Professional Documents

Culture Documents

Derivatives & Hedging: Required

Uploaded by

Yella Mae Pariña RelosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives & Hedging: Required

Uploaded by

Yella Mae Pariña RelosCopyright:

Available Formats

DERIVATIVES & HEDGING

HEDGING

On December 1, 2016, Yamato Company entered into forward exchange contracts to purchase US $ 1, 000 in 90 days for

delivery on March 1, 2017 for P40.15. The exchange rates available on various dates are as follows:

12/1/16 12/31/16 3/1/17

Spot Rate P40.00 P40.30 P40.20

30-day forward rate P40.05 P40.45 P40.40

60-day forward rate P40.10 P40.40 P40.50

90-day forward rate P40.15 P40.45 P40.60

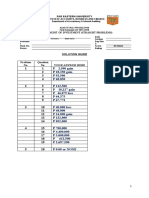

Case 1: EXPOSED LIABILITY

On December 1, 2016, Yamato Company purchased inventory for US $ 1, 000 payable on March 1, 2017

Case 2: UNRECOGNIZED FOREIGN CURRENCY FIRM COMMITMENT – FAIR VALUE HEDGE

On December 1, 2016, Yamato Company to purchase special order goods from New York Company. The contract

meets the requirements of a firm commitment and will take place in 90 days or on March 1, 2017.

Case 3: HEDGE OF A FORECASTED TRANSACTION – CASH FLOW HEDGE

On December 1, 2016, Yamato Company expects to purchase a machine for $ 1, 000 in US on March 1, 2017. The

transaction is probable but there is no binding agreement for this purchase and is to be denominated in dollars.

Case 4: SPECULATION

Yamato Company entered into the forward contract for speculative purposes in anticipation for a gain, and enters

into a contact on December 1, 2016 to acquire US $ 1, 000 on March 1, 2017.

OPTIONS

On December 1, 2016, YOU Company paid P6, 000 to purchase a 90-day put option for FC 400, 000. The option’s purpose

is to hedge an exposed accounts receivable of FC 400, 000 from a sale of merchandise. The merchandise is to be shipped

on December 1, 2016, payment for which is due on March 1, 2017.

Relevant rates and market values at different dates are as follows:

12/1/16 12/31/16 3/1/17

Spot rate (Market price) P1.20 P1.12 P1.13

Strike price (Exercise price) P1.20 P1.20 P1.20

Fair value of Put Option P6, 000 P36, 000 P28, 000

REQUIRED:

Prepare journal entries for the above information.

You might also like

- Foreign Currency TranactionDocument11 pagesForeign Currency TranactionAngelieNo ratings yet

- BE2 Good Governance and Social ResponsibilityDocument25 pagesBE2 Good Governance and Social ResponsibilityYella Mae Pariña RelosNo ratings yet

- Quiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Document6 pagesQuiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Kenneth Christian WilburNo ratings yet

- Quiz 3 ProblemsDocument11 pagesQuiz 3 ProblemsRiezel PepitoNo ratings yet

- TAX 1 - Income Tax - 1Document8 pagesTAX 1 - Income Tax - 1Yella Mae Pariña RelosNo ratings yet

- Foreign CurrencyDocument4 pagesForeign CurrencyDyheeNo ratings yet

- Investment in Debt Securities 2Document4 pagesInvestment in Debt Securities 2dfsdfdsf100% (1)

- Derivatives & HedgingDocument10 pagesDerivatives & HedgingKimberly IgnacioNo ratings yet

- Samplepractice Exam 18 April 2017 Questions and AnswersDocument21 pagesSamplepractice Exam 18 April 2017 Questions and AnswersMAG MAGNo ratings yet

- Problems - Investment in Equity SecuritiesDocument10 pagesProblems - Investment in Equity SecuritiesPrince Calica100% (1)

- May 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyDocument7 pagesMay 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyROMAR A. PIGANo ratings yet

- Accountin 07-07 Cost Acctg 1Document11 pagesAccountin 07-07 Cost Acctg 1Yella Mae Pariña RelosNo ratings yet

- Invent Invest PpeDocument10 pagesInvent Invest PpeLorie Jae DomalaonNo ratings yet

- Wahyudi-Syaputra Assignment-2 Akl-IiDocument4 pagesWahyudi-Syaputra Assignment-2 Akl-IiWahyudi SyaputraNo ratings yet

- FOREX Part1Document1 pageFOREX Part1lender kent alicanteNo ratings yet

- FOREX Part1Document1 pageFOREX Part1misonim.eNo ratings yet

- 3 DERIVATIVES AND HEDGING ACTIVITIES FinalDocument2 pages3 DERIVATIVES AND HEDGING ACTIVITIES FinalCha ChieNo ratings yet

- AfarDocument11 pagesAfarDonna Mae HernandezNo ratings yet

- 07 - Foreign Currency TransactionsDocument5 pages07 - Foreign Currency TransactionsMelody Gumba50% (2)

- Derivatives 2Document4 pagesDerivatives 2Jenelyn Ubanan100% (1)

- Mid Term Advanced Accounting 2 - Negina - 19 April 2021Document2 pagesMid Term Advanced Accounting 2 - Negina - 19 April 2021NybexysNo ratings yet

- 2020-02-ACCA112-OPTION CONTRACT-ILLUS 1 and 2Document7 pages2020-02-ACCA112-OPTION CONTRACT-ILLUS 1 and 2Nicole Anne Santiago SibuloNo ratings yet

- FOREX - LectureDocument4 pagesFOREX - LectureJEP WalwalNo ratings yet

- AFAR 3 AnswersDocument5 pagesAFAR 3 AnswersTyrelle Dela CruzNo ratings yet

- Mock Quiz 3 FAR InvestmentSecutities X InventoriesDocument11 pagesMock Quiz 3 FAR InvestmentSecutities X InventoriesMARISA SYLVIA CAALIMNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- Invent Invest PpeDocument9 pagesInvent Invest PpeRaca DesuNo ratings yet

- ASSIGNMENT 407 - Audit of InvestmentsDocument3 pagesASSIGNMENT 407 - Audit of InvestmentsWam OwnNo ratings yet

- Accounting 30 For SetDocument7 pagesAccounting 30 For SetJennywel CaputolanNo ratings yet

- Forex Exchange Rate Risk Review QuestionsDocument14 pagesForex Exchange Rate Risk Review QuestionsEdga WariobaNo ratings yet

- Handout 3.0 ACP 313 Derivatives and Hedging Accounting - v2Document5 pagesHandout 3.0 ACP 313 Derivatives and Hedging Accounting - v2LOUIEVIE MAY SAJULGANo ratings yet

- Quiz 3 - Problems & SollutionsDocument12 pagesQuiz 3 - Problems & SollutionsRiezel PepitoNo ratings yet

- Illustrative Problems On IAS 2 InventoriesDocument2 pagesIllustrative Problems On IAS 2 InventoriesAnne Marieline BuenaventuraNo ratings yet

- LT Debts Scenarios W Suggested AnswersDocument3 pagesLT Debts Scenarios W Suggested Answerskeisha santosNo ratings yet

- Foreign Currency Transactions-HedgingDocument2 pagesForeign Currency Transactions-HedgingMixx MineNo ratings yet

- Clapton Guitar Company Entered Into The Following Transactions During 2016Document1 pageClapton Guitar Company Entered Into The Following Transactions During 2016Taimur TechnologistNo ratings yet

- Forex PDFDocument5 pagesForex PDFErika LanezNo ratings yet

- FOREX Part3Document2 pagesFOREX Part3misonim.eNo ratings yet

- Effect of Changes in Foreign Currency Exchange RatesDocument5 pagesEffect of Changes in Foreign Currency Exchange RatesArn KylaNo ratings yet

- Forex & DerivativesDocument6 pagesForex & Derivativessarahbee100% (1)

- InvestmentDocument18 pagesInvestmentEmiaj Francinne MendozaNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document20 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesNo ratings yet

- Problem 4: Auditing and Assurance Concepts and ApplicationDocument7 pagesProblem 4: Auditing and Assurance Concepts and ApplicationJasmineNo ratings yet

- May 2020 - AP Drill 3 (Investments and Inventories) - FinalDocument7 pagesMay 2020 - AP Drill 3 (Investments and Inventories) - FinalROMAR A. PIGANo ratings yet

- 2023.05.10 Exercise - Audit of Financing Cycle 2 With Answers-1Document3 pages2023.05.10 Exercise - Audit of Financing Cycle 2 With Answers-1misonim.eNo ratings yet

- Prelim ExamDocument5 pagesPrelim Examdasha limNo ratings yet

- FOREX With HEDGING Recognized Asset and Liab IllustrationsDocument4 pagesFOREX With HEDGING Recognized Asset and Liab IllustrationsLovely Jaze SalgadoNo ratings yet

- Fund and Other Investments & DerivativesDocument4 pagesFund and Other Investments & DerivativesShaira BugayongNo ratings yet

- Equity InvestmentsDocument2 pagesEquity InvestmentsNhajNo ratings yet

- My CoursesDocument23 pagesMy CoursesCasper John Nanas MuñozNo ratings yet

- Accounting 106 Quiz On Forwards, Futures and OptionsDocument1 pageAccounting 106 Quiz On Forwards, Futures and OptionsLee SuarezNo ratings yet

- On July 1 2016 Roland Company Exchanged 18 000 of ItsDocument1 pageOn July 1 2016 Roland Company Exchanged 18 000 of ItsMuhammad ShahidNo ratings yet

- Forex Hedging Handout 1Document9 pagesForex Hedging Handout 1Sheira Mae GuzmanNo ratings yet

- Foreign CurrencyDocument7 pagesForeign CurrencyLoraine Garcia GacuanNo ratings yet

- Notes in Term Bonds and Serial Bonds (Discount or Premium)Document12 pagesNotes in Term Bonds and Serial Bonds (Discount or Premium)Jae GrandeNo ratings yet

- Unit 3 Hedging InstrumentDocument1 pageUnit 3 Hedging InstrumentAndrea BreisNo ratings yet

- EXERCISES Accounting For Foreign Transactions 1Document2 pagesEXERCISES Accounting For Foreign Transactions 1Kimberly IgnacioNo ratings yet

- LT Debts Scenarios W Suggested AnswersDocument4 pagesLT Debts Scenarios W Suggested AnswersSam SalvadorNo ratings yet

- Quiz - Effects of ForexDocument8 pagesQuiz - Effects of ForexVicky CastroNo ratings yet

- C3 Risk ManagementDocument9 pagesC3 Risk Managementtmpvd6gw8fNo ratings yet

- ForexDocument3 pagesForexhotdog kaNo ratings yet

- Cost Behavior: Analysis and Use: Management Accounting (Volume I) - Solutions ManualDocument19 pagesCost Behavior: Analysis and Use: Management Accounting (Volume I) - Solutions ManualYella Mae Pariña RelosNo ratings yet

- The Database AdministratorDocument18 pagesThe Database AdministratorYella Mae Pariña RelosNo ratings yet

- This Is The Parts of Air Compressor After DismantlingDocument5 pagesThis Is The Parts of Air Compressor After DismantlingYella Mae Pariña RelosNo ratings yet

- This Is The Parts of Air Compressor After DismantlingDocument5 pagesThis Is The Parts of Air Compressor After DismantlingYella Mae Pariña RelosNo ratings yet

- That Is The Casing of The Gear PumpDocument3 pagesThat Is The Casing of The Gear PumpYella Mae Pariña RelosNo ratings yet

- MARE 201A Auxiliary Machinery 1Document22 pagesMARE 201A Auxiliary Machinery 1Yella Mae Pariña RelosNo ratings yet

- Scientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysDocument20 pagesScientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysYella Mae Pariña RelosNo ratings yet

- Aline Aprille C. Mendez, MBA: Bachelor of Science in Business Administration Department Fairview, Quezon CityDocument9 pagesAline Aprille C. Mendez, MBA: Bachelor of Science in Business Administration Department Fairview, Quezon CityYella Mae Pariña RelosNo ratings yet

- Mary Elijah P. Relos VI-Matatag Q1 Q2 Q3 Q4 Q5 Total 20% First 10 7 8 6 10 41 8.2 Second 9 10 7 10 7 43 8.6 Third 7 8 6 9 10 40 8 Fourth 8 9 6 10 9 42 8.4Document2 pagesMary Elijah P. Relos VI-Matatag Q1 Q2 Q3 Q4 Q5 Total 20% First 10 7 8 6 10 41 8.2 Second 9 10 7 10 7 43 8.6 Third 7 8 6 9 10 40 8 Fourth 8 9 6 10 9 42 8.4Yella Mae Pariña RelosNo ratings yet

- Mary Elijah P. Relos Vi-Matatag MR - Romando Vedra Math TeacherDocument1 pageMary Elijah P. Relos Vi-Matatag MR - Romando Vedra Math TeacherYella Mae Pariña RelosNo ratings yet

- Business Administration Department: National College of Business and Arts Aline Aprille C. Mendez, MbaDocument2 pagesBusiness Administration Department: National College of Business and Arts Aline Aprille C. Mendez, MbaYella Mae Pariña RelosNo ratings yet

- Approaches in Estimating National Income (Group 4)Document6 pagesApproaches in Estimating National Income (Group 4)Yella Mae Pariña RelosNo ratings yet

- If I Were A VoiceDocument1 pageIf I Were A VoiceYella Mae Pariña Relos100% (1)

- Nfjpia Mockboard 2011 p1 - With AnswersDocument12 pagesNfjpia Mockboard 2011 p1 - With AnswersRhea SamsonNo ratings yet

- Resignation Letter: To: Mr. Arden CabigasDocument1 pageResignation Letter: To: Mr. Arden CabigasYella Mae Pariña RelosNo ratings yet

- KundimanDocument1 pageKundimanYella Mae Pariña RelosNo ratings yet

- TAX 1 - 2nd Sem Income TaxDocument8 pagesTAX 1 - 2nd Sem Income TaxYella Mae Pariña RelosNo ratings yet