Professional Documents

Culture Documents

Tax 101 PDF

Uploaded by

Ashley Levy San Pedro0 ratings0% found this document useful (0 votes)

19 views11 pagesOriginal Title

Tax 101.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views11 pagesTax 101 PDF

Uploaded by

Ashley Levy San PedroCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

Why does government

collect taxes?

The government collects taxes to provide

basic services such as education, health,

infrastructure, and other social services for all.

Taxes are also used to build

schools, hospitals, roads and

various infrastructure for

connectivity, and industrial and

Ey-qare lac 16 revel Ueto

These taxes are used to pay for

our doctors, teachers, soldiers,

and other government

personnel and officials.

these investments would give the people an opportunity

ite in economic progress and nation-bui

(OU Rance ear)

What are taxes

BEY Oe Teme L-1C ag

contributions of everyone to

raise revenue for nation-building.

The revenue raised is used to pay for our

doctors, teachers, soldiers, and other

government personnel and officials, as

well as for building schools, hospitals,

roads, and other infrastructure.

OU bec ea

Why does government

collect taxes?

The government collects taxes to provide

basic services such as education, health,

infrastructure, and other social services for all.

Taxes are also used to build

schools, hospitals, roads and

various infrastructure for

connectivity, and industrial and

agricultural facilities.

BU SRE M Le ooo

our doctors, teachers, soldiers,

and other government

personnel and officials.

Prioritizing these investments would give the people an opportunity

to contribute in economic progress and nation-build'

(Sl kare ea

Who pays taxes

We all pay taxes, either directly or indirectly. We pay taxes

according to our income and/or level of consumption.

is based on is

the ability-to-pay based on the amount of

principle wherein people goods and services

with higher income utilized such that the

should pay more. recom LOMO mac

higher the tax you pay.

(Ol kee eas

Who pays taxes?

Filipinos residing in the Philippines are taxed

based on income earned here and abroad.

In the case of Filipinos living abroad, they are

only taxed based on their income earned in the

Philippines. Similarly, resident aliens and

non-resident aliens in the Philippines are taxed

based on their income earned in the country.

Who pays taxes?

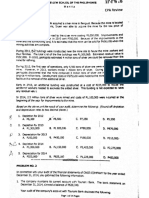

The following are the number of taxpayers by income bracket:

ETM eee mila)

262,815 taxpayers

Pree este

Sisto

250,000 to 500,000

EOC Ey

Pree ed

Pl teogey

140,000 to 250,000

CERO

Pa eel

17.92B tax due mnt

‘ a hay

Ree Dear

Soret s Reo or

Besecenecenecenencesetay, ste er late

CORTE CURTIN ececenecececececece occ)

CEST aes eveteretecetese®,

, i :

SCENE Tree

SUEY Se rat

ERROR

CY MO Pa er ey

Cae Ree Crd

2.55B tax due

ROR

SPC

98.21B income/sales

ee Emenee

250,391 taxpayers

Beer Neue

360.89M tax due

a Chg

** Taxpayers include both compensation income earners, and self-employed and professionals

*** income/sales and tax due distribution based on DOF estimates

© [fly aac

Where do my taxes go?

For every Php100 we contribute through our taxes,

Php40 goes to the local government, while the

Php60 is used by the national government to invest

in programs and projects that benefit the whole country.

National government

Local government

The local government units use their share of the national

funds, together with local funds, to provide services to its

people. Part of this goes to the local development fund to

provide better infrastructure and economic services.

(Sl kare ea

Where do my taxes go

Taxes are used to fund social

services and investment in

infrastructure and human

capital development.

aeRO mee eMe lL NU EI C Ce RCO S

poorest through targeted transfers (e.g. 4Ps,

pension to qualified senior citizens, allowance

for PWDs, PhilHealth).

(Ol kao ea

What are the different

kinds of taxes

Taxes can either be direct or indirect.

Een eae R dali 1 Kms] (6) are collected based

from your income and properties. on consumption. Examples include

Examples include personal and Col oM eb CPAP ACID oR

corporate income taxes, property and documentary stamp tax (DST).

and capital taxes.

(OU haere ea

What are the tax rates for

the different kinds of taxes

is a type of indirect tax imposed on

goods and services. It is typically passed on to the buyer as part

of the selling price. Both imported and domestic goods and

services are covered by VAT, but there are many exemptions.

For non-exempt For exports and For selected goods

domestic and export-related and services

imported goods and transactions

ae

(OU keer ea

What are the tax rates for

the different kinds of taxes?

Income tax is a direct tax paid by an individual

or organization imposed on:

Compensation ee Poly

ited Practice of Tax on deposits,

BS] CVT Som] 4 Felco SoA REL RI CRI Te]

taxable bonuses, gains from sale of dividends

Lixo XLT assets, and other

other allowances income not covered

by compensation

FD www.dofgev.ph #Taxt01

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- OBLICON ReviewerDocument54 pagesOBLICON ReviewerMaria Diory Rabajante93% (301)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fa1 2014Document339 pagesFa1 2014hanamay_07100% (1)

- Quality Control Practice SetDocument6 pagesQuality Control Practice SetAshley Levy San PedroNo ratings yet

- ReceivablesDocument5 pagesReceivablesAshley Levy San PedroNo ratings yet

- Ar MCQDocument4 pagesAr MCQAshley Levy San PedroNo ratings yet

- Risk AssessmentDocument9 pagesRisk AssessmentAshley Levy San PedroNo ratings yet

- P1 923 PDFDocument7 pagesP1 923 PDFAshley Levy San PedroNo ratings yet

- Chapter06.Activity-Based Management and Cost Management ToolsDocument16 pagesChapter06.Activity-Based Management and Cost Management ToolsAshley Levy San PedroNo ratings yet

- Cpar Pw-ApDocument14 pagesCpar Pw-ApAshley Levy San PedroNo ratings yet

- T02 - Installment Sales & Consignment Sales PDFDocument7 pagesT02 - Installment Sales & Consignment Sales PDFAshley Levy San PedroNo ratings yet

- Activity-Based Costing: Assignment Classification TableDocument26 pagesActivity-Based Costing: Assignment Classification TableAshley Levy San PedroNo ratings yet

- Garrison ABCDocument18 pagesGarrison ABCAshley Levy San PedroNo ratings yet

- Obligations SummaryDocument18 pagesObligations SummaryAshley Levy San PedroNo ratings yet

- May 09 Final Pre-Board (At)Document13 pagesMay 09 Final Pre-Board (At)Ashley Levy San PedroNo ratings yet

- 1st PB-ATDocument12 pages1st PB-ATLovenia MagpatocNo ratings yet

- Interest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeDocument3 pagesInterest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeAshley Levy San PedroNo ratings yet

- FAR ReviewerDocument17 pagesFAR ReviewerAshley Levy San Pedro50% (2)