Professional Documents

Culture Documents

BDO V Republic Digest

Uploaded by

Trem GallenteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BDO V Republic Digest

Uploaded by

Trem GallenteCopyright:

Available Formats

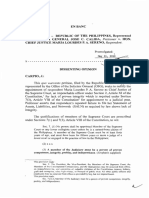

BANCO DE ORO vs.

REPUBLIC OF THE PHILIPPINES

G.R. No. 198756, January 13, 2015

This case involves P35 billion worth of 10-year zero-coupon treasury

bonds issued by the Bureau of Treasury (BTr) denominated as the Poverty

Eradication and Alleviation Certificates or the PEACe Bonds. These PEACe

Bonds would initially be purchased by a special purpose vehicle on behalf of

Caucus of Development NGO Networks (CODE-NGO), repackaged and sold at

a premium to investors. The net proceeds from the sale will be used to endow

a permanent fund to finance meritorious activities and projects of accredited

non-government organizations (NGOs) throughout the country. In relation to

this, CODE-NGO wrote a letter to the Bureau of Internal Revenue (BIR) to

inquire as to whether the PEACe Bonds will be subject to withholding tax of

20%. The BIR issued several rulings beginning with BIR Ruling No.020-2001

(issued on May 31, 2001) and was subsequently reiterated its points in BIR

Ruling No. 035-200119 dated August 16, 2001 and BIR Ruling No. DA-175-

0120. The rulings basically say that in determining whether financial assets

such as a debt instrument are deposit substitute, the “20 or more individual or

corporate lenders rule” should apply. Likewise, the “at any one time” stated in

the rules should be construed as “at the time of the original issuance.”

With this BTr made a public offering of the PEACe Bonds to the

Government Securities Eligible Dealers (GSED) wherby RCBC won as the

highest bidder for approximately 10.17 billion, resulting in a discount of

approximately 24.83 billion. RCBC Capital Capital entered into an

underwriting agreement with CODE-NGO, whereby RCBC Capital was

appointed as the Issue Manager and Lead Underwriter for the offering of the

PEACe Bonds.

In October 7, 2011, BIR issued BIR RULING NO. 370-2011 in response

to the query of the Secretary of Finance as to the proper tax treatment of the

discounts and interest derived from Government Bonds. It cited three other

rulings issued in 2004 and 2005. The above ruling states that the all treasury

bonds (including PEACe Bonds), regardless of the number of

purchasers/lenders at the time of origination/issuance are considered deposit

substitutes. In the case of zero-coupon bonds, the discount (i.e. difference

between face value and purchase price/discounted value of the bond) is

treated as interest income of the purchaser/holder.

Ruling:

The PEACe Bonds, according to the SC, requires further information for

proper determination of whether these bonds are within the purview of

deposit substitutes. The Court noted that it may seem that the lender is only

CODE-NGO through RCBC. However, the underwriting agreement reveals

that the entire 35billion worth of zero-coupon bonds were sourced directly

from the undisclosed number of investors. These are the same investors to

whom RCBC Capital distributed the PEACe Bonds all at the time of the

origination or issuance. Hence, until there is information as to whether the

PEACe Bonds are found within the coverage of deposit substitutes, the proper

procedure for the BIR is to collect the unpaid final withholding tax directly

from RCBC Capital/ CODE-NGO, or any lender if such be the case.

The court also noted that according to the NIRC, Section 24, interest

income received by individuals from long term deposits or investments with a

holding period of not less than five years is exempt from final tax.

The decision provided the definition of deposit substitute 1997 National

Internal Revenue Code which placed the 20-lender rule. In particular, Section

22 (Y) states that a debt instrument shall mean “an alternative form of

obtaining funds from the public (the term 'public' means borrowing from

twenty (20) or more individual or corporate lenders at any one time) other

than deposits, through the issuance, endorsement, or acceptance of debt

instruments for the borrower’s own account” The determination as to whether

a deposit substitute will be imposed with 20% final withholding tax rests on

the number of lenders.

When there are 20 or more lenders/investors in a transaction for a

specific bond issue, the seller is required to withhold the 20% final income tax

on the imputed interest income from the bonds. The SC cited Sections 24(B)

(1), 27(D)(1), and 28(A)(7) of the 1997 NIRC. These provisions state the

imposition of a final tax rate of 20% upon the amount of interest from any

currency bank deposit and yield or any other monetary benefit from deposit

substitutes. On the other hand, for instruments not considered as deposit

substitutes, these will be subjected to regular income tax. The prevailing

provision is Section 32(A). Hence, should the deposit substitute involves less

than 20 lenders in a transaction, the income is considered as “income derived

from whatever source”.

The “gain” referred to in Section 32 (A) pertains to that realized from

the trading of bonds at maturity rate or the gain realized by the last holder of

the bonds when redeemed at maturity. In the case of discounted instruments,

like the zero-coupon bonds, the trading gain shall be the excess of the selling

price over the book value or accreted value of the instruments.

As for the BIR Rulings issued in 2001, the SC finds that the

interpretation of the phrase “at any one time”, is “to mean at the point of

origination alone is unduly restrictive” On the other hand, the 2011 BIR Ruling

which relied on the 2004 and 2005 BIR Rulings is void for creating a

distinction between government bonds and those issued by private

corporations, when there is none in the law. Further, it completely

disregarding the 20-lender rule under the NIRC since it says, “all treasury

bonds regardless of the number of purchasers/lenders at the time of

origination/issuance are considered deposit substitutes”

You might also like

- Banco de Oro, Et Al. Vs Republic of The PhilippinesDocument2 pagesBanco de Oro, Et Al. Vs Republic of The PhilippinesDane Pauline AdoraNo ratings yet

- BDO v. RepublicDocument4 pagesBDO v. RepublicBojo100% (1)

- Banco de Oro Vs RepublicDocument2 pagesBanco de Oro Vs RepublicDanica Faye100% (4)

- BANCO DE ORO V REPUBLICDocument2 pagesBANCO DE ORO V REPUBLICJoanna Reyes100% (1)

- BDO Vs RepublicDocument4 pagesBDO Vs RepublicJeffrey Magada0% (1)

- ING Banking vs. CIR (Digest)Document2 pagesING Banking vs. CIR (Digest)Theodore Dolar100% (1)

- CIR vs. St. Luke's Medical CenterDocument2 pagesCIR vs. St. Luke's Medical CenterTogz Mape100% (1)

- ANPC v. BIR rules membership fees non-taxableDocument2 pagesANPC v. BIR rules membership fees non-taxableDerek C. Egalla100% (2)

- 17 CIR v. Tours SpecialistsDocument3 pages17 CIR v. Tours SpecialistsChedeng KumaNo ratings yet

- UST Faculty of Civil Law Dean's Circle EventDocument2 pagesUST Faculty of Civil Law Dean's Circle EventBae IreneNo ratings yet

- ING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Document2 pagesING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Anonymous MikI28PkJc100% (2)

- CIR Vs CA, CTA, and GCL Retirement Plan TAXDocument2 pagesCIR Vs CA, CTA, and GCL Retirement Plan TAXLemuel Angelo M. Eleccion100% (1)

- Air Canada v. CIR DigestDocument2 pagesAir Canada v. CIR Digestpinkblush717100% (3)

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- CIR Vs de La SalleDocument2 pagesCIR Vs de La SalleOlenFuerte100% (6)

- South African Airways v. CIR DIGESTDocument4 pagesSouth African Airways v. CIR DIGESTkathrynmaydevezaNo ratings yet

- CIR Vs General Foods DigestDocument3 pagesCIR Vs General Foods DigestGil Aldrick FernandezNo ratings yet

- DOMINGO VS. GARLITOS TAXES COMPENSATEDDocument1 pageDOMINGO VS. GARLITOS TAXES COMPENSATEDAdhara CelerianNo ratings yet

- Tax Treaties and International Double TaxationDocument4 pagesTax Treaties and International Double TaxationHannah Desky100% (1)

- Case #26 CIR v. CTA and Smith Kline (1984) (Digest)Document4 pagesCase #26 CIR v. CTA and Smith Kline (1984) (Digest)Leslie Joy PantorgoNo ratings yet

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)

- Smi-Ed vs. Cir - 2016Document2 pagesSmi-Ed vs. Cir - 2016Anny Yanong100% (3)

- Ing Bank v. CIR / G.R. No. 167679 / July 22, 2015Document1 pageIng Bank v. CIR / G.R. No. 167679 / July 22, 2015Mini U. Soriano100% (1)

- Fernandez Hermanos vs. Cir and CtaDocument1 pageFernandez Hermanos vs. Cir and CtamwaikeNo ratings yet

- Visayan Cebu Terminal Vs CirDocument2 pagesVisayan Cebu Terminal Vs CirylaineNo ratings yet

- CIR v. Isabela Cultural Corp.Document4 pagesCIR v. Isabela Cultural Corp.kathrynmaydevezaNo ratings yet

- Commissioner of Internal Revenue vs. Premium Leisure Corp. CTA (En Banc)Document1 pageCommissioner of Internal Revenue vs. Premium Leisure Corp. CTA (En Banc)kimNo ratings yet

- CIR Euro Phil DigestDocument2 pagesCIR Euro Phil DigestMyrnaJoyPajoJapos0% (1)

- Marubeni v. CIR DigestDocument4 pagesMarubeni v. CIR DigestStradivariumNo ratings yet

- Cir Vs Boac 149 SCRA 395Document3 pagesCir Vs Boac 149 SCRA 395Kaye de LeonNo ratings yet

- Creba v. Romulo Case DigestDocument2 pagesCreba v. Romulo Case DigestApril Rose Villamor60% (5)

- 5 Case Digest Cir Vs Estate of TodaDocument2 pages5 Case Digest Cir Vs Estate of TodaChrissy Sabella0% (1)

- G.R. No. L-53961Document1 pageG.R. No. L-53961Jannie Ann DayandayanNo ratings yet

- CIR v. Tours Specialist Inc.Document2 pagesCIR v. Tours Specialist Inc.Gyrsyl Jaisa GuerreroNo ratings yet

- Tax Refund Case Analysis for Toledo Power CompanyDocument2 pagesTax Refund Case Analysis for Toledo Power CompanyClar Napa100% (1)

- CIR vs. CTA and Smith Kline & French Overseas Co. (Philippine branch) deductibility of head office overhead expensesDocument1 pageCIR vs. CTA and Smith Kline & French Overseas Co. (Philippine branch) deductibility of head office overhead expensesscartoneros_1No ratings yet

- CIR vs. MarubeniDocument3 pagesCIR vs. MarubeniPaula Elize Advincula CabreraNo ratings yet

- IBC Vs Amarilla Tax Case DigestDocument3 pagesIBC Vs Amarilla Tax Case DigestCJNo ratings yet

- 1 Case Digest of Nursery Care Vs AcevedoDocument2 pages1 Case Digest of Nursery Care Vs AcevedoChrissy Sabella100% (2)

- Aguinaldo Vs CIR #Tax-1Document2 pagesAguinaldo Vs CIR #Tax-1Earl TagraNo ratings yet

- Commisioner of Internal Revenue vs. Lucio L. Co. Et Al Gr. No. 241424 February 26,2020Document1 pageCommisioner of Internal Revenue vs. Lucio L. Co. Et Al Gr. No. 241424 February 26,2020Juvenal HernandezNo ratings yet

- Cs Garment, Inc. vs. Commissioner of Internal RevenueDocument1 pageCs Garment, Inc. vs. Commissioner of Internal RevenueKia Bi100% (1)

- PNB Vs CIR (2015)Document2 pagesPNB Vs CIR (2015)Zaira Gem Gonzales100% (1)

- Cir v. MeralcoDocument2 pagesCir v. MeralcoKhaiye De Asis AggabaoNo ratings yet

- PICOP v. CADocument2 pagesPICOP v. CAVon Lee De LunaNo ratings yet

- CIR vs. Filinvest Development Corp.Document2 pagesCIR vs. Filinvest Development Corp.Cheng Aya50% (2)

- Used Actually, Directly and Exclusively For Educational Purposes Shall Be Exempt From Taxes and DutiesDocument2 pagesUsed Actually, Directly and Exclusively For Educational Purposes Shall Be Exempt From Taxes and DutiesJasper Alon100% (2)

- CIR V CA, CTA and A. Soriano CorpDocument1 pageCIR V CA, CTA and A. Soriano Corpearl0917100% (1)

- Diageo v. CIRDocument2 pagesDiageo v. CIRTeff Quibod100% (1)

- PHILIPPINE AMUSEMENT AND GAMING CORPORATION (PAGCOR) vs. THE BUREAU OF INTERNAL REVENUE (BIR), G.R. No. 172087 March 15, 2011 Case DigestDocument2 pagesPHILIPPINE AMUSEMENT AND GAMING CORPORATION (PAGCOR) vs. THE BUREAU OF INTERNAL REVENUE (BIR), G.R. No. 172087 March 15, 2011 Case DigestJacinto Jr Jamero100% (4)

- 2018 - PAL vs. CIRDocument2 pages2018 - PAL vs. CIRJimcris HermosadoNo ratings yet

- CIR V Fitness by DesignDocument3 pagesCIR V Fitness by Designsmtm06100% (3)

- Bdo V CirDocument5 pagesBdo V CirAnselmo Rodiel IVNo ratings yet

- Banco de Oro V RepublicDocument20 pagesBanco de Oro V RepublicKJ ArgallonNo ratings yet

- 2015-2016 Tax Case DigestDocument114 pages2015-2016 Tax Case DigestD Del Sal100% (3)

- Bdo vs. Republic PDFDocument2 pagesBdo vs. Republic PDFnesteamackNo ratings yet

- TaxRev - BDO v. RPDocument76 pagesTaxRev - BDO v. RPkjhenyo218502No ratings yet

- G.R. No. 172509, February 04, 2015 China Banking Corporation, Petitioner, V. Commissioner of INTERNAL REVENUE, RespondentDocument13 pagesG.R. No. 172509, February 04, 2015 China Banking Corporation, Petitioner, V. Commissioner of INTERNAL REVENUE, RespondentybunNo ratings yet

- BDO Vs RPDocument9 pagesBDO Vs RPLarry John AustinNo ratings yet

- BDO V REPUBLICDocument10 pagesBDO V REPUBLICJe MercNo ratings yet

- Motion To Reset SampleDocument2 pagesMotion To Reset SampleTrem GallenteNo ratings yet

- Prosecution must establish guilt relying on own evidence not weakness of defenseDocument1 pageProsecution must establish guilt relying on own evidence not weakness of defenseTrem GallenteNo ratings yet

- Betty GepulleDocument1 pageBetty GepulleTrem GallenteNo ratings yet

- Pilipinas Total Gas v. CIRDocument2 pagesPilipinas Total Gas v. CIRTrem GallenteNo ratings yet

- PEOPLE OF THE PHILIPPINES vs. MINANGAdocxDocument1 pagePEOPLE OF THE PHILIPPINES vs. MINANGAdocxTrem GallenteNo ratings yet

- DEPARTMENT OF AGRARIAN REFORM VS. ROBLESdocxDocument1 pageDEPARTMENT OF AGRARIAN REFORM VS. ROBLESdocxTrem GallenteNo ratings yet

- PEOPLE OF THE PHILIPPINES vs. MINANGAdocxDocument1 pagePEOPLE OF THE PHILIPPINES vs. MINANGAdocxTrem GallenteNo ratings yet

- PEOPLE OF THE PHILIPPINES vs. MINANGAdocxDocument1 pagePEOPLE OF THE PHILIPPINES vs. MINANGAdocxTrem GallenteNo ratings yet

- Betty GepulleDocument1 pageBetty GepulleTrem GallenteNo ratings yet

- DST MOVERS CORPORATION V PGICDocument3 pagesDST MOVERS CORPORATION V PGICTrem Gallente100% (1)

- Remedial LawDocument1 pageRemedial LawTrem GallenteNo ratings yet

- Betty GepulleDocument1 pageBetty GepulleTrem GallenteNo ratings yet

- Republic Vs BagtasDocument2 pagesRepublic Vs BagtasTrem GallenteNo ratings yet

- FULL TEXT Quiazon V BelenDocument8 pagesFULL TEXT Quiazon V BelenTrem GallenteNo ratings yet

- Spouses Gregorio and Josefa Yu vs. Ngo Yet Te (Di Ko Ganung Naintindihan)Document4 pagesSpouses Gregorio and Josefa Yu vs. Ngo Yet Te (Di Ko Ganung Naintindihan)Trem GallenteNo ratings yet

- Personal Liability of Corporate Officers Under Trust ReceiptsDocument7 pagesPersonal Liability of Corporate Officers Under Trust ReceiptsTrem GallenteNo ratings yet

- Guaranty CasesDocument7 pagesGuaranty CasesTrem GallenteNo ratings yet

- PNB vs. Luzon Surety and CA ruling on surety liability for interestDocument5 pagesPNB vs. Luzon Surety and CA ruling on surety liability for interestTrem GallenteNo ratings yet

- Guaranty CasesDocument7 pagesGuaranty CasesTrem GallenteNo ratings yet

- Revised Penal Code (Title II) PDFDocument12 pagesRevised Penal Code (Title II) PDFisamokerNo ratings yet

- Somewhere Over The RainbowDocument1 pageSomewhere Over The RainbowTrem GallenteNo ratings yet

- CarpioDocument26 pagesCarpioRapplerNo ratings yet

- Estate Tax PrelimsDocument28 pagesEstate Tax PrelimsSeanmigue TomaroyNo ratings yet

- RPC CodalDocument8 pagesRPC CodalMoncie SantosNo ratings yet

- DocDocument68 pagesDocTrem GallenteNo ratings yet

- The Doctrine of Operative FactDocument3 pagesThe Doctrine of Operative FactTrem GallenteNo ratings yet

- 81Document2 pages81Trem GallenteNo ratings yet

- You - Basil ValdezDocument1 pageYou - Basil ValdezgerwinryanrabayaNo ratings yet

- CIR v. NEXT MOBILE, INC. GR No. 212825. December 7, 2015Document2 pagesCIR v. NEXT MOBILE, INC. GR No. 212825. December 7, 2015Jernel JanzNo ratings yet

- TIFIA Program GuideDocument66 pagesTIFIA Program GuideKunqi ZhangNo ratings yet

- Key Fact StatementDocument3 pagesKey Fact Statementamansingh21031992No ratings yet

- Tariff Methodology For The Setting of Pipeline Tariffs - 5th Edition PDFDocument41 pagesTariff Methodology For The Setting of Pipeline Tariffs - 5th Edition PDFChicoUiobiNo ratings yet

- Part I Accounts QuestionDocument11 pagesPart I Accounts QuestionAMIN BUHARI ABDUL KHADERNo ratings yet

- Acctg 115 - CH 10 SolutionsDocument22 pagesAcctg 115 - CH 10 SolutionschinmusicianNo ratings yet

- Time Value of MoneyDocument1 pageTime Value of MoneyAlelie dela CruzNo ratings yet

- Treasury Rules Vol-II PDFDocument300 pagesTreasury Rules Vol-II PDFAneela TabassumNo ratings yet

- Prevent Fraud With Vigilance ChecksDocument12 pagesPrevent Fraud With Vigilance Checkseknath2000No ratings yet

- 1.3.2 Business Revenues Costs and ProfitsDocument3 pages1.3.2 Business Revenues Costs and ProfitsEmaadB EmaadBNo ratings yet

- Credit DigestDocument1 pageCredit DigestBreth1979No ratings yet

- 10 Financial Principles That Are BiblicalDocument5 pages10 Financial Principles That Are BiblicalLuis JohnsonNo ratings yet

- Consolidated Financial Statements of Miguel CorporationDocument9 pagesConsolidated Financial Statements of Miguel CorporationAra Mae Sta CatalinaNo ratings yet

- Chapter 11Document38 pagesChapter 11muiz ahmad0% (1)

- Chapter 3 Section 4Document2 pagesChapter 3 Section 4Chie TanganNo ratings yet

- Loan Syndication For Domestic Borrowings in Merchant BankingDocument24 pagesLoan Syndication For Domestic Borrowings in Merchant BankingKinjal ShahNo ratings yet

- Fa2 Tut 5Document5 pagesFa2 Tut 5Truong Thi Ha Trang 1KT-19No ratings yet

- Structured Trade - Preexport - FinanceDocument15 pagesStructured Trade - Preexport - Financeachopra14No ratings yet

- Promotion Study Material I To II and II To III-1Document131 pagesPromotion Study Material I To II and II To III-1Shuvajoy ChakrabortyNo ratings yet

- Chapter 4Document19 pagesChapter 4airaNo ratings yet

- Tata Motors Equity Research ReportDocument29 pagesTata Motors Equity Research Reportjohn paulNo ratings yet

- DebtFreeSecrets+V1 1Document45 pagesDebtFreeSecrets+V1 1Raul Fraul100% (1)

- Financial Rehabilitation and Insolvency Act RA No. 10142Document7 pagesFinancial Rehabilitation and Insolvency Act RA No. 10142MarkNo ratings yet

- Financing the Mozal Aluminum ProjectDocument19 pagesFinancing the Mozal Aluminum ProjectSimran MalhotraNo ratings yet

- LBS Tutorial 7 FinanceDocument3 pagesLBS Tutorial 7 FinancegiovanniNo ratings yet

- 10 Things NOT To Do When Applying For A Credit CardDocument15 pages10 Things NOT To Do When Applying For A Credit CardElmerDolendoTorrevillaNo ratings yet

- True or FalseDocument5 pagesTrue or FalseTsukishima Kei100% (1)

- Installments in Simple Interest ExplainedDocument7 pagesInstallments in Simple Interest ExplainedRitwik50% (2)

- Lesson 1. Financial Statements (Cabrera & Cabrera, 2017)Document10 pagesLesson 1. Financial Statements (Cabrera & Cabrera, 2017)Axel MendozaNo ratings yet

- Schwartz Jules - Finance and Accounting For The Non-Financial Manager Part 1Document65 pagesSchwartz Jules - Finance and Accounting For The Non-Financial Manager Part 1William GallegoNo ratings yet

- Problem 8 14 To To 8 18Document24 pagesProblem 8 14 To To 8 18Hendriech Del Mundo62% (13)