Professional Documents

Culture Documents

Lecture Notes

Uploaded by

Abhijeet SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture Notes

Uploaded by

Abhijeet SinghCopyright:

Available Formats

Business and Science of Clean Energy

Lecture 3rd, March 27th, The Carbon footprint of an organization

Carbon footprint can be divided into three:

o Direct emission

o Indirect emission

o Other indirect emission

Activity Carbon footprint calculation

Manufacturing paper

Printing

Distribution

How would the carbon footprint of a product bought in a retail sore differ from the computation for a

newspaper? Does the design of the org. matter to its carbon footprint?

Complexities: Supply Chain

* Buying something from Amazon and buying from local store have a different footprint

Key Decisions

How to improve operational efficiency

What capacity to build & what kind of battery

How to achieve coordination in the supply chain

How to cement supplies to get material (rare material, Lithium)

To improve technology or to get into price war with 2nd tier producers (China)

Whether to form a partnership and with whom

How to reduce cost – manufacturing cost and Raw material

Whether to expand globally; production capabilities

do we have the technology available? – Is it competitive and whars over edge

o How do we determine viability?

Prototype

Building a business case

Time-frame of decision making

Tesla: 60 KWH or energy of storage

Estimated mileage: 4-5 km/ kwh

Well-to-wheel efficiency

Power generation ---- charging efficiency --- motor

50% 80-90% efficiency from gasoline is 20%

Comparison of specific energy

Lead-acid battery --- 0.035 kwh/kg

Gasoline 12 KWH/kg

NiMH battery 0.061 kWh/ Kg

Li-ion battery 0.15-0.21 kWh/kg

2008 Tesla 56 kWh ~ 454 kg battery

Toyota RAV4 EV ~ similar weigh weight delivers 27 kwh

How much demand?

Pre-sell (early read on demand) – work with car manufacturers

Market segment

Government regulation

Price point

o Scale of operations

o Gas price

o Productivity

Capacity creation

+ve -ve

High return if demand is high Risk to investment (return could be low)

Economies of scale to lower cost Over creation of capacity

Low prices, low return

Larger market share

Minimizing lost sales from higher capacity

Faster learning curve

Tesla estimates an upfront investment of $5billion in a factory to produce 500K units annually

What is the risk in this investment?

Newsvendor model – capacity investment optimization (Case 1)

Demand is uniformly distributed between 0 and 2 million units

How much capacity should you create?

You might also like

- Syllabus 6630 2017Document10 pagesSyllabus 6630 2017Abhijeet SinghNo ratings yet

- Cabot Corporation As3586Document6 pagesCabot Corporation As3586Abhijeet SinghNo ratings yet

- Airbus A380 - A Model For DisruptionDocument11 pagesAirbus A380 - A Model For DisruptionAbhijeet SinghNo ratings yet

- Sid Sname Gpa Sizehs 123 Mankad 3.3 345 Hand 3.9 80 543 Goddes 3.1 2000 892 Modi 5.8 2300Document1 pageSid Sname Gpa Sizehs 123 Mankad 3.3 345 Hand 3.9 80 543 Goddes 3.1 2000 892 Modi 5.8 2300Abhijeet SinghNo ratings yet

- Bio Magnetism Future of Health PDFDocument32 pagesBio Magnetism Future of Health PDFAbhijeet Singh100% (3)

- BCGAssociatePosition KbEDocument1 pageBCGAssociatePosition KbEAbhijeet SinghNo ratings yet

- Rosewood Case AnalysisDocument4 pagesRosewood Case AnalysisAbhijeet SinghNo ratings yet

- The Battlefield of The MindDocument25 pagesThe Battlefield of The MindAbhijeet SinghNo ratings yet

- Gayatri MeditationDocument1 pageGayatri MeditationAbhijeet SinghNo ratings yet

- Adani Power ProspectusDocument484 pagesAdani Power ProspectusKumar RahulNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Harmonic Distortion CSI-VSI ComparisonDocument4 pagesHarmonic Distortion CSI-VSI ComparisonnishantpsbNo ratings yet

- Micro Economics SummaryDocument62 pagesMicro Economics SummaryEVS PRADEEPNo ratings yet

- Muscovy DucksDocument27 pagesMuscovy DucksStephenNo ratings yet

- Mortal Kombat XDocument24 pagesMortal Kombat XMindSpaceApocalypseNo ratings yet

- The World Wide WebDocument22 pagesThe World Wide WebSa JeesNo ratings yet

- Mid Semester Question Paper Programming in CDocument8 pagesMid Semester Question Paper Programming in CbakaNo ratings yet

- VLLAR2019Document81 pagesVLLAR2019Christian MallorcaNo ratings yet

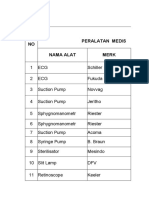

- Daftar Kalibrasi Peralatan MedisDocument34 pagesDaftar Kalibrasi Peralatan Medisdiklat rssnNo ratings yet

- Taxicab Operators V BOTDocument2 pagesTaxicab Operators V BOTHazel P.No ratings yet

- Catalog Electrical Products en - 339 - 1Document20 pagesCatalog Electrical Products en - 339 - 1H 8CNo ratings yet

- Vocabulary List Year 6 Unit 10Document2 pagesVocabulary List Year 6 Unit 10Nyat Heng NhkNo ratings yet

- Bp344 RampDocument29 pagesBp344 RampmaeNo ratings yet

- Rhea Huddleston For Supervisor - 17467 - DR2Document1 pageRhea Huddleston For Supervisor - 17467 - DR2Zach EdwardsNo ratings yet

- Am Bio PhonicsDocument21 pagesAm Bio PhonicsLaura Nataly VillaNo ratings yet

- DS - LWT300 - SF - A4 EN Rev BDocument4 pagesDS - LWT300 - SF - A4 EN Rev BZts MksNo ratings yet

- List of MarketingDocument78 pagesList of MarketingMohamad IchwanNo ratings yet

- Manaloto V Veloso IIIDocument4 pagesManaloto V Veloso IIIJan AquinoNo ratings yet

- Artificial Intelligence/Search/Heuristic Search/astar SearchDocument6 pagesArtificial Intelligence/Search/Heuristic Search/astar SearchAjay VermaNo ratings yet

- Pricelist Jan 2023Document7 pagesPricelist Jan 2023Rahmat FadilNo ratings yet

- Presentation - 02 Reliability in Computer SystemsDocument24 pagesPresentation - 02 Reliability in Computer Systemsvictorwu.ukNo ratings yet

- Eco SPARDocument3 pagesEco SPARMohammad LabinNo ratings yet

- Pas 38 Pas 41 Pas 40Document12 pagesPas 38 Pas 41 Pas 40Leddie Bergs Villanueva VelascoNo ratings yet

- Ten Rules of NetiquetteDocument11 pagesTen Rules of NetiquetteAriel CancinoNo ratings yet

- Definition of Unit HydrographDocument5 pagesDefinition of Unit HydrographPankaj ChowdhuryNo ratings yet

- a27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eDocument762 pagesa27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eRed DiggerNo ratings yet

- Bonus 6 - Mastering ASP - NET Core SecurityDocument147 pagesBonus 6 - Mastering ASP - NET Core SecurityDark Shadow100% (1)

- RODEL LUZ y ONG, Petitioner, People of The Philippines, Respondent. FactsDocument1 pageRODEL LUZ y ONG, Petitioner, People of The Philippines, Respondent. FactsBee Raagas100% (1)

- EC1002 Commentary 2022Document32 pagesEC1002 Commentary 2022Xxx V1TaLNo ratings yet

- ChinatownDocument1 pageChinatownAiken KomensenNo ratings yet

- Canon IR2016J Error Code ListDocument4 pagesCanon IR2016J Error Code ListZahidShaikhNo ratings yet