Professional Documents

Culture Documents

Exemption Criteria

Uploaded by

Bilal Ahmed0 ratings0% found this document useful (0 votes)

6 views2 pagestaxes

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttaxes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesExemption Criteria

Uploaded by

Bilal Ahmedtaxes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Exemption Criteria

Exemption Policy

1. Exemption is granted on the basis of accreditation/recognition of the professional credentials

of the candidate.

2. The Executive Council of ICPAP may consider the members of professional bodies or holders

of university degrees for grant of exemption in any paper(s) /course(s).

3. Each paper/course passed by the candidate is matched with the CPA curriculum and

considered for grant of exemption subject to its full coverage of all the topics and subjects

included in the study program of CPA.

4. Only such paper/course is considered which has been passed in any professional

examination(s) not below the level of Masters or Graduation (i.e. minimum fourteen years

study level/program).

5. Exemption will be considered in only the subject/paper which has been passed by securing at

least 50% marks, in any examination of a reputable professional institution or university.

6. Holders of professional qualification (with minimum level of graduation) in accounts, audit,

finance, taxation, law, commerce, business administration, economics, banking, human

resource, and other relevant subjects are usually considered for grant of exemption.

7. Executive Council of ICPAP may consider the professionals in the faculties (referred to in para-

6 above)for grant of exemption(s) in the field(s) of their experience/practice subject to:

1. Possession of minimum three years post qualification experience or practice for grant

of exemption in one subject/paper;

2. Counting of specific experience/practice for exemption in only one paper/course at a

time, so, double benefit of the same period will not be admissible; and

3. Submission of creditable evidence/proof of the claimed experience or practice, failing

which the proposal for admissibility of exemption shall stand rejected.

8. Exemption on subject to subject basis or full may be allowed to the members of the credible

professional accounting and auditing bodies.

9. Exemption on the basis of an exemption shall not be permissible

10. Exemptions granted to one student cannot be quoted as precedent, as the same are accorded

after minute examination of candidate’s credentials including credibility of university or

professional body awarding degree or diploma and Student’s specialization/expertise,

experience, employing organization’s status and market standing as well as acceptability by

the business community etc.

11. Candidates seeking exemption(s) shall apply on the prescribed form along with requisite fee,

supporting certificates/ evidences and mapping of claimed exemption(s) with CPA syllabus, at

least two weeks earlier to submission of application for registration/admission.

12. Executive Council of ICPAP may, at its discretion, decide upon the proposals for grant of

exemptions on case to case basis, which shall be final and not challenge-able at any forum

including the courts of law.

You might also like

- Advertisement No 03 2017Document10 pagesAdvertisement No 03 2017Nasir KhattakNo ratings yet

- Analysis Report On IMU Report April 2017Document4 pagesAnalysis Report On IMU Report April 2017Bilal AhmedNo ratings yet

- Snowden Criticizes Facebook Monopoly on Social Media NewsDocument14 pagesSnowden Criticizes Facebook Monopoly on Social Media NewsBilal AhmedNo ratings yet

- Daily AllowanceDocument31 pagesDaily Allowanceshafek100% (1)

- Rob Steen - Why Is Captaincy The Domain of Batsmen - Cricket - ESPN CricinfoDocument3 pagesRob Steen - Why Is Captaincy The Domain of Batsmen - Cricket - ESPN CricinfoBilal AhmedNo ratings yet

- How Eight Years of Barack Obama Created Donald TrumpDocument17 pagesHow Eight Years of Barack Obama Created Donald TrumpBilal AhmedNo ratings yet

- The Aura That Jades But Never Fades - The HinduDocument5 pagesThe Aura That Jades But Never Fades - The HinduBilal AhmedNo ratings yet

- Snowden Criticizes Facebook Monopoly on Social Media NewsDocument14 pagesSnowden Criticizes Facebook Monopoly on Social Media NewsBilal AhmedNo ratings yet

- CP FundPolicyDocument8 pagesCP FundPolicyBilal AhmedNo ratings yet

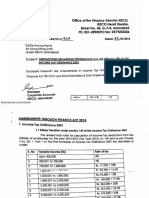

- Tax Rates SlabsDocument3 pagesTax Rates SlabsBilal AhmedNo ratings yet

- Adult Literacy and Non Formal Basic Education in KP Jails Main PoitsDocument2 pagesAdult Literacy and Non Formal Basic Education in KP Jails Main PoitsBilal AhmedNo ratings yet

- Conveyance Allowance 2012 2Document2 pagesConveyance Allowance 2012 2Mohan LalNo ratings yet

- Barq-E-Tabasu by Shaukat ThanviDocument97 pagesBarq-E-Tabasu by Shaukat ThanviBilal AhmedNo ratings yet

- Net To GrossDocument5 pagesNet To GrossBilal AhmedNo ratings yet

- Revised TADA Rates 2012 PakistanDocument2 pagesRevised TADA Rates 2012 PakistanBilal AhmedNo ratings yet

- 10 Classic Children's and YA Books That Will Never Be Dated - BOOK RIOT10 Classic Children's and YA Books That Will Never Be Dated - BOOK RIOTDocument8 pages10 Classic Children's and YA Books That Will Never Be Dated - BOOK RIOT10 Classic Children's and YA Books That Will Never Be Dated - BOOK RIOTBilal AhmedNo ratings yet

- 9-Nature or NurtureDocument68 pages9-Nature or NurtureBilal AhmedNo ratings yet

- 12 Month Profit and Loss Projection1Document1 page12 Month Profit and Loss Projection1Bilal AhmedNo ratings yet

- 100 Best Novels Modern LibraryDocument4 pages100 Best Novels Modern Librarylawshenoy100% (1)

- 1776 Thomas PaineDocument27 pages1776 Thomas PaineBilal AhmedNo ratings yet

- Total Quality Management 890Document19 pagesTotal Quality Management 890Bilal AhmedNo ratings yet

- Islamic History & Culture-I-10Document2 pagesIslamic History & Culture-I-10Bilal AhmedNo ratings yet

- Human Influince On Banking SectorDocument15 pagesHuman Influince On Banking SectorBilal AhmedNo ratings yet

- Chup by Mumtaz MuftiDocument134 pagesChup by Mumtaz MuftiBTghazwa100% (2)

- Internship Report On 222222Document71 pagesInternship Report On 222222Bilal Ahmed100% (1)

- AuditingDocument48 pagesAuditingBilal AhmedNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Organization Behavior Test Bank Robbins Ob14 Tif12 Organization Behavior Test Bank Robbins Ob14 Tif12Document52 pagesOrganization Behavior Test Bank Robbins Ob14 Tif12 Organization Behavior Test Bank Robbins Ob14 Tif12mohaNo ratings yet

- The Making of A Radio Rookies Story: From Day One To AirDocument17 pagesThe Making of A Radio Rookies Story: From Day One To AirJermain GibsonNo ratings yet

- Kaikorai Primary School: N e W S L e T T e RDocument6 pagesKaikorai Primary School: N e W S L e T T e RKaikorai_SchoolNo ratings yet

- Bilingual Education: Some Policy Issues: Pádraig Ó Riagáin and Georges LüdiDocument35 pagesBilingual Education: Some Policy Issues: Pádraig Ó Riagáin and Georges LüdiProfesoraELENo ratings yet

- FT-20 Flight Mechanics Term Test-2Document2 pagesFT-20 Flight Mechanics Term Test-2BRIAN LOPEZNo ratings yet

- 9709 s15 Ms 11Document9 pages9709 s15 Ms 11Sasha MallaNo ratings yet

- Grammar Practice - Irregular VerbsDocument2 pagesGrammar Practice - Irregular VerbsEvaNo ratings yet

- ST ND RD TH: Master Teacher For Grade 1Document2 pagesST ND RD TH: Master Teacher For Grade 1France BejosaNo ratings yet

- Sun Drop DayzDocument31 pagesSun Drop DayzWolfRiverMediaNo ratings yet

- Note-Making: Principles and PracticeDocument2 pagesNote-Making: Principles and PracticeMaryhel ManabatNo ratings yet

- Level of Awareness and Acceptability On The PUPVMGO of The PUPMB Stakeholders of Academic Year 2018-2019 Background of The StudyDocument4 pagesLevel of Awareness and Acceptability On The PUPVMGO of The PUPMB Stakeholders of Academic Year 2018-2019 Background of The StudyAnnie AlbertoNo ratings yet

- Fall 2019 JAPN 101 Course Info - Department - Syllbus OnlyDocument4 pagesFall 2019 JAPN 101 Course Info - Department - Syllbus OnlyCat RemnanNo ratings yet

- Past Simple Regular Verbs Fun Activities Games 18699Document2 pagesPast Simple Regular Verbs Fun Activities Games 18699Pablo l.vNo ratings yet

- Second Quarter Lesson Plan in English 7Document5 pagesSecond Quarter Lesson Plan in English 7Mark Vincen GuindanaoNo ratings yet

- Electrical Engineer Job Jebel AliDocument1 pageElectrical Engineer Job Jebel AliPrakash SelvarajNo ratings yet

- Dhaka International University: Class RoutineDocument1 pageDhaka International University: Class RoutineSakebul IslamNo ratings yet

- Las For Fitness, Sports, and Recreational Leadership (Sports Track) - Week 1 and 2Document4 pagesLas For Fitness, Sports, and Recreational Leadership (Sports Track) - Week 1 and 2Yonelo Jr Abancio100% (1)

- EP3-Pacing Guide 3sessionsDocument39 pagesEP3-Pacing Guide 3sessionsRonald RamónNo ratings yet

- Online Examination System ProjectDocument31 pagesOnline Examination System ProjectMohammed Sajeer79% (14)

- Clinical Frailty ScaleDocument1 pageClinical Frailty ScaleERUTHKNo ratings yet

- Caribbean Examinations Council: ''Barcode Area" " Front Page Bar CodeDocument16 pagesCaribbean Examinations Council: ''Barcode Area" " Front Page Bar CodeKiona RadlinNo ratings yet

- CS604 - Finalterm Solved Mcqs Solved With ReferencesDocument49 pagesCS604 - Finalterm Solved Mcqs Solved With Referenceschi50% (2)

- 3rd Year MBBS Assessment in 3 BlocksDocument5 pages3rd Year MBBS Assessment in 3 BlocksEngecoon AcademyNo ratings yet

- Software Application Written Technical Test Series5Document2 pagesSoftware Application Written Technical Test Series5daskmrsrvNo ratings yet

- Cookery 11 q1 w3 Mod3Document23 pagesCookery 11 q1 w3 Mod3romarchristianorigenesNo ratings yet

- Said Mohamed Amine CVDocument2 pagesSaid Mohamed Amine CVAmine SaïdNo ratings yet

- SMK English Class Assessment RecordDocument48 pagesSMK English Class Assessment RecordfarahtermiziNo ratings yet

- The Recursive Loop of Shame - An Alternate Gestalt TherapyDocument15 pagesThe Recursive Loop of Shame - An Alternate Gestalt TherapyblackstarfallNo ratings yet

- Miles & SnowDocument14 pagesMiles & SnowRabia IhsanNo ratings yet

- Calacatta Oro CatalogoDocument7 pagesCalacatta Oro CatalogoOscar MoralNo ratings yet