Professional Documents

Culture Documents

Chapter 11 Case (Week 10 Case) - Part 1-FTC

Uploaded by

FUCK OFFOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 11 Case (Week 10 Case) - Part 1-FTC

Uploaded by

FUCK OFFCopyright:

Available Formats

Part I

D, a domestic corporation, has a branch office located within country X. D’s management projects that in the next

taxable year, D will have a pre-tax profit of $1,000, $800 from U.S. operations and $200 from the branch in X.

Assume X taxes corporate income at a rate of 31%, and the United States taxes corporate income at a rate of 21%.

1. If management’s projections are accurate, what will D’s excess credit be in the next taxable year?

Now assume D’s management plans to establish a second foreign branch in country Y. Y taxes corporate income at

a flat rate of 16%. What amount of profits would the branch in Y have to generate in order to eliminate the excess

credit generated by the branch in X?

Each dollar of country Y income will:

Increase FTC limitation by_______________

Increase D’s foreign tax paid by ______________

Excess limitation = __________________

2. The excess limitation of _____ per each dollar of country Y income can be used to reduce the excess FTC of ____

per each dollar of country X income.

To completely eliminate the excess FTC in part 1, country Y branch needs to produce taxable income of

______________

3. Now assume that the rules X uses to source income differ from those used by the United States. For example, X

may use an activity-based sourcing rule for income from inventory sales whereas the United States uses a title

passage rule. Therefore, D may be able to restructure its operations such that a portion of the $800 profit currently

classified as U.S. source income is recharacterized as foreign source income, but only for U.S. tax purposes. How

much of the $800 profit would have to be recharacterized as foreign source income in order to eliminate the excess

credit generated by the country X branch?

Each dollar of resourced income will:

increase D’s FTC limitation by ______ and

has no effect on foreign tax paid to country X.

To completely eliminate the excess FTC in part 1, D needs to resource income of __________

4. How would your answer to #3 change if any resourcing of D’s profits for U.S. tax purposes also increases D’s

taxable income for country X tax purposes?

5. Assume you are a U.S. lawmaker who wishes to prevent U.S. companies from engaging in the type of cross-

crediting referred to in Part 2. What type of foreign tax credit limitation system would prevent cross-crediting

between branches in different countries?

6. If your U.S. and/or foreign firms have a calendar year end, search its/their annual report for the year ending

December 2017 for the impact of the Tax Cut and Jobs Act of 2017.

Part II

A.

B.

C.

D.

You might also like

- Chapter 14Document41 pagesChapter 14wrzmstr2No ratings yet

- IMChap 011Document24 pagesIMChap 011Aaron Hamilton100% (2)

- Summary Adv Tax1Document4 pagesSummary Adv Tax1Muhammad AlfarrabieNo ratings yet

- CSM - CHP 12 - Accounting For Income TaxDocument4 pagesCSM - CHP 12 - Accounting For Income TaxaseppahrudinNo ratings yet

- Individual Taxation 2013 7th Edition Pratt Test BankDocument21 pagesIndividual Taxation 2013 7th Edition Pratt Test Bankrobertmasononiqrbpcyf100% (16)

- Quiz 1Document5 pagesQuiz 1gabie stgNo ratings yet

- Homework ES 2 Solution ACCT 553Document5 pagesHomework ES 2 Solution ACCT 553Mohammad IslamNo ratings yet

- Taxnz118 - Assumed Knowledge Quiz 08042019Document12 pagesTaxnz118 - Assumed Knowledge Quiz 08042019Wasir RahmanNo ratings yet

- Maryland Mortgage Program - Recapture TaxDocument12 pagesMaryland Mortgage Program - Recapture TaxNishika JGNo ratings yet

- Canadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test Bankalisonfernandezmerzigfkap100% (15)

- How To Calculate Loan AmountsDocument7 pagesHow To Calculate Loan AmountseramossotoNo ratings yet

- Deffered TaxDocument20 pagesDeffered TaxRasel AshrafulNo ratings yet

- C13 CHP 15-16-2 HW PRB Exempt Organ Multistate 2013Document3 pagesC13 CHP 15-16-2 HW PRB Exempt Organ Multistate 2013NitinNo ratings yet

- 1-4e Income Taxes: Formula For Federal Income Tax On IndividualsDocument3 pages1-4e Income Taxes: Formula For Federal Income Tax On IndividualsMeriton KrivcaNo ratings yet

- Chapter 16 QuizDocument3 pagesChapter 16 Quizbeckkl05No ratings yet

- AICPA - CPA Reg 2017Document12 pagesAICPA - CPA Reg 2017Gene'sNo ratings yet

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (21)

- Principles of Taxation For Business and Investment Planning 16th Edition Jones Solutions ManualDocument20 pagesPrinciples of Taxation For Business and Investment Planning 16th Edition Jones Solutions Manualkevahanhksf100% (30)

- Principles of Business TaxationDocument10 pagesPrinciples of Business TaxationMuhammad Yasir GondalNo ratings yet

- Accounting For Income TaxesDocument4 pagesAccounting For Income TaxesSilvia alfonsNo ratings yet

- CAS QuizDocument6 pagesCAS QuizLeng ChhunNo ratings yet

- Section 1: Accrued Revenue: Mastering Adjusting EntriesDocument4 pagesSection 1: Accrued Revenue: Mastering Adjusting EntriesMarc Eric Redondo50% (2)

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- CH 11 - Smartbook Accounting 201Document6 pagesCH 11 - Smartbook Accounting 201Gene'sNo ratings yet

- Calculate Federal and Provincial TaxesDocument36 pagesCalculate Federal and Provincial TaxesRyan YangNo ratings yet

- Deductions From Gross IncomeDocument30 pagesDeductions From Gross IncomeKatherine Ederosas50% (4)

- US Internal Revenue Service: F1040esn - 2004Document5 pagesUS Internal Revenue Service: F1040esn - 2004IRSNo ratings yet

- C. Liability - 2, 3 - 4 SessionDocument18 pagesC. Liability - 2, 3 - 4 SessionBareera NasirNo ratings yet

- Taxes and The Division of Foreign Operating Income Among Royalties, Interest, Dividends and Retained EarningsDocument22 pagesTaxes and The Division of Foreign Operating Income Among Royalties, Interest, Dividends and Retained EarningsayeshaNo ratings yet

- Quiz on Income TaxationDocument2 pagesQuiz on Income TaxationVergel Martinez100% (1)

- Group Work #1 With SolutionsDocument3 pagesGroup Work #1 With SolutionsShadi MorakabatiNo ratings yet

- Aq 10Document58 pagesAq 10Minie KimNo ratings yet

- Required: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisDocument3 pagesRequired: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisJARED DARREN ONGNo ratings yet

- Repatriation Taxes and Dividend Distortions: Forum On Moving Towards A Territorial Tax SystemDocument24 pagesRepatriation Taxes and Dividend Distortions: Forum On Moving Towards A Territorial Tax SystemSaina ChuhNo ratings yet

- AICPA Released Questions FAR 2015 DifficultDocument33 pagesAICPA Released Questions FAR 2015 DifficultAZNGUY100% (2)

- Principles of Taxation For Business and Investment Planning 2014 17Th Edition Jones Test Bank Full Chapter PDFDocument68 pagesPrinciples of Taxation For Business and Investment Planning 2014 17Th Edition Jones Test Bank Full Chapter PDFrosyseedorff100% (9)

- US Internal Revenue Service: F1040esn - 2001Document5 pagesUS Internal Revenue Service: F1040esn - 2001IRSNo ratings yet

- USALaw TaxationDocument4 pagesUSALaw TaxationBoyan ZrncicNo ratings yet

- How Can Tax On PfizerDocument4 pagesHow Can Tax On PfizerMheg NervidaNo ratings yet

- International Taxation: Mcgraw-Hill/Irwin Rights ReservedDocument33 pagesInternational Taxation: Mcgraw-Hill/Irwin Rights ReservedChuckNo ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Corporate Tax Rules & Forms OverviewDocument64 pagesCorporate Tax Rules & Forms OverviewRachel Sayson100% (1)

- Ratios Test PaperDocument7 pagesRatios Test Papermeesam2100% (1)

- CAFR DoxDocument2 pagesCAFR Doxjohn muhanda muNo ratings yet

- Income Taxes - AssessmentDocument5 pagesIncome Taxes - Assessmentglobeth berbanoNo ratings yet

- FFA 2nd MockDocument7 pagesFFA 2nd MockSalman RaoNo ratings yet

- QB Income TaxesDocument6 pagesQB Income TaxesSarthak MalhotraNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 3108 Deductions From Gross IncomeDocument17 pages3108 Deductions From Gross IncomeMae Angiela TansecoNo ratings yet

- ACCT217 - Corporate & Partnership Taxation Sample ExamDocument15 pagesACCT217 - Corporate & Partnership Taxation Sample ExamKim LeNo ratings yet

- Correct! A Public Company Should Disclose Information About Profit or Loss andDocument15 pagesCorrect! A Public Company Should Disclose Information About Profit or Loss andJoana Trinidad100% (1)

- Case 1 Sample SolutionsDocument9 pagesCase 1 Sample SolutionsBillie JeanNo ratings yet

- AvianCorp Fall 2013Document2 pagesAvianCorp Fall 2013braveusmanNo ratings yet

- ACC101 Chapter9newDocument19 pagesACC101 Chapter9newXiao HoNo ratings yet

- Chapter 18Document12 pagesChapter 18ks1043210No ratings yet

- Taxation - PB - 19thDocument9 pagesTaxation - PB - 19thKenneth Bryan Tegerero TegioNo ratings yet

- Plant Design EngineeringDocument53 pagesPlant Design EngineeringkirankumarNo ratings yet

- Income Tax Calculator - TaxScoutsDocument1 pageIncome Tax Calculator - TaxScoutsnadine.massabkiNo ratings yet

- 1601 EqDocument2 pages1601 EqJam DiolazoNo ratings yet

- Ahtasham Ahmed Case - CompressedDocument19 pagesAhtasham Ahmed Case - CompressedarsssyNo ratings yet

- 2550Q InstructionsDocument1 page2550Q InstructionsMay RamosNo ratings yet

- Icitss Project FileDocument21 pagesIcitss Project FileShrey JainNo ratings yet

- Wage Summary TemplateDocument14 pagesWage Summary TemplatenarayanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaustabha DasNo ratings yet

- Employee Earnings Statement DetailsDocument1 pageEmployee Earnings Statement DetailsSenku IshigamiNo ratings yet

- Deduction 80gga by Anmol Gulati 2013360 Mcom PDFDocument18 pagesDeduction 80gga by Anmol Gulati 2013360 Mcom PDFAnmol GulatiNo ratings yet

- Mykzhrpayslip 20230303Document1 pageMykzhrpayslip 20230303Cruiser GohNo ratings yet

- Anokita Thar N2G32130Document1 pageAnokita Thar N2G32130prashant singhNo ratings yet

- RSPL Limited: Payslip For The Month of JUNE 2021Document1 pageRSPL Limited: Payslip For The Month of JUNE 2021Manju ManjappaNo ratings yet

- Generate E-Way Bill for Construction Materials TransportDocument3 pagesGenerate E-Way Bill for Construction Materials TransportAkash PradhanNo ratings yet

- Tax Identification Number (TIN) Taxpayer Form Fee DeadlineDocument2 pagesTax Identification Number (TIN) Taxpayer Form Fee DeadlineFabiano JoeyNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument6 pagesRequest For Taxpayer Identification Number and CertificationTaj R.100% (1)

- A222 Tutorial 3 ALLOWANCESDocument2 pagesA222 Tutorial 3 ALLOWANCESChye Poh LimNo ratings yet

- Invoice 1694411360796Document2 pagesInvoice 1694411360796Dhiraj DwivediNo ratings yet

- Taxation of Individuals 2018 Edition 9th Edition Spilker Test BankDocument61 pagesTaxation of Individuals 2018 Edition 9th Edition Spilker Test Bankanthonywilliamsfdbjwekgqm100% (27)

- January 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Document8 pagesJanuary 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Zechariah Kennedy100% (1)

- DM Realty Developers Private LimitedDocument1 pageDM Realty Developers Private LimitedsimplepannuNo ratings yet

- Service Tax Liability: Income To Purshottam Agarwal From LBF Publications, Admanum Packing & IndividualDocument6 pagesService Tax Liability: Income To Purshottam Agarwal From LBF Publications, Admanum Packing & Individualg26agarwalNo ratings yet

- A and B Are IncorrectDocument6 pagesA and B Are IncorrectdgdeguzmanNo ratings yet

- Petron v. TiangcoDocument2 pagesPetron v. TiangcoAlmarius CadigalNo ratings yet

- Form 13614-c Intake - Interview Quality Review Sheet 2Document4 pagesForm 13614-c Intake - Interview Quality Review Sheet 2api-593063995No ratings yet

- Hardware Plywood: MetroDocument2 pagesHardware Plywood: MetroJustpositive StuffNo ratings yet

- NIRC Amendments Up To 2016Document3 pagesNIRC Amendments Up To 2016jusang16No ratings yet

- Al Malik Life Sciences Price List (Zoic) - 23Document10 pagesAl Malik Life Sciences Price List (Zoic) - 23Faiz ArchitectsNo ratings yet

- SLT eBill-00388129090718ImageDocument1 pageSLT eBill-00388129090718ImageYasas Amarashinghe CICRA CampusNo ratings yet

- Estate tax calculation and deductions for Damon SalvatoreDocument5 pagesEstate tax calculation and deductions for Damon SalvatoreJheng Jingco89% (9)

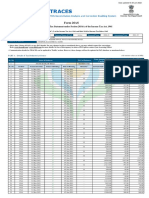

- Form 26AS Tax StatementDocument9 pagesForm 26AS Tax StatementPeeyush SolankiNo ratings yet