Professional Documents

Culture Documents

Potential Revenue From Regulating Marijuana in Connecticut

Uploaded by

MPPCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Potential Revenue From Regulating Marijuana in Connecticut

Uploaded by

MPPCopyright:

Available Formats

Every

day across Connecticut, individuals purchase marijuana on the unregulated, illegal market.

Marijuana prohibition not only fails to stop these sales, it also prevents the state from realizing tax

revenue on them. This brief analysis estimates the tax revenue Connecticut stands to gain if it replaces

marijuana prohibition with a system of regulation and taxation. These figures are based on 25% tax

rate during an “early sales” period lasting until around January 1, 2020, and then a $50 per ounce

excise tax. Both rates would be in addition to Connecticut’s standard 6.35% sales tax.

As this analysis shows, during the first year, Connecticut can anticipate $71 million in tax

revenue from “early sales.” Once producers and retailers can meet demand, Connecticut can expect

its excise and sales tax revenue from marijuana sales to Connecticut residents to total $166

million per year. The state can also anticipate significant additional tax revenue — quite possibly

matching or exceeding in-state sales — from tourists and visitors until New York and other

neighboring states have regulated sales.1

Annual consumption: Because the adult-use marijuana market in Connecticut is currently

unregulated, it’s impossible to precisely quantify how much marijuana is consumed. This projection

uses federally gathered information to develop an estimate of marijuana consumption. Based on a

February 2014 White House report,2 Americans consume between a low-end estimate of 4,198 metric

tons (MT) and a high-end estimate of 8,396 MT of marijuana each year.3 Averaging those estimates, we

come up with 6,297 MT.

According to a 2014 survey conducted by the National Survey on Drug Use and Health (NSDUH),

270,000 adults in Connecticut reported consuming marijuana in the past month.4 Nationwide, the

NSDUH reported that 20,416,000 adults used marijuana on a monthly basis.5 Thus, Connecticut’s

proportion of marijuana consumers is 1.32% of the total in the U.S.

By applying the proportion of marijuana consumers who live in Connecticut to the nationwide

estimate of total consumption, we estimate that 83.28 MT (2,937,525 ounces) of marijuana are

consumed each year in Connecticut. Of the 270,000 past-month consumers, 23,037 are currently

registered patients,6 or roughly 8.5%. Reducing the projected amount of marijuana consumed in the

state by that figure leaves an estimated 2,686,975 ounces that would be taxed at $50 per ounce.

Importantly, this figure includes only Connecticut’s own residents and excludes the potential tax

windfall from residents of neighboring states, should Connecticut regulate marijuana for adult use

before they do. As a 2015 report the RAND Corporation prepared for Vermont found, the first state to

make marijuana legal in a region could realize far more tax revenue — perhaps even exponentially

more — due to the influx of tourists.7 Notably, Colorado — which borders sparsely populated areas

and thus has a far lower proportion of marijuana consumers within a two hour drive of it than

1 When calculated using the current prices in the Connecticut illicit market the estimate rises to between $121.5 million and $243.million per

year.

2 “What America’s Users Spend on Illegal Drugs: 2000-2010.” Prepared for the Office of National Drug Control Policy by the RAND

Corporation. February 2014.

3 Id. at figure 5.5 (p. 58).

4 https://www.samhsa.gov/data/sites/default/files/1/1/NSDUHsaeConnecticut2014.pdf

5 https://www.samhsa.gov/data/sites/default/files/NSDUHsaeNational2014.pdf

6 http://www.ct.gov/dcp/cwp/view.asp?a=4287&Q=533228&PM=1&dcpNav=|

7 Caulkins, Kilmer, Kleiman, MacCoun, Midgette, Oglesby, Pacula, Reuter, Considering Marijuana Legalization, Insights for Vermont and Other

Jurisdictions, RAND Corporation, 2015.

Connecticut — estimated that in the first nine months of marijuana sales, 90% of sales in mountain

communities and 45% of sales in metro areas were to visitors.8

Long Island and New York City’s populations alone are more than triple Connecticut’s population.

Although Massachusetts and Maine have legalized marijuana for adult use, delays in the launch of their

programs this year allows Connecticut to become the first state east of the Mississippi with an

operational program. If Connecticut is the first — or even one of the first — in the region, visitors

could come from the entire region.

Annual tax revenue: Using Colorado’s marijuana prices, based on a $50 per ounce excise tax and the

state’s 6.35% sales tax, each ounce sold legally in the state would yield around $61.90 in retail taxes.

(The post-tax price to consumers would out-compete the illicit market because most of the cost of

marijuana is due to prohibition. The per-ounce price in Colorado is nearly $100 less than the price of

marijuana in Connecticut.) Based on above estimates for marijuana consumption in Connecticut — and

excluding registered patients — the state could expect approximately $166 million per year in tax

revenue from Connecticut residents once regulated businesses are fully ramped up and meeting

demand. As long as Connecticut has open adult-use stores when neighboring states do not,

revenue could easily double when visitors are taken into account.

This estimate is based on a fully implemented system, which is able to meet demand. Given that

Connecticut has the advantage of being able to learn lessons from other states’ regulations, and that it

already has licensed dispensaries and cultivators that could convert to also serve non-medical

consumers, we anticipate this revenue could be generated by year two if the state moves to promptly

implement the law. To realize the full revenue, it would also be essential to ensure an adequate

number of new cultivators and retailers are licensed.

Early sales tax revenue: We anticipate around $71 million in tax revenue could be raised in year

one by allowing early sales from facilities operated by dispensaries and package liquor stores,

if sales are taxed at a 25% retail excise rate. (This assumes dispensaries would meet 30% of

Connecticut residents’ demand during the first year.)9

This is not a novel ideal: Oregon and Nevada both allowed early sale from dispensaries. However, early

sales should only be allowed to the extent that they do not create shortages for patients or drive up

patient prices.

Licensing revenue: In the first year, the state would generate licensing fees from producers, package

liquor stores, and dispensaries engaged in early sales, as well as applicants for permanent licenses for

testing labs, retailers, product manufacturers, and cultivation facilities.

Additional revenue sources: Taxed and regulated marijuana markets also create additional revenue

sources for the state, including income taxes, and ancillary businesses such as testing labs,

construction, suppliers, accountants, electricians, and many others. A forward-thinking marijuana

policy also encourages more residents to remain in the state, and even induces in-migration,

particularly among those aged 25-30. This results in more economic activity and tax revenue.10

8 See: U.S. Population Density Map (By Counties) https://www.census.gov/dmd/www/pdf/512popdn.pdf

9 If early sales are able to meet 30% of in-state demand (806,067 ounces), at the price of medium-quality street marijuana in Connecticut,

(estimated at $281.04 per ounce) that would be $226.5 million in sales (pre-tax) to non-patients in year one. Applying a 25% excise tax and

then a 6.35% standard sales tax results in $71 million in tax revenue from early sales. The price of marijuana is from PriceofWeed.com.

10 https://merryjane.com/news/are-people-moving-to-canna-legal-states-just-for-weed: A moving company aggregator asked why people

were moving, and found that of 1,500 inbound moves to the eight states where marijuana is legal, five percent volunteered that that was a

reason for moving.

You might also like

- Medical Cannabis Provides An Alternative To OpiatesDocument1 pageMedical Cannabis Provides An Alternative To OpiatesMPPNo ratings yet

- Petition Urging Governors To Protect Medical Cannabis AccessDocument70 pagesPetition Urging Governors To Protect Medical Cannabis AccessMPPNo ratings yet

- MPP Policy Paper - Regulating Cannabis Oil VaporizersDocument7 pagesMPP Policy Paper - Regulating Cannabis Oil VaporizersMPPNo ratings yet

- GQR Connecticut Poll January 2020Document1 pageGQR Connecticut Poll January 2020MPPNo ratings yet

- Marijuana Policy Progress Report 2019 Legislative UpdateDocument28 pagesMarijuana Policy Progress Report 2019 Legislative UpdateMPP100% (3)

- 2020 Vermont Poll ResultsDocument7 pages2020 Vermont Poll ResultsMPPNo ratings yet

- Prescribing Versus Recommending Medical CannabisDocument2 pagesPrescribing Versus Recommending Medical CannabisMPPNo ratings yet

- Medical Cannabis Implementation TimelinesDocument10 pagesMedical Cannabis Implementation TimelinesMPPNo ratings yet

- Decriminalization and Expungement in NY: An Overview of A0840 / S06579Document1 pageDecriminalization and Expungement in NY: An Overview of A0840 / S06579MPPNo ratings yet

- Marijuana Policy Map May 2020Document1 pageMarijuana Policy Map May 2020MPPNo ratings yet

- Severe Pain and Medical CannabisDocument1 pageSevere Pain and Medical CannabisMPPNo ratings yet

- Breakdown of Fees in Adult-Use StatesDocument6 pagesBreakdown of Fees in Adult-Use StatesMPPNo ratings yet

- Simon Poll March 2019Document14 pagesSimon Poll March 2019MPPNo ratings yet

- Medical Marijuana MapDocument1 pageMedical Marijuana MapMPPNo ratings yet

- D.C.'s Medical Marijuana ProgramDocument2 pagesD.C.'s Medical Marijuana ProgramMPPNo ratings yet

- 2018 SIU Paul Simon Public Policy Institute Legalization PollDocument4 pages2018 SIU Paul Simon Public Policy Institute Legalization PollMPPNo ratings yet

- 2017 SIU Paul Simon Public Policy Institute Legalization PollDocument7 pages2017 SIU Paul Simon Public Policy Institute Legalization PollMPPNo ratings yet

- New Jersey Progress ReportDocument2 pagesNew Jersey Progress ReportMPPNo ratings yet

- Progress Report New York Medical Marijuana ProgramDocument2 pagesProgress Report New York Medical Marijuana ProgramMPPNo ratings yet

- What Does Former AG Sessions' Marijuana Enforcement Memo Mean in Practice?Document2 pagesWhat Does Former AG Sessions' Marijuana Enforcement Memo Mean in Practice?MPPNo ratings yet

- Medical Marijuana by The NumbersDocument2 pagesMedical Marijuana by The NumbersMPPNo ratings yet

- Expungement: Removing The Life-Long Stigma Caused by Marijuana ProhibitionDocument1 pageExpungement: Removing The Life-Long Stigma Caused by Marijuana ProhibitionMPPNo ratings yet

- Maryland Progress ReportDocument2 pagesMaryland Progress ReportMPPNo ratings yet

- U.S. Attorneys' Comments Post Cole Memo RecissionDocument8 pagesU.S. Attorneys' Comments Post Cole Memo RecissionMPPNo ratings yet

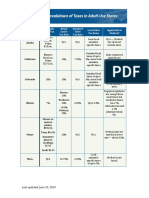

- Breakdown of Taxes in Adult-Use StatesDocument2 pagesBreakdown of Taxes in Adult-Use StatesMPPNo ratings yet

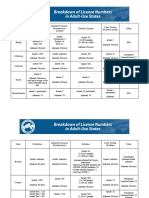

- Breakdown of License Numbers in Adult-Use StatesDocument2 pagesBreakdown of License Numbers in Adult-Use StatesMPPNo ratings yet

- Sessions Asks Congress To Undo Medical Marijuana ProtectionsDocument3 pagesSessions Asks Congress To Undo Medical Marijuana ProtectionsMPPNo ratings yet

- Revenue From Adult Use StatesDocument5 pagesRevenue From Adult Use StatesMPPNo ratings yet

- Safe, Legal Access To Marijuana Can Help Fight The Opioid EpidemicDocument1 pageSafe, Legal Access To Marijuana Can Help Fight The Opioid EpidemicMPPNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Authority MBADocument26 pagesAuthority MBADhruba Jyoti GogoiNo ratings yet

- Putul Nacher Itikotha by Manik Bandopadhy PDFDocument123 pagesPutul Nacher Itikotha by Manik Bandopadhy PDFSharika SabahNo ratings yet

- "Sanctuary Cities" and Community PolicingDocument3 pages"Sanctuary Cities" and Community PolicingPublic Information OfficeNo ratings yet

- Nations and NationalismDocument6 pagesNations and NationalismSupriyaVinayakNo ratings yet

- US Institute of PeaceDocument25 pagesUS Institute of PeaceAyush PandeyNo ratings yet

- Prof Rehman Sobhan's Two Economies To 2 NationsDocument2 pagesProf Rehman Sobhan's Two Economies To 2 NationsMohammad Shahjahan SiddiquiNo ratings yet

- Meralco Vs Castro Bartolome DigestDocument2 pagesMeralco Vs Castro Bartolome Digestkarljoszef50% (2)

- Philippine Studies and Pilipinolohiya: Two Heuristic Views in The Study of Matters FilipinoDocument3 pagesPhilippine Studies and Pilipinolohiya: Two Heuristic Views in The Study of Matters FilipinoMiguel CameroNo ratings yet

- Reviewer in Administrative Law by Atty SandovalDocument23 pagesReviewer in Administrative Law by Atty SandovalRhei BarbaNo ratings yet

- Denise Meyerson Jurisprudence - Chapter 5Document21 pagesDenise Meyerson Jurisprudence - Chapter 5Busi MhlongoNo ratings yet

- 1st Batch Crim Rev - Cases 1 To 45 (Complete)Document57 pages1st Batch Crim Rev - Cases 1 To 45 (Complete)Rio Vin100% (1)

- United States Court of Appeals, Fourth CircuitDocument8 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- The Two Nation TheoryDocument6 pagesThe Two Nation TheoryMehr Shah82% (17)

- JDR Intellectual Property CasesDocument39 pagesJDR Intellectual Property CasesMary Grace Dionisio-RodriguezNo ratings yet

- Tutorial CPCDocument4 pagesTutorial CPCAkmal Safwan100% (1)

- Implementing Community Policing in Nigeria - 1Document23 pagesImplementing Community Policing in Nigeria - 1AustinIwarNo ratings yet

- Show Cause Notice: Government of PakistanDocument3 pagesShow Cause Notice: Government of PakistanFAIZ AliNo ratings yet

- Pol607 Question Bank - International Relations - II R20, March 25-3-2023Document4 pagesPol607 Question Bank - International Relations - II R20, March 25-3-2023Kavya ReddyNo ratings yet

- COM 4 HSC - Korean WarDocument10 pagesCOM 4 HSC - Korean Warmanthan pujaraNo ratings yet

- Stout v. Jefferson County (Alabama) - Doc 1001 - AttachmentsDocument385 pagesStout v. Jefferson County (Alabama) - Doc 1001 - AttachmentsTrisha Powell CrainNo ratings yet

- 27-08-2017 - The Hindu - Shashi Thakur - Link 2Document41 pages27-08-2017 - The Hindu - Shashi Thakur - Link 2AKshita LaNiNo ratings yet

- Pakistan International Airlines vs. Ople 190 SCRA 1990 GR 61594 September 28 1990Document1 pagePakistan International Airlines vs. Ople 190 SCRA 1990 GR 61594 September 28 1990Kiara ChimiNo ratings yet

- KarenDocument2 pagesKarenMay Cuales AutencioNo ratings yet

- Damodaram Sanjivayya National Law University Viskhapatnam, A.P, IndiaDocument24 pagesDamodaram Sanjivayya National Law University Viskhapatnam, A.P, IndiaSwetha PolisettiNo ratings yet

- Articles of Incorporation - Alpha Sigma LexDocument4 pagesArticles of Incorporation - Alpha Sigma LexBianca PastorNo ratings yet

- Phoenix Journal #187: by Gyeorgos Ceres HatonnDocument133 pagesPhoenix Journal #187: by Gyeorgos Ceres HatonnMeckanicNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnJulie Payne-King100% (2)

- Vitug vs. Court of Appeals 183 SCRA 755, March 29, 1990Document2 pagesVitug vs. Court of Appeals 183 SCRA 755, March 29, 1990TEtchie TorreNo ratings yet

- This Is The OneDocument5 pagesThis Is The Oneapi-193697950No ratings yet

- Contractual Obligations - Legal AspectsDocument20 pagesContractual Obligations - Legal AspectsGeramer Vere DuratoNo ratings yet