Professional Documents

Culture Documents

Shree Cement LTD.: Credit Analysis & Research Limited

Uploaded by

lalitsharmachoklattyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shree Cement LTD.: Credit Analysis & Research Limited

Uploaded by

lalitsharmachoklattyCopyright:

Available Formats

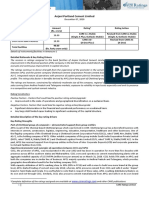

SHREE CEMENT LTD.

Long term bank facilities CARE AA+

Short-term bank facilities PR1+

Short Term Debt PR1+

Long Term Borrowing CARE AA+

Rating

CARE has upgraded the rating assigned to the long term bank facilities of Rs.968.2 crore

(reduced from Rs.1112.1 crore) of Shree Cement Ltd (SCL) to ‘CARE AA+’ (Double A

plus) from the existing CARE AA (Double A). Also, CARE has retained the ‘PR1+’ (PR

One plus) rating assigned to the short-term bank facilities of Rs.100 crore (enhanced

from Rs.60 crore) of SCL. CARE has also upgraded the rating assigned to the proposed

Long Term Borrowing (LTB) programme (nomenclature changed from NCD) of Rs.500

crore of SCL to ‘CARE AA+’ (Double A plus) from the existing CARE AA (Double A).

The proposed LTBs shall have a bullet repayment at the end of seven years from the

date of availment. Further, CARE has retained the ‘PR1+’ (PR one plus) rating

assigned to the Short Term Debt (STD) programme upto Rs.500 crore (enhanced from

Rs.400 crore) of SCL for a maturity period upto 90 days, with daily put and call option.

Facilities/Instruments with ‘CARE AA’ rating are considered to offer high safety for

timely servicing of debt obligations. Such facilities/instruments carry very low credit risk.

CARE assigns ‘+’ or ‘-’ signs to be shown after the assigned rating (wherever necessary)

to indicate the relative position within the band covered by the rating symbol.

Facilities/Instruments with ‘PR1+’ rating would have strong capacity for timely payment

of short-term debt obligations and carry lowest credit risk. ‘PR1+’ is CARE’s highest

rating for short term facilities/instruments.

The long term rating has been upgraded from CARE AA (Double A) to CARE AA+ (Double

A plus) in view of SCL’s significant improvement in performance in FY09 despite volatile

economic environment, increased amount of liquid funds invested in mutual funds &

bank fixed deposits (Rs.1265.4 crore as on Mar.31, 2009), continuously having

comfortable debt-servicing parameters, achieving largest market share in Northern

region and significant advancement in ongoing projects. The ratings assigned to SCL also

draw strength from its long & satisfactory track record with rich experience of its

promoters, qualified management team, increasing capacity & high capacity utilisation,

strong operational efficiency on the back of backward integration (limestone & power)

and usage of pet coke, highly energy efficient cement plants, successful track record in

project implementation, satisfactory financial position with high & steady growth in

topline and bottomline, high profitability margins, improving cash accruals, comfortable

liquidity ratios, SCL’s position as one of the lowest cost cement players in the country,

earning modest level of additional income through sale of power & carbon credit and

Government support & thrust on infrastructure creation. However, the ratings also factor

CREDIT ANALYSIS & RESEARCH LIMITED

in capacity additions expected to be on-stream in FY10 leading to expected decline in

cement price and increasing competition & consolidation in the domestic industry. Trend

in sales price realisation in the context of huge capacity addition expected,

Governmental policy regarding infrastructure development and volatility in crude oil &

pet coke prices shall remain the key rating sensitivities.

Company Background

SCL, incorporated in 1979 and belonging to Shri B.G.Bangur - H. M. Bangur faction of

Bangur family of Kolkata, is engaged in cement manufacturing with its seven plants

(aggregate capacity – 7.9 mn tonnes p.a.) - two at Beawar and five at RAS in Rajasthan.

The company has established backward linkages with captive limestone mines and

Captive Power Plants (CPPs), the major cost constituents in cement manufacturing. SCL

is further augmenting its captive power capacity at RAS and adding grinding capacity at

Suratgarh, Rajasthan & Roorkee, Uttaranchal. In FY09, the company had also started

selling surplus power generated at its captive facilities.

SCL’s cement plants are considered among the most energy efficient plants in the

country and the company is one of the lowest cost cement players in the country. All the

cement plants have OHSAS 18001, ISO 9002 and ISO 14001 certification. Over the

years, the company has obtained various awards and accreditations.

Operations

SCL generally produces four grades of cement, viz., 53/ 43 / 33 grades Ordinary

Portland Cement (OPC) & Pozzolana Cement (PPC) and sells under the established brand

names ‘Shree’, ‘Shree Ultra’, ‘Bangur cement’ and ‘Tuff Cemento 3566’. These brands

are well established and have gained wide acceptance in Northern and Central India

where SCL operates. During FY09, the market share of the company continued to

increase to 4.3% in India and about 19% in northern region (as against 3.3% & 16%

respectively); thereby catapulting the company to numero uno position in the region.

SCL extended its streak of high performance to FY09 with capacity utilisation continuing

to remain above unity owing to blending of fly-ash with cement. Total net sales in FY09

grew by 28.6% over FY08 on account of surge in cement sales (by 24.8%) and sale of

surplus power amounting to Rs.80.6 crore (as against nil in FY08). The increase in

cement sales was due to increase in sales quantity and higher Average Net Sales Price

Realisation (ANSPR). The company was able to post 22.7% rise in quantity of cement

sold, despite some over-supply concerns in northern region, owing to its strong brand

image and better & concentrated marketing efforts. The realisations went up in view of

increased amount (98% in FY09 against 86% in FY08) of sales being carried out on free-

on-road basis (i.e., inclusive of freight charges), in line with the industry trend. The

company has started selling surplus power generated at its captive power units to

Rajasthan Power Procurement Centre (RPPC – a nodal agency incorporated by

CREDIT ANALYSIS & RESEARCH LIMITED 2

Government of Rajasthan) and on Indian Energy Exchange, India’s first automated

online electricity trading exchange platform.

The major cost drivers are expenses on raw material, power & fuel and freight, which

together comprised 77% of cost of sales in FY09. Limestone, the primary raw material, is

sourced from captive mines located in close proximity to the cement plants and

accounted for 6.5% of the aggregate cost of sales incurred during FY09. The company

has been able to reduce average cost of limestone, over the years, on account of

increased usage of better quality limestone available from mines at RAS. Fly-ash

generally comprised a major share (24.5% in FY09) of aggregate raw material expenses

in view of high transportation cost, despite the material being available free. The

transportation cost increased substantially during FY09 owing to increase in fuel prices,

surge in dispatched volume & increased sales on free-on-road basis. High transportation

cost is the main reason for SCL setting up grinding units at locations in close proximity to

market as well as fly ash sources.

SCL’s plants are among the most energy efficient plants in the world in terms of

electricity and fuel consumption per tonne of cement. SCL continued to improve on this

front and electricity consumption decreased further to 76.72 kWh/tonne in FY09 (from

79.35 kWh/tonne in FY08), which is significantly lower than the industry average of 100

kWh/tonne and benchmark level of around 85 kWh/tonne for major cement players). On

the fuel front, SCL has been saving significantly due to use of pet coke (cheaper with

high calorific value) both in power and cement plants. The petcoke remnants of CPP are

used for substituting the original material required in clinkerisation process, thereby

reducing aggregate consumption cost of petcoke. Despite this, the power & fuel

expenses have been witnessing an uptrend in the past few years owing to increase in

business volume coupled with increase in pet coke and petroleum prices. However, given

the fact that SCL’s entire fuel requirement is met through pet coke, the company is

placed relatively in a better position as compared to its peers using coal as fuel. Further,

the company also earned carbon credits and sold off substantial portion of the same in

FY09, thus adding to its bottomline.

New Project

SCL is, currently, setting up various projects comprising expansion of clinkerisation

capacity, setting up two grinding units - one at Suratgarh (Rajasthan) & another at

Roorkee (Uttaranchal), and five CPPs (three are coal based and two are waste heat

recovery based) at existing cement plant sites in RAS and Beawar in Rajasthan.

Involving a total outlay of Rs.1136 crore, the projects are being funded at a debt-equity

ratio of 0.36:1. Financial closure has been achieved and the company has spent Rs.554

crore on the projects till April 30, 2009. The projects are likely to be completed by

March, 2010, in phases, with clinkerisation plant expected to commence soon.

CREDIT ANALYSIS & RESEARCH LIMITED 3

Financial Performance

During FY09, cement industry witnessed huge capacity addition, growth in demand and

more or less stable prices. The growth in demand and strong brand image helped the

company to post 24.8% rise in cement sales in FY09 over FY08. This, coupled with sale

of surplus power led total net sales to grow by 28.6% during the aforesaid period (CARG

of 38.4% during FY07-FY09). However, PBILDT witnessed a relatively lower y-o-y growth

of 11.7% (CARG of 26.3% during FY07-FY09) owing to relatively higher growth in power

& fuel and freight expenses (on account of rise in crude oil prices). Accordingly, PBILDT

margin, though declined, was satisfactory in FY09.

Capital charge declined during the period under consideration on account of substantial

reduction in depreciation (as no new assets was capitalised during the year). Accordingly,

PAT (after defd. tax) increased by about 68% over FY08 and PAT margin improved. GCA

also improved and was comfortable at Rs.784.9 crore in FY09 vis-à-vis term loan repayment

obligation.

Overall gearing and long-term debt equity ratios improved, as on Mar.31, 2009, and

continued to be comfortable. The company had an investment of Rs.1,265.4 crore in

mutual funds and fixed deposits as on Mar.31, 2009 indicating use of most of the

borrowings for arbitrage purpose. If this is adjusted, overall gearing would become

below unity (0.19 as on Mar.31, 2009). Interest coverage has generally been

satisfactory.

Liquidity position of SCL, as reflected in current ratio of 2.45 as on Mar.31, 2009, was

satisfactory. Further, the investment of Rs.1,265.4 crore lying in mutual funds and

unencumbered fixed deposits, as on Mar.31, 2009, also indicate comfortable liquidity

position of the company.

CREDIT ANALYSIS & RESEARCH LIMITED 4

Financial Results

(Rs. crore)

For the year ending / As on March 31, 2007 2008 2009

(Audited)

Net sales 1403.1 2108.2 2710.9

Total income 1424.2 2177.1 2787.3

PBILDT 614.0 877.3 979.7

Interest & finance charges 12.1 52.7 77.4

Depreciation 317.2 407.9 205.4

PAT (before defd. tax) 200.7 325.6 579.5

PAT (after defd. tax) 273.4 340.3 571.4

GCA 517.9 733.5 784.9

Total capital employed 1498.1 2166.7 2695.8

Equity share capital 34.8 34.8 34.8

Tangible networth (net of revaluation

reserve) 566.7 836.0 1199.6

Key Ratios

Growth in Total income (%) 104.00 52.86 28.03

Growth in PBILDT (%) 148.44 42.89 11.68

Growth in PAT -after defd. tax (%) 292.92 24.47 67.91

PBILDT/Total operating income (%) 43.14 40.60 35.40

PAT (before defd. tax)/Total income (%) 14.09 14.96 20.79

PAT (after defd. tax)/Total income (%) 19.20 15.63 20.50

ROCE - operating (%) 25.31 26.52 32.65

RONW (%) 56.70 48.35 56.14

Debt equity ratio 1.59 1.55 1.03

Overall gearing ratio 1.64 1.59 1.25

Interest coverage 24.53 8.91 10.01

Total debt / Available NCA 2.20 1.94 1.73

Current ratio 2.13 2.92 2.45

Average collection period (days) 5 6 6

Average finished goods inventory period

(days) 7 6 5

Adjustments

i) Although the unit IV was commissioned on Mar.26, 2007, SCL charged depreciation on plant &

machinery of unit IV for six months in FY07 amounting to Rs.110.8 crore. Similarly, depreciation

charged on sixth plant, in FY08, was in excess by Rs.70.9 crore, as the plant was in use for only 9 days.

The effect of aforesaid additional depreciation has been negated in our analysis.

ii) Fixed assets revalued earlier was restated at their historical cost in FY08. Additional depreciation (upon

revaluation of fixed assets) was charged to P&L A/c and the corresponding amount was transferred to

Special Reserve from Revaluation Reserve. As such treatment was ignored in FY07, no adjustment has

been made in FY08 results for the purpose of this analysis.

iii) Sundry creditors for capital goods substituted by long term loans have been excluded from current

liabilities for the purpose of calculation of current ratio.

iv) Security deposits from customers have been considered as long-term liability as these are interest

bearing long-term deposits.

Industry Review

The Indian cement industry, with installed capacity of 217.8 mn tonnes p.a. (mtpa), is

the second largest in the world following China, accounting for about 5% of world

CREDIT ANALYSIS & RESEARCH LIMITED 5

production. The industry is further divided into five main regions viz. north, south, west,

east and central as cement is a freight intensive industry rendering transportation of

cement over long distances uneconomical.

The demand for cement continued to grow during FY09 on the back of increased

infrastructure spending by the Government of India and new industrial projects being

implemented, despite slowdown in real estate sector, the major consumer for cement.

Consequently, the cement production recorded a growth of 7.8% during the year (from

168.3 mn tonnes in FY08 to 181.4 mn tonnes in FY09) with 9.9% growth in northern

region. However, consumption in the northern region increased only by 2.3%, as against

8.4% for the whole country.

During FY09, the northern region witnessed 9.6% growth in dispatches (to 41.1 mt), as

against all-India average of about 8%, on the back of increased construction activity for

upcoming Commonwealth games in 2010 (to be held in New Delhi). The prices declined

marginally during August-November, 2008, but increased back to March, 2008 level by

March, 2009, in line with the trend witnessed in the industry. On the other hand, the

industry faced turbulence and unpredictability owing to significant volatility in crude-oil

and pet coke prices. SCL, currently, is market leader in the northern region followed by J

K Cement, Ambuja Cement and Grasim.

Cement sector is likely to continue to grow, though at reduced rate (at about 8.6% in

FY10), given the Government’s thrust on infrastructure. GoI has identified infrastructure

creation as an important tool to fight ongoing slowdown in the economy and have

unveiled quite a few measures providing thrust to the core sectors including cement

sector. RBI has also taken measures to increase investible resources in the economy in

order to encourage investment. These measures together have helped in bolstering the

demand for the cement and prices have witnessed an uptrend alongwith increased

dispatches, which is a positive sign for the sector. The momentum is likely to continue

with more such measures expected to be implemented. However, large capacities are

also expected to come on-stream during FY10 resulting in over-capacity, which might, in

turn, affect prices. In the long term, the level of consolidation and growth in regional

demand will also play a crucial role in price determination.

June 2009

Disclaimer

CARE’s ratings are opinions on credit quality and are not recommendations to sanction, renew, disburse or

recall the concerned bank facilities. CARE has based its ratings on information obtained from sources believed

by it to be accurate and reliable. CARE does not, however, guarantee the accuracy, adequacy or completeness

of any information and is not responsible for any errors or omissions or for the results obtained from the use of

such information. Most entities whose bank facilities are rated by CARE have paid a credit rating fee, based on

the amount and type of bank facilities.

CREDIT ANALYSIS & RESEARCH LIMITED 6

CARE is headquartered in Mumbai, with Offices all over India. The office addresses and

contact numbers are given below:

HEAD OFFICE: MUMBAI

Mr. D.R. Dogra Mr. Rajesh Mokashi

Managing Director Dy. Managing Director

Cell : +91-98204 16002 Cell : +91-98204 16001

E-mail : dr.dogra@careratings.com E-mail: rajesh.mokashi@careratings.com

Mr. Ankur Sachdeva

Head - Business Development

Cell : +91-9819698985

E-mail: ankur.sachdeva@careratings.com

4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway,

Sion (East), Mumbai 400 022 Tel.: (022) 67543456 Fax: (022) 67543457

Website: www.careratings.com

OFFICES

Mr.Mehul Pandya Mr.Sundara Vathanan

Regional Manager Regional Manager

307, III Floor, Iscon Mall, No.G1, Canopy Royal Manor,

Near Jodhpur Cross Road, Near Manipal Hospital,

Satellite, Rustombagh, Off Airport Road,

Ahmedabad - 380 015. Bangalore - 560 017.

Tel – 079 6631 1821/22 Tel – 080 2520 5575

Mobile - 98242 56265 Mobile – 98803 60878

E-mail: E-mail: sundara.vathanan@careratings.com

mehul.pandya@careratings.com

Mr.Ashwini Jani Mr. Rahul Patni

Regional Manager Regional Manager

Unit No. O-509/C, Spencer Plaza, 302, `Priya Arcade’

5th Floor, No. 769, 8-3-826, Yellareddyguda,

Anna Salai, Srinagar Colony,

Chennai 600 002 Hyderabad - 500 073.

Tel: 2849 7812/2849 0811 Tel – 040 6675 8386

Mobile – 91766 47599 Mobile – 91600 04563

E-mail :ashwini.jani@careratings.com E-mail: rahul.patni@careratings.com

Mr. Sukanta Nag Ms.Swati Agrawal

Regional Manager Regional Manager

3rd Floor, Prasad Chambers 710 Surya Kiran,

(Shagun Mall Building) 19 K.G. Road,

10A, Shakespeare Sarani New Delhi - 110 001.

Kolkata - 700 071. Tel – 011 2331 8701/2371 6199

Tel – 033 2283 1800/1803 Mobile – 98117 45677

Mobile – 98311 70075 E-mail :swati.agrawal@careratings.com

E- mail: sukanta.nag@careratings.com

CREDIT ANALYSIS & RESEARCH LIMITED 7

You might also like

- Prism Cement Investor Update May 2014Document5 pagesPrism Cement Investor Update May 2014abmahendruNo ratings yet

- Rashmi Sponge Iron Ratings ReaffirmedDocument6 pagesRashmi Sponge Iron Ratings ReaffirmedSoumyakanti S. Samanta (Pgdm 09-11, Batch II)No ratings yet

- MSP Metallics Ltd.Document5 pagesMSP Metallics Ltd.Suraj ShawNo ratings yet

- Birla Corporation Pat at Rs 319.88 Crores: Press Release 28 April 2011Document2 pagesBirla Corporation Pat at Rs 319.88 Crores: Press Release 28 April 2011Sk Irfanul HaqueNo ratings yet

- Director Report 2013 2014Document16 pagesDirector Report 2013 2014saichakrapani3807No ratings yet

- Shree Cement's Growth in Cement and Power BusinessDocument5 pagesShree Cement's Growth in Cement and Power BusinessChandan AgarwalNo ratings yet

- Prism Cement Limited: Investor Update Feb 2014Document5 pagesPrism Cement Limited: Investor Update Feb 2014abmahendruNo ratings yet

- M&A ASSIGNMENT ON MERGERS AND ACQUISITIONSDocument7 pagesM&A ASSIGNMENT ON MERGERS AND ACQUISITIONSAbhishek ShawNo ratings yet

- Final Fadm Presentation2Document58 pagesFinal Fadm Presentation2shubbhi27No ratings yet

- Rain Commodities LTD Initiating - CoverageDocument24 pagesRain Commodities LTD Initiating - CoverageCindrella TaraNo ratings yet

- Ultra Tech Final 2007Document16 pagesUltra Tech Final 2007pvinayakamNo ratings yet

- M&A - Cia Ii: Gammon India Ltd. and AtslDocument7 pagesM&A - Cia Ii: Gammon India Ltd. and AtslAnurag JaiswalNo ratings yet

- Amman TRY Sponge and Power Private LimitedDocument4 pagesAmman TRY Sponge and Power Private LimitedKathiresan Mathavi's SonNo ratings yet

- Lanco Capital BudgetDocument78 pagesLanco Capital BudgetDeepak AroraNo ratings yet

- Anjani Cement Ratings Revised to CARE ADocument5 pagesAnjani Cement Ratings Revised to CARE ASandy SanNo ratings yet

- Birla Cement WorksDocument71 pagesBirla Cement WorksrohittakNo ratings yet

- Chairman Statement 2008Document3 pagesChairman Statement 2008Gyan PrakashNo ratings yet

- Directors Report: A View of Hot Metal Pouring ProcessDocument5 pagesDirectors Report: A View of Hot Metal Pouring ProcessRavish Kumar ThakurNo ratings yet

- Shree Cement (SHRCEM) : Strong Growth VisibilityDocument13 pagesShree Cement (SHRCEM) : Strong Growth VisibilitygirishrajsNo ratings yet

- Investor Update Oct 2012Document5 pagesInvestor Update Oct 2012abmahendruNo ratings yet

- A Project Training ReportDocument92 pagesA Project Training ReportmaanubediNo ratings yet

- KSB AnalysisDocument7 pagesKSB AnalysisCharles LeeNo ratings yet

- Promoter's Background: Equity Shares Locked-In For One YearDocument8 pagesPromoter's Background: Equity Shares Locked-In For One YearabeeraksNo ratings yet

- CARE_Sunflag_4.01.2024Document9 pagesCARE_Sunflag_4.01.2024Swapnil SomkuwarNo ratings yet

- PR Mahamaya Sponge Iron 8jan24Document9 pagesPR Mahamaya Sponge Iron 8jan24Rohit MotapartiNo ratings yet

- JK LaxmiDocument7 pagesJK LaxmiRockyBalboaaNo ratings yet

- ACC - Case StudyDocument11 pagesACC - Case StudyAbhinav AroraNo ratings yet

- The Following Are The Objectives of The StudyDocument6 pagesThe Following Are The Objectives of The StudyChetan SankhlaNo ratings yet

- Accenture 2016 Shareholder Letter10 K006Document6 pagesAccenture 2016 Shareholder Letter10 K006ziaa senNo ratings yet

- Summary 2Document16 pagesSummary 2Harishankar PareekNo ratings yet

- 630669700d28f Cil Fundamental Analysis VishleshaksDocument12 pages630669700d28f Cil Fundamental Analysis VishleshaksSounak MandalNo ratings yet

- Analysis of India Cement LTD 2011Document19 pagesAnalysis of India Cement LTD 2011Kr Nishant100% (1)

- Gujarat State Petronet Limited: Vol. 2/09-10 April 24, 2010Document6 pagesGujarat State Petronet Limited: Vol. 2/09-10 April 24, 2010amibscmcaNo ratings yet

- Reliance PowerDocument5 pagesReliance PowersaucydivaNo ratings yet

- GAIL (India) LTD 2008Document189 pagesGAIL (India) LTD 2008Md Azeemulla100% (1)

- Firm Analysis - ACC Cements: Project Report - Competition and StrategyDocument17 pagesFirm Analysis - ACC Cements: Project Report - Competition and StrategySanju VisuNo ratings yet

- Texmaco Rail & Engineering: PCG ResearchDocument13 pagesTexmaco Rail & Engineering: PCG ResearchumaganNo ratings yet

- The Indian Cements LTD: Retail ResearchDocument22 pagesThe Indian Cements LTD: Retail ResearchumaganNo ratings yet

- Best Cement Stocks To Buy NowDocument34 pagesBest Cement Stocks To Buy Nowshubh13septemberNo ratings yet

- Recruitment and Selection at Shree CementDocument122 pagesRecruitment and Selection at Shree CementSmartydr100% (1)

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- Shree Cement LTD.: Summer Training ProjectDocument29 pagesShree Cement LTD.: Summer Training ProjectJain Ronak100% (1)

- CementDocument2 pagesCementRohit ReturajNo ratings yet

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- The Tata Power Company Limited 202214Document11 pagesThe Tata Power Company Limited 202214pratik567No ratings yet

- AMBUJA ANALYSISDocument10 pagesAMBUJA ANALYSISAbhishek AgrawalNo ratings yet

- Shivam Cements Limited: (ICRANP) LA+ Upgraded /A1 ReaffirmedDocument6 pagesShivam Cements Limited: (ICRANP) LA+ Upgraded /A1 ReaffirmedvikramNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- Prakash Industries LTDDocument10 pagesPrakash Industries LTDrahuljain.srspl100% (2)

- Coal India LTD.: Published DateDocument4 pagesCoal India LTD.: Published DatePragyanDasNo ratings yet

- Chairman'S Address: Global OutlookDocument6 pagesChairman'S Address: Global OutlookabhinandanboradNo ratings yet

- Amtek India LTD F I R S T C A L L: SynopsisDocument18 pagesAmtek India LTD F I R S T C A L L: Synopsissneha.j26No ratings yet

- CRISIL Research - Ipo Grading Rat - Modern TubeDocument12 pagesCRISIL Research - Ipo Grading Rat - Modern Tubejaydeep daveNo ratings yet

- KRC Uttam 27aug09Document1 pageKRC Uttam 27aug09sabri1234No ratings yet

- JP Associates LTD.Document13 pagesJP Associates LTD.AKHIL1211No ratings yet

- SAIL Annual Report 2018-19Document204 pagesSAIL Annual Report 2018-19Ashutosh kumarNo ratings yet

- Sailar201819 PDFDocument204 pagesSailar201819 PDFShikha MishraNo ratings yet

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeFrom EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNo ratings yet

- Knowledge and Power: Lessons from ADB Energy ProjectsFrom EverandKnowledge and Power: Lessons from ADB Energy ProjectsNo ratings yet

- Lala Lajpat Rai College: Public Relations Project Rough Draft Topic: Nike V/S AdidasDocument34 pagesLala Lajpat Rai College: Public Relations Project Rough Draft Topic: Nike V/S AdidasNikitha Dsouza75% (4)

- Module 2 - Introduction To A Web-AppDocument17 pagesModule 2 - Introduction To A Web-AppJASPER WESSLYNo ratings yet

- April 10, 2015 Strathmore TimesDocument28 pagesApril 10, 2015 Strathmore TimesStrathmore TimesNo ratings yet

- QUIZ - FinalsDocument5 pagesQUIZ - FinalsFelsie Jane PenasoNo ratings yet

- Marine Products Systems CatalogueDocument97 pagesMarine Products Systems CatalogueJhonnatan Quispe Franco100% (1)

- SG LO2 Apply Fertilizer (GoldTown)Document2 pagesSG LO2 Apply Fertilizer (GoldTown)Mayiendlesslove WhiteNo ratings yet

- Solaris 10 Service - (Management Facility (SMF: Oz Melamed E&M Computing Nov 2007Document18 pagesSolaris 10 Service - (Management Facility (SMF: Oz Melamed E&M Computing Nov 2007Anonymous 4eoWsk3100% (3)

- Ipocc User Interface enDocument364 pagesIpocc User Interface enMarthaGutnaraNo ratings yet

- List of Non-Scheduled Urban Co-Operative Banks: Sr. No. Bank Name RO Name Head Office Address PincodeDocument65 pagesList of Non-Scheduled Urban Co-Operative Banks: Sr. No. Bank Name RO Name Head Office Address PincodemanojNo ratings yet

- 32-5-1 - Social ScienceDocument19 pages32-5-1 - Social Sciencestudygirl03No ratings yet

- Breakdown Maintenance in SAP Asset ManagementDocument11 pagesBreakdown Maintenance in SAP Asset ManagementHala TAMIMENo ratings yet

- PT-E - Fundamentals of Process Plant Layout and Piping DesignDocument14 pagesPT-E - Fundamentals of Process Plant Layout and Piping DesignNofrizal HasanNo ratings yet

- Aartv Industrial Training ReportDocument48 pagesAartv Industrial Training ReportRupal NaharNo ratings yet

- 280Document6 pages280Alex CostaNo ratings yet

- Examination Handbook NewDocument97 pagesExamination Handbook Newdtr17No ratings yet

- GT2-71D Amplifier Unit Data SheetDocument3 pagesGT2-71D Amplifier Unit Data SheetKenan HebibovicNo ratings yet

- SafeCargo PDFDocument76 pagesSafeCargo PDFSyukry MaulidyNo ratings yet

- List of Family Outing EpisodesDocument7 pagesList of Family Outing EpisodesFanny KesumaliaNo ratings yet

- Service Level ManagementDocument8 pagesService Level Managementrashmib1980No ratings yet

- (Lecture 10 & 11) - Gearing & Capital StructureDocument18 pages(Lecture 10 & 11) - Gearing & Capital StructureAjay Kumar TakiarNo ratings yet

- Institute of Actuaries of India declares CT1 exam resultsDocument18 pagesInstitute of Actuaries of India declares CT1 exam resultsRohit VenkatNo ratings yet

- Competition Patriotism and Collaboratio PDFDocument22 pagesCompetition Patriotism and Collaboratio PDFAngga PrianggaraNo ratings yet

- Cau Truc To HopDocument1,258 pagesCau Truc To Hopkhôi trươngNo ratings yet

- Delhi Metro Rail Corporation LTD Jr. Engineer Results PDFDocument3 pagesDelhi Metro Rail Corporation LTD Jr. Engineer Results PDFedujobnewsNo ratings yet

- MAST20026 Real Analysis With Applications, August 10, 2011. This Document Was Produced by Steve Carnie and Adapted by Alex GhitzaDocument2 pagesMAST20026 Real Analysis With Applications, August 10, 2011. This Document Was Produced by Steve Carnie and Adapted by Alex Ghitzavanessa8pangestuNo ratings yet

- Portarlington Parish NewsletterDocument2 pagesPortarlington Parish NewsletterJohn HayesNo ratings yet

- Cobas B 123 POC System: Instructions For Use, Version 13.0 Software Version 4.17Document354 pagesCobas B 123 POC System: Instructions For Use, Version 13.0 Software Version 4.17zelNo ratings yet

- Crusher RC Classic RC-II OM FN 23830 (En)Document128 pagesCrusher RC Classic RC-II OM FN 23830 (En)julio cesarNo ratings yet

- Estimate For New College BuildingDocument8 pagesEstimate For New College BuildingslummdogNo ratings yet

- Damayan Benefit PolicyDocument2 pagesDamayan Benefit PolicyMSWDO STA. MAGDALENANo ratings yet