Professional Documents

Culture Documents

2018 TSP Catch-Up Contributions and Effective Date Chart

Uploaded by

Anonymous O6Pgmls4Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2018 TSP Catch-Up Contributions and Effective Date Chart

Uploaded by

Anonymous O6Pgmls4Copyright:

Available Formats

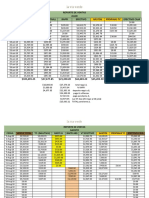

2018 THRIFT SAVINGS PLAN (TSP) CATCH-UP CONTIBUTIONS

EFFECTIVE DATE CHART

It is important to verify your benefits election/deductions on your Leave and Earnings Statement (LES)

each pay period. Notify a BEST counselor immediately of any problem. An error in deductions may

result in an indebtedness to the government. The annual maximum TSP Catch- up Contributions for

2018 is $6,000.

If you enroll or make a TSP The effective The Catch-Up Pay Amount Deducted to

change during this pay period. date of your deduction will Periods contribute the

election will reflect in the Elective Deferral

be. paycheck/LES you Limit

receive on:

10 Dec 17 to 23 Dec 17 24 Dec 17 12 Jan 18 26 $231

24 Dec 17 to 6 Jan 18 7 Jan 18 26 Jan 18 25 $240

7 Jan 18 to 20 Jan 18 21 Jan 18 9 Feb 18 24 $250

21 Jan 18 to 3 Feb 18 4 Feb 18 23 Feb 18 23 $261

4 Feb 18 to 17 Feb 18 18 Feb 18 9 Mar 18 22 $273

18 Feb 18 to 3 Mar 18 4 Mar 18 23 Mar 18 21 $286

4 Mar 18 to 17 Mar 18 18 Mar 18 6 Apr 18 20 $300

18 Mar 18 to 31 Mar 18 1 Apr 18 20 Apr 18 19 $316

1 Apr 18 to 14 Apr 18 15 Apr 18 4 May 18 18 $334

15 Apr 18 to 28 Apr 18 29 Apr 18 18 May 18 17 $353

29 Apr 18 to 12 May 18 13 May 18 1 Jun 18 16 $375

13 May 18 to 26 May 18 27 May 18 15 Jun 18 15 $400

27 May 18 to 9 Jun 18 10 Jun 18 29 Jun 18 14 $429

10 Jun 18 to 23 Jun 18 24 Jun 18 13 Jul 18 13 $462

24 Jun 18 to 7 Jul 18 8 Jul 18 27 Jul 18 12 $500

8 Jul 18 to 21 Jul 18 22 Jul 18 10 Aug 18 11 $546

22 Jul 18 to 4 Aug 18 5 Aug 18 24 Aug 18 10 $600

5 Aug 18 to 18 Aug 18 19 Aug 18 7 Sep 18 9 $667

19 Aug 18 to 1 Sep 18 2 Sep 18 21 Sep 18 8 $750

2 Sep 18 to 15 Sep 18 16 Sep 18 5 Oct 18 7 $858

16 Sep 18 to 29 Sep 18 30 Sep 18 19 Oct 18 6 $1000

30 Sep 18 to 13 Oct 18 14 Oct 18 2 Nov 18 5 $1200

14 Oct 18 to 27 Oct 18 28 Oct 18 16 Nov 18 4 $1500

28 Oct 18 to 10 Nov 18 11 Nov 18 30 Nov 18 3 $2000

11 Nov 18 to 24 Nov 18 25 Nov 18 14 Dec 18 2 $3000

25 Nov 18 to 8 Dec 18 9 Dec 18 28 Dec 18 1 $6000

You might also like

- 2019 TSP Catch-Up Contributions and Effective Date ChartDocument1 page2019 TSP Catch-Up Contributions and Effective Date ChartRayNo ratings yet

- 2019 TSP Contributions and Effective Date ChartDocument1 page2019 TSP Contributions and Effective Date ChartRayNo ratings yet

- La Via Verde July-August 2018 Sales ReportDocument8 pagesLa Via Verde July-August 2018 Sales ReportDiana Grise SanchezNo ratings yet

- Reporte de Ventas Via Verde Al 15 AgostoDocument5 pagesReporte de Ventas Via Verde Al 15 AgostoDiana Grise SanchezNo ratings yet

- Revenue Per Employee CalculatorDocument2 pagesRevenue Per Employee Calculatorsucheta menonNo ratings yet

- Payment Scheme 3.21.2fDocument1 pagePayment Scheme 3.21.2fFara Dinaa SusiloNo ratings yet

- Reporte de Ventas Via Verde Al 02 SeptDocument29 pagesReporte de Ventas Via Verde Al 02 SeptDiana Grise SanchezNo ratings yet

- Reporte de Ventas Via Verde Al 07 SeptDocument31 pagesReporte de Ventas Via Verde Al 07 SeptDiana Grise SanchezNo ratings yet

- Reporte de Ventas Via Verde Al 10 SeptDocument28 pagesReporte de Ventas Via Verde Al 10 SeptDiana Grise SanchezNo ratings yet

- Pension AlimenticiaDocument1 pagePension AlimenticiaMayesi Hernandez ZapataNo ratings yet

- BPI Trading Account: Running TOTAL 81,435.32 Total Cost + CashDocument3 pagesBPI Trading Account: Running TOTAL 81,435.32 Total Cost + CashjonNo ratings yet

- NO Tanggal Sumber Nominal: Total Rp19,145,000Document7 pagesNO Tanggal Sumber Nominal: Total Rp19,145,000ghgggtNo ratings yet

- For Students 24 9 19 Pivot-TablesDocument21 pagesFor Students 24 9 19 Pivot-TablesKr RishiNo ratings yet

- Total 40,100.10 Total 9,298.05 Total 2,062.80Document4 pagesTotal 40,100.10 Total 9,298.05 Total 2,062.80kuro hanabusaNo ratings yet

- Información del préstamo de $100 en 48 cuotasDocument4 pagesInformación del préstamo de $100 en 48 cuotasJosealberto MezaNo ratings yet

- Escuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 2Document9 pagesEscuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 2Isaac Andres Pech SanchezNo ratings yet

- Tabelle AssestmentDocument6 pagesTabelle AssestmentrosyNo ratings yet

- Rincian Iuran Anggota Pdgi Tulang Bawang Yang Di Transfer Ke Rekening PBDocument1 pageRincian Iuran Anggota Pdgi Tulang Bawang Yang Di Transfer Ke Rekening PBamarmakrufahNo ratings yet

- Dynamic Chart ScrollDocument7 pagesDynamic Chart ScrollPADMANABHAN33No ratings yet

- Buku Stok Koperasi ATKDocument7 pagesBuku Stok Koperasi ATKariani alghomaishaNo ratings yet

- Finanzas 2022Document18 pagesFinanzas 2022william gutierrezNo ratings yet

- Capex Budget 2019: Fixed Assets Register (Prior Spend)Document8 pagesCapex Budget 2019: Fixed Assets Register (Prior Spend)Umair KamranNo ratings yet

- Controle de Pagamento Dos ContratosDocument13 pagesControle de Pagamento Dos Contratosgeo construçoesNo ratings yet

- Fecha N. Factura ValorDocument4 pagesFecha N. Factura ValorBrayan DavidNo ratings yet

- Apuestas GBDocument1 pageApuestas GBgabrielaNo ratings yet

- Apuestas GBDocument1 pageApuestas GBgabrielaNo ratings yet

- Escuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 4Document28 pagesEscuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 4AnetteNo ratings yet

- Monthly Attendance Tracker - Baidoa Road Project - AUG 2021Document5 pagesMonthly Attendance Tracker - Baidoa Road Project - AUG 2021Cabdiqafaar CabdiNo ratings yet

- DiciembreDocument2 pagesDiciembrealecarendonNo ratings yet

- Trading PlanDocument54 pagesTrading Planandriantsoo tonioNo ratings yet

- Coins and Canada - 5 Cents 1858 To 1901 - Canadian Coins Price Guide and ValuesDocument5 pagesCoins and Canada - 5 Cents 1858 To 1901 - Canadian Coins Price Guide and ValuesAmado KhammashNo ratings yet

- September 2018 Bills: Merrick BankDocument1 pageSeptember 2018 Bills: Merrick BankSilvia LopezNo ratings yet

- IntegradoraDocument184 pagesIntegradoraAnetteNo ratings yet

- September 2018 Bills: Merrick BankDocument1 pageSeptember 2018 Bills: Merrick BankSilvia LopezNo ratings yet

- Check BoxDocument3 pagesCheck BoxPamuji Al-FaruqNo ratings yet

- Luz Del ExelDocument2 pagesLuz Del ExelPeter Creed CdlmNo ratings yet

- Loan amortization schedule table for $400,000Document1 pageLoan amortization schedule table for $400,000Oscar IsidoroNo ratings yet

- Rekap Laporan Sarapan Mughni Energi BumiDocument4 pagesRekap Laporan Sarapan Mughni Energi BumiFauzi WiyonoNo ratings yet

- GuerreroexcelapplicationDocument3 pagesGuerreroexcelapplicationapi-404295644No ratings yet

- Detalle 16 Al 30 Septiembre.Document2 pagesDetalle 16 Al 30 Septiembre.perlaramirezNo ratings yet

- Daily Report 2021 - Rudi KurniawanDocument46 pagesDaily Report 2021 - Rudi KurniawanRudi KurniawanNo ratings yet

- Customer Subscription Plans and Revenue ReportDocument9 pagesCustomer Subscription Plans and Revenue ReportAnishNo ratings yet

- Trading PlanDocument6 pagesTrading PlanRiyanNo ratings yet

- Disciplined Trader Academy Trade Log TemplateDocument873 pagesDisciplined Trader Academy Trade Log TemplateJasonNo ratings yet

- Cashback Tokopedia Income ReportDocument12 pagesCashback Tokopedia Income ReportAgung P. GaniNo ratings yet

- 52 Week Money Challenge Template Choose Day and SumDocument2 pages52 Week Money Challenge Template Choose Day and SumNicolle IlídioNo ratings yet

- Waste Disposal Monitoring Chart ProjectDocument3 pagesWaste Disposal Monitoring Chart Project刘文俊No ratings yet

- Manajemen Investasi - Novia Melati - 1701035041Document8 pagesManajemen Investasi - Novia Melati - 1701035041NoviaNo ratings yet

- Harga Ongkir Total Status Keterangan Varian Tanggal Transaksi Jumlah Pembelian (Set)Document9 pagesHarga Ongkir Total Status Keterangan Varian Tanggal Transaksi Jumlah Pembelian (Set)Cicih SusilawatiNo ratings yet

- Harga Ongkir Total Status Keterangan Varian Tanggal Transaksi Jumlah Pembelian (Set)Document9 pagesHarga Ongkir Total Status Keterangan Varian Tanggal Transaksi Jumlah Pembelian (Set)Cicih SusilawatiNo ratings yet

- Manajemen Investasi - Novia Melati - 1701035041Document14 pagesManajemen Investasi - Novia Melati - 1701035041NoviaNo ratings yet

- Tugas Pivot TikDocument5 pagesTugas Pivot TikAulia ZakiyahNo ratings yet

- Bookkeeping 4Document15 pagesBookkeeping 4Valen Lea GiovaniNo ratings yet

- Pembenihan Lele 1Document8 pagesPembenihan Lele 1Fakhrudin IfaNo ratings yet

- Rajdeep Kirana Store Account StatementDocument9 pagesRajdeep Kirana Store Account StatementKiran GolwadNo ratings yet

- Report of monthly income from 2015 to 2019Document2 pagesReport of monthly income from 2015 to 2019nato carvalhoNo ratings yet

- Controle de Calibração de MesasDocument25 pagesControle de Calibração de MesasNeemias CamargoNo ratings yet

- 2019 PricingDocument1 page2019 Pricingapi-444533631No ratings yet

- 2010 Dates & RatesDocument1 page2010 Dates & RatesJordiMiróMiróNo ratings yet

- Energized Electrical PermitDocument3 pagesEnergized Electrical PermitMohd AzharNo ratings yet

- Lori Howard Tort Claim Against Frank G. Bowne and Post Falls PDDocument1 pageLori Howard Tort Claim Against Frank G. Bowne and Post Falls PDWilliam N. GriggNo ratings yet

- Job Description of School Health Nurse Front Page by Shylin (2 Files Merged)Document6 pagesJob Description of School Health Nurse Front Page by Shylin (2 Files Merged)Leon Peter100% (1)

- Documentos Hana 1909Document44 pagesDocumentos Hana 1909yakapaNo ratings yet

- Cost Accounting NotesDocument17 pagesCost Accounting NotesAyushi Dwivedi0% (1)

- The Concept:: However, The Advantages of Employing Both Bonded Labour and Contract Labour Are The SameDocument4 pagesThe Concept:: However, The Advantages of Employing Both Bonded Labour and Contract Labour Are The SamePadma CheelaNo ratings yet

- Performance Measures QuestionsDocument7 pagesPerformance Measures QuestionsMohammad EssamNo ratings yet

- Accounting Information SystemDocument11 pagesAccounting Information SystemJoshua Oranga0% (1)

- 02 Kanto Region (Kaigofukushishi) 12000017Document4 pages02 Kanto Region (Kaigofukushishi) 12000017bnp2tkidotgodotidNo ratings yet

- Standard Costing QuizDocument2 pagesStandard Costing QuizmercyvienhoNo ratings yet

- YAS Clinic Group Employee Clearance FormDocument1 pageYAS Clinic Group Employee Clearance FormMahra AlMazroueiNo ratings yet

- The Influence of Work Environment On Employee Engagement of Local Government Unit in Municipality of Candelaria ZambalesDocument15 pagesThe Influence of Work Environment On Employee Engagement of Local Government Unit in Municipality of Candelaria ZambalesInternational Journal of Arts, Humanities and Social Studies (IJAHSS)No ratings yet

- Electroplus Case Study AnalysisDocument5 pagesElectroplus Case Study Analysiskookie bunnyNo ratings yet

- Proposed Cadre RestractureDocument2 pagesProposed Cadre RestractureRanjan MohantyNo ratings yet

- European Resume Format PDFDocument2 pagesEuropean Resume Format PDFJacob0% (1)

- 2 Ibm 02 XdaanruysschaertxinternshipprocessDocument13 pages2 Ibm 02 Xdaanruysschaertxinternshipprocessapi-318096431No ratings yet

- Why Men Earn More SummaryDocument4 pagesWhy Men Earn More SummaryAlDobkoNo ratings yet

- RAVS Requirements Fit For DutyDocument2 pagesRAVS Requirements Fit For DutyJason FlowersNo ratings yet

- Performance Appraisal at Jindal BrothersDocument31 pagesPerformance Appraisal at Jindal BrothersHarsh KardamNo ratings yet

- Applied Economics Quarter 4 SWOT AnalysisDocument22 pagesApplied Economics Quarter 4 SWOT AnalysisYuri TagalaNo ratings yet

- Case Analysis - N12 Technologies: Submitted by - Srishti Bhateja (19021141116)Document4 pagesCase Analysis - N12 Technologies: Submitted by - Srishti Bhateja (19021141116)srishti bhatejaNo ratings yet

- SALONDocument38 pagesSALONcarolNo ratings yet

- HR Project Manager Resume ExampleDocument2 pagesHR Project Manager Resume ExampleAnuragNo ratings yet

- Rituals for Spiritual and Physical WellbeingDocument23 pagesRituals for Spiritual and Physical WellbeingWild RiftNo ratings yet

- HR Policy Manual SummaryDocument142 pagesHR Policy Manual SummaryAhmed RazaNo ratings yet

- Ncert Sol Class 12 Business Studies ch2 PrinciplesDocument11 pagesNcert Sol Class 12 Business Studies ch2 PrinciplesAHMED AlpNo ratings yet

- Introducing Groundwork LeedsDocument12 pagesIntroducing Groundwork LeedsGroundwork LeedsNo ratings yet

- 12 HR Practices in SBI 2016 PDFDocument9 pages12 HR Practices in SBI 2016 PDFPrateek DadhichNo ratings yet

- Modern Labor Economics: Gender, Race, and Ethnicity in The Labor MarketDocument60 pagesModern Labor Economics: Gender, Race, and Ethnicity in The Labor MarketsamuelNo ratings yet

- Kings College Painting Supervisor JobDocument3 pagesKings College Painting Supervisor Jobsiva8000No ratings yet