Professional Documents

Culture Documents

Subscription Scheme Smart Value For Sbi

Uploaded by

Biswa Jyoti GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Subscription Scheme Smart Value For Sbi

Uploaded by

Biswa Jyoti GuptaCopyright:

Available Formats

SSL smartvalue Plan

Customer Copy

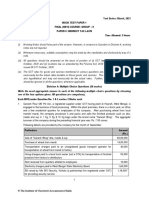

Table 1.1

SSL smartvalue Plan

SMART3.1 2499 3249 130% 3 Years 6 Months 1,299,600 0.25% 0.03% 0.03% (0.05%) 35 (70)

SMART4.1 4499 6749 150% 3 Years 12 Months 2,699,600 0.25% 0.025% 0.03% (0.04%) 25 (50)

SMART5.1 7499 11249 150% 3 Years 12 Months 5,624,500 0.20% 0.02% 0.025% (0.04% 20 (40)

SMART6.1 12999 19499 150% 5 Years 12 Months 12,999,333 0.15% 0.015% 0.02% (0.03%) 15 (30)

SMART7.1 24999 37499 150% 5 Years 12 Months 37,499,000 0.10% 0.01% 0.01% (0.02%) 10 (20)

Particulars Smart3.1 Smart4.1 Smart5.1 Smart6.1 Smart7.1

Minimum Brokerage (per share) – 3 Paise 2 Paise 1 Paise 1 Paise 1 Paise

Cash Market Segment

Note: 1) The mentioned Subscription scheme (smartvalue) plan is non-refundable . 2) The smartvalue plan is only applicable to Equity & Equity Derivatives segment

3) Minimum brokerage for Futures segment is Re. 0.01 per share.

ID: Intraday I C/F: Carry forward

Table 1.2

Smart 3.1 Smart 4.1 Smart 5.1 Smart 6.1 Smart 7.1

Gross Plan Charges

2861 5151 8586 14884 28624

(Including ST@14.5%)

Trading Platform - Offline BS+Web+EXE+App BS+Web+EXE+App BS+Web+EXE+Apps BS+Web+EXE+Apps BS+Web+EXE+Apps

Trading Platform - Online Web+EXE+App Web+EXE+App Web+EXE+App Web+EXE+App Web+EXE+App

BS: Branch Support I App: SSL mobile application I EXE: SSL Terminal Software (SBISMART)

Terms & Conditions:

1) The Gross Plan Charges are non-refundable.

2) Scheme start date will be from Date of Account opening or date of realization of subscription amount, whichever is later.

3) Scheme tenure refers to the period up to which the Smart Value subscription plan is valid. During the scheme tenure, client will be levied

the corresponding brokerage rates as mentioned in the table 1.1 above.

4) Cash Back benefit refers to refund of the brokerage paid by the client during the cash back validity period. Actual refund/cash back is

limited to the corresponding cash back value limit prescribed in table 1.1 above.

SSL smartvalue Plan

Customer Copy

5) Cash Back benefit is applicable only for self executed trades entered by client through SSL's web platform, trading software & mobile

application. No Cash back will be provided for assisted trades i.e., trades entered through online/offline/branch dealers and/or Call &

Trade dealers.

6) Cash back will only be provided on the Net Plan Value.

7) The cash back will be credited to the client's ledger account on the first week of the calendar month following the month in which the cash

back validity period is ending. For example, if the cash back validity period is till 27th September, the actual payout will be credited in the

1st Week of October.

8) Minimum brokerage for Futures segment is Re. 0.01 per share

9) Service Tax of 14.5% (or as applicable) will be in addition to the Plan Value and will be collected up front

10) This Offer is applicable to Resident Indians only. This offer is not applicable to SSL employees.

11) Scheme is only applicable to accounts opened on or after 15.07.2015.

12) A client can subscribe to only one offer plan at any point of time. Any other concession scheme cannot be clubbed with this scheme.

13) The subscription amount may be paid via Direct Debit, Cheque, Internet Banking, fund transfer, NEFT, fund lien or via adjustment in the

client's available margin. All payment should be made from the designated bank account of the customer.

14) Clients will not be refunded the unused plan value or cash back value at the end of the scheme.

15) At least one trade should be entered by the client in every six calendar months from the start of the scheme tenure, for the scheme to

remain valid. For this purpose, end of the corresponding calendar month will be calculated as the cut-off date. In case the customer, does

not transact once in six calendar months, the plan will automatically lapse at the end of the sixth month and scheme benefits will no longer

apply. In such case, the customer will be charged standard brokerage rates as mentioned in the Account Opening Form, from the next day

of the lapse.

16) All statutory / regulatory levies and other charges including but not limited to Securities Transaction Tax, SEBI Turnover Fees, Exchange

Transaction Charges, Stamp Duty and Service Tax shall be charged separately over and above the brokerage. Also, Demat transaction

charges incurred by the client for delivery trades will be chargeable and the same will not be deducted from the Plan Value.

17) The above plans are subject to regulatory norms in force from time to time and may be discontinued under any regulatory directions or for

any other reason, without giving prior intimation to the client.

18) In the Smart Value subscription scheme, client will be charged brokerage as per the corresponding slab. This brokerage cannot be

adjusted against the subscription amount paid up front.

19) For any disputes pertaining to the Offer, the decision of SSL will be final and binding.

20) In case of any queries/further clarifications, please call on toll free no. 1800 22 3345 (MTNL/BSNL Users) / 1800 209 9345 (Private Telecom

Users) or send Email on: helpdesk@sbicapsec.com

ACKNOWLEDGEMENT

We acknowledge the receipt of Form No. / Trading Account No. _____________________________________with

a. Please tick the appropriate plan:

o SMART3.1 o SMART4.1 o SMART5.1 o SMART6.1 o SMART7.1

b. Cheque No. ______________________ Amount (Rs) ___________________ Date __________________

Bank Name _______________________________________ Branch Name ______________________________

c. Direct debit authorization collected (if applicable) : o Yes / o No

d. Any other mode of payment made by customer. o NEFT I o Internet Banking / Fund Transfer

o Fund Lien I o Margin Adjustment.

Transaction ID / Ref. No. __________________________ _______________________________________

Employee id & Name of SSL Representative

SSL smartvalue Plan

Office Copy

Terms & Conditions:

1) The Gross Plan Charges are non-refundable.

2) Scheme start date will be from Date of Account opening or date of realization of subscription amount, whichever is later.

3) Scheme tenure refers to the period up to which the Smart Value subscription plan is valid. During the scheme tenure, client will be levied the corresponding

brokerage rates as mentioned in the table 1.1 above.

4) Cash Back benefit refers to refund of the brokerage paid by the client during the cash back validity period. Actual refund/cash back is limited to the

corresponding cash back value limit prescribed in table 1.1 above.

5) Cash Back benefit is applicable only for self executed trades entered by client through SSL's web platform, trading software & mobile application. No Cash

back will be provided for assisted trades i.e., trades entered through online/offline/branch dealers and/or Call & Trade dealers.

6) Cash back will only be provided on the Net Plan Value.

7) The cash back will be credited to the client's ledger account on the first week of the calendar month following the month in which the cash back validity

period is ending. For example, if the cash back validity period is till 27th September, the actual payout will be credited in the 1st Week of October.

8) Minimum brokerage for Futures segment is Re. 0.01 per share

9) Service Tax of 14.5% (or as applicable) will be in addition to the Plan Value and will be collected up front

10) This Offer is applicable to Resident Indians only. This offer is not applicable to SSL employees.

11) Scheme is only applicable to accounts opened on or after 15.07.2015.

12) A client can subscribe to only one offer plan at any point of time. Any other concession scheme cannot be clubbed with this scheme.

13) The subscription amount may be paid via Direct Debit, Cheque, Internet Banking, fund transfer, NEFT, fund lien or via adjustment in the client's available

margin. All payment should be made from the designated bank account of the customer.

14) Clients will not be refunded the unused plan value or cash back value at the end of the scheme.

15) At least one trade should be entered by the client in every six calendar months from the start of the scheme tenure, for the scheme to remain valid. For this

purpose, end of the corresponding calendar month will be calculated as the cut-off date. In case the customer, does not transact once in six calendar

months, the plan will automatically lapse at the end of the sixth month and scheme benefits will no longer apply. In such case, the customer will be charged

standard brokerage rates as mentioned in the Account Opening Form, from the next day of the lapse.

16) All statutory / regulatory levies and other charges including but not limited to Securities Transaction Tax, SEBI Turnover Fees, Exchange Transaction

Charges, Stamp Duty and Service Tax shall be charged separately over and above the brokerage. Also, Demat transaction charges incurred by the client

for delivery trades will be chargeable and the same will not be deducted from the Plan Value.

17) The above plans are subject to regulatory norms in force from time to time and may be discontinued under any regulatory directions or for any other reason,

without giving prior intimation to the client.

18) In the Smart Value subscription scheme, client will be charged brokerage as per the corresponding slab. This brokerage cannot be adjusted against the

subscription amount paid up front.

19) For any disputes pertaining to the Offer, the decision of SSL will be final and binding.

20) In case of any queries/further clarifications, please call on toll free no. 1800 22 3345 (MTNL/BSNL Users) / 1800 209 9345 (Private Telecom Users) or send

Email on: helpdesk@sbicapsec.com

I/We the undersigned wish to avail below mention scheme offered by SBICAP Securities Limited

? Please tick the appropriate plan:

o SMART3.1 o SMART4.1 o SMART5.1 o SMART6.1 o SMART7.1

Enclosed herewith Cheque no. ________________________ in favor of SBICAP Securities Limited Dated ________________

Bank Name___________________________________________ Bank Branch Name ________________________________

? Direct debit authorization collected (if applicable) : o Yes / o No

? Any other mode of payment made by customer. o NEFT I o Internet Banking / Fund Transfer

o Fund Lien I o Margin Adjustment. I Transaction ID / Ref. No. _______________________

I agree to all the terms & conditions mentioned in the scheme.

Client Name : _________________________________ PAN No. : _________________________________

Place : _________________________________

Date : _________________________________ Form No. / Trading AC No. : _______________________________

Employee ID : ___________

Employee Name : _________________________________

________________________________

Employee Signature : _________________________________

Client Signature

You might also like

- Patriot 2012 2.4LDocument292 pagesPatriot 2012 2.4LJosé de JesúsNo ratings yet

- Gallstones Removal ReportDocument32 pagesGallstones Removal ReportRichard JacksonNo ratings yet

- Vaidyas of Bengal ModifiedDocument27 pagesVaidyas of Bengal ModifiedBiswa Jyoti Gupta100% (4)

- Construction Contract TemplateDocument7 pagesConstruction Contract TemplateJer FortzNo ratings yet

- Writers 39 Forum - 07 2018 PDFDocument68 pagesWriters 39 Forum - 07 2018 PDFGala Caesar AnugerahNo ratings yet

- Arduino Electronics Blueprints - Sample ChapterDocument33 pagesArduino Electronics Blueprints - Sample ChapterPackt Publishing100% (1)

- Design Construction and Maintenance of A Biogas Generator PDFDocument23 pagesDesign Construction and Maintenance of A Biogas Generator PDFBiswa Jyoti GuptaNo ratings yet

- Ball Balancing RobotDocument67 pagesBall Balancing RobotdorivolosNo ratings yet

- KB240203GPBSU - KFS & Sanction LetterDocument10 pagesKB240203GPBSU - KFS & Sanction Letterdinesh211988No ratings yet

- Methodology CO2-Tool Electricity Gas and Heat From Biomass - Version 1Document47 pagesMethodology CO2-Tool Electricity Gas and Heat From Biomass - Version 1Biswa Jyoti GuptaNo ratings yet

- CondonationDocument2 pagesCondonationEspinagloryNo ratings yet

- Common CPPP MergedDocument633 pagesCommon CPPP Mergedphnv.raghuram2009No ratings yet

- Title:Mwanzo Baraka Management Information SystemDocument24 pagesTitle:Mwanzo Baraka Management Information Systemmoses100% (1)

- 2DOF Ball Balancer Product InformationDocument2 pages2DOF Ball Balancer Product InformationSaqib KhattakNo ratings yet

- Deped Matatag CurriculumDocument22 pagesDeped Matatag CurriculumNELLY L. ANONUEVO100% (5)

- XAT Decision Making QuestionsDocument16 pagesXAT Decision Making Questionskaran nikamNo ratings yet

- PRO0750 Smart Value Income Plan BrochureDocument10 pagesPRO0750 Smart Value Income Plan BrochureJignesh PatelNo ratings yet

- Electronic Weighing ScaleDocument17 pagesElectronic Weighing ScaleVicky KaloniaNo ratings yet

- Your Renewal Premium Receipt: Receipt Number: 0366160700008 Date: 12 Nov 2019Document1 pageYour Renewal Premium Receipt: Receipt Number: 0366160700008 Date: 12 Nov 2019Nag PallaNo ratings yet

- CLL110 MajorDocument2 pagesCLL110 MajorManisha MishraNo ratings yet

- HL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448Document2 pagesHL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448KanakaReddyKannaNo ratings yet

- BDApps Lite User GuideDocument80 pagesBDApps Lite User GuideMezbah UddinNo ratings yet

- 6.voice Integrated Speed and Direction Control For DC MotorDocument4 pages6.voice Integrated Speed and Direction Control For DC MotorRamsathayaNo ratings yet

- Form For Dewas 10Document2 pagesForm For Dewas 10Sujay SarkarNo ratings yet

- E Book On ADC ProductsDocument29 pagesE Book On ADC ProductsSudharani YellapragadaNo ratings yet

- Mics Rapid Revision Notes CA FinalDocument38 pagesMics Rapid Revision Notes CA FinalShraddha NepalNo ratings yet

- Advances in Steering MechanismsDocument32 pagesAdvances in Steering Mechanismsacmilan4eva1899No ratings yet

- Maharashtra State Electricity Distribution Co. LTD.: Estimate/Firm Quotation DetailsDocument2 pagesMaharashtra State Electricity Distribution Co. LTD.: Estimate/Firm Quotation Detailsabhipawar0407No ratings yet

- SA Withdrawal New - Settlement FormDocument6 pagesSA Withdrawal New - Settlement Formimran zaidiNo ratings yet

- PHM Medisavers 2015 Insurance Policy SampleDocument24 pagesPHM Medisavers 2015 Insurance Policy SampleNazim Saleh100% (1)

- New PdsDocument5 pagesNew PdsnadiaNo ratings yet

- Put Coin and Draw PowerDocument74 pagesPut Coin and Draw PowerAjaysinh ParmarNo ratings yet

- Chapter FiveDocument7 pagesChapter FiveChala tursaNo ratings yet

- PRUWith YouDocument4 pagesPRUWith YouMurugan AnathanNo ratings yet

- Short Fall in Qualifying Service For Pension To Be Taken From GDS ServiceDocument5 pagesShort Fall in Qualifying Service For Pension To Be Taken From GDS ServiceK RAGAVENDRAN67% (3)

- Filled Pension Claim Format PDFDocument4 pagesFilled Pension Claim Format PDFAjay BNo ratings yet

- Power Factor Project PDFDocument5 pagesPower Factor Project PDFPritam100% (1)

- Serial Port Control Register SCON of 8051 8031 MicrocontrollerDocument3 pagesSerial Port Control Register SCON of 8051 8031 MicrocontrollerAhmad N Effendi KälteNo ratings yet

- Great Cash Wonder (Launch) Write-UpDocument8 pagesGreat Cash Wonder (Launch) Write-UpAlex GeorgeNo ratings yet

- Ball Balancing ProjectDocument21 pagesBall Balancing ProjectMo KhNo ratings yet

- Connection Diagrams: Display ConnectorDocument2 pagesConnection Diagrams: Display ConnectorPratik ShelarNo ratings yet

- Sudx Programable Indexer: Operations and Service ManualDocument56 pagesSudx Programable Indexer: Operations and Service ManualLuis Margaret Aldape0% (1)

- User Manual For IREPS Reverse AuctionDocument14 pagesUser Manual For IREPS Reverse AuctionVikash Singhi0% (1)

- Rectangular WaveguideDocument5 pagesRectangular WaveguideSarveenaNo ratings yet

- Saibaan Calculator MarsDocument8 pagesSaibaan Calculator MarsMasood A. RanaNo ratings yet

- TN Gov Regulations For Playschool 2015 PDFDocument12 pagesTN Gov Regulations For Playschool 2015 PDFSabsNo ratings yet

- Grant Source GTC-O - Mar 2020Document4 pagesGrant Source GTC-O - Mar 2020Sonia BolivarNo ratings yet

- Exide Life Insurance Online Premium ReceiptDocument9 pagesExide Life Insurance Online Premium ReceiptPradeep Mathew Varghese100% (1)

- IOT Temperature Mask Scan Entry SystemDocument5 pagesIOT Temperature Mask Scan Entry Systemsoham kanchalwarNo ratings yet

- Vikas 2018 SBLC BhubaneswarDocument320 pagesVikas 2018 SBLC BhubaneswarTejaswiNo ratings yet

- Application For CI868 RedundancyDocument5 pagesApplication For CI868 RedundancyAnthony Cadillo100% (1)

- MTP May 2021 QDocument10 pagesMTP May 2021 QÑïkêţ BäûðhåNo ratings yet

- Cdma Call ProcessingDocument7 pagesCdma Call Processingnishuhumtum123100% (1)

- DSP 3rd ECE-II Sem MID2 BitsDocument4 pagesDSP 3rd ECE-II Sem MID2 Bitsnick furiasNo ratings yet

- Security Sevices Agreement Standard - Writer Coeporate - Edit Yellow PartDocument22 pagesSecurity Sevices Agreement Standard - Writer Coeporate - Edit Yellow PartKabir HillNo ratings yet

- Personal Loan Agreement: Bajaj Finance LimitedDocument12 pagesPersonal Loan Agreement: Bajaj Finance LimitedShafiah SheikhNo ratings yet

- High-Frequency WeldingDocument22 pagesHigh-Frequency WeldingSharun SureshNo ratings yet

- EBLR Loan Interest Switching Application FormDocument1 pageEBLR Loan Interest Switching Application FormMathew KSNo ratings yet

- Sustaining PromoDocument11 pagesSustaining PromoCarla Dela CruzNo ratings yet

- Global LaunchDocument11 pagesGlobal LaunchNicole De GuzmanNo ratings yet

- Ooredoo Group - RFP - MODE - Commercial ProposalDocument7 pagesOoredoo Group - RFP - MODE - Commercial ProposalAntony KanyokoNo ratings yet

- Equity ProductsDocument15 pagesEquity ProductsVivek SoniNo ratings yet

- Dai TNCDocument8 pagesDai TNCKhairulNo ratings yet

- Web App Development Proposal & Contract To HFLDocument12 pagesWeb App Development Proposal & Contract To HFLmalawianboiNo ratings yet

- I Got All These Questions Collected From Our MembersDocument15 pagesI Got All These Questions Collected From Our MembersvishalNo ratings yet

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- 03 - Business TransactionDocument28 pages03 - Business TransactionLeandro FariaNo ratings yet

- TermsDocument4 pagesTermsAdnan AkhtarNo ratings yet

- Terms and Conditions of NPCI Platinum Rupay Debit CardDocument24 pagesTerms and Conditions of NPCI Platinum Rupay Debit CardPrince MathewNo ratings yet

- Value PackDocument1 pageValue PackxytiseNo ratings yet

- Experiment 2 3 4 Total Solid Ts Total SuDocument9 pagesExperiment 2 3 4 Total Solid Ts Total SuBiswa Jyoti GuptaNo ratings yet

- Extraction of Methane From Natural Product and Natural Wastes: A ReviewDocument4 pagesExtraction of Methane From Natural Product and Natural Wastes: A ReviewBiswa Jyoti GuptaNo ratings yet

- Monte Carlo Fashions Limited - RHP - 21 November 2014Document336 pagesMonte Carlo Fashions Limited - RHP - 21 November 2014Biswa Jyoti GuptaNo ratings yet

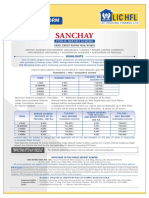

- LIC Housing Finance LTD FDDocument6 pagesLIC Housing Finance LTD FDBiswa Jyoti GuptaNo ratings yet

- Chapter 1-1-100pDocument100 pagesChapter 1-1-100pBiswa Jyoti GuptaNo ratings yet

- (Download) RBI Mains 2014 Paper 3: Finance and Management: InstructionsDocument2 pages(Download) RBI Mains 2014 Paper 3: Finance and Management: InstructionsBiswa Jyoti GuptaNo ratings yet

- BaDocument23 pagesBam aNo ratings yet

- Research Chapter 12Document9 pagesResearch Chapter 12Dr. Abdul KhaliqNo ratings yet

- Caracterizacion Sensores F (Version 1)Document40 pagesCaracterizacion Sensores F (Version 1)Freddy ChimboNo ratings yet

- Coduri PR VWDocument196 pagesCoduri PR VWAlexandru CepanNo ratings yet

- Paul Hanson's Custom Patches For The GT-10Document3 pagesPaul Hanson's Custom Patches For The GT-10Jaime Hernandez HernandezNo ratings yet

- Questions About Murder and HistoryDocument19 pagesQuestions About Murder and HistoryIris Kaye AbelleraNo ratings yet

- Pulungan 2021Document4 pagesPulungan 2021Khofifah Erga SalsabilaNo ratings yet

- The Angel Next Door Spoils Me Rotten - 01 (Yen Press)Document228 pagesThe Angel Next Door Spoils Me Rotten - 01 (Yen Press)Gilbert ValenzuelaNo ratings yet

- Self-Esteem-Envy CrimStut Draft1Document37 pagesSelf-Esteem-Envy CrimStut Draft1William Mellejor MontezaNo ratings yet

- Windbg Usefull CommandsDocument2 pagesWindbg Usefull Commandsthawker69No ratings yet

- Alienation and Recognition of Ancestral Domains: Group I Section Ii-BDocument8 pagesAlienation and Recognition of Ancestral Domains: Group I Section Ii-BHarry Dave Ocampo PagaoaNo ratings yet

- Charcot JointDocument8 pagesCharcot JointAtika SugiartoNo ratings yet

- Applied - 11 - Practical Research 1 - Sem I and II - CLAS2 - Qualitative and Quantitative Research and The Kinds of Research Across Fields - PNS - v3Document25 pagesApplied - 11 - Practical Research 1 - Sem I and II - CLAS2 - Qualitative and Quantitative Research and The Kinds of Research Across Fields - PNS - v3Lovely Trixie D. DandalNo ratings yet

- Global Tuberculosis Report 2014Document171 pagesGlobal Tuberculosis Report 2014Promosi Sehat100% (1)

- 9th Bio Chapter 1 (1-32)Document32 pages9th Bio Chapter 1 (1-32)gmian9012No ratings yet

- Ch-2 Forms of Business OrganisationDocument7 pagesCh-2 Forms of Business OrganisationGajendra SainiNo ratings yet

- MTS-AFC-5267-0017 - Method Statement For Trail Section For Laying of EME-2 - BBME-3Document7 pagesMTS-AFC-5267-0017 - Method Statement For Trail Section For Laying of EME-2 - BBME-3Adrian FrantescuNo ratings yet

- Sikhism-Struggle of Gurus Against Mughal Empire of IndiaDocument45 pagesSikhism-Struggle of Gurus Against Mughal Empire of IndiaBruno AquinoNo ratings yet

- Nyaa Student Handbook PDFDocument63 pagesNyaa Student Handbook PDFAntonio UngureanNo ratings yet

- MTD 13AO772H755 (2007) Parts Diagram For Deck Assembly 46 Inch 1Document6 pagesMTD 13AO772H755 (2007) Parts Diagram For Deck Assembly 46 Inch 1Cristhian De La BarraNo ratings yet

- Bausa, Ampil, Suarez, Parades & Bausa For Petitioner. CV Law Office & Associates For Private RespondentsDocument32 pagesBausa, Ampil, Suarez, Parades & Bausa For Petitioner. CV Law Office & Associates For Private RespondentsChesza MarieNo ratings yet

- Ayurveda Colleges in Kerala: Kasaragod ShoranurDocument2 pagesAyurveda Colleges in Kerala: Kasaragod Shoranurdhango22No ratings yet

- Chemistry Teaching - Science or Alchemy?Document7 pagesChemistry Teaching - Science or Alchemy?Blanca PachónNo ratings yet