Professional Documents

Culture Documents

MCC Schedule - Illustration

Uploaded by

dhfbbbbbbbbbbbbbbbbbh0 ratings0% found this document useful (0 votes)

7 views1 pageddddddddddddddddddd

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentddddddddddddddddddd

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageMCC Schedule - Illustration

Uploaded by

dhfbbbbbbbbbbbbbbbbbhddddddddddddddddddd

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

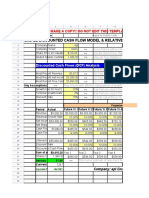

MCC Schedule -Illustration:

Capital Structure Market Value/Sh. Dividend/Sh.

Debt (10 yrs. Bond) 35% $ 1067.10 $ 90

Ps 5% $ 75 $ 7.20

Common Equity 60% $ 35 $3

Preferred stock & Common stock Can be issued at the current market price value.

Firm marginal tax rate: 40%

Growth at constant rate: 5%

Debt:

Face Value of debt: $ 1000

Flotation cost for issuing new debt: none

(interest paid annually)

The company can issue new 10-years debt with the same Characteristics up to max $105m

If amount excess $ 105m (same characteristics, but issuing price will match the face value)

Retained Earnings:

Retained Earnings forecast to increase: $ 120m coming year.

Cost for issuing Preferred stocks:

2% of selling price as long as amount issued ≤ $ 15m

4% of selling price > $ 15m

Common Stock:

Cost to issue new common stock = 6% if amount ≤ $ 90m issued

= 8% if amount > $ 90m issued

To Construct the MCC schedule for this company.

1. Compute the break points

2. Compute the cost of capital for each component

3. Calculate the weighted average of theses component costs to obtain the WACC

You might also like

- Assignment 5 - CH 10 - The Cost of Capital PDFDocument6 pagesAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- Assignment # 5 22 CH 10Document5 pagesAssignment # 5 22 CH 10Ibrahim AbdallahNo ratings yet

- After-Tax Weighted Average Cost of Capital (WACC)Document6 pagesAfter-Tax Weighted Average Cost of Capital (WACC)Kenny HoNo ratings yet

- FF AssignmentDocument8 pagesFF Assignmentjeaner2008No ratings yet

- Problem Solving 10Document6 pagesProblem Solving 10Ehab M. Abdel HadyNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)Document3 pagesNanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)asdsadsaNo ratings yet

- Exercises + Answers - The Cost of CapitalDocument6 pagesExercises + Answers - The Cost of CapitalWong Yong Sheng Wong100% (1)

- Cost of Capital Nov 2023Document7 pagesCost of Capital Nov 2023tmpvd6gw8fNo ratings yet

- Topic 7 - Cost of CapitalDocument2 pagesTopic 7 - Cost of CapitalKSNo ratings yet

- Chapter008 SolutionsDocument4 pagesChapter008 SolutionsJimmy JenkinsNo ratings yet

- Review+for+Exam+1Document4 pagesReview+for+Exam+1Mahina NozirovaNo ratings yet

- Business Valuation and Stock Valuation ExamDocument2 pagesBusiness Valuation and Stock Valuation ExamDaMaterial Gyrl MbaNo ratings yet

- One-year rate sensitivity test assetsDocument6 pagesOne-year rate sensitivity test assetsAnton VelkovNo ratings yet

- Jun18l1cfi-C01 Qa PDFDocument3 pagesJun18l1cfi-C01 Qa PDFJuan Pablo Flores QuirozNo ratings yet

- Jun18l1cfi-C01 QaDocument3 pagesJun18l1cfi-C01 QaJuan Pablo Flores QuirozNo ratings yet

- Ch09 - Cost of Capital 12112020 125813pmDocument13 pagesCh09 - Cost of Capital 12112020 125813pmMuhammad Umar BashirNo ratings yet

- Chapter 7 Math SolutionDocument5 pagesChapter 7 Math SolutionRakib AhmedNo ratings yet

- Shapiro CHAPTER 6 SolutionsDocument10 pagesShapiro CHAPTER 6 SolutionsjzdoogNo ratings yet

- 2008-12-16 033910 newFinExmnewDocument5 pages2008-12-16 033910 newFinExmnewIslam FarhanaNo ratings yet

- Final Exam/2: Multiple ChoiceDocument4 pagesFinal Exam/2: Multiple ChoiceJing SongNo ratings yet

- Midterm Review Winter 2019Document11 pagesMidterm Review Winter 2019Gurveen Kaur100% (1)

- Delossantos Mas2Document9 pagesDelossantos Mas2jackie delos santosNo ratings yet

- Solution - Problems and Solutions Chap 8Document8 pagesSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- Problem Set Capital StructureQADocument15 pagesProblem Set Capital StructureQAIng Hong100% (1)

- Practice Questions-Week 8 Cost of CapitalDocument2 pagesPractice Questions-Week 8 Cost of CapitalTanveer AhmedNo ratings yet

- Solved Problems Cost of CapitalDocument16 pagesSolved Problems Cost of CapitalPrramakrishnanRamaKrishnan0% (1)

- FM PQDocument3 pagesFM PQOmer Zahid100% (1)

- Cruz Janna Kassandra Midterm Practice ProblemsDocument6 pagesCruz Janna Kassandra Midterm Practice ProblemsMiguel PultaNo ratings yet

- Exam 2 PracticeDocument4 pagesExam 2 PracticeRaunak KoiralaNo ratings yet

- Final Exam CorporateDocument4 pagesFinal Exam CorporateCiptawan CenNo ratings yet

- Tutorial Practice QuestionsDocument5 pagesTutorial Practice QuestionsMuneeba ShoaibNo ratings yet

- FM19 Finals Q1 Stocks Bonds PortfolioDocument4 pagesFM19 Finals Q1 Stocks Bonds PortfolioJuren Demotor DublinNo ratings yet

- Sem 2 Question Bank (Moderated) - Financial ManagementDocument63 pagesSem 2 Question Bank (Moderated) - Financial ManagementSandeep SahadeokarNo ratings yet

- Managerial Final ExampleDocument8 pagesManagerial Final ExamplemgiraldovNo ratings yet

- Answer Unit 6 Written AssignmentDocument2 pagesAnswer Unit 6 Written AssignmentbuihuonguyenNo ratings yet

- AnswerDocument13 pagesAnswerEhab M. Abdel HadyNo ratings yet

- Module 4 - ValuationDocument29 pagesModule 4 - ValuationKishore JohnNo ratings yet

- Fin 370 All My Finance LabDocument12 pagesFin 370 All My Finance Labjupiteruk0% (1)

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- 2 Time Value of MoneyDocument46 pages2 Time Value of MoneyABHINAV AGRAWALNo ratings yet

- FIM Exercise AnsDocument6 pagesFIM Exercise AnsSam MNo ratings yet

- Simple Discounted Cash Flow Model & Relative ValuationDocument14 pagesSimple Discounted Cash Flow Model & Relative ValuationlearnNo ratings yet

- Cost of Capital ProblemsDocument5 pagesCost of Capital ProblemsYusairah Benito DomatoNo ratings yet

- Wacc Practice 1Document3 pagesWacc Practice 1Ash LayNo ratings yet

- ACCA F9 Financial Management Solved Past PapersDocument304 pagesACCA F9 Financial Management Solved Past PapersSalmancertNo ratings yet

- Calculating WACC for a Company's Capital Budgeting ProjectDocument3 pagesCalculating WACC for a Company's Capital Budgeting ProjectSaboorNo ratings yet

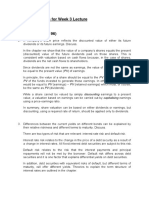

- Tutorial Answers For Week 3 Lecture Questions (Page 96)Document4 pagesTutorial Answers For Week 3 Lecture Questions (Page 96)Nadia ZahraNo ratings yet

- MCQSDocument3 pagesMCQSGhulam Mustufa AnsariNo ratings yet

- Equity Valuation: B, K & M Chapter 13Document28 pagesEquity Valuation: B, K & M Chapter 13Fatima MosawiNo ratings yet

- Wacc Practice 1Document11 pagesWacc Practice 1saroosh ul islamNo ratings yet

- Cost of capital tutorialDocument3 pagesCost of capital tutorialNhi HoangNo ratings yet

- Ch9Cost of CapProbset 13ed - MastersDFDocument4 pagesCh9Cost of CapProbset 13ed - MastersDFJaneNo ratings yet

- 57b2e7d35a4d40b8b460abe4914d711a.docxDocument6 pages57b2e7d35a4d40b8b460abe4914d711a.docxZohaib HajizubairNo ratings yet

- A'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 16 & 19Document7 pagesA'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 16 & 19PRA MBANo ratings yet

- Cost of Capital QuestionsDocument18 pagesCost of Capital QuestionsRonmaty VixNo ratings yet

- Cost of Capital Solved ProblemsDocument16 pagesCost of Capital Solved ProblemsHimanshu Sharma84% (206)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Book 1Document1 pageBook 1dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Baseball Salaries 2016 Hypothetical DataDocument1 pageBaseball Salaries 2016 Hypothetical DatadhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Contemporary Issues in Accounting: Powerpoint Presentation by Matthew Tilling ©2012 John Wiley & Sons Australia LTDDocument41 pagesContemporary Issues in Accounting: Powerpoint Presentation by Matthew Tilling ©2012 John Wiley & Sons Australia LTDdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- The Conceptual Framework For Financial Reporting - PART IIDocument20 pagesThe Conceptual Framework For Financial Reporting - PART IIdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- FAR Study PlanDocument11 pagesFAR Study PlandhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Chapter 1 Introduction To Accounting TheoryDocument20 pagesChapter 1 Introduction To Accounting TheorydhfbbbbbbbbbbbbbbbbbhNo ratings yet

- CH 2Document25 pagesCH 2dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- FAR Study PlanDocument11 pagesFAR Study PlandhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Review Problems 1rDocument8 pagesReview Problems 1rYousefNo ratings yet

- Introduction To It 2018Document53 pagesIntroduction To It 2018dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- The Conceptual Framework For Financial Reporting - PART IDocument35 pagesThe Conceptual Framework For Financial Reporting - PART IdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Contemporary Ch2 NotesDocument3 pagesContemporary Ch2 NotesdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Ch12 PPT RankinDocument21 pagesCh12 PPT RankinAmiteshNo ratings yet

- Contemporary SylDocument3 pagesContemporary SyldhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Process Costing Chapter 5 ExercisesDocument7 pagesProcess Costing Chapter 5 Exercisesdhfbbbbbbbbbbbbbbbbbh88% (8)

- Ch. 4 Job-Order CostingDocument39 pagesCh. 4 Job-Order CostingdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Ch.2 Cost Terms and PurposesDocument30 pagesCh.2 Cost Terms and PurposesdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Ch02 TB RankinDocument8 pagesCh02 TB RankinAnton VitaliNo ratings yet

- Introduction to Assurance and Financial AuditingDocument179 pagesIntroduction to Assurance and Financial AuditingJimmy Chan68% (60)

- Assurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsonDocument21 pagesAssurance Services and The Integrity of Financial Reporting, 8 Edition William C. Boynton Raymond N. JohnsondhfbbbbbbbbbbbbbbbbbhNo ratings yet

- M13 Gitman50803X 14 MF C13Document92 pagesM13 Gitman50803X 14 MF C13dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Boynton SM Ch.06Document18 pagesBoynton SM Ch.06Eza RNo ratings yet

- Risk and Refinements in Capital BudgetingDocument75 pagesRisk and Refinements in Capital BudgetingdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- 2012 AICPA Auditing QuestionsDocument61 pages2012 AICPA Auditing Questionsblackseth100% (1)

- M14 Gitman50803X 14 MF C14Document70 pagesM14 Gitman50803X 14 MF C14dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Ch08 TB RankinDocument7 pagesCh08 TB RankinAnton VitaliNo ratings yet

- M10 Gitman50803X 14 MF C10Document58 pagesM10 Gitman50803X 14 MF C10dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Principles of Managerial Finance: Chapter 11Document54 pagesPrinciples of Managerial Finance: Chapter 11Crystal Nedd100% (3)