Professional Documents

Culture Documents

Etwm MP 21 1 Col R1.indd

Uploaded by

sekhargOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Etwm MP 21 1 Col R1.indd

Uploaded by

sekhargCopyright:

Available Formats

smart stats

In Mutual funds 22

This Loans and deposits 25

Section Alternate investments 26

ET WEALTH TOP 50 STOCKS

Every week we put about 3,000 stocks through four key filters and rate them on a mix of factors. The end result of this

exercise is the listing of the top 50 stocks based on the composite rating to help ease your fortune hunt.

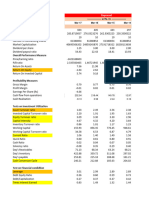

RANK PRICE ` GROWTH%* VA L UAT I O N R AT I O S RISK R AT I N G Fast Growing Stocks

Current Previous Stock Revenue Net Div Downside Bear No. of Consensus Top 5 stocks with the highest expected revenue

Rank Rank Price Profit PE PB Yield PEG Risk Beta Analysts Rating % growth over the previous year.

Vedanta 1 1 295.45 31.91 118.67 15.85 1.81 6.52 0.21 1.44 1.45 23 4.87

Oberoi Realty 149

PGCIL 2 2 206.05 31.05 36.10 14.46 2.16 2.08 0.39 0.82 0.58 39 4.46

Apollo Tyres 3 3 250.70 16.67 341.90 11.63 1.75 1.16 0.04 1.25 1.75 27 4.44 Petronet LNG 77

Petronet LNG 4 5 251.60 76.57 39.68 21.61 4.55 0.99 0.23 1.15 1.28 40 3.85 Havells India 53

JK Cement 5 4 999.55 27.54 78.84 30.87 3.97 0.80 0.38 1.04 0.54 26 4.61

Motherson Sumi Sys. 49

GSPL 6 7 210.15 41.97 64.44 21.95 2.66 0.73 0.34 1.38 1.33 31 3.93

Engineers India 48

PTC India 7 6 116.20 42.09 29.50 8.29 0.89 2.53 0.28 1.39 2.76 13 4.54

Hindalco Industries 8 10 240.45 18.47 181.01 26.01 1.17 0.45 0.17 1.39 2.11 29 4.62 See revenue column in the adjacent table.

NMDC 9 9 127.60 32.84 39.39 15.84 1.78 4.04 0.21 1.19 2.29 24 3.21

CESC 10 11 1,013.15 19.18 43.07 19.31 1.32 0.98 0.23 1.37 2.40 28 4.36

VA Tech Wabag 11 8 603.70 25.47 96.28 32.22 3.32 0.67 0.33 1.20 1.28 19 4.74 Least Expensive Stocks

GAIL India 12 12 468.40 24.65 43.77 23.49 2.01 1.96 0.54 0.99 1.25 38 3.74 The 5 stocks with the lowest forward PE.

Oberoi Realty 13 13 487.20 148.52 189.86 43.91 2.90 0.41 0.23 1.40 0.91 20 4.05

PTC India 8.29

ONGC 14 14 180.65 10.38 25.24 11.30 1.05 3.32 0.46 0.92 1.28 37 4.32

ONGC 11.30

NTPC 15 15 181.15 22.60 18.97 14.01 1.54 2.63 0.72 0.84 1.09 34 4.47

Cyient 16 17 575.75 19.03 31.26 18.92 3.07 1.79 0.61 1.11 0.91 26 4.65 IRB Infrastructure 11.31

Cholamandalam Investments 17 23 1,278.75 40.84 52.92 27.74 4.61 0.43 0.58 1.30 1.30 26 4.65 Apollo Tyres 11.63

ACC 18 22 1,667.90 31.05 96.33 51.67 3.61 1.01 0.57 0.95 1.19 41 3.29 Trident 13.44

Tata Power 19 16 94.70 15.04 141.98 40.49 1.93 1.37 0.23 0.88 1.14 26 3.12 See PE column in the adjacent table.

JK Lakshmi Cement 20 19 409.60 37.95 197.12 56.37 3.45 0.18 0.29 1.22 1.11 27 4.15

Ambuja Cements 21 20 262.50 26.98 71.73 46.55 2.67 1.06 0.72 0.92 0.94 41 3.12

InterGlobe Aviation 22 18 1,121.55 38.19 59.94 24.36 10.70 2.95 0.54 1.20 1.51 19 4.32 Best PEGs

JSW Steel 23 26 254.85 22.66 38.43 17.36 2.70 0.88 0.45 1.29 1.80 33 3.88 Top 5 stocks with the least price earning to

growth ratio.

Jubilant Life Sciences 24 24 656.70 35.35 40.44 17.82 3.05 0.47 0.48 1.41 2.07 16 4.94

Cadila Healthcare 25 29 428.75 37.07 45.85 29.52 6.31 0.73 0.66 1.42 1.62 42 3.93 Hindalco

Industries NMDC

Oil India 26 28 361.95 24.05 14.98 18.15 0.98 3.86 0.81 1.02 0.21 31 3.74

BHEL 27 25 92.00 17.84 225.55 74.27 1.04 1.12 0.33 1.29 2.29 43 2.16

0.17 0.21

IRB Infrastructure 28 27 229.75 5.80 25.69 11.31 1.54 3.20 0.43 1.33 2.68 26 4.19

Trident 29 30 89.00 14.89 31.45 13.44 1.65 1.49 0.41 1.63 2.92 12 4.58 0.04

Cipla 30 31 600.90 23.62 99.14 48.20 3.88 0.33 0.48 1.04 1.25 42 3.67 0.21 0.23

Engineers India 31 34 187.60 47.53 36.84 38.47 4.47 1.63 0.93 1.37 1.49 19 4.32

HeidelbergCement India 32 37 155.80 3.63 124.59 46.31 3.65 1.28 0.37 1.50 1.03 10 4.50 Apollo Tyres Vedanta Petronet LNG

Natco Pharma 33 32 940.60 35.11 64.18 33.83 9.97 0.79 0.52 1.73 1.97 19 4.63

See PEG column in the adjacent table.

KEC International 34 36 322.20 22.73 49.98 27.39 5.27 0.50 0.54 1.45 1.99 30 4.40

Kalpataru Power 35 33 443.80 11.39 70.50 37.20 2.86 0.45 0.36 1.17 1.97 22 4.50

Dr Reddy's Laboratories 36 43 2,284.05 15.11 46.81 31.55 3.05 0.88 0.65 1.14 1.13 46 3.20

Maruti Suzuki India 37 35 8,599.10 32.26 26.94 34.53 6.99 0.86 1.28 0.72 0.98 54 4.39

Income Generators

Top 5 stocks with the highest dividend yield.

India Cements 38 39 173.85 12.43 105.73 35.31 1.03 0.57 0.24 1.78 3.59 21 3.86

DB Corp 39 38 360.80 18.90 22.70 17.73 4.17 1.09 0.75 0.87 0.19 22 4.41 Vedanta | 6.52

JSW Energy 40 42 83.75 45.57 37.66 21.77 1.33 0.61 0.55 1.58 2.80 24 2.50 NMDC | 4.04

Havells India 41 40 509.30 53.01 83.55 65.69 9.68 0.67 0.74 1.30 1.03 40 3.05 Oil India | 3.86

Reliance Industries 42 47 921.55 25.77 21.79 18.16 2.06 0.58 0.94 0.96 1.89 41 4.17 ONGC | 3.32

Dalmia Bharat 43 46 3,153.30 27.95 159.09 81.19 5.65 0.07 0.52 1.34 1.87 27 4.52 IRB Infra | 3.20

Grasim Industries 44 NR 1,169.90 43.05 26.27 17.26 1.74 0.47 0.73 1.11 1.57 15 4.07

Container Corp Of India 45 48 1,308.00 20.76 33.07 46.47 3.61 1.14 0.65 1.03 0.92 32 3.31

Motherson Sumi Systems 46 41 365.20 49.34 22.70 48.51 9.36 0.55 0.68 1.04 1.23 38 4.16

Dividend stocks are considered

Gujarat Gas 47 NR 879.10 31.73 129.54 55.06 7.30 0.35 0.40 1.04 0.85 21 3.81 safe stocks during a downturn.

Figures indicate what an investor

Persistent Systems 48 49 654.25 14.80 20.84 16.72 2.58 0.92 0.82 0.86 0.82 36 3.94

can earn as dividend for every

Jagran Prakashan 49 50 165.10 14.84 16.70 15.60 2.52 1.83 0.74 0.94 1.13 20 4.30 `100 invested.

Coromandel International 50 NR 518.75 22.07 61.26 31.75 5.24 0.98 0.52 1.36 2.49 14 4.21

* The figures under this head are for expected growth. NR: Not in the ranking. Data as on 29 Nov 2017. Source: Bloomberg

Least Risky

Top 5 stocks with the lowest downside risk.

expected to show growth in revenue, net weight to net profit growth and 10% to analysts covering the stock (the

Methodology profit and EPS (earnings per share) in the growth in EPS (the higher, the better, higher, the better) and 10% to

DB Corp

in the next four quarters. The final two for each parameter). Growth is consensus rating (a composite rating 0.87

The four filters used to arrive at filters were that the companies should calculated by comparing the based on the recommendations by all Persistent

the Top 50 stocks have made profits in the past four ’consensus estimate’ for the next 12 analysts who track a stock. Again, the Systems

Only traded stocks: Of the about 7,000 quarters and have a positive net worth. months with the historical 12-month higher, the better). 0.86

listed stocks, only actively traded stocks Rating rationale values. 4. ... and so do the risks.

were considered. Power Grid

Having arrived at the final stocks 2. ... but only at reasonable valuation. Total weight: 10%. Two kinds of risks

Corp of India NTPC

Only big stocks: Only companies with universe, we ranked them using the Total weight: 40%, which comprises were considered. A 5% weight was

an average market capitalisation and following four principles. 10% weight to PE ratio, 10% to PB assigned to downside risk and bear 0.82 0.84

revenue of over `1,000 crore were A percentile rating (on a 1-100 scale) is ratio, 10% to PEG ratio (the lower, beta each (the lower, the better, in

considered. given to each parameter and the the better, for all three parameters) both cases).

Maruti

Only well tracked: We picked stocks composite ranking is arrived at using the and 10% to dividend yield (the higher,

Suzuki India

that are tracked by at least 10 analysts. weighted average of these parameters. the better).

The ranking methodology has been developed 0.72

Only profitable and growing: We 1. Growth is the key... 3. Analysts’ views matter... by Narendra Nathan. A detailed explanation

considered only those stocks that are Total weight: 30%, which comprises Total Weight: 20%, which comprises of the methodology is available at

See downside risk and bear beta columns

10% weight to revenue growth, 10% 10% weight to the total number of www.economictimes.com/wealth

in the adjacent table.

You might also like

- Performance of Select Stocks Over Last 20 Years (2000-2020)Document12 pagesPerformance of Select Stocks Over Last 20 Years (2000-2020)GANESHNo ratings yet

- Maryam Finance Project-1-11Document1 pageMaryam Finance Project-1-11Tutii FarutiNo ratings yet

- Principal Personal Tax Saver Fund Rating and PerformanceDocument6 pagesPrincipal Personal Tax Saver Fund Rating and PerformanceksrygNo ratings yet

- Fastest growing Australian startupsDocument1 pageFastest growing Australian startupsRomon YangNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- Market 11 Aug 2014 3.30 PMDocument2 pagesMarket 11 Aug 2014 3.30 PMasifNo ratings yet

- Ambee Pharma Square Pharma Aci Beacon IBNSINA Marico Pharm Aid Orion Infusion Beximc o Pharma GSKDocument2 pagesAmbee Pharma Square Pharma Aci Beacon IBNSINA Marico Pharm Aid Orion Infusion Beximc o Pharma GSKRiazboniNo ratings yet

- Financial Analysis 2 - ScribdDocument6 pagesFinancial Analysis 2 - ScribdSanjay KumarNo ratings yet

- HDFC EquityDocument6 pagesHDFC EquityDarshan ShettyNo ratings yet

- Reliance Tax Saver (ELSS) Fund Rating: High Return, Above Average PerformanceDocument4 pagesReliance Tax Saver (ELSS) Fund Rating: High Return, Above Average PerformanceKrishnan ChockalingamNo ratings yet

- Stock DetailsDocument2 pagesStock DetailsNilesh DhandeNo ratings yet

- Nifty Junior BeES Fund Rating and Performance AnalysisDocument6 pagesNifty Junior BeES Fund Rating and Performance AnalysisGNo ratings yet

- ValueResearchFundcard RelianceGrowth 2010dec30Document6 pagesValueResearchFundcard RelianceGrowth 2010dec30Maulik DoshiNo ratings yet

- P&L Statement of Power ProjectDocument4 pagesP&L Statement of Power ProjectSunil PeerojiNo ratings yet

- Distribution of Active Companies With Respect To Paidup CapitalDocument5 pagesDistribution of Active Companies With Respect To Paidup CapitaldipmalaNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Petro Chemi ExcelDocument3 pagesPetro Chemi ExcelshreejaNo ratings yet

- INDIAN ENERGY ANALYSISDocument18 pagesINDIAN ENERGY ANALYSISRasulNo ratings yet

- Narayana Hrudayalaya RatiosDocument10 pagesNarayana Hrudayalaya RatiosMovie MasterNo ratings yet

- Row Labels Business Target (Feb + Mar)Document6 pagesRow Labels Business Target (Feb + Mar)Ajay KhowalaNo ratings yet

- ValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Document4 pagesValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Rahul AnandNo ratings yet

- TEC Testing Sheets - Tracker 100716Document10 pagesTEC Testing Sheets - Tracker 100716pradeepreddycvNo ratings yet

- Swadeshi PolytexDocument10 pagesSwadeshi Polytexshauryaslg1No ratings yet

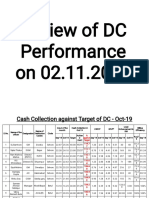

- Review of DC Performance On 02.11.2019Document21 pagesReview of DC Performance On 02.11.2019Subhash DhakarNo ratings yet

- Elnet TechnologDocument10 pagesElnet TechnologankiosaNo ratings yet

- 5 - Extracted - EMB Series 50-Extracto PG - 119-153Document1 page5 - Extracted - EMB Series 50-Extracto PG - 119-153heinz billNo ratings yet

- Narration Dec-99 Dec-99 Dec-99 Dec-99 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CaseDocument10 pagesNarration Dec-99 Dec-99 Dec-99 Dec-99 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst Casechandrajit ghoshNo ratings yet

- Comparison of All Mutual Funds: Anish Vyas Roll No: 2Document12 pagesComparison of All Mutual Funds: Anish Vyas Roll No: 2Anish VyasNo ratings yet

- Kingston Educational Institute: Ratio AnalysisDocument1 pageKingston Educational Institute: Ratio Analysisdhimanbasu1975No ratings yet

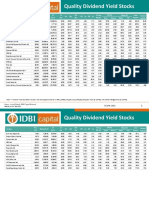

- Quality Dividend Yield Stocks Jan 22 03 January 2022 478756522Document4 pagesQuality Dividend Yield Stocks Jan 22 03 January 2022 478756522Jaikanth MuthukumaraswamyNo ratings yet

- June 2Document5 pagesJune 2Pallavi M SNo ratings yet

- FM DataDocument113 pagesFM DatadhanrajNo ratings yet

- Fundcard: Aditya Birla Sun Life Tax Relief 96Document36 pagesFundcard: Aditya Birla Sun Life Tax Relief 96Deepak VaswaniNo ratings yet

- Index Dashboard MAR2021Document2 pagesIndex Dashboard MAR2021Âj AjithNo ratings yet

- Bajaj Auto Financial Ratios AnalysisDocument17 pagesBajaj Auto Financial Ratios AnalysisYuvraj BholaNo ratings yet

- Narration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDocument9 pagesNarration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseShahzada KhanNo ratings yet

- Balance Sheet of Kansai Nerolac PaintsDocument5 pagesBalance Sheet of Kansai Nerolac Paintssunilkumar978No ratings yet

- Index Dashboard: Broad Market IndicesDocument2 pagesIndex Dashboard: Broad Market IndicesVagaram ChowdharyNo ratings yet

- Index Dashboard FEB2024Document2 pagesIndex Dashboard FEB2024ridhimac47No ratings yet

- Global Macro Indicators - 29 Oct 19Document7 pagesGlobal Macro Indicators - 29 Oct 19Ram AhujaNo ratings yet

- Tre Project PcuDocument11 pagesTre Project Pcugoo odNo ratings yet

- Stocks Listed by Price to Earnings RatioDocument3 pagesStocks Listed by Price to Earnings RatioGeorge Khris DebbarmaNo ratings yet

- Cross-Sectional AnalysisDocument13 pagesCross-Sectional AnalysisSourajit SanyalNo ratings yet

- June 14Document5 pagesJune 14Pallavi M SNo ratings yet

- TVS Motor Company Financial Analysis and ComparisonDocument21 pagesTVS Motor Company Financial Analysis and ComparisonBharat ChaudharyNo ratings yet

- Fundcard: Franklin India Taxshield FundDocument4 pagesFundcard: Franklin India Taxshield FundvinitNo ratings yet

- Fundcard: Tata India Tax Savings FundDocument4 pagesFundcard: Tata India Tax Savings FundKrishnan ChockalingamNo ratings yet

- Index Dashboard AUG2020Document2 pagesIndex Dashboard AUG2020PNo ratings yet

- U S DividendChampions-LIVEDocument8 pagesU S DividendChampions-LIVEmdc8223No ratings yet

- P4 Basement Safety Factor PlotDocument5 pagesP4 Basement Safety Factor PlotTing Sheng ChongNo ratings yet

- Market 8 Aug 2014 3.30 PMDocument2 pagesMarket 8 Aug 2014 3.30 PMasifNo ratings yet

- Nifty range calculator with expected price changesDocument13 pagesNifty range calculator with expected price changesbrijsingNo ratings yet

- LC-02 RebarDocument1 pageLC-02 RebarRafikNo ratings yet

- Appendix - B: Percentage Score Percentage ScoreDocument6 pagesAppendix - B: Percentage Score Percentage Scorebalavenkat20090% (1)

- Attractive Bluechips 19 Aug 2020 1517Document5 pagesAttractive Bluechips 19 Aug 2020 1517rajNo ratings yet

- 0552Document1 page0552Aman GargNo ratings yet

- Major Pharma Companies Performance OverviewDocument28 pagesMajor Pharma Companies Performance OverviewADNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- Etwm MP 28 1 Col R1.inddDocument1 pageEtwm MP 28 1 Col R1.inddsekhargNo ratings yet

- Steps To Collate The Results When Controller CrashedDocument2 pagesSteps To Collate The Results When Controller CrashedsekhargNo ratings yet

- Steps To Collate The Results When Controller CrashedDocument2 pagesSteps To Collate The Results When Controller CrashedsekhargNo ratings yet

- Citrix LoadRunner 1Document15 pagesCitrix LoadRunner 1PTGuyNo ratings yet

- Load Runner Best PracticesDocument25 pagesLoad Runner Best PracticessekhargNo ratings yet

- Citrix LoadRunner 1Document15 pagesCitrix LoadRunner 1PTGuyNo ratings yet

- Citrix LoadRunner 1Document15 pagesCitrix LoadRunner 1PTGuyNo ratings yet

- Steps To Collate The Results When Controller CrashedDocument2 pagesSteps To Collate The Results When Controller CrashedsekhargNo ratings yet

- Advanced Java Material Download FromDocument148 pagesAdvanced Java Material Download Fromswathisural100% (1)

- Citrix LoadRunner 1Document15 pagesCitrix LoadRunner 1PTGuyNo ratings yet

- Performance Testing White PaperDocument3 pagesPerformance Testing White PapersekhargNo ratings yet

- 10 1 1 67Document12 pages10 1 1 67sekhargNo ratings yet

- HTDASLRDocument41 pagesHTDASLRsekhargNo ratings yet

- HTDASLRDocument41 pagesHTDASLRsekhargNo ratings yet

- Introduction To HP Load Runner Getting Familiar With Load Runner 4046Document28 pagesIntroduction To HP Load Runner Getting Familiar With Load Runner 4046DurgaCharan KanaparthyNo ratings yet

- Introduction To HP Load Runner Getting Familiar With Load Runner 4046Document28 pagesIntroduction To HP Load Runner Getting Familiar With Load Runner 4046DurgaCharan KanaparthyNo ratings yet

- Capacity Planning PDD FinalDocument47 pagesCapacity Planning PDD Finalsekharg100% (1)

- Capacity Planning PDD FinalDocument47 pagesCapacity Planning PDD Finalsekharg100% (1)

- Interim Order in Respect of Mr. Vijay Kumar GabaDocument10 pagesInterim Order in Respect of Mr. Vijay Kumar GabaShyam SunderNo ratings yet

- G o RT No 202Document2 pagesG o RT No 202nmsusarla999No ratings yet

- 10000004182Document58 pages10000004182Chapter 11 DocketsNo ratings yet

- CICA CIA Guide Audits of Financial Statements That Contain Amounts That Have Been Determined Using Actuarial CalculationsDocument44 pagesCICA CIA Guide Audits of Financial Statements That Contain Amounts That Have Been Determined Using Actuarial CalculationsGarima TiwariNo ratings yet

- JP Morgan - Project BloomDocument3 pagesJP Morgan - Project BloomAngel Blue CruzNo ratings yet

- Revue AERES HCERES Mars2016Document727 pagesRevue AERES HCERES Mars2016Emy des JardinsNo ratings yet

- Short Exercises guideDocument38 pagesShort Exercises guideSaqib Jawed100% (2)

- CAS Investment Partners April 2022 Letter To InvestorsDocument25 pagesCAS Investment Partners April 2022 Letter To InvestorsZerohedgeNo ratings yet

- 100 Business Blog SitesDocument4 pages100 Business Blog SiteslamarwattsNo ratings yet

- Summer Internship Project Swan Investmart LimitedDocument46 pagesSummer Internship Project Swan Investmart LimitedAMAN PANDEYNo ratings yet

- Cash Flow Analysis and Financial PlanningDocument26 pagesCash Flow Analysis and Financial PlanningMara LacsamanaNo ratings yet

- Forecasting Financial Statements and Additional Funds NeededDocument20 pagesForecasting Financial Statements and Additional Funds Neededthe__wude8133No ratings yet

- Acb3 10Document37 pagesAcb3 10gizachew alekaNo ratings yet

- ProjectDocument42 pagesProjectPiyush JindalNo ratings yet

- Baglamukhi Masala Fs 2076-77Document17 pagesBaglamukhi Masala Fs 2076-77sudhakar ShakyaNo ratings yet

- Khanifah, Et Al. (2019) - Environmental PerformanceDocument9 pagesKhanifah, Et Al. (2019) - Environmental PerformanceSyefirabellaNo ratings yet

- Investment in Cambodia Prepared by Chan BonnivoitDocument64 pagesInvestment in Cambodia Prepared by Chan BonnivoitMr. Chan Bonnivoit100% (2)

- Financial Performance Analysis of Eastern Bank LimitedDocument49 pagesFinancial Performance Analysis of Eastern Bank Limitedmd_shagorNo ratings yet

- Derivatives and Risk Management Class 1: A. Course IntroductionDocument2 pagesDerivatives and Risk Management Class 1: A. Course IntroductionasjkdnadjknNo ratings yet

- GuruFocus Report 0P0000BK9ADocument14 pagesGuruFocus Report 0P0000BK9AcarminatNo ratings yet

- Summer Project Shubham Khare Enr 15031Document319 pagesSummer Project Shubham Khare Enr 15031sanmaheNo ratings yet

- 52 InsurDocument2 pages52 InsurtgaNo ratings yet

- Cbse Model QP Class Xii (KMS)Document269 pagesCbse Model QP Class Xii (KMS)aleenaNo ratings yet

- Service Marketing of Icici BankDocument41 pagesService Marketing of Icici BankIshan VyasNo ratings yet

- Mama TheoDocument17 pagesMama TheophantomhabzicNo ratings yet

- Business Plan - T@P India CHOCOLATE Pvt. Ltd. - Uummm Chocolet - Presentation 1Document16 pagesBusiness Plan - T@P India CHOCOLATE Pvt. Ltd. - Uummm Chocolet - Presentation 1Tushar CholepatilNo ratings yet

- REliance Growth FundsDocument60 pagesREliance Growth FundsBhushan KelaNo ratings yet

- Tasty BitesDocument41 pagesTasty Bitesrakeshmoney99No ratings yet

- Fortnightly Status Report 4 For Dissertation WorkDocument9 pagesFortnightly Status Report 4 For Dissertation WorkPratik VashisthaNo ratings yet

- Studi Kelayakan Pendirian Pabrik Pakan Ternak Ayam Ras Petelur Di Kota Payakumbuh Oleh: Muhammad Royyan Hidayatullah Azwar HarahapDocument17 pagesStudi Kelayakan Pendirian Pabrik Pakan Ternak Ayam Ras Petelur Di Kota Payakumbuh Oleh: Muhammad Royyan Hidayatullah Azwar Harahapberkas abdulhafidNo ratings yet