Professional Documents

Culture Documents

Bonds - April 11 2018

Uploaded by

Tiso Blackstar Group0 ratings0% found this document useful (0 votes)

15 views3 pagesBonds - April 11 2018

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBonds - April 11 2018

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pagesBonds - April 11 2018

Uploaded by

Tiso Blackstar GroupBonds - April 11 2018

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Markets and Commodity figures

11 April 2018

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 863 15.38 bn Rbn 16.50 158 31.22 bn Rbn 32.83

Week to Date 2 807 59.96 bn Rbn 66.00 1 100 151.03 bn Rbn 155.89

Month to Date 8 123 174.55 bn Rbn 186.08 2 276 317.08 bn Rbn 327.70

Year to Date 86 379 2 755.48 bn Rbn 2 870.74 21 565 2 706.47 bn Rbn 2 757.71

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 35 1.33 bn Rbn 1.44 17 1.04 bn Rbn 0.99

Current Day Sell 33 1.56 bn Rbn 1.71 19 8.17 bn Rbn 8.83

Net 2 -0.23 bn Rbn -0.27 -2 -7.13 bn Rbn -7.84

Buy 146 6.31 bn Rbn 6.71 44 5.48 bn Rbn 5.29

Week to Date Sell 130 6.18 bn Rbn 6.76 100 29.28 bn Rbn 31.24

Net 16 0.13 bn Rbn -0.06 -56 -23.80 bn Rbn -25.95

Buy 448 20.23 bn Rbn 21.42 114 13.95 bn Rbn 13.53

Month to Date Sell 400 21.66 bn Rbn 23.37 192 63.85 bn Rbn 68.32

Net 48 -1.44 bn Rbn -1.96 -78 -49.90 bn Rbn -54.78

Buy 6 112 353.38 bn Rbn 368.81 1 053 116.53 bn Rbn 111.54

Year to Date Sell 5 526 334.14 bn Rbn 351.93 1 375 427.65 bn Rbn 465.47

Net 586 19.24 bn Rbn 16.88 -322 -311.12 bn Rbn -353.93

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 8.616%

All Bond Index Top 631.286

20 Composite 630.907 -0.64% 7.37%

GOVI 8.496%Split - 627.944

ALBI20 Issuer Class GOVI 627.648 -0.60% 7.05%

OTHI 8.921%

ALBI20 Issuer Class Split - 646.422

OTHI 645.819 -0.73% 8.21%

CILI15 2.313%

Composite Inflation 261.310

Linked Index Top 15 261.443 -0.68% 3.40%

ICOR 3.137%

CILI15 Issuer Class 281.304

Split - ICOR 281.523 -0.60% 3.86%

IGOV 2.272%

CILI15 Issuer Class 260.333

Split - IGOV 260.456 -0.69% 3.40%

ISOE 2.975%

CILI15 Issuer Class 257.890

Split - ISOE 258.286 -0.15% 2.92%

MMI JSE Money Market Index

0 236.705 236.662 0.25% 2.11%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Jan 2020

AFRICA 6.945% 6.940% 6.58% 7.31%

R203 REPUBLIC OF SOUTH

Feb 2020

AFRICA 8.185% 8.180% 7.69% 8.40%

ES18 ESKOM HOLDINGS

MarLIMITED

2021 7.170% 7.165% 6.87% 7.59%

R204 REPUBLIC OF SOUTH

Jan 2023

AFRICA 8.635% 8.630% 8.35% 8.98%

R207 REPUBLIC OF SOUTH

Feb 2023

AFRICA 8.875% 8.870% 8.57% 9.19%

R208 REPUBLIC OF SOUTH

Feb 2023

AFRICA 7.525% 7.520% 7.24% 7.94%

ES23 ESKOM HOLDINGSAprLIMITED

2026 9.375% 9.375% 9.17% 9.85%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.095% AFRICA 8.095% 7.88% 8.64%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 8.490% 8.485% 8.28% 9.19%

ES26 ESKOM HOLDINGSFebLIMITED

2031 8.560% 8.555% 8.36% 9.25%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 8.665% 8.665% 8.46% 9.39%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.180% 10.190% 9.96% 10.76%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 8.825% 8.830% 8.61% 9.58%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 8.850% 8.860% 8.62% 9.52%

ES33 ESKOM HOLDINGSJanLIMITED

2037 8.915% 8.925% 8.69% 9.68%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 8.975% 8.985% 8.76% 9.77%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 8.960% 8.970% 8.73% 9.74%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 10.355% 10.365% 10.13% 11.05%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 9.025% 9.035% 8.80% 9.82%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 8.990% 9.000% 8.76% 9.77%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.320% 6.320% 6.32% 6.56%

JIBAR1 JIBAR 1 Month 6.675% 6.675% 6.63% 6.92%

JIBAR3 JIBAR 3 Month 6.900% 6.900% 6.87% 7.16%

JIBAR6 JIBAR 6 Month 7.408% 7.400% 7.38% 7.60%

RSA 2 year retail bond 6.75% 0 0 0

RSA 3 year retail bond 7.00% 0 0 0

RSA 5 year retail bond 7.75% 0 0 0

RSA 3 year inflation linked retail

3.00%

bond 0 0 0

RSA 5 year inflation linked retail

3.25%

bond 0 0 0

RSA 10 year inflation linked retail

3.50%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Modern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondFrom EverandModern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondRating: 4 out of 5 stars4/5 (2)

- Bonds - April 13 2018Document6 pagesBonds - April 13 2018Tiso Blackstar GroupNo ratings yet

- Bonds - August 16 2018Document3 pagesBonds - August 16 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 6 2018Document6 pagesBonds - April 6 2018Tiso Blackstar GroupNo ratings yet

- Bonds - October 18 2017Document3 pagesBonds - October 18 2017Tiso Blackstar GroupNo ratings yet

- Bonds - April 30 2018Document6 pagesBonds - April 30 2018Tiso Blackstar GroupNo ratings yet

- Bonds - April 26 2018Document6 pagesBonds - April 26 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - October 2 2018Document3 pagesBonds - October 2 2018Tiso Blackstar GroupNo ratings yet

- Bonds - August 27 2019Document3 pagesBonds - August 27 2019Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - August 3 2021Document3 pagesBonds - August 3 2021Lisle Daverin BlythNo ratings yet

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Bonds - September 11 2018Document3 pagesBonds - September 11 2018Tiso Blackstar GroupNo ratings yet

- Bonds - September 22 2019Document3 pagesBonds - September 22 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 10 2018Document3 pagesBonds - May 10 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - May 24 2018Document3 pagesBonds - May 24 2018Tiso Blackstar GroupNo ratings yet

- Bonds - September 11 2019Document3 pagesBonds - September 11 2019Tiso Blackstar GroupNo ratings yet

- Bonds - April 17 2018Document3 pagesBonds - April 17 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 10 2018Document3 pagesBonds - September 10 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - March 6 2018Document6 pagesBonds - March 6 2018Tiso Blackstar GroupNo ratings yet

- Bonds - September 30 2019Document3 pagesBonds - September 30 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - August 29 2019Document3 pagesBonds - August 29 2019Lisle Daverin BlythNo ratings yet

- Bonds - April 20 2021Document3 pagesBonds - April 20 2021Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 15 2018Document3 pagesBonds - February 15 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 6 2018Document3 pagesBonds - February 6 2018Tiso Blackstar GroupNo ratings yet

- Bonds - August 12 2019Document3 pagesBonds - August 12 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 14 2019Document3 pagesBonds - February 14 2019Tiso Blackstar GroupNo ratings yet

- Bonds - November 6 2018Document6 pagesBonds - November 6 2018Tiso Blackstar GroupNo ratings yet

- Bonds - February 14 2018Document3 pagesBonds - February 14 2018Tiso Blackstar GroupNo ratings yet

- Bonds - August 28 2019Document3 pagesBonds - August 28 2019Lisle Daverin BlythNo ratings yet

- Bonds - July 11 2019Document3 pagesBonds - July 11 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 7 2018Document6 pagesBonds - March 7 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 5 2018Document3 pagesBonds - April 5 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - August 19 2019Document3 pagesBonds - August 19 2019Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 28 2017Document3 pagesBonds - September 28 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - August 21 2019Document3 pagesBonds - August 21 2019Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 4 2018Document3 pagesBonds - April 4 2018Tiso Blackstar GroupNo ratings yet

- Bonds - April 16 2020Document3 pagesBonds - April 16 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 11 2021Document3 pagesBonds - May 11 2021Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - August 23 2018Document3 pagesBonds - August 23 2018Tiso Blackstar GroupNo ratings yet

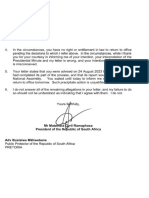

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Document2 pagesArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Anti Corruption Working GuideDocument44 pagesAnti Corruption Working GuideTiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

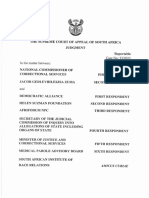

- JudgmentDocument30 pagesJudgmentTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- Statement From The SA Tourism BoardDocument1 pageStatement From The SA Tourism BoardTiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- Collective InsightDocument10 pagesCollective InsightTiso Blackstar GroupNo ratings yet

- JP Verster's Letter To African PhoenixDocument2 pagesJP Verster's Letter To African PhoenixTiso Blackstar GroupNo ratings yet

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- Tobacco Bill - Cabinet Approved VersionDocument41 pagesTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- Collective Insight September 2022Document14 pagesCollective Insight September 2022Tiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - June 1 2021Document2 pagesSanlam Stratus Funds - June 1 2021Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- The ANC's New InfluencersDocument1 pageThe ANC's New InfluencersTiso Blackstar GroupNo ratings yet

- Critical Skills List - Government GazetteDocument24 pagesCritical Skills List - Government GazetteTiso Blackstar GroupNo ratings yet

- Bonds - June 8 2022Document3 pagesBonds - June 8 2022Lisle Daverin BlythNo ratings yet

- Behavioral Finance and The Psychology of Investing: Mcgraw-Hill/IrwinDocument54 pagesBehavioral Finance and The Psychology of Investing: Mcgraw-Hill/IrwinNINDI VAULIANo ratings yet

- Sneha Black BookDocument53 pagesSneha Black BookAshwathi SumitraNo ratings yet

- Preference SharesDocument5 pagesPreference ShareshasnaglowNo ratings yet

- Report Indian Capital Market 2023Document52 pagesReport Indian Capital Market 2023bhanjasomanath4No ratings yet

- Micro Finance Page1Document55 pagesMicro Finance Page1Anshi ChawlaNo ratings yet

- Zacks Valuation SecretsDocument11 pagesZacks Valuation SecretsAli100% (2)

- Treasury ManagementDocument47 pagesTreasury Managementsinghsudhir261No ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- Ilovepdf MergedDocument100 pagesIlovepdf MergedsaiyuvatechNo ratings yet

- SEC RulesDocument316 pagesSEC RulesravisseNo ratings yet

- A Study On Technical Analysis of Selected Stocks in Indian Capital Market For Making Future DecisionsDocument46 pagesA Study On Technical Analysis of Selected Stocks in Indian Capital Market For Making Future DecisionsSharon ThomasNo ratings yet

- Handbook of Fixed Income Money Market and Derivatives Association of India FimmdaDocument88 pagesHandbook of Fixed Income Money Market and Derivatives Association of India FimmdaPoornima Solanki100% (1)

- 1908GMPb PDFDocument41 pages1908GMPb PDFKirillNo ratings yet

- Trendline Trading: by Admiral Markets Trading CampDocument10 pagesTrendline Trading: by Admiral Markets Trading CampKiran KrishnaNo ratings yet

- DSE Assignment SummaryDocument14 pagesDSE Assignment SummaryDipongkorPaulNo ratings yet

- Iqmethod ValuationDocument48 pagesIqmethod ValuationAkash VaidNo ratings yet

- Test Question (Foreign Exchange)Document20 pagesTest Question (Foreign Exchange)Meraj TalukderNo ratings yet

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- 66 - 4 - 1 - Business StudiesDocument23 pages66 - 4 - 1 - Business StudiesbhaiyarakeshNo ratings yet

- Appendix A: Sample QuestionsDocument9 pagesAppendix A: Sample QuestionsYashNo ratings yet

- 1981 Stock Traders AlmanacDocument1 page1981 Stock Traders AlmanacCopy JunkieNo ratings yet

- Business Valuations Business ValuationsDocument12 pagesBusiness Valuations Business ValuationsAliNo ratings yet

- Chart Slides Powerpoint TemplateDocument36 pagesChart Slides Powerpoint TemplateBuyanaa DorjNo ratings yet

- CFTC Commitments of Traders Report - CME (Futures Only) 06082013Document10 pagesCFTC Commitments of Traders Report - CME (Futures Only) 06082013Md YusofNo ratings yet

- Volatility As An Asset Class PDFDocument44 pagesVolatility As An Asset Class PDFSanket PatelNo ratings yet

- Assignment 405Document2 pagesAssignment 405Shyam KrishnanNo ratings yet

- (Merrill Lynch, Youssfi) Convexity Adjustment For Volatility SwapsDocument18 pages(Merrill Lynch, Youssfi) Convexity Adjustment For Volatility Swapsm325075No ratings yet

- Return and Risk Capital Asset Pricing Model CAPM Ch10Document7 pagesReturn and Risk Capital Asset Pricing Model CAPM Ch10Reckon IndepthNo ratings yet

- Fakeout To The Quasimodo LevelDocument229 pagesFakeout To The Quasimodo LevelNguyễn Quang HuyNo ratings yet

- Introduction To Security MarketDocument41 pagesIntroduction To Security MarketdeeptiNo ratings yet