Professional Documents

Culture Documents

Syllabus For Bachelor of Commerce W.E.F. 2013-2014: Resource Management

Uploaded by

Abhinav DixitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syllabus For Bachelor of Commerce W.E.F. 2013-2014: Resource Management

Uploaded by

Abhinav DixitCopyright:

Available Formats

Syllabus for Bachelor of Commerce

w.e.f. 2013-2014

Note: Paper setter will set nine questions in all. Question No. 1 comprising of five short types

questions carrying four (4) marks each is compulsory. It covers the entire syllabus. Answer to

each question should not be more than one page. Candidate is required to attempt four

questions from the remaining eight questions carrying 15 marks each.

B.Com. (General):

A student pursuing B.Com. (General) has to study six papers in 3rd, 4th, 5th & 6th semester.

Note:- A student pursuing B.Com. (General) will have to choose one optional paper in each of the 3 rd, 4th, 5th & 6th

semesters. Regarding choice of optional papers following rules have to be observed by the candidate:-

(i) Optional papers are divided into three optional groups i.e. Finance & Taxation, Marketing, and Human

Resource Management.

(ii) A candidate will have to continue the same specialization group opted once in 3 rd semester, it will not be

changed in subsequent semesters.

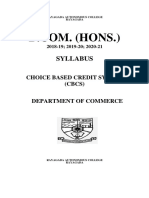

B.Com. (Hons.):

A student pursuing B.Com. (Hons.) has to study seven papers in 3rd, 4th, 5th & 6th semester.

Note:-Regarding choice of optional papers following rules have to be observed by the candidate:-

(i) Optional papers are divided into three optional groups i.e. Finance & Taxation, Marketing, and Human

Resource Management.

(ii) Student opting for B.Com. (Hons) will have to opt for both the papers from the same optional group i.e.

Finance & Taxation, Marketing, and Human Resource Management. Further, a candidate will have to

continue the same specialization group opted once in 3 rd semester in subsequent semesters also.

Specialization group cannot be changed.

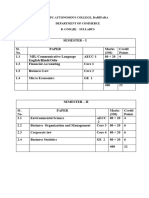

SCHEME OF EXAMINATION

B.Com. Ist Semester

Course Code Course Title External Internal Total Marks

BC 101 Financial Accounting 80 20 100

BC 102 Business Communication Skills 80 20 100

BC 103 Micro Economics 80 20 100

BC 104 Principles of Management 80 20 100

BC 105 Business Mathematics-I 80 20 100

BC 106* Introduction to Computer Applications 80 20 100

*Internal Assessment based on Practical.

B.Com. IInd Semester

Course Code Course Title External Internal Total Marks

BC 201 Advanced Financial Accounting 80 20 100

BC 202 Macro Economics 80 20 100

BC 203 Business Environment 80 20 100

BC 204 Organisational Behaviour 80 20 100

BC 205 Business Mathematics-II 80 20 100

BC 206* IT and E-Commerce* 80 20 100

BC 207 Environmental Studies (Qualifying Paper) 100

*Internal Assessment based on Practical.

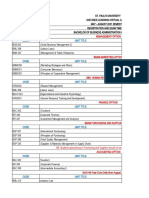

B.Com. IIIrd Semester

Compulsory Papers

Course Code Course Title External Internal Total Marks

BC 301 Corporate Accounting-I 80 20 100

BC 302 Business Statistics 80 20 100

BC 303 Human Resource Management 80 20 100

BC 304 Principles of Marketing 80 20 100

BC 305 Business Laws-I 80 20 100

Optional Group-I (Finance & Taxation):

BC 306 Financial Institutions & Markets 80 20 100

BC 307 Accounting and Reporting Standards 80 20 100

Optional Group-II (Marketing):

BC 308 Advertising 80 20 100

BC 309 Rural Marketing 80 20 100

Optional Group-III (Human Resource Management)

BC 310 Industrial Relations and Laws 80 20 100

BC 311 Compensation Management 80 20 100

B.Com. IVth Semester

Course Code Course Title External Internal Total Marks

BC 401 Corporate Accounting-II 80 20 100

BC 402 Business Environment in Haryana 80 20 100

BC 403 Financial Management 80 20 100

BC 404 Company Law-I 80 20 100

BC 405 Business Laws-II 80 20 100

Optional Group-I (Finance & Taxation):

BC 406 Fundamentals of Insurance 80 20 100

BC 407 Central Excise & Customs 80 20 100

to be replaced with

Customs Procedure and Practice

for the Session 2017-2018

Optional Group-II (Marketing):

BC 408 Supply Chain Management 80 20 100

BC 409 Management of Sales Force 80 20 100

Optional Group-III (Human Resource Management):

BC 410 International Human Resource Management 80 20 100

BC 411 Human Resource Development 80 20 100

B.Com. Vth Semester

Course Code Course Title External Internal Total Marks

BC 501 Cost Accounting 80 20 100

BC 502 Entrepreneurship Development 80 20 100

BC 503 Income Tax-I 80 20 100

BC 504 Company Law-II 80 20 100

BC 505 Materials Management 80 20 100

Optional Group-I (Finance & Taxation):

BC 506 Investment Management 80 20 100

BC 507 Service Tax & VAT 80 20 100

to be replaced with

Goods and Services Tax

for the Session 2017-2018 and 2018-2019

Optional Group-II (Marketing ):

BC 508 Industrial Marketing 80 20 100

BC 509 Services Marketing 80 20 100

Optional Group-III (Human Resource Management):

BC 510 Business Ethics and Corporate Governance 80 20 100

BC 511 Business Policy and Strategic Management 80 20 100

B.Com. VIth Semester

Course Code Course Title External Internal Total Marks

BC 601 Management Accounting 80 20 100

BC 602 Auditing 80 20 100

BC 603 Income Tax-II 80 20 100

BC 604 Security Market Operations 80 20 100

BC 605 International Marketing 80 20 100

Optional Group-I (Finance & Taxation):

BC 606 Foreign Exchange Management 80 20 100

BC 607 Corporate Governance 80 20 100

Optional Group-II (Marketing):

BC 608 Retail Management 80 20 100

BC 609 Marketing Research 80 20 100

Optional Group-III (Human Resource Management):

BC 610 Strategic Human Resource Management 80 20 100

BC 611 Corporate Evolution and Strategic Implementation 80 20 100

BC-407: Central Excise & Customs to be replaced with Customs Procedure and Practice for the Session 2017-2018

BC-407

CUSTOMS PROCEDURE AND PRACTICE

External Marks: 80

Internal Marks: 20

Time: 3 Hours

Note: Paper setter will set nine questions in all. Question No. 1 comprising of five short types

questions carrying four (4) marks each is compulsory. It covers the entire syllabus. Answer to

each question should not be more than one page. Candidate is required to attempt four

questions from the remaining eight questions carrying 15 marks each.

Role of customs in international trade.

Organisation of customs in India: administrative and operational authorities.

Regulatory framework - an overview of Customs Act, 1962 and Customs Tariff Act, 1975.

Assessable value, baggage, bill of entry, bill of export suitable goods, duty, exporter, foreign going vessel, air

craft goods, import, import manifest, importer, prohibited goods, shopping bill stores, bill of lading, export

manifest, DOB, FAS, ClF, GATT, letter of credit.

Kinds of duties: basic, auxiliary, additional or countervailing; basis of levy- ad valorem, specific duties.

Prohibition of exportation and importation of goods and provisions regarding notified and specified goods.

Import of goods- free import and restricted import.

Types of restricted import- prohibited goods, canalized goods, and import against licensing.

REFERENCES

Sareen V.K and Sharma Ajay, “Indirect tax laws”, Kalyani Publications.

Dhingra Joy, “Indirect Taxes” Kalyani Publications

BC-507: Service Tax & VAT to be replaced with Goods and Services Tax for the Session 2017-2018 and 2018-2019

BC-507

GOODS AND SERVICES TAX

External Marks: 80

Internal Marks: 20

Time: 3 Hours

Note: Paper setter will set nine questions in all. Question No. 1 comprising of five short types questions

carrying four (4) marks each is compulsory. It covers the entire syllabus. Answer to each question

should not be more than one page. Candidate is required to attempt four questions from the

remaining eight questions carrying 15 marks each.

GST: meaning, taxable person, registration: procedure and documents required.

Levy and collection of GST

Time and place of supply of goods and services, value of taxable supply

Computation of input tax credit and transfer of input tax credit

Tax invoice credit and debit note

Various returns to be filed under GST

Payment of tax including TDS, Interest Provisions on delayed payment

Offences and penalties.

REFERENCES

Ahuja Girish & Gupta Ravi, Practical approach to Income tax, Wealth Tax and Central sales tax

(Problems and Solutions with Multiple choice questions); Bharat Law House Pvt. Ltd., New Delhi.

Central Excise Act.

Central Sales Tax Act.

Customs Act.

Goods and Services Tax Act.

You might also like

- Insur XDocument15 pagesInsur XJuan CumbradoNo ratings yet

- Economics of Regulation and AntitrustDocument14 pagesEconomics of Regulation and AntitrustPablo Castelar100% (1)

- B - Com - Hons - 2017-2018Document50 pagesB - Com - Hons - 2017-2018sainipreetpalNo ratings yet

- Syllabus For Bachelor of Commerce (Vocational) Scheme W.E.F. 2015-2016 Tax Procedure and Practice (Vocational Course)Document6 pagesSyllabus For Bachelor of Commerce (Vocational) Scheme W.E.F. 2015-2016 Tax Procedure and Practice (Vocational Course)sainipreetpalNo ratings yet

- BC-101 Financial Accounting-I BC-102 Micro Economics BC-103 Principles of Business Management BC-104 Computer Applications in BusinessDocument42 pagesBC-101 Financial Accounting-I BC-102 Micro Economics BC-103 Principles of Business Management BC-104 Computer Applications in BusinessManjot SinghNo ratings yet

- SDS UgDocument63 pagesSDS UgiamamitxsinghNo ratings yet

- Hons PDFDocument48 pagesHons PDFRagini KumariNo ratings yet

- Bcom SyllabusDocument41 pagesBcom SyllabusVikash BudhrajaNo ratings yet

- MBA Curriculum 2020Document9 pagesMBA Curriculum 2020Rakesh NairNo ratings yet

- Pass Scheme of Examination For Secrecy PDFDocument52 pagesPass Scheme of Examination For Secrecy PDFRahulNo ratings yet

- Jiwaji University Gwalior: Bachelor of Business Administration Syllabus AND Examination Scheme 2005-2008Document54 pagesJiwaji University Gwalior: Bachelor of Business Administration Syllabus AND Examination Scheme 2005-2008Diwakar PariharNo ratings yet

- Pass 2018-19 IGU PDFDocument53 pagesPass 2018-19 IGU PDFPreeti SainiNo ratings yet

- The Branch of ICMAB Are Given BelowDocument9 pagesThe Branch of ICMAB Are Given BelowBattle ALONE009No ratings yet

- BBA DEB SyllabusDocument70 pagesBBA DEB SyllabusCIIS ADMISSIONNo ratings yet

- Syllabus W.E.F 2017-18.-1Document111 pagesSyllabus W.E.F 2017-18.-1Naman ThakurNo ratings yet

- BBA (General) 2012-13Document40 pagesBBA (General) 2012-13Ravi KumarNo ratings yet

- Syllabus Bcom (Hons & Pass) CBCS PDFDocument96 pagesSyllabus Bcom (Hons & Pass) CBCS PDFTophan PradhanNo ratings yet

- Scheme of Examination & Syllabi of Bachelor of Business AdministrationDocument40 pagesScheme of Examination & Syllabi of Bachelor of Business Administrationpradeep prajapatiNo ratings yet

- Sl. No. Subject Code Subject Title Internal Assessm Ent Marks Written Examinatio N Marks TotalDocument23 pagesSl. No. Subject Code Subject Title Internal Assessm Ent Marks Written Examinatio N Marks TotalKD TricksNo ratings yet

- Bcom Part 2 AUDITINGDocument4 pagesBcom Part 2 AUDITINGMaham AfzalNo ratings yet

- Mba Syllabus 3rd Sem Finance and HRDocument12 pagesMba Syllabus 3rd Sem Finance and HRvishwanath286699No ratings yet

- Syallbus Commerce GM UnivDocument38 pagesSyallbus Commerce GM Univayusharma1608No ratings yet

- BCOMDocument42 pagesBCOMnibeditan261No ratings yet

- Su Bba Syllabus - 2019 - Sem III To ViDocument44 pagesSu Bba Syllabus - 2019 - Sem III To ViGauravNo ratings yet

- SMSJNTUHR22BBA (DataAnalytics) SyllabusDocument50 pagesSMSJNTUHR22BBA (DataAnalytics) Syllabusamma srinivasNo ratings yet

- COMMERCE New - SyllabusDocument34 pagesCOMMERCE New - SyllabusSahil Swaynshree SahooNo ratings yet

- BBA SyllabusDocument67 pagesBBA SyllabusSubham .MNo ratings yet

- B, Com Calicut SyllaBUSDocument79 pagesB, Com Calicut SyllaBUSjahfarNo ratings yet

- FileDocument7 pagesFilekavya.eurodreamsNo ratings yet

- Appendix E ADocument42 pagesAppendix E ASANTOSH MOHARANANo ratings yet

- BcomDocument48 pagesBcomSrividya SNo ratings yet

- U0001 720176616526272017661652619Document42 pagesU0001 720176616526272017661652619Rohan KotabagiNo ratings yet

- MRSPTU BBA (Sem 1-6) SyllabusDocument30 pagesMRSPTU BBA (Sem 1-6) SyllabusGurpreet SandhuNo ratings yet

- HRD BookDocument31 pagesHRD BookSameer SultanNo ratings yet

- CBCS Course Structure 2020-21Document37 pagesCBCS Course Structure 2020-21tamilarasan6382tamilNo ratings yet

- Attachment PDFDocument88 pagesAttachment PDFissa fernandesNo ratings yet

- Syllabus 3Sem.-6Sem.Document33 pagesSyllabus 3Sem.-6Sem.Smart Earn 2020 ONLINENo ratings yet

- Corp. Ac. - SyllabusDocument2 pagesCorp. Ac. - SyllabusVishakh KrishnanNo ratings yet

- BComDocument2 pagesBComSk.Abdul NaveedNo ratings yet

- HonsDocument49 pagesHonsAASHUTOSH KASHYAPNo ratings yet

- 5th Semester SyllabusDocument7 pages5th Semester SyllabusRahul ChachraNo ratings yet

- Scheme of B.com Vocational Course (Tax Procedure & Practices) - BDocument41 pagesScheme of B.com Vocational Course (Tax Procedure & Practices) - BNasimNo ratings yet

- Collega PDFDocument50 pagesCollega PDFMadhav AsijaNo ratings yet

- PART-II (III & IV Semester) 2021-22, 2022-23, 2023-24Document47 pagesPART-II (III & IV Semester) 2021-22, 2022-23, 2023-24JassNo ratings yet

- Mba HHM 2022 23Document40 pagesMba HHM 2022 23Gurvendra PratapNo ratings yet

- May - August 2021 TimetableDocument34 pagesMay - August 2021 TimetableMARSHANo ratings yet

- New Scheme of B.Com Pass Course Due To Change in The Pattern of Practical Only Wef 2016-17 - 5 - 9 - 17Document54 pagesNew Scheme of B.Com Pass Course Due To Change in The Pattern of Practical Only Wef 2016-17 - 5 - 9 - 17Aditya RajputNo ratings yet

- Revised Examination Time Table All Courses Except Mba & McaDocument2 pagesRevised Examination Time Table All Courses Except Mba & McaAkhilesh DubeyNo ratings yet

- Institute of Business Studies: Ch. Charan Singh University Campus MeerutDocument59 pagesInstitute of Business Studies: Ch. Charan Singh University Campus MeerutNamit VermaNo ratings yet

- Syllabus - M.Com - Bhadrak Autonomous CollegeDocument28 pagesSyllabus - M.Com - Bhadrak Autonomous CollegeRamesh Chandra DasNo ratings yet

- University of Lucknow Master of Applied Economics Programme Regulations 2020Document31 pagesUniversity of Lucknow Master of Applied Economics Programme Regulations 2020nirbhay singhNo ratings yet

- Bcom 2016Document151 pagesBcom 2016praveenpk0917No ratings yet

- Syllabus: Choice Based Credit System (CBCS)Document41 pagesSyllabus: Choice Based Credit System (CBCS)Shilpi ChakrabortyNo ratings yet

- A & F - App28 - R&SDocument29 pagesA & F - App28 - R&SBeloved DhinaNo ratings yet

- Bcom Part 1 COMPUTER APPLICATION IN BUSINESSDocument3 pagesBcom Part 1 COMPUTER APPLICATION IN BUSINESSMaham AfzalNo ratings yet

- Syllabus (Semester Pattern) Session 2021-22: Shaheed Mahendra Karma Vishwavidyalaya, Bastar Jagdalpur, ChhattisgarhDocument37 pagesSyllabus (Semester Pattern) Session 2021-22: Shaheed Mahendra Karma Vishwavidyalaya, Bastar Jagdalpur, ChhattisgarhAlankrita TripathiNo ratings yet

- Scheme of Examination and Course Structure B. Voc. in Banking Financial Services and Insurance (BFSI)Document3 pagesScheme of Examination and Course Structure B. Voc. in Banking Financial Services and Insurance (BFSI)sainipreetpalNo ratings yet

- Final Date Sheet For Online Exam of Private Affiliated CollegesDocument5 pagesFinal Date Sheet For Online Exam of Private Affiliated CollegesRasheed doustamNo ratings yet

- Revised Regulation 2013 14 General - App 27 - RsDocument27 pagesRevised Regulation 2013 14 General - App 27 - RssuganNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

- Capgemini SpeakUpPolicy EnglishDocument13 pagesCapgemini SpeakUpPolicy EnglishGokul ChidambaramNo ratings yet

- Exchange of Immovable PropertyDocument3 pagesExchange of Immovable PropertyCharran saNo ratings yet

- Beza KebedeDocument113 pagesBeza Kebedeabenezer nardiyasNo ratings yet

- Marketing PlanDocument39 pagesMarketing PlansyedaNo ratings yet

- Introduction To Configuration: SAP University Alliances Authors Simha R. MagalDocument39 pagesIntroduction To Configuration: SAP University Alliances Authors Simha R. MagalJennylyn Yu ForteNo ratings yet

- Acct 555 - Week 1 AssignmentDocument8 pagesAcct 555 - Week 1 AssignmentJasmine Desiree WashingtonNo ratings yet

- Occupational Health & SafetyDocument30 pagesOccupational Health & SafetyMuhammad Zun Nooren BangashNo ratings yet

- Fdy2eusin0rzf PDFDocument20 pagesFdy2eusin0rzf PDFNguyen Thanh TriNo ratings yet

- Store FormatsDocument13 pagesStore FormatsVijayargavan Pasupathinath100% (1)

- Vending Services Business PlanDocument40 pagesVending Services Business PlanLiudmyla ShersheniukNo ratings yet

- f5 PDFDocument12 pagesf5 PDFSteffiNo ratings yet

- ATOM Ride-Hailing AgreementDocument7 pagesATOM Ride-Hailing AgreementRaedNo ratings yet

- Organization ProfileDocument2 pagesOrganization ProfilebalasudhakarNo ratings yet

- SI0020 SAP Fundamental: Logistics - ProcurementDocument20 pagesSI0020 SAP Fundamental: Logistics - ProcurementBinsar WilliamNo ratings yet

- FA 1 Distance ModuleDocument175 pagesFA 1 Distance ModuleBereket Desalegn100% (5)

- Operations On Functions Worksheet 6Document4 pagesOperations On Functions Worksheet 6Johnmar FortesNo ratings yet

- Partnership: Basic Considerations and Formation: Advance AccountingDocument53 pagesPartnership: Basic Considerations and Formation: Advance AccountingZyrah Mae Saez100% (1)

- Intellectual Property Rights - Question BankDocument14 pagesIntellectual Property Rights - Question BankKarthikNo ratings yet

- MarketingDocument33 pagesMarketingFranita AchmadNo ratings yet

- Make-to-Order Production For Sales Kits With Vari-Ant Configuration (4OC - DE)Document14 pagesMake-to-Order Production For Sales Kits With Vari-Ant Configuration (4OC - DE)Larisa SchiopuNo ratings yet

- Group Case AnalysisDocument5 pagesGroup Case AnalysisMislav Matijević100% (1)

- Man Power Resourcing in Reliance JioDocument56 pagesMan Power Resourcing in Reliance JioSomya Trivedi100% (2)

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- 6th Semester Rural Marketing Final Book With Cover Page 2022Document92 pages6th Semester Rural Marketing Final Book With Cover Page 2022Rakhi Arora100% (1)

- Business Topics 1Document40 pagesBusiness Topics 1MCL EnglishNo ratings yet

- Minimum Wage 2014-2015Document3 pagesMinimum Wage 2014-2015Anand ChinnappanNo ratings yet

- (By Cash Only) : State Bank of IndiaDocument2 pages(By Cash Only) : State Bank of IndiaPiyushNo ratings yet

- Responsibilities:: Christine Jane S. DarlucioDocument2 pagesResponsibilities:: Christine Jane S. DarlucioMarian LorenzoNo ratings yet