Professional Documents

Culture Documents

The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of Capital

Uploaded by

Aditya MukherjeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of Capital

Uploaded by

Aditya MukherjeeCopyright:

Available Formats

THE WM. WRIGLEY JR.

COMPANY:

CAPITAL STRUCTURE, VALUATION

AND COST OF CAPITAL

Group 11

ADITYA MUKHERJEE (M002-16)

ATISHAY JAIN (M012-16)

KOUNIK KUNDU (M027-16)

NEERAJ VERMA (M118-16)

Aurora Borealis LLC pursues an “active investor” strategy where they “identify opportunities for a

corporation restructure, invest significantly in the stock of the target firm and then undertake a

process of persuading management and directors to restructure.” Susan Chandler working for

Aurora Borealis LLC was asked by Blanka Dobrynin to research The Wrigley Company as a potential

investment. Under recapitalisation, Chandler must determine whether The Wrigley Company should

issue an equivalent dividend or repurchase an equivalent amount of shares in order to maximise

shareholder value.

Accordingly, Chandler listed the following findings which are critical to making the decision.

1. Market value of common equity- $13.1bn

2. Borrowing capability- $3bn

3. Credit rating of The Wrigley Company- Between B and BB

4. Yield- 13%

5. Revenue growth rate- 10%

6. Earnings growth rate- 9%

7. Total assets (2001)- $1.76bn

8. Marginal tax rate- 40%

9. Pre-tax cost of debt- 13%

10. Market risk premium- 7%

11. Shares outstanding- 232.441mn

12. Wrigley family ownership- 21% of common stock and 58% of Class B stock

We will try to find out the effect on WACC to identify the effect of leverage on the company finances

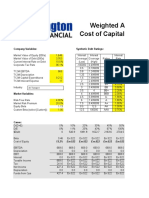

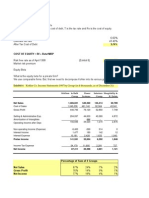

Cost of Equity (Before Recapitalization)

Market Risk Premium 7%

20 Yr Risk free rate 5.65%

Beta 0.75

Ke 10.900%

Share Price 56.37

O/S Shares (in millions) 232.441

Value of Firm (in $ billions)

Value of unlevered Firm 13.10

Debt capacity 3.00

Value of tax shield 1.2

Value of levered Firm 14.30

MV of Equity in levered firm 11.30

Financial Ratio Value Credit Rating

EBIT Interest Coverage 1.41 B

Funds from Operations/Debt 18.82% B

Free Op CF/Debt 15.99% BBB

RoC 21.12% A

Op Income/Sales 21.32% A

LTD/Capital 70.15% BB

Tot Debt/Capital 70.15% BB

From the above table we can see that company has high chances of getting a BB or a BBB rating.

Below we try to compare the effective cost of borrowing for different ratings:

Assumed cost of Debt

Tax Rate 40%

Pre Tax cost of Debt (Rating B) 14.66%

After Tax cost of Debt 8.80%

Pre Tax cost of Debt (Rating BB) 12.75%

After Tax cost of Debt 7.65%

Pre Tax cost of Debt (Rating BBB) 10.89%

After Tax cost of Debt 6.54%

WACC (After Recapitalization)

New D/E 0.265

Levered Beta 0.87

Ke (L) 11.74%

D/V 0.210

E/V 0.790

WACC (as per BBB) 10.65%

WACC (as per BB) 10.88%

WACC (as per B) 11.12%

The above calculations show that:

If the firm gets Credit Rating B, then it’s WACC is more than the cost of equity

If the firm gets Credit Rating BB, then it’s WACC is almost equivalent to cost of equity

If the firm gets Credit Rating BBB, then it’s WACC is less than the cost of equity

If the firm gets a B or BB rating then, it is not a good idea to take a loan as taking Debt is not serving

the intended purpose of reducing the WACC for the firm, while adding unnecessary risk to the

capital structure.

You might also like

- Kohler CompanyDocument3 pagesKohler CompanyDuncan BakerNo ratings yet

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Blue Ocean Strategy - UpdatedDocument61 pagesBlue Ocean Strategy - UpdatedMinhaj Aca50% (2)

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezNo ratings yet

- BerkshireDocument30 pagesBerkshireNimra Masood100% (3)

- Paper Wrigley gr.4Document9 pagesPaper Wrigley gr.4shaherikhkhanNo ratings yet

- TN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalDocument108 pagesTN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalStanisla Lee0% (2)

- Weighted Average Cost of Capital CalculationDocument9 pagesWeighted Average Cost of Capital CalculationinoocentkillerNo ratings yet

- Marriott (2) ..Document13 pagesMarriott (2) ..veninsssssNo ratings yet

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDocument19 pagesThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalMai Pham100% (1)

- Exercises On Designing Data WarehouseDocument5 pagesExercises On Designing Data WarehouseNicholas Kare0% (1)

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- Case 30: Efficient Financing DiscussionsDocument5 pagesCase 30: Efficient Financing Discussionswaldek87No ratings yet

- DamodaranDocument49 pagesDamodaranSukanta ChatterjeeNo ratings yet

- Roche S Acquisition of GenentechDocument34 pagesRoche S Acquisition of GenentechPradipkumar UmdaleNo ratings yet

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- NumericalReasoningTest4 Solutions PDFDocument31 pagesNumericalReasoningTest4 Solutions PDFAlexandra PuentesNo ratings yet

- Boeing's New 7E7 AircraftDocument10 pagesBoeing's New 7E7 AircraftTommy Suryo100% (1)

- UST Debt Recapitalization AnalysisDocument4 pagesUST Debt Recapitalization Analysisstrongchong0050% (2)

- William WrigleyDocument8 pagesWilliam WrigleyRajaram Iyengar100% (2)

- KohlerDocument10 pagesKohleragarhemant100% (1)

- Midland Energy Resources Case Study: FINS3625-Applied Corporate FinanceDocument11 pagesMidland Energy Resources Case Study: FINS3625-Applied Corporate FinanceCourse Hero100% (1)

- WrigleyDocument28 pagesWrigleyKaran Rana100% (1)

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionPedro José ZapataNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Wharton - 2015 Resume BookDocument36 pagesWharton - 2015 Resume BookMy50% (2)

- Sample UFOCDocument18 pagesSample UFOCjyothiullas0% (1)

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- Wrigley Case AnswerDocument4 pagesWrigley Case AnswerYehan MatuilanaNo ratings yet

- Scope & Objectives of Engg. Management PDFDocument7 pagesScope & Objectives of Engg. Management PDFCrystal PorterNo ratings yet

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- Wrigley CaseDocument15 pagesWrigley CaseDwayne100% (4)

- Wm. Wrigley Jr. Company Capital Structure Valuation Cost of CapitalDocument8 pagesWm. Wrigley Jr. Company Capital Structure Valuation Cost of CapitalNicholas Reyner Tjoegito100% (4)

- Worldwide Paper Company: Case Solution Company BackgroundDocument4 pagesWorldwide Paper Company: Case Solution Company BackgroundJauhari WicaksonoNo ratings yet

- Sampa Video: Project ValuationDocument18 pagesSampa Video: Project Valuationkrissh_87No ratings yet

- 4 - 5 Consumption and Investment - Week04-05Document39 pages4 - 5 Consumption and Investment - Week04-05Aldo Situmorang100% (1)

- Sampa VideoDocument24 pagesSampa VideodoiNo ratings yet

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- Wrigley CalculationDocument13 pagesWrigley CalculationAnindito W WicaksonoNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust Incapi-371968794% (16)

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Document6 pagesAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- Blaine-Kitchenware Case CalculationsDocument6 pagesBlaine-Kitchenware Case CalculationsDennis Alexander Guerrero100% (1)

- Corp Finance HBS Case Study: Debt Policy at UST IncDocument4 pagesCorp Finance HBS Case Study: Debt Policy at UST IncTang LeiNo ratings yet

- AirThread Valuation MethodsDocument21 pagesAirThread Valuation MethodsSon NguyenNo ratings yet

- Ch 14-07 Build Elliott's Optimal Capital StructureDocument6 pagesCh 14-07 Build Elliott's Optimal Capital StructureHerlambang Prayoga100% (1)

- Case 5Document15 pagesCase 5Qiao LengNo ratings yet

- 66112438X 2Document12 pages66112438X 2Zayd AhmedNo ratings yet

- Average EV/Sales, EV/EBITDA and P/E Ratios for Automotive CompaniesDocument6 pagesAverage EV/Sales, EV/EBITDA and P/E Ratios for Automotive CompaniesAhmed NiazNo ratings yet

- Case 30 The WM Wrigley J Company QuestionsDocument1 pageCase 30 The WM Wrigley J Company Questionsodie99No ratings yet

- Wm. Wrigley Jr. Co.: Capital Structure, Valuation & Cost of CapitalDocument14 pagesWm. Wrigley Jr. Co.: Capital Structure, Valuation & Cost of Capitalsotki4100% (1)

- SFM Wrigley JR Case Solution HBRDocument17 pagesSFM Wrigley JR Case Solution HBRHayat Omer Malik100% (1)

- Wrigley CaseDocument12 pagesWrigley Caseresat gürNo ratings yet

- The History and Business of Wm. Wrigley Jr. CompanyDocument7 pagesThe History and Business of Wm. Wrigley Jr. CompanySyed Ahmedullah Hashmi100% (1)

- CASE Exhibits - HertzDocument15 pagesCASE Exhibits - HertzSeemaNo ratings yet

- KKTiwari - 18214263 - Worldwide Paper Company-2016Document5 pagesKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNo ratings yet

- California Pizza KitchenDocument4 pagesCalifornia Pizza KitchenMarvi Ahmad100% (2)

- Carter LBODocument1 pageCarter LBOEddie KruleNo ratings yet

- Ugcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCoDocument6 pagesUgcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCotimbulmanaluNo ratings yet

- Wrigley Case GRP 5Document13 pagesWrigley Case GRP 5Kobi Garbrah0% (1)

- Jones Electrical DDocument2 pagesJones Electrical DAsif AliNo ratings yet

- Hertz LBO Questions for Potential BuyersDocument1 pageHertz LBO Questions for Potential BuyerskiubiuNo ratings yet

- WACC Calculation Comparable Companies Unlevered Beta Capital StructureDocument1 pageWACC Calculation Comparable Companies Unlevered Beta Capital StructureIkramNo ratings yet

- Exercises and Answers Chapter 3Document12 pagesExercises and Answers Chapter 3MerleNo ratings yet

- Session 12 (Chap1, 4, 5 of Titman, 2014)Document14 pagesSession 12 (Chap1, 4, 5 of Titman, 2014)Thu Hiền KhươngNo ratings yet

- AE 315 Case Study 1 Curt Manufacturing Solution Support MJBTDocument4 pagesAE 315 Case Study 1 Curt Manufacturing Solution Support MJBTArly Kurt TorresNo ratings yet

- Osjdioahfnlk, MNLKJLDocument10 pagesOsjdioahfnlk, MNLKJLAlex NievaNo ratings yet

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDocument11 pagesManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- American AirlinesDocument12 pagesAmerican AirlinesAditya MukherjeeNo ratings yet

- Making Customers Loyal Through Value CreationDocument4 pagesMaking Customers Loyal Through Value CreationAditya MukherjeeNo ratings yet

- Dynamic Pricing For A Football ClubDocument12 pagesDynamic Pricing For A Football ClubAditya MukherjeeNo ratings yet

- Power DocumentDocument8 pagesPower DocumentAditya MukherjeeNo ratings yet

- Gate SyllabusDocument3 pagesGate Syllabusmurthy237No ratings yet

- Walsh Construction, Rock Ventures Submit Final Jail ProposalsDocument2 pagesWalsh Construction, Rock Ventures Submit Final Jail ProposalsWayne CountyNo ratings yet

- Nestle Letter To State of Ohio Announcing Layoffs in SolonDocument3 pagesNestle Letter To State of Ohio Announcing Layoffs in SolonWKYC.comNo ratings yet

- Human Resource Management Mid-term Chapter ReviewDocument5 pagesHuman Resource Management Mid-term Chapter ReviewChattip KorawiyothinNo ratings yet

- Comprehensive risk management framework for AMMBDocument41 pagesComprehensive risk management framework for AMMBنورول ازلينا عثمانNo ratings yet

- Capital Gains Taxes and Offshore Indirect TransfersDocument30 pagesCapital Gains Taxes and Offshore Indirect TransfersReagan SsebbaaleNo ratings yet

- Vol. 4 Issue 2 FullDocument90 pagesVol. 4 Issue 2 FullOmPrakashNo ratings yet

- PESTEL AnalysisDocument2 pagesPESTEL AnalysisCarly Greatrex50% (2)

- PakistanDocument230 pagesPakistanzahidhussain4uNo ratings yet

- Indian Agriculture - Challenges and OpportunitiesDocument3 pagesIndian Agriculture - Challenges and OpportunitiesLearner84No ratings yet

- Egypt - Trade - European CommissionDocument3 pagesEgypt - Trade - European CommissionTarek ElgebilyNo ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- F.A Foreign AidDocument3 pagesF.A Foreign AidSadia HaqueNo ratings yet

- OutcomeofBoardMeeting10082023 10082023173019Document5 pagesOutcomeofBoardMeeting10082023 10082023173019PM LOgsNo ratings yet

- Public Debt Definition Impacts GrowthDocument4 pagesPublic Debt Definition Impacts GrowthHiền LưuNo ratings yet

- Incatema Agribusiness CapabilitiesDocument14 pagesIncatema Agribusiness CapabilitiesJaimeNo ratings yet

- Chola MS Insurance Annual Report 2019 20Document139 pagesChola MS Insurance Annual Report 2019 20happy39No ratings yet

- Chapter 12 Complex GroupsDocument18 pagesChapter 12 Complex GroupsrhinoNo ratings yet

- SociologyDocument153 pagesSociologyuocstudentsappNo ratings yet

- ACE Variable IC Online Mock Exam - 08182021Document11 pagesACE Variable IC Online Mock Exam - 08182021Ana FelicianoNo ratings yet

- Accounting For InventoryDocument26 pagesAccounting For InventoryOgahNo ratings yet

- Global Supply Chain InfrastructureDocument3 pagesGlobal Supply Chain InfrastructureSreehari SNo ratings yet

- Long-Term Debt, Preferred Stock, and Common Stock Long-Term Debt, Preferred Stock, and Common StockDocument22 pagesLong-Term Debt, Preferred Stock, and Common Stock Long-Term Debt, Preferred Stock, and Common StockRizqan AnshariNo ratings yet