Professional Documents

Culture Documents

Letter To Minister Mop&Ng

Uploaded by

ramchander0 ratings0% found this document useful (0 votes)

24 views7 pagesok

Original Title

Letter to Minister Mop&Ng

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentok

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views7 pagesLetter To Minister Mop&Ng

Uploaded by

ramchanderok

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

ASSOCIATION OF SCIENTIFIC & TECHNICAL OFFICERS ay

‘OIL AND NATURAL GAS CORPORATION LTD., NEW DELHI

Registered wih the Registrar of Societies U.P, Lucknow, Registration No.172 (1967-68) Medaledes

SANJAY GOEL

PRESIDENT, GHC

No, ASTO-CWC/2016-17 /President/MoP&NG Date: 22.03.2017

To,

Shri Dharmendra Pradhan

Hon'ble Minister of Petroleum & Natural Gas,

Government of India,

Shastri Bhavan, New Delhi.

Sub.: Report of the 3 Pay Revision Committee.

Sir,

On behalf of the Association of Scientific and Technical Officers (ASTO), ONGC, we

‘would like to put on record our most sincere appreciation and gratitude to the Government of

India for the timely constitution and submission of the report by the 3! Pay Revision

Committee, constituted for pay revision of CPSEs. This is for the first time in history that the Pay

Revision Committee report for CPSEs has been submitted without any extensions before the

due date of pay revision.

Sir, securing a rapid and sustainable economic growth, generation of employment,

reduction of disparities in income & wealth and creation of the values for a free and equal

society have been the foremost objective of the present government. All CPSEs are

contributing to this effort by helping in building a base for a state of the art infrastructure, bring

about a planned development of the entire country and improve living condition of the masses.

‘As a matter of fact, public enterprises are extended arms of the government for economic

development and in achieving socio economic objectives.

Sir, the Public Sector Undertakings with the twin objectives of creating a sustainable

business as well as ensuring socio economic development of the society have an identity

distinctive of both, the private sector and the government. Thus the high level of responsibility

and accountability of the ONGC executives with distinctive objectives may please be

appreciated and they may be remunerated accordingly to ensure high level of effectiveness in

achieving these objectives. Further, while the ONGC executives do not aspire to be

compensated at par with the global industry peers, the compensation needs to be taken care of

in a way to keep them highly motivated to ensure sustainable growth in the highly competitive

business environment,

Sir, we had made several representations with the 3" PRC and had put up the issues

concerning us In the existing pay structure. While the Committee had looked into the Issues

and has made efforts to address them, there are some recommendations in the report which

would contravene the existing guidelines / provisions and would result in taking away some of

the existing benefits. We would also like to apprise your kind self same of the issues affecting

the compensation of the executives of Oil and Natural Gas Corporation (ONGC). The issues have

been highlighted and are enclosed herewith for your kind perusal and sympathetic

consideration.

In view of above, Sir, your kind intervention is highly solicited in resolving the issues

highlighted for the benefit of the executives of ONGC and boost the morale to ensure a

sustainable growth of the company.

With warm regards,

Enclosure: As stated above.

Copy to:

1. The Secretary, Ministry of Petroleum & Natural Gas, Government of India, New Delhi.

2. The Secretary, Department of Public Enterprises, Government of India, New Delhi,

3, The C&MD, ONGC, PDDUU Bhavan, Vasant Kunj, New Delhi.

4, The Director (HR), ONGC, PDDUU Bhavan, Vasant Kunj, New Delhi,

1. Existing Pay Anomalies/ Aberrations:

A number of pay aberrations have arisen after the implementation of the last PRC

(01.01.2007). Aberrations are in the form of:

* Junior Executives drawing more salary than Senior Executives.

Executives joining the organization after 01.01.2007 are drawing considerably

less pay than those joining before 01.01.2007.

Staff level employee with similar vintage drawing more salary than an

executive.

These anomalies will have an add-on / cumulative effect with the implementation of

the 3 PRC.

It is requested that the respective Boards be authorized to address these pay

differences / aberrations before implementation of the pay revision w.e.f.

01.01.2017.

2. Fitment benefit:

The fitment benefit recommended by the earlier PRCs was:

i). 20% during the 1 PRC (Basic +DA as on 1.1.97)

ii). 30% during the 2 PRC (Basic +DA as on 01.01.07)

Further, the 2 PRC for CPSEs as well as the 7" Pay Revision Commission had

recommended graded fitment, keeping in view the greater degree of responsibility

and accountability at higher levels. The 7th Pay Revision Commission has

accordingly, recommended fitment benefit ranging from 14.22% to 25.00%.

The 3" PRC has acknowledged that CPSEs being commercial entities should

provide for reasonable increase in the fixed pay at a uniform level and compensate

more to the senior level executives from variable pay (PRP). However, the PRP as

recommended by the 3 PRC is governed by multitude factors wherein the

individual's performance is an inconsequential component.

Thus, keeping in view the above rationale, it is requested that graded fitment may

also be recommended at 15% to 25% of Basic + DA for EO to CMD level in graded

pattern.

3. Increments:

The 3 PRC has recommended 3% annual and promotion increment. However as

the degree of responsibility and accountability increases at higher levels, the

compensation level thus should rise equitably. As such it is suggested that the

promotional increment may be kept t 5%.

»

a

4, Cafeteria Allowance:

The 7" CPC as well as 3° PRC have suggested reduction of the percentage based

allowances by a factor of 0.8. However the Cafeteria Allowance, which is currently

50% has been recommended to be reduced to 35% by the 3° PRC ie. reduction

by a factor of 0.7. It is thus requested that the Cafeteria Allowance be kept at 40%,

keeping in view the implementation of the factor of 0.8.

5. Performance Related Pay

The 3" PRC has recommended that the overall profits for distribution of PRP shall

be limited to 5% of the year's profit accruing only from core business activities and

the ratio of PRP from profit for the year to Incremental profit for the year shall be

65:35,

Public Sector Undertakings (PSUs) in India are the entities which have the status of

being Government-owned companies and are considered as ‘State’ under Article

12 of the Constitution of India. CPSEs apart from economic and commercial

considerations have a social obligation for the welfare of public at large. Besides,

the PSUs serve the interest of society by taking responsibility for the impact of their

activities on customers, employees, shareholders, communities and the

environment in all aspects of their operations. Accordingly, the CPSEs generally

undertake a number of non-commercial responsibilities in furtherance of their

commercial objectives.

Further, it is a known fact that exploration of Hydrocarbons per se is a highly risky

business and profitability at times is beyond the control of ONGC due to market

driven prices / Government of India interventions and thus, the Profitability of the

CPSEs are not on the commercial factors alone.

In order to undertake huge social responsibility towards countrymen, as per

Government of India directive, ONGC has extended support in the name of subsidy

for the last three years, as enumerated below for kind consideration:

SI.No. [FY Amount

4 2013-14 Rs. 56,384.29 Crs |

2. 2014-15 Rs. 36,299.62 Crs |

3. 2015-16 Rs._ 1,096.12 Crs |

This had an impact on the Company's Profitability. Incremental Profit is an

important factor in performance related pay (PRP), which is to the tune of 35%. In

view of the circumstances listed above, it is not possible for an E&P company like

ONGC to sustain incremental profits year after year. /t is requested that the ratio of

65:35, be made to 80:20. ,

1A

As per the existing guidelines for allocable profits for PRP, the overall cap for 5% of

PBT exists for allocation of PRP. The 3° PRC has also maintained the overall limit

of 5% of PBT for distribution of PRP.

The ceiling of 5% of PBT, in the current scenario itself, will be insufficient to meet

the requirement of full PRP payment, after implementation of pay revision. It is

therefore suggested that the ceiling for allocable profit be enhanced to 7.5% of PBT

to justify the PRP.

6. Location based Compensatory Allowances

The 2nd PRC had recommended that the following allowances will be outside the

purview of Cafeteria Allowance:

a) North East Allowance (inclusive for Ladakh Region) limited to 12.5% of BP;

b) Allowance for Underground Mines limited to 15% of BP;

c) Special Allowance (up to 10% of BP) for serving in the difficult and far flung

areas;

d) Non-practicing Allowance for Medical Officers up to 25% of BP.

However, the 3 PRC has clubbed the above allowances at (a) & (c) above under

the location based compensatory allowances. However, with the rider clause that

only the higher rate of Allowance will be applicable in the event of a place falling in

more than one category has been introduced which would result in reduction of

benefits for employees posted in field locations. Currently employees working in

field operations are paid the special allowance under item (c) above. It is therefore

requested that rider clause may be removed.

7. Work based Hardship Duty Allowances:

The 3rd PRC has recommended that payment of work based hardship duty

allowance up to 12% of Basic Pay shall be admissible for following hardship duty: -

a. For performing duty in Underground mines,

b. For performing duty at Offshore exploration site, and

c. For performing duty at Hydro-project site located within 200 kilometers from

the international border of the country.

During interactions with PRC, ASTO had requested that due to the difficult nature

of E&P activity the upstream oil companies personnel posted directly in the field be

motivated by introducing offshore / onshore allowance. We are thankful to PRC for

understanding specific problems being faced by E&P personnel, like ONGC. It is

requested that the allowances for offshore and onshore site duties may not be

combined with any other allowance and be kept separate. /t is requested that the

following offshore/ onshore allowance may be introduced:

Offshore Allowance — 35 % of Basic Pay, and

Onshore Allowance — 20% of Basic Pay \

Further, the Board may also be empowered to decide on any other work based

hardship duty allowances, which may not be appearing in the above list but are of

same or similar nature, within the ceiling prescribed above.

8. Periodicity

The 3rd PRC's has recommended that the review of the compensation & benefits

structure of the CPSE executives should happen in line with the periodicity as

decided for Central Government employees but it should not be later than 10 years.

However, it is requested that the periodicity of compensation structure should be a

tenure of 5 years or alternatively, there should be provision to allow full merger of

actual DA with Basic Pay, after 5 years , i.e. as on 01.01.2022.

9. House Rent Allowance (HRA)

It is requested that the rates of HRA may be retained as per existing rates i.e. 30%,

20% and 10% for different categories of cities.

Moreover, we would like to draw your kind attention to the practical & objective

problem of implementation of population based classification of cities. At some

locations which are industrial towns/tourist places, the rental rates are far higher

than the category under which they are classified.

10. Leased accommodation

As per the 3" PRC, the respective Board of CPSE has been empowered to decide

the lease rental ceilings applicable for the different level of executives. The above

recommendations toward lease accommodation facility shall be applicable in lieu of

availing HRA for rented accommodation. However, if an executive is staying in

his/her own house then normally he or she should be entitled to the HRA amount

but if the said house is taken as lease accommodation for self-occupation purpose,

then in such case the lease rental ceilings (after adjusting the House Rent

Recovery amount) should not exceed the net applicable HRA amount.

It is requested that on sel-lease, maintenance charges be kept out of the net

applicable HRA.

41. Family Planning and Higher Qualification Incentives:

Prior to the pay revision of 2007, incentives in the form of additional increments

were provided for family planning and higher qualification. The purpose of these

incentives was to promote small families and up gradation of knowledge and skills

by the employees. These allowances need fo be reintroduced to motivate

employee to follow the small family norms and upgrade their qualifications. Higher /

additional qualifications leads to acquisition of new skill set by the employees

leading to better productivity.

Ww

412. Funding/Payment towards gratuity:

The concern of CPSEs that the ceiling of 30% of BP + DA on superannuation

benefits is not sufficient to meet the requirements, has been appreciated by the 3°

PRC in order to address the issues & it has been recommended that

funding/payment towards the additional amount beyond the gratuity of Rs. 10.0

lakhs shall allowed to be outside the limit of 30% of BP + DA

However, it is requested that gratuity being a statutory benefit, the total amount of

gratuity may be kept outside the limit of 30% of BP + DA in order to provide

adequate social security to the retiring senior citizens.

You might also like

- FileHandlerIGTUW 1 PDFDocument2 pagesFileHandlerIGTUW 1 PDFramchanderNo ratings yet

- 7 68 2021 Pesb - 2Document5 pages7 68 2021 Pesb - 2ramchanderNo ratings yet

- Slow Jio 4G Speed - Here's A Method To Increase Jio Speed But Why Bother - Technology NewsDocument14 pagesSlow Jio 4G Speed - Here's A Method To Increase Jio Speed But Why Bother - Technology NewsramchanderNo ratings yet

- Finance BillDocument284 pagesFinance BillbsaikrishnaNo ratings yet

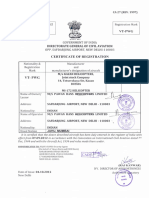

- C of R New VT-PWGDocument1 pageC of R New VT-PWGramchanderNo ratings yet

- 7 Star Dotcom Pvt. LTD.: Customer Name: Address: Email Id: STB No.: Card No.: Mobile No.Document4 pages7 Star Dotcom Pvt. LTD.: Customer Name: Address: Email Id: STB No.: Card No.: Mobile No.ramchanderNo ratings yet

- 145 T2 15.100Document5 pages145 T2 15.100ramchander100% (1)

- PC 02Document76 pagesPC 02ramchanderNo ratings yet

- FileHandlerIGTUW 1 PDFDocument2 pagesFileHandlerIGTUW 1 PDFramchanderNo ratings yet

- Acceptance Orders of Govt On Fifth CPC PDFDocument13 pagesAcceptance Orders of Govt On Fifth CPC PDFramchanderNo ratings yet

- GST Details Jet AirwaysDocument2 pagesGST Details Jet AirwaysramchanderNo ratings yet

- Dtu 2 Nd2 Round 2017Document2 pagesDtu 2 Nd2 Round 2017ramchanderNo ratings yet

- PC 02Document76 pagesPC 02ramchanderNo ratings yet

- 1.1 Aviation and Electronics: A Symbiotic RelationshipDocument9 pages1.1 Aviation and Electronics: A Symbiotic RelationshipramchanderNo ratings yet

- File HandlerDocument1 pageFile HandlerramchanderNo ratings yet

- Airbus Safety First Magazine 25Document44 pagesAirbus Safety First Magazine 25ramchanderNo ratings yet

- H175 HelicopterDocument4 pagesH175 HelicopterΑγγελος ΠιλατηςNo ratings yet

- Gns Commlsstoll: IlrrurrrDocument1 pageGns Commlsstoll: IlrrurrrramchanderNo ratings yet

- Monthly Remunaration List DPE EmployeeDocument3 pagesMonthly Remunaration List DPE EmployeeramchanderNo ratings yet

- Ongc Welfare Scheam Hr-ErDocument68 pagesOngc Welfare Scheam Hr-Erramchander100% (1)

- 3rd Sem Ece PDFDocument1 page3rd Sem Ece PDFramchanderNo ratings yet

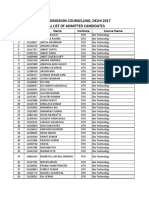

- Joint Admission Counselling, Delhi 2017 Final List of Admitted CandidatesDocument109 pagesJoint Admission Counselling, Delhi 2017 Final List of Admitted Candidatessneh lataNo ratings yet

- Ac - 43-215 FaaDocument11 pagesAc - 43-215 Faaramchander100% (2)

- FACILITIES in ONGC (Updated From Time To Time)Document13 pagesFACILITIES in ONGC (Updated From Time To Time)ramchander100% (1)

- 7th CPC - Ranks of Army Officers & Corresponding Level in Pay Matrix - Central Government Employee News and ToolsDocument5 pages7th CPC - Ranks of Army Officers & Corresponding Level in Pay Matrix - Central Government Employee News and ToolsramchanderNo ratings yet

- AnnexuresDocument22 pagesAnnexuresramchanderNo ratings yet

- Acceptance Orders of Govt On Fifth CPC PDFDocument13 pagesAcceptance Orders of Govt On Fifth CPC PDFramchanderNo ratings yet

- Airbus FAST57 PDFDocument40 pagesAirbus FAST57 PDFrenjithaeroNo ratings yet

- Airbus FAST58 PDFDocument44 pagesAirbus FAST58 PDFJay R SVNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)