Professional Documents

Culture Documents

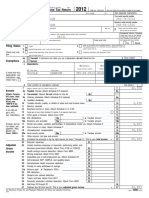

California Resident Income Tax Return Form 540 2EZ 2017

Uploaded by

Phylicia MorrisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

California Resident Income Tax Return Form 540 2EZ 2017

Uploaded by

Phylicia MorrisCopyright:

Available Formats

Check for Errors Print Form Reset Form Help

TAXABLE YEAR FORM

2017 California Resident Income Tax Return 540 2EZ

Check here if this is an AMENDED return.

Your first name Initial Last name Suffix Your SSN or ITIN

A

If joint tax return, spouse’s/RDP’s first name Initial Last name Suffix Spouse’s/RDP’s SSN or ITIN

R

Additional information (see instructions)

Street address (number and street) or PO box Apt. no/ste. no. PMB/private mailbox

RP

City (If you have a foreign address, see instructions.) State ZIP code

Foreign country name Foreign province/state/county Foreign postal code

Date Your DOB (mm/dd/yyyy) Spouse’s/RDP’s DOB (mm/dd/yyyy)

of

Birth

Prior If you filed your 2016 tax return under a different last name, write the last name only from the 2016 tax return.

Name Your prior name Spouse’s/RDP’s prior name

Filing Status Filing Status. Check the box for your filing status. See instructions.

Check only one.

1 Single

2 Married/RDP filing jointly (even if only one spouse/RDP had income)

4 Head of household. STOP! See instructions.

5 Qualifying widow(er) with dependent child. Enter year spouse/RDP died.

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . . . . . . . .

Exemptions 6 If another person can claim you (or your spouse/RDP) as a dependent on his or her tax return,

even if he or she chooses not to, you must see the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . . . . . . 7

8 Dependents: (Do not include yourself or your spouse/RDP) Enter number of dependents here. . . . 8

Dependent 1 Dependent 2 Dependent 3

First Name

Last Name

SSN

Dependent’s

relationship

to you

3111173 Form 540 2EZ 2017 Side 1

Check for Errors Print Form Reset Form Help

Your name: Your SSN or ITIN:

Whole dollars only

Taxable

Income and 9 Total wages (federal Form W-2, box 16). See instructions. . . . . . . . . . . . . . . . . . 9 , . 00

Credits

10 Total interest income (Form 1099-INT, box 1). See instructions. . . . . . . . . . . . . . 10 , . 00

11 Total dividend income (Form 1099-DIV, box 1a). See instructions. . . . . . . . . . . . 11 , . 00

12 Total pension income . See instructions. Taxable amount. . . . . . . . 12 , . 00

13 Total capital gains distributions from mutual funds (Form 1099-DIV, box 2a).

See instructions.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 , . 00

Enclose, but do

not staple, any 16 Add line 9, line 10, line 11, line 12, and line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . 16 , . 00

payment.

17 Using the 2EZ Table for your filing status, enter the tax for the amount on line 16.

Caution: If you checked the box on line 6, STOP. See instructions for

completing the Dependent Tax Worksheet. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 , . 00

18 Senior exemption: See instructions. If you are 65 or older and entered 1 in the

box on line 7, enter $114. If you entered 2 in the box on line 7, enter $228. . . . . 18 . 00

19 Nonrefundable renter’s credit. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . 19 . 00

20 Credits. Add line 18 and line 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 . 00

21 Tax. Subtract line 20 from line 17. If zero or less, enter -0-. . . . . . . . . . . . . . . . . 21 , . 00

22 Total tax withheld (federal Form W-2, box 17 or Form 1099-R, box 12). . . . . . . . 22 , . 00

23 Earned Income Tax Credit (EITC). See instructions for FTB 3514. . . . . . . . . . . . . 23 , . 00

24 Total payments. Add line 22 and line 23. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 , . 00

Use Tax

25 Use tax. Do not leave blank. See instructions. . . . . . . 25 , . 00

If line 25 is zero, check if: No use tax is owed.

You paid your use tax obligation directly to CDTFA.

Overpaid 26 Payments balance. If line 24 is more than line 25, subtract line 25 from line 24. . 26 , . 00

Tax/

Tax Due. 27 Use Tax balance. If line 25 is more than line 24, subtract line 24 from line 25. . 27 , . 00

28 Overpaid tax. If line 26 is more than line 21, subtract line 21 from line 26. . . . . . 28 , . 00

29 Tax due. If line 26 is less than line 21, subtract line 26 from line 21.

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 , . 00

This space reserved for 2D barcode

Side 2 Form 540 2EZ 2017 3112173

Check for Errors Print Form Reset Form Help

Your name: Your SSN or ITIN:

Voluntary Contributions

Code Amount

California Seniors Special Fund. See instructions ������������������������������������������������������������������������� 400 . 00

Alzheimer’s Disease/Related Disorders Fund. ������������������������������������������������������������������������������� 401 . 00

Rare and Endangered Species Preservation Voluntary Tax Contribution Program. . . . . . . . . . . . . 403 . 00

California Breast Cancer Research Voluntary Tax Contribution Fund. . . . . . . . . . . . . . . . . . . . . . . 405 . 00

California Firefighters’ Memorial Fund. ������������������������������������������������������������������������������������������ 406 . 00

Emergency Food for Families Voluntary Tax Contribution Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . 407 . 00

California Peace Officer Memorial Foundation Fund. ���������������������������������������������������������������������� 408 . 00

California Sea Otter Fund. �������������������������������������������������������������������������������������������������������������� 410 . 00

California Cancer Research Voluntary Tax Contribution Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 413 . 00

School Supplies for Homeless Children Fund ������������������������������������������������������������������������������� 422 . 00

State Parks Protection Fund/Parks Pass Purchase ����������������������������������������������������������������������� 423 . 00

Protect Our Coast and Oceans Voluntary Tax Contribution Fund . . . . . . . . . . . . . . . . . . . . . . . . . . 424 . 00

Keep Arts in Schools Voluntary Tax Contribution Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 425 . 00

State Children’s Trust Fund for the Prevention of Child Abuse . . . . . . . . . . . . . . . . . . . . . . . . . . . . 430 . 00

Prevention of Animal Homelessness and Cruelty Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 431 . 00

Revive the Salton Sea Fund ������������������������������������������������������������������������������������������������������������ 432 . 00

California Domestic Violence Victims Fund ����������������������������������������������������������������������������������� 433 . 00

Special Olympics Fund ������������������������������������������������������������������������������������������������������������������� 434 . 00

Type 1 Diabetes Research Fund ����������������������������������������������������������������������������������������������������� 435 . 00

California YMCA Youth and Government Voluntary Tax Contribution Fund . . . . . . . . . . . . . . . . . . 436 . 00

Habitat for Humanity Voluntary Tax Contribution Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 437 . 00

California Senior Citizen Advocacy Voluntary Tax Contribution Fund . . . . . . . . . . . . . . . . . . . . . . . 438 . 00

Native California Wildlife Rehabilitation Voluntary Tax Contribution Fund . . . . . . . . . . . . . . . . . . . 439 . 00

Rape Backlog Kit Voluntary Tax Contribution Fund. ������������������������������������������������������������������������ 440 . 00

30 Add amounts in code 400 through code 440. These are your total contributions. . . . . . . . . . . . . . 30 . 00

3113173 Form 540 2EZ 2017 Side 3

Check for Errors Print Form Reset Form Help

Your name: Your SSN or ITIN:

Amount 31 AMOUNT YOU OWE. Add line 27, line 29, and line 30. See instructions. Do not send cash.

You Owe Mail to: FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 , . 00

Pay online – Go to ftb.ca.gov/pay for more information.

Direct 32 REFUND OR NO AMOUNT DUE. Subtract line 30 from line 28. See instructions.

Deposit Mail to: FRANCHISE TAX BOARD

(Refund

Only) PO BOX 942840

SACRAMENTO CA 94240-0001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 , . 00

Fill in the information to authorize direct deposit of your refund into one or two accounts.

Do not attach a voided check or a deposit slip. Have you verified the routing and

account numbers? Use whole dollars only.

All or the following amount of my refund (line 32) is authorized for direct deposit into the

account shown below:

Type

Routing number Checking Account number 33 Direct deposit amount

Savings , . 00

The remaining amount of my refund (line 32) is authorized for direct deposit into the account shown below:

Type

Routing number Checking Account number 34 Direct deposit amount

Savings , . 00

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to

ftb.ca.gov/forms and search for 1131. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the information on this tax return is true, correct, and complete.

Your signature Date Spouse’s/RDP’s signature (if a joint tax return, both must sign)

X X

Your email address. Enter only one email address. Preferred phone number

Sign ( )

Here Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

It is unlawful

to forge a

spouse’s/RDP’s Firm’s name (or yours, if self-employed) PTIN

signature.

FEIN

Joint tax return?

See instructions. Firm’s address

Do you want to allow another person to discuss this tax return with us? See instructions. . . . Yes No

Print Third Party Designee’s Name Telephone Number

( )

Side 4 Form 540 2EZ 2017 3114173

You might also like

- 2016 California Resident Income Tax Return Form 540 2ezDocument4 pages2016 California Resident Income Tax Return Form 540 2ezapi-354477702No ratings yet

- 2016 540 California Resident Income Tax ReturnDocument5 pages2016 540 California Resident Income Tax Returnapi-351213976No ratings yet

- 2016 California Resident Income Tax Return Form 540 2ezDocument4 pages2016 California Resident Income Tax Return Form 540 2ezapi-351598796No ratings yet

- 2016 540 California Resident Income Tax ReturnDocument34 pages2016 540 California Resident Income Tax Returnapi-3512139760% (1)

- 16 540-SignedDocument5 pages16 540-Signedapi-352277890No ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- f1040 2018 PDFDocument3 pagesf1040 2018 PDFSara HeadrickNo ratings yet

- MGPTaxReturn 2019Document49 pagesMGPTaxReturn 2019KGW NewsNo ratings yet

- f1040 DFTDocument3 pagesf1040 DFTgheorghe garduNo ratings yet

- U.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010Document6 pagesU.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010victor liuNo ratings yet

- Dawn Income Tax 2019-07-21 - 1563756758720 PDFDocument6 pagesDawn Income Tax 2019-07-21 - 1563756758720 PDFDawn Smith100% (1)

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Document2 pagesFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- Time For TaxDocument108 pagesTime For TaxCj johnson100% (1)

- Report Excess Estate or Trust Deductions on Form 1040Document6 pagesReport Excess Estate or Trust Deductions on Form 1040shahabNo ratings yet

- Tax ReturnDocument15 pagesTax ReturnCristóbal Rodas100% (1)

- 2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)Document7 pages2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)atul0070No ratings yet

- Manandhar Anju 218 22Document28 pagesManandhar Anju 218 22MDV VehiclesNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNo ratings yet

- 2020 TaxReturnDocument2 pages2020 TaxReturnlindamariejohnson1981No ratings yet

- 2017 TaxReturnDocument7 pages2017 TaxReturntripsrealplugNo ratings yet

- f1040 PDFDocument2 pagesf1040 PDFHazem El SayedNo ratings yet

- HRBlockDocument7 pagesHRBlocksusu ultra menNo ratings yet

- U.S. Individual Income Tax Return: Rivera Rivera 582-93-4508 JoseDocument12 pagesU.S. Individual Income Tax Return: Rivera Rivera 582-93-4508 JoseJose Rivera100% (2)

- Kim Gilbert 2018 PDFDocument25 pagesKim Gilbert 2018 PDFKim Gilbert50% (2)

- FTF 2023-01-11 1673425648918Document12 pagesFTF 2023-01-11 1673425648918Charles Goodwin100% (1)

- f1040 PDFDocument2 pagesf1040 PDFPio Rivas JrNo ratings yet

- MGPTaxReturn 2021Document93 pagesMGPTaxReturn 2021KGW NewsNo ratings yet

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- Prentice Halls Federal Taxation 2015 Individuals 28Th Edition Pope Solutions Manual Full Chapter PDFDocument48 pagesPrentice Halls Federal Taxation 2015 Individuals 28Th Edition Pope Solutions Manual Full Chapter PDFDavidGarciaerfq100% (8)

- 2020 Tax Return Documents (KELLY DAVID F - Client Copy)Document5 pages2020 Tax Return Documents (KELLY DAVID F - Client Copy)Toomuch0% (1)

- Form 1040 tax return summaryDocument190 pagesForm 1040 tax return summaryMari Clarke0% (1)

- Solution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, HigginsDocument2 pagesSolution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, Higginsa882650259No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument28 pagesU.S. Individual Income Tax Return: Filing StatusSenae Lopez100% (3)

- Unknown PDFDocument4 pagesUnknown PDFomar hernandezNo ratings yet

- Nina's Tax Return 2020Document6 pagesNina's Tax Return 2020tam67% (3)

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocument31 pagesElectronic Filing Instructions For Your 2019 Federal Tax ReturnJose Miguel Hernandez CarelaNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetLabNo ratings yet

- Jesse A Stancil: On-Line Self Select PIN Without Direct Debit Tax Return Signature/Consent To DisclosureDocument11 pagesJesse A Stancil: On-Line Self Select PIN Without Direct Debit Tax Return Signature/Consent To DisclosureJesse StancilNo ratings yet

- 2021 TaxReturnDocument9 pages2021 TaxReturnTerry ParkerNo ratings yet

- US Internal Revenue Service: f8453 - 1996Document2 pagesUS Internal Revenue Service: f8453 - 1996IRSNo ratings yet

- Cars1dav 21i CCDocument25 pagesCars1dav 21i CCDavid CarsonNo ratings yet

- 1040 Merged PDFDocument9 pages1040 Merged PDFGreyson ChamberlainNo ratings yet

- f1040 DFTDocument3 pagesf1040 DFTCNBC.com100% (1)

- Preview Copy Do Not File: Eduardo Valle 463 41 4299Document3 pagesPreview Copy Do Not File: Eduardo Valle 463 41 4299evalle13No ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- California Online E-File Return Authorization For Individuals 8453-OL 2019Document1 pageCalifornia Online E-File Return Authorization For Individuals 8453-OL 2019Alex PanNo ratings yet

- YAMIDocument12 pagesYAMIStephany PolancoNo ratings yet

- File 1040 U.S. Individual Income Tax ReturnDocument2 pagesFile 1040 U.S. Individual Income Tax Returnmarcel100% (1)

- 2019 TaxReturn PDFDocument6 pages2019 TaxReturn PDFdavid barrow100% (2)

- Application for BIR RegistrationDocument1 pageApplication for BIR RegistrationSeuljjang Kang100% (1)

- BIR Form ApplicationDocument1 pageBIR Form ApplicationVanessa HaliliNo ratings yet

- BIR Form 1902 PDFDocument1 pageBIR Form 1902 PDFClarisse30No ratings yet

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocument11 pagesElectronic Filing Instructions For Your 2019 Federal Tax ReturnCoughman Matt67% (3)

- FTF 2019-05-02 1556819863569 PDFDocument5 pagesFTF 2019-05-02 1556819863569 PDFWilliam Davis0% (1)

- US Internal Revenue Service: f709 - 2005Document4 pagesUS Internal Revenue Service: f709 - 2005IRS100% (1)

- Within The Team and Company Based On Performance and Your InterestsDocument1 pageWithin The Team and Company Based On Performance and Your InterestsPhylicia MorrisNo ratings yet

- Within The Team and Company Based On Performance and Your InterestsDocument1 pageWithin The Team and Company Based On Performance and Your InterestsPhylicia MorrisNo ratings yet

- Paper Report 2Document1 pagePaper Report 2Phylicia MorrisNo ratings yet

- Music History Full SummaryDocument1 pageMusic History Full SummaryPhylicia MorrisNo ratings yet

- Within The Team and Company Based On Performance and Your InterestsDocument1 pageWithin The Team and Company Based On Performance and Your InterestsPhylicia MorrisNo ratings yet

- Music History Full SummaryDocument1 pageMusic History Full SummaryPhylicia MorrisNo ratings yet

- Trade PikachuDocument6 pagesTrade PikachuPhylicia MorrisNo ratings yet

- Within The Team and Company Based On Performance and Your InterestsDocument1 pageWithin The Team and Company Based On Performance and Your InterestsPhylicia MorrisNo ratings yet

- Within The Team and Company Based On Performance and Your InterestsDocument1 pageWithin The Team and Company Based On Performance and Your InterestsPhylicia MorrisNo ratings yet

- Paper Report 3Document1 pagePaper Report 3Phylicia MorrisNo ratings yet

- MUS 566 Final Exam Listening Qs Study GuideDocument1 pageMUS 566 Final Exam Listening Qs Study GuidePhylicia MorrisNo ratings yet

- Music History NotesDocument6 pagesMusic History NotesPhylicia MorrisNo ratings yet

- Freshman and Sophmore Undergrad Rep and Readings PSUDocument3 pagesFreshman and Sophmore Undergrad Rep and Readings PSUPhylicia MorrisNo ratings yet

- Music History Study SheetDocument2 pagesMusic History Study SheetPhylicia MorrisNo ratings yet

- Suite in E Minor, BWV 996 - Alfred DörffelDocument7 pagesSuite in E Minor, BWV 996 - Alfred DörffelPhylicia MorrisNo ratings yet

- Principal Percussion Audition RepertoireDocument3 pagesPrincipal Percussion Audition RepertoirePhylicia MorrisNo ratings yet

- Sight ReadingDocument1 pageSight ReadingPhylicia MorrisNo ratings yet

- Lesson Plan 1Document2 pagesLesson Plan 1Phylicia MorrisNo ratings yet

- M300 Classic Grand Marimba Parts ListDocument2 pagesM300 Classic Grand Marimba Parts ListPhylicia MorrisNo ratings yet

- M46M Part NumbersDocument3 pagesM46M Part NumbersPhylicia MorrisNo ratings yet

- Colin Hill's Curriculum Vitae MasterDocument22 pagesColin Hill's Curriculum Vitae MasterPhylicia MorrisNo ratings yet

- Beginning Snare Drum CurriculumDocument2 pagesBeginning Snare Drum CurriculumPhylicia MorrisNo ratings yet

- Sight ReadingDocument1 pageSight ReadingPhylicia MorrisNo ratings yet

- M46M Part NumbersDocument3 pagesM46M Part NumbersPhylicia MorrisNo ratings yet

- Music History Study Sheet (Antiquity)Document1 pageMusic History Study Sheet (Antiquity)Phylicia MorrisNo ratings yet

- Mus565 MteDocument10 pagesMus565 MtePhylicia MorrisNo ratings yet

- Fallen Undertale ThemeDocument1 pageFallen Undertale ThemePhylicia MorrisNo ratings yet

- Opportunities For Artists and Performer Application GuidelinesDocument5 pagesOpportunities For Artists and Performer Application GuidelinesPhylicia MorrisNo ratings yet

- Opportunities For Artists and Performer Application GuidelinesDocument5 pagesOpportunities For Artists and Performer Application GuidelinesPhylicia MorrisNo ratings yet

- Sight ReadingDocument1 pageSight ReadingPhylicia MorrisNo ratings yet

- Account StatementDocument13 pagesAccount StatementMoses MguniNo ratings yet

- Canons of TaxationDocument2 pagesCanons of Taxationmadeeha_2475% (4)

- Prepare Bank and Financial ReceiptDocument26 pagesPrepare Bank and Financial ReceiptTavya JamesNo ratings yet

- CP Redeemed As On 24-01-2023Document136 pagesCP Redeemed As On 24-01-2023Prem JeswaniNo ratings yet

- Mean Vs Median Vs ModeDocument12 pagesMean Vs Median Vs ModekomalmongaNo ratings yet

- Excel AmortizationDocument16 pagesExcel AmortizationLaarnie QuiambaoNo ratings yet

- Chapter 13Document31 pagesChapter 13batataNo ratings yet

- Ae Sce Presentation Group 14Document11 pagesAe Sce Presentation Group 14Kisan KhuleNo ratings yet

- Forex Extra QuestionsDocument9 pagesForex Extra QuestionsJuhi vohraNo ratings yet

- Open Banking: How To Design For Financial Inclusion: Ariadne Plaitakis and Stefan StaschenDocument46 pagesOpen Banking: How To Design For Financial Inclusion: Ariadne Plaitakis and Stefan StaschenOmar Bairan100% (1)

- Comparative Analysis of Marketing Strategies in Financial ServicesDocument69 pagesComparative Analysis of Marketing Strategies in Financial ServicesSanjana BansodeNo ratings yet

- Procter & Gamble: Expansion PlanDocument6 pagesProcter & Gamble: Expansion PlanSarthak AgarwalNo ratings yet

- David Sm14 TB 05Document9 pagesDavid Sm14 TB 05AymanAl-GhanimNo ratings yet

- How Social Entrepreneurship Can Drive Economic GrowthDocument8 pagesHow Social Entrepreneurship Can Drive Economic GrowthAadhavan ParthipanNo ratings yet

- A38 - Rani - Digital Labour Platforms and Their Contribution To Development OutcomesDocument4 pagesA38 - Rani - Digital Labour Platforms and Their Contribution To Development OutcomesPhilip AchokiNo ratings yet

- CRM Industry LandscapeDocument26 pagesCRM Industry LandscapeAdityaHridayNo ratings yet

- Blue World City IslamabadDocument6 pagesBlue World City Islamabadreal Estate100% (1)

- Chapter 3 & 4 Banking An Operations 2Document15 pagesChapter 3 & 4 Banking An Operations 2ManavAgarwalNo ratings yet

- Company Registration in EthiopiaDocument121 pagesCompany Registration in Ethiopiadegu kassaNo ratings yet

- Eo 398-2005 PDFDocument2 pagesEo 398-2005 PDFDalton ChiongNo ratings yet

- The Nature of Staffing: Chapter One Staffing Models and StrategyDocument32 pagesThe Nature of Staffing: Chapter One Staffing Models and StrategyHasib AhsanNo ratings yet

- Material Requirements PlanningDocument38 pagesMaterial Requirements PlanningSatya BobbaNo ratings yet

- ALTHURUPADU BID DOCUMENT Judicial Preview (7 - 11-2019)Document125 pagesALTHURUPADU BID DOCUMENT Judicial Preview (7 - 11-2019)Habeeb ShaikNo ratings yet

- Swifttrip Analysis - Investor'S MouDocument3 pagesSwifttrip Analysis - Investor'S Mounnaemeka ObowuNo ratings yet

- Chatto Management 4n Activity 6Document2 pagesChatto Management 4n Activity 6LabLab ChattoNo ratings yet

- Introduction to India's Oil and Gas IndustryDocument15 pagesIntroduction to India's Oil and Gas IndustryMeena HarryNo ratings yet

- Exercise 2 - CVP Analysis Part 1Document5 pagesExercise 2 - CVP Analysis Part 1Vincent PanisalesNo ratings yet

- Retail ManagementDocument40 pagesRetail Managementij 1009No ratings yet

- FABM2 Q2 Mod14Document26 pagesFABM2 Q2 Mod14Fretty Mae AbuboNo ratings yet

- Strengths of The Alkaline Water Company IncDocument7 pagesStrengths of The Alkaline Water Company IncIshan BavejaNo ratings yet