No ratings yet

- Media Chinese Int'l Berhad: Expecting Stronger Adex Ahead - 31/5/2010Document3 pagesMedia Chinese Int'l Berhad: Expecting Stronger Adex Ahead - 31/5/2010Rhb InvestNo ratings yet

- PitchBook_2020_Annual_Global_Private_Debt_ReportDocument13 pagesPitchBook_2020_Annual_Global_Private_Debt_ReportrclericiNo ratings yet

- How To Boost AXP by 50 BillionDocument33 pagesHow To Boost AXP by 50 BillionnpapadokostasNo ratings yet

- RBC August 2015 PDFDocument13 pagesRBC August 2015 PDFtheredcornerNo ratings yet

- PDD Holdings (PDD) - Addressing Key Investor Debates Post Upgrade Domestic Ad Growth Outlook & Temu Risks The Key Focuses BuyDocument20 pagesPDD Holdings (PDD) - Addressing Key Investor Debates Post Upgrade Domestic Ad Growth Outlook & Temu Risks The Key Focuses BuyYuqingNo ratings yet

- Glaucus Research - West China Cement - HK 2233 - Strong Sell August 8 2012Document52 pagesGlaucus Research - West China Cement - HK 2233 - Strong Sell August 8 2012mistervigilanteNo ratings yet

- Conn's Inc.: Investor Meetings Recap - Good Visibility Into Impressive EPS GrowthDocument10 pagesConn's Inc.: Investor Meetings Recap - Good Visibility Into Impressive EPS GrowthAshokNo ratings yet

- Investor Presentation: 9M / Q3FY20Document46 pagesInvestor Presentation: 9M / Q3FY20Zk PNo ratings yet

- Valuation Report of Warrp: Company Logo AreaDocument22 pagesValuation Report of Warrp: Company Logo AreaNguyen Khanh HoangNo ratings yet

- Hi-Crush Partners LP: U.S. ResearchDocument6 pagesHi-Crush Partners LP: U.S. ResearchtheredcornerNo ratings yet

- 2023 q4 Earnings Results PresentationDocument25 pages2023 q4 Earnings Results PresentationZerohedgeNo ratings yet

- CB Insights Fintech Trends Report 2016Document67 pagesCB Insights Fintech Trends Report 2016prsntNo ratings yet

- Global Banking Brochure 2022Document16 pagesGlobal Banking Brochure 2022kuntari01031970No ratings yet

- BTG Pactual - Meliuz PDFDocument4 pagesBTG Pactual - Meliuz PDFRenan Dantas SantosNo ratings yet

- Valuation of Bata Shoe Company (Bangladesh) LimitedDocument44 pagesValuation of Bata Shoe Company (Bangladesh) LimitedRakib HasanNo ratings yet

- Finance: Practice QuestionsDocument33 pagesFinance: Practice QuestionsMahtab Chondon100% (1)

- Duluth Holdings Inc.: October 8, 2018 DLTH - NasdaqDocument3 pagesDuluth Holdings Inc.: October 8, 2018 DLTH - Nasdaqashok yadavNo ratings yet

- Pretium Resources - Broker Reports - Thomson One - 3 MonthsDocument39 pagesPretium Resources - Broker Reports - Thomson One - 3 MonthsJZNo ratings yet

- Frabby & Associates - SCLDocument20 pagesFrabby & Associates - SCLgohoji4169No ratings yet

- Digital Dispatch Initiating CoverageDocument30 pagesDigital Dispatch Initiating Coveragegreid34100% (1)

- VALUE INVESTING IN THE TWILIGHT ZONEDocument29 pagesVALUE INVESTING IN THE TWILIGHT ZONETimothyNgNo ratings yet

- TCS Financial ModelDocument47 pagesTCS Financial ModelAnshul NemaNo ratings yet

- Disney Trading Comps AnalysisDocument4 pagesDisney Trading Comps AnalysisyhcdyhdNo ratings yet

- Vietnam Banks: The Sector To Own Significant Potential Upside in The Next 12 MonthsDocument56 pagesVietnam Banks: The Sector To Own Significant Potential Upside in The Next 12 MonthsViet HoangNo ratings yet

- Nike Case AnalysisDocument10 pagesNike Case AnalysisFarhan SoepraptoNo ratings yet

- TPG Specialty Lending ResearchDocument25 pagesTPG Specialty Lending ResearchaaquibnasirNo ratings yet

- Canaccord GenuityDocument16 pagesCanaccord Genuity765ayeshaNo ratings yet

- Breadtalk Group LTD: Singapore Company GuideDocument11 pagesBreadtalk Group LTD: Singapore Company GuideBrandon TanNo ratings yet

- HSBC Holdings PLCDocument9 pagesHSBC Holdings PLCAnonymous P73cUg73LNo ratings yet

- WP Earnings q3 2018 Final RDocument14 pagesWP Earnings q3 2018 Final RTarek DomiatyNo ratings yet

- argusDocument8 pagesargusapi-740565012No ratings yet

- Corrected Transcript Mcdonald's Corp. (MCD Us) q2 2020 Earnings Call 28 July 2020-8-30 Am EtDocument21 pagesCorrected Transcript Mcdonald's Corp. (MCD Us) q2 2020 Earnings Call 28 July 2020-8-30 Am EtHarshad VisheNo ratings yet

- Hock Seng Lee Berhad: 1HFY12/10 Net Profit Grows by A Whopping 36% YoY - 26/08/2010Document3 pagesHock Seng Lee Berhad: 1HFY12/10 Net Profit Grows by A Whopping 36% YoY - 26/08/2010Rhb InvestNo ratings yet

- Annual Report 2003 PDFDocument140 pagesAnnual Report 2003 PDFvinskaNo ratings yet

- Chapter 1 Answer Key 10ce Foundations of Financial ManagementDocument4 pagesChapter 1 Answer Key 10ce Foundations of Financial ManagementPanda875No ratings yet

- B2B booking platform connects international education agents with schoolsDocument1 pageB2B booking platform connects international education agents with schoolsRicardo DlrNo ratings yet

- Samantha Schacher V Johnny ManzielDocument3 pagesSamantha Schacher V Johnny ManzielDarren Adam Heitner100% (5)

- CCME AuditDocument4 pagesCCME AuditwctbillsNo ratings yet

- China Mediaexpress Holdings, IncDocument4 pagesChina Mediaexpress Holdings, IncwctbillsNo ratings yet

- CCME Top Pick of 2011 Northland SecuritiesDocument8 pagesCCME Top Pick of 2011 Northland SecuritieswctbillsNo ratings yet

- CCME Sas99 Audit FlowDocument4 pagesCCME Sas99 Audit FlowwctbillsNo ratings yet

- CCME Oct 18th, 2010 Global Hunter Securities ReportDocument21 pagesCCME Oct 18th, 2010 Global Hunter Securities ReportfalankeNo ratings yet

- MOT CCME ExclusiveDocument2 pagesMOT CCME ExclusivewctbillsNo ratings yet

- CCME Oct 15th, 2010 Global Hunter ReportDocument5 pagesCCME Oct 15th, 2010 Global Hunter ReportwctbillsNo ratings yet

- CTR Aug 2008 Research Report On CCMEDocument57 pagesCTR Aug 2008 Research Report On CCMEwctbillsNo ratings yet

- CCME Beijing Sept 092010Document33 pagesCCME Beijing Sept 092010wctbillsNo ratings yet

- CCME Investor Day Conference 7sept2010Document34 pagesCCME Investor Day Conference 7sept2010wctbillsNo ratings yet

- Module 8 AssignmentDocument4 pagesModule 8 AssignmentRosario CabarrubiasNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- All Template Chapter 6 As of September 10 2019Document32 pagesAll Template Chapter 6 As of September 10 2019Aira Dizon50% (2)

- Ang & Bekaert - 2007 - RFS - Stock Return Predictability Is It ThereDocument58 pagesAng & Bekaert - 2007 - RFS - Stock Return Predictability Is It ThereẢo Tung ChảoNo ratings yet

- Atal Pension Yojana contribution chart and minimum guaranteed pension amountsDocument1 pageAtal Pension Yojana contribution chart and minimum guaranteed pension amountsG Pavan Kumar100% (1)

- Merger of e CommerceDocument9 pagesMerger of e CommerceWesley100% (1)

- Cyient LTD.: Q1FY20: Weak Quarter, Lack VisibilityDocument7 pagesCyient LTD.: Q1FY20: Weak Quarter, Lack VisibilityADNo ratings yet

- .Paper - V - Sec.I - Direct Taxes PDFDocument238 pages.Paper - V - Sec.I - Direct Taxes PDFMichelle MarkNo ratings yet

- Cleantech-Matters FW0009 PDFDocument48 pagesCleantech-Matters FW0009 PDFSirsanath BanerjeeNo ratings yet

- Insurance Commission Ruling on Life Insurance ClaimsDocument8 pagesInsurance Commission Ruling on Life Insurance ClaimsMarioneMaeThiamNo ratings yet

- EM Equal Weighted FactsheetDocument2 pagesEM Equal Weighted FactsheetRoberto PerezNo ratings yet

- TDS CertificateDocument2 pagesTDS Certificatetauqeer25No ratings yet

- Costs, Scale of Production and Break-Even Analysis: Revision AnswersDocument4 pagesCosts, Scale of Production and Break-Even Analysis: Revision AnswersQ. T.100% (1)

- Indian Tax ManagmentDocument242 pagesIndian Tax ManagmentSandeep SandyNo ratings yet

- Mom and Pop Stores SurvivalDocument2 pagesMom and Pop Stores Survivallonely_hrt123@yahoo.comNo ratings yet

- Internship Report ON F.E.S.C.O of PakistanDocument54 pagesInternship Report ON F.E.S.C.O of PakistanBILALNo ratings yet

- Annual Financial Statements: Diplom-Kaufmann Albert Ackstaller Steuerberater Freisinger Str. 2 85414 KirchdorfDocument7 pagesAnnual Financial Statements: Diplom-Kaufmann Albert Ackstaller Steuerberater Freisinger Str. 2 85414 KirchdorfElizabeth Sánchez LeónNo ratings yet

- RSM230 Chapter NotesDocument15 pagesRSM230 Chapter NotesJoey LinNo ratings yet

- Court of Tax Appeals First Division: Republic of The Philippines Quezon CityDocument4 pagesCourt of Tax Appeals First Division: Republic of The Philippines Quezon Cityanorith88No ratings yet

- Kalbe Farma TBK 31 Des 2020Document173 pagesKalbe Farma TBK 31 Des 2020A. A Gede Wimanta Wari Bawantu32 DarmaNo ratings yet

- Question Bank NvsDocument6 pagesQuestion Bank NvsDeepak DileepNo ratings yet

- Chapter 8Document30 pagesChapter 8carlo knowsNo ratings yet

- Microeconomics: The Costs of ProductionDocument8 pagesMicroeconomics: The Costs of ProductiondewiNo ratings yet

- The Case of The Troubled TrusteeDocument177 pagesThe Case of The Troubled TrusteeAspirantNo ratings yet

- Dallas Police and Fire Pension BriefingDocument85 pagesDallas Police and Fire Pension BriefingTristan HallmanNo ratings yet

- CMA Class 9 Def FDocument69 pagesCMA Class 9 Def FshishirNo ratings yet

- THPS-1 Spring 20110Document4 pagesTHPS-1 Spring 20110bugzlyfeNo ratings yet

- THE ECONOMIC VALUE of UNPAID HOUSEWORK and CHILD CARE in NOVA SCOTIADocument123 pagesTHE ECONOMIC VALUE of UNPAID HOUSEWORK and CHILD CARE in NOVA SCOTIARonald ColmanNo ratings yet

- Hero Honda focuses on CRM; may slowly slash advertisingDocument4 pagesHero Honda focuses on CRM; may slowly slash advertisingAmit DashNo ratings yet

- Chapter 17 Flashcards - QuizletDocument34 pagesChapter 17 Flashcards - QuizletAlucard77777No ratings yet