Professional Documents

Culture Documents

Business Combination-Acquisition of Net Assets

Uploaded by

MelodyLongakitBacatanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Combination-Acquisition of Net Assets

Uploaded by

MelodyLongakitBacatanCopyright:

Available Formats

BUSINESS COMBINATION

ACQUISITION OF NET ASSETS

1. On January 1, 2012, Marks Company purchased the net assets of Spencer Company by paying P 850,000 cash and

issuing shares of stocks at P 3,110,000 fair market value. Book value and fair value data on the Statement of Financial

Position on January 1, 2012 are as follows:

Marks Company Spencer Company

Book Value Fair Value Book Value Fair Value

Cash P 4,600,000 P 4,600,000 P 300,000 P 300,000

Accounts Receivable 1,000,000 1,000,000 980,000 980,000

Inventory 1,500,000 1,300,000 710,000 600,000

Building & Equipment, net 1,800,000 1,460,000 1,520,000 1,064,000

Goodwill - - 90,000 80,000

TOTAL ASSETS 8,900,000 8,360,000 3,600,000 3,024,000

========== ========== =========== =========

Liabilities P 1,000,000 P 1,000,000 P 570,000 P 570,000

Capital Stock 1,600,000 600,000

Additional paid in capital 900,000 960,000

Retained Earnings 5,400,000 1,470,000_

TOTAL LIAB & SHE 8,900,000 3,600,000

========== ==========

Marks incurred and paid legal and brokerage fees of P 25,000 for business combination; stocks issuance cost of P

23,000 and Pn 12,000 indirect acquisition costs. It is determinable that contingency fee of P 11,800 would be paid

within the year.

I. Total assets after the business combination

a. P 11,991,200 c. P 12,531,200

b. P 13,381,200 d. P 12,351,200

II. Stockholders’ equity after the business combination

a. P 7,900,000 c. P 10,937,600

b. P 11,010,000 d. P 10,949,400

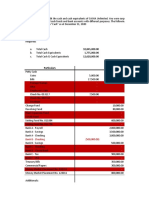

2. A condensed Statement of Financial Position at August 31, 2012 and related current fair value data for Apple

Company are presented below;

Apple Company

Statement of Financial Position

August 31, 2012

Carrying Amount Fair Value

Assets:

Current assets P 368,000 P 404,000

Plant assets 592,000 690,000

Patent, net 58,500__ 48,000

Total Assets 1,019,000

Liabilities & SHE:

Current liabilities P 107,500 P 107,000

Long term debt 280,000 297,500

Capital stock, P 20 par 210,000

Retained earnings 421,500__

Total Liabilities and SHE 1,019,000

On September 1, 2012, Eve Corporation issued 10,700 shares of its P 24 par value common stocks (current fair value

P 33 per share) and P 145,000 cash for the net assets of Apple Company. Of the P 47,500 out of pocket costs paid by

Eve on September 1, 2012, P 26,500 were indirect costs and the remainder were legal fees and finder’s fees related

to the business combination.

I. How much is the net increase in the stockholders equity in the books of the surviving company as a result of the

business combination?

a. P 592,000 c. P 518,500

b. P 545,000 d. P 496,200

3. The following are the Statement of Financial Position of Top and Shop Corporation as of December 31, 2011:

Top Shop

Cash P 150,000 P 10,000

Receivable 35,000 7,500

Inventories 40,000 12,500

Land 37,500 50,000

Building, net 110,000 50,000

Equipment, net 75,000_ 120,000_

Total Assets P 447,500 P 250,000

========== ==========

Accounts payable P 92,500 P 30,000

Ordinary shares, P 10 par 250,000 100,000

Share premium 25,000 70,000

Retained Earnings 80,000_ 50,000_

Total Liabilities & SHE P 447,500 P 250,000

========== ===========

Top decided to acquire the net assets of Shop on January 1, 2012. Top will issue 9,500 ordinary shares with market

value of P 17 per share and cash purchase price of P 14,000, Shop will be dissolved. The book values reflect fair values

except for building of Top, which has a net realizable of P 21,000 and P 64,000 respectively. Top also paid for the cost

of registering and issuing securities amounting to P 7,500, direct costs of combination amounting to P 11,000 and

indirect costs amounting to P 5,000.

I. How much is the total assets after the combination?

a. P 720,000 c. P 722,000

b. P 706,000 d. P 682,500

II. How much is the total shareholders’ equity after the combination?

a. P 516,000 c. P 560,000

b. P 509,000 d. P 493,000

You might also like

- Wiley CPA Examination Review Password DownloadslideDocument753 pagesWiley CPA Examination Review Password DownloadslideMelodyLongakitBacatan100% (7)

- Project 4 - Forecasting Financial StatementsDocument56 pagesProject 4 - Forecasting Financial StatementsTulasi ReddyNo ratings yet

- AFAR Notes by Dr. Ferrer PDFDocument21 pagesAFAR Notes by Dr. Ferrer PDFjexNo ratings yet

- AFAR Notes by Dr. Ferrer PDFDocument21 pagesAFAR Notes by Dr. Ferrer PDFjexNo ratings yet

- Practical Accounting 1-MockboardzDocument9 pagesPractical Accounting 1-MockboardzMoira C. Vilog100% (1)

- Home Office ExampleDocument5 pagesHome Office ExampleGwenn VillamorNo ratings yet

- ROI, residual income, and required returnsDocument21 pagesROI, residual income, and required returnsGelyn CruzNo ratings yet

- 1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Document10 pages1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Margaux Phoenix KimilatNo ratings yet

- Mas Resa 2018 PDFDocument16 pagesMas Resa 2018 PDFMelodyLongakitBacatanNo ratings yet

- BIR Form 1800 - Donor's Tax ReturnDocument2 pagesBIR Form 1800 - Donor's Tax ReturnangelgirlfabNo ratings yet

- AFAR ProblemsDocument45 pagesAFAR ProblemsElena Llasos84% (31)

- Errors and Irregularities in The Transaction CycleDocument22 pagesErrors and Irregularities in The Transaction CycleVatchdemonNo ratings yet

- Unit 6 AUDIT OF INTANGIBLE ASSETS Lecture Notes 2020Document11 pagesUnit 6 AUDIT OF INTANGIBLE ASSETS Lecture Notes 2020Marynelle Labrador Sevilla100% (1)

- Internal Auditing Wiley TestBank PDFDocument15 pagesInternal Auditing Wiley TestBank PDFMelodyLongakitBacatanNo ratings yet

- CPA Review School Philippines Audit EngagementDocument4 pagesCPA Review School Philippines Audit EngagementshambiruarNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- UE-Caloocan Comprehensive Exam Reviewer Subjects CoverageDocument124 pagesUE-Caloocan Comprehensive Exam Reviewer Subjects CoverageCamille CastroNo ratings yet

- Master Budget Assignment Solution VADocument17 pagesMaster Budget Assignment Solution VAMasuk Hasan100% (1)

- Chapter 7 Audit Planning: Assessment of Control RiskDocument26 pagesChapter 7 Audit Planning: Assessment of Control RiskJeffreyBeridaNo ratings yet

- Chapter 14 Other SolutionDocument18 pagesChapter 14 Other SolutionChristine BaguioNo ratings yet

- Instruction: Show Your Solution. No Solution Incorrect AnswerDocument1 pageInstruction: Show Your Solution. No Solution Incorrect AnswerRian ChiseiNo ratings yet

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- JollibeeDocument18 pagesJollibeeNocQuisaotNo ratings yet

- Sycip Gorres Velayo & Co.: HistoryDocument5 pagesSycip Gorres Velayo & Co.: HistoryYonko ManotaNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Supporting ComputationDocument5 pagesSupporting ComputationSuenNo ratings yet

- Sol Man Sec 6 SQ1 PDFDocument4 pagesSol Man Sec 6 SQ1 PDFHope Trinity EnriquezNo ratings yet

- AUD 1206 Case Analysis RisksDocument2 pagesAUD 1206 Case Analysis RisksRNo ratings yet

- Afar 107 - Business Combination Part 2Document4 pagesAfar 107 - Business Combination Part 2Maria LopezNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Ans To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsDocument188 pagesAns To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsLouise GazaNo ratings yet

- F3ch2dilemna Socorro SummaryDocument8 pagesF3ch2dilemna Socorro SummarySushii Mae60% (5)

- BAFINAR Quiz 6 R FinalDocument4 pagesBAFINAR Quiz 6 R FinalJemNo ratings yet

- Business Policy Activity 2Document3 pagesBusiness Policy Activity 2Motopatz BrionesNo ratings yet

- Auditing Problems Intangibles Impairment and Revaluation PDFDocument44 pagesAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaNo ratings yet

- Isc Is An International Manufacturing Company With Over 100 SubsidiariesDocument2 pagesIsc Is An International Manufacturing Company With Over 100 SubsidiariesAmit PandeyNo ratings yet

- Audit of Receivable Wit Ans KeyDocument19 pagesAudit of Receivable Wit Ans Keyalexis pradaNo ratings yet

- Seatwork - Advacc1Document2 pagesSeatwork - Advacc1David DavidNo ratings yet

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaNo ratings yet

- 1.1 Assignment1 Internal Audit and The Audit Committee and Types of AuditDocument4 pages1.1 Assignment1 Internal Audit and The Audit Committee and Types of AuditXexiannaNo ratings yet

- Expert Q&A SolutionsDocument3 pagesExpert Q&A SolutionsSitiNadyaSefrilyNo ratings yet

- Chapter 17 Consolidated Fs Part 1 Afar Part 2Document23 pagesChapter 17 Consolidated Fs Part 1 Afar Part 2Kathrina RoxasNo ratings yet

- Risk-Based Internal Auditing and Identifying Operational RisksDocument5 pagesRisk-Based Internal Auditing and Identifying Operational RisksMaricar PinedaNo ratings yet

- Audit Equity AccountsDocument8 pagesAudit Equity AccountsEmerlyn Charlotte FonteNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Ia3 IsDocument3 pagesIa3 IsMary Joy CabilNo ratings yet

- Partnership Accounting QuestionsDocument15 pagesPartnership Accounting QuestionsNhel AlvaroNo ratings yet

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Document1 pagePrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versNo ratings yet

- Case Carolina-Wilderness-Outfitters-Case-Study PDFDocument8 pagesCase Carolina-Wilderness-Outfitters-Case-Study PDFMira miguelito50% (2)

- ACT631 Assurance Principles, Professional Ethics and Good Governance PDFDocument6 pagesACT631 Assurance Principles, Professional Ethics and Good Governance PDFMarnelli CatalanNo ratings yet

- Administrative Office ManagementDocument44 pagesAdministrative Office ManagementLea VenturozoNo ratings yet

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- CPALEDocument1 pageCPALERalph Clarence NicodemusNo ratings yet

- Psa 401Document5 pagesPsa 401novyNo ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Document16 pagesACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lanceNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- AE120 - Final Activity 1Document1 pageAE120 - Final Activity 1Krystal shaneNo ratings yet

- Chapter 14Document47 pagesChapter 14darylleNo ratings yet

- Answer The Following With Speed and Accuracy. Solutions Must Be DisclosedDocument4 pagesAnswer The Following With Speed and Accuracy. Solutions Must Be DisclosedUNKNOWNNNo ratings yet

- Lyceum of The Philippines University Manila College of Business AdministrationDocument166 pagesLyceum of The Philippines University Manila College of Business AdministrationVanessa SisonNo ratings yet

- QUizzer 4 - Overall With AnswerDocument20 pagesQUizzer 4 - Overall With AnswerJan Elaine CalderonNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Far TB2Document195 pagesFar TB2MarieJoiaNo ratings yet

- SW - NpoDocument1 pageSW - NpoGwy HipolitoNo ratings yet

- PFRS 12 Disclosure RequirementsDocument26 pagesPFRS 12 Disclosure RequirementsMeiNo ratings yet

- MainDocument16 pagesMainArjay DeausenNo ratings yet

- Kinney 8e - CH 17Document18 pagesKinney 8e - CH 17Mr. FoxNo ratings yet

- Audit Theory Chapter 7 Overview of FS Audit ProcessDocument13 pagesAudit Theory Chapter 7 Overview of FS Audit ProcessAdam SmithNo ratings yet

- 07 - Revenue - Consignment Sales PDFDocument17 pages07 - Revenue - Consignment Sales PDFCarla MarieNo ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- CORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSDocument5 pagesCORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSjjjjjjjjjjjjjjjNo ratings yet

- Acquisition of Stocks and Business CombinationsDocument2 pagesAcquisition of Stocks and Business CombinationsMark Joseph OlinoNo ratings yet

- PFRS 3 Business Combination ProblemsDocument3 pagesPFRS 3 Business Combination ProblemsRay Allen UyNo ratings yet

- Teaching Profession Assessment QuestionsDocument9 pagesTeaching Profession Assessment QuestionsMelodyLongakitBacatanNo ratings yet

- Multiple CamScanner ScansDocument20 pagesMultiple CamScanner ScansMelodyLongakitBacatanNo ratings yet

- Tax 2018Document7 pagesTax 2018MelodyLongakitBacatanNo ratings yet

- Bowling Pe4Document49 pagesBowling Pe4MelodyLongakitBacatanNo ratings yet

- Mas Resa 2018 PDFDocument16 pagesMas Resa 2018 PDFMelodyLongakitBacatanNo ratings yet

- A Guide To TRAIN RA10963 PDFDocument18 pagesA Guide To TRAIN RA10963 PDFJay Ryan Sy Baylon100% (2)

- Business Combination-Intercompany Sale of InventoryDocument1 pageBusiness Combination-Intercompany Sale of InventoryMelodyLongakitBacatanNo ratings yet

- Testbank For Business FinanceDocument49 pagesTestbank For Business FinanceSpencer1234556789No ratings yet

- A Guide To TRAIN RA10963 PDFDocument18 pagesA Guide To TRAIN RA10963 PDFJay Ryan Sy Baylon100% (2)

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Cambridge O Level: ACCOUNTING 7707/24Document20 pagesCambridge O Level: ACCOUNTING 7707/24For GamingNo ratings yet

- Understanding and Analysis and Interpretation of Financial StatementsDocument18 pagesUnderstanding and Analysis and Interpretation of Financial StatementsLara FloresNo ratings yet

- Investments That Do Not Normally Change in Value Are Disclosed On The Balance Sheet As Cash and Cash EquivalentsDocument3 pagesInvestments That Do Not Normally Change in Value Are Disclosed On The Balance Sheet As Cash and Cash EquivalentsHussainNo ratings yet

- Brooks Problem SolutionsDocument25 pagesBrooks Problem Solutionsimperdible0No ratings yet

- Latihan CH 1 EA-DDocument18 pagesLatihan CH 1 EA-DBeLoopersNo ratings yet

- Corporation Code Title IIDocument25 pagesCorporation Code Title IIzcel delos ReyesNo ratings yet

- Mike Owjai Manufacturing Financial Statements and Analysis 2014 vs 2013Document20 pagesMike Owjai Manufacturing Financial Statements and Analysis 2014 vs 2013Alvaro LopezNo ratings yet

- NN5 Chap 5Document41 pagesNN5 Chap 5Nguyet NguyenNo ratings yet

- Accounting TermDocument7 pagesAccounting TermThangdong QuayNo ratings yet

- Ch12in 1Document44 pagesCh12in 1Smile LyNo ratings yet

- FA2e Chapter12 Solutions ManualDocument78 pagesFA2e Chapter12 Solutions Manual齐瀚飞No ratings yet

- SolMan Chapter3 ABC 2022 EditionDocument9 pagesSolMan Chapter3 ABC 2022 EditionrylNo ratings yet

- Fsao: Acc02b2/act02b2/rek2b01Document8 pagesFsao: Acc02b2/act02b2/rek2b01Thulani NdlovuNo ratings yet

- Retained EarningsDocument9 pagesRetained EarningsCamille GarciaNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument20 pagesAudit of The Capital Acquisition and Repayment Cycleputri retno100% (1)

- Stock Dividend: Date of PaymentDocument6 pagesStock Dividend: Date of PaymentmercyvienhoNo ratings yet

- Vivaldi SpA Financial StatementDocument2 pagesVivaldi SpA Financial StatementRani AdhirasariNo ratings yet

- Lcci Level 4 Certificate in Financial Accounting ASE20101 Resource Booklet Nov 2019Document8 pagesLcci Level 4 Certificate in Financial Accounting ASE20101 Resource Booklet Nov 2019Musthari KhanNo ratings yet

- B2 2022 May QNDocument11 pagesB2 2022 May QNRashid AbeidNo ratings yet

- CombinepdfDocument208 pagesCombinepdfH. TэлмэнNo ratings yet

- Assignment 3 Consolidation. Subsequent To The Date of AcquisitionDocument4 pagesAssignment 3 Consolidation. Subsequent To The Date of AcquisitionAivan De LeonNo ratings yet

- CAE 2 Financial Accounting and Reporting: Lyceum-Northwestern UniversityDocument15 pagesCAE 2 Financial Accounting and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet