Professional Documents

Culture Documents

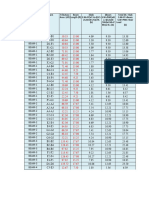

Cash Flow Year Time ( Million) PV at 13% Formula in Column D

Uploaded by

Ives LeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Year Time ( Million) PV at 13% Formula in Column D

Uploaded by

Ives LeeCopyright:

Available Formats

A B C D E

1 Cash Flow

2 Year Time (£ million) PV at 13% Formula in Column D

3 1986 0 -457 -457.0 =C3/1.13^B3

4 1987 1 -476 -421.2 =C4/1.13^B4

5 1988 2 -497 -389.2 =C5/1.13^B5

6 1989 3 -522 -361.8 =C6/1.13^B6

7 1990 4 -551 -337.9 =C7/1.13^B7

8 1991 5 -584 -317.0 =C8/1.13^B8

9 1992 6 -619 -297.3 =C9/1.13^B9

10 1993 7 211 89.7 =C10/1.13^B10

11 1994 8 489 183.9 =C11/1.13^B11

12 1995 9 455 151.5 =C12/1.13^B12

13 1996 10 502 147.9 =C13/1.13^B13

14 1997 11 530 138.2 =C14/1.13^B14

15 1998 12 544 125.5 =C15/1.13^B15

16 1999 13 636 129.8 =C16/1.13^B16

17 2000 14 594 107.3 =C17/1.13^B17

18 2001 15 689 110.2 =C18/1.13^B18

19 2002 16 729 103.2 =C19/1.13^B19

20 2003 17 796 99.7 =C20/1.13^B20

21 2004 18 859 95.2 =C21/1.13^B21

22 2005 19 923 90.5 =C22/1.13^B22

23 2006 20 983 85.3 =C23/1.13^B23

24 2007 21 1,050 80.6 =C24/1.13^B24

25 2008 22 1,113 75.6 =C25/1.13^B25

26 2009 23 1,177 70.8 =C26/1.13^B26

27 2010 24 17,781 946.4 =C27/1.13^B27

28

29 Sum: 249.8 =SUM(D3:D27)

30

31 Instead, use Excel's NPV function: 249.8 =NPV(0.13,C4:C27) + C3

Table 7-1

Forecast cash flows and present values in 1986 for the Channel Tunnel project. The investment at the time

appeared to have a positive NPV of 249.8 million.

You might also like

- Measurement table for volume, dry weight and densityDocument2 pagesMeasurement table for volume, dry weight and densityDiegoMaldonadoPachecoNo ratings yet

- Solution Shallow SETTLEMENT PDFDocument7 pagesSolution Shallow SETTLEMENT PDFRaja SyarifNo ratings yet

- Susu Kunak 3 PDFDocument2 pagesSusu Kunak 3 PDFAsunaNo ratings yet

- Insurance Policy Amortization ScheduleDocument1 pageInsurance Policy Amortization Scheduledaenille belduaNo ratings yet

- 2-9 Date Int. Paid Int - Expense Premium C/ADocument1 page2-9 Date Int. Paid Int - Expense Premium C/AJj FajardoNo ratings yet

- Volvo CamshaftsDocument1 pageVolvo CamshaftsMilos ProticNo ratings yet

- ACCT105 Quiz 11 - Depreciation calculationsDocument8 pagesACCT105 Quiz 11 - Depreciation calculationsAway To PonderNo ratings yet

- DME: A Clean Alternative FuelDocument14 pagesDME: A Clean Alternative FuelrozNo ratings yet

- Time Value of Money - KeyDocument11 pagesTime Value of Money - KeyJewel Sheryn Amponin100% (1)

- Diseño Exp - Trat ExtraDocument8 pagesDiseño Exp - Trat ExtraMO AleNo ratings yet

- MPOB Grading ManualDocument22 pagesMPOB Grading ManualSundian NaderrajNo ratings yet

- Operating System AssessmentsDocument12 pagesOperating System AssessmentsMaria MercadoNo ratings yet

- Ejercicios Triángulos: Alumno: Bruno Eduardo Jimenez Baños 201Document9 pagesEjercicios Triángulos: Alumno: Bruno Eduardo Jimenez Baños 201Angela JimenezNo ratings yet

- Column ReportDocument134 pagesColumn ReportRenren Bassig0% (1)

- Appendix-5: Design of UndersluiceDocument8 pagesAppendix-5: Design of UndersluicekkgbkjNo ratings yet

- UAS 1 Soil MechanicsDocument5 pagesUAS 1 Soil MechanicsColdNo ratings yet

- FormulasDocument5 pagesFormulasAnaliaNo ratings yet

- Bending Schedule: You Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterDocument1 pageBending Schedule: You Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterViraj VoditelNo ratings yet

- Ejercicio de Balance MetalurgicoDocument11 pagesEjercicio de Balance MetalurgicoAlee Silva MiñanNo ratings yet

- Background Glass - Part-2 - Plate CalculationDocument16 pagesBackground Glass - Part-2 - Plate CalculationusonNo ratings yet

- Reb Hammer 2 PDFDocument2 pagesReb Hammer 2 PDFsallysel90No ratings yet

- Structures ThesisDocument3 pagesStructures ThesisAbhijith SharmaNo ratings yet

- L R Kmen: Siksaeday Knnaeday KuredayDocument1 pageL R Kmen: Siksaeday Knnaeday KuredaySopheaNo ratings yet

- Answers and Equations for Investment Quotient Test ChaptersDocument3 pagesAnswers and Equations for Investment Quotient Test ChaptersJudeNo ratings yet

- Calculo de Zapatas FinalDocument96 pagesCalculo de Zapatas FinalRosmery YanaNo ratings yet

- Trabajo de MercadosDocument16 pagesTrabajo de MercadosMARIA JOSE CORRALES FREIRENo ratings yet

- Charlevoix County News - January 09, 2014Document10 pagesCharlevoix County News - January 09, 2014Dave Baragrey100% (1)

- Chapter 8 Cost Calculation Guide for Chemical Process EquipmentDocument31 pagesChapter 8 Cost Calculation Guide for Chemical Process EquipmentShameerSamsuriNo ratings yet

- Cut/Fill Report: Volume SummaryDocument2 pagesCut/Fill Report: Volume SummaryBryan BarahonaNo ratings yet

- Chapter 01Document18 pagesChapter 01mehta_mayurNo ratings yet

- PracticandoDocument18 pagesPracticandoమాయ్రే ఫ్లోర్స్ జురాడోNo ratings yet

- Ship Stability: Calculating Free Surface Effects and Righting ArmsDocument24 pagesShip Stability: Calculating Free Surface Effects and Righting ArmsAli BadyNo ratings yet

- F'C Fy Es Ec B H Ø5/8": kg/cm2 kg/cm2 kg/cm2 kg/cm2 M M cm2Document28 pagesF'C Fy Es Ec B H Ø5/8": kg/cm2 kg/cm2 kg/cm2 kg/cm2 M M cm2Gino SimonsNo ratings yet

- Comparativa en Milimetros de Roscas en PulgadasDocument1 pageComparativa en Milimetros de Roscas en PulgadasProyectos IngemetzaNo ratings yet

- 300W. Power MosfetDocument6 pages300W. Power MosfetManshi SinghNo ratings yet

- BESI POLOS SPECIFICATIONSDocument5 pagesBESI POLOS SPECIFICATIONSmuhamad ridwanNo ratings yet

- Design of Slab: Fcu FY AS Total AS Main RFT + As Add RFT Cover (CM) R M 10 5/ (B D 2) Mu R B D 2/10 5Document2 pagesDesign of Slab: Fcu FY AS Total AS Main RFT + As Add RFT Cover (CM) R M 10 5/ (B D 2) Mu R B D 2/10 5لا للظلمNo ratings yet

- Foundation Design Programs For Isolated and Combined Footing Design With EstimateDocument212 pagesFoundation Design Programs For Isolated and Combined Footing Design With EstimateAndrea MagtutoNo ratings yet

- Octave Solution for Classical ELDDocument4 pagesOctave Solution for Classical ELDsantanu senNo ratings yet

- Section 1 : Mastering Depreciation Testbank Solutions Depreciation On The Financial Statements V. Tax ReturnDocument4 pagesSection 1 : Mastering Depreciation Testbank Solutions Depreciation On The Financial Statements V. Tax ReturnSamuel ferolinoNo ratings yet

- Drill 1 - ObligationDocument128 pagesDrill 1 - ObligationChristine PedronanNo ratings yet

- Chps 1-2 EOC Soltns Corporate FinanceDocument5 pagesChps 1-2 EOC Soltns Corporate FinanceHenry7272No ratings yet

- Maths Revision TitleDocument5 pagesMaths Revision TitleJARSHNI A/P SANGLI DEVAN MoeNo ratings yet

- Bribery ScandalDocument1 pageBribery ScandalMosiur RahmanNo ratings yet

- Timbrado2020 DanielDocument3 pagesTimbrado2020 DanielSERGIO LOPEZNo ratings yet

- Timbrado2020 DanielDocument3 pagesTimbrado2020 DanielSERGIO LOPEZNo ratings yet

- Compound interest word problemsDocument5 pagesCompound interest word problemsHassan ShehadiNo ratings yet

- Design of SlabDocument6 pagesDesign of SlabAJothamChristianNo ratings yet

- Hand Column CalculationDocument10 pagesHand Column CalculationAhsan UlNo ratings yet

- 12-Sco-Pld-Pdgc-12-17 - Rg-12-Scv-Det-Pdgc-16 - R03 - Bloco CDocument1 page12-Sco-Pld-Pdgc-12-17 - Rg-12-Scv-Det-Pdgc-16 - R03 - Bloco CDAMIÃO WELLINGTONNo ratings yet

- Given The Following Data For The Given Area and The Crop To Be Planted: KC Value For Sugarcane 1.15 Eto Value For The Area 5.9Mm/DayDocument6 pagesGiven The Following Data For The Given Area and The Crop To Be Planted: KC Value For Sugarcane 1.15 Eto Value For The Area 5.9Mm/Dayjlachule-1No ratings yet

- World Bank Funded Transport Connectivity and Assets Management ProjectDocument4 pagesWorld Bank Funded Transport Connectivity and Assets Management ProjectTCAMP WP1No ratings yet

- efDocument3 pagesefapi-736978511No ratings yet

- MD5 - With ExampleDocument7 pagesMD5 - With ExampleAhmed Hesham89% (19)

- WR401 01 Design of SyphonDocument7 pagesWR401 01 Design of Syphonale hopeju2009100% (1)

- Design of SyphonDocument7 pagesDesign of SyphonraghurmiNo ratings yet

- COMM 324 Assignment 3Document14 pagesCOMM 324 Assignment 3Amir BayatNo ratings yet

- 3Document5 pages3jlachule-1No ratings yet

- Landscape Site Grading Principles: Grading with Design in MindFrom EverandLandscape Site Grading Principles: Grading with Design in MindRating: 5 out of 5 stars5/5 (1)

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- TF 10000110Document8 pagesTF 10000110AnthonyStevenNo ratings yet

- GuestDocument2 pagesGuestIves LeeNo ratings yet

- Oa6sp B15-18Document4 pagesOa6sp B15-18Ives LeeNo ratings yet

- Some Tools of Economic Analysis: © 2006 Thomson/South-WesternDocument30 pagesSome Tools of Economic Analysis: © 2006 Thomson/South-WesternIves LeeNo ratings yet

- Oa6sp B15-18Document4 pagesOa6sp B15-18Ives LeeNo ratings yet

- Research Methods: 1. Course DescriptionDocument4 pagesResearch Methods: 1. Course DescriptionIves LeeNo ratings yet

- 5 - Valuation of Non-Market GoodsDocument28 pages5 - Valuation of Non-Market GoodsIves LeeNo ratings yet

- Micro Ch04 PresentationDocument63 pagesMicro Ch04 PresentationLucky Singh100% (1)

- Ecns309 NotesDocument117 pagesEcns309 NotesIves LeeNo ratings yet

- Ipo RitterDocument6 pagesIpo RitterIves LeeNo ratings yet

- The Science of Macroeconomics: AcroeconomicsDocument29 pagesThe Science of Macroeconomics: AcroeconomicsDeri YantoNo ratings yet

- Fiancnace Chap 9Document2 pagesFiancnace Chap 9kingofdealNo ratings yet

- Finding The Future Value of $24 Using A Spreadsheet Inputs: Formula in Cell B8Document1 pageFinding The Future Value of $24 Using A Spreadsheet Inputs: Formula in Cell B8Ives LeeNo ratings yet

- Managerial Economics Demand TheoryDocument34 pagesManagerial Economics Demand TheoryIves LeeNo ratings yet

- Finding The Present Value of Multiple Cash Flows Using A Spreadsheet Time Until CF Cash Flow Present Value Formula in Col CDocument2 pagesFinding The Present Value of Multiple Cash Flows Using A Spreadsheet Time Until CF Cash Flow Present Value Formula in Col CIves LeeNo ratings yet

- 08 Technical AnalysisDocument10 pages08 Technical AnalysisIves LeeNo ratings yet

- Chapter06-Bonds Excel 7eDocument2 pagesChapter06-Bonds Excel 7eIves LeeNo ratings yet

- 3103 31501 1 OutDocument3 pages3103 31501 1 OutIves LeeNo ratings yet

- Some Tools of Economic Analysis: © 2006 Thomson/South-WesternDocument30 pagesSome Tools of Economic Analysis: © 2006 Thomson/South-WesternIves LeeNo ratings yet

- Final Practice SolDocument11 pagesFinal Practice SolChris MoodyNo ratings yet

- Effects of unemployment benefits and payroll taxesDocument1 pageEffects of unemployment benefits and payroll taxesIves LeeNo ratings yet

- 04 Standards of Professional ... Dance - Duties To ClientsDocument22 pages04 Standards of Professional ... Dance - Duties To ClientsIves LeeNo ratings yet

- Economics: A Contemporary Introduction 7Th Edition: by William A. MceachernDocument25 pagesEconomics: A Contemporary Introduction 7Th Edition: by William A. MceachernIves LeeNo ratings yet

- Ma 242 Midterm 1 W Solutions 2006 Linear Algebra Nikola Popovic PDFDocument5 pagesMa 242 Midterm 1 W Solutions 2006 Linear Algebra Nikola Popovic PDFIves LeeNo ratings yet

- The Science of Macroeconomics: AcroeconomicsDocument29 pagesThe Science of Macroeconomics: AcroeconomicsDeri YantoNo ratings yet

- CH 10 - Instructor PPT Global Edition Strategic ManagementDocument37 pagesCH 10 - Instructor PPT Global Edition Strategic ManagementIves LeeNo ratings yet

- Some Tools of Economic Analysis: © 2006 Thomson/South-WesternDocument30 pagesSome Tools of Economic Analysis: © 2006 Thomson/South-WesternIves LeeNo ratings yet

- 03 Standards of Professional ... Egrity of Capital MarketsDocument14 pages03 Standards of Professional ... Egrity of Capital MarketsIves LeeNo ratings yet

- 06 Standards of Professional ... Ecommendations, and ActioDocument15 pages06 Standards of Professional ... Ecommendations, and ActioIves LeeNo ratings yet