Professional Documents

Culture Documents

Ppbi

Uploaded by

Rupal Rohan DalalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ppbi

Uploaded by

Rupal Rohan DalalCopyright:

Available Formats

Duration:1hr Code: Max 20 Marks

Q.1 Fill in the Blanks (05)

1. RTGS means_____________

2. Overdraft facility is not available to ____________

3. Scheduled banks are included n the scheduled in ____________

4. Banks are ____________ Institution

5. Debit card is known as ____________ card.

Q.2 Answer in One sentence (05)

1. What is banker?

2. What is banking company?

3. What is internet banking?

4. What is Overdraft?

5. What is Credit Card?

Q.3 Attempt Any TWO (10)

1. Explain Function of RBI

2. Write a note on Overdraft.

3. Explain Function of commercial Bank.

Duration:1hr Code: Max 20 Marks

Q.1 Fill in the Blanks (05)

1. RTGS means_____________

2. Overdraft facility is not available to ____________

3. Scheduled banks are included n the scheduled in ____________

4. Banks are ____________ Institution

5. Debit card is known as ____________ card.

Q.2 Answer in One sentence (05)

1. What is banker?

2. What is banking company?

3. What is internet banking?

4. What is Overdraft?

5. What is Credit Card?

Q.3 Attempt Any TWO (10)

1. Explain Function of RBI

2. Write a note on Overdraft.

3. Explain Function of commercial Bank.

Duration:1hr Code: Max 20 Marks

Q.1 Match the column (05)

Group A Group B

1. Current Deposit a) Current Account Holder

2. Fixed Deposit b) Cumulative deposit

3. Pledge c) Time deposit

4. Recurring Deposit d) Demand deposit

5. Overdraft e) Bailment of goods

Q.2 Answer in One sentence (05)

1. What is banking?

2. What is Tele banking?

3. What is Merchant banking?

4. What is Recurring Deposit?

5. What is Factoring?

Q.3 Attempt Any TWO (10)

1. Explain Needs of Bank.

2. Explain Role of RBI.

3. Write a note on co-operative bank.

Duration:1hr Code: Max 20 Marks

Q.1 Match the column (05)

Group A Group B

1. Current Deposit a) Current Account Holder

2. Fixed Deposit b) Cumulative deposit

3. Pledge c) Time deposit

4. Recurring Deposit d) Demand deposit

5. Overdraft e) Bailment of goods

Q.2 Answer in One sentence (05)

1. What is banking?

2. What is Tele banking?

3. What is Merchant banking?

4. What is Recurring Deposit?

5. What is Factoring?

Q.3 Attempt Any TWO (10)

1. Explain Needs of Bank.

2. Explain Role of RBI.

3. Write a note on co-operative bank.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Particulars Amount Refreshment ExpensesDocument2 pagesParticulars Amount Refreshment ExpensesRupal Rohan DalalNo ratings yet

- Money Market Instruments: Write A CommentDocument4 pagesMoney Market Instruments: Write A CommentRupal Rohan DalalNo ratings yet

- Aroma Write Up ProspectusDocument1 pageAroma Write Up ProspectusRupal Rohan DalalNo ratings yet

- ATKT Total StudentsDocument1 pageATKT Total StudentsRupal Rohan DalalNo ratings yet

- Shailendra Education Society's Arts, Science and Commerce College, Dahisar (E), Mumbai 400068 Attendence Month: September 2017Document8 pagesShailendra Education Society's Arts, Science and Commerce College, Dahisar (E), Mumbai 400068 Attendence Month: September 2017Rupal Rohan DalalNo ratings yet

- Cost & Management AccountingDocument5 pagesCost & Management AccountingRupal Rohan DalalNo ratings yet

- A Project Report: On Study of Microfinance (Self-Help Groups)Document7 pagesA Project Report: On Study of Microfinance (Self-Help Groups)Rupal Rohan DalalNo ratings yet

- Equity Investments PPT PresentationDocument80 pagesEquity Investments PPT PresentationRupal Rohan Dalal100% (1)

- Kajal IntroDocument42 pagesKajal IntroRupal Rohan DalalNo ratings yet

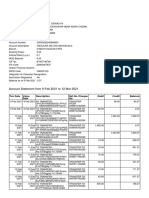

- Account Statement As of 15-03-2018 10:27:08 GMT +0530: TXN Date Value Date Cheque No. Description Debit Credit BalanceDocument1 pageAccount Statement As of 15-03-2018 10:27:08 GMT +0530: TXN Date Value Date Cheque No. Description Debit Credit BalanceRupal Rohan DalalNo ratings yet

- February Attendance 2018Document15 pagesFebruary Attendance 2018Rupal Rohan Dalal0% (1)

- Duration: - 1hr Code: - 20 Marks: ST STDocument2 pagesDuration: - 1hr Code: - 20 Marks: ST STRupal Rohan DalalNo ratings yet

- NISM - VII Question BankDocument56 pagesNISM - VII Question BankRupal Rohan DalalNo ratings yet

- Criterion 1 - Curricular Aspects (100) : 1.1.1 QLM Girish SirDocument6 pagesCriterion 1 - Curricular Aspects (100) : 1.1.1 QLM Girish SirRupal Rohan DalalNo ratings yet

- Study On Training and Development in The Insurance Sector in IndiaDocument14 pagesStudy On Training and Development in The Insurance Sector in IndiaRupal Rohan DalalNo ratings yet

- Service Marketing in Banks PDFDocument67 pagesService Marketing in Banks PDFRupal Rohan DalalNo ratings yet

- Marketing Research of Kodak Picture KioskDocument83 pagesMarketing Research of Kodak Picture KioskPratik LaudNo ratings yet

- A Comparative Study Between Flipkart and Amazon IndiaDocument33 pagesA Comparative Study Between Flipkart and Amazon IndiaRupal Rohan DalalNo ratings yet

- Chapter1: Introduction of Indian BankDocument46 pagesChapter1: Introduction of Indian BankRupal Rohan DalalNo ratings yet

- Praposal For Minor Research Submitted To University of MumbaiDocument5 pagesPraposal For Minor Research Submitted To University of MumbaiRupal Rohan DalalNo ratings yet

- July ATTENDANCE FOR SY N TY CLASSESDocument10 pagesJuly ATTENDANCE FOR SY N TY CLASSESRupal Rohan DalalNo ratings yet

- A Comparative Study Between Flipkart and Amazon IndiaDocument33 pagesA Comparative Study Between Flipkart and Amazon IndiaRupal Rohan DalalNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Module 5 - Fundamental Principles of ValuationDocument55 pagesModule 5 - Fundamental Principles of ValuationTricia Angela Nicolas100% (1)

- Active-Dms-Partner-25032022 BJ Fin PDFDocument700 pagesActive-Dms-Partner-25032022 BJ Fin PDFAmeer PNo ratings yet

- Nism Xiii Common Derivatives Short NotesDocument64 pagesNism Xiii Common Derivatives Short NotesAnsh DoshiNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSeeni Sathish KumarNo ratings yet

- Plagiarism Detector - Originality: Miroljub HadzicDocument206 pagesPlagiarism Detector - Originality: Miroljub HadzicĐorđeHadžićNo ratings yet

- Assignment of Banking LawDocument24 pagesAssignment of Banking LawTOON TEMPLENo ratings yet

- Episode 3 of The Ascent of Money Focuses On The Place Where Shares of Public Listed Companies Are TradedDocument1 pageEpisode 3 of The Ascent of Money Focuses On The Place Where Shares of Public Listed Companies Are Tradeddani qintharaNo ratings yet

- Accounting For Financial ManagementDocument54 pagesAccounting For Financial ManagementEric RomeroNo ratings yet

- Payslip-Fppl e 11 (Amit Deshpande) Oct 2023Document3 pagesPayslip-Fppl e 11 (Amit Deshpande) Oct 2023deshpande8813No ratings yet

- Unit 4: by Ankita UpadhyayDocument65 pagesUnit 4: by Ankita UpadhyayAarushi CharurvediNo ratings yet

- Rupee Max FormccbDocument2 pagesRupee Max FormccbDesikanNo ratings yet

- 5, 6 & 7 Capital BudgetingDocument42 pages5, 6 & 7 Capital BudgetingNaman AgarwalNo ratings yet

- Indebtedness Assumed Exceeds Tax Basis of Property SoldDocument3 pagesIndebtedness Assumed Exceeds Tax Basis of Property SoldJemalyn De Guzman TuringanNo ratings yet

- Flowchart Real Property TaxDocument1 pageFlowchart Real Property TaxPrincess Mae SamborioNo ratings yet

- Financial Markets and InstitutionsDocument28 pagesFinancial Markets and Institutionsmomindkhan100% (4)

- E-Raseed Acknowledgment Receipt: Location: CabinaDocument2 pagesE-Raseed Acknowledgment Receipt: Location: CabinaMahmood AliNo ratings yet

- 2021422953/2/elite Automobiles & Trading Ltd. 8,420.00Document3 pages2021422953/2/elite Automobiles & Trading Ltd. 8,420.00Jamil PinkuNo ratings yet

- Acct Statement - XX8872 - 04022023Document2 pagesAcct Statement - XX8872 - 04022023Avinesh GuptaNo ratings yet

- Account Statement From 9 Feb 2021 To 12 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 9 Feb 2021 To 12 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceABHINAV DEWALIYANo ratings yet

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Financial LiteracyDocument2 pagesFinancial LiteracyLeocila EdangNo ratings yet

- Addendum To SOBC Jan-June 2018Document4 pagesAddendum To SOBC Jan-June 2018Shaza FaizanNo ratings yet

- 2020 Sem 2 EUP222 CAPITAL BUDGETING NOTES PDFDocument104 pages2020 Sem 2 EUP222 CAPITAL BUDGETING NOTES PDFSaiful MunirNo ratings yet

- EFFECT OF FISCAL POLICY STOCK MARKET PERFORMANCE (2) LatestDocument40 pagesEFFECT OF FISCAL POLICY STOCK MARKET PERFORMANCE (2) LatestMajorNo ratings yet

- Compound InterestDocument40 pagesCompound InterestSharmaine BeranNo ratings yet

- BSP Circular 730Document5 pagesBSP Circular 730gmcgarcia2973No ratings yet

- Yorkville Advisors Completes 10M Equity Facility With QuriusDocument2 pagesYorkville Advisors Completes 10M Equity Facility With QuriusYorkvilleAdvisorsNo ratings yet

- Barangay Summary of Supplies and Materials IssuedDocument11 pagesBarangay Summary of Supplies and Materials IssuedAnne Sherly Odevilas50% (2)

- Pecm 1Document131 pagesPecm 1Dharshanth .SNo ratings yet

- Felula Desfealucy - Thesis Presentation PDFDocument12 pagesFelula Desfealucy - Thesis Presentation PDFFelula DesfealucyNo ratings yet