Professional Documents

Culture Documents

Investment Behaviour in The International Oil and Gas Industry

Uploaded by

janiceOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Behaviour in The International Oil and Gas Industry

Uploaded by

janiceCopyright:

Available Formats

Investment behaviour in the international oil and gas industry : essays in empirical petroleum

economics

Original version

Investment behaviour in the international oil and gas industry : essays in empirical petroleum

economics by Klaus Mohn, Stavanger : University of Stavanger, 2008 (PhD thesis UiS, no. 51)

Abstract

High growth and welfare aspirations will require massive energy investment

in the years ahead of us, especially in the non-OECD area. With more than 60

per cent of primary energy supply, oil and natural gas play a dominant role in

today’s global energy market. Even with high ambitions to contain

greenhouse gas emissions and arrest global warming, petroleum is likely to

remain an important source of energy in a 20-year perspective. A good

understanding of the investment process among oil and gas companies is

important to grasp the full picture of oil and gas supply. Insights from oil and

gas investment studies may translate into policies to improve the security of

energy supply, to promote energy efficiency and economic growth, and to pull

people out of poverty through the extension of affordable energy.

In petro-states like Norway, oil and gas investments play an important role for

macroeconomic fluctuations in the short to medium term. A proper

understanding of investment behaviour in the oil and gas industry is therefore

useful for economists, market analysts, policy-makers, and everyone who

takes an interest in economic and financial market fluctuations. Moreover,

strategies for resource management become important for any country rich in

petroleum resources. In this context, the links between exploration, reserve

accumulation, field development and production become important both to

corporate strategists and to policy-makers.

Profit maximisation is the key behavioural assumption for international oil

and gas companies, as for most other industries. However, some features are

specific to oil and gas production. The reserve concept is unique to nonrenewable

resource industries, and so is exploration activity. High capital

intensity, imperfect competition, and extensive political attention are some

other distinguishing characteristics. Industry-specific methods and tailored

analyses are therefore required. Combining industry-specific theories of

investment behaviour with the best statistical methods available, this thesis

adds new empirical insights on issues of capital formation and interaction

between companies and markets in the international oil and gas industry.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Vedic Astrology OverviewDocument1 pageVedic Astrology Overviewhuman999100% (8)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- M13 - Solution of TrianglesDocument5 pagesM13 - Solution of Triangles9703693564No ratings yet

- Lambika YogaDocument2 pagesLambika Yogavsyamkumar100% (3)

- Oracle Time and Labor - Data SheetDocument5 pagesOracle Time and Labor - Data Sheetbilaltanoli@gmail.comNo ratings yet

- Math 7: "The Nearest Approximation To An Understanding of Life Is To Feel It and Realize It To The Fullest."Document16 pagesMath 7: "The Nearest Approximation To An Understanding of Life Is To Feel It and Realize It To The Fullest."benjamin ladesma0% (1)

- Chapter 08Document18 pagesChapter 08hana_kimi_91No ratings yet

- Vijay Solvex PROJECT "Retention Strategy"Document110 pagesVijay Solvex PROJECT "Retention Strategy"Jayesh SinghNo ratings yet

- 05 Askeland ChapDocument10 pages05 Askeland ChapWeihanZhang100% (1)

- Openstack Deployment Ops Guide PDFDocument197 pagesOpenstack Deployment Ops Guide PDFBinank PatelNo ratings yet

- BearsDocument1 pageBearsjaniceNo ratings yet

- What Is KTVDocument1 pageWhat Is KTVjaniceNo ratings yet

- Tutorial 2 - QDocument1 pageTutorial 2 - QjaniceNo ratings yet

- Principal Elements of English Law: Stare DecisisDocument1 pagePrincipal Elements of English Law: Stare DecisisjaniceNo ratings yet

- Tutorial 1Document2 pagesTutorial 1janiceNo ratings yet

- T7Q Absorption Costing and Marginal Costing 20170213Document4 pagesT7Q Absorption Costing and Marginal Costing 20170213janice0% (1)

- Corporate GovernanceDocument50 pagesCorporate GovernancejaniceNo ratings yet

- Testing The Capital Asset Pricing Model With Local Maximum Likelihood MethodsDocument13 pagesTesting The Capital Asset Pricing Model With Local Maximum Likelihood MethodsjaniceNo ratings yet

- Writing TipsDocument3 pagesWriting TipsjaniceNo ratings yet

- MPRA Paper 12752Document34 pagesMPRA Paper 12752janiceNo ratings yet

- Article 17 Determinants of Corporate Governance and Corporate1Document7 pagesArticle 17 Determinants of Corporate Governance and Corporate1janiceNo ratings yet

- Corporate Finance EssayDocument6 pagesCorporate Finance EssayjaniceNo ratings yet

- Higher Education Is Key To Economic DevelopmentDocument2 pagesHigher Education Is Key To Economic DevelopmentjaniceNo ratings yet

- The Importance of Investing in HealthDocument2 pagesThe Importance of Investing in HealthjaniceNo ratings yet

- Higher Education Is Key To Economic DevelopmentDocument2 pagesHigher Education Is Key To Economic DevelopmentjaniceNo ratings yet

- Upper Six 2013 STPM Physics 2 Trial ExamDocument11 pagesUpper Six 2013 STPM Physics 2 Trial ExamOw Yu Zen100% (2)

- 74VHCU04Document6 pages74VHCU04Alexandre S. CorrêaNo ratings yet

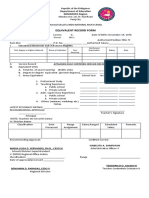

- Equivalent Record Form: Department of Education MIMAROPA RegionDocument1 pageEquivalent Record Form: Department of Education MIMAROPA RegionEnerita AllegoNo ratings yet

- Advantages of Computerizing and Networking ComputersDocument5 pagesAdvantages of Computerizing and Networking ComputersIn BioNo ratings yet

- ClarifierDocument2 pagesClarifierchagar_harshNo ratings yet

- Gizmotchy 3 Element Complete Assembly InstructionsDocument5 pagesGizmotchy 3 Element Complete Assembly InstructionsEuropaNo ratings yet

- Image Formation in Plane Mirrors: Ray DiagramsDocument3 pagesImage Formation in Plane Mirrors: Ray DiagramsSouvik BanerjeeNo ratings yet

- Linked ListDocument83 pagesLinked Listshahida18No ratings yet

- Analysis I - SyllabusDocument3 pagesAnalysis I - SyllabusJUan GAbrielNo ratings yet

- The Teacher and The LearnerDocument23 pagesThe Teacher and The LearnerUnique Alegarbes Labra-SajolNo ratings yet

- No-Till For Micro Farms: The Deep-Mulch Method (Lean Micro Farm)Document20 pagesNo-Till For Micro Farms: The Deep-Mulch Method (Lean Micro Farm)Chelsea Green PublishingNo ratings yet

- Land Equivalent Ratio, Growth, Yield and Yield Components Response of Mono-Cropped vs. Inter-Cropped Common Bean and Maize With and Without Compost ApplicationDocument10 pagesLand Equivalent Ratio, Growth, Yield and Yield Components Response of Mono-Cropped vs. Inter-Cropped Common Bean and Maize With and Without Compost ApplicationsardinetaNo ratings yet

- Thick Seam Mining Methods and Problems Associated With It: Submitted By: SAURABH SINGHDocument13 pagesThick Seam Mining Methods and Problems Associated With It: Submitted By: SAURABH SINGHPrabhu PrasadNo ratings yet

- Iso 696 1975Document8 pagesIso 696 1975Ganciarov MihaelaNo ratings yet

- Vee 2003Document14 pagesVee 2003Syed faizan Ali zaidiNo ratings yet

- ICO Basic SyllabusDocument11 pagesICO Basic SyllabusRaúl Plasencia Salini100% (1)

- CANAVAN' and VESCOVI - 2004 - CMJ X SJ Evaluation of Power Prediction Equations Peak Vertical Jumping Power in WomenDocument6 pagesCANAVAN' and VESCOVI - 2004 - CMJ X SJ Evaluation of Power Prediction Equations Peak Vertical Jumping Power in WomenIsmenia HelenaNo ratings yet

- Provisional List of Institutes1652433727Document27 pagesProvisional List of Institutes1652433727qwerty qwertyNo ratings yet

- Genigraphics Poster Template 36x48aDocument1 pageGenigraphics Poster Template 36x48aMenrie Elle ArabosNo ratings yet

- Theravada BuddhismDocument21 pagesTheravada BuddhismClarence John G. BelzaNo ratings yet

- MIL (Second Quarter)Document13 pagesMIL (Second Quarter)Menma ChanNo ratings yet

- Thermal Physics KPN MurthyDocument151 pagesThermal Physics KPN MurthyRithish BarathNo ratings yet