Professional Documents

Culture Documents

Engineering: Contractors' All Risks (CAR)

Uploaded by

Jun Falcon0 ratings0% found this document useful (0 votes)

34 views1 pageContractors All-Risk Insurance Info Sheet

Original Title

InfoSheet CAR

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentContractors All-Risk Insurance Info Sheet

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views1 pageEngineering: Contractors' All Risks (CAR)

Uploaded by

Jun FalconContractors All-Risk Insurance Info Sheet

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Contractors’ All Risks

ENGINEERING (CAR)

CAR offers comprehensive protection against physical

loss or damage to the building in relation to contract

works and other civil engineering works; construction

plant and equipment and/or construction machinery.

This policy may be taken out for all buildings and

civil engineering projects such as office/residential

buildings, factory and power plant buildings, roads

and bridges. It also provides “all risks” cover against

any sudden, unforeseen and accidental physical loss

or damage to the insured contract works on the

project site.

This product provides a supplementary Third Party

Liability (TPL) that covers third party property damage

and/or bodily injury that occurs in connection with Claim Documents:

the execution of the project.

1 . Sworn statement of proof of loss

Requirements for Quotation: 2. Non-waiver agreement

3. Detailed incident report

1 . Title of the Contract/Project 4. Photographs of damaged properties or structures

2. Complete address of the Project Site 5. Full copy of the construction agreement

3. Information about the Project Owner 6. Breakdown of the contract value/bill of materials

4. Information about the Contractors/Sub-contractors/ 7. Detailed rehabilitation/repair cost estimate for the

Suppliers/Manufacturers damaged properties or structures

5. Estimated Completion/Contract Duration 8. PERT/CPM and/or bar chart (as necessary)

9. Accomplishment report as to the time of the loss

6. 100% Total Contract Price

(as necessary)

7. Submit a copy of the Construction Agreement, Bill 10.Other technical plans (as necessary) for e.g.

of Materials, Time Schedule and other relevant construction plans and/or drawings, such as plant

project documents as may be required by the layout, structural analysis and design, etc.

Underwriters

For Theft and Burglary Claims

Claim Procedure: 1 . Photographic evidence of the point of entry

and/or exit

1. The Insured should: 2. Police report

a) notify Pioneer or his broker/ agent within 14 3. Inventory of stolen and/or missing properties

days from date of loss occurrence, to give 4. Documentary evidence as proof of loss,

an indication of the nature and extent of loss e.g. invoices, etc.

or damage; For Third Party Liability Claims

b) take all steps within his power to minimize the a. Bodily injury and/or death

extent of the loss or damage; 1 . Original copies of medical receipts and other

c) preserve the parts affected and make them related expenses

available for inspection by a representative or 2. Doctors’ certification regarding the extent of

surveyor of Pioneer;

injury

d) furnish all such information and documentary

3. Copy of formal complaint/subpoena if the third

evidence as may be required by Pioneer; and

party has taken legal action against the Insured

e) inform the police authorities in case of loss or

4. Written statements of the witnesses

damage due to theft, burglary or sabotage.

b. Property damage

2. Insured is given sixty (60) days from the date of

1 . Repair cost estimate for the damaged properties

the loss to submit/render a proof of loss duly

2. Quotations for the repair

signed and sworn to by the Insured, stating:

a) the knowledge and belief of the time/origin of

the loss

b) amount of loss encumbrances Contact Information:

c) all other contracts of insurance

d) all other information related to the insured Connie Uy

properties 812 7777 loc. 524

3. The Insured or any of his representatives should connie.uy@pioneer.com.ph

always make themselves available for the +63 917 867 8923

inspection of the incident.

PIONEER INSURANCE & SURETY CORPORATION

Pioneer House Makati, 108 Paseo de Roxas, Legaspi Village, Makati City 1229, Philippines

Tel: +63 2 812 7777 • Fax: +63 2 817 1461 • www.pioneer.com.ph

You might also like

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Sample 2Document89 pagesSample 2Magnolia HermosoNo ratings yet

- Legal Documents: Sargasso Construction & Dev'T. Corp / Aliño Construction Corporation (J.V.)Document89 pagesLegal Documents: Sargasso Construction & Dev'T. Corp / Aliño Construction Corporation (J.V.)Magnolia HermosoNo ratings yet

- General Accident: Comprehensive Personal LiabilityDocument1 pageGeneral Accident: Comprehensive Personal LiabilityJun FalconNo ratings yet

- Check List For Various Noc's: ../affidavit For Consent To Establish ../affidavit For Consent To Operate PDFDocument23 pagesCheck List For Various Noc's: ../affidavit For Consent To Establish ../affidavit For Consent To Operate PDFshubham kumarNo ratings yet

- Private Car Policy WordingDocument9 pagesPrivate Car Policy WordingILAYAPERUMAL KNo ratings yet

- Burglary and HousebreakingDocument2 pagesBurglary and HousebreakingyatzirigNo ratings yet

- Motor Insurance: Frequently Asked Question's (FAQ's)Document9 pagesMotor Insurance: Frequently Asked Question's (FAQ's)Af ZalNo ratings yet

- MahaRERA Sectins in ExcelDocument6 pagesMahaRERA Sectins in ExcelNayan NagdaNo ratings yet

- 4A-Notices Etc-HandoutDocument9 pages4A-Notices Etc-Handoutbelal aljamalNo ratings yet

- Research On Preparing Eot Application, Analyzing and Certification by Ar Ridha RazakDocument40 pagesResearch On Preparing Eot Application, Analyzing and Certification by Ar Ridha RazakRidha Razak100% (3)

- Bio Data Form: Permanent ResidenceDocument5 pagesBio Data Form: Permanent Residencevijayasimhareddy ireddyNo ratings yet

- Land development documentsDocument3 pagesLand development documentsJeem Paulo OcampoNo ratings yet

- Group 8 Termination of Contract Written ReportDocument13 pagesGroup 8 Termination of Contract Written ReportPeachy Anne VARGASNo ratings yet

- HLURB RequirementsDocument2 pagesHLURB RequirementsIpe ClosaNo ratings yet

- B S L G H D D: Icensing Nspection HecklistDocument10 pagesB S L G H D D: Icensing Nspection HecklistJohn SlorNo ratings yet

- Research On Insurance CompanyDocument1 pageResearch On Insurance CompanySumesh ShahNo ratings yet

- Mo 64 1999Document11 pagesMo 64 1999emmanuel dela resmaNo ratings yet

- Blank Royalty Contact Palawan A-BDocument4 pagesBlank Royalty Contact Palawan A-BLilvic Galera-SabladNo ratings yet

- Topographic Survey ProposalDocument3 pagesTopographic Survey ProposalCatherine MartinezNo ratings yet

- Building permit requirements checklistDocument1 pageBuilding permit requirements checklistDesiree Faith V. DumadagNo ratings yet

- 14911-2008-Grand Monaco Estate Developers Inc.20220530-11-Of1jj6Document5 pages14911-2008-Grand Monaco Estate Developers Inc.20220530-11-Of1jj6Ren Mar CruzNo ratings yet

- Manage Chattel Mortgage Foreclosure ProcessDocument4 pagesManage Chattel Mortgage Foreclosure ProcessJan RootsNo ratings yet

- BPOS FileDocument10 pagesBPOS FileJoann Saballero HamiliNo ratings yet

- Notification Loss Damage Electronic Equipment Insurance: The New India Assurance Company LimitedDocument5 pagesNotification Loss Damage Electronic Equipment Insurance: The New India Assurance Company LimitedALOK BHARTINo ratings yet

- Strategy for Effective Commercial Property ManagementDocument10 pagesStrategy for Effective Commercial Property ManagementSani HabibuNo ratings yet

- Steps in Applying Building PermitDocument2 pagesSteps in Applying Building PermitAllysa Aisla LacsamanaNo ratings yet

- Construction Contract: BELLE CORPORATION, A Domestic Corporation DulyDocument27 pagesConstruction Contract: BELLE CORPORATION, A Domestic Corporation DulyRoy PersonalNo ratings yet

- Plan Development Permits in MinutesDocument10 pagesPlan Development Permits in MinutesJenny JudanNo ratings yet

- Guarantee and Warranty RequirementsDocument3 pagesGuarantee and Warranty RequirementsEfz EfzNo ratings yet

- RULE 128: October 8, 2019 2019 Amendments To The 1989 Revised Rules On Evidence (A.M. NO. 19-08-15-SC)Document25 pagesRULE 128: October 8, 2019 2019 Amendments To The 1989 Revised Rules On Evidence (A.M. NO. 19-08-15-SC)ervingabralagbonNo ratings yet

- Condominium and Subdivision Registration RequirementsDocument7 pagesCondominium and Subdivision Registration RequirementsJeem Paulo OcampoNo ratings yet

- UWUCWPhaseIIBNCBSW BOQDocument53 pagesUWUCWPhaseIIBNCBSW BOQUditha AnuruddthaNo ratings yet

- ISR Mark IVDocument26 pagesISR Mark IVbobyNo ratings yet

- Guidline For Final SurveyDocument5 pagesGuidline For Final SurveyADHAR SHARMANo ratings yet

- Application Form For Video or Photographic Shooting Permission at Centrally Protected MonumentsDocument2 pagesApplication Form For Video or Photographic Shooting Permission at Centrally Protected MonumentsPramod SinghNo ratings yet

- Class D: Manual of Operation For The Adls Provincial Lending Centers Pre-Release DocumentationDocument4 pagesClass D: Manual of Operation For The Adls Provincial Lending Centers Pre-Release DocumentationAnonymous ykxB88cJNo ratings yet

- Citizens Charter: Campaign Finance Office - Public Works 2022Document3 pagesCitizens Charter: Campaign Finance Office - Public Works 2022banate LGUNo ratings yet

- Filing, Recording, and Discharge of Vessel Documents and InstrumentsDocument2 pagesFiling, Recording, and Discharge of Vessel Documents and InstrumentsmoNo ratings yet

- DRMC BoqDocument16 pagesDRMC BoqE.F. AlamilloNo ratings yet

- Microsoft Word - TNCD&BR 2019 - Book - 02.02.2019 - TNCDRBR-2019Document10 pagesMicrosoft Word - TNCD&BR 2019 - Book - 02.02.2019 - TNCDRBR-2019snyyvcqrsharklaseNo ratings yet

- Section 9 Checklist of Technical and FinancialDocument3 pagesSection 9 Checklist of Technical and FinancialGreater Mchines100% (1)

- BP2 P2 Notice of AwardDocument2 pagesBP2 P2 Notice of AwardByrne Ferreras100% (1)

- Form ADocument2 pagesForm AKaviyarasu VelmuruganNo ratings yet

- Citizens Charter Attachment CDocument95 pagesCitizens Charter Attachment CjohnpaulacostaNo ratings yet

- Evid 3E CodalDocument21 pagesEvid 3E CodalXL KnightNo ratings yet

- Building Permit Checklist - Sauyo Extension OfficeDocument1 pageBuilding Permit Checklist - Sauyo Extension OfficeGel NonatoNo ratings yet

- Set 1Document73 pagesSet 1Vijaya ChandNo ratings yet

- SpecificationsDocument24 pagesSpecificationsjakiri cerdina100% (1)

- Exhibit 10Document15 pagesExhibit 10Bitcoin Lawsuit100% (1)

- Empire East Land Holdings, Inc. vs. Capitol Industrial Construction Groups, Inc. 566 SCRA 473, September 26, 2008Document15 pagesEmpire East Land Holdings, Inc. vs. Capitol Industrial Construction Groups, Inc. 566 SCRA 473, September 26, 2008TEtchie TorreNo ratings yet

- Project Proposal PDFDocument3 pagesProject Proposal PDFgumamelaSiAko subscribeNo ratings yet

- (2002) SGHC 201Document13 pages(2002) SGHC 201Dan CooperNo ratings yet

- BP 220 - Registration & License To SellDocument6 pagesBP 220 - Registration & License To SellKLASANTOSNo ratings yet

- Building permission undertakingDocument8 pagesBuilding permission undertakingHEMABHUSHANAMNo ratings yet

- Revenue Memorandum Order No. 021-20: I. BackgroundDocument8 pagesRevenue Memorandum Order No. 021-20: I. BackgroundHADTUGINo ratings yet

- DISPOSAL AND APPRAISAL CopyDocument7 pagesDISPOSAL AND APPRAISAL Copymelancholic lonerNo ratings yet

- Moduk Defcon 526 - 2002Document2 pagesModuk Defcon 526 - 2002shejtemaeiNo ratings yet

- 2019 Rules On Evidence Rules OnlyDocument23 pages2019 Rules On Evidence Rules OnlyNasheya InereNo ratings yet

- Cargo: Coverage For The Transport of Goods or CargoDocument1 pageCargo: Coverage For The Transport of Goods or CargoJun FalconNo ratings yet

- InfoSheet CGLDocument1 pageInfoSheet CGLJun FalconNo ratings yet

- InfoSheet CGLDocument1 pageInfoSheet CGLJun FalconNo ratings yet

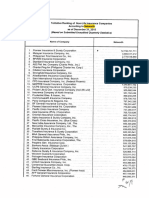

- Ranking NL Networth2015Document2 pagesRanking NL Networth2015Jun FalconNo ratings yet

- Professional Liability Proposal Form - EditableDocument4 pagesProfessional Liability Proposal Form - EditableJun FalconNo ratings yet

- Alert: Be ALERT: Make Sure The Kids in Your School Are ProtectedDocument1 pageAlert: Be ALERT: Make Sure The Kids in Your School Are ProtectedJun FalconNo ratings yet

- Engineering: Contractors' All Risks (CAR)Document1 pageEngineering: Contractors' All Risks (CAR)Jun FalconNo ratings yet

- Comprehensive insurance for businessesDocument1 pageComprehensive insurance for businessesJun FalconNo ratings yet

- Bonds Requirements (Corporation)Document1 pageBonds Requirements (Corporation)Jun FalconNo ratings yet

- Info Sheet - Drone InsuranceDocument1 pageInfo Sheet - Drone InsuranceJun FalconNo ratings yet

- Aircraft Insurance Proposal - EditableDocument5 pagesAircraft Insurance Proposal - EditableJun FalconNo ratings yet

- Travel InsuranceDocument6 pagesTravel InsuranceJun FalconNo ratings yet

- Info Sheet - Internet Security and Privacy InsuranceDocument1 pageInfo Sheet - Internet Security and Privacy InsuranceJun FalconNo ratings yet

- ApplyInsuranceHullMachineryPandIDocument1 pageApplyInsuranceHullMachineryPandIJun FalconNo ratings yet

- InfoSheet BurglaryDocument1 pageInfoSheet BurglaryJun FalconNo ratings yet

- Nonlife Gross Premiums 2014 (As of 2015.02.26)Document2 pagesNonlife Gross Premiums 2014 (As of 2015.02.26)Jun FalconNo ratings yet

- Burglary Insurance Application Form - EditableDocument2 pagesBurglary Insurance Application Form - EditableJun FalconNo ratings yet

- Nonlife Premiums Earned 2014 (As of 2015.02.26)Document2 pagesNonlife Premiums Earned 2014 (As of 2015.02.26)Jun FalconNo ratings yet

- Nonlife Networth 2014 (As of 2015.02.26)Document2 pagesNonlife Networth 2014 (As of 2015.02.26)Jun FalconNo ratings yet

- Cargo: Coverage For The Transport of Goods or CargoDocument1 pageCargo: Coverage For The Transport of Goods or CargoJun FalconNo ratings yet

- Insurance Memo Circular Re Licensing of Insurance Agents - IMC 3 - 1993 PDFDocument9 pagesInsurance Memo Circular Re Licensing of Insurance Agents - IMC 3 - 1993 PDFJun FalconNo ratings yet

- Schedule of Rates For Bonds: Amount Not More ThanDocument1 pageSchedule of Rates For Bonds: Amount Not More ThanAndreNo ratings yet

- CAR Summary of RequirementsDocument1 pageCAR Summary of RequirementsJun FalconNo ratings yet

- Burglary Insurance Application FormDocument1 pageBurglary Insurance Application FormJun FalconNo ratings yet

- Bonds RequirementsDocument1 pageBonds RequirementsJun FalconNo ratings yet

- KYC Form 1 for Corporate Clients - AMLA ComplianceDocument1 pageKYC Form 1 for Corporate Clients - AMLA ComplianceJun FalconNo ratings yet

- Best Insurer in The Philippines - Euromoney SurveyDocument2 pagesBest Insurer in The Philippines - Euromoney SurveyJun FalconNo ratings yet

- Aviation Insurance Application FormDocument2 pagesAviation Insurance Application FormJun FalconNo ratings yet

- 632 MA Lichauco vs. ApostolDocument2 pages632 MA Lichauco vs. ApostolCarissa CruzNo ratings yet

- Abrogar Vs Cosmos Bottling CoDocument2 pagesAbrogar Vs Cosmos Bottling CoCyrus AvelinoNo ratings yet

- THE JOKE by MILAN KUNDERA-CHARACTER ANALYSISDocument6 pagesTHE JOKE by MILAN KUNDERA-CHARACTER ANALYSISHanza FarzinNo ratings yet

- HY-SEQ16x3v2 by HY-Plugins 2018Document27 pagesHY-SEQ16x3v2 by HY-Plugins 2018domaNo ratings yet

- Repeal Honor KillingsDocument13 pagesRepeal Honor KillingsJustine M.No ratings yet

- HIST 1A - Readings in Philippine History (Prelim, Midterm, Finals)Document88 pagesHIST 1A - Readings in Philippine History (Prelim, Midterm, Finals)Crystel Jazamae100% (1)

- CMKX ProgramDocument3 pagesCMKX ProgramVincent J. CataldiNo ratings yet

- Section 24Document40 pagesSection 24KEITH ANDREWS PON-ANNo ratings yet

- I. What Is Online Child Sexual ExploitationDocument2 pagesI. What Is Online Child Sexual ExploitationBryan Manlapig50% (2)

- Instructions: Blogs: Fame and FortuneDocument3 pagesInstructions: Blogs: Fame and FortuneFlavia Dartora GrasseliNo ratings yet

- Fall 2013 IPG General CatalogDocument204 pagesFall 2013 IPG General CatalogIndependent Publishers GroupNo ratings yet

- The Great Hack and data privacy in the PhilippinesDocument2 pagesThe Great Hack and data privacy in the PhilippinesVINCENT ANGELO ANTENo ratings yet

- Durga Prasad Vs Baldeo - PDF - Business Law - LawsuitDocument37 pagesDurga Prasad Vs Baldeo - PDF - Business Law - LawsuitRUTUJANo ratings yet

- Brenner, Meyll - 2020 - Robo-Advisors A Substitute For Human Financial Advice-AnnotatedDocument8 pagesBrenner, Meyll - 2020 - Robo-Advisors A Substitute For Human Financial Advice-AnnotatedVina Permata sariNo ratings yet

- Singapore: "If You Do Not Seek Out Allies and Helpers, Then You Will Be Isolated and Weak."Document2 pagesSingapore: "If You Do Not Seek Out Allies and Helpers, Then You Will Be Isolated and Weak."sochealaoNo ratings yet

- Police revoke driving fineDocument3 pagesPolice revoke driving fineErika KárászNo ratings yet

- Basic Gender Concepts: Aurora R. Chavez-De GuzmanDocument52 pagesBasic Gender Concepts: Aurora R. Chavez-De GuzmanJL AcojedoNo ratings yet

- ks2 Mathematics 2023 Paper 1Document20 pagesks2 Mathematics 2023 Paper 1Ben DoverNo ratings yet

- An Overview of Veterinary Malpractice LawsDocument3 pagesAn Overview of Veterinary Malpractice LawsRalph GalagalaNo ratings yet

- Show Dont Tell Descriptive Writing Practice WorksheetDocument10 pagesShow Dont Tell Descriptive Writing Practice WorksheetNisa KamaruddinNo ratings yet

- Introduction To Maternity Pediatric Nursing Leifer 5th Edition Test BankDocument36 pagesIntroduction To Maternity Pediatric Nursing Leifer 5th Edition Test Banklaxator.rabotru5i37100% (35)

- LandBank of The Philippines v. CADocument4 pagesLandBank of The Philippines v. CAbearzhugNo ratings yet

- Dawn Editorials 23 Oct PDFDocument18 pagesDawn Editorials 23 Oct PDFQasim AliNo ratings yet

- Department of Educati56ssssssssssssssssssssssssssssssDocument2 pagesDepartment of Educati56ssssssssssssssssssssssssssssssNelson Equila CalibuhanNo ratings yet

- Partnership WorksheetDocument4 pagesPartnership WorksheetHamdan MushoddiqNo ratings yet

- Complaint (Jones v. Flossmoor) (File-Stamped)Document21 pagesComplaint (Jones v. Flossmoor) (File-Stamped)Lauren TrautNo ratings yet

- Block 2Document140 pagesBlock 2shivani mishraNo ratings yet

- Job Seeking OilerDocument3 pagesJob Seeking OilerDamar Lintas Buana Co., Ltd.No ratings yet

- The Fabric of Indigeneity: Ainu Identity, Gender, and Settler Colonialism in JapanDocument327 pagesThe Fabric of Indigeneity: Ainu Identity, Gender, and Settler Colonialism in JapanDaniela Sánchez50% (2)

- Community Engagement, Solidarity and CitizenshipDocument3 pagesCommunity Engagement, Solidarity and CitizenshipEɪ DəNo ratings yet

- Summary of Neil Postman's Amusing Ourselves to DeathFrom EverandSummary of Neil Postman's Amusing Ourselves to DeathRating: 4 out of 5 stars4/5 (2)

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (241)

- The Things We Make: The Unknown History of Invention from Cathedrals to Soda CansFrom EverandThe Things We Make: The Unknown History of Invention from Cathedrals to Soda CansNo ratings yet

- The Great Bridge: The Epic Story of the Building of the Brooklyn BridgeFrom EverandThe Great Bridge: The Epic Story of the Building of the Brooklyn BridgeRating: 4.5 out of 5 stars4.5/5 (59)

- Crossings: How Road Ecology Is Shaping the Future of Our PlanetFrom EverandCrossings: How Road Ecology Is Shaping the Future of Our PlanetRating: 4.5 out of 5 stars4.5/5 (10)

- Piping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationFrom EverandPiping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationRating: 4 out of 5 stars4/5 (18)

- The Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsFrom EverandThe Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsRating: 4.5 out of 5 stars4.5/5 (6)

- The Things We Make: The Unknown History of Invention from Cathedrals to Soda CansFrom EverandThe Things We Make: The Unknown History of Invention from Cathedrals to Soda CansRating: 4.5 out of 5 stars4.5/5 (21)

- An Architect's Guide to Construction: Tales from the Trenches Book 1From EverandAn Architect's Guide to Construction: Tales from the Trenches Book 1No ratings yet

- Engineering Critical Assessment (ECA) for Offshore Pipeline SystemsFrom EverandEngineering Critical Assessment (ECA) for Offshore Pipeline SystemsNo ratings yet

- To Engineer Is Human: The Role of Failure in Successful DesignFrom EverandTo Engineer Is Human: The Role of Failure in Successful DesignRating: 4 out of 5 stars4/5 (137)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseFrom EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseRating: 5 out of 5 stars5/5 (3)

- Methodology for Estimating Carbon Footprint of Road Projects: Case Study: IndiaFrom EverandMethodology for Estimating Carbon Footprint of Road Projects: Case Study: IndiaNo ratings yet

- Nuclear Energy in the 21st Century: World Nuclear University PressFrom EverandNuclear Energy in the 21st Century: World Nuclear University PressRating: 4.5 out of 5 stars4.5/5 (3)

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedFrom EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedRating: 5 out of 5 stars5/5 (1)

- Building Construction Technology: A Useful Guide - Part 1From EverandBuilding Construction Technology: A Useful Guide - Part 1Rating: 4 out of 5 stars4/5 (3)

- A Welder's Guide to Handrails and Railing Codes: Everything You Need to Know about Handrails and the Building Codes That Regulate ThemFrom EverandA Welder's Guide to Handrails and Railing Codes: Everything You Need to Know about Handrails and the Building Codes That Regulate ThemNo ratings yet

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionFrom EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionRating: 4.5 out of 5 stars4.5/5 (2)

- Field Guide for Construction Management: Management by Walking AroundFrom EverandField Guide for Construction Management: Management by Walking AroundRating: 4.5 out of 5 stars4.5/5 (3)

- The E-Myth Contractor: Why Most Contractors' Businesses Don't Work and What to Do About ItFrom EverandThe E-Myth Contractor: Why Most Contractors' Businesses Don't Work and What to Do About ItRating: 4 out of 5 stars4/5 (16)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideFrom Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideRating: 3.5 out of 5 stars3.5/5 (7)

- Markup & Profit: A Contractor's Guide, RevisitedFrom EverandMarkup & Profit: A Contractor's Guide, RevisitedRating: 5 out of 5 stars5/5 (11)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)