Professional Documents

Culture Documents

Memorandum of Entry Recording Creation of Equitable Mortgage

Uploaded by

Anonymous WplpBJlF2k0 ratings0% found this document useful (0 votes)

23 views3 pages1. This document records the creation of an equitable mortgage between ABC Limited (the borrower) and a bank.

2. ABC Limited deposited title deeds related to its immovable property with the bank to secure repayment of credit facilities up to Rs. [amount] provided by the bank.

3. The equitable mortgage was created with the intention of securing repayment of principal, interest, charges, and expenses due from ABC Limited to the bank under various loan agreements.

Original Description:

equitable mortage

Original Title

Moe

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This document records the creation of an equitable mortgage between ABC Limited (the borrower) and a bank.

2. ABC Limited deposited title deeds related to its immovable property with the bank to secure repayment of credit facilities up to Rs. [amount] provided by the bank.

3. The equitable mortgage was created with the intention of securing repayment of principal, interest, charges, and expenses due from ABC Limited to the bank under various loan agreements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views3 pagesMemorandum of Entry Recording Creation of Equitable Mortgage

Uploaded by

Anonymous WplpBJlF2k1. This document records the creation of an equitable mortgage between ABC Limited (the borrower) and a bank.

2. ABC Limited deposited title deeds related to its immovable property with the bank to secure repayment of credit facilities up to Rs. [amount] provided by the bank.

3. The equitable mortgage was created with the intention of securing repayment of principal, interest, charges, and expenses due from ABC Limited to the bank under various loan agreements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Memorandum of Entry Recording

Creation of Equitable Mortgage

MEMORANDUM OF ENTRY RECORDING that

Shri ____________________________________ the Director of M/s. ABC LIMITED, a

Company having its registered office at _____________________________________

(hereinafter referred to as the “Borrower”) attended the office of

__________________________________ (hereinafter referred to as “the Bank”) situate

at _________________ _________________ on the __________ day of

________________ 200__ and delivered to and deposited with Shri

____________________________ an authorized Officer of the Bank the documents of title

relating to the immovable property of the Borrower more particularly described in the First

Schedule hereunder written and which said documents of title are more particularly

described in the Second Schedule hereunder written, intending to make the said deposit

as security for the payment and discharge of all indebtedness and liabilities of the Borrower

to the Bank under the loan documents dated ___ _____ 200__ .

When making the said deposit, the said Shri ________________ ____________ on

behalf of the Borrower declared, admitted and confirmed to the Bank as under:-

(a) The Borrower is the Owner of and well and sufficiently seized and possessed of the

immovable property described in the First Schedule hereunder (hereinafter referred

to as “the said immovable property”).

(b) In terms of the said loan documents, the Bank has allowed the Borrower various

credit facilities by granting all or some or any of the credit facilities by way of

Overdraft, Demand Loans, Loans, Cash Credits, Term Loans, pre-shipment and

post-shipment credits, opening of letters of credit, issuing of guarantees,

Negotiation and discounting of bills and cheques, inland as well as foreign and such

other facilities as from time to time required by the said Borrower for amounts not

exceeding the principal sum of Rs. ________________/- (Rupees

_____________________________ only) on the terms and conditions specified

therein.

(c) One of the conditions of the grant of the aforesaid credit facilities is that the

repayment of the said principal sum of

Rs. ____________________/- (Rupees ________________only) and all accruing

interest, discount, commission, charges and all kind of costs and expenses payable

to or incurred by the Bank in relation thereto alongwith all other further dues, cost,

expenses etc. shall stand secured by creation of equitable mortgage of the said

immovable property in favour of the Bank.

(d) By its Board Resolution passed at its meeting held on _________ day of

__________200____, the Board of Directors of the Borrower, Shri

______________________, the Director of the Borrower company is authorised to

create the said security by way of equitable mortgage of the said immovable

property and to deposit the said title deeds with the Bank.

(e) The Borrower has accordingly with intent to carry out their said obligation and to

creating the said security of the said immovable property described in the First

Schedule hereunder written deposited with the Bank the said title deeds more

particularly described in the Second Schedule hereunder written with the intention

that the said property would remain as security for such repayment.

(f) That the said deposit of the title deeds by the said

Shri _____________________________ was made on behalf of the Borrower

with intent to create a mortgage by deposit of title deeds of the said

premises in favour of the Bank as security to secure repayment of all monies

including interest, costs, charges and expenses due or becoming due and payable

by the Borrower to the Bank under or in respect of all or some or any of the

facilities either in Indian or foreign currencies granted and/or agreed to be granted

to the Borrower and for any other indebtedness and liabilities, past, present and

future of the Borrower to the Bank.

(g) That the documents of title now deposited with the Bank were the only documents

of title in possession of the Borrower in respect of the said premises of the

Borrower and that the Borrower is the absolute owner of the said property and that

the Borrower has marketable title thereto.

(h) That there is no mortgage, charge, lien or any other encumbrance or attachment

on the said immovable property or any part thereof by any Government or local

authority or by Income Tax Department and that no notice has been issued and/or

served on the Borrower under the Rules 2, 16 or 51 or any other Rules of the

Second Schedule to the Income Tax Act, 1961, or under any other law.

(i) and that the Borrower has not entered into any agreement for sale, transfer or

alienation thereof or any part or parts thereof and that no encumbrance hereafter

will be created by the Borrower except with the express prior permission in writing

of the Bank so long as the Borrower continues to be indebted to or remain liable to

the Bank on any account.

(j) Shri _______________________ on behalf of the Borrower also acknowledges

that the maximum amount intended to be secured by the said mortgage created as

aforesaid was for the purpose of Section 79 of the Transfer of Property Act, 1882

and for no other purpose and without affecting the Borrower’s full liability to the

Bank under the said mortgage for all subsisting liabilities together with interest and

all costs, charges and expenses thereof.

THE FIRST SCHEDULE ABOVE REFERRED TO:

(Description of the immoveable property)

THE SECOND SCHEDULE ABOVE REFERRED TO:

(List of Title Deeds)

IN WITNESS WHEREOF the Bank has recorded the fact of aforesaid deposit of titled

deeds by these presents the day and year first hereinabove written.

SIGNED by Shri __________________, )

Asst. General Manager (Credit), )

Advances Department at ______________ )

Branch and the authorised officer of the Bank )

for and on behalf of ________________ Bank )

Note: This Memorandum records the fact of deposit of title deeds on behalf of the

Mortgagee and is not a contract between the parties. It will attract only stamp

duty as applicable and will not require registration. However, simultaneously

a Declaration in writing in terms of this Memorandum should also be separately

obtained from the person making deposit of title deeds.

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Format Indenture of Second MortgageDocument3 pagesFormat Indenture of Second Mortgage519129002003No ratings yet

- MortgageDocument27 pagesMortgageadv shilpa patheyNo ratings yet

- CH 100Document2 pagesCH 100vijhay_adsuleNo ratings yet

- Declaration in Support of Equitable MortgageDocument3 pagesDeclaration in Support of Equitable Mortgagevijhay_adsuleNo ratings yet

- Attachment Hypothecation Agree - FinalDocument11 pagesAttachment Hypothecation Agree - FinalMuskan goriaNo ratings yet

- Moa For Property CollateralDocument6 pagesMoa For Property CollateralRalph AnitoNo ratings yet

- Deed of HypothecationDocument2 pagesDeed of HypothecationJay Evans100% (1)

- Memorandum of Agreement Blank FormDocument6 pagesMemorandum of Agreement Blank FormRosaz8183% (18)

- Bandhan Bank Kisan Credit Card AgriculturalLoanAgreementDocument30 pagesBandhan Bank Kisan Credit Card AgriculturalLoanAgreementdsouzaraymond78No ratings yet

- TRIPARTITE AGREEMENT Latest18122021Document5 pagesTRIPARTITE AGREEMENT Latest18122021aatishsutardasNo ratings yet

- TPT AGT On Stamp CN Rs100 ProformaDocument3 pagesTPT AGT On Stamp CN Rs100 ProformajokifNo ratings yet

- TPT AGT On Stamp CN Rs100 ProformaDocument3 pagesTPT AGT On Stamp CN Rs100 Proformaamo tptyNo ratings yet

- 20-Bank Guarantee FormatDocument3 pages20-Bank Guarantee Formatskantaraj100% (3)

- Loan Against Property AgreementDocument34 pagesLoan Against Property AgreementAli Khan AKNo ratings yet

- MSI Temp 5.11.10Document11 pagesMSI Temp 5.11.10Randy LorenzanaNo ratings yet

- Lease Deed This LEASE DEED Made at - , Gujarat On This The - Day ofDocument31 pagesLease Deed This LEASE DEED Made at - , Gujarat On This The - Day ofPriyankaNo ratings yet

- Amount Rs. This Forms Part of The PERSONAL LOAN Agreement Executed Between - Insert The NameDocument13 pagesAmount Rs. This Forms Part of The PERSONAL LOAN Agreement Executed Between - Insert The NameKapil KaroliyaNo ratings yet

- Memorandum of Agreement Between Power Finance Corporation Limited ANDDocument7 pagesMemorandum of Agreement Between Power Finance Corporation Limited ANDAyan RoyNo ratings yet

- Contrato de Mutuo en InglesDocument2 pagesContrato de Mutuo en InglesloloNo ratings yet

- Sample Loan With REMDocument14 pagesSample Loan With REMYcel CastroNo ratings yet

- Undertaking From BorrowerDocument7 pagesUndertaking From BorrowerDivyesh Varun D VNo ratings yet

- Loan Contract Rev.5.18.11Document10 pagesLoan Contract Rev.5.18.11Akkibet SyntechNXNo ratings yet

- Agreement Personal LoanDocument8 pagesAgreement Personal LoanAnkush KotakNo ratings yet

- Mortgage Assumption Agreement Template PDFDocument4 pagesMortgage Assumption Agreement Template PDFMarcLouieMagbitangTiraoNo ratings yet

- Loan AgreementDocument9 pagesLoan AgreementLeboNo ratings yet

- Articles of AgreementDocument3 pagesArticles of AgreementSeemab HussainNo ratings yet

- Legal Forms - Assignment 1Document39 pagesLegal Forms - Assignment 1Aianna Bianca Birao (fluffyeol)No ratings yet

- Overdraft Against Property AgreementDocument18 pagesOverdraft Against Property AgreementmanugeorgeNo ratings yet

- Agreement of Hypothecation BY - Insert The Name of The Borrower - in Favour of The South Indian Bank LTDDocument9 pagesAgreement of Hypothecation BY - Insert The Name of The Borrower - in Favour of The South Indian Bank LTDNitish KumarNo ratings yet

- Tripatite Agreement: Officer and Senior Manaeer Shri R.P.Setia (Here After Called The Bank WhichDocument5 pagesTripatite Agreement: Officer and Senior Manaeer Shri R.P.Setia (Here After Called The Bank WhichpardeepbthNo ratings yet

- Escrow Agreement 1Document4 pagesEscrow Agreement 1Konan SnowdenNo ratings yet

- Mortgage DeedDocument4 pagesMortgage DeedsubbuNo ratings yet

- Bills Discounting Agreement South Indian Bank PDFDocument7 pagesBills Discounting Agreement South Indian Bank PDFbaba ramdevNo ratings yet

- Tripartite Agreement FormatDocument4 pagesTripartite Agreement FormatRAJESH KALRA80% (5)

- Acknowledgement of Indebtedness (Pengakuan Hutang)Document2 pagesAcknowledgement of Indebtedness (Pengakuan Hutang)ridhofauzisNo ratings yet

- Undertaking - COVID Personal Loan CPLDocument4 pagesUndertaking - COVID Personal Loan CPLAshish gautamNo ratings yet

- Credit Surety AgreementDocument4 pagesCredit Surety Agreementevangareth0% (1)

- Loan AgreementDocument4 pagesLoan Agreementskelly nuada100% (1)

- Loan With DacionDocument3 pagesLoan With DacionJesstony RepayoNo ratings yet

- Deed of Mortgage (DPC)Document4 pagesDeed of Mortgage (DPC)Rajdeep MukherjeeNo ratings yet

- Deed of Hypothecation HP LawRato4Document3 pagesDeed of Hypothecation HP LawRato4Arnav TaraiyaNo ratings yet

- Deed of PledgeDocument4 pagesDeed of Pledgeshreya bhattacharjeeNo ratings yet

- Cont WBG FMTDocument3 pagesCont WBG FMTJKKNo ratings yet

- Loan Agreement SwarojgarDocument4 pagesLoan Agreement SwarojgarDhruv ChandwaniNo ratings yet

- SBP Financing Scheme For Renewable Energy: RE-1 Refinance Application FormDocument10 pagesSBP Financing Scheme For Renewable Energy: RE-1 Refinance Application FormMuhammad Bilal QadirNo ratings yet

- 4-29 Simple Mortgage DeedDocument5 pages4-29 Simple Mortgage Deedvikrant pandeyNo ratings yet

- Hindu Marriage FormsDocument4 pagesHindu Marriage Formsgnsr_1984No ratings yet

- Supplementary Agreement SarfaesiDocument2 pagesSupplementary Agreement Sarfaesiraj sahilNo ratings yet

- MODT - First Time-Third Party VimpalDocument15 pagesMODT - First Time-Third Party Vimpaldhruv bhanderiNo ratings yet

- Tripartite Agreement1Document8 pagesTripartite Agreement1saniyasenNo ratings yet

- Drafting Apperance and PleadingsDocument6 pagesDrafting Apperance and PleadingsPrathamesh PaiNo ratings yet

- Deed of Assignment SampleDocument3 pagesDeed of Assignment SampleRaphael PelinggonNo ratings yet

- SD - Loan Agreement - Format - 2021Document3 pagesSD - Loan Agreement - Format - 2021dcniveNo ratings yet

- RLLR - PGB - 1115 - Term Loan Agreement (Personal Loan)Document8 pagesRLLR - PGB - 1115 - Term Loan Agreement (Personal Loan)kanwariqbalsinghNo ratings yet

- Loan Agreement Lender Loan NumberDocument6 pagesLoan Agreement Lender Loan Numbermr_3647839No ratings yet

- This Deed of MortgageDocument2 pagesThis Deed of MortgageAAKANKSHA BHATIANo ratings yet

- Joint Venture AgreementDocument9 pagesJoint Venture Agreementgreghawthorne1No ratings yet

- Cyo ChargeDocument32 pagesCyo Chargeotto walikwaNo ratings yet

- Installment Loan AgreeementDocument4 pagesInstallment Loan AgreeementCyrus Santos100% (1)

- Indian Economics at A GlanceDocument5 pagesIndian Economics at A GlanceAnonymous WplpBJlF2kNo ratings yet

- Biasing Bipolar Junction Transistors (BJTS) : CC B CDocument6 pagesBiasing Bipolar Junction Transistors (BJTS) : CC B CAnonymous WplpBJlF2kNo ratings yet

- Policy Optimization For Dynamic Power ManagementDocument21 pagesPolicy Optimization For Dynamic Power ManagementAnonymous WplpBJlF2kNo ratings yet

- Smart Dust: K. Pister, J. Kahn, B. Boser (UCB) S. Morris (MLB)Document21 pagesSmart Dust: K. Pister, J. Kahn, B. Boser (UCB) S. Morris (MLB)Anonymous WplpBJlF2kNo ratings yet

- Dd/Mm/Yyyy: Request For ReservationDocument14 pagesDd/Mm/Yyyy: Request For ReservationSouvik BardhanNo ratings yet

- A Case Study On Liquidity Analysis of Nic Asia Bank: A Project Work ProposalDocument13 pagesA Case Study On Liquidity Analysis of Nic Asia Bank: A Project Work ProposalSaphal GhimireNo ratings yet

- Chapter 12Document1 pageChapter 12Evelyn RiesNo ratings yet

- UNISEL Guide To Registration 2014Document21 pagesUNISEL Guide To Registration 2014IscUniselNo ratings yet

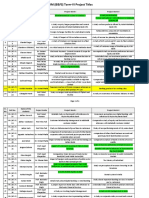

- PGDM (B&FS) Project Titles-1Document5 pagesPGDM (B&FS) Project Titles-1PranitNo ratings yet

- Intacc-Cash and Cash EquivalentsDocument3 pagesIntacc-Cash and Cash Equivalentsdenise ambasanNo ratings yet

- Advance Financial ManagementDocument3 pagesAdvance Financial ManagementAMIT08006No ratings yet

- Research Proposal On Mobile Banking - PDF 2 PDFDocument12 pagesResearch Proposal On Mobile Banking - PDF 2 PDFCRING VEDIONo ratings yet

- ProposalDocument10 pagesProposalSagar KarkiNo ratings yet

- Union Bank Limited Internship ReportDocument60 pagesUnion Bank Limited Internship Reportsaleemkhp50% (2)

- The Banking Industry in The UAEDocument4 pagesThe Banking Industry in The UAEMuhammad Ahsan AkramNo ratings yet

- HLP 0910Document226 pagesHLP 0910Li Hei EltNo ratings yet

- The Impact of Changes in Interest Rate PDocument91 pagesThe Impact of Changes in Interest Rate PJuan Fernando SubiranaNo ratings yet

- PDFFile5b2780d4bf42a8 02107843Document338 pagesPDFFile5b2780d4bf42a8 02107843Vinit MNo ratings yet

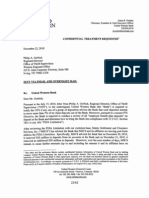

- BNP - Development Credit Bank 08072010Document24 pagesBNP - Development Credit Bank 08072010Zeenat KerawalaNo ratings yet

- The Bankruptcy of Lehman Brothers: Causes of Failure & Recommendations Going ForwardDocument20 pagesThe Bankruptcy of Lehman Brothers: Causes of Failure & Recommendations Going Forwardroohan AdeelNo ratings yet

- Mohit Sharma Vertical HeadDocument3 pagesMohit Sharma Vertical HeadKriday SharmaNo ratings yet

- Uni EngDocument6 pagesUni Engapi-198175022No ratings yet

- A1 Customer Information FormDocument2 pagesA1 Customer Information FormJimmy TangonanNo ratings yet

- Other Bank Services Safety Deposit BoxDocument3 pagesOther Bank Services Safety Deposit BoxTien BernabeNo ratings yet

- NBFC Project Report by MS. Sonia JariaDocument34 pagesNBFC Project Report by MS. Sonia JariaSonia SoniNo ratings yet

- Klarna Case StudyDocument2 pagesKlarna Case Studyarkadii0% (1)

- PGVCL HowtoapplyDocument3 pagesPGVCL HowtoapplyDhaval PatelNo ratings yet

- SFCK PresentnDocument43 pagesSFCK PresentnFasna FathimaNo ratings yet

- Princ Ch29 PresentationDocument36 pagesPrinc Ch29 PresentationCresca Cuello CastroNo ratings yet

- 2242-2630 (Tab C Exs. 83-94 (G) ) (PUBLIC)Document392 pages2242-2630 (Tab C Exs. 83-94 (G) ) (PUBLIC)GriswoldNo ratings yet

- BBS 2019 02 RahmanDocument13 pagesBBS 2019 02 RahmanFeyissa TayeNo ratings yet

- January 2016 1451979191 13Document4 pagesJanuary 2016 1451979191 13amit yadavNo ratings yet

- CFI 5115 QuestionsDocument9 pagesCFI 5115 QuestionsFungai Mukundiwa0% (1)

- CTBC Form & Consent FormDocument2 pagesCTBC Form & Consent FormJhon Micheal AlicandoNo ratings yet