Professional Documents

Culture Documents

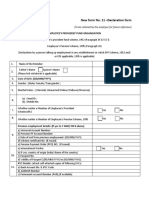

EPF Declaration Form

Uploaded by

vishalkavi18Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EPF Declaration Form

Uploaded by

vishalkavi18Copyright:

Available Formats

www.epfindia.gov.

in

Composite Declaration Form -11

(To be retained by the employer for future reference)

EMPLOYEES' PROVIDENT FUND ORGANISATION

Employees' Provident Funds Scheme, 1952 (Paragraph 34 & 57) &

Employees' Pension Scheme, 1995 (Paragraph 24)

(Declaration by a person taking op employment in any establishment on which EPF Scheme, 1952 and /or EPS, 1995 is applicable)

I Name of the member

2

Father's Name D

Spouse's Name

D

3 Date ofBirth: ( DD/ MM I YYYY )

4 Gender: (Male/Femaleffransgender)

5 Marital Status: (Married/U nmarried/W idow/W idower/Divorcee)

(a) Email ID:

6

(b) Mobile No.:

Present employment details:

7 Date of joining in the current establishment (DD/MM/YYYY)

KYC Details: (attach selfattested copies of following KYCs)

a) Bank Account No. :

8 b) IFS Code of the branch:

c) AADHAR Number

d) Permanent Account Number (PAN), if available

Whether earlier a member of Employees' Provident Fund Scheme, Yes/No

9

1952

10 Whether earlier a member of Employees' Pension Scheme, 1995 Yes/No

Previous employment details: (if Yes to 9 AND/OR 10 above I - Un-exempted

Establishment Universal PF Account Date of joining Date of exit Scheme PPONumber Non

Name & Address Account Number (DD/MM/ (DD/MM/ Certificate (if issued) Contributory

Number YYYY) YYYY) No. (if Period

issued (NCP) Days

11

Previous employment details: (if Yes to 9 AND/OR 10 above) - For Exempted Trusts

Name & Address of the Trust UAN Member Date of Date of exit Scheme Non

EPS Ale joining (DD/MM/ Certificate Contributory

Number (DD/MM/ YYYY) No. (if Period (NCP)

YYYY) issued Days

12

a) International Worker: Yes /No

13 b) If yes, state country of origin (India/Name of other country)

c) Passport No.

d) Validity of passport [(DD/MM/YYYY) to (DD/MM/YYYY)]

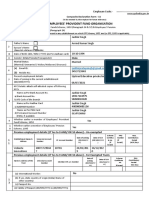

UNDERTAKJNG

I) Certified that the particulars are true to the best of my knowledge.

2) I authorize EPFO to use my Aadhar for verification/authentication/e-KYC purpose for service delivery.

3) Kindly transfer the funds and service details, if applicable, from the previous PF account as declared above to the present P.F.

Account as I am an Aadhar verified employee in my previous PF Accounl *

4) In case of changes in above details, the same will be intimated to employer at the earliesl

Date:

Place: Signature of Member

DECLARATION BY PRESENT EMPLOYER

A. The member Mr/Ms/Mrs ......................................................................... has joined on ......................................... and has been

allotted PF No.......................................................................and UAN ................................................................................................ .

B. In case the person was earlier not a member of EPF Scheme, 1952 and EPS, 1995:

• Please Tick the Appropriate Option:

The KYC details of the above member in the UAN database

D Have not been uploaded

D Have been uploaded but not approved

D Have been uploaded and approved with DSC/e-sign.

C. In case the person was earlier a member of EPF Scheme, 1952 and EPS, 1995:

• Please Tick the Appropriate Option:-

0 The KYC details of the above member in the UAN database have been approved with E-sign/Digital Signature

Certificate and transfer request has been generated on portal.

D The previous Account of the member is not Aadhar verified and hence physical transfer form shall be initiated.

Date: Signature of Employer with Seal of

Establishment

*Auto transfer of previous PF account would be possible in respect of Aadhar verified employees only. Other employees are requested to

file physical claim (Form-13) for transfer of account from the previous establishment.

You might also like

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Composite Declaration Form: Employees'Document2 pagesComposite Declaration Form: Employees'Keshav SarafNo ratings yet

- FORM No 11 (NEW)Document2 pagesFORM No 11 (NEW)selvampanneer121No ratings yet

- Composite Declaration Form-11 Employees' Provident Fund OrganisationDocument2 pagesComposite Declaration Form-11 Employees' Provident Fund OrganisationHarshit SuriNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- PF Membership Details in Form 11Document2 pagesPF Membership Details in Form 11AbhilashNo ratings yet

- Composite Declaration FORM 11Document4 pagesComposite Declaration FORM 11Yaswanth ChallaNo ratings yet

- Sample Filled EPF Composite Declaration Form 11Document2 pagesSample Filled EPF Composite Declaration Form 11Varalakshmi SharanNo ratings yet

- Form 11 (Download Here) - 54061825463895 - 54388549640084Document3 pagesForm 11 (Download Here) - 54061825463895 - 54388549640084Kishore NithyaNo ratings yet

- PF - Form 11Document2 pagesPF - Form 11Log SquareNo ratings yet

- PF Declaration Form 11 New-Ayesha KhanDocument3 pagesPF Declaration Form 11 New-Ayesha KhanMalik PrintNo ratings yet

- India Statutory Form TemplateDocument11 pagesIndia Statutory Form TemplateMadhusudan MadhuNo ratings yet

- Joining Docket DocumentsDocument9 pagesJoining Docket Documentsgh75zs5m4dNo ratings yet

- Sample Composite Form 11Document2 pagesSample Composite Form 11Yuga NayakNo ratings yet

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamNo ratings yet

- PF Form11 & Declaration FormDocument2 pagesPF Form11 & Declaration Formalapati NagalaxmiNo ratings yet

- Composite Form 11 - EditableDocument1 pageComposite Form 11 - EditableSoumya BanerjeeNo ratings yet

- New FormDocument2 pagesNew FormPondara Naveen BadatyaNo ratings yet

- New Form 11Document2 pagesNew Form 11నీలం మధు సూధన్ రెడ్డిNo ratings yet

- P.F. Form 11Document1 pageP.F. Form 11DattaNo ratings yet

- EPF - New Form No. 11 - Declaration FormDocument2 pagesEPF - New Form No. 11 - Declaration FormNaveen SNo ratings yet

- EPF Form 11Document3 pagesEPF Form 11warm bloodNo ratings yet

- IN Form 11Document1 pageIN Form 11Chetan DhuriNo ratings yet

- Form 11 - PF Declaration1Document2 pagesForm 11 - PF Declaration1ADITYA R P 1937302No ratings yet

- QTPL Form 11Document2 pagesQTPL Form 11PreritNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormPAINNo ratings yet

- (To Be Retained by The Employer For Future Reference) : Employees'Provident Fund OrganisationDocument3 pages(To Be Retained by The Employer For Future Reference) : Employees'Provident Fund Organisationshashi kiranNo ratings yet

- 1 - EPF - Form No. 11 (Sample)Document1 page1 - EPF - Form No. 11 (Sample)Rajdeep GaharwarNo ratings yet

- Employees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Document1 pageEmployees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Yash SellsNo ratings yet

- PFForm 11Document1 pagePFForm 11sanjith_shelly290No ratings yet

- Employees' Provident Fund OrganisationDocument2 pagesEmployees' Provident Fund OrganisationMuthiah ManiNo ratings yet

- Employees' Provident Fund Organisation: New Form: 11 - Declaration FormDocument1 pageEmployees' Provident Fund Organisation: New Form: 11 - Declaration Formhareesh bathalaNo ratings yet

- Employees' Provident Fund Organisation: Composite Declaration Form - 11Document5 pagesEmployees' Provident Fund Organisation: Composite Declaration Form - 11Yashveer Pratap SinghNo ratings yet

- Print Form 11Document2 pagesPrint Form 11Andrew WinnerNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document3 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Lance LeoNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11naresh2891No ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormDharshan ChandrasekaranNo ratings yet

- 7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Document1 page7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Vakati HemasaiNo ratings yet

- Form11 - 111018740Document2 pagesForm11 - 111018740muskan davidNo ratings yet

- Employees' Provident Fund OrganisationDocument1 pageEmployees' Provident Fund Organisationvikas kunduNo ratings yet

- PFForm 11Document1 pagePFForm 11mohan vamsiNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormsarveshNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Yash JainNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormRajeshNo ratings yet

- PF Declaration Form No.-11Document2 pagesPF Declaration Form No.-11soumodip chakrabortyNo ratings yet

- EPF Form-11Document1 pageEPF Form-11PulkKit SharMaNo ratings yet

- LTFS Statutory KitDocument12 pagesLTFS Statutory KitAyyanzeroNo ratings yet

- PF Membership Details in Form 11 TemplateDocument2 pagesPF Membership Details in Form 11 TemplateNisumba SoodhaniNo ratings yet

- No: Manual/Amendment/20: For Web Circulation OnDocument4 pagesNo: Manual/Amendment/20: For Web Circulation OnKeyur DattaniNo ratings yet

- EPF - FormDocument1 pageEPF - FormBavithraNo ratings yet

- Eram Shaikh - Onboarding KIT Template 23 May 2022Document97 pagesEram Shaikh - Onboarding KIT Template 23 May 2022Tariq ShaikhNo ratings yet

- Epf Form No 11Document1 pageEpf Form No 11Narayanprasad GhosalNo ratings yet

- PF Form AgreementDocument2 pagesPF Form AgreementbindusNo ratings yet

- Lei C4 - 392-E.5-: - 4-6B Plat' I. S c.4Document4 pagesLei C4 - 392-E.5-: - 4-6B Plat' I. S c.4jasdeep singhNo ratings yet

- Mahesh Band Venkah. Bandi: Kyc Details: (Attach Self Attested Copies of Following KVCS)Document2 pagesMahesh Band Venkah. Bandi: Kyc Details: (Attach Self Attested Copies of Following KVCS)NEW PREMIUMNo ratings yet

- New Form No.11-Declaration Form: Employees Provident Fund OrganizationDocument2 pagesNew Form No.11-Declaration Form: Employees Provident Fund OrganizationbhargavaNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- LTE Parameters (TK414)Document2 pagesLTE Parameters (TK414)vishalkavi18No ratings yet

- ESI Form2Document2 pagesESI Form2Jay NayakNo ratings yet

- 4 Ltelayer3analysispart2 160408140151Document210 pages4 Ltelayer3analysispart2 160408140151Budavarapu MaheshNo ratings yet

- Exit Interview FormDocument4 pagesExit Interview Formvishalkavi18No ratings yet

- 1550 Lnf1087404 r12b Lte Performance OptimizationDocument3 pages1550 Lnf1087404 r12b Lte Performance OptimizationPapitch Do DuneNo ratings yet

- LTE Optimization GuidelineDocument55 pagesLTE Optimization Guidelineaxenic0450% (2)

- Form 15 Under Contract ActDocument1 pageForm 15 Under Contract Actvishalkavi18No ratings yet

- 3g Kpi ParametersDocument2 pages3g Kpi ParametersAmit DevNo ratings yet

- Lte CDRDocument1 pageLte CDRvishalkavi18No ratings yet

- Telecom AcademyDocument57 pagesTelecom Academyvishalkavi18No ratings yet

- InterFreq (Band) Thresholds For A1, A2, A5Document1 pageInterFreq (Band) Thresholds For A1, A2, A5vishalkavi18No ratings yet

- 06 - C Telia Sonera Optimization CaseDocument10 pages06 - C Telia Sonera Optimization Casenm7713No ratings yet

- Telecom AcademyDocument57 pagesTelecom Academyvishalkavi18No ratings yet

- Avgpwrfwd (Watts) Rssi - Rise - 1X - DB: C1Xavoicetotaltccfrate C1Xavoiceszasgndeficit C1Xavoiceiarate C1Xa - Total - SeizuresDocument3 pagesAvgpwrfwd (Watts) Rssi - Rise - 1X - DB: C1Xavoicetotaltccfrate C1Xavoiceszasgndeficit C1Xavoiceiarate C1Xa - Total - Seizuresvishalkavi18No ratings yet

- Nokia Volte Optimization - QualityDocument20 pagesNokia Volte Optimization - QualityHazem Maher83% (12)

- 11 RA4120BEN15GLA1 Initial Parameter Planning - PDF Lte (Telecommunication) Duplex (Telecommunications)Document93 pages11 RA4120BEN15GLA1 Initial Parameter Planning - PDF Lte (Telecommunication) Duplex (Telecommunications)vishalkavi18No ratings yet

- Optional Power FeatureDocument24 pagesOptional Power Featurevishalkavi18No ratings yet

- Netact OSSDocument2 pagesNetact OSSvishalkavi18No ratings yet

- Optional Power FeatureDocument24 pagesOptional Power Featurevishalkavi18No ratings yet

- RF Parameter StatementDocument12 pagesRF Parameter Statementvishalkavi18No ratings yet

- Optimization of DRX Parameter For Power Saving in Lte - IJRETDocument4 pagesOptimization of DRX Parameter For Power Saving in Lte - IJRETvishalkavi18No ratings yet

- DefnitionsDocument1 pageDefnitionsvishalkavi18No ratings yet

- LTE Messaging Analysis and Performance Optimization PDFDocument229 pagesLTE Messaging Analysis and Performance Optimization PDFvishalkavi18No ratings yet

- LTE Frequency Bands & Spectrum AllocationsDocument4 pagesLTE Frequency Bands & Spectrum Allocationsvishalkavi18No ratings yet

- Nokia Volte Optimization - QualityDocument20 pagesNokia Volte Optimization - QualityHazem Maher83% (12)

- Guide To Optimizing LTE Service DropsDocument52 pagesGuide To Optimizing LTE Service DropsCharles WeberNo ratings yet

- Basics of Blocks and Drops: Seizures or AttemptsDocument3 pagesBasics of Blocks and Drops: Seizures or Attemptsvishalkavi18No ratings yet

- Basics of Blocks and Drops: Seizures or AttemptsDocument3 pagesBasics of Blocks and Drops: Seizures or Attemptsvishalkavi18No ratings yet

- LTE Messaging Analysis and Performance Optimization PDFDocument229 pagesLTE Messaging Analysis and Performance Optimization PDFvishalkavi18No ratings yet

- Netact OSSDocument2 pagesNetact OSSvishalkavi18No ratings yet

- CONTRIBN MADE by Deming, Juran and CrosbyDocument14 pagesCONTRIBN MADE by Deming, Juran and CrosbySachin Methree100% (1)

- Reading Passage 1: You Should Spend About 20 Minutes On Questions 1-12 Which Are Based On Reading Passage 1Document2 pagesReading Passage 1: You Should Spend About 20 Minutes On Questions 1-12 Which Are Based On Reading Passage 1Melisa CardozoNo ratings yet

- DataDocument85 pagesDataMyk Twentytwenty NBeyond100% (1)

- Marina Bay SandsDocument5 pagesMarina Bay SandsTauqeer A. BalochNo ratings yet

- TableauDocument5 pagesTableaudharmendardNo ratings yet

- Dn7064519 - Installing Flexi Cabinet For IndoorDocument63 pagesDn7064519 - Installing Flexi Cabinet For Indoorlettymc100% (1)

- TG Synchronization Connections For RbsDocument11 pagesTG Synchronization Connections For RbsJack Sprw67% (3)

- Motor Driver Board Tb6560-5axisDocument14 pagesMotor Driver Board Tb6560-5axisAli Asghar MuzzaffarNo ratings yet

- IEEE Conf 2018 TrackNet - A - Deep - Learning - Based - Fault - Detection - For - Railway - Track - InspectionDocument5 pagesIEEE Conf 2018 TrackNet - A - Deep - Learning - Based - Fault - Detection - For - Railway - Track - InspectionkaruldeepaNo ratings yet

- Managing Risk: Chapter SevenDocument39 pagesManaging Risk: Chapter SevenGrinaldo VasquezNo ratings yet

- Organic PoolsDocument163 pagesOrganic PoolsEdu Socolovsky100% (3)

- Media Gateway SoftswitchDocument10 pagesMedia Gateway SoftswitchMahmoud Karimi0% (1)

- Xiaopan OS InstallationDocument6 pagesXiaopan OS InstallationMuhammad SyafiqNo ratings yet

- Cascaded Transformers:: Figure 1.basic 3 Stage Cascaded TransformerDocument3 pagesCascaded Transformers:: Figure 1.basic 3 Stage Cascaded TransformeryugendraraoknNo ratings yet

- ME8595 SyllabusDocument1 pageME8595 SyllabusDeepak sakthiNo ratings yet

- 5th Issue October 10Document12 pages5th Issue October 10The TartanNo ratings yet

- ALR Compact Repeater: Future On DemandDocument62 pagesALR Compact Repeater: Future On DemandmickycachoperroNo ratings yet

- MapObjects inVBNET PDFDocument34 pagesMapObjects inVBNET PDFWanly PereiraNo ratings yet

- MotRadar System PrinciplesDocument26 pagesMotRadar System PrinciplesReadmotNo ratings yet

- Manual Do Consumo de Gases DC - TruLaser - 1030 - 2011-08-09 - METRIC - VERSIONDocument65 pagesManual Do Consumo de Gases DC - TruLaser - 1030 - 2011-08-09 - METRIC - VERSIONveraNo ratings yet

- 04 Cuculic Celic PrencDocument8 pages04 Cuculic Celic PrencStanislava RokvicNo ratings yet

- 07-GB Column BasesDocument14 pages07-GB Column BasesAUNGPSNo ratings yet

- Container Parts in Detail PDFDocument32 pagesContainer Parts in Detail PDFSathishSrs60% (5)

- Hand Free DrivingDocument8 pagesHand Free DrivingNurulAfikaNo ratings yet

- LX Capacity Chart Hydrogen SCFM 10-2008 PDFDocument5 pagesLX Capacity Chart Hydrogen SCFM 10-2008 PDFZack AmerNo ratings yet

- Understanding ZTPFDocument41 pagesUnderstanding ZTPFsanjivrmenonNo ratings yet

- Naruto - NagareboshiDocument2 pagesNaruto - NagareboshiOle HansenNo ratings yet

- 100-DBMS Multiple Choice QuestionsDocument17 pages100-DBMS Multiple Choice Questionsbiswarupmca67% (3)

- PresPrescient3 Extinguishing Control Panelcient 3 SLDocument4 pagesPresPrescient3 Extinguishing Control Panelcient 3 SLIgor NedeljkovicNo ratings yet

- Dual-Phase, Quick-PWM Controllers For IMVP-IV CPU Core Power SuppliesDocument45 pagesDual-Phase, Quick-PWM Controllers For IMVP-IV CPU Core Power Supplieslucian1961No ratings yet