Professional Documents

Culture Documents

Audit Task 2

Uploaded by

a2b7127Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Task 2

Uploaded by

a2b7127Copyright:

Available Formats

U.S.

SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 21407 / February 4, 2010

Securities and Exchange Commission v. Bank of America

Corporation, Civil Action Nos. 09-6829, 10-0215 (S.D.N.Y)

Bank Of America Agrees to Pay $150 Million to Settle SEC Charges

The Securities and Exchange Commission today filed a motion seeking court approval of a

proposed settlement whereby Bank of America will pay $150 million and strengthen its

corporate governance and disclosure practices to settle SEC charges that the company failed to

properly disclose employee bonuses and financial losses at Merrill Lynch before shareholders

approved the merger of the companies in December 2008.

The SEC previously filed two sets of charges in the U.S. District Court for the Southern District

of New York alleging Bank of America failed to disclose material information to shareholders

prior to their vote to approve the merger with Merrill Lynch. In the first enforcement action on

Aug. 3, 2009, the Commission charged Bank of America with failing to disclose, in proxy

materials soliciting shareholder votes for approval of the merger, its prior agreement authorizing

Merrill to pay year-end bonuses of up to $5.8 billion to its employees prior to the closing of the

merger. In the second enforcement action on Jan. 12, 2010, the Commission charged Bank of

America with failing to disclose the extraordinary losses that Merrill sustained in October and

November 2008.

Under the terms of the proposed settlement, which are subject to approval by the Honorable Jed

S. Rakoff, the $150 million penalty will be distributed to Bank of America shareholders harmed

by the Bank’s alleged disclosure violations. The Commission will propose a distribution plan at

a later date.

The proposed settlement requires Bank of America to implement and maintain seven remedial

undertakings for a period of three years:

Retain an independent auditor to perform an audit of the Bank’s internal disclosure

controls, similar to an audit of financial reporting controls currently required by the

federal securities laws.

Have its Chief Executive and Chief Financial Officers certify that they have reviewed all

annual and merger proxy statements.

Retain disclosure counsel who will report to, and advise, the Board’s Audit Committee

on the Bank’s disclosures, including current and periodic filings and proxy statements.

Adopt a “super-independence” standard for all members of the Board’s Compensation

Committee that prohibits them from accepting other compensation from the Bank.

Maintain a consultant to the Compensation Committee that would also meet super-

independence criteria.

Provide shareholders with an annual non-binding “say on pay” with respect to executive

compensation.

Implement and maintain incentive compensation principles and procedures and

prominently publish them on Bank of America’s Web site.

The proposed settlement includes a Statement of Facts describing the details behind the

allegations in the actions based on the discovery record.

The SEC is grateful for the support and cooperation of Attorney General Andrew Cuomo and the

Office of the New York State Attorney General. The SEC also thanks Attorney General Roy

Cooper, Attorney General of the State of North Carolina, and his staff for their collaboration on

the terms of the proposed settlement. The SEC acknowledges the assistance of the U.S.

Attorney’s offices for the Southern District of New York and Western District of North Carolina,

the Federal Bureau of Investigation, and the Office of The Special Inspector General for the

Troubled Asset Relief Program in the investigation leading to the actions.

U.S. SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 21384 / January 20, 2010

Accounting and Auditing Enforcement Release No. 3108 / January 20, 2010

Securities and Exchange Commission v. General Re Corporation, Civil Action

No. 10 Civ 458 (S.D.N.Y.)

SEC Charges General Re Corporation for Role in AIG and Prudential Accounting

Frauds

The Securities and Exchange Commission today charged General Re Corporation for its

involvement in separate schemes by American International Group and Prudential

Financial, Inc. to manipulate and falsify their reported financial results.

The complaint alleges that a foreign subsidiary of Gen Re entered into two sham

“reinsurance” transactions with AIG in 2000 to improperly allow AIG to reverse the

declining reserve trend and falsely report additions to both loss reserves and premiums

written. Senior officials at Gen Re helped AIG structure the two sham transactions. The

contracts show reinsurance transactions that appeared to transfer risk to AIG, but the

transactions did not transfer risk.

The complaint further alleges that Gen Re separately entered into a series of sham

reinsurance contracts with Prudential’s property and casualty division from 1997 to

2002. The contracts had no economic substance and purpose other than to allow

Prudential to build up and then draw down on an off-balance sheet asset or “finite

bank” parked with Gen Re. As a result of the sham transactions, Prudential improperly

recognized more than $200 million in revenues in 2000, 2001, and 2002. Gen Re

received fees totaling $8.1 million for structuring and executing the scheme with

Prudential.

Without admitting or denying the allegations in the complaint, Gen Re has consented to

a judgment enjoining it from aiding and abetting violations of Sections 13(b)(2)(A) and

13(b)(2)(B) of the Securities Exchange Act of 1934 and directing it to pay $12.2 million

in disgorgement and prejudgment interest. The settlement is subject to court approval.

In determining to accept Gen Re’s settlement offer, the SEC took Gen Re’s remediation

efforts and cooperation into account. Among the efforts SEC considered: Gen Re’s

comprehensive, independent review of its operations conducted at the outset of the

government’s investigations the results of which were shared with investigators; Gen

Re’s substantial assistance in the government’s successful civil and criminal actions

against individuals involved in the scheme with AIG; and Gen Re’s internal corporate

reforms designed to strengthen oversight of its operations. Those reforms entail

dissolving a subsidiary involved with the AIG transactions, appointing an independent

director to its Board of Directors, forming a committee consisting of senior managers to

review and approve complex transactions, requiring legal review of proposed finite or

loss mitigation contracts, and fortifying its internal audit functions and underwriting

rules.

The SEC previously charged AIG with securities fraud and improper accounting, and the

company settled the charges by paying more than $800 million among other remedies.

The SEC also previously charged AIG former chairman Maurice R. “Hank” Greenberg

and former chief financial officer Howard I. Smith, as well as former senior executives of

Gen Re for their roles in connection with the scheme with AIG. The Commission

separately charged Prudential with securities laws violations in 2008.

You might also like

- Attorneys For Midland Loan Services, Inc.: Declaration of Ronald F. Greenspan Pagel Of3Document3 pagesAttorneys For Midland Loan Services, Inc.: Declaration of Ronald F. Greenspan Pagel Of3Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Filed: United States Court of Appeals Tenth CircuitDocument33 pagesFiled: United States Court of Appeals Tenth CircuitScribd Government DocsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- 123 PDFDocument3 pages123 PDFauliaNo ratings yet

- Questions Chapter 2Document4 pagesQuestions Chapter 2Minh Thư Phạm HuỳnhNo ratings yet

- 22890761Document198 pages22890761William HarrisNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- U.S. Trustee's Objection To Evercore Partners's G.M. FeesDocument17 pagesU.S. Trustee's Objection To Evercore Partners's G.M. FeesDealBook100% (3)

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADocument12 pagesAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNo ratings yet

- Fox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Document27 pagesFox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Chapter 11 DocketsNo ratings yet

- 12Document12 pages12Yvon BaguioNo ratings yet

- Freddie Mac Scandal Report PDFDocument4 pagesFreddie Mac Scandal Report PDFaditikhasnisNo ratings yet

- Morton Pierce Affidavit in BofA-Merrill CaseDocument18 pagesMorton Pierce Affidavit in BofA-Merrill CaseDealBookNo ratings yet

- Request Jud Not W Motion Joinder 4-29-13 0Document518 pagesRequest Jud Not W Motion Joinder 4-29-13 0Nancy Duffy McCarronNo ratings yet

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument17 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsNo ratings yet

- Filed: United States Court of Appeals Tenth CircuitDocument34 pagesFiled: United States Court of Appeals Tenth CircuitScribd Government DocsNo ratings yet

- Pro Hac Vice) : United States Bankruptcy Court Southern District of New YorkDocument11 pagesPro Hac Vice) : United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- '/'-:,..:-LTT - ,-!L - /. - : United States Bankruptcy Court Southern District of New YorkDocument11 pages'/'-:,..:-LTT - ,-!L - /. - : United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- Express Investments VS BayantelDocument7 pagesExpress Investments VS BayantelOlivia FelNo ratings yet

- Attorneys For Midland Loan Services, IncDocument5 pagesAttorneys For Midland Loan Services, IncChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- ResCap KERP OpinionDocument22 pagesResCap KERP OpinionChapter 11 DocketsNo ratings yet

- Settlement USDOJ FILING News Release1Document3 pagesSettlement USDOJ FILING News Release1Razmik BoghossianNo ratings yet

- Press RealeaseDocument3 pagesPress RealeaseShavira IsnainiNo ratings yet

- International Collection Services Inc Debt CollectorDocument5 pagesInternational Collection Services Inc Debt CollectorghostgripNo ratings yet

- HarborView ComplaintDocument53 pagesHarborView Complaintny1davidNo ratings yet

- JobsOhio Bond Deal CircularDocument253 pagesJobsOhio Bond Deal CircularJosephNo ratings yet

- Daniels Fund Ethics Initiative University of New Mexico HTTPDocument12 pagesDaniels Fund Ethics Initiative University of New Mexico HTTPMuhammad TariqNo ratings yet

- OCIE Exam Process OverviewDocument45 pagesOCIE Exam Process OverviewSEC Compliance ConsultantsNo ratings yet

- Bankruptcy and ReorganizationDocument13 pagesBankruptcy and ReorganizationAnkita ChauhanNo ratings yet

- Executive Summary of The Sarbanes-Oxley Act of 2002 P.L.107-204Document6 pagesExecutive Summary of The Sarbanes-Oxley Act of 2002 P.L.107-204Antonio AshbyNo ratings yet

- Attorneys For Ad Hoc Committee of Preferred ShareholdersDocument8 pagesAttorneys For Ad Hoc Committee of Preferred ShareholdersChapter 11 DocketsNo ratings yet

- In The Court of Chancery of The State of DelawareDocument60 pagesIn The Court of Chancery of The State of Delaware林子羊No ratings yet

- Conway Release Aug 21Document4 pagesConway Release Aug 21mgreenNo ratings yet

- WorldCom CaseDocument9 pagesWorldCom CaseunjustvexationNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- United States District Court Southern District of Florida Miami DivisionDocument35 pagesUnited States District Court Southern District of Florida Miami Divisionmenelao1No ratings yet

- Sarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014Document12 pagesSarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014jadeen serviceNo ratings yet

- Congress Disclosures Enron Corporation Worldcom Financial StatementsDocument4 pagesCongress Disclosures Enron Corporation Worldcom Financial StatementsMichael Olmedo NeneNo ratings yet

- 10000004182Document58 pages10000004182Chapter 11 DocketsNo ratings yet

- Sample Forensic Audit 26045678Document15 pagesSample Forensic Audit 26045678KNOWLEDGE SOURCENo ratings yet

- National Settlement Executive SummaryDocument4 pagesNational Settlement Executive SummaryDinSFLANo ratings yet

- 2010 0114 EnforcementMeasuresDocument2 pages2010 0114 EnforcementMeasuresShyamal PatelNo ratings yet

- Toys R Us Debtors Motion For Entry of OrdersDocument124 pagesToys R Us Debtors Motion For Entry of OrdersStephen LoiaconiNo ratings yet

- Ex Rel. Laurence SchneiderDocument22 pagesEx Rel. Laurence Schneiderlarry-612445No ratings yet

- MBTC vs. ASBDocument17 pagesMBTC vs. ASBJann RosalesNo ratings yet

- Attorneys For Five Mile Capital Partners LLCDocument31 pagesAttorneys For Five Mile Capital Partners LLCChapter 11 DocketsNo ratings yet

- Media Contact: Investor Relations ContactsDocument1 pageMedia Contact: Investor Relations ContactsStan DielNo ratings yet

- #119914 V2 - Mti NotcredappempcorporaterecoveryDocument6 pages#119914 V2 - Mti NotcredappempcorporaterecoveryChapter 11 DocketsNo ratings yet

- AICPA Irs Pcaob Ald 2014 QTR 4Document8 pagesAICPA Irs Pcaob Ald 2014 QTR 4dudenyc0% (1)

- Sarbanes Oxley ActDocument17 pagesSarbanes Oxley Actglenndso100% (2)

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document19 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- Federal Reserve Board Releases Orders Related To The Previously Announced Monetary Sanctions Against Five Banking Organizations Release Date: February 13, 2012Document47 pagesFederal Reserve Board Releases Orders Related To The Previously Announced Monetary Sanctions Against Five Banking Organizations Release Date: February 13, 201283jjmack100% (2)

- New York v. Davis, Et AlDocument60 pagesNew York v. Davis, Et AlDealBookNo ratings yet

- U.S. Small Business Administration Office of Inspector General Washington, DC 20416Document4 pagesU.S. Small Business Administration Office of Inspector General Washington, DC 20416Larry stylinsonNo ratings yet

- Chapter 18: Audit of Long-Term Liabilities: Review QuestionsDocument11 pagesChapter 18: Audit of Long-Term Liabilities: Review Questionstrixia nuylesNo ratings yet

- 19 Dark PPT TemplateDocument15 pages19 Dark PPT TemplateKurt W. DelleraNo ratings yet

- Blutms Saas AgreementDocument7 pagesBlutms Saas AgreementAbayomi OlatidoyeNo ratings yet

- Minority Rights in The Constitution of India: Original Research ArticleDocument5 pagesMinority Rights in The Constitution of India: Original Research ArticleSaiby KhanNo ratings yet

- चाणक्य नीति 3Document5 pagesचाणक्य नीति 3saurabh.sangat3733No ratings yet

- Details of Assembly Segment of PCDocument1,698 pagesDetails of Assembly Segment of PCDhawal VasavadaNo ratings yet

- SSC - 6 - H - AK - HO7.1 - Ashoka, The Emperor Who Gave Up WarDocument2 pagesSSC - 6 - H - AK - HO7.1 - Ashoka, The Emperor Who Gave Up WarNitinNo ratings yet

- Mco BookDocument985 pagesMco BookMuurish DawnNo ratings yet

- Israel Tour 2014 With Nigel & Rochelle MerrickDocument20 pagesIsrael Tour 2014 With Nigel & Rochelle MerrickInnerFaithTravelNo ratings yet

- Mukhtasar Ithbat Al-Raj'a - The Return of The Mahdi PDFDocument24 pagesMukhtasar Ithbat Al-Raj'a - The Return of The Mahdi PDFAfzal SumarNo ratings yet

- K AnswersDocument451 pagesK AnswersMark McGovernNo ratings yet

- Plaintiff-Appellee Vs Vs Accused-Appellants: Second DivisionDocument25 pagesPlaintiff-Appellee Vs Vs Accused-Appellants: Second DivisionMaureen AntallanNo ratings yet

- "Secret Love Song" (Feat. Jason Derulo) : "I Was Made For Loving You" (Feat. Ed Sheeran)Document1 page"Secret Love Song" (Feat. Jason Derulo) : "I Was Made For Loving You" (Feat. Ed Sheeran)Lady Lou Ignacio LepasanaNo ratings yet

- Isabelo V. Velasquez For Appellant. Assistant Solicitor General Jose G. Bautista and Solicitor Jorge R. Coquia For AppelleeDocument3 pagesIsabelo V. Velasquez For Appellant. Assistant Solicitor General Jose G. Bautista and Solicitor Jorge R. Coquia For AppelleejojoNo ratings yet

- C.A. 616Document37 pagesC.A. 616Margrein M. GreganaNo ratings yet

- Summary of The FRIA LawDocument13 pagesSummary of The FRIA LawKulit_Ako1100% (3)

- 219 Order On Motion For Summary JudgementDocument21 pages219 Order On Motion For Summary JudgementThereseApelNo ratings yet

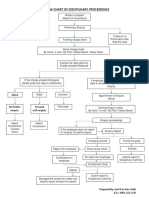

- Grievance Redressal Flow ChartDocument1 pageGrievance Redressal Flow ChartAmit PaulNo ratings yet

- Asher Associates, LLC Et Al v. Baker Hughes Oilfield Operations, Inc. - Document No. 6Document4 pagesAsher Associates, LLC Et Al v. Baker Hughes Oilfield Operations, Inc. - Document No. 6Justia.comNo ratings yet

- PAT - Pardo Vs Hercules LumberDocument1 pagePAT - Pardo Vs Hercules LumberLorenaNo ratings yet

- Ylith B. Fausto, Jonathan Fausto, Rico Alvia, Arsenia Tocloy, Lourdes Adolfo and Anecita Mancita, Petitioners, vs. Multi Agri-ForestDocument1 pageYlith B. Fausto, Jonathan Fausto, Rico Alvia, Arsenia Tocloy, Lourdes Adolfo and Anecita Mancita, Petitioners, vs. Multi Agri-ForestAbby EvangelistaNo ratings yet

- Deed of AdjudicationDocument2 pagesDeed of AdjudicationMona Lee100% (4)

- 23rd Moot CaseDocument22 pages23rd Moot CaseYogender YadavNo ratings yet

- The Role of Indian Judiciary in Achieving Social JusticeDocument21 pagesThe Role of Indian Judiciary in Achieving Social JusticeShivani SinghNo ratings yet

- People V Mandorio (From Scribd)Document1 pagePeople V Mandorio (From Scribd)LawstudentArellanoNo ratings yet

- 2020 KUSA Product Catalog - FinalDocument7 pages2020 KUSA Product Catalog - FinalTapes AndreiNo ratings yet

- Cal 25-2 Owners ManualDocument49 pagesCal 25-2 Owners ManualRobert LordNo ratings yet

- Module 4Document18 pagesModule 4Jennifer FabroNo ratings yet

- Petition 4 of 2019Document14 pagesPetition 4 of 2019wanyamaNo ratings yet

- Law Relating To Sexual Harassment of Women at The Workplace in India: A Critical ReviewDocument23 pagesLaw Relating To Sexual Harassment of Women at The Workplace in India: A Critical ReviewAhmedNo ratings yet

- Jose Rizal's Homage To Luna and HidalgoDocument13 pagesJose Rizal's Homage To Luna and HidalgoJoe Kent100% (1)