Professional Documents

Culture Documents

Rockwell DR Apr 2013 Fighter Radars Finally Going AESA Aerospace America PDF

Uploaded by

Luiz AlvesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rockwell DR Apr 2013 Fighter Radars Finally Going AESA Aerospace America PDF

Uploaded by

Luiz AlvesCopyright:

Available Formats

Fighter radars finally going AESA

JUST AS THIS COLUMN WENT TO PRESS The U.S. fighter radar market will

sequestration kicked in, which means grow substantially with increasing JSF

some major programs will see reduced production in the second half of our

funding. However, delays in F-35 JSF forecast, but for the next few years the

‘production’ over the past several Air Force F-15 and Navy F/A-18E/F

years have probably already helped will be worth equal or larger shares of

more than hindered active electron- the market. The F-22 Raptor radar—the

ically scanned array (AESA) radar de- first major production fighter AESA—

velopment for fighter aircraft. In the will soldier on for decades. But low- F-35

past year, the USAF was finally forced cost AESA antenna upgrades for hun-

to fund major upgrades to existing dreds or even thousands of U.S. and

F-15 and F-16 aircraft, which will re- international F-16s are likely to be craft. In mid-2011, the APG-81 and

main the backbone of the Air Force worth a relatively small sliver of the Northrop’s AN/AAQ-37 electrooptical

for decades, with or without JSF. overall market, as technological matu- distributed aperture system (EODAS)

AESA antennas comprise a matrix rity and competition between North- aboard CATBird participated in North-

of individual active transmit/receive rop Grumman and Raytheon keep to- ern Edge 2011 exercises. In early 2012,

modules—mini-radars—that can be tal values down. the APG-81 and EODAS detected,

configured electronically to scan mul- tracked, and targeted multiple rocket

tiple targets and switch between them JSF delays and legacy upgrades launches during NASA’s ATREX

almost instantaneously. By contrast, Designed from the start for air-to- (anomalous transport rocket experi-

mechanically scanned array antennas ground missions, and given its lesser ment) event at Wallops Island, Vir-

must physically rotate to change field power, the JSF will carry an integrated ginia. Reportedly, the APG-81 contin-

of regard, and can typically track tar- AESA radar and sensor system. These uously tracked missiles most of the

gets with only a single beam. AESAs will have shorter range but greater ca- time, with EODAS repeatedly losing

also are expected to have reduced fail- pabilities than Northrop Grumman/ and reacquiring the simulated ballistic

ure rates and maintenance require- Raytheon’s F-22 AN/APG-77 (though missiles. The APG-81 has still not been

ments compared to complex mechan- the first Increment 3.1 F-22 was de- effectively tested aboard a JSF aircraft.

ical antennas, and to provide ‘graceful ployed in early 2012, adding an air-to- A major reason for JSF delays—es-

degradation’ in the event of damage ground synthetic aperture radar, or pecially in integrating diverse systems

or partial system failure. SAR, mode). aboard the actual aircraft—is the mas-

Northrop Grumman’s MIRFS (mul- sive amount of new software code

tifunction integrated RF system) is the needed for the plane’s truly integrated

integrated avionics system in develop- avionics/sensors/electronics systems.

ment for JSF since 1996, with the In April 2012, Mark Maybury, chief sci-

company’s AN/APG-81 AESA multi- entist of the Air Force, claimed that

function nose array the most impor- 90% of JSF functionality will be cyber-

tant and expensive sensor. It will pro- based, compared with 70% for the

vide near-simultaneous air-to-ground F-22, 60% for the B-2, and 20% for the

and air-to-air radar modes, as well as F-15.

high-gain electronic support measures Even getting sensor data off board

and electronic attack jamming func- raises new complexities. Harris’s low-

tions. The X-band APG-81 will also in- observable MADL (multifunction ad-

teract with other frequency band an- vanced data link) was designed specif-

tennas in apertures around the ically for the JSF, and will limit data

stealthy JSF. transference to other JSFs within a for-

In January 2009, Lockheed Martin mation or designated MADL-equipped

completed the first JSF with a com- command and control elements. This

plete mission system. In June 2009, will create a new form of ‘stovepiping’

The AN/APG-81 AESA will provide near-simultaneous

air-to-ground and air-to-air radar modes for the Northrop Grumman began APG-81 just as international militaries are seek-

Joint Strike Fighter. test flights aboard its CATBird test air- ing fully networked C4ISR.

22 AEROSPACE AMERICA/APRIL 2013

begin low-rate initial production

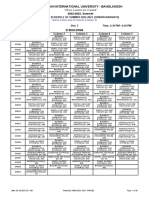

FIGHTER RADAR MARKET FORECAST (LRIP) of Raytheon’s AESA AN/APG-

RDT&E+Procurement available to the U.S. 82(V)1 radar system. As of late 2012,

APG-82 operational testing was set to

$2.5 begin in March, with the first produc-

tion installations slated for early FY14.

F-15C/Ds are already getting Raytheon

2.0 AESA AN/APG-63(V)3 upgrades.

The international F-15 AESA mar-

ket has also become remarkably ro-

FY13 $billions

1.5 bust, following Singapore’s pioneering

purchase of the APG-63(V)3 for its

F-15SGs. In March 2012, the Air Force

1.0 awarded $11.4 billion to Boeing for 84

new F-15SA fighter aircraft, systems,

and munitions for Saudi Arabia. An

0.5 additional $18 billion will go to up-

grading 70 older Saudi F-15S aircraft,

as well as support services.

0.0 All these various APG-63/82 up-

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 grades should be worth more than $4

F-16 AESA F-22 (APG-77) JSF (APG-81) billion in our forecast period, making

F-15 (APG-63/82) Other

F-15 radars one of the world’s largest

F-18 (APG-79) CAGR 12.1% (FY13–FY18); 6.2% (FY13–22)

radar programs over the next 10 years.

The service waited longer before

JSF’s stealthy role could backfire in capability until next decade. Until contracting F-16 AESA upgrades. This

operational terms, if it proves ineffi- then, JSF could remain a very expen- is perhaps because Northrop Grum-

cient for ‘non-near-peer’ conflicts. So sive 700-kt scout plane (with little abil- man’s AN/APG-68 is a newer system

far, only Israel has been approved to ity to get sensor data off-board, al- than F-15 radars, with the latest (V)9

install its own radio, data link, and though Link-16 was

electronic warfare systems. Radars and tested in 2012), and the

most systems for most users will re- Air Force is finally fund-

main unique JSF systems with little in- ing billions of dollars of

ternational variability. Once produc- AESA radar upgrades for

tion is under way, expect Northrop its functional fighters.

Grumman to profit mightily from the In September 2012,

APG-81. USAF planners discussed

But JSF travails continued this year, how many existing air-

with the possibility of major program craft the Air Force ex-

delays or reductions. Software devel- pects to keep in service

opment continues to fall behind even through 2030, as JSF pro-

restructured schedules; less than 10% curement rates remained

of limited combat capability software uncertain. Up to 249

(Block 2B) was available for integra- F-15C/Ds could be re-

tion and testing by late 2012, accord- tained, with at least 175

ing to a report by the DOD’s director to be kept until 2035, and

of operational test and evaluation possibly all 249. The 220-

(DOT&E). Block 2B is the first soft- aircraft F-15E fleet will fly

ware with any weapons capability. through 2030. And all

Block 3F (full combat capability) is to will likely now get new

enter 33 months of flight testing in AESA radars.

early 2014, but has made “virtually no In September 2011,

progress,” according to the DOT&E. the Air Force granted the

With these delays, the Air Force F-15E Radar Moderniza- Northrop Grumman is offering the SABR (top) for the F-16 upgrade,

might have no significant JSF combat tion Program approval to while Raytheon is proposing the RACR.

AEROSPACE AMERICA/APRIL 2013 23

FIGHTER RADAR MARKET SHARE Libya campaign). Although Northrop’s

RDT&E+Procurement available to the U.S. mechanically scanned APG-68 radar is

still in production for new F-16s, Ray-

FY13 $billions theon so far seems at only a small dis-

100%

advantage in offering its own antenna,

as it is currently producing many more

80%

AESA systems than Northrop, with

APG-63/79/82 production ongoing.

The F-16 AESA upgrade market

could be huge, with production possi-

60%

bly in the thousands. But it is too early

to forecast with confidence—will there

be continuing competitions, or will

40%

Northrop or Raytheon dominate? Will

an initial USAF/South Korea/Taiwan

buy knock one or the other out of fu-

20%

ture competitions? AESA upgrades for

USAF F-15s have so far been ex-

tremely expensive, with $8 million or

0%

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22

more funded for each upgrade—con-

siderably more than a complete new-

build radar a few years ago. If SABR

Northrop Grumman Raytheon Available Lockheed Martin [scant] and RACR genuinely provide ‘drop-in’

flight-line retrofit antennas, and if Se-

lex, Elta, and others also offer viable

versions still in production for foreign their AESA radar. Korea plans to up- alternatives, can these upgrades cost

military sales (including an $88-million grade about 134 KF-16C/Ds. Taiwan more than the $2 million we have es-

contract in June 2012 for 43 radars for will upgrade about 146 Block 20 timated (when the Selex Vixen 500E

Thailand, Oman, and Iraq), and a total F-16A/Bs, with its first upgraded air- AESA radar costs only $3 million for

of more than 2,500 APG-68s delivered craft to be delivered in 2021. In Au- the entire system)?

worldwide. But in June the Air Force gust 2012, Seoul surprisingly chose If not, then the total funding for

finally approved an acquisition strat- BAE Systems to conduct its upgrade APG-68 AESA upgrades will really not

egy to “mitigate [JSF] fielding delays” (for an initial $1.1 billion) instead of be great, certainly not as much as a

with their F-16 CAPES (combat avion- Lockheed Martin (with an initial $1.85 major program like the APG-77 or

ics programmed extension suite) pro- billion from Taiwan). That opened the APG-81, and profit margins will be

gram, the heart of which will be a new possibility of a split F-16 AESA market low. Guaranteed noncompetitive radar

AESA radar. and of reinjecting some much-needed programs such as the F-35 JSF will

Plans call for a five-year, $330-mil- competition for future international continue to earn much more money.

lion CAPES development program; programs. For the first round of USAF/South

$1.64 billion will be allotted for an ini- Korea/Taiwan F-16 AESA buys, some

tial USAF procurement of 300 F-16s, SABR and RACR reports indicate Northrop Grumman’s

with installations from 2018 through A winner for this first (and probably SABR may be the Air Force’s preferred

2022. The service does not yet plan to biggest) round of USAF/South Korea/ choice, apparently because of lower

upgrade their 700 other in-service Taiwan F-16 AESA buys will report- expected costs compared to RACR. We

F-16s, but we suspect a large portion edly be chosen this year or in 2014. It provide a speculative forecast, without

will get CAPES, and foreign military will be either Northrop Grumman’s picking a winner.

sales are also highly likely. In an effort SABR (scalable agile beam radar) or

to speed development, the Air Force Raytheon’s RACR (Raytheon advanced Super Hornet and Raytheon

has named Lockheed Martin the sole combat radar). Raytheon’s APG-79 AESA radar was

qualified source for this upgrade, but RACR is derived from the APG-79 developed for the Navy F/A-18E/F, for

the radar has not yet been chosen. AESA antenna on the Super Hornet. new builds and as a retrofit replace-

Immediately following the USAF’s SABR is based on Northrop Grum- ment for the AN/APG-73. It provides

CAPES decision, in July 2012, South man’s AN/APG-80 on UAE Block 60 F- increased detection and tracking ranges

Korea and Taiwan both agreed to ma- 16s (in early 2012, the company (vs. the mechanically scanned APG-

jor F-16 upgrade deals of their own. claimed its APG-80 as the first produc- 73), multitarget tracking, a SAR mode,

These will be managed by the Air tion AESA in combat, operationally and preplanned product improve-

Force, with the U.S. allowed to choose deployed aboard UAE F-16s in the ments. The latter includes a jamming

24 AEROSPACE AMERICA/APRIL 2013

function to supplement the Super Hor- with Singapore about AESA radar up-

net’s IDECM (integrated defense elec- grades for its air force’s F-16C/Ds.

tronic countermeasures) suite. Raytheon supplied APG-63(V)3 AESA

The first LRIP radar was delivered radars for Singapore’s F-15SG.

for flight testing in January 2005, with

full-rate production approved in July Northrop/Raytheon duopoly

2007. The Navy’s current plans have Preceding the APG-79 was Raytheon’s

the APG-79 equipping more than 500 AN/APG-63(V)2 AESA, produced in

Super Hornets, including EA-18G limited numbers for USAF F-15Cs and

Growler electronic attack aircraft, but arguably the first fighter AESA radar

this number could easily rise. In early (Japan’s F-2 J/APG-1 also claims that

2011, Boeing and the Navy marked honor). With major production pro-

delivery of the 500th Super Hornet to grams today for the F-15C/D, F-15E,

the service’s tactical aircraft fleet. In and Super Hornet, Raytheon has been

March 2011, Raytheon delivered the the market leader since last decade, at The APG-79 AESA was developed for the Navy

250th APG-79 to Boeing. In February least in terms of numbers. But with JSF F/A-18E/F.

2012, Raytheon reported that its man- alone, Northrop Grumman will soon

ufacturing facility in Forest, Missis- surpass Raytheon in funding value, what if F-16 costs are greater than an-

sippi, was producing up to six radars ramping up to a potentially dominant ticipated, but Northrop will likely win

a month, and is capable of doubling position by the end of this decade. at least half of future F-16 funding, if

that rate. Total APG-79 program costs Even if Raytheon wins the bulk of only because it has built all 2,500+ of

could reach or exceed $6 billion. future F-16 AESA upgrades, we do not the APG-68s to be upgraded.

In February 2012, reports indicated see how this situation could change. David R. Rockwell

Raytheon had been in discussions Available funding could grow some- drockwell@tealgroup.com

AIAA Guidance, Navigation,

and Control Conference 199–22

22 A

August

Marriott

M

st 201

2013

ott Boston Copley Place

Plac

Boston,n Massach

Massachusettss

AIAA Atmospheric Flight

Mechanics Conference FOR MORE INFORMATION

AND TO REGISTER GO TO:

AIAA Modeling and Simulation www.aiaa.org/boston2013AA

Technologies Conference JOIN THE CONVERSATION

ON TWITTER:

#aiaaGNC

AIAA Infotech@Aerospace 2013 SPONSORSHIP AND EXHIBIT

Conference OPPORTUNITIES

Contact:

Merrie Scott

Phone: +1.703.264.7530

Email: merries@aiaa.org

CONFERENCE OVERVIEW

Four conferences will combine in 2013 to provide the world’s premier

forum for presentation, discussion, and collaboration of science,

research, and technology inthese highly related aerospace fields.

AEROSPACE AMERICA/APRIL 2013 25

You might also like

- SPAviation 2008-03Document36 pagesSPAviation 2008-03Luiz AlvesNo ratings yet

- Tender Enquiry (Press Tender) : Page: 1 of 5Document38 pagesTender Enquiry (Press Tender) : Page: 1 of 5Luiz AlvesNo ratings yet

- Ada 294714Document156 pagesAda 294714Luiz AlvesNo ratings yet

- Hunter J May 2013 Extending The Viper USAF F 16 Upgrades in Detail Combat Aircraft Vol 14 No 5Document6 pagesHunter J May 2013 Extending The Viper USAF F 16 Upgrades in Detail Combat Aircraft Vol 14 No 5Luiz AlvesNo ratings yet

- Defending: Naval BasesDocument16 pagesDefending: Naval BasesLuiz AlvesNo ratings yet

- SPAviation 2010-09Document48 pagesSPAviation 2010-09Luiz AlvesNo ratings yet

- SPAviation 2010-09Document48 pagesSPAviation 2010-09Luiz AlvesNo ratings yet

- Ruivo J Aug 2011 Portugal S Potent Punch Combat Aircraft Vol 12 No 8 PDFDocument4 pagesRuivo J Aug 2011 Portugal S Potent Punch Combat Aircraft Vol 12 No 8 PDFLuiz AlvesNo ratings yet

- Air Force Radar HistoryDocument60 pagesAir Force Radar HistoryCAP History Library100% (5)

- Air Force Radar HistoryDocument60 pagesAir Force Radar HistoryCAP History Library100% (5)

- Grant S 1998 The Radar Game Understanding Stealth and Aircraft Survivability IRIS Independent Research PDFDocument59 pagesGrant S 1998 The Radar Game Understanding Stealth and Aircraft Survivability IRIS Independent Research PDFLuiz Alves100% (1)

- US Department of Transportation 2013 Highway Functional Classification PDFDocument70 pagesUS Department of Transportation 2013 Highway Functional Classification PDFLuiz AlvesNo ratings yet

- Aircraft Runway LengthDocument43 pagesAircraft Runway LengthLuiz AlvesNo ratings yet

- Star Wars - Timeline Gold 46xDocument295 pagesStar Wars - Timeline Gold 46xjamesmccrae75% (4)

- Rockwell DR Apr 2013 Fighter Radars Finally Going AESA Aerospace America PDFDocument4 pagesRockwell DR Apr 2013 Fighter Radars Finally Going AESA Aerospace America PDFLuiz AlvesNo ratings yet

- A Simple Correction For Slug Tests in Small Diameter Wells PDFDocument5 pagesA Simple Correction For Slug Tests in Small Diameter Wells PDFLuiz AlvesNo ratings yet

- CPT For RookiesDocument7 pagesCPT For RookiesLuiz AlvesNo ratings yet

- Análise de Incerteza de Cenários de Bombeamento e Tratamento em Áreas ContaminadasDocument18 pagesAnálise de Incerteza de Cenários de Bombeamento e Tratamento em Áreas ContaminadasLuiz AlvesNo ratings yet

- Standard Penetration TestDocument8 pagesStandard Penetration TestRodneyXerri100% (1)

- Subsurface Exploration Using The Standard Penetration Test and The Cone Penetrometer TestDocument19 pagesSubsurface Exploration Using The Standard Penetration Test and The Cone Penetrometer TestDeepak Kumar MallickNo ratings yet

- 031 - Campaign Series - Yarmuk 636 AD. The Muslim Conquest of SyriaDocument93 pages031 - Campaign Series - Yarmuk 636 AD. The Muslim Conquest of SyriaLuiz Alves100% (8)

- Evaluating The In-Situ Hydraulic Conductivity of Soft Soil Under Land Reclamation Fills With BAT PermeameterDocument8 pagesEvaluating The In-Situ Hydraulic Conductivity of Soft Soil Under Land Reclamation Fills With BAT PermeameterLuiz AlvesNo ratings yet

- Evaluating The In-Situ Hydraulic Conductivity of Soft Soil Under Land Reclamation Fills With BAT PermeameterDocument8 pagesEvaluating The In-Situ Hydraulic Conductivity of Soft Soil Under Land Reclamation Fills With BAT PermeameterLuiz AlvesNo ratings yet

- Aquifers of the Upper Tietê River Basin: Water Availability and Vulnerability to PollutionDocument8 pagesAquifers of the Upper Tietê River Basin: Water Availability and Vulnerability to PollutionScott MeyerNo ratings yet

- 2) Annex I - List of GoodsDocument1 page2) Annex I - List of GoodsLuiz AlvesNo ratings yet

- CPT For RookiesDocument7 pagesCPT For RookiesLuiz AlvesNo ratings yet

- Performance of Levee Underseepage Controls: A Critical ReviewDocument52 pagesPerformance of Levee Underseepage Controls: A Critical ReviewLuiz AlvesNo ratings yet

- Microcrack Pattern Propagations and Rock Quality Designation of Batu CavesDocument14 pagesMicrocrack Pattern Propagations and Rock Quality Designation of Batu CavesLuiz AlvesNo ratings yet

- CPT For RookiesDocument7 pagesCPT For RookiesLuiz AlvesNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- S. No Sales Invopanel Date Order No. Sub Order Customer NameDocument75 pagesS. No Sales Invopanel Date Order No. Sub Order Customer NameDeepesh AgarwalNo ratings yet

- Basic PLC VDEE 2Document70 pagesBasic PLC VDEE 2Lawrence DataNo ratings yet

- Ikw75n60t TeslaDocument14 pagesIkw75n60t TeslaRaduNo ratings yet

- Ls 33600 DatasheetDocument2 pagesLs 33600 DatasheetSilviu TeodoruNo ratings yet

- Holiday Homework for Class XII - Summary of AssignmentsDocument15 pagesHoliday Homework for Class XII - Summary of AssignmentsIshaan SharmaNo ratings yet

- 2007 RAM 1500 3.7L V6 P0509 IAC Valve Circuit HighDocument4 pages2007 RAM 1500 3.7L V6 P0509 IAC Valve Circuit HighWillie AustineNo ratings yet

- NCS TIB 85-10 Vol2Document142 pagesNCS TIB 85-10 Vol2celticfyrNo ratings yet

- Day 3 Slot 3 Mid Sm23 SummerDocument32 pagesDay 3 Slot 3 Mid Sm23 SummerNayeem SarkarNo ratings yet

- Chapter7 Refractometry - Book PartialDocument18 pagesChapter7 Refractometry - Book PartialVallik TadNo ratings yet

- Testing Procedure of Three Phase TransformerDocument9 pagesTesting Procedure of Three Phase TransformerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- HJC X2 Durable Film Capacitor THB Heavy DutyDocument22 pagesHJC X2 Durable Film Capacitor THB Heavy DutySignal AgulNo ratings yet

- IM-250 SP User GuideDocument27 pagesIM-250 SP User GuideLuis Antonio Hernandez CastroNo ratings yet

- Tvs LP 45 LiteDocument2 pagesTvs LP 45 LiteDevendra Dev0% (1)

- sb06 06 r3Document3 pagessb06 06 r3Henry Huayhua100% (1)

- RF Sealing TheoryDocument3 pagesRF Sealing Theorykirandasi123No ratings yet

- Alstom Otcf Ansi WebDocument8 pagesAlstom Otcf Ansi WebReji KurianNo ratings yet

- 2019 Summer Model Answer Paper (Msbte Study Resources)Document23 pages2019 Summer Model Answer Paper (Msbte Study Resources)Jayesh BaravkarNo ratings yet

- JD723A - JD724B User's Manual R1.6Document115 pagesJD723A - JD724B User's Manual R1.6Fernando BenjumedaNo ratings yet

- Lift Controlling SystumDocument2 pagesLift Controlling Systumsatish laguriNo ratings yet

- Mahmood v. Research in MotionDocument28 pagesMahmood v. Research in MotionPriorSmartNo ratings yet

- 1.UPS2000-G Series (6-20kVA) Datasheet 06 - (20180207)Document2 pages1.UPS2000-G Series (6-20kVA) Datasheet 06 - (20180207)cirta4ever IBN BadisNo ratings yet

- Beyond BeatmatchingDocument187 pagesBeyond BeatmatchingShortStrangle100% (2)

- And Charging Infrastructure: Course Format Other InfoDocument1 pageAnd Charging Infrastructure: Course Format Other Infobrijendra21No ratings yet

- 2020 Annual Report Melexis enDocument156 pages2020 Annual Report Melexis enAnthonyWittendorpNo ratings yet

- Manual de Información Técnica Promass 83A PDFDocument36 pagesManual de Información Técnica Promass 83A PDFFredy BarretoNo ratings yet

- Modified Sine-Wave Inverter Enhanced With New WaveformDocument3 pagesModified Sine-Wave Inverter Enhanced With New WaveformJoão Pedro AlmeidaNo ratings yet

- Mobile Path Loss Formula LabDocument11 pagesMobile Path Loss Formula LabaditNo ratings yet

- Hegel Catalogue 2010Document11 pagesHegel Catalogue 2010LukaszNo ratings yet

- TEC40092203Document11 pagesTEC40092203Dhanesh GoelNo ratings yet

- EEQ3Document5 pagesEEQ3Rookie Thursday OrquiaNo ratings yet