Professional Documents

Culture Documents

AT

Uploaded by

Ashley Levy San Pedro0 ratings0% found this document useful (0 votes)

33 views12 pagesAT

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAT

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views12 pagesAT

Uploaded by

Ashley Levy San PedroAT

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 12

REVIEW QUESTIONS

Ethics for Professional Accountants in the Palippines?

a, The code is divided into two parts, part A and part

8

b, Part reiers td generat lpplication of te code

‘ ok RE yy to those prlesional

hich statement i¢_incorects regarding the Revised

Philippines?

2. Professional accountants refer to persons who 2

Certified Public Accountants (CPA) and who held 3

valid cxrtiicate issued by the Board of

Accountancy.

b, Where'a local law Is in conflict with @ provision of

the IFAC Code, the IFAC Code requirement

prevails

c. Phe Revised Code of Ethics for Professional

Accountants in the Philippines is mandatory for all

CPA's ard is applicable’ to professional servi

performed in the Philippines on or after January

2011; early adoption is permitted.

4. Amember body of IFAC of frm shall not apply less

Stringent standards than those stated In this Code:

However if member body oF firm ts prohibited

from complying wth certain ports of this Code by

parts of this Code.

D °

Part A: GENERAL APPLICATION OF THE TESBA CODE:

k Section 100 ~ Introduction & Fundamental

0

rinciples

hich of the following statements _best describes why

the profession of CPAS has deemed essential to

promulgate a code of ethics and to establish a}

frecnanlsm for enforcing observance ofthe code?

2A astingishing mark of 2 profession Is is

fecceptance of responsibilty to the public

bb. A prereq site to success is the establishment of an

Gthical code that stresses primarily the

professioxa's responsibilty to clients and

‘alleagues

cc. Rrequirzment of most state laws calls for the

professien to establish a code of ethics.

ad. An essential means. of ‘self-protection for the

Drofessien is the establishment of flexible ethical

Standards by the profession

Fundamental principles

4. "tn order to achieve the objectives of the accountan

profession, professional accoubtants have to observe a

umber of prerequisites or fundamental. principles.

The fundamental” principles include the folowing,

except

Tntegnty and objecovity

Professicnal competence and due care

Confidendalky and professional benavior

Confidence

Page 1 of 11

en

‘code of ‘Ethics for Professional Accountants In “1

7

fe

the code Threats nd seteguards

HK PORS sone anes epming e cate of 8

FundamentaL principles ace potentially affected by

I. 'Seltinterest threat IV. Famuilanity threat

1, Self review threat. Intimidation threat

i. Advocacy threat

2. [Ml If, 1V and V

be nm mandy

This refers to the threet thot a_financial_or_other

Interest wll inappropriately ivluenée the protessia

‘ccountant’s Judgment or Behavior

Self Interest threat. Advocacy threat

BL Self-review threat. Familiar threat

1p and mt

a. Lonty

This refers to the threat that a professional accountant

wil not appropriately evaluate the results of a previous

judgment made or service performed by the

professional accountant, or by another inaividual within

fhe professional scccuntarcs firm or employing

frganization, on which the accountent wil rely when

forming ® judgment as par of providing 8 current

a. Selt-nterest threat

" &, Advocacy threat

b Seitreview threat

6. Familiy threat

It refers to the threat thet a professional accountant

* (il peamste-a-cieat’s or employer's position to the

point that the professional accountant’s objectivity is

Eompromised

fo. "Seltinterest threat

Bi Seltreview threat

Advocacy threat

4G Familiarity threat

It refers to the threat thet due to @ long or close

Felationship with a ‘client or employer, a professional

‘bccountant wil be too sympathetic to thelr interests or

too accepting of ther work, anc

2. Selrinterest threat c.Advocacy threat

B. Sellreview threat 4. Familanty threat

Intimidation threat

an is not 2 threat to in

fundamental principles.

bls the threat that 2 professional accountant wil be

deterred from acting ohisctvely because of actual

or perceived pressures, including attempts. to

‘exercise undue Influence over Ute professional

accountant,

Is the threat that a financial or other interest wil

Inappropriately influence the professional

‘accountants Judgment or behavior.

4, allot the above.

jendence, but only to

Statement 1: Safeguards are actions or oth

measures that may eliminate threats or reduce

tO an acceptable level.

‘Statement 2: They fall nto fo broad cat

Safeguards created by the profession, I

regulation; and (b) Safeguards in

‘environment.

2. True, True

B, True, False

Conceptual framework

BA

Part A of the code of professional ethics establishes the

fundamental principles of professional ethics for

professional accountants and provides, 9 conceptual

framework that professional accountants shell apply to

‘complying with the fundamental principles, A

professional “ accountant shall” use professional

Judgment “In appiy'ng this conceptual. framework.

Which of the following statements relating to. the

conceptual framework is ineorrect?

2 Identify threats "to compliance with the

fundamental “principles "and evaluate the

significance ofthe threats identified

b. Apply safeguards, when necessery, to elimi

the threats or reduce them to an acceptable level

© Safeguards are necessary when the professions

ccountant determines that the threats are nol

a ‘evel at which a reasonable and Informed third

arty would be likely to conclude, weighing all the

Specie fects and circumstances’ avaliable te the

Professional accountant at that time, thot

Compliance with the fundamental principles is not

compromised.

4. No safeguards ore necessary as long as the

professional accountants adhere to. applicable

technical standards,

Ethical contict resolution

2D

y

‘professional accountant may be required to resolve a

Conflict In complying with the fundamental principles,

When ‘nitiating either 3 formal or informal confi:

Tesolution “process, the folowing factors, either

Inaividualy or together with other factors, may. be

Televant tothe resolution provess

1. Relevant facts

W, Ethical eves involved

IM. Fundamental principles related to the motter in

question

Established internal procedures

V. Alternative courses of action,

a. Ti Ps

111,11 and v

BTM angi

4. Aller tne above

When faced with significant ethical issues, and having

considered the relevant factors, a professional

‘2ccountant shall determine the appropriate course. of

18. Which of

the following, except

2. Follow the estabished polices of the employing

organization to seex a resolution ef such confit

. Should not consult with those charged | with

‘Governance of the organization, such as the board

(Of directors or the auait committee,

IF a significant. confit cannot be resolved, @

professional accountant “may wish to” obtain

professional advice from the relevant professional

body or legal advisors, and. thereby. obtain

Quidance on ethics! Issues Without’ breaching

Confidentiality

4. If, after exhausting all relevant possiblities, the

Secountant should, where possible, refuse te

Femain associated with the matter creating the!

thin! confer remains Unresolved, » 50,

confit.

Deters rapt an suction 29 otecty

eee prema oe ae

our objectstyand ney?

Behe Pena a tegny poses te obligation on

all professional accountants to be stightforward

and honest In professional and Business

relationships. Integrity also implies flr dealing

and truthfulness.

b. The principle of ebjectivity imposes en obligation

ton al professional accountants nat to compromise

their professional or business judgment because of

bias, conflict of interest or the undue influence of

others.

© A professional accountant shall not perform a

professional service if 9 circumstance _ of

Felationship blases or unduly influences the

‘ccountant’s professional judgment with respect to

that service

4. Allofthe above

16. A professional accountant should not be associates

wun reports, ‘retums, "commummeetons_or other

Inormstbn tha (nls on approneate meates repo

Is provides)?

2." Contain a false or misleading staemnent

8. Contains “statements ‘or nformaton. furished

recklessly ‘or. without ‘any’ reel" knowleage of

winether they are true or fie.

¢. Orrits oF “obscures Information required to be

Submitted and such omission or obscurity would Be

misleading.

4. Alofthe above

Section 130 - Professional competence and due care

17. The ornciple of professional competence and due care

Imposes the following oBtgations or all professional

‘2ccountants, except

To maintain professional knowledge and skit at the

level required to ensure that clients or employers

receive competent professional service; and

b, To act diligently. in. accordance ‘with applicable

technicst—and professional standards wren

Drovicing professional services,

© Tov exercise of unsound Judgment in applying

rofessionel “knowledge "and skill” In the

Derformance of professional servics,

4. To take reasonable steps to ensure that those

Working under the professional accountant’s

‘authority ina professional capacity nave:

‘approprite training’ and. supervision and where

appropriate, make’ clients, empioyers or ‘ether

users of the accountant’s professional services

‘aware ofthe limitations inherent in the services,

the following is incovrect

Drofessional competence and cue care?

2. Professional competence may be d vided Into three

separate phases,

b, The attainment of

requires

‘education,

© The “maintenance of professional competence

requires a continuing awareness of developracnt ia

the accountancy profession

4. Diligence encompasses the responsibilty to act in

accordance with the requirements, “of

assignment, carefully, thoroughly and on a timely

basis

regarding

Professional competence

Initaly a high standeed Of” general

419. Which of the folowing Is the least requ red in attaining

professional competence?

8. High standard of general education. -

'. Specific education, training end ‘examination in

professionally relevant subjects,

«. Period of meaningful work experience

4. Continuing awareness of ‘evelopment In the

‘accountancy profession.

Section 140 Confidentiality

Cs Wien of the following is Incorrect regarding

‘confidentiat?.

3 The principle of confidentiality imposes

‘obligation on ll professional accountants to real

from disclosing ‘outside the firm or employi

‘organization confidential information acquired 2s &

result of professional ang business relationships

‘without proper and. specific authority or unless

there Is 2 legal or professional right’ or duty to

isclose “and using confidential Information

acquired as a result of professional and business

Felationstips to their personal advantage or the

advantage of third parties.

b, The duty of confidentiality ceases after the end of

the relationship between the professional

‘ccauntant and the client or employer.

& Confidentiaity. should. always be observed by

professional accountant unless specific authority

has been given to disclose information or there Is 8

legal oF grofessional duty to clsclose.

4. Confidentiality. requires that 2 _ professional

‘accountant acquiring information In the course of

berformirg professional services neither uses nor

‘Sppear” to ‘use that. Information. for personal

Sdvantags or for the advantage ofa third party.

(>) Section 200 Introduction

Fight to disclose confidential Information in each of the

following, except

2. Fo comply with technical standards and ethics

requirements

b. Fovdisclose to BIR fraudulent scheme committed by

the ellent on payment ef Income tax.

To comply with the qualty review of a member

Body or professional body

4, To fespend to an inqulry or tnvestigation by @

‘member bady or regulatory body.

‘Section 150 -Professional Behavior

33°the principle. of professional behavior Imposes an

‘bligation on professional accountants to

2. Comply with relevant laws and regulations

B. Avoll any aectlon that may bring discredit to the

profession

fc. Botha and b

Neither s nor b

3, In marketing and promoting themselves and thet

work, professional accountants. shall be honest and

truthful, Professional accountants shall not:

3. Bring the profession into disrepute

B. Make excggerated claims forthe services they are

dole to affer, the qualifications they possess, or

fexperience they have galned; oF

& Make dlsparaging references or unsubstantiated

Comparisons to the Work of others.

«4, Allor the above.

PART B: PROFESSIONAL ACCOUNTANTS IN PUBLIC

PRACTICE

Be Bromples of creunstances that create self-interest

tivent fora professionel accountant im pubte practice

Imola the folowing, except

by A member of the assurance team having a aect

financial terest in the assurance clent.

b, Aifrm noving undue dependence on total fes,from

2 client. a

& Acmember of the assurance team having»

Sonieantcigge business relatonship with’ an

‘stzuranct cle.

Ds

18, Examples _of circumstances,

4. A firm issuing an assurance report onthe

fetfectiveness of the operation of financial systems ,

‘fRer designing or implementing the systems.

25, Examples of circumstances that create sell

selbinterest

threats for 2 professional accountant In public practice

Include the following, except

2 A firm being concerned about the possibilty of

losing a signiteent- cent.

b. Remember of the audit team entering

employment negotiations vith the audit cient

& Afiem entering Tato a costingeat-fee arrangement

felating to an assurance engagement.

4, A firm having preoared the original data used to

‘generate records that are the subject matter of the

Ssturance engagement,

Examples of circumstances that create self-review

threats for 2 professional accountant in public prattice

Include, except:

2. A member of the assurance team being, oF having

fecently been, 2 director oF officer of the client.

b. Aimember of the assurance team being, or having

recently Been, employed by the client in a position

fo exert significant influence over the ‘subject

matter of the engagement.

The firm performing service for an_ assurance

Ghent. that directly affects the subject metter

Information of the aesurance engagement.

4. Riprotessional accountant éiseovering 9 significant

err when evaluating the results of a previous,

professional service performed by @ member of the

professional accountants frm.

--Exemples of circumstances that create familiarity

threats far @ professional accountant in publ practice

‘3. A member of the engagement team having a.ciose

or immediate forily member wna Is a director or

otncar of the cllant. ——

b. Amember of the engagement team having 2 close

for immediate family meinber who is an employee

‘of the client who is 19 9 position to exeet significant

fnfluence over the subject matter” of the

engagement.

Both (a) and (by

either (a) nor (b)

that create familanty

{rons for-arptafessona accountant in publ preci

2. A director or officer of the client of an employee in

2 position to exert sigiiticant influence over the

Subject matter of the ensagsment having recently

served as the engagement partner.

b. A professional accountant accepting gifts or

referential treatment trom 9° client, unless the

Walue is trivial oF inconsequential,

‘Senior personne! having a long association withthe

assurance cent

1d, Rilof the above

treats for @ professional accountant in public practice

Include the folowing, except

a» Avfirn being threatened with dismissal from

‘ent engagement

An aut elent indicating that it wll aot

planned nonassurance contract to the fim fi

firm continues to dieagree with. the

accounting treatment fer a particular t

‘A-firm being threatened ‘with tigation |

allen i

4. The fim: promoting shares in an auelt cent

130. examples cts that create Jatmidation

thrests for Broessional accountant In PAE

Include the folowing, except:

2. firm oeing pressuredto reduce Inaporopriate

the extent of work performed In order to reduce

& professional accountant feeling pressured to

agree with the Judgment of a lent employee

because the employee has more expertise on the

matter quest,

© A professional accountant being informed by 3

bartner of the fem that 9 planned promotion Wi

ot occur untess the accountant agrees with an

‘ua client's inappropriate accounting treatment

9. A professional accountant acting as sn advocate on

‘with ties parties,

behalf ct an_auait client In ligation or oo 0)

6

Safeguards

31, Sefeguards created by the profession, legislation or

‘eauloten nce he folowtigr went

2 Edvetons traning ond Cipher requrements

for entry Into the profession

, Continaing eeucstion requirements.

© Legislation” governing the Independence

Fequirer ents of the frm,

4. Poles and procedures that emphasize the

‘assurance liens commitment to fair firancal

reporting

Ke Safeguards in the work environment, Include the

9

following, ence

2 Professional

lscipinery processes,

Gtandarés end mentoring and

make managerial decision,

Internal procedures that ensure objective chol

ln commissioning non-assurance engagements;

A coorcte governance structure, such a: an audit

committee, that provides. appropriate. oversight

‘and communications regarding firm's services,

The assurance cient has competent employees io

7,

33. Safeguards in the work_savironment, Include the

fellowing except

Firm ledtership that stresses the importance of

Independence and the expectation that members

of assurance teams will actin the public interest,

». External review of the fms, quality. conirol

system

€ Policies and procedures to implement and monitor

quality central oF assurance engagements

4. Policies and. procedures that wil enable the

Identification of interests or relationships between

the flem or members of the assurance team and

assurance elents,

Section 210 - Professional Appointment

Existing acco.ntant, a5 defined In the Code of Ethics,

3, A professional accountant employed in industry,

‘commerce, the public sector or education,

‘A professionel accountant’ In public. practice

‘currently volding an auait appointment or corrying

‘out accourting, texation, -consuking or similar

professional services fora cllet,

Those persons who noid a valld certincate lesued

by the Board of Accountancy.

0. A’ sole proprietor, or each partner or person

‘ccupying positon similar to that ofa partner

‘and each staff in a practice providing professional

Services to a client irespectve of thelr functional

Coa,

‘audit, tex oF consulting) and

Stee In” a" practice having

professional accountants

managerial responsioitles,

5. The term receiving accountant Includes the following,

excent

2° professional accountant in pubile practice to

Wwnom the existing aecountant has referred. tax

‘engagement

. Avprofezsional accountant in public practice to

funom the client of the existing accountant has

Feferred aucit engagement.

© A professional accountant in publle practice who Is

Conculted In order to meet the needs of the client.

4. A professional. eccountant. In public practice

Currently holding an audit appointment or carrying

fut accounting,. taxation, consulting, or Similar

professional services for 9 client,

Before accepting a new cilent relationship, 9

professions! accountont in public practice should

Eonsider the following, except: .

2, Acceptance would create any threats to compliance

with the fundamental prineples, such as, potential

threats to integrity oF professional behavior may

be created from, for example, questionable issues

associated “with the client (ts owners,

management and activities).

. ‘The significance of any threats and the necessary

safeguards necessary 10 eliminate them or reduce

them to an acceptobie level

Where it''s not possible (9 reduce the threats to an

acceptable level, 2. protessional accountant. in

public practice shoula’ decine to enter Into. the

Gent retationshin

ilof the above

‘A professional accountant in pubic prectce should

agree to provide only those serhees, tat we

Profesional accountant i public pracies is competent

to perform.” Before accepting "s. spectic chent

engagement, 2 protesions| ccountart Is Qube

Brattice shosld consider the laiouing eaeeot:

8 Whether acceptance mouid create sny' threats to

eomplance with the funcomontal prneples Eee

example, 2 sel-inerest treat 26" praesianey

competence ana. dic care is. created i tn

engagement team ‘does not possese eee “ontee

acquire, the competencies necessary 80 prope

a. Bini the somnpenest me

significance of any lheats and the necessar

safequards necessary to cimnate them ores

them to an accepaable iver

© When 9 professional accountant in public practice

intends to rely on the sdvice or work ot anteaee

{he "profesional accountent in muha eee

shoul evaluate “wnether Suer a hese

warranted. The professional accounea ar Sy:

Bractice should consider factor such os reputeare

expertise, resources. avaldble “and, apoieeens

professional" snd cincal” ‘standards ae

Information may be gained trom prior ascocisnen

with tne expert or from consulting Stes

4d. Aitorthe above

The following statements relate to 9 professional

‘accountant in public practice who Is psked to replace

anther professional sccountant. in ‘public praction,

whichis ineaerect?|

2A professional accountant in public practice shall

determine whether there are any ressons for not

‘accepting the engagement, such as circumstances

Page 4 of 11

www.prtccom.ph

Dn

that threaten compliance with the fundament

a rT ith the fundame

b. Tt may require direct communication with th

existing accountant to establish the facts and

Creumstances behind the proposed change.

© An existing accountant iS not bound by

‘confidenvalty. Hence, should ordinary volunteer

Information about the client's affairs.

6. professional accountant in public practice wil

preferably In wing, to Initiate alscussion with 2

existing eecountant.

‘Section 220 - Conflicts of Interest

19. A professional accountont in public practice should take

reasonable slepe to identily circumstances that could

pose a confict of interest. Such circumstances may

five rise to the following threats to compliance with

the findomental principles, except

2 A threat 20 objectivity such as when 2 professional

‘accountant in public practice competes dlrectly

Wwth 2 client of has a Joint venture or similar

Grrangenient with 2 major competitor of a clent.

A threat to objectivity or confidentiality such as

finen 2 professional accountant In public practi

performs services for elents whose interests are

ESanict er the chante are in ispute with each other

In rlation to the matter or transaction In question.

G Nelther ¢ nor b

Bother ana b

40, Which ofthe following statements relating to conflicts

cElnterests

Se BRE merst pose atest to one

ere a's indatenal preclen, ea

Sct cra oe pefeconsi pear

Se eeecimined er reseed 00

Meeptabe inet “treat, she “spneaton, oF

ce ere ante m bie

eae al nce tan tot opropiate

Bn, gsc etgegermet or tet esgnaton

See ee eset erasoemen

(Son

wo. GRES prtessoaaccountnt in publ pace

Wet reefs Genet fr

res cette eh tay ot ay net eon

sey ety eget moter where te

Ey jee cee vata const

PTS Mea by tele then

ee tat ln pbc pace must Pl

Sse a eof a paies the mater

cree Sine cnt mteres

eRe

Rather nero

‘Section 230 - Second Opinions

BE "Stustions where a professional accountant in public

practice is tsked fo provide 2 second opinion on the

Sppitetion of accounting, auditing, reporting or other

Standards or prinales to. specific circumstances or

‘SShsscoone by or on behalf of @ company or an entity

that's not a9 existing cent may give rise to threats to

Compliance, with the. fundamental principles. For

‘Gxampie, there may be a threat to in

Sheurnstances where the second opinion is not xg

i

Sn the same. set of facts that were made available te

the exsting accountant, or Is based on inadeaus

fevcence?

1 Professianal competence and due care

1. Integrity

Professinal behavior

._Objectivty

Page 5 of 13

47, Advertsing a5 defined in

48, With regard to. marketing professional services, the

section 240 ~ Fees and Other Types of Remuneration

2. Ifthe fee quoted for a professional service Is so Tow, it

may. be difficult for the CPA to perform the

Engagement. In eccordance with applicable technical

‘ond professional stendards for that price. This situation

may create 9 self-interest threat to

2. "Objectivity

.Professional competence and cue care

€. Professional behavior

4. Integrity

fees enarged for assurance engagements should be 3

fair reflection of tre value of the work involved. "In

determining professional fees, the Following should be

taken into accourt, except

The level of training and expenence of the persons

necessarily engaged on the work.

b. The time necessenly occupied by each person

engaged on the wark.

‘e. The outcome or result of a transaction or the result

ofthe work performed:

1, The skill and knowledge required for the type of

work involved.

ZA, Which of the following Is not a contingent fee?

Ba fee that is fixed by 2 court or other public

‘uthonty.

Anvarrangement wneredy no fee wil be charged

Gniess a Specifed finding or result = attained,

c. Anau fee thet fe bared on 59% of the client's

SGyanted net income for the currant year.

4g. Ritee that iz dependent upon the approval of the

‘Sesurance dient’s fosn epplication,

45. With respect to the acceptance of contingent fees for

professionel ethics, the Code of ethics indicates the

firm

"should not accept cantingent fees

6 Should “exabien aparonriate safeguards. sround

Seceptance af a contiogent fee

fe Should seeept contingst f2e only for assurance

Services ether than 7 a!

4, should accept contingent fees if tis customary in

the country

section 250 - Marketing Professional Services

46 The communication to the. public. of facts about 2

Srofessional accountant shieh'are not designed for the

Jetiberate promotion ofthat ofessianal accountant

3 Publicity Indirect promotion

B. Advertsing &. Solictation

1 Code of Ethics, means

2. The communication to the public of fects about 2

professional accountant which are not Gesigned for

fhe deliberate promcton that. professional

accountant

, The aporoach to @ potential cient for the purpose

of effenng professional services.

The communication tothe public of information as

to the services oF skill provided by professional

‘accountants. in public practice with |@ view to

procuring professional business.

4. Any ofthe above.

Case of ethics Indicates that

‘direct marketing fs prohibited

1, marketing Is allowed i lawful y

marketing should be Nonest and truthful

4, marketing of audit services is prohibited

Section 260 ~ Gifts and Hospital

Ms and hospitality from a ellen, ‘Such an offer

Ordinary gives rise Yo Uweatt to compliance with the

fondamental principles. Wich “of the following

statements ieiaeare=t?

oF Saknleat rest to objectivity

ita gift trom 9 client Is accepted.

b, Intimidation threats to objectivity May result from,

{the possibity of such offers being made publi

& Tre significance of such thrents wil depend on the

nature, value and intent behind the offer.

4. When the threats cannot be eliminated or reduced,

to an acceptable level through the application of

safeguards, 9 professional accountant In. publ

practice may accent such an offer

vay be ereated

0. Which of the following statements Isciacorect when @

professional accountant considering to have custosy of

lent assets?

2. professional accountant in publie practice should

not assume custody of client monies or other

_ssets unless perinitted to do so by low

. The holding of client assets creates’ threats to

compliance with the fundamental principles; for

example, there is a seltinterest threat

professional behavior and may be a sell interest

reat to objectivity ersng from holding cient

Professional accountants in puble practice should

bbe aware of threats to. compliance. with the

fundamental. prinaplet. through association with

such assets, for example, ifthe assets were found

to derive from ilegah setivites, such ys money

Taundening

©. Allof the above statements are cored

FS 270 ~ Custody of Client Assets

Yo safeguard against threats, a _ professional

‘2ccountant In public practice entrusted with money (ot

other assets) belonging to others should: (Choose the

Incorrect statement)

8. Keep such assets together with personal of firm

eset. ;

Use such assets only for the ‘purpose for whlch

they are intended

At all times, be ready to account for those assets,

‘and any income, dividends or gain generated, t

‘Bay persons entitled to such accounting.

Comply sith ell holding oF and accounting for such

assets.

ction 280 - Objectivity-All Services

‘A professional accountant in publle practice should

Consider when provising any professional” servi

whether there. are treats to. compliance. witht

| fundamental princiole of “objectivity. resulting ro

having interests In, or relationships with, @ cllent or

Girectrs, officers or employees.

‘fama threat to objecivty ena be created fom

2 tammy or dose persvol or business relationship,

ote rue ‘fae Tue

8, Yue, Fae Fate

- Safeguards against

bsecvty may inte te folowing, oxcot

may be’ ofered/ 8, Withdrawin the engagament

Section 290 - Independence-Audit

Engagements

A Conceptual Framework Approach to Independence

sme

threats to compliance with

team or

uperitory procedures

Terminating the inci! or ines relationship

ving rise to the ret

c. Biseusing “the Issue with igher_ levels of

manogerestwtin the frm or with those eharaes

with governance ofthe clon

4. Morte above

vd Review

nie ofthe following most completly Jeseribes how

Independence has been etined by the accountancy

rotession?

Br possessing the abilty to act wth integrty and

txercse objectvty and professional skeptic

b. ecepting responsibilty to act proessionally and in

accordance wt iaws and regultns

Avoiding the appearance of signcant interest in

the affairs of an assurance cient.

4, Performing. en essurance service

‘eewpoint o the pubic

fromthe

following statements are

Independence, except

1 Independence consists of independence of mind

‘and Independence in a earance

, Independence of mind is the state of mind thet

permits the provision of #0) opinion vnthau being

difected by Influences thet compromise

Drofessionel judgment, allowing an indiviaual to act

With Inteerty, and’ exercise” objectivity and

professional skepticism.

Independence in appearance Is tye avoidance of

fact and circumstances Mat are ao signinenrt

feasonable’ and. informed third party, having

Knowledge of ail relevant information incucing

any safeguards applied, would rea-onably condluge

a'trm’s or a member of the a-surance. team's

integrity, objectivity or professionel skepticism hac

been compromised.

6. All of the above are correct statements regarding

Independence

cgrtect_ regarding

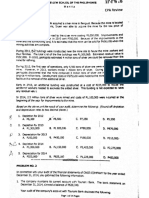

For assurance engagements provided to an aut

lent, the folowing should be indepencent of the chet

| The members ofthe

[The tm

{Network fms

tier rete

—[Wes | Yes | We te:

Hyer [No [No Les]

57. When identifies threats to indenencenc

‘andthe firm. decides. to accept 0” continue. the

‘assurance ‘engagement, the decision should be

‘documented. The firm's documentation should includes

‘2 Adescrption ofthe threats loentifed,

Bb. The safeguards applied to eliminate or reduce

tareats to an acceptable level

Both aor >

Nelther a nor b

re significant

Networks and Network Firms

ps

L

rs

mt

w.

the elie

‘Statement 1: If firm is deemed to be

rm is: deemed to be 9 network

frm, the Mm shal! be independent of the audit cents

Of the other firms within the network (unless otherwise

db Stated i tis Code), the independence requirements)

{in this section that opply to a network fm apply t

ny entity, such as 9 consulting practice or

Professional law practice, that meets the definition of @

fetwork firm irespectve of whether the ently ise

‘meets the dfiniton of fm.

Statement 2° The determination of whether the

Professional resources shared are significant, and

therefore the firms are network firms, shall be made

based on the relevant facts and circumstances.

a. True, True © False, True

DL True, False 4. False, False

ible Interest Entties anc Related Entities

Under section 290.25 of the code of’ professional

eles, public interest entitles are

a, Alisted enthes

B._ Any enty defined by regulation or legislation 9s a

public interest entity.

ce Any entity for whieh the audit ts required by—

Fegulatlon” or. legislation to. be conducted In

compliance "with the same. Independence

Fequlrements that apply to the audit of listed

entities, Such regulation may be promulgated by

‘any. relevant regulater, Including” an audit

regulator.

2, Alnor the above

{an entty Isa related entity to a public interest entity I

that entity has any ofthe following raatonships with

Anentity tnat hae director incirect control over

the client the liens mazerial to such entity;

‘An entity witha sitect nancial interest in the

Cent if that entity has significant Inluence over

the cent ang the inerest in the cent material

to such entity;

fan erty ever which the client nas direct or

Inalrect contr,

Ian entity i which the chent, or an entity related to

the cient under li} above, has a direct financial

tentty and the nierest is material to the chent an

Atpelated entity to (IN); ane

interest that gies it sigalficant iluence over suc

5

vv. anentity which ¥s under common contro with the

Ghent (2 site” entity") I the sister enity and the

Sent ere both materal to the eabty that controls

both the cient and sister ent

a VII ‘nm andy

b) 1M I anaiv Alef the above

Financial Interests - Prowcions applicable to all assurance

#

Financial interest means

B.any.onkaecour” which 1s used solely for the

banking of chents” monies.

b, Any monies received by 9 professional accountant

fn'puble practice to Be held or paid out on the

Instruction of the person from whom oF on whose

behalf they are receive.

cA financial interest Deneficially owed through a

folectve investment vehicie, estate, trust or other

Itermediary over which the Individual or exbty

has no contrl.

4. An interest in an equity or other securty,

Gebenture, loan or other debt instrument of ah

fentty, induding nights and eblgatons to acquire

62. a member ofthe assurance team, oF their immediate

family member, has a direct financial interest, or

a,

Cu

such an Interest and derivatives d rectly related to

such Interest

Taterio! indirect financial interest, in the assurance

Ghent, the sel-loterest threat created would be so

Significant they only safeguards availabe to eliminate

fhe threat or reduce to an acceptabie level would be

five to (choose the incorrect one)

3. Dispose of the direct financial interest prior to the

Individual becoming a member of the assurance

team.

b, Dispose of the Indirect financial interest in total

prior to the Individual becoming a member of the

‘assurance team.

Dispose of 2 sulfident amount of the indirect

‘oancial interest £0 that the remaining interest is

ro longer matertal prior to the Individuel becoming

‘member of the assurance team.

4. Limit the pariipation of the member of the

‘essurance team,

Ifa member of the assurance team, of their immediate

family member receives, by way of, for example, 30

Innertance, gift of, as a result of & merger, 2 direct

{nonela!ngerestor'a materia indirect financil interest

Intne assurance ellent, self-interest threat would be

Geated. The folowing safeguards should be appied to

iiminate the threat or reduce It to an_coeptable level

a bisposing. of the Tnaneial Interest at the eariest

practeal date.

b, Removing the

{he asguronce engagement

Either a orb.

4G, Netther 8 nor bs

[A close business relationship between @ firm or 2

Tae aeaurance

member-of the assuraace team anc

Gent or Is management, or between the firm, 2

fRetwork fem and financial statement audit client may

create

Br Advocecy and self-review threats

8: Setrinterest and selt-review threats

© Selhinterest and intimation teats

¢. Seltreview and farienty threats

Jsoans and Guarantees

{65 The flowing loans and guarantees would not create 3

threat to independence, except

2A leon fom, or 8 guarantee thereof by, an

fssurance lent that Is 9 bark of 2 similar

Institution, to the frm, provided te loan is made

Under normal. lending procedures, terms. and

feauirements and the loan is immaterial to beth

the firm ara the assurance cect,

b. Avloan ffom, or a guarantee thereof by, an

fsturance cllent. that is a Dark or 9. similar

institution, fo a member of the assurance team of

their immediate family, provided the loan is made

Under normal” lending procedures, terms. and

requirements

‘e. Depostts made by, or brokerage accounts of, 2 frm

fr a member of the assurance team with an

assurance client that @ Dank, broker of simlar

Insttution, provided the depositor account & held

Under normal commercil terms

1. Ilthe fm, of a member of the assurance team,

makes 3 laan to an assurance client, that i not a

Bank oF similar institution, or guarantees such an,

‘assurance dlent’s boring.

Page 7 of 11

www.prtc.com.ph

‘AT.1919-

‘member of the assurance team from

Te

if

EXCEL PROFESSIONAL SERVICES, INC.

‘nd Persons! Reatonshies

5. Famiy ana personal reatonthips between # member

of the assurance team ana 9 aiesor, an OMe? oF

ertan employees. gesanaing on Pie ele, oF the

‘esurance cient east hnery create

a. Seanterect vest c Intimidatcn treat

Tees

Dx

Employment witn Assurance Cit

a) 167. A director, an officer or an employee of the assurance

lent ins postion to exert rect. and. agnifeant

Iifience over the subject matter of the assurance

‘engagement has bees 9 member of the essurance

team or partner ef tre fem. The stvation least ikely

create

3. Seteinterest threat

B.Set-review threst

Intimization teest

4. Familaney tweet

68. If member ofthe assurance teom, partner o- form

partner of the fm nas joines the assurance cent

‘Significance cf the setunterest, tamianty”

lntimidation threats creates is east lcely affected

ar"The ‘pesion te. lec nas taken atthe

'. The amount of any involvement the individu! will

have with the assurance team,

= The length of time thet the individual wes &

‘member ofthe assurance team or frm.

4. The former postion of the Inccunl within the.

169. A former ofcer,drecior or employee ofthe assurance

situation will least hcely create. —

fa Seltintres: vest e- Intimigaton treat

B. Seltreview wrest 6. Famerty uest

u Recent Service with Assurance Clients

Long “Association of Senior Personnel with Assurance

‘Canes ~ Auctt Chents chat are Usted Enter

70. Using the same engagement partner or the same

Individual for the engagement quslty conte! review on

2 financial statemen: avi over 3 pro}nged period

may create 3

4 Selfereview threst

1: Intimidation test

& Famitanty threat

G Setrinterest treat

tnt mun tren ok a ts

ence tea en eee

rotated after serving’ in either capacty, or

{combination thereof, for a pre-defined periad, normaly

rho more thon

2. Syears © 7 years

B. 6 years 10 years,

‘The parner may continue serve, as the tea

Engagement partner” before rotating off the’

fengagement for how many years after aust cent

becomes 9 isted ertty?

2. One year Three years

Two years &. Fouryears

ring Accounting Records and Financial Statements

Sit fm, oF nelMork Ter, personnel providing su

Besistonce make metagement decisions, the Se

feview threat created could not be reduced to

Seeeplable level by ony seleguards. Examples of such

managerial decisions :t-luce the following, except

pare etermining oF charsing. Journal ents, oF che

Classifeations for accounts er Lansections or other

Sezounting records without obtaining the approval

ff the auat clients

age 8 of 11

‘www.prte.com.ph

‘Authorzing or approving transactions

Preparing source documents oF rigiating data

(iasudng deasions on evaluation assumptions), OF

‘ratung changes to such documerts or data,

& Aaesting on audt cent in rsolving account

reconciliation problems.

ne

‘These following services are considered to be 8 normal

part of the audit process and donot, under

CGreumstances, threaten incependenct, except

Analyzing and accumulating ration for

regulatory reporting

Assisting” inthe preparation of consolidated

finaneal statements

Drafting disclosure lems

Having custody of an assurance client's assets.

Preparing Accounting Records and Financial Stetements =

Genera! Provisions

JS it te firm is involved inthe preparation of accounting

ecores or financial statements ano. those. financial

Statements are subsequently the subject matter of an

Suck engagement of the fem, ens wil mast likely

2. 'Sel-nteres treat

BL Sefereview threat

«ntimigavion enreat

6. Famiianty threat

Preparing Accounting Records and Financic! Statements ~

‘Audie Cents that are not Usted Entities

76. The firm, or 2 network frm, may frovide an aut

lent that 1 not a tated envisy wer accounting and

bookkeaning services, inciscrny payrcll services, ot 3

roubine cr mechonica! nature, proud! any se raved

fhreat crented i reguced to an sceeptasie eve!

Examples of such services least Iaelyinciuce

83, Recording transactions for wnicn the aust cent has

determined or approved “ne appronnate account

Saseeaten

5. Posting coded transactions to the aust alents

genera eager

& Preparing financial statements

Information in the tat balance,

4. Determining and posting Journal entries without

jobtaming the approval of tre uit cent

bases on

Provision of I Systems Services to Audit Cliente

77. The provision of services by a firm oF network fem to

fan. aucit cient. that iavowe the design and

Implementation ef financial Inormatien. teenncleay

Systerns that re used te generate fe-mation forming

bor of a clans financial statements nay most Ike

FT Serrinteres threat ¢.Intimiacton twee

DL Selfreview threat. Familarity threat

Recrulting Senior Management

78.Therecruttment Of senior management for a0

assurance client, sucn as those in 8 postion 0 affect

the subject of the assurance engagement Moy least

ety erste

oe Egrrmeres test c. Icimdeting test,

8 Aavocoey teat. Fomar sy treat

Fees and pricing

79: Which af the following Is not likely £9

Incependence? meer

Bone total fees generated by an essurance client

repeevertalorge proportion of a fens total fees

Fees due from an assurance client ‘or professional

services remain unpaid for 91099 be.

cc Avtiem obtains an assurance engagement at as

Signcantly Tower fee level that tit chorges By

{the predecessor frm, of quoted by cther Nem.

te a threat to

AT.1919

Pn. SROFESSIONAL SERVICES, IN —

ce

‘court or other pubic authonty established fees

Part ¢:

BUSINESS

Section 300 ~ tntroduction

80. Under the code of crofecsicnal ethics, crcumstances

that may create “rellsterest threats. for those

Professional accountans in business Include

Financial interests, loans or guarantees

Incentive compensation arrangements

Inappropriate personal use af corpoete assets

PROFESSIONAL

ACCOUNTANTS IN

p

Se

‘Organization, verre

Busines, creumstances th i

: at may create sel-review

{rents ncuce, buses dels or cme bes

Subject to review end jusiaton by the. same

Brofessiona ‘secounart i business. reonabe Tor

taking thse decisions or preparing that date

Statement 2: For professional accountants if

business, when turtverng the legitimate. goals and

objectives "of "ther employing" orgenzations

brotessionel accountants in business may promote te

arganizaton’s postion, provided any statements made

are neither fase

Tet misleading. "Such actions

182. Under the code of professona) ethics, circumstances

hat. may create. familatty threats for profesional

‘accountants in business Include

| A professional accountant in business in 8 poston’

Toliivenee fiiancal or nosinancel_ reporting or

DDusiness deusiens having an'immediote or close

amily memiber wha isin postion to benefit fom

that fluence

{long association with business contacts infuencing

business decisions

Aeceptance of 2. gift or preferential treatment,

UUniegs the value i clearly Inignincan

4, Allofthe above

D

b.

83. Creumstances that may create Intimidation theeats to

Drofessional accountant n business Include

Be Threat’ of dismissal or replacement of the

professional accountant in business or a dose or

Immediate. fomiy member. over. ssagreement

bout the application of an accountng prineoie or

the way in whieh Amancio Information Is t0 be

reported

‘RGomiant personality attempting to inuence the

decision mocig process, for example with regard

to the awarding of contracts or the application Of

‘a accounting prnoste.

Both (@) and (0)

Nether (a) ner (o>)

jon 310 - Potential Confilets

‘A professional accountant in business should support

‘the leglumate and ethical objectives established by the

‘employer and the rules and procedures drawn up in

Support of those “objectives, Nevertheless, where

Complance with. the fundamental principles Is

threatened, a professional accountant in business must

{Consider a response te the craumstances

‘The significance of threats arising from such pressures,

such as Intimidation threat, should be evaluated and,

It they are ether than clearly Insignificant, safeguards

Should be considered and eppled as necessary to

ellminate them or reduce them to an scceptable level

3. Tue, Troe ‘False, “ue

B. True, Faise 4. False, raise

es,

Examples of safeguards against threats creates. by

potentat conflet between the employing organisation

land the professional obligations to comply with the

fundamental principles include the folowing, except

8." Obtaining advice where appropriate trem within

te employing organization, an” Independent

professional advisor or a relevant. professions!

body.

The” exstence of a formel dispute resolution

process within tre employing orga zation

Seung tegat advice,

A ofthe above are safeguards.

.

jection 320 - Preparation and Reporting of

tr praseat business Information fay. honesty an

‘2ecordonce: with relevant profesional standoras. 0

{hat the lformation wi Be understood ints content

ntormation

26. A professional accountant in business shoulé prepare

“Theeats to compliance with the fundarental principles,

for example seltintarest or intmiaaton treats. to

‘bjecovty oF professional competence and-cue care,

may be crested where a professional secountant In

‘Business may be pressured to become associated with

‘isteading Information or to become associated with

‘steading information through the actions of others.

“True, True alee, True

5. True, False 4. False, “alse

Ja7. wnen a professional accountant ic business aces

threats to'comlance with the fundor ental princes,

be or she shal do te following, erceg?

3 “Evaluate the threats nn, IF thoy are other thon

Geary. insighifeant, "safeguards. should "be

Eonsidered and applied as naces:ary fo eilmmate

them or reduce chem to an acceptaleleve

‘Safeguards may Include consultatin wt superiors

‘nithin the employing organzaticn, for example,

the aus commitee or other Bocy responeibie fer

(governance, or witha relevant prtessiana body

inere iis rot possible to reduce the threat to a9

Baeceptable level, 9. professiona’ accountant. In

business should refuse to remain associated wth

Information they considers or may be misieacing,

‘The profesional accountant In tusinese may St

wish fo seek legal advice e resig

4

ection 330 ~ Acting with Sufficient Expertise

28, The fundamental prineipe of profess ana! competence

‘and evecare requires that a professcnal accountant

Business shoule only undertake significant tasks for

tihicn the professional aecoustant in buemess Nas, oF

fan ebtain, sufsent speific traning O° experience

(Choose the incorrect statement)

3." professional accountan: in business should not

Intentionally mislead a erploye’ as tothe level of

frpertce or experience nozsesced, nor should 2

professional accountant io Busiress Tal to seek

Sppropriate expert advice and assistance when

requires.

Fenty and evaluate treats, such as: insufcent

tine for properly performing or completing the

Felevant duties; Incomplete, restcted oF otherwise

Inadequate Information 4 perfo7ming the cuties

Page 9 of fi

www.prte.com.ph

AT.1919

EXCEL PROFESSIONAL SERVICES. INC.

a

property: insuficent experience, taining and/or

+ Gteaton; "and inadequate resources for

proper performance of the dutles

. The signieance ofthe threats should be evaluated

‘ang, if they are other than leary Insignfleart,

Ssfequards ‘should be considered and applied as

Recessary to climinate them or reduce them To 89

‘ceptable level

Winere threats connot be eliminated or reduced to

| fan acceptable evel, professional accountants In

Busines shoud consider whether {0 refuse

perform the duties In question and may nct be

Clearly communicated.

‘Section 340 ~ Financial Interests.

}89- Professional accountants. in business may have

nancial interests, or may know of financial interests of

immediate or cose family members, Uhat could, 19

certain ckcumstonces, give, rise "to threate (2

Compliance witn the’ fundamental principles. For

example, sel-interest threats to ‘objectivity oF

Configentiaity may be created through the existence of

fectlon 350 - Inducements

the i 0. A professional accountant in business or an immediate

fr clone family member may be offered an Inducement

‘ot may make am offered af inducement, such 25, IR,

hospitaty, preferential treatment end inappropriate

Bppeals U6 tendnip or loyalty. Oflers of inducements

‘may ereate threats to complance with the fundemental

Drincpes, (Choose the incorrect statement)

2. "Sulrinterest threats to oblectivty or confidentiality

fre created wnere an inducement i= made in on

‘attempt to unduly infuence actions or decisions,

‘encourage illegal or dshorest behavior oF obto0

‘confident information.

Inimiation threats to objectivity or confidentioty

fare created if such an Induceren:|s accepted and

itis followed by threats to make that offer public

‘and domoge the reputation of ether the

professional” accountant i) business or an

Frmediste or close family meme

c. Aiprofessionsl secountant ia business should not

ore an inducement to. improperly. Influence

professional judgment of a third party.

the motive and’ opportunity to manipulate pree ¢. ‘if evaluated threats are other than larly

sensitive Information In oder to gai financially. Insignificant, safeguards should rot be consicnres

: fand applied as necessary to elminate them or

[A professional accountant in business should nelther reduce them to on acceptable level,

manipulate information nor use” confidential

Information for personal gain

2. Tue, True © False, True

bl True, False &. False, False = now do the DIY drill -

DO.T-YOURSELF (DIY) DRILL

rpose for establishing a code of conduct (4.

rotessional organization tos

juce the. ikelineed. that. members of the

profession wil be sued for substandard work

Ensure that all mainbars of the provestion perform

at approximately the same level of competence

=. Demonstrate acceptance of responsity to the

Interests of those served by the profession.

Require members of the profession to, exhibit

foyalty in all matters pertaining to the afas of

their organization.

ACPA should mointain objectivity and be tree of

interest vinen performing

2. Ladaits, but aot any ather professional services

Bi. “All assurance services, But not other profess onal

. All assurance and tax services, but not other

professional services.

Ii professional services.

nor ne, utr ot peed to ue

[eed wicematon stenad toma lent. wien

ihe otoninyskustone woud be 8 wolaton of tis

reaulemertt

reared to the infomation request of &

Sorcha

4

b. ta respond to 2 quality review request of the state f\

‘board of accountancy.

cw inate 2 complaint with the board of

‘Secountancy.

4d, Soenaure adequate disclosure In accordance with |

Press.

C tac

competence aa cored pbc accourtantincuces

a ining exces

ing the technics aualiictions to perform an

‘engagement.

be, Fotsessing the abity to supervise and evaluate

the quality of sat work

‘Warranting the infty of the work perormes.

Consulting others if aettonal techaieat information

Ie needed.

‘

onthe Code of Ethics for Professional

tants, treats to compliance with fundamental

principles arse from al ofthe Tollowiny except

2 Sattinerest. The audit relationship.

B. Advocacy 4. Intimication

Wien of the following 1s qat-a-broad category of

safeguards that mitigate or elimivate threats to

Compliance yith fundamental principles?

oats seated by the profesor, Jet,

be. Safeguards created to assure proper taining within

both the clent ang environment

«¢ Safeguards implemented by the cl ent.

4. Sateguords Implemented. by the. frm, inclucing

palcies and procedures to Implervent professional

nd regulatory requirements.

or

fearance to

3 Appear to an independent third party not to have

CSmoromised their integrity

Become independent infact.

€. Comply with te Inernetional audiing standards of

felawork

4. Evalyation of all matters of contsuing accounting

significance

atrives 12 achieve independence in

page 10 of 11

www.prte.com.ph

Redufefiee and fabity

Mant ec concen profession

idepenent fact

Comply with Pane

te Fader tile performing an audit, strives to achieve! )15. The CPA In public practice vilates the Code of

() 7 Se — sional Ethics for CPAS If he accapts 9 fee which

{19 torre srs pute fr ag on

2 nedatys

B. tfaeeraane, a

Non fomptance wen GAA

4. Conoenttty.

10, A small CPA fem provides audit services to a loge

local company. almost eighty percent ofthe CPA firm's

Fevenues ‘come from ths cllent, Which statement Is

most ely tobe true?

a rance of Independence may be lacking.

Bb. (The small CPa'tie oes not have the proficiency

(te bertorm a larger aut B

cc. Xba situation is savsfactory ifthe autor exercise

due skeptical negative assurance care inthe aud

4, ‘The auditor shoule. provide an “emphasis of @

matter peragraph to. hlsfher nucle report

‘adequately aisclosing this information and then It

‘may issue an unqualified opinion.

‘advoceey,

Tammanty “3nd

‘interest, seieview,

Inimidetion threats

. Independence Is nat an element that's considered

t inthe aust process,

Independence is immaterial

statements

@. Independence 1s not 2 requirement of IFAC's Code

to the inane

oF ethics,

32. tn eaafs when the threat to incependence is significant

15 fo safeguards are avaliable to reduce Mt C0 29

table level, which of the following actions should

raxen? ho.

Eliminating the actwvtes of Interests creating the |” (

threat,

, Refusing to accept oF continue the assurance

tegagement

Either a or

& Nettner a nor’

Lf an audit ffm clecovers threats to Independence with

ton audt engagement, the Code ef Ethies for I.

De»

acument the issue. 1.

44, Evaluate the signficence of the threats and apoly

lppropratesafenuords. to reduce them tan

tm.

Flat sum fees

4. Per diem fees

2. Contingent fee

Retainer fees

‘rxed by 2 public authority.

don 9 price quotation submitted

competitive bidding.

Determined based on the

proceedings.

d. Payeble alter 2 species finding was obtained.

resuts of judicial

/acfofpia.t0 the Code of Professional Conduct, forthe

‘aubtr to be considered Independent with respect to

the 2015 auelt, the 2014 audR fees must be peld

before the

12.2014 report is issued

B. 2015 hele work Is started

©. 2015 report is issued

4, 2016 held work's started

6. fe company has not paid its 2014 auctt fees

/tne Code of Professional Ethics, which of the

lowing may a practicing CPA do in connection with

lucationa seminars?

'. Send announcements about his eppearance on a

Seminar program t9 non-clents or Invite them t©

tena.

b. Sponsor @ seminar and send invitations to non-

‘c. Allow himself to be listed as a tex expert on the

4 istibute fm iterature at the seminar to non

Greats on o relevant topic being discussed at the

Seprinar

Ar, wrote an articie for, publication In_PICPA

tants Journal of News Magazine. The Code of

sional Etnies would be violated ifthe C2A allows

fe article to state that the CPA Was 8

2, Member of PICPA

1B. Professor ata school of professional accountancy

2) Partner in @ national CPA frm

4. practitioner specializing in providing tax services.

recruitment of senior manacement for an

urance client, such a= those in-e position to affect

te subject of the assurance engagement may least

ey ereate what threat

‘3 Selrinterest, Intimidation

B. favocacy & Famianty

‘The {lowing statements relate to the accounting

profesion:

“Th mer /public trust and confidence, the

professions! person must convince the pubic that

hie wll place puble service abead of persona!

rene

CPA certificate Is evidence of brsic competence

im the iscine of accounting t the time tre

‘ertreate is granted.

‘code of professional conduct i¢ ane of the most

Important "istinguishing characteristics of 3

profession.

State whether the foregoing statements are true or

fase

2. Allof the statements are true.

. Oniy one ofthe statements is true.

©. Only two of the statements are tru

4. Allofthe statements ae false

(= end of AT.1919 -©

Page 11 of 11

AT.1919)

Xo ew

Excel Professional Services

Management Firm of Professional Review and Training Center (PRTC)

fai {aon Han 7238344724790 + Cuba, Lagu (04) 5453807 + Bilan (0515) 291111

pad {isan Wala hy (0) 430A aly (aa) 297800 28

(Mindanao) Cagayan De Oro City (088) 3093073 * Davao City (082) 225004:

Inc.

Fed iF”

ia Veal

‘ ae

GRE cee UGRCPA REVIEW f** Ren VAlbe2

ATUBON Foe ASountncy Passion ar YOM

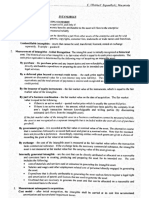

Introduction te Assurance and Rud Engagements yf ecroser 2015

Tah akd nhl

bay | Lecture NoTEs ‘8 fe ot ae

Accountancy Protesnfaels, Repatvation

The Certitled Pubic Accountant (PA) Examinations

AL applicants for seaisraton for the prectice of

‘ccountancy shall bé required. to undergo a een

by the

‘examination be_auen

(Bory in soch_ laces

‘Regulation Commission (PRC)

nd dates a5

) may designe

‘The places/venues and dates of examinations sh

Incudod. inthe Sevedule of Profersonal Weansire

Examinations forthe year lesued by the Commision,

uaications of Applicants for Examinations SEC IY

‘Any person appying for examination shall establish the

folowing roquistes to the eatsaction of the Board thot

se: :

Fe of Bachelor of Science In

of ony minal offense

tow y

erative

scope 6 éxamination — ww (S

‘The licensure exemination for CPAs shall. cover the

Following subjects

‘Theory of Accounts

Business Law and Taxation

Management Services

‘Auating Theory

‘uating Problems

Practieal counting Problems

2 Praca! Accounting Problems Tt

ating (and Resut) Inthe Licensure Examination SUP

1+ PASSED General! average of 25%, with no grade

(owertbon soe any sje "a? "90

SEATON ce maja majo a

ead eel A

Tene crt NC a Stig Sata

se trae ated Yee Nal be

of examinavons less.fe/she submits evidence to the

Entsfoction of the Board that ‘he/she-enfoled’ in anc

Completed. at least 24 unis of subjects given In the

Teensure examination

Conditional and cemoval examinations shall be counted as

ne comaiste examination

Greed plonat halnet

Page 1 of 1: Tag ~flalyele

Bigenperrtncto emit ol lh wre

i tie meg

Fas arte us

oth feat

‘Www. Drtc.com.DhD fmt Vokuat fy. pten

Ino BL saan distiok Kime “Gabe f

et

Issuance of Certicate ‘ef “Regisration (CoR) and

professional Identification Card (PIC) — Sek) 70.

~SCC(? Alceaisiot be issued to examinees who pass the licensure

epee ee ee eg

eee eam eae

ate ra

tne

You might also like

- Ar MCQDocument4 pagesAr MCQAshley Levy San PedroNo ratings yet

- Chapter06.Activity-Based Management and Cost Management ToolsDocument16 pagesChapter06.Activity-Based Management and Cost Management ToolsAshley Levy San PedroNo ratings yet

- ReceivablesDocument5 pagesReceivablesAshley Levy San PedroNo ratings yet

- Risk AssessmentDocument9 pagesRisk AssessmentAshley Levy San PedroNo ratings yet

- Quality Control Practice SetDocument6 pagesQuality Control Practice SetAshley Levy San PedroNo ratings yet

- Activity-Based Costing: Assignment Classification TableDocument26 pagesActivity-Based Costing: Assignment Classification TableAshley Levy San PedroNo ratings yet

- Cpar Pw-ApDocument14 pagesCpar Pw-ApAshley Levy San PedroNo ratings yet

- P1 923 PDFDocument7 pagesP1 923 PDFAshley Levy San PedroNo ratings yet

- T02 - Installment Sales & Consignment Sales PDFDocument7 pagesT02 - Installment Sales & Consignment Sales PDFAshley Levy San PedroNo ratings yet

- Garrison ABCDocument18 pagesGarrison ABCAshley Levy San PedroNo ratings yet

- 1st PB-ATDocument12 pages1st PB-ATLovenia MagpatocNo ratings yet

- OBLICON ReviewerDocument54 pagesOBLICON ReviewerMaria Diory Rabajante93% (301)

- Obligations SummaryDocument18 pagesObligations SummaryAshley Levy San PedroNo ratings yet

- May 09 Final Pre-Board (At)Document13 pagesMay 09 Final Pre-Board (At)Ashley Levy San PedroNo ratings yet

- FAR ReviewerDocument17 pagesFAR ReviewerAshley Levy San Pedro50% (2)

- Fa1 2014Document339 pagesFa1 2014hanamay_07100% (1)

- Interest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeDocument3 pagesInterest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeAshley Levy San PedroNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)