Professional Documents

Culture Documents

Contract Coverage Under Title II of The Social Security Act: File Three Copies of This Form

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contract Coverage Under Title II of The Social Security Act: File Three Copies of This Form

Uploaded by

IRSCopyright:

Available Formats

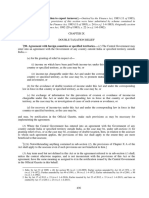

Contract Coverage Under Title II

Form 2032

(Rev. July 2007)

of the Social Security Act

OMB No. 1545-0137

File three copies

For use by an American employer to extend social security coverage to

Department of the Treasury of this form

Internal Revenue Service U.S. citizens and resident aliens employed by its foreign affiliates.

Name of American employer Employer identification number

Address number and street (P.O. Box if no mail delivery to street address) Apt. or suite no.

City, state, and ZIP code

This Form 2032 is filed as (check applicable box(es)):

1 An original (new) agreement.

This agreement is effective for services performed on and after (for original agreements only, check one):

a The first day of the calendar quarter in which the submission processing field director signs this agreement.

b The first day of the calendar quarter following the calendar quarter in which the submission processing field director signs

this agreement.

2 An amendment to an agreement previously entered into.

3 An election to apply the rules in effect after April 20, 1983, to agreements in effect on that date. By making this election,

U.S. resident aliens as well as U.S. citizens will be covered by social security.

If this is an amended election or agreement, provide the following information:

on

(Location where previous Form 2032 was filed) (Date submission processing field director signed original agreement on Form 2032)

4 This agreement extends the federal insurance system under Title II of the Social Security Act to certain services performed outside the

United States by U.S. citizens and resident aliens employed by any of the foreign affiliates listed below. For an amendment to an agreement

without making the election to apply the post-April 20, 1983 rules, this amendment extends Title II social security coverage to certain

services performed outside the United States by U.S. citizens employed by any of the foreign affiliates listed below.

Note. Enter foreign affiliate addresses below in the following order: city, province or state, and country. Do not abbreviate the country

name, and follow the country’s practice for entering the postal code. If this agreement includes more than four foreign affiliates, attach a

separate sheet of paper identified as part of this agreement with the name and address of each additional foreign affiliate.

a Name and address of foreign affiliate c Name and address of foreign affiliate

b Name and address of foreign affiliate d Name and address of foreign affiliate

5 Estimated number of employees to be initially covered by this agreement, amendment, or election:

Nonagricultural employees © Agricultural employees ©

This agreement applies to all services performed outside the United States by each U.S. citizen or resident alien employed by any of the foreign

affiliates named. However, the agreement applies only to the extent that payments to each employee for the services would be considered wages

if paid by the employer for services performed in the United States. This agreement does not apply to any service that is considered employment

for purposes of the employee tax and the employer tax under the Federal Insurance Contributions Act.

For an original agreement, an amendment to an agreement that was entered into after April 20, 1983, or an election to apply the rules in effect after

April 20, 1983, to agreements in effect on that date, the American employer declares that it owns at least a 10% interest (directly or through one or

more entities) in the voting stock or profits of each foreign entity named above. It also declares that section 3121(l) does not prevent this agreement.

For an amendment to an agreement in effect on April 20, 1983, without making the election to apply the new rules in effect after that date, the

domestic corporation declares that (a) it owns at least 20% of the voting stock of each foreign corporation named above, or (b) it owns at least

20% of the voting stock of a foreign corporation that owns more than 50% of the voting stock of each foreign corporation named above. It also

declares that section 3121(l) does not prevent this agreement.

The American employer agrees:

1. To pay amounts equal to the taxes that would be imposed by sections 3101 and 3111 if the payment for the services was considered wages;

2. To pay, on written notification and demand, amounts equal to the interest, additions to taxes, and penalties that would apply if the payment

for the services were considered wages; and

3. To comply with the applicable regulations under section 3121(l).

This agreement (or amended agreement or election) is entered into under the provisions of section 3121(l) of the Internal Revenue Code and the

applicable regulations.

Signature of individual authorized to enter into this Title Date

agreement for the American employer

Field Director, Submission Processing Location Date

For Privacy Act and Paperwork Reduction Act Notice, see back of form. Cat. No. 49954D Form 2032 (Rev. 7-2007)

Form 2032 (Rev. 7-2007) Page 2

What’s New Where To File To extend coverage to any foreign affiliate not

covered by an agreement, indicate the name and

The addresses for filing Form 2032 have Send three copies of this form to: address of the foreign affiliate on line 4 and

changed. See Where To File below. Internal Revenue Service check the box on line 2 for the amended

Ogden, UT 84201-0023 agreement, and the box on line 3 for the

election.

General Instructions An American employer already filing Form 941,

Employer’s Quarterly Federal Tax Return, should Effective date. Generally, the election will be

Section references are to the Internal Revenue file Form 2032 with the Internal Revenue Service effective on the day following the quarter in

Code. where the employer files Form 941 (generally which the election is signed by the field director.

Before April 21, 1983, only domestic their principal place of business). For electronic

corporations could enter into this agreement to Form 941 filers, send Form 2032 to Internal

cover only U.S. citizens employed by foreign Revenue Service, Cincinnati, OH 45999-0038. No Termination of Agreement

subsidiaries. For this agreement, a foreign Enter on Form 2032 the employer identification Once you enter into an agreement, you cannot

subsidiary was defined as a foreign corporation number (EIN) as shown on Form 941. This will terminate it, either in its entirety or with respect

in which: help the IRS process your form faster. to any foreign affiliate. However, the agreement

● at least 20% of the voting stock was owned will terminate for a foreign entity at the end of

by the domestic corporation, or Completing Form 2032 any quarter in which the foreign entity, at any

time in that quarter, ceased to be your foreign

● more than 50% of the voting stock was Complete Form 2032 in triplicate. Each copy of affiliate.

owned by another foreign corporation in which the form must be signed and dated by the

the domestic corporation owned at least 20% of individual authorized to enter into the agreement,

the voting stock. amendment, or election. Attach to each form Privacy Act and Paperwork Reduction Act

After April 20, 1983, any American employer evidence showing the authority for such Notice. We ask for the information on this form

(no longer limited to a domestic corporation) can individual to sign the form. For example, to carry out the Internal Revenue laws of the

enter into this agreement to cover U.S. resident corporations must include a certified copy of the United States. We need it to figure and collect

aliens as well as U.S. citizens employed by a minutes of the board of directors’ meeting. the right amount of tax. Section 6109 requires

foreign affiliate. For this agreement, a foreign After the director signs and dates the form, it you to provide your taxpayer identification

affiliate is any foreign entity (no longer limited to constitutes the agreement, amendment, or number (SSN or EIN). Section 3121 of the

a foreign corporation) in which the American election authorized by section 3121(l). The IRS Internal Revenue Code allows employees of

employer owns at least a 10% interest in the will return one copy of Form 2032 to the foreign affiliates to be covered under social

voting stock or profits. This interest must be American employer, send one copy to the Social security. Routine uses of this information include

owned directly or through one or more entities. Security Administration, and keep one copy with giving it to the Social Security Administration for

A domestic corporation having an agreement all related papers. use in calculating social security benefits, the

in effect that was entered into before April 21, Department of Justice for civil and criminal

Original agreements. Check the box on line 1. litigation, and cities, states, and the District of

1983, can elect to apply the post-April 20, 1983 Also check the applicable box on line 1a or b to

rules to such agreements. If a domestic Columbia for use in administering their tax laws.

designate when the agreement will take effect. We may also disclose this information to federal

corporation makes this election, social security

coverage will be extended to U.S. resident alien Amending agreements. You may amend an and state agencies to enforce federal nontax

employees of any foreign subsidiary for which agreement at any time to extend coverage to criminal laws and to combat terrorism. We may

U.S. citizens are currently covered by an existing any foreign affiliate not covered by an existing also give the information to foreign countries

agreement. In addition, the election allows a agreement. File Form 2032 in triplicate, and under tax treaties. If you want this coverage, you

domestic corporation to extend social security check the box on line 2. If you amend an are required to give us this information. If you fail

and Medicare coverage to U.S. citizens and agreement entered into on or before April 20, to provide this information in a timely manner, or

resident aliens employed by a foreign entity that 1983, without making the election to apply the you provide incorrect or fraudulent information,

did not qualify for coverage under the old 20% rules in effect after that date, the agreement and you may be denied this coverage and you may

ownership rules, but that now qualifies under the amendments will continue to be governed by the be liable for penalties and interest.

10% ownership rules. rules in effect before April 21, 1983. You are not required to provide the

Note. The United States has social security Effective date. If you file an amendment to an information requested on a form that is subject

(totalization) agreements with specific countries. agreement on Form 2032 to include foreign to the Paperwork Reduction Act unless the form

These agreements ensure that social security affiliates not previously covered, and if the field displays a valid OMB control number. Books or

taxes are paid to only one country. However, director signs the amendment during the quarter records relating to a form or its instructions must

these agreements may affect the withholding for which the original agreement is first effective be retained as long as their contents may

requirements resulting from filing Form 2032. For or during the first month following that quarter, become material in the administration of any

more information, see Social Security and the amendment will be effective as of the Internal Revenue law. Generally, tax returns and

Medicare Taxes in Pub. 54, Tax Guide for U.S. effective date of the original agreement. But if return information are confidential, as required

Citizens and Resident Aliens Abroad. the amendment is signed by the field director by section 6103.

Purpose of form. An American employer uses after the end of the 4th month for which the The time needed to complete and file this form

this form to: original agreement is in effect, the amendment will vary depending on individual circumstances.

will not be effective until the first day of the The estimated average time is: Recordkeeping,

● Enter into the agreement specified in 3121(l) to quarter following the one in which the field

extend coverage under Title II of the Social 4 hr., 46 min.; Learning about the law or the

director signed the amendment. form, 35 min.; Preparing and sending the form

Security Act to U.S. citizens and resident aliens

abroad by foreign affiliates, Election to apply post-April 20, 1983 rules. A to the IRS, 42 min. If you have comments

domestic corporation having an agreement in concerning the accuracy of these time estimates

● Amend a previous agreement, or or suggestions for making this form simpler, we

effect that was entered into before April 21,

● Elect to apply the rules in effect after April 20, 1983 (old agreement), may elect to have the would be happy to hear from you. You can write

1983, to agreements in effect on that date. rules in effect after April 20, 1983, apply to the to: Internal Revenue Service, Tax Products

For this agreement, an American employer is old agreement. File Form 2032 in triplicate, and Coordinating Committee, SE:W:CAR:MP:T:T:SP,

an employer that is: check the box on line 3. 1111 Constitution Ave. NW, IR-6406,

● The United States or any instrumentality If you make this election, it will be effective for Washington, DC 20224. Do not send Form 2032

thereof, all foreign entities covered by the agreement. By to this address. Instead, see Where To File

making the election, U.S. resident alien above.

● An individual who is a resident of the United

States, employees as well as U.S. citizen employees will

● A partnership if two-thirds or more of the be covered by the agreement.

partners are residents of the United States,

● A trust if all the trustees are residents of the

United States, or

● A corporation organized under the laws of the

United States or of any state.

Printed on recycled paper

You might also like

- Election To Be Treated As A Possessions Corporation Under Section 936Document2 pagesElection To Be Treated As A Possessions Corporation Under Section 936IRSNo ratings yet

- F 2553Document3 pagesF 2553alpinetigerNo ratings yet

- Hard Word Produces 2002 ISDA MADocument6 pagesHard Word Produces 2002 ISDA MAroy_parNo ratings yet

- Contract With An Individual For Personal Services: The Privacy Act Statement Is Found at The End of This FormDocument2 pagesContract With An Individual For Personal Services: The Privacy Act Statement Is Found at The End of This FormHans Peter Tari HerewilaNo ratings yet

- W-4t Word Format ExampleDocument1 pageW-4t Word Format ExampleFreeman Lawyer100% (1)

- W 4t Word Format Example 2Document1 pageW 4t Word Format Example 2dmpaul32No ratings yet

- w4 VoluntaryDocument1 pagew4 Voluntarycrazybuttful100% (1)

- Statement For Claiming Exemption From Withholding On Foreign Earned Income Eligible For The Exclusion(s) Provided by Section 911Document2 pagesStatement For Claiming Exemption From Withholding On Foreign Earned Income Eligible For The Exclusion(s) Provided by Section 911douglas jonesNo ratings yet

- Exhibitpanelsforconservationexhibit Final PDFDocument28 pagesExhibitpanelsforconservationexhibit Final PDFAvinash waghNo ratings yet

- US Internal Revenue Service: f8878 - 2002Document2 pagesUS Internal Revenue Service: f8878 - 2002IRSNo ratings yet

- Instructions For Form 1042-SDocument37 pagesInstructions For Form 1042-SWalter GuttlerNo ratings yet

- f8832 PDFDocument7 pagesf8832 PDFCC100% (1)

- Fax Numbers For Filing Form 2553 Have ChangedDocument5 pagesFax Numbers For Filing Form 2553 Have ChangedMichael ZambitoNo ratings yet

- IrsnoticeDocument1 pageIrsnoticeRidalyn AdrenalynNo ratings yet

- Securities and Exchange Commission (SEC) - Formn-4Document28 pagesSecurities and Exchange Commission (SEC) - Formn-4highfinanceNo ratings yet

- Voluntary Withholding Agreement: Termination or Withdrawal From W-4 AgreementDocument2 pagesVoluntary Withholding Agreement: Termination or Withdrawal From W-4 Agreementkildea90% (20)

- Form 8832Document7 pagesForm 8832Benne JamesNo ratings yet

- Isda MasterDocument14 pagesIsda MasterChi Yin CheungNo ratings yet

- Securities and Exchange Commission (SEC) - Formf-4Document15 pagesSecurities and Exchange Commission (SEC) - Formf-4highfinanceNo ratings yet

- Contrato Avanzada Progresista (07/18/19)Document8 pagesContrato Avanzada Progresista (07/18/19)TalCualNo ratings yet

- Filing of Resolutions and Agreements To The Registrar Under Section 117Document14 pagesFiling of Resolutions and Agreements To The Registrar Under Section 117Prathap ChowdaryNo ratings yet

- Annex UreDocument2 pagesAnnex UreKunal RajkhowaNo ratings yet

- Formf 6Document5 pagesFormf 6new oneNo ratings yet

- New Mailing Address: The Form You Are Looking For Begins On The Next Page of This File. Before Viewing ItDocument8 pagesNew Mailing Address: The Form You Are Looking For Begins On The Next Page of This File. Before Viewing ItjdNo ratings yet

- Form DGT - Certificate of Domicile of Nonresident (Indonesia WHT) - ExecutedDocument2 pagesForm DGT - Certificate of Domicile of Nonresident (Indonesia WHT) - ExecutedAjuna KaliantigaNo ratings yet

- COSTAR GROUP INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-20Document3 pagesCOSTAR GROUP INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-20http://secwatch.comNo ratings yet

- sd1 EngDocument4 pagessd1 EngGZMO GroupNo ratings yet

- Securities and Exchange Commission (SEC) - Formf-7Document7 pagesSecurities and Exchange Commission (SEC) - Formf-7highfinanceNo ratings yet

- HUD Form 9887Document6 pagesHUD Form 9887DBHAAdminNo ratings yet

- I 8233 VUNGLDocument5 pagesI 8233 VUNGLMarouane AzamiNo ratings yet

- F 8832Document6 pagesF 8832IRS0% (1)

- Application Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Document5 pagesApplication Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Prabhu KnNo ratings yet

- Securities and Exchange Commission (SEC) - Formsb-1Document7 pagesSecurities and Exchange Commission (SEC) - Formsb-1highfinanceNo ratings yet

- It Bare ActDocument4 pagesIt Bare ActAbhinav SwarajNo ratings yet

- Eren v. Commissioner, 4th Cir. (1999)Document7 pagesEren v. Commissioner, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Godrej 24Document77 pagesGodrej 24Rohan BagadiyaNo ratings yet

- Incorporation Form IIDocument4 pagesIncorporation Form IIQasim AkramNo ratings yet

- OMB FARA FormDocument7 pagesOMB FARA FormTitle IV-D Man with a planNo ratings yet

- Guidelines 1702-EX June 2013 PDFDocument4 pagesGuidelines 1702-EX June 2013 PDFRica Rianni GisonNo ratings yet

- Form6 WorkingDocument5 pagesForm6 WorkingMarlon MccarthyNo ratings yet

- Form s3Document18 pagesForm s3kirill.evseev2016No ratings yet

- US Internal Revenue Service: I2555ez - 1997Document3 pagesUS Internal Revenue Service: I2555ez - 1997IRSNo ratings yet

- Generic Ic Disc PresentationDocument55 pagesGeneric Ic Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Unity 4Q22 ReportDocument17 pagesUnity 4Q22 ReportJASON CHOWNo ratings yet

- In Re Sutron Corporation 01062004 Authority For Aar040013COM169529Document13 pagesIn Re Sutron Corporation 01062004 Authority For Aar040013COM169529shreya pooniaNo ratings yet

- Tax InterviewDocument1 pageTax InterviewAbde RahimNo ratings yet

- W 4tDocument1 pageW 4tfredlox92% (13)

- Instructions For Form 8233: (Rev. November 2020)Document6 pagesInstructions For Form 8233: (Rev. November 2020)lika-hasyim-7199No ratings yet

- BORLAND SOFTWARE CORP 8-K (Events or Changes Between Quarterly Reports) 2009-02-23Document19 pagesBORLAND SOFTWARE CORP 8-K (Events or Changes Between Quarterly Reports) 2009-02-23http://secwatch.comNo ratings yet

- Why and Where To Set Up A Foreign Trust For Asset Protectionffjqr PDFDocument3 pagesWhy and Where To Set Up A Foreign Trust For Asset Protectionffjqr PDFshirticicle02No ratings yet

- Ford 2021 Annual ReportDocument218 pagesFord 2021 Annual ReportHoangNo ratings yet

- CoverDocument3 pagesCoverDagmawi ZewdieNo ratings yet

- 18 000029 1Document32 pages18 000029 1BobNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- PRETRIAL Complaint FeTuadlesDocument7 pagesPRETRIAL Complaint FeTuadlesPatricia Nicole BalgoaNo ratings yet

- Doctrine of Separability in IndiaDocument4 pagesDoctrine of Separability in IndiaPolsani Ajit RaoNo ratings yet

- Reyes vs. VitanDocument2 pagesReyes vs. VitanMark Catabijan CarriedoNo ratings yet

- Pale Privileged CommunicationDocument9 pagesPale Privileged CommunicationDiane UyNo ratings yet

- Ground Team Leader Legal IssuesDocument21 pagesGround Team Leader Legal IssuesCAP History Library100% (1)

- Essay On Nationalism in IndiaDocument6 pagesEssay On Nationalism in IndiaPeter ShimrayNo ratings yet

- After Apprehension RPTDocument2 pagesAfter Apprehension RPTPaul Amigo50% (2)

- 2017 Case Digests - Criminal LawDocument233 pages2017 Case Digests - Criminal Lawedrea86% (7)

- Constitutional Law de Agbayani Vs Philippine National Bank G.R. No. L-23127 PDFDocument7 pagesConstitutional Law de Agbayani Vs Philippine National Bank G.R. No. L-23127 PDFJoannMarieBrenda delaGenteNo ratings yet

- People vs. Apduhan (Block B)Document2 pagesPeople vs. Apduhan (Block B)martinmanlod100% (1)

- Solutions EditedDocument2 pagesSolutions Editedpaulinavera100% (1)

- What Is People PowerDocument7 pagesWhat Is People PowerJerica AlondraNo ratings yet

- Republic v. Lee PDFDocument5 pagesRepublic v. Lee PDFJanna SalvacionNo ratings yet

- Tourism and Local Agenda 21 - The Role of Local Authorities in Sustainable TourismDocument64 pagesTourism and Local Agenda 21 - The Role of Local Authorities in Sustainable TourismInnovaPeruConsultingNo ratings yet

- SenateDocument4 pagesSenateJen GaoiranNo ratings yet

- In The Matter of V R Hemantraj Vs Stanbic Bank Ghana LTD & Anr Civil Appeal No.9980-2018 - 2019!01!18 19-37-15Document2 pagesIn The Matter of V R Hemantraj Vs Stanbic Bank Ghana LTD & Anr Civil Appeal No.9980-2018 - 2019!01!18 19-37-15UKNo ratings yet

- Karen Essay ContestDocument2 pagesKaren Essay ContestReenan SabadoNo ratings yet

- Aquino v. Municipality of Malay, AklanDocument2 pagesAquino v. Municipality of Malay, AklanAntonio BartolomeNo ratings yet

- National Law Institute University Bhopal: R. M. D. Chamarbaugwalla The Union of IndiaDocument13 pagesNational Law Institute University Bhopal: R. M. D. Chamarbaugwalla The Union of IndiaSHUBHAM KAMALNo ratings yet

- Impact of Criminal Behaviour in SocietyDocument4 pagesImpact of Criminal Behaviour in Societysmohonto200516No ratings yet

- Contoh Report TextDocument1 pageContoh Report TextRandi naufNo ratings yet

- Alsons Development vs. Heirs of ConfessorDocument16 pagesAlsons Development vs. Heirs of ConfessorRuby Patricia MaronillaNo ratings yet

- Flexi Mock Cat-1Document73 pagesFlexi Mock Cat-1XYZ ANONYMOUSNo ratings yet

- Colonial Legacy, Women's Rights PDFDocument22 pagesColonial Legacy, Women's Rights PDFthayaneNo ratings yet

- LLB Sylabus PDFDocument94 pagesLLB Sylabus PDFrentechsolutionNo ratings yet

- Brown Case and Central CaseDocument13 pagesBrown Case and Central CaseAllenMarkLuperaNo ratings yet

- Laguna Lake Development Authority VDocument2 pagesLaguna Lake Development Authority VErikha AranetaNo ratings yet

- Non-Circumvention - Finder's Fee AgreementDocument3 pagesNon-Circumvention - Finder's Fee AgreementDirectorNo ratings yet

- Formats Nomination Facility DepositorsDocument11 pagesFormats Nomination Facility DepositorsSimran Jeet SinghNo ratings yet

- Gang Stalking Flyer3Document1 pageGang Stalking Flyer3Dan Williams100% (1)