Professional Documents

Culture Documents

C H S&P W B: Larkson Ellas Eekly Ulletin

Uploaded by

georgevarsasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C H S&P W B: Larkson Ellas Eekly Ulletin

Uploaded by

georgevarsasCopyright:

Available Formats

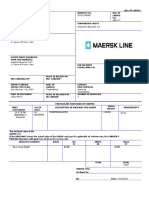

CLARKSON HELLAS

S&P WEEKLY BULLETIN

3rd DECEMBER 2013

DRY CARGO VESSELS

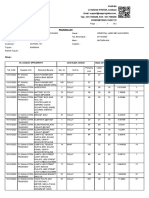

VESSEL DWT BLT DETAILS SS/DD PRICE BUYER

HOKURIKU MARU SS 3/14

94.274 1995 MITSUBISHI MITS 7UEC60LS USD 8.9 M CHINA

(COAL CARRIER) DD 3/14

SS 10/14

CAROL 75.608 1999 MITSUI B+W 7S50MC-C rgn USD 14.3 M GREECE

DD 10/14

SS 10/14

BEL EAST 68.519 1995 SASEBO B+W 5S60MC USD 8.5 M GREECE

DD 10/14

B+W 6S50MC-C SS 2/15

MAPLE CREEK 53.474 2005 IMABARI USD 19.5 M TUFTON OCEANIC

C 4X30 DD 2/15

B+W 6S50MC-C SS 4/16

BORON NAVIGATOR 50.341 2001 KAWASAKI USD 15.4 M POLFORCE

C 4X30 DD 4/16

MITS 6UEC52LA SS 9/14

IVS KWAITO 32.573 2004 KANDA xs USD 15.5 M HONG KONG

C 4X30 DD 9/14

SUL 6RTA58 SS 1/15

NOTORI DAKE 29.105 1985 IMABARI USD 3 M UNDISCLOSED

C 4X25 DD 1/15

B+W 5L42MC SS 3/17

BULK SUNSET 18.315 1997 SHIKOKU USD 4.7 M UNDISCLOSED

C 3X30 DD 6/15

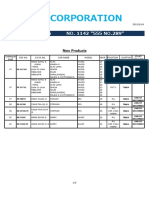

TANKERS

VESSEL DWT BLT DETAILS SS/DD PRICE BUYER

MAN/B+W

SS 10/17 USA

RIO GENOA 159.395 2005 UNIVERSAL 6S70MC-C USD 35 M

DD 4/15 (Ridgebury Tankers)

DH

TWEEN – CONTAINERS – REEFERS – RORO

VESSEL DWT BLT DETAILS SS/DD PRICE BUYER

STORK-WARTS

KROONBORG 1995 6SW38 SS 11/15 UNDISCLOSED

9.085 USD 1.5 M

(CONT) NETHERLANDS 494 TEU DD 11/13 (AS IS)

Ice 1A

MAN 9L32/40

BBC UKRAINE 2000 TIANJIN SS 12/15

4.710 390 TEU USD 5 M NEW GUINEA

(HEAVY LIFT MPP) XINGANG DD 12/15

C 2X80

HANSHIN 6LF58

SKALVA SS 2/15

9.498 1985 MIHO 474 TEU USD 1.55 M SYRIA

(MPP) DD 2/15

C 2X50

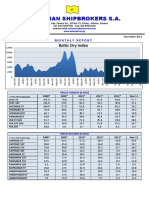

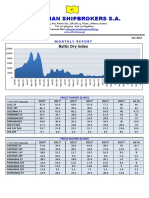

RATES

BALTIC INDEX EXCHANGE RATE BUNKER PRICES

BDI 1922 + 439 EURO/USD 1.3576 BUNKERS ROTTERDAM SPORE FUJAIRAH

BCI 3316 + 926 YEN/USD 0,0097 IFO 380 580.5 607.5 615.5

BPI 1741 + 379 BRENT IFO 180 607 618 645

BSI 1507 + 114 110.68 MDO - 950.5 -

Clarkson Hellas Weekly S+P Bulletin 1

NEWBUILDING

Significant volumes of ordering to report this week across both Dry and Wet markets. Starting with the

large sizes in dry, Oldendorff Carriers are reported to have declared the sixth in a series of 207,000

DWT Newcastlemax at HHI, with delivery in the second quarter of 2015. At Hanjin Subic, STX Pan

Ocean have contracted two firm 150,000 DWT Capesize, planned for delivery in the second half of

2016 and for charter to KEPCO. One order to report in the Kamsarmax sector, with Klaveness

declaring the third and fourth in a series of 82,000 DWT bulk carriers at Jiangsu New Yangzijiang.

With a further two options still outstanding, these latest vessels are due to deliver in 2016.

The majority of reported ordering this week in dry has been focussed on the Ultramax sector, starting

with Oldendorff Carriers contracting six firm plus six option 64,000 DWT Ultramax at Qingshan

Shipyard. Delivery of the firm vessels is planned for 2015 and 2016. At Guangzhou Huangpu, KC

Maritime have placed an order for four firm 64,000 Ultramax, with pricing undisclosed, delivery of all

four vessels is due within 2016. In the same size, Clients of Golden Ocean have declared three further

options at Chengxi for delivery in the first half of 2016, taking the total series to six vessels.

A similarly busy week in the Handy market, with it coming to light that Clients of Precious Shipping

have signed for two firm 38,500 DWT Handysize bulkers at Shanhaiguan, with delivery from the

second quarter of 2015. Also at Qingshan, Atlantska Plovidba have declared the third vessel in a

series of 38,700 DWT bulkers, due for delivery in mid-2015. Vogemann are reported to have declared

two further options for 36k Handysize at Weihai Samjin, again for delivery within 2015. Only one order

to report in dry this week at a Japanese yard, with PacBasin ordering two firm 37,400 DWT bulkers at

Kanda, with delivery due in the second half of 2016.

Further ordering in the product tanker market this week, with Navig8 Product Tankers declaring

options for two further 112,000 DWT LR2 product tankers at GSI, with delivery of both vessels in the

final quarter of 2016. Hyundai Mipo are understood to have taken further orders for MR tankers this

week with clients of Latsis contracting five firm 52,000 DWT coated tankers for delivery within 2016. In

the same sector, clients of Metrostar Management have declared a further four options for 52,000

DWT MRs at SPP, taking the series to a total of ten firm vessels. Pricing is undisclosed, although

delivery is similarly planned for 2016. In the chemical market, Arcoin have contracted two firm plus two

option 19,800 DWT stainless steel tankers at Xinle Shipbuilding in China, with delivery from 2015.

In containers, China’s Bank of Communications Financial Leasing have contracted five firm plus two

option 9,300 TEU container carriers at Samsung. Delivery of the series is planned from mid-2015, with

pricing in the region USD 85 Mill per vessel. In the US, VT Halter have taken an order for 2,400

TEU/400 car RORO-Container vessels, with both vessels to LNG fuelled. Pricing for this order remains

undisclosed, however delivery was announced for April and October 2017. In the MPP sector, COSCO

Shipping Ltd. (COSCOL) have announced an order for four firm 36,000 DWT multipurpose vessels at

Huangpu, each with a container capacity of 2,000 TEU. Pricing is undisclosed, however delivery is

split between 2015 and 2016.

In the gas market this week, Elcano are understood to have contracted two firm 174,000 CBM LNG

carriers at Koyo Dock. Both are to be fitted with LNG dual fuel main engines and for delivery in 2017.

Similarly at DSME, Clients of Teekay LNG Partners have declared the fifth in a series of 173,400 CBM

LNG carriers with delivery due in 2017. Lastly, Dorian LPG have declared two further options for

84,000 CBM LPG carriers at HHI, with delivery of both vessels in 2015.

(THE INFORMATION CONTAINED IN THIS REPORT HAS BEEN OBTAINED FROM VARIOUS MARKET SOURCES. WE

BELIEVE THIS INFORMATION TO BE CORRECT BUT WE CAN NOT GUARANTEE ITS ACCURACY OR COMPLETENESS.

HENCE WE CAN NOT BE HELD RESPONSIBLE FOR ANY ACTION OR FAILURE TO TAKE ACTION UPON RELIANCE ON

INFORMATION CONTAINED HEREIN. THIS REPORT MUST NOT BE REPRODUCED OR DISTRIBUTED TO ANY THIRD

PARTY.)

Clarkson Hellas Weekly S+P Bulletin 2

You might also like

- CLARKSON HELLAS S&P WEEKLY BULLETIN HIGHLIGHTSDocument2 pagesCLARKSON HELLAS S&P WEEKLY BULLETIN HIGHLIGHTSgeorgevarsasNo ratings yet

- Clarkson Hellas Weekly S+P Bulletin SpotlightDocument2 pagesClarkson Hellas Weekly S+P Bulletin SpotlightgeorgevarsasNo ratings yet

- C H S&P W B: Larkson Ellas Eekly UlletinDocument3 pagesC H S&P W B: Larkson Ellas Eekly UlletingeorgevarsasNo ratings yet

- Sale and Purchase: Hellas S&P Weekly Bulletin 30 September 2019Document2 pagesSale and Purchase: Hellas S&P Weekly Bulletin 30 September 2019VGNo ratings yet

- South LakeDocument1 pageSouth LakeJoe VelezNo ratings yet

- BBT Ships Schedule WharvesDocument7 pagesBBT Ships Schedule WharvesPro[ML] YTNo ratings yet

- Optima's Report Week 46.2018Document5 pagesOptima's Report Week 46.2018Angelica KemeneNo ratings yet

- Report 05 01 2024Document3 pagesReport 05 01 2024bill duanNo ratings yet

- Optima 2018 05Document5 pagesOptima 2018 05api-389619753No ratings yet

- June-112023 10Document10 pagesJune-112023 10Charmange “Mhen” ManansalaNo ratings yet

- All Fabrics Dyeing Program On 20 Mar: UNIT-03Document7 pagesAll Fabrics Dyeing Program On 20 Mar: UNIT-03shironum hinNo ratings yet

- New Mangalore Port Trust DATE: 13/08/2021: Ships Waiting at AnchorageDocument1 pageNew Mangalore Port Trust DATE: 13/08/2021: Ships Waiting at AnchorageKeerthan PoojaryNo ratings yet

- All Fabrics Dyeing Program On 16 Mar: UNIT-03Document7 pagesAll Fabrics Dyeing Program On 16 Mar: UNIT-03shironum hinNo ratings yet

- Xy-Sa-Gpi2304-1 CidDocument4 pagesXy-Sa-Gpi2304-1 CidrafaelNo ratings yet

- Update DES Day Pit 9 Perjam 17Document1 pageUpdate DES Day Pit 9 Perjam 17Iccang DewiNo ratings yet

- NullDocument3 pagesNullapi-26010927No ratings yet

- Part1 (2Document2 pagesPart1 (2Aziz KosencigNo ratings yet

- Inv 01-30-23Document4 pagesInv 01-30-23frincess laboneteNo ratings yet

- E2-Daftar Lot JKT 19-09-2023Document10 pagesE2-Daftar Lot JKT 19-09-2023punyakubaruNo ratings yet

- Stock 9 SeptemberDocument12 pagesStock 9 SeptemberAnisa MahardikaNo ratings yet

- TDMS Asset RegisterDocument1 pageTDMS Asset RegisterssetrdbtbrNo ratings yet

- Track Link - Korea Brand PartsDocument8 pagesTrack Link - Korea Brand PartsdefidhanNo ratings yet

- Daily Hardware Report Detail - 11!10!23Document1 pageDaily Hardware Report Detail - 11!10!23cayep73No ratings yet

- CLJOC Well SD-24P Bit RecordDocument1 pageCLJOC Well SD-24P Bit RecordThem Bui XuanNo ratings yet

- Compass Maritime Weekly Market ReportDocument6 pagesCompass Maritime Weekly Market ReportJoel SegoviaNo ratings yet

- SD-24P Bit Record 2Document1 pageSD-24P Bit Record 2Them Bui XuanNo ratings yet

- TDMS Asset RegisterDocument1 pageTDMS Asset RegisterssetrdbtbrNo ratings yet

- Industrial Machinery & Tractor TyresDocument2 pagesIndustrial Machinery & Tractor TyresFelipe HernándezNo ratings yet

- LIST UNIT BACKLOG SITE INFRASTRUKTURDocument2 pagesLIST UNIT BACKLOG SITE INFRASTRUKTURKhairullahNo ratings yet

- D5LC50 Summary Drawings ASSEMBLY: 36664: Edition Du 14/11/03Document21 pagesD5LC50 Summary Drawings ASSEMBLY: 36664: Edition Du 14/11/03Lionel TabeauNo ratings yet

- Monitoring Backlog New 2021 InfrastrukturDocument2 pagesMonitoring Backlog New 2021 InfrastrukturKhairullahNo ratings yet

- Position - List - Tank 17 11 2023Document8 pagesPosition - List - Tank 17 11 2023simionalex1987No ratings yet

- Dimensions Are For Reference Only. All Dimensions Are Subject To Change Upon Production. Unless Otherwise SpecifiedDocument1 pageDimensions Are For Reference Only. All Dimensions Are Subject To Change Upon Production. Unless Otherwise SpecifiedRUN GONo ratings yet

- STOCK CABANG DPS 4 MARET 2024 - Google SpreadsheetDocument1 pageSTOCK CABANG DPS 4 MARET 2024 - Google Spreadsheet5ales7oyotaNo ratings yet

- Permissible F.W. Draught Berthing Performance June 2018Document2 pagesPermissible F.W. Draught Berthing Performance June 2018Riaz AhmedNo ratings yet

- KARISMA MOTOR STOCK UPDATE JANUARY 2018Document101 pagesKARISMA MOTOR STOCK UPDATE JANUARY 2018GedeNo ratings yet

- Field Notes InsideDocument1 pageField Notes InsideAtty. Lei AtienzaNo ratings yet

- Monitoring Beton RSST (1) - 1Document4 pagesMonitoring Beton RSST (1) - 1Arga D. PutraNo ratings yet

- DSM1219010Document3 pagesDSM1219010Rizky Syah JayaNo ratings yet

- Advanced - Week 11 - 16.03.11Document11 pagesAdvanced - Week 11 - 16.03.11georgevarsasNo ratings yet

- 6 Received Fabrics 2023Document21 pages6 Received Fabrics 2023ini jawabanNo ratings yet

- 12 Received Fabrics 2023Document19 pages12 Received Fabrics 2023ini jawabanNo ratings yet

- Antara - Antara Kai 164362 (Spnu2840474)Document2 pagesAntara - Antara Kai 164362 (Spnu2840474)Agil MuldahNo ratings yet

- S10 Trail Blazer My Link Charcoal Grey 2012/14Document91 pagesS10 Trail Blazer My Link Charcoal Grey 2012/14Sergio SilvaNo ratings yet

- IN325AABDocument1 pageIN325AABRyan SmithNo ratings yet

- Lewisville Arrest ReportsDocument2 pagesLewisville Arrest ReportswestzoneblogsNo ratings yet

- Xy-Sa-Gpi2304-2 PLDDocument2 pagesXy-Sa-Gpi2304-2 PLDrafaelNo ratings yet

- Bangladesh Express Co. LTD.: Inbound ManifestDocument1 pageBangladesh Express Co. LTD.: Inbound ManifestMimma afrinNo ratings yet

- Update DES Day Pit 9 Per Jam 11Document1 pageUpdate DES Day Pit 9 Per Jam 11Iccang DewiNo ratings yet

- Update DES PIT 9 Per Jam 21Document1 pageUpdate DES PIT 9 Per Jam 21Iccang DewiNo ratings yet

- Entrada Super 3 2022.01.22Document3 pagesEntrada Super 3 2022.01.22Alimentos LIVETNo ratings yet

- MR 796 Abs MY13 ENDocument178 pagesMR 796 Abs MY13 ENYuri FabresNo ratings yet

- SPC - Multistrada 950 S Spoked Wheels - en - My19Document172 pagesSPC - Multistrada 950 S Spoked Wheels - en - My19Martin StangeNo ratings yet

- Nabors Rig 4 1/2 XH 16.60 S-135 27 1/2 " ROTARY: 12"flow LineDocument3 pagesNabors Rig 4 1/2 XH 16.60 S-135 27 1/2 " ROTARY: 12"flow LineThiban KumarNo ratings yet

- Monster 796abs en MY14Document140 pagesMonster 796abs en MY14Yuri FabresNo ratings yet

- Sciisa Job Kimbelry ClarkDocument4 pagesSciisa Job Kimbelry ClarktitoNo ratings yet

- Summary Project Moving Rig Pdsi 38.2 #56 (M#330 - M#119 Os) - (19 April 2023 - 30 April 2023)Document4 pagesSummary Project Moving Rig Pdsi 38.2 #56 (M#330 - M#119 Os) - (19 April 2023 - 30 April 2023)Erwin SyahNo ratings yet

- List Nav Mar 20Document1 pageList Nav Mar 20schrot hansNo ratings yet

- TMY Corporation Announces New Automotive Parts Products for 2019Document5 pagesTMY Corporation Announces New Automotive Parts Products for 2019Eleazar PavonNo ratings yet

- KBF constant climate chamber service manualDocument140 pagesKBF constant climate chamber service manualgeorgevarsasNo ratings yet

- Arpadis - Raw Material Recycler - 21.04.19Document1 pageArpadis - Raw Material Recycler - 21.04.19georgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.02.15 PDFDocument19 pagesAthenian Shipbrokers - Monthy Report - 14.02.15 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers Monthly Report Baltic Dry Index Prices Tankers Bulk CarriersDocument20 pagesAthenian Shipbrokers Monthly Report Baltic Dry Index Prices Tankers Bulk Carriersgeorgevarsas0% (1)

- Solvents: Northwest EuropeDocument8 pagesSolvents: Northwest EuropegeorgevarsasNo ratings yet

- Clarkson Hellas 13.12.16Document2 pagesClarkson Hellas 13.12.16georgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 16.07.15Document17 pagesAthenian Shipbrokers - Monthy Report - 16.07.15georgevarsasNo ratings yet

- Solvents: Northwest EuropeDocument7 pagesSolvents: Northwest EuropegeorgevarsasNo ratings yet

- Solvents: Northwest EuropeDocument9 pagesSolvents: Northwest EuropegeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.06.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 14.06.15 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 13.12.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 13.12.15 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.01.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 14.01.15 PDFgeorgevarsasNo ratings yet

- Clarkson Hellas 13.11.25 PDFDocument2 pagesClarkson Hellas 13.11.25 PDFgeorgevarsasNo ratings yet

- Clarkson Hellas 13.12.09 PDFDocument2 pagesClarkson Hellas 13.12.09 PDFgeorgevarsasNo ratings yet

- Clarkson Hellas 13.11.04 PDFDocument3 pagesClarkson Hellas 13.11.04 PDFgeorgevarsasNo ratings yet

- Clarkson Hellas 13.10.14 PDFDocument3 pagesClarkson Hellas 13.10.14 PDFgeorgevarsasNo ratings yet

- Clarkson Hellas 13.10.07 PDFDocument3 pagesClarkson Hellas 13.10.07 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.05.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 14.05.15 PDFgeorgevarsasNo ratings yet

- Monthly report on shipping prices and Baltic Dry IndexDocument17 pagesMonthly report on shipping prices and Baltic Dry IndexgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.03.15 PDFDocument17 pagesAthenian Shipbrokers - Monthy Report - 14.03.15 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.07.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 14.07.15 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers S.A.: Baltic Dry IndexDocument17 pagesAthenian Shipbrokers S.A.: Baltic Dry IndexgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 13.12.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 13.12.15 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.06.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 14.06.15 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.02.15 PDFDocument19 pagesAthenian Shipbrokers - Monthy Report - 14.02.15 PDFgeorgevarsasNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.01.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 14.01.15 PDFgeorgevarsasNo ratings yet

- Mr. Anggi PDFDocument2 pagesMr. Anggi PDFsusi gloryNo ratings yet

- Stansted Express Order ConfirmationDocument2 pagesStansted Express Order ConfirmationMutaz HassanNo ratings yet

- Section A Module 1 - Gathering and Processing Information 1. Read The Following Extract Carefully and Then Answer The Questions That FollowDocument2 pagesSection A Module 1 - Gathering and Processing Information 1. Read The Following Extract Carefully and Then Answer The Questions That FollowSelena Reid0% (1)

- Repor 2 PDFDocument344 pagesRepor 2 PDFHanna TbNo ratings yet

- 5G interference with radar altimetersDocument3 pages5G interference with radar altimetersShanmugiNo ratings yet

- B W Sea Transport 03062013Document127 pagesB W Sea Transport 03062013christianaq17No ratings yet

- Oferta Piese DaciaDocument4 pagesOferta Piese DaciaSava SergiuNo ratings yet

- An Empirical Study On Project Logistics at EPC Projects of BangladeshDocument8 pagesAn Empirical Study On Project Logistics at EPC Projects of BangladeshInternational Journal of Innovative Science and Research Technology100% (2)

- Iraqi Airways ETicket (MSIA6T) - THAMERDocument2 pagesIraqi Airways ETicket (MSIA6T) - THAMERAli Thamer0% (1)

- Car Park Designers' Handbook (Part 03 of 05)Document44 pagesCar Park Designers' Handbook (Part 03 of 05)Adam Michael GreenNo ratings yet

- WLC 23aug2022 100342Document286 pagesWLC 23aug2022 100342EssamNo ratings yet

- Line(s)Document8 pagesLine(s)TL LeNo ratings yet

- Part 9Document121 pagesPart 9sadjuharNo ratings yet

- Grab Receipt ADR-76466260-8-672Document2 pagesGrab Receipt ADR-76466260-8-672ReyCharlesParconNo ratings yet

- Kempegowda Bus Terminal DsDocument4 pagesKempegowda Bus Terminal Dsnithin rasure0% (2)

- Dimensions (MM) : Rigid 6x4Document4 pagesDimensions (MM) : Rigid 6x4Sameh MohamedNo ratings yet

- Banihal-Qazigund TunnelDocument14 pagesBanihal-Qazigund TunnelAmit JainNo ratings yet

- Ticket Barcelona Paris 3132568029Document1 pageTicket Barcelona Paris 3132568029tele testNo ratings yet

- Palestine Polytechnic UniversityDocument40 pagesPalestine Polytechnic UniversityAhmad Abu GhzalaNo ratings yet

- Motorized Trolley Without CraneDocument6 pagesMotorized Trolley Without CraneAnsarMahmoodNo ratings yet

- Sesión 27 Formato BL-comercio ExteriorDocument1 pageSesión 27 Formato BL-comercio ExteriorDariel PrerNo ratings yet

- Civil Aeronautics BoardDocument34 pagesCivil Aeronautics BoardJoshua Sarasua100% (1)

- Transportation County Projects Fact SheetDocument16 pagesTransportation County Projects Fact Sheettom_scheckNo ratings yet

- TRANSPO Bar Q'sDocument10 pagesTRANSPO Bar Q'sJenCastilloNo ratings yet

- Bibliography and Annexure - FinalDocument9 pagesBibliography and Annexure - Finalvenkatanand1965No ratings yet

- DCS A-29B ChecklistDocument10 pagesDCS A-29B ChecklistbemadicobNo ratings yet

- Task 1: Write Down at Least Three Reasons For and Three Against Having Your Own CarDocument2 pagesTask 1: Write Down at Least Three Reasons For and Three Against Having Your Own CarРогић НевенNo ratings yet

- UPRT (Upset Prevention & Recovery Training) : Background InformationDocument3 pagesUPRT (Upset Prevention & Recovery Training) : Background InformationKonstantinos AIRMANNo ratings yet

- Electronic Ticket Receipt: ItineraryDocument2 pagesElectronic Ticket Receipt: ItineraryJuan Carlos ChambiNo ratings yet

- Bill of Lading - Terms and ConditionsDocument13 pagesBill of Lading - Terms and ConditionsDuDu SmileNo ratings yet