Professional Documents

Culture Documents

MAS 2017 01 Management Accounting Concepts Techniques For Planning and Control

Uploaded by

Mitch Delgado EmataOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MAS 2017 01 Management Accounting Concepts Techniques For Planning and Control

Uploaded by

Mitch Delgado EmataCopyright:

Available Formats

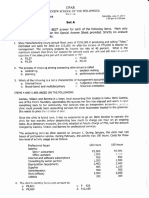

Republic of the Philippines

SORSOGON STATE COLLEGE

PRE-REVIEW LECTURE IN MANAGEMENT ADVISORY SERVICES

Management accounting concepts & techniques

for planning and control ROMAN JULIO B. INFANTE

PROBLEM 1 – CVP Analysis

After reviewing its cost structure (variable costs of P6.00 per unit and monthly fixed cost of P120,000) and potential market,

Jolina C. Romcris Company established what is considered to be a reasonable selling price. The company expected to sell

50,000 units per month and planned its monthly results as follows:

SALES P 500,000

VARIABLE COSTS 300,000

CONTRIBUTION MARGIN P 200,000

FIXED COSTS 120,000

INCOME BEFORE TAXES P 80,000

INCOME TAXES (40%) 32,000

NET INCOME P 48,000

(A) What is the contribution margin ratio?

Contribution Margin (CM) = Total Sales – Total Variable Costs

Contribution Margin per Unit (CM per unit) =Selling price per unit – Variable Cost per Unit

Contribution Margin Ratio (CM%) = CM ÷ Total Sales

-or-

= CM per unit ÷ Selling price per unit

(B) What is the break-even point in units?

BEP Sales = Fixed Cost (FC) ÷ CM%

BEP Units = FC ÷ CM per unit

(C) All other factors remaining unchanged, how much increase in profit would Jolina expect if the number of units sold is

55,000 (before tax)?

(D) If the company determined that a particular advertising campaign had a high probability of increasing sales by 3,000

units, how much could it pay for such a campaign without reducing its planned profits?

(E) A plan includes an increase in advertising cost of P20,000. What is the minimum increase in unit sales to compensate

for the increase in advertising cost?

(F) If the company wants a P60,000 before-tax profit, how many units must it sell?

Required Unit Sales Before Tax Profit + FC

=

at Target Profit * CM per unit

(G) If the company wants a 10% before tax return on sales, what level of sales in pesos does it need?

Required Sales at Before Tax Profit + FC

Target Profit*

=

CM%

Note: Profit should be on a Before-Tax basis in using this formula.

(H) If the company wants a P45,000 after tax profit, how many units must it sell?

If the Target Profit is in After Tax figure, use the following formula to convert to before tax basis:

Before Tax After Tax Profit

Profit = 1- Tax Rate

(I) If the company wants an after-tax return on sales of 9%, how many units must it sell?

(J) If the company wants an after-tax profit P45,000 on its expected sales volume of 50,000 units, what price must it

charge?

(K) If the company wants a before-tax return on sales of 16% on its expected sales volume of 50,000 units, what price

must Jolina charge?

(L) The company is considering offering its salespeople a 5% commission on sales. What would be the total peso-sales

required in order to implement the commission plan and still earn the planned pre-tax income of P80,000?

(M) What is the margin of safety in peso sales and the margin of safety ratio at the expected sales of 50,000 units?

Margin of Safety (MOS) = Actual Sales – BEP Sales

Margin of Safety Ratio (MOS%) = MOS ÷ Actual Sales

(N) Assuming that the cost structure remains unchanged, but the volume of sales is expected to increase to 60,000 units,

what is the new margin of safety ratio and the amount of profit after-tax?

(O) What is the degree of operating leverage based on expected level of sales?

Page 1 of 5 MAS 2017-01

Degree Operating Leverage (DOL) = CM ÷ Operating Income

HIGH OL LOW OL

Low VC High VC

High FC Low FC

High CM Low CM

High BEP Low BEP

Sales after BEP have Sales after BEP have lesser

greater impact on profits impact on profits

Note: DOL X MOS% = 100%, thus,

DOL = 1 ÷ MOS% and

MOS% = 1 ÷ DOL

(P) Assuming that the cost structure and the selling price remains constant, what is the percentage of change in profit and

the new expected profit after tax if the company can sell 55,000 units?

Change in Profit = Change in Sales Peso x CM%

-or-

= % change in Sales x DOL

(Q) The operations manager believes variable cost will increase to P8.25 per unit. The sales manager believes the selling

price can be increased. What is the new selling price that will give the same contribution margin ratio?

(R) The operations manager believes variable cost will increase to P8.25 per unit. The sales manager believes increasing

the selling price may not be a good decision. What is the new breakeven point in units?

PROBLEM 2 – Standard Costing

Price Variance = (Actual Price – Standard Price) x Actual Quantity Purchased

Quantity* Variance = (Actual Quantity Used – Standard Quantity Used) x Standard Price

* Volume Variance = (Expected production – Actual production) x Standard Price

Nose-to-Nose Company operates with a standard cost accounting system and uses cost variances as a means of detecting

costs that may require more control. A standard cost sheet for a component that is manufactured exclusively in one plant

is as follows:

Direct Materials (5 units @ P8) P 40.00

Direct Labor (0.5 hour @ P40) 20.00

Variable Overhead (0.5 direct labor hour @ P6) 3.00

Fixed Overhead (0.5 direct labor hour @ P10) 5.00

Standard Unit Cost P 68.00

Data from the past year were as follows:

1. Purchased 1,550,000 units of materials at a cost of 4. Used 1,480,000 units of materials in production.

P12,430,000 5. Utilized 150,000 direct labor hours.

2. Manufactured 295,000 units of product and sold 6. Spent P5,960,000 for direct labor.

275,000 units. 7. Spent P910,000 for variable overhead.

3. Budgeted P1,500,000 for fixed overhead for the year. 8. Spent P1,525,000 for fixed overhead.

Using standard costing system, determine the following variances:

a. Material Price Variance

b. Material Usage (Efficiency) Variance

c. Labor Rate Variance

d. Labor Efficiency Variance

e. Variable Overhead Budget Variance (break this into spending and efficiency)

f. Fixed Overhead Budget Variance

g. Fixed Overhead Volume Variance

h. Using normal costing, analyze the overhead variance into four components

Page 2 of 5 MAS 2017-01

PROBLEM 3 - Variable Costing

Absorption VS Variable

Absorption Variable

DM √ √

DL √ √

VOH √ √

FOH √ X

VOX X X

FOX X X

√ - Product Cost

X – Period Cost

Absorption Costing (Conventional/Full Costing) Variable Costing (Direct/Differential/Marginal Costing)

Sales xxx Sales xxx

Cost of Sales xxx Variable Costs xxx

Gross Margin xxx Contribution Margin xxx

Operating Expenses xxx Fixed Costs xxx

Operating Income xxx Operating Income xxx

Profit/Ending Inventory Reconciliation*

P=S AC = VC -

P>S AC > VC AC - FOHU(P - S) = VC

P<S AC < VC AC + FOHU(P - S) = VC

* Unit Cost is constant over time

* Fixed cost variance are written off rather than prorated to inventory balances

AC NI XX VC NI XX

BEG FOH XX BEG FOH (XX)

END FOH (XX) END FOH XX

VC NI XX AC NI XX

Note: No fixed cost variance under variable costing

Sherrill Corporation produces a single product. The following is a cost structure applied to its first year of operations.

Sales price P15 per unit

Variable costs:

SG&A P2 per unit

Production P4 per unit

Fixed costs (total cost incurred for the year):

SG&A P14,000

Production P20,000

During the first year, Sherrill Corporation manufactured 5,000 units and sold 3,800. There was no beginning or ending

work-in-process inventory.

a. How much income before income taxes would be reported if Stanley uses absorption costing?

b. How much income before income taxes would be reported if variable costing was used?

c. Show why the two costing methods give different income amounts.

PROBLEM 4 – BUDGETING

Sales Budget Cash Collections Budget

Units to be sold xx Collections for current month’s sale xx

Selling price per unit xx Collections for prior months’ sale xx

Sales pesos xx Receipts from transactions other than sale xx

Total cash receipts xx

Page 3 of 5 MAS 2017-01

Patsy Company has the following collection pattern for its accounts receivable:

40 percent in the month of sale

50 percent in the month following the sale

8 percent in the second month following the sale

2 percent uncollectible

The company has recent credit sales as follows:

April: P200,000

May: 420,000

June: 350,000

How much should the company expect to collect on its receivables in June?

Production Budget (Units) DM Budget (Units)

Beginning FG xx Production xx

Production xx x DM per FG produced xx

GAS xx DM used xx

Units to be sold (xx) Beginning DM xx

Ending FG xx Purchases xx

DM Available xx

DM Used (xx)

Ending DM xx

DM Budget (Pesos)

Purchases (in units) xx

x Cost per DM xx

Purchases (pesos) xx

Southworth Company

Southworth Company manufactures Product A from three raw materials (X, Y, and Z). The following table

indicates the number of pounds of each material that is required to manufacture the product:

Material X Material Y Material Z

2 3 2

2 1 2

3 2 2

The company has a policy of maintaining an inventory of finished goods on the product equal to 25 percent of

the next month's budgeted sales. Listed below is the sales budget for the first quarter of 2021:

Month Product A

Jan. 10,000

Feb. 9,000

Mar. 11,000

a. Refer to Southworth Company. Assuming that the company meets its required inventory policy, prepare

a production budget for the first 2 months of 2021.

b. Refer to Southworth Company. Unit costs of materials X, Y, and Z are respectively P4, P3, and P5. The

Southworth Company has a policy of maintaining its raw material inventories at 50 percent of the next

month's production needs. Assuming that this policy is satisfied, prepare a material purchases budget

for all three materials in both pounds and pesos for January.

Page 4 of 5 MAS 2017-01

Other pro-forma budgets:

DL Budget OH Budget

Production xx Activity base xx

x Std time allowed/unit xx x VOH rate per activity xx

Std time allowed xx Total VOH Cost xx

x Cost per DL time xx + Fixed OH xx

DL Cost xx Total OH xx

Selling and Admin Budget Total OH xx

Units to be sold xx Noncash OH (xx)

x Var SA per unit sold xx Cash based OH xx

Total Var SA Cost xx

+Fixed SA Cost xx Cash Budget

Total SA Cost xx Beginning balance xx

Cash receipts xx

Total SA Cost xx Cash disbursements (xx)

Noncash SA Cost (xx) Cash excess xx

Cash based SA xx -Minimum balance (xx)

(Cash needed)/available (xx)/xx

Cash to borrow/(invest) xx/(xx)

Ending balance xx

PROBLEM 5 – Activity Based Management

McMahon Company would like to institute an activity-based costing system to price products. The company's

Purchasing Department incurs costs of P550,000 per year and has six employees. Purchasing has determined

the three major activities that occur during the year.

Allocation # of Total

Activity Measure People Cost

Issuing purchase orders # of purchase orders 1 P150,000

Reviewing receiving reports # of receiving reports 2 P175,000

Making phone calls # of phone calls 3 P225,000

During the year, 50,000 phone calls were made in the department; 15,000 purchase orders were issued; and

10,000 shipments were received. Product A required 200 phone calls, 150 receiving reports, and 50 purchase

orders. Product B required 350 phone calls, 400 receiving reports, and 100 purchase orders.

a. Determine the amount of purchasing department cost that should be assigned to each of these

products.

b. Determine purchasing department cost per unit if 1,500 units of Product A and 3,000 units of Product

B were manufactured during the year.

“It is not a question of how much money you have, but how wise you are to save it” – Shaquille O’Neal,

DBA

Page 5 of 5 MAS 2017-01

You might also like

- (At) 01 - Preface, Framework, EtcDocument8 pages(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- R3 - ARC - AP and ATDocument10 pagesR3 - ARC - AP and ATOliver SalamidaNo ratings yet

- Key Quiz 3 1st 2022 20223Document4 pagesKey Quiz 3 1st 2022 20223Leslie Mae Vargas ZafeNo ratings yet

- GOVT ACCOUNTING OVERVIEWDocument15 pagesGOVT ACCOUNTING OVERVIEWTroisNo ratings yet

- Understanding Variable and Fixed Overhead Costs and VariancesDocument13 pagesUnderstanding Variable and Fixed Overhead Costs and VariancesElla Mae TuratoNo ratings yet

- Dr. Lee's patient service revenue calculation under accrual basisDocument6 pagesDr. Lee's patient service revenue calculation under accrual basisAndrea Lyn Salonga CacayNo ratings yet

- Notes on Credit Analysis and Financial DecisionsDocument1 pageNotes on Credit Analysis and Financial DecisionsGray JavierNo ratings yet

- Accounting 4 Note Payable and Debt RestructureDocument2 pagesAccounting 4 Note Payable and Debt RestructurelorenNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Non-Routine DecisionsDocument5 pagesNon-Routine DecisionsVincent Lazaro0% (1)

- Master in Managerial Advisory Services: Easy QuestionsDocument13 pagesMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNo ratings yet

- Sale and Leaseback Accounting QuestionsDocument28 pagesSale and Leaseback Accounting QuestionsEdrickLouise DimayugaNo ratings yet

- Kaladkaren Corporation Bankruptcy Liquidation StatementsDocument51 pagesKaladkaren Corporation Bankruptcy Liquidation StatementsrenoNo ratings yet

- Cost Accounting Quiz 5 Joint Products & By-Products CostingDocument7 pagesCost Accounting Quiz 5 Joint Products & By-Products CostingshengNo ratings yet

- Ia3 IsDocument3 pagesIa3 IsMary Joy CabilNo ratings yet

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNo ratings yet

- 08 - Activity Based Costing and Balance ScorecardDocument4 pages08 - Activity Based Costing and Balance ScorecardMarielle CastañedaNo ratings yet

- Accounting controls for special transactionsDocument12 pagesAccounting controls for special transactionsRNo ratings yet

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- You Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123Document3 pagesYou Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123chiji chzzzmeowNo ratings yet

- Unit 7 Audit of IntangiblesDocument10 pagesUnit 7 Audit of IntangiblesVianca Isabel PagsibiganNo ratings yet

- MAS Handout CH4 DiffCostAnaDocument2 pagesMAS Handout CH4 DiffCostAnaAbigail TumabaoNo ratings yet

- Standard Costing and Variance Analysis: This Accounting Materials Are Brought To You byDocument16 pagesStandard Costing and Variance Analysis: This Accounting Materials Are Brought To You byChristian Bartolome LagmayNo ratings yet

- AC&VCDocument6 pagesAC&VCjsus22No ratings yet

- Consolidated Net IncomeDocument1 pageConsolidated Net IncomePJ PoliranNo ratings yet

- 3.3 Exercise - Improperly Accumulated Earnings TaxDocument2 pages3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganNo ratings yet

- Management Science Chapter 10Document44 pagesManagement Science Chapter 10Myuran SivarajahNo ratings yet

- MAS Handout-Relevant Costing PDFDocument5 pagesMAS Handout-Relevant Costing PDFDivine VictoriaNo ratings yet

- Management Services II Final ExamDocument5 pagesManagement Services II Final ExamBry LgnNo ratings yet

- Problem 1: The Statement of Affairs: Straight ProblemsDocument5 pagesProblem 1: The Statement of Affairs: Straight ProblemsJemNo ratings yet

- Cost Accounting - Exercise 1Document2 pagesCost Accounting - Exercise 1Anna MaglinteNo ratings yet

- JPIA-MCL Academic-EventsDocument17 pagesJPIA-MCL Academic-EventsJana BercasioNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Edoc - Pub Problems Solving Masdocx PDFDocument6 pagesEdoc - Pub Problems Solving Masdocx PDFReznakNo ratings yet

- Process CostingDocument6 pagesProcess Costingbae joohyun0% (2)

- Activity Based CostingDocument55 pagesActivity Based CostingCeline Marie AntonioNo ratings yet

- MAS-07: RESPONSIBILITY ACCOUNTING & TRANSFER PRICINGDocument7 pagesMAS-07: RESPONSIBILITY ACCOUNTING & TRANSFER PRICINGClint AbenojaNo ratings yet

- Answer Key Chapter 1 Audit of Investments and Related AccountsDocument22 pagesAnswer Key Chapter 1 Audit of Investments and Related AccountsBazinga HidalgoNo ratings yet

- Variance AnalysisDocument21 pagesVariance Analysismark anthony espiritu0% (1)

- CRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSDocument6 pagesCRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSRovern Keith Oro CuencaNo ratings yet

- Use The Following Information For Question 1 and 2Document12 pagesUse The Following Information For Question 1 and 2Leah Mae NolascoNo ratings yet

- Acctg26: Intermediate Accounting 3Document33 pagesAcctg26: Intermediate Accounting 3Jeane Mae BooNo ratings yet

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNo ratings yet

- Budgeting Activity - DayagDocument5 pagesBudgeting Activity - DayagAlexis Kaye DayagNo ratings yet

- 208 BDocument10 pages208 BXulian ChanNo ratings yet

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Psa 550 FNDocument1 pagePsa 550 FNkristel-marie-pitogo-4419No ratings yet

- 4 5 AnswersDocument4 pages4 5 AnswersKesselNo ratings yet

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- Shenista Inc. Product Profit AnalysisDocument3 pagesShenista Inc. Product Profit Analysismohitgaba19No ratings yet

- Q Cost Concept and CVP Problems With Answers PDFDocument26 pagesQ Cost Concept and CVP Problems With Answers PDFEunice BernalNo ratings yet

- Chapter 16Document16 pagesChapter 16redearth29No ratings yet

- Compute P/E ratios, dividend yields, and book-to-market ratiosDocument2 pagesCompute P/E ratios, dividend yields, and book-to-market ratiosJaneth NavalesNo ratings yet

- Activity-Based Costing Activity Center Cost Driver Amount of Activity Center CostDocument2 pagesActivity-Based Costing Activity Center Cost Driver Amount of Activity Center Costasdfghjkl zxcvbnmNo ratings yet

- Cost Accounting Document SummaryDocument95 pagesCost Accounting Document SummaryJohn Laurence LoplopNo ratings yet

- Department of Accountancy: Page - 1Document16 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Operating and Financial LeverageDocument36 pagesOperating and Financial LeverageKiena AnthiaNo ratings yet

- STCM 04 Ge CVPDocument2 pagesSTCM 04 Ge CVPdin matanguihanNo ratings yet

- Conso Sale of PpeDocument6 pagesConso Sale of PpeMitch Delgado EmataNo ratings yet

- CRC-ACE REVIEW SCHOOL AUDITING PROBLEMSDocument8 pagesCRC-ACE REVIEW SCHOOL AUDITING PROBLEMSLuzviminda Maruzzo100% (2)

- MOAform HCJCJDocument4 pagesMOAform HCJCJMitch Delgado EmataNo ratings yet

- A Guide To TRAIN RA10963 PDFDocument18 pagesA Guide To TRAIN RA10963 PDFJay Ryan Sy Baylon100% (2)

- Alphanumeric Tax Codes (Atc) Industries Covered by Vat ATC Industries Covered by Vat ATC Industries Covered by Vat ATCDocument1 pageAlphanumeric Tax Codes (Atc) Industries Covered by Vat ATC Industries Covered by Vat ATC Industries Covered by Vat ATCbekbek12No ratings yet

- PWCPH Taxalert-08 PDFDocument14 pagesPWCPH Taxalert-08 PDFKyll MarcosNo ratings yet

- Checklist of DocumentsDocument1 pageChecklist of DocumentsMitch Delgado EmataNo ratings yet

- Cambridge O Level: English Language 1123/21Document8 pagesCambridge O Level: English Language 1123/21Fred SaneNo ratings yet

- Parliamentary Procedure in The Conduct of Business MeetingDocument14 pagesParliamentary Procedure in The Conduct of Business MeetingEstephanie SalvadorNo ratings yet

- CP Officer Exam AnswerDocument3 pagesCP Officer Exam AnswerDaniel GetachewNo ratings yet

- AR15 Forging ReceiverDocument105 pagesAR15 Forging ReceiverNO2NWO100% (10)

- Meltdown: The New Normal Call of The Wild Gear of The YearDocument93 pagesMeltdown: The New Normal Call of The Wild Gear of The YearAppaeommasaranghaeNo ratings yet

- Blackman Et Al 2013Document18 pagesBlackman Et Al 2013ananth999No ratings yet

- ASTMH Exam Brochure 18 FNLDocument17 pagesASTMH Exam Brochure 18 FNLNgô Khánh HuyềnNo ratings yet

- User Manual - User Manual - Original and Genuine Veronica® 1W PLL (1WPLLM)Document39 pagesUser Manual - User Manual - Original and Genuine Veronica® 1W PLL (1WPLLM)Carlos Evangelista SalcedoNo ratings yet

- Barangay Budget Authorization No. 11Document36 pagesBarangay Budget Authorization No. 11Clarissa PalinesNo ratings yet

- Icpo Naft 4Document7 pagesIcpo Naft 4Juan AgueroNo ratings yet

- Energy and Memory Efficient Clone Detection in WSN AbstractDocument4 pagesEnergy and Memory Efficient Clone Detection in WSN AbstractBrightworld ProjectsNo ratings yet

- Summer's TowerDocument8 pagesSummer's TowerSum SumNo ratings yet

- Forces and Motion Chapter ExplainedDocument11 pagesForces and Motion Chapter ExplainedMaridjan WiwahaNo ratings yet

- Guerrero vs. CA - DigestDocument2 pagesGuerrero vs. CA - DigestMarionnie SabadoNo ratings yet

- 2008 Consumer Industry Executive SummaryDocument139 pages2008 Consumer Industry Executive SummaryzampacaanasNo ratings yet

- Dleg0170 Manual PDFDocument20 pagesDleg0170 Manual PDFEmmanuel Lucas TrobbianiNo ratings yet

- Leader in Water Purification Systems RougingDocument16 pagesLeader in Water Purification Systems RougingtomcanNo ratings yet

- What Digital Camera - May 2016Document100 pagesWhat Digital Camera - May 2016Alberto ChazarretaNo ratings yet

- Tinbridge Hill Overlook Final PlansDocument22 pagesTinbridge Hill Overlook Final PlansEzra HercykNo ratings yet

- CSCI369 Lab 2Document3 pagesCSCI369 Lab 2Joe Ong ZuokaiNo ratings yet

- CMC Internship ReportDocument62 pagesCMC Internship ReportDipendra Singh50% (2)

- Grader 14 M Caterpillar BrouchorDocument2 pagesGrader 14 M Caterpillar Brouchorjude tallyNo ratings yet

- Inflammability and Health Risks of Lubricant Oil 5W30 SNDocument9 pagesInflammability and Health Risks of Lubricant Oil 5W30 SNPerformance Lubricants, C.A.No ratings yet

- Assam State Sec ListDocument8 pagesAssam State Sec ListShyam KumarNo ratings yet

- Field Attachment Report Format For All Third Year Students - Final For Use by StudentsDocument2 pagesField Attachment Report Format For All Third Year Students - Final For Use by StudentsJoseph Kayima50% (2)

- Display Kit GuideDocument9 pagesDisplay Kit GuidemfabianiNo ratings yet

- Domestic Ro Price List 2021Document6 pagesDomestic Ro Price List 2021den oneNo ratings yet

- DATABASE Kawasan Industri PolugadungDocument20 pagesDATABASE Kawasan Industri PolugadungRina Rachman100% (1)

- 17 "Flow" Triggers That Will Increase Productivity - Tapping Into Peak Human Performance in BusinessDocument7 pages17 "Flow" Triggers That Will Increase Productivity - Tapping Into Peak Human Performance in BusinessFilipe RovarottoNo ratings yet

- Unified HSE Passport Standard LRDocument60 pagesUnified HSE Passport Standard LRSHRISH SHUKLANo ratings yet