Professional Documents

Culture Documents

List of Case Digest (Midterm) - Tax 1

Uploaded by

stephcllo0 ratings0% found this document useful (0 votes)

88 views1 pagetax

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttax

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

88 views1 pageList of Case Digest (Midterm) - Tax 1

Uploaded by

stephcllotax

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

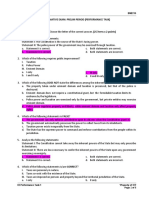

TAX 1 CASE DIGEST

ATTY. VICENTE V CAÑONEO

1. Cebu Portland Cement vs CTA L-29059 (Lifeblood of the Government)

2. Municipal of Makati vs CA GR 89898 (Exempt from Execution)

3. CIR vs Algue Inc L-28896 (Lifeblood Theory)

4. BPI Family Savings Bank vs CA 330 SCRA 507, April 12, 2000 (Mutual Observance of Fairness and Honesty)

5. CIR vs Tokyo Shipping Company 244 SCRA 332, May 26, 1995 (Claim for Tax Refund)

6. CIR vs Mitsubishi Metal Corp 181 SCRA 214, Jan 22, 1990 (Exemption of Japanes Government Owned Bank)

7. Phil Bank of Communication vs CIR, et. al 302 SCRA 241, Jan 28, 1999 (Summary collection does not infringe due

process)

8. Sison vs Ancheta, GR 59431, July 25, 1984, 130 SCRA 654 (Uniformity, Equal Protection and Due Process not violated

when BP 135 adopted gross income taxation)

9. Tolentino vs Sec of Finance and CIR, GR 11545 (Progressive Rule of Taxation)

10. ABAKADA Guro vs Exec Secretary, 469 SCRA 1, Sept 1 2005 and October 18, 2005

11. Maceda vs Macaraeg 223 SCRA 217 (Classification of Taxes)

12. Procter and Gamble vs Municipality of Jagna , 94 SCRA 894 (Nature and Amount of License)

13 CIR vs CTA and Ateneo de Manila, GR 115349, April 18, 1997, 271 SCRA 605 (Interpretation and Construction of Tax

Statutes)

14. Hydro Resources vs CA, L-80276, December 21, 1990

15. CIR vs Benguet Corp, 463 SCRA 28 (2005)

16. CIR vs Bursmeiters & Wain Scandinavian, GR153205, Jan 2007 (Reversal Ruling may not be given retroactive effect)

17. Pepsi Cola vs Tanauan 69 SCRA 460 (31) (Double Taxation)

18 CIR vs SC Johnson and Sons 309 SCRA 87 (1999)(32)

19. Delpher Trades Corp vs IAC 157 SCRA 349 (Tax exempt transfer of Property to a corporation resulting to control)

20. CIR vs Benigno Toda, 438 SCRA 290 (2004) (Meaning of Fraud, Tax Avoidance / Evasion)

21. Domingo vs Garlitos, 8 SCRA 443

22. CIR vs Pascor Reality and Dev Corp, 309 SCRA 402 (1999)

23. Marcos II vs CA 270 SCRA 47 (1997)

24. Meralco Securities Corp vs Savellano, 117 SCRA 804

25. Republic vs CA 366 SCRA 489 (2001)

26. Aurelio P Reyes vs Col of Internal Revenue, CTA No 42, July 26, 1956 and William Li Yao vs Col CTA No July 30, 1956

27. CIR vs CA, CTA and Fortune Tobacco Corp, GR No 119761, August 29, 1996, 261 SCRA 236

28. CIR vs Burroughs, LTD GR No 66653, June 19, 1986, 142 SCRA 324 (Effect of Revocation of Ruling)

29. PBC vs CIR, GR No 112024, Jan 29, 1999 (Wrong interpretation will not prejudice the government)

30. CIR vs Bursmeiters & Wain Scandinavian, GR153205, Jan 2007 (Non-Reactivity of BIR Ruling; 0% VAT on Export

Services)

You might also like

- Taxation 1 1 Semester SY 2022-2023: Course Syllabus Professor: Judge Gil G. Bollozos, CpaDocument22 pagesTaxation 1 1 Semester SY 2022-2023: Course Syllabus Professor: Judge Gil G. Bollozos, CpaRon AceNo ratings yet

- Sample Objections To Rule 45 Subpoena in United States District CourtDocument3 pagesSample Objections To Rule 45 Subpoena in United States District CourtStan BurmanNo ratings yet

- Tax 2 List of Cases PART 1Document10 pagesTax 2 List of Cases PART 1MarieNo ratings yet

- Up Remedial Law Reviewer PDFDocument274 pagesUp Remedial Law Reviewer PDFstephcllo100% (4)

- CR - ILLEGAL Practice of Dentistry - Mco - 012020Document2 pagesCR - ILLEGAL Practice of Dentistry - Mco - 012020Chester Caro100% (1)

- Administrative Law Course OutlineDocument3 pagesAdministrative Law Course OutlinePatricia Pineda100% (2)

- San Beda PartnershipDocument32 pagesSan Beda PartnershipLenard Trinidad79% (14)

- Cases in Legal PhilosophyDocument2 pagesCases in Legal PhilosophyJustine M.100% (1)

- Brondial Notes - Criminal ProcedureDocument21 pagesBrondial Notes - Criminal ProcedureArvi Geronga100% (2)

- Administrative and Election Law Syllabus 22Document12 pagesAdministrative and Election Law Syllabus 22Joey CelesparaNo ratings yet

- Labor Standards 2018 Bar Examtake Home AssignmentDocument11 pagesLabor Standards 2018 Bar Examtake Home AssignmentJeNo ratings yet

- Taxation 1 OutlineDocument15 pagesTaxation 1 OutlineNori LolaNo ratings yet

- The Wise MenDocument2 pagesThe Wise MenKevin Arellano BalaticoNo ratings yet

- Spec ProDocument80 pagesSpec ProRolan Jeff Amoloza Lancion100% (2)

- H - Conflict of Interest of Corporate Lawyers PDFDocument31 pagesH - Conflict of Interest of Corporate Lawyers PDFsigfridmonteNo ratings yet

- Restrictions of Government LawyersDocument44 pagesRestrictions of Government LawyersstephclloNo ratings yet

- D The Olowing Extract On Alternative Sentencing Carefuly and List FIVE MAIN Points Aa PoibleDocument6 pagesD The Olowing Extract On Alternative Sentencing Carefuly and List FIVE MAIN Points Aa Poibleaidan kamraj100% (1)

- Course Outline Taxation I General Principles Concept, Nature, and Characteristics of Taxation and TaxesDocument4 pagesCourse Outline Taxation I General Principles Concept, Nature, and Characteristics of Taxation and TaxesJunelyn T. EllaNo ratings yet

- Forensic EngineeringDocument40 pagesForensic Engineeringkk.osain100% (1)

- Course Outline-Tax ReviewDocument36 pagesCourse Outline-Tax ReviewMaan100% (1)

- Tax Syllabus 2021Document11 pagesTax Syllabus 2021Vincent TanNo ratings yet

- Article 3, Section 4 - E, Villanueva vs. PDIDocument3 pagesArticle 3, Section 4 - E, Villanueva vs. PDIJeremy Luglug100% (3)

- Digested Cases in Taxation I, Part 1Document35 pagesDigested Cases in Taxation I, Part 1lonitsuaf89% (9)

- Ipl CaseDocument4 pagesIpl CasestephclloNo ratings yet

- PLM TAX 2 2016-2017 List of Cases & Assigned StrudentsDocument19 pagesPLM TAX 2 2016-2017 List of Cases & Assigned StrudentsCharlie Pein100% (1)

- Torts Batch 2Document95 pagesTorts Batch 2stephclloNo ratings yet

- Taxation 1 Part 2Document23 pagesTaxation 1 Part 2Mylene GarciaNo ratings yet

- Remedial Law 1 Atty EleazarDocument147 pagesRemedial Law 1 Atty EleazarstephclloNo ratings yet

- Taxation 1 Course Syllabus A. General Principles of Taxation I. TaxationDocument11 pagesTaxation 1 Course Syllabus A. General Principles of Taxation I. TaxationAjay Ann De La CruzNo ratings yet

- Requirements For Practice of LawDocument55 pagesRequirements For Practice of LawstephclloNo ratings yet

- Requirements For Practice of LawDocument55 pagesRequirements For Practice of LawstephclloNo ratings yet

- Torts and Damages-ReviewerDocument33 pagesTorts and Damages-Reviewerjhoanna mariekar victoriano84% (37)

- Insurance Digest CasesDocument57 pagesInsurance Digest CasesJing Dalagan100% (4)

- Succession Balane PDFDocument150 pagesSuccession Balane PDFWaldemar JohasanNo ratings yet

- Nego Cases - Atty. Reyes (Ausl)Document7 pagesNego Cases - Atty. Reyes (Ausl)Anonymous 3hf2TXf100% (1)

- Continental Micronesia v. BassoDocument2 pagesContinental Micronesia v. BassoRogelio Jr. AdlawanNo ratings yet

- 12 James v. US (1961)Document1 page12 James v. US (1961)Marlene TongsonNo ratings yet

- Special Lectures On Election Laws: Atty. Voltaire G. San PedroDocument165 pagesSpecial Lectures On Election Laws: Atty. Voltaire G. San PedrostephclloNo ratings yet

- Special Lectures On Election Laws: Atty. Voltaire G. San PedroDocument165 pagesSpecial Lectures On Election Laws: Atty. Voltaire G. San PedrostephclloNo ratings yet

- Volume 14 01Document807 pagesVolume 14 01අපේ පොත් එකතුවNo ratings yet

- Totality Rule PDFDocument3 pagesTotality Rule PDFLenie Ricardo Dela CruzNo ratings yet

- Unknown Author - Property HIZON NotespdfDocument137 pagesUnknown Author - Property HIZON NotespdfstephclloNo ratings yet

- Syllabus Tax 1 2019 2020Document8 pagesSyllabus Tax 1 2019 2020Sand FajutagNo ratings yet

- Persons DigestDocument2 pagesPersons DigestNatepogiNo ratings yet

- Compliance Awareness and Advocacy in The Civil Rights MovementDocument6 pagesCompliance Awareness and Advocacy in The Civil Rights Movementapi-299665237No ratings yet

- Tax II CasesDocument3 pagesTax II CasesIELTSNo ratings yet

- Tax Law CasesDocument4 pagesTax Law CasesCarmz SumileNo ratings yet

- Foundation University College of Law Taxation I Topics Covered: A. General PrinciplesDocument2 pagesFoundation University College of Law Taxation I Topics Covered: A. General PrinciplesDario TorresNo ratings yet

- Tax 1 Course Syllabus Ay2013-2014Document14 pagesTax 1 Course Syllabus Ay2013-2014Juris PoetNo ratings yet

- Taxlaw Review Outline - General Principles and RemediesDocument13 pagesTaxlaw Review Outline - General Principles and RemediesJacqueline TimbrenaNo ratings yet

- Vii. Remedies of The Government: Syllabus For Taxation II (SY 2018-2019) Atty. Jon LigonDocument5 pagesVii. Remedies of The Government: Syllabus For Taxation II (SY 2018-2019) Atty. Jon LigonAstrid Gopo BrissonNo ratings yet

- Part I Syllabus General Principles of Taxation 2023 1Document5 pagesPart I Syllabus General Principles of Taxation 2023 1Jake VidNo ratings yet

- LDocument3 pagesLDiane JulianNo ratings yet

- MOF Co. Inc. v. Shin Yang Brokerage Corp.Document10 pagesMOF Co. Inc. v. Shin Yang Brokerage Corp.Kristine JoyNo ratings yet

- Additional TaxDocument3 pagesAdditional TaxMel ManatadNo ratings yet

- PART II SyllabusDocument4 pagesPART II SyllabusYanilyAnnVldzNo ratings yet

- Syllabus Stat ConDocument4 pagesSyllabus Stat ConTeejay Norman D. MercadoNo ratings yet

- Income TaxDocument15 pagesIncome TaxpatotiwotieNo ratings yet

- Syllabus TaxDocument23 pagesSyllabus TaxMark M. MabalayNo ratings yet

- Martin Mendoza OutlineDocument7 pagesMartin Mendoza OutlineSef KimNo ratings yet

- Remedies Procedure Lecture NotesDocument13 pagesRemedies Procedure Lecture NotesSusannie AcainNo ratings yet

- Tax 1 Course Outline 2018-2019 Final RevisionDocument9 pagesTax 1 Course Outline 2018-2019 Final Revisionjorg100% (1)

- Syllabus Part 1 - NIRC Remedies (Revised Latest)Document8 pagesSyllabus Part 1 - NIRC Remedies (Revised Latest)Jonathan UyNo ratings yet

- Course Outline-Tax ReviewDocument27 pagesCourse Outline-Tax ReviewMaanNo ratings yet

- Tax Rev FGHDocument2 pagesTax Rev FGHDenardConwiBesaNo ratings yet

- Tax Cases ListDocument7 pagesTax Cases ListjamesNo ratings yet

- Torts Course Outline'Document8 pagesTorts Course Outline'Eeh MahNo ratings yet

- Taxation 1 Syllabus 2023Document21 pagesTaxation 1 Syllabus 2023Marble TesoroNo ratings yet

- Statcon Related CasesDocument2 pagesStatcon Related CasesMacha CosefNo ratings yet

- First Lepanto Taisho Insurance v. CIR 695 SCRA 639: A. Power of Taxation Is Inherently Legislative in CharacterDocument3 pagesFirst Lepanto Taisho Insurance v. CIR 695 SCRA 639: A. Power of Taxation Is Inherently Legislative in CharacterMary Fatima BerongoyNo ratings yet

- Powers of Administrative AgenciesDocument4 pagesPowers of Administrative Agenciesmarge carreonNo ratings yet

- Tax I Course Outline July 24 2019Document17 pagesTax I Course Outline July 24 2019Justin YañezNo ratings yet

- Civpro Syllabus Part3Document3 pagesCivpro Syllabus Part3SarahSantiagoNo ratings yet

- Civil Procedure Digests Incomplete and Unedited 1 PDFDocument93 pagesCivil Procedure Digests Incomplete and Unedited 1 PDFLuelle PacquingNo ratings yet

- Consolidated Tax 1 SyllabusDocument10 pagesConsolidated Tax 1 SyllabusChuck NorrisNo ratings yet

- Transfer Taxes and VATDocument3 pagesTransfer Taxes and VATDianne Medel GumawidNo ratings yet

- Taxation Syllabus - Atty. BoaconDocument2 pagesTaxation Syllabus - Atty. BoaconceejayeNo ratings yet

- Tax I Syllabus Part IDocument3 pagesTax I Syllabus Part IForth BridgeNo ratings yet

- Course SyllabusDocument4 pagesCourse SyllabusLisa BautistaNo ratings yet

- Course Outline For Agrarian Reform Law LPUDocument7 pagesCourse Outline For Agrarian Reform Law LPURuperto A. Alfafara IIINo ratings yet

- Income Taxation Part 6Document5 pagesIncome Taxation Part 6KanraMendozaNo ratings yet

- Baniqued Tariff and Customs CodeDocument3 pagesBaniqued Tariff and Customs CodeMRNo ratings yet

- I. General Principles of Taxation A. Definition and Concepts of Taxation Power of TaxationDocument20 pagesI. General Principles of Taxation A. Definition and Concepts of Taxation Power of TaxationAvarie BayubayNo ratings yet

- Syllabus Rules 46 To 71Document4 pagesSyllabus Rules 46 To 71Kaye MendozaNo ratings yet

- 2modules 1 and 2 - Taxation 1Document6 pages2modules 1 and 2 - Taxation 1Gerard Relucio OroNo ratings yet

- How to Exercise Statutory Powers Properly: Cayman Islands Administrative LawFrom EverandHow to Exercise Statutory Powers Properly: Cayman Islands Administrative LawNo ratings yet

- Newsroom Law: A Legal Guide for Commonwealth Caribbean JournalistsFrom EverandNewsroom Law: A Legal Guide for Commonwealth Caribbean JournalistsNo ratings yet

- Is Bad-Faith the New Wilful Blindness?: The Company Directors’ Duty of Good Faith and Wilful Blindness Doctrine Under Common Law Usa (Delaware) and Uk (England): a Comparative StudyFrom EverandIs Bad-Faith the New Wilful Blindness?: The Company Directors’ Duty of Good Faith and Wilful Blindness Doctrine Under Common Law Usa (Delaware) and Uk (England): a Comparative StudyNo ratings yet

- Petition for Certiorari Denied Without Opinion: Patent Case 93-1518From EverandPetition for Certiorari Denied Without Opinion: Patent Case 93-1518No ratings yet

- Reforming Mining Law: A Look at Transnational Corporations’ Activities in the Democratic Republic of Congo Within the Doctrine of Corporate Social ResponsibilityFrom EverandReforming Mining Law: A Look at Transnational Corporations’ Activities in the Democratic Republic of Congo Within the Doctrine of Corporate Social ResponsibilityNo ratings yet

- SYLLABUS FOR CIVIL PROCEDURE Part III - Cases AssignmentDocument13 pagesSYLLABUS FOR CIVIL PROCEDURE Part III - Cases AssignmentstephclloNo ratings yet

- Simple Loan or Mutuum Royal Shirt Factory, Inc. V CoDocument5 pagesSimple Loan or Mutuum Royal Shirt Factory, Inc. V CoRufino Gerard MorenoNo ratings yet

- Heirs of Medrano Vs de VeraDocument2 pagesHeirs of Medrano Vs de VerastephclloNo ratings yet

- Law Student Rule: Problem Areas in Legal Ethics Arellano University School of Law - Arellano Law Foundation 2015-2016Document28 pagesLaw Student Rule: Problem Areas in Legal Ethics Arellano University School of Law - Arellano Law Foundation 2015-2016KesTerJeeeNo ratings yet

- Insurance Cases Part 1Document113 pagesInsurance Cases Part 1stephclloNo ratings yet

- Civ Digests PDFDocument333 pagesCiv Digests PDFCresteynTeyngNo ratings yet

- Ateneo 2007 Commercial Law (Insurance) PDFDocument16 pagesAteneo 2007 Commercial Law (Insurance) PDFBenjo MarceloNo ratings yet

- Public Office, Chapters 1-3Document24 pagesPublic Office, Chapters 1-3stephclloNo ratings yet

- Heirs of Medrano Vs de VeraDocument2 pagesHeirs of Medrano Vs de VerastephclloNo ratings yet

- Torts Batch 1Document138 pagesTorts Batch 1stephclloNo ratings yet

- Transpo Part 1Document5 pagesTranspo Part 1stephclloNo ratings yet

- How To Change Your Child's SurnameDocument8 pagesHow To Change Your Child's SurnameDagul JauganNo ratings yet

- United States v. Donaldson, 10th Cir. (2016)Document6 pagesUnited States v. Donaldson, 10th Cir. (2016)Scribd Government DocsNo ratings yet

- LLR Group 3 Written Report 2Document47 pagesLLR Group 3 Written Report 2Kate DeseoNo ratings yet

- Natural Resources and Environmental LawDocument49 pagesNatural Resources and Environmental LawRay John Uy-Maldecer AgregadoNo ratings yet

- 03 Performance Task 1TAXATIONDocument5 pages03 Performance Task 1TAXATIONRianna CclNo ratings yet

- West Bengal Disturbed Areas Act, 1947Document3 pagesWest Bengal Disturbed Areas Act, 1947Latest Laws TeamNo ratings yet

- Psupt Henry Y. Duque Vs Hon. Ombudsman G.R. Nos. 225188 & 225277 PSSUPT. Asher A. Dolina Vs Hon. OmbudsmanDocument2 pagesPsupt Henry Y. Duque Vs Hon. Ombudsman G.R. Nos. 225188 & 225277 PSSUPT. Asher A. Dolina Vs Hon. OmbudsmanVannyve Baluyut- NavaltaNo ratings yet

- Legal Framework: Public Service Delivery in The PhilippinesDocument49 pagesLegal Framework: Public Service Delivery in The PhilippinesVivian Escoto de BelenNo ratings yet

- Problems and Issues in Mandatory Overtime - ppt-2Document27 pagesProblems and Issues in Mandatory Overtime - ppt-2Ann Grethel Tan100% (1)

- First Division January 8, 2018 A.C. No. 10689 ROMEO A. ALMARIO, Complainant Atty. Dominica Llera-Agno, Respondent Decision Del Castillo, J.Document4 pagesFirst Division January 8, 2018 A.C. No. 10689 ROMEO A. ALMARIO, Complainant Atty. Dominica Llera-Agno, Respondent Decision Del Castillo, J.abcdefNo ratings yet

- People of The Philippines, Plaintiff-Appellee vs. Olive Rubio Mamaril, Accused-AppellantDocument6 pagesPeople of The Philippines, Plaintiff-Appellee vs. Olive Rubio Mamaril, Accused-AppellantLester BalagotNo ratings yet

- 3philippine Ports Authority Employees EthicsDocument5 pages3philippine Ports Authority Employees EthicsGenesis AlbaricoNo ratings yet

- People Vs ReyesDocument6 pagesPeople Vs ReyesIsidore1 TarolNo ratings yet

- BRIDGESTONE AMERICAS TIRE OPERATIONS, LLC Et Al v. PACIFIC EMPLOYERS INSURANCE COMPANY DocketDocument3 pagesBRIDGESTONE AMERICAS TIRE OPERATIONS, LLC Et Al v. PACIFIC EMPLOYERS INSURANCE COMPANY DocketACELitigationWatchNo ratings yet

- Ebcl Test Paper by EvaDocument5 pagesEbcl Test Paper by EvaasadNo ratings yet

- Deed of Sale of Motor VehicleDocument1 pageDeed of Sale of Motor VehiclePrince DumioNo ratings yet

- 332 Supreme Court Reports Annotated: People vs. MagtibayDocument18 pages332 Supreme Court Reports Annotated: People vs. MagtibayAji AmanNo ratings yet