Professional Documents

Culture Documents

NFCL Project

Uploaded by

Senthamiz SelvanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NFCL Project

Uploaded by

Senthamiz SelvanCopyright:

Available Formats

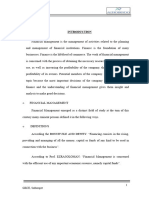

INTRODUCTION

Finance is regarded as “THE LIFE BLOOD OF BUSINESS

ENTERPRISE”. Finance function has become so important that it has given birth to

financial management as a separate subject. So, this subject is acquiring universal

applicability. Financial Management is that managerial activity which is concerned with the

planning and controlling and of the firm’s financial resources. As a separate activity or

discipline is of recent origin it was a branch of economics till 1890. Still today it has no

unique today of knowledge of its own, and it draws heavily on economy for its theoretical

concepts.

The subject of financial management is of immense interest to both academicians and

practicing managers. It is of great interest to academicians because the subject is still

developing, and there are still certain areas where controversies exist for which no unanimous

solutions have been reached as yet. Practicing Managers are interested in this subject

because among the most crucial decisions of the firm are those which relate to finance and an

understanding of the theory of financial management provides them with conceptual and

analytical insights.

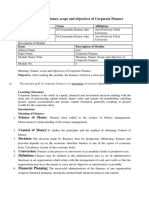

Scope of Finance Management:

Firms create manufacturing capacities for production for goods; some provide

services to customers. They sell their goods or services to earn profits. They raise funds to

acquire manufacturing and other facilities. Thus, the three most important activities of a

business firm are:

Production

Marketing

Finance

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 1

A firm secures whatever capital it needs and employees it (finance activity) in activities

that generate returns on invested capital (production and marketing activities). A business

firm thus is an entity that engages in activities to perform the functions of finance, production

and marketing. The raising of capital funds and using them for generating returns to the

supplies of funds is called the finance function of the firm.

FUNCTION OF FINANCIAL MANAGEMENT

Two significant contribution to the development of modern theory of financial

management are:

Theory of Portfolio Management developed by Harry Markowitz in 1950, which deals

with portfolio selection with risky investment. This theory uses statistical concepts to

quantify the risk-return characteristics of holding a group/portfolio of securities,

investment or assets.

The theory of Leverage and Valuation of Fire developed by Modigliani and Miller in

1958. They have shown by introducing analytical approach as to how the financial

decision making in any firm be oriented towards maximization of the value of the

firm and the maximization of the shareholders wealth.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 2

Type of Financial Actions:

1. The Financial Management of trading or manufacturing firms

2. Financial Management of Financial Institutions.

3. Financial activities relating to investment activities.

International Finance:

Public Finance:

Functions are broadly classified into three groups. Those relating to resource

allocation, those covering the financing of these investments and theses determining how

much cash are taken out and how much reinvested.

Investment decision

Financing decision

Dividend decision

Liquidity decision

I) Investment Decision:

Firms have scarce resources that must be allocated among competitive uses. The

financial management provides a frame work for firms to take these decisions wisely. The

investment decisions include not only those that create revenues and profits (e.g. introducing

a new product line) but also those that save money.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 3

So, the investment decisions are the decisions relating to assets composition of the

firm. Assets can be classified into fixed assets and current assets, and therefore the

investment decisions can also be bifurcated into Capital Budgeting decisions and the Working

Capital Management.

The Capital Budgeting decisions are more crucial for any firm. A finance manager

may be asked to decide about.

1. Which asset should be purchased out of different alternative options;

2. To buy an asset or to get it on lease;

3. To produce a part of the final product or to procure it from some other supplier;

4. To by or not an other firm as a running concern;

5. Proposal of merger of other group firms to avail the synergies of consolidation.

Working Capital Management, on the other hand, deals with the Management of

current assets of the firm. Though the current assets do not contribute directly to the earnings,

yet their existence is necessitated for the proper, efficient and optimum utilization of fixed

assets. There are dangers of both the excessive working capital as well as the shortage of

working capital. A finance manager has to ensure sufficient and adequate working capital to

the firm.

II Financing Decisions:

As firms make decisions concerning where to invest these resources, they have also to

decide two they should raise resources. There are two main sources of finance for nay firm,

the shareholders funds and the borrowed funds. The borrowed funds are always repayable

and require payment of a committed cost in the form of interest on a periodic basis. The

borrowed funds are relatively cheaper but always entail risk.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 4

The risk is known as the financial risk i.e., the risk of insolvency due to non-payment

of interest or non-repayment of capital amount. The shareholders fund is the main source of

funds to any firm. This may comprise of the equity share capital, preference share capital and

the accumulated profits. Firms usually adopt a policy of employing both the borrowed funds

as well as the shareholders funds to finance their activities. The employment of these sources

in combination is also known as financial management.

III) Dividend Decisions:

Another major area of the decision marking by a finance manager is known as the

Dividend decisions which deal with the appropriation of after tax profits. These profits are

available to be distributed among the shareholders or can be retained by the firm for

reinvestment with in the firm. The profits which are not distributed are impliedly retained in

the firm. Al firms whether small or big, have to decide how much of the profits should be

reinvested back in the business and how much should be taken out in form of dividends i.e.,

return on capital. On one hand, paying out more to the owners may help satisfying their

expectations; on the other hand, doing so has other implications as a business that reinvests

less will tend to grow slower.

Reinvestment opportunities available to the firm,

The opportunity rate of the shareholders.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 5

INDUSTRY PROFILE

India has been predominantly considered as an agricultural dependent economy.

Agriculture plays a very dominant role as more than one-fourth of our GDP come from this

sector. Nearly 70% of population depends on the agriculture for their lively-hood. The basic

need for an agricultural dependant economy is fertilizers and urea is one of the main

fertilizers. India is the second largest manufacturing country in the world.

All fertilizers consist if three main ingredients.

Nitrogen—(N) -- which promotes general plant growth

Phosphorous—(P) -- which promotes flowering

Potassium – (K) – which promotes strong roots.

The ingredients are mixed in various combinations because plants have different needs.

The combinations are indicated by a three number code:

The first number is the percent of nitrogen (N)

The second number is the percent of phosphorus (P)

The third number is the percent of potassium (K)

About Fertilizer:

Fertilizer is simply, plant food. Just like the human body needs vitamins and

minerals, plants need nutrients in order to grow. Plants need large amounts of three nutrients

– nitrogen, phosphorus, and potassium. These are commonly referred to as macronutrients.

Fertilizer makers take those three nutrients from nature and put them into soluble forms that

plants can easily use.

There are a number of other nutrients plants need in small amounts. These are

referred to as the minor nutrients, or micronutrients. These many nutrients are typically

produced separately, but end up being mixed together in varying amounts to match the needs

of a particular crop. The analysis found on each bag or bulk shipment of fertilizer tells the

farmer or consumer the amount of nutrients being supplied. States have a system of laws and

regulations that ensure the fertilizer is properly labeled and delivers the amount for nutrients

stated on the bag.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 6

Our world would be vastly different without commercial fertilizers. Following world

war II, new technologies allowed for the rapid expansion of fertilizer production. Coupled

with growing food demand and the development of higher-yielding crop varieties, fertilizer

helped fuel the Green Revolution. Today, the abundance of food we enjoy is just one way

fertilizers help enrich the world around us.

While fertilizers provide many important benefits that are necessary for our way of

life, the improper use of fertilizers can harm our environment. We’ve used the most recent

developments in science to study our products and make sure safety comes first.

FERTILIZER:

Fuel for growing plants just like humans and animals, plants need adequate water,

sufficient food, and protection from diseases and pests to be healthy. Commercially produced

fertilizers give growing plants the nutrients they crave in the form they can most readily

absorb and use: nitrogen (N), available phosphate (P) and soluble potash (K), Elements

needed in smaller amounts, or micronutrients, include iron (Fe), zinc (Zn), copper (Cu) and

boron (B).

Each crop year, certain amounts of these nutrients are depleted and must be returned

to the soil to maintain fertility and ensure continued, healthy future crops. Scientists project

that the earth’s soil contains less than 20 percent of the organic plant nutrients needed to meet

our current food production needs. Therefore, through the scientific application of

manufactured fertilizers, farmers are meeting the challenge of the future, today.

Another component of plant DNA is phosphate, which helps plants to use water

efficiently. It also helps to promote root growth and improves the quality of grain and

accelerates its ripening. And potassium, commonly called potash, is important because it is

necessary for photosynthesis, which is the production, transportation and accumulation of

sugars in the plant. Potash makes plants hardy and helps them to withstand the stress of

drought and fight off disease.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 7

Fertilizer Types:

Because every crop is different and the soils and weather conditions crops are grown

in vary dramatically around the world, commercial fertilizers, which are manufactured from

natural sources, come in many formulations.

Combining air with hydrogen using natural gas as the feedstock makes ammonia, the

building block for nitrogen fertilizers. Ammoniated phosphates, which include mono

ammonium phosphate (MAP) and diammonium phosphate (DAP), are made by reacting

ammonia with phosphoric acid. Muriate of potash, also called potassium chloride, is made

from mine ores that have been processed to remove naturally occurring salts.

Ammonium nitrate is a solid fertilizer containing approximately 34 percent nitrogen

that is water soluble and used in various fertilizer solutions. Aqua ammonia is another

nitrogen-based fertilizer made by combining ammonia with water. It contains up to 25

percent nitrogen and is either applied directly to the soil or is used to manufacture phosphate

fertilizers.

Nitrogen solutions are water solutions of ammonia, ammonium nitrate and,

sometimes, urea, a solid fertilizer containing approximately 45 percent nitrogen, and other

soluble compounds of nitrogen. Nitrogen solutions are used in ammoniating super phosphate,

the manufacture of complete fertilizer and for direct injection into the soil. They vary in

composition and nitrogen content and are sometimes applied under pressure.

NITROGEN (N):

Nitrogen is a part of all plant proteins and is a component of DNA and RNA – the

“blueprints” for genetic characteristics. It is necessary for plant growth and chlorophyll

production. Nitrogen is the building b lock for many fertilizers. Where does N come from?

Nitrogen is present in vast quantities in the air, making up about 78 percent of the

atmosphere. Nitrogen from the air is combined with natural gas in a complex chemical

process to make ammonia.

PHOSPHOURUS/PHOSPHATE (P):

Phosphorus as a nutrient is sometimes most valuable to plants when put near the seed

for early plant health and root growth. Plant root uptake is dependent on an adequate supply

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 8

of soil P. Phosphorus is relatively insoluble in water. The water in most soils must replace all

of the P in the soil water 2 to 3 times each day to meet the crop’s demand for P. Phosphorus

compounds help in directing where energy will be used. Phosphorus compounds are needed

in plant photosynthesis to “repackage” and transfer energy. Phosphate is also a component of

DNA, so it is one of the building blocks of genes and chromosomes. Phosphorus is involved

in seed germination and helps plants to use water efficiently. Where does P come from?

Phosphorus occurs in natural geological deposits. Deposits can be found in the U.S. and

other parts of the world.

Potassium/Potash (K):

Potassium protects plants against stresses. Potassium protects plants from cold winter

temperatures and helps them to resist invasion by pests such as weeds and insects. Potassium

stops wilting, helps roots stay in one place and assists in transferring food. Potassium is a

regulator. It activates plant enzymes and ensures the plant uses water efficiently. Potassium

is also responsible for making sure the food you buy is fresh. Where does K come from? The

element potassium is seventh in order of abundance in the Earth’s crust.

Through long-term natural processes K filters into the oceans and seas. Over time,

these bodies of water evaporate, leaving behind mineral deposits. Although some of these

deposits are covered with several thousands of feet of earth, it is mined as potash or

potassium chloride. Potash ore may be used without complex chemical conversion; just some

processing is necessary to remove impurities such as common salt.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 9

FOOD FOR THE GROWING WORLD

Industry at a glance:

Since 1883 the industry has worked to promote the advances in the development and

application of fertilizers that have helped to feed a hungry world. The revolutionary concept

of plant nutrition was born from the discovery of the biological role of chemical elements in

plant nutrition and the need to feed a growing population concentrated away from the farm in

the rising industrial centers of the world.

Because of modern fertilizers, world food production since 1960 has more than

doubled, keeping pace with the population explosion. Today, the fertilizer industry is poised

to help produce the food that will be needed to feed the world’s projected 9 billion people in

2025.

The fertilizer industry is essentially concerned with the provision of three major plant

nutrients – nitrogen (N), phosphorous (P) and potassium (K) – in plant available form. Each

nutrient is responsible for different aspects of plant growth and health.

Fertilizers:

Regulated for quality and safety like other manufactured goods, fertilizers are

regulated for quality and safety at the federal and state levels. Every state in the country, plus

Puerto Rico, has its own fertilizer regulatory program, usually administered by the state

department of agriculture.

State Regulation:

State regulation is concerned with consumer protection, labeling, the protection of

human health and the environment, and the proper handling and application of fertilizers.

Fertilizers are regulated at the state level because soil conditions vary dramatically from state

to state across the country. For example, the rocky, thin soils of New England are vastly

different from the deep, rich black soils of the Midwest Corn Belt. A different level of

fertilizer nutrients in the soil, different crops (potatoes versus corn, for instance) and different

weather and cropping patterns require state-specific regulation.

Where Science and safety come first the modern commercial fertilizer industry was

founded on the revolutionary scientific discovery in the last part of the 18 th century that

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 10

chemical elements play a direct role in plant nutrition. This initial concept was supported by

direct scientific experiment and opened the way for industrial-scale manufacturing of

fertilizers of all types in the 19 th century, beginning with superphosphate in 1843. this was

followed by ammonium sulphate, sodium nitrate and, finally, in the first two decades of the

20th century, the manufacturing of synthetic nitrogen fertilizers directly from atmospheric

nitrogen.

Assessing Fertilizer Safety:

Fertilizer research and development historically have been focused on maximizing

economic crop yields from given rates of nutrient application. Since the advent of the

modern environmental movement in the 1960s, research has also been concerned with

minimizing potentially adverse human health and environmental effects from fertilizer

manufacture and application.

As part of its continuing commitment to safety, in 1996. the Fertilizer Institute

initiated a comprehensive safety assessment project to determine the risks, if any, of metals in

fertilizer. Small amounts of metals are found in phosphate and potash fertilizers due to their

presence in the mined ore bodies. In addition to phosphate and potash products, some

micronutrient fertilizers. Which come from both mined ores and recycled wastes, also

contain metals.

Fertilizers Enrich our World:

Improvements in agricultural efficiency through research and technology increase

food output while protecting the environment and enriching our world in numerous ways.

Fertilizers feed the growing world. As the world’s population continues to climb

toward an estimated 8.5 billion in 2040, experts estimate that food production must increase

more than two percent annually to even maintain current diets. Commercial fertilizers will be

key in the fight to feed the growing world.

Fertilizers protect the environment. The efficient use of fertilizer also helps to

conserve the natural environment. With fertilizers and modern high yield farming practices,

more food is produced per acre each year, so land may be conserved. Fertilizers, used

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 11

properly, help to prevent the widespread loss of habitat that results from wasteful “slash and

burn” low-yield farming, which is a major global environmental threat.

Fertilizers at work in industry:

Aside from their benefits to agriculture, fertilizer components are central to such

industrial process as semiconductor chip making, resin manufacture, cattle feed production,

metal finishing, the manufacture of detergents, fiberglass insulation and more, even rocket

fuel.

Global Fertilizer Consumption

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 12

COMPANY PROFILE

THE NAGARJUNA GROUP

Our founder Sri K.V.K. Raju (28.11.1928 – 16.06.1993) laid the foundation of the

Nagarjuna Group in 1974 with an investment of Rs. 50 millions. He was a visionary and a

professional technocrat entrepreneur who realized the importance of Core Sectors to an

economy like ours. He has guided the group with his philosophy

SERVING SOCIETY THROUGH INDUSTRY

Nagarjuna Fertilizers and Chemicals Limited (NFCL) is the first gas based fertilizer

factory in South India. The plant is based on the latest fertilizer technology from M/s.

Snamprogetti, Italy for Urea process with an installed capacity of 1500 Mt/day for each unit.

The ammonia process is based on technology from M/s. Haldor Topsoe, Denmark with an

installed capacity of 900 MT/day per each unit.

The feed stock for unit – I is natural gas and feed stock for Unit – II is NG/Naphtha.

The current consumption of natural gas is 2.15 million standard cubic meters per day and 500

MT of Naphtha per day. The natural gas is being received through pipe lines from Tatipaka

situated 92 Kms away from the factory and is marketed by M/s Gas Authority of India

Limited. Napththa is being supplied by M/s HPCL. The water requirement of 6.0 Million

Gallons/day is received from Samalkot Summer Reservoir through two pipeline.

Finance:

The total cost of the existing complex is Rs. 2156 crores (Rs. 1186 crores for Unit-I

and Rs. 970 crores for Unit – II). This consists of loan of Rs. 1,162 crores (Rs. 515 crores for

Unit-I and Rs. 647 crores for Unit – II) sanctioned by IDBI, IFCI, ICICI, UTI, LIC, GIC and

also Banks. The foreign exchange component of Rs. 781.07 cores was met by the Indian

Financial Institutions like IDBI, IFCI & ICICI and also by Italian Buyers credit. The public

and promoters subscribed the equity portion of Rs. 332.12 crores. The internal reserves of

Rs. 323 crores were utilized for construction of Unit – II.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 13

LIVING IN HARMONY WITH NATURE – NFCL’S CONTRIBUTION

TO ECOLOGY

Environmental protection is an avowed corporate philosophy and the plant is built on

the principle of zero-effluent discharge and is totally eco-friendly. NFCL’s aim is to maintain

ecological harmony, which is NATURE’S INVALUABLE AND BEAUTIFUL GIFT TO

MANKIND.

Man can live in harmony with the environment only when mankind is guided by

respect for the Mother Earth and all living things. Nagarjuna Fertilizers and Chemicals

Limited believe that Industry should exist in harmony with nature. In pursuance of the

corporate vision, and as a humble contribution to the Mother Nature, the complete ecological

system in and around the factory has been changed by establishing a K.V.K.RAJU

SUNDARAVANAMU in an area of 747 acres surrounding the Complex.

The entire area has been covered with 4,50,000 plants consisting of 170 species,

transforming a once highly saline marshy area devoid of any vegetation into a lush green

arboreal park. The establishment of 1 KM wide KVK Sundaravanam is an integral part of

overall natural ecological system consisting of eleven water bodies for fish, habitat for animal

life and sanctuary for both indigenous as well as migratory birds with the factory nestled in

the most natural and idyllic surroundings created with dedication.

An integrated Environmental Management Plan (EMP) has been incorporated in the

basic design itself to ensure strict adherence to International Standards. The investment on

pollution control equipment in the Plant is close to Rs. 110 crores of capital investment and

recurring expenditure of Rs. 6 crores being spent annually for operating and maintaining the

equipment.

MAIN FEATURES OF ECO-SYSTEM:

A forestation:

740 acres of area has been planted with 4.5 lakh saplings of 170 species. Weak areas

have been planted with selected species based on criteria like tolerance to salinity, availability

from local sources and their ability survive with least maintenance. A full-fledged nursery

with mist chamber and sprinkler irrigation system has been developed for supply of plants to

a forestation programme.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 14

Animal Enclosures:

A deer park with spotted deer has been set up in an area of six hectares with chain-

link fence on all sides. Separate enclosures for birds, rabbits and certain other animals are

made available. Some of these animals like jungle cat, fox, jackals, mongooses, squirrels,

bats, snakes, and turtles are also being let out freely in this eco-system as a part of our animal

conservation programme.

Use of Treated Effluent:

The total treated effluent generated from the factory is being utilized through a

network of over 17 KM of PVC pipeline for sustenance of the eco-system to show the purity

levels of the effluents and the technological efficiency of the plant equipment.

Awareness Programme:

As a part of NFCL’s sincere endeavor to bring awareness about the benefits of cleaner

environment on the general standards of life, company has started “GREENING THE

ROADS” of Kakinada in Phases. As a part of this programme, flowering trees were planted

on either side of the 4 km length of roads from Bhanugudi Junction to Nagamallithota and

from Nagamallithota to NFCL. This programme is being extended to further areas in phases.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 15

NEED & SCOPE OF THE STUDY

Need for the Study

In India of plenty human and nature resources are available but the capital

resources are highly restricted. A understanding of financial management

practices. Is necessary to utilize limited capital resources efficiently and

effectively in order to norms, for sound financial management in various

organization it is necessary to study the financial management practices in

auto parts industry particular reference to NFCL LTD., KAKINADA.

It is useful for the owners who are interested in the Return on investment

earnings per share by comparing the details for different periods to assess

the period of the firm.

It is useful for the employees and consumers in their own field of interest.

It is useful for the students like me, to make an analysis for enhancing our

knowledge and skills in the filed of financial management.

Scope of the Study

This study is carried in the months of may-June. The data for the study are

collected from the balance sheet, profit and loss account and various schedules

relating to it for six years from

This study covers analysis like ratio analysis; funds flow statement, comparative

financial statements, common size financial statements and Trend analysis and also

include SWOT analysis.

It covers the various activities in the organization and measures the profitability,

solvency and efficiency for six successive years of he firm. Based on the analysis a

trend is to be drawn for a further period of five years.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 16

OBJECTIVES OF THE STUDY

This project work is aimed to attain the following major objectives.

The objectives are:

1. To know about the fertilizer industry and business activities of M/s. Nagarjuna

Fertilizers and Chemicals Limited, Kakinada

2. To study the ability of the firm to meet its current requirements.

3. To study the extent to which the firm has used its long-term solvency by borrowing

funds.

4. To study the overall operating efficiency in performance of M/s. Nagarjuna Fertilizers

and Chemicals Limited, Kakinada.

5. To study the efficiency with which the firm is utilizing its various assets in generating

sales.

6. To suggest guidelines to the company for improving its financial position.

RESEARCH METHODOLOGY

The required for this study would be collected through two sources i.e.,

METHODS

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 17

PRIMARY DATA SECONDARY DATA

1. Primary Data:

The primary data comprises information obtained by the candidate during discussions

with Heads of Departments and from the meeting with officials and staff.

2. Secondary Data:

The secondary data has been collected from information through Annual Reports,

Public Report, Bulleting and other Printed Materials supplied by the Company.

In the present study 1/4th of the total information of time is from primary data and the

rest is from the secondary data.

LIMITATIONS OF STUDY

1. The study is limited to NFCL, Kakinada; it does not relate to any other company of

Nagarjuna Group or other firm’s of Fertilizer Industry.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 18

2. The smaller time frame for understanding this study is also a significant limitation.

3. The ratios are calculated on the basis of past data; these are not future indicators.

4. The scope of study is limited to the last five years balance sheets.

5. The analysis is made basing only on the Annual Reports of NFCL.

THEORETICAL BACKGROUND OF PROJECT

CONCEPTS OF WORKING CAPITAL

Finance is the life blood of every business activity without which the wheels of

modern organization back bone system cannot be greased. Working capital management is

one of the important facets of a firm’s overall financial management. It is concerned with the

management of firm’s current accounts, which include current assets into optimal use by

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 19

speeding up their flow to ensure that money does not stagnate any way in any form. The

management of working capital is becoming increasingly important as firms realize that

approximately half of the investments are in working capital. Working capital sphere,

therefore, throws open a welcome challenge and an opportunity for the finance mange to play

a key role for effective planning, controlling, directing and utilizing the working funds in

NFCL.

According to SCHLLER HALEY managing current assets require more attention

them managing plant equipment expenditure too large an investment in current asset’s means

typing up capital than can be used providently else where on the other hand too little.

Investment can also be expensive.

CONCEPT OF WORKING CAPITAL:

To understand the concept of working capital it is important to know the precise

meaning of current assets and current liabilities. Current assets are those assets, which are

used in the production and selling operations of the business and can be converted into cash

with in a year. They comprise inventory, debtors, bills receivable, marketable securities, cash

and bank balances. Current liabilities are those which are intended to be paid during the

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 20

accounting period out of current assets or the income of the business. They include bank

loans, loan other than bank, bills payable and sundry creditors. Two concepts of working

capital now in vague are found useful in the management of working capital viz., gross and

net. The former concept concerns with the quantitative approach whilst the latter deals with

qualitative approach. The project is mainly based on study on working capital management

in NFCL.

GROSS WORKING CAPITAL CONCEPT:

Working capital employed in business concern is equal to the total current assets

employed. This is known as circulating capital or operating capital as these rotate

continuously as long as the firm exits. The gross working capital concept focuses attention

on two aspects of current assets management. They are :

a. Optimum investment in current assets and

b. financing of current assets. To quote Westion and Brigham, gross working capital refers to

firms investment in short term assets such as cash, short term securities, accounts receivable

and inventors. The supporters of this concept like Field, Baker and Mallot, Mead argued that

the management is more concerned with total current assets as they constitute the total funds

for operating purpose.

NET WORKING CAPITAL CONCEPT:

The qualitative concept examine working capital as excess of current assets over

current liabilities. Working capital deficit excess if current liabilities exceed current assets.

Similar views are express by Guthmann and Doughal and McMullan Accounts Hand Book

also completely endorses this view Gerstenberg Supports it the following way:

“Any comprehensive discussion on the working capital included the excess of current

assets over current liabilities”.

Famous economists like Lincoln, Stevens and sailors fully endorsed this concept and

expressed that it helps creditors and inventors judge the financial soundness of an enterprise.

Another alternative definition of net working capital is that portion of firm’s current assets

which is financed with long term funds. Net working capital, thus indicates the liquidity of

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 21

the business while gross working capital indicates the quantum of working capital with which

the business has to operate.

NEED FOR WORKING CAPITAL:

The need for working capital in a business undertaking cannot be over emphasized.

The objective of financial decision making is to maximize the shareholders wealth. To

achieve this it is necessary to generate sufficient profits. The extent to which profits can be

earned will naturally depend upon the magnitude of the sales among other things. A

successful sales programme is in other words necessary for earning profits by any business

enterprise. However, sales do not convert into cash instantly. There is invariably a time lag

between the sale of goods and the receipt of cash. There is, therefore, a need for working

capital in the form of current assets to deal with the problem arising out of the lack of

immediate realization of cash against goods sold. Sufficient working capital is thus,

necessary to sustain sales activity.

FACTORS INFLUENCING WORKING CAPITAL:

The business undertaking should plan its operations in such a way it should have

neither too much nor too little working capital. The total working capital requirements are

determined by a variety of factors. The factors which determine the quantum of working

capital in a business undertaking are as follows.

1. General nature of the business-companies which sell a service and the too for

immediate cash, require little working capital. But for a manufacturing firm which

produces a product and sells it on credit basis, working capital requires is high

2. Production cycle if the production process is lengthy working capital required is more

and vice-versa.

3. Speed of operating cycle if the speed of operating cycle is slow working capital

needed is high.

4. Credit terms if the company purchase raw materials on credit basis and sells finished

goods o cash basis, working capital requirements will be low.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 22

5. Growth and expansion – Firms with larger growth prospects demand greater working

capital.

6. Dividend policy – firms pursuing a liberal dividend policy require more working

capital.

7. Other factors

(a) Production policies

(b) Unpredictability in the availability of raw materials.

(c) Depreciation Policies

(d) Impact of business cycles

(e) Operating efficiency and

(f) Absence of Coordination between production and distribution policies.

WORKING CAPITAL CYCLE AND ITS MANAGEMENT – AN

EXPLANATORY NOTE

The general factors as explained above that too those factors which are uncontrollable

due to external reasons of nature, lead-time of manufacture and existence of market

conditions would limit ones effort of meticulous management by the controllable constituents

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 23

of Working Capital requiring judicious management by the controllable constituents of

working capital requiring judicious options of applicability should consume almost all the

time for efficient management. In order to understand the management of working capital in

all its faces, I deal with the constituents of working capital, its management, so also the

financing forms available in the following paragraphs.

For the purpose of analysis of following working capital cycle is framed. The cycle

shown below is a typical working capital cycle. Its change in shape, reduction in length

could be, where products are sold on cash, fully or partially, materials purchased on cash or

credit, which have been dealt-with in the “Management” part of it in a narrative form.

The working capital operating cycle normally confines to a year to year with

reference to which various factors affecting working capital are evaluated. Working capital

cycle is the period within which either raw material converts itself to cash or commences

with cash and ends with cash.

RAW MATERIALS

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 24

The component of the raw material in a working capital cycle assumes vary

significant role. Generally more than 50% of the year turnover are spent on raw materials

undue accumulation of raw material tells upon a profitability due to costs of its carrying.

The maintenance of optimum level of inventories of Ra- Materials maximizes with

lower working capital requirement and shortage of Raw Materials lead to disruption in

production, non-utilization of capacities of production and consequent adverse impact on

profitability (since larger generation from higher profitability directly leads to lesser cost on

working capital). There have been scientific methods established not only for procurement

but also for storing. Working capital cycle is the period within which either raw material

converts itself to cash or commences with cash and ends with cash necessitate certain

inevitable volume to be stored, in case of finished goods many factors to keep at optimum

level would be controllable. There can be host of measures that could be taken for

maintaining minimum quantity in the form of finished goods.

RECEIVABLES:

The sale of the products against cash would be an ideal situation to eliminate a stage

in the working capital cycle thus achieving the objective of drastic reduction in its length and

the requirement of working capital. The existence of numerous competitors in the era of

globalization and liberalized economy, such sales on cash could only be next to impossible if

growth of the organization is any aspiration. In the present complex market scenario one lead

the other, in offering more value for money to their customers and extending credit has been

one such major step. This encounters the organization with substantial blockage of working

capital. Indiscriminate extension of credits in the name of growth could erase the entire

profitability and as stated above non-extending of credit would keep the organization out of

business. A great deal of planning and efficiency is warranted to keep receivables at the

optimum level. I would choose to little elaborate on two measures in this regard.

1. LAYING DOWN CREDIT POLICY:

The organization specifying applicability of general credit policy i.e., the period of

credit extendable as a thumb rule would fall short of its effort in controlling receivables. The

credit policy requires to be more selective and should bear, the growth, recoverability, the

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 25

product strength, distribution network etc., in its upper most mind. The variation in credit

policy could also customer based. As we would observe there would be two sets of

organizations, one looking for a lower margin with high growth through a liberal credit

policy, the other one, higher margin with reasonable growth through a conservative credit

policy.

The credit policy should not lay-down the period of credit but also a well through out

procedures for extending credit in order to prevent or minimize the debts going bad. A

systematic evaluation of customers credibility, financial strength and their usefulness to the

organization in terms of quantum of sale etc. would fetch desired results. The credit policy

should specify the level of management authorized to extend general credit and instead of

decentralizing the power of extending any further dispensation such decisions could be taken

by fairly senior personnel, few in number. Depending upon the market conditions the policy

could also specify incentives for early payments like cash discounts, so also interest on

delayed payments.

2. MONITORING RECEIVABLES:

Monitoring receivables are as important, if not more, as laying down a credit policy. It

has to be constant and continuous in order to bring down the level of receivables to an

optimum level in conformity with the laid down credit policy of the organization. When we

talk of monitoring receivables two ready indicators are remembered. The collection period

and the age of the book debts.

a. Collection period

The collection period would be in terms of number of days average credit sales. Such a

calculation area-wise, marketing personnel wise at frequent intervals would provide

information for selective credit control. An application of incentive for faster collection in

certain selective areas also would render possible, the collection faster.

b. Aging to Book Debts:

The collection efforts could be intensified on greater analysis of receivables from the

point of view of the number of days it is outstanding. Higher the number of days, the debt is

outstanding, the probability of it becoming doubtful of recovery is higher. Earlier detection

of such outstanding from customers would facilitate taking hard decisions of stoppage of

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 26

further sales, in order to minimize bad debts. Collection of book debts just as per the credit

policy would enable the organization to achieve planned profitability.

It would be an art and efficiency of the marketing personnel in an organization which

enables overall monitoring of receivables effective and to keep at an optimum level.

CASH AND ITS MANAGEMENT

Cash is the starting point and the end point of a working capital cycle. I have

explained the foregoing paragraphs about each of the stages in the working capital and its

management. The management necessarily means, ways and means of maintaining as low

level in each stage possible, without hampering the laid down objectives of the organization

of growth and profitability. While explaining these the efforts were only to reduce the

conversation period at each stage and to reach to the cash stage as early as possible. Cash

management therefore includes efficiency of inventory management, work-in-process

management, receivables management etc., having dealt with these, I would opt to deal with

other prominent factors affecting cash management.

Cash management as such, of course, depends on the nature of the organization,

market conditions for the products deals with by the organization policies perused, other

external factors affecting etc.,

The management of cash mainly should serve the following objectives.

a. The cost of capital being a major component in the determinates of profitability, the

optimum level of its maintenance is so essential that any shortage even temporarily

would disrupt the whole activity of the organization. It would fail to meet its

commitments to employees statutory authorities etc. the suppliers would loose

confidence in the organization and there would be lack of competitiveness in

supplying the materials ultimately leading to substantial higher in-puts costs. On

the other hand indiscriminate holding of cash, higher than necessary, would result in

loss of interest apart from stagnation in growth and profitability. It would be the

Endeavour of the organization to rotate cash as fast as possible maintaining cash in

its form at the minimum.

b. The inflow and the outflow of cash should be nearly matched in order to enable

meeting of all its commitments on time at minimum cost.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 27

c. The cash should be available even at the time of an unexpected deviation in the plan

of production and sale.

d. Maintaining lower cash position would also lead to demoralization, lower

productivity, unfavorable bargaining power, strained industrial relations, affecting

good will etc., maintaining higher cash position would lead to complacency, higher

doubtful debts, higher non-moving item of inventory, obsolescence etc., since it

tends to take the operations with less diligence.

Management of cash is an important as any other component of working

capital. It involves, planning zero based budgeting, exercising economy in

spending making short-term and long-term forecasts etc.

The inflows and outflows are required to be monitored continuously with

reference to the plan, for identifying the deviations for corrective action.

1. Efficient Debt Collection System:

While dealing with monitoring receivables I have touched upon the need for Reducing

book debts and also control of book debts through aging analysis. In addition, the system

could build in the following for accelerating debt collection even within the overall credit

policy of the organization.

a. Extending cash discounts for early payment by the customers. As long as margin on

the products sold in higher than the cost of borrowed capital, faster collection by this

system resulting in quicker rotation of cash could result in higher profitability.

b. Collection through demand drafts in place of cheques, particularly that from

outstations.

c. Opening up of as many collection bank accounts as required near to the sales point for

quicker realization.

d. Adopting faster mode of transfer of funds from collection accounts at various

locations to the overdraft account of the organization, say, by money transfer,

telegraphic/tele transfers, quick collection system introduced by the banks etc.

2. Economy in Disbursement:

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 28

Better management of cash could be achieved through exercise of economy on

disbursements. The following measures would be useful.

a. Collection bank account should be as many but the disbursement bank accounts

should be as few as possible. The authority to disburse should be centralized with few

senior level personnel to render monitoring easy and effective.

b. Proper assessment of man power to restrict expenses on labour.

c. Exploring possibilities of exercising economy in all major operating costs.

d. Availing maximum credit form the suppliers, at the same time not leading to higher

prices for material. A larger period of credit could be availed by extending non-fund

based guarantees either letter of credits or bank guarantees.

3. Temporary Investment in Marketable Securities:

There can not be a perfect match between inflow and outflow of cash. In view of

necessity to provide for contingencies, temporary surplus cash situation might exist.

FINANCING THE WORKING CAPITAL NEEDS:

Financing working capital needs of a business enterprise is yet another key area

wherein the finance manager can play an active role. He can employ different sources in

financing of current assets. There exist three distinct sources of financing current assets.

1. Long Term Financing: It consists equity and preference shares retained earnings

debentures and borrowed funds from financial institutions.

2. Short Term Financing: It includes short term bank loans, commercial papers,

and factoring bills receivables.

3. Spontaneous Financing: It acts as an instantaneous source which includes trade

credit and accruals. Every firm tries its best for the maximum use of the spontaneous

sources which are cost free.

In financing current assets the choice is exclusively between short term and long term

sources since the spontaneous sources were exploited on routine lines. The finance

manager has to decide the extent of long terms and short term sources to finance his

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 29

concerns working capital requirements depending upon the conditions under which the

company operates, the type of product it manufactures, its earning power, the interest

charges on different sources of funds and their availability. The short sources of funds

involves less cost and have more flexibility but more risky than the long term source of

funds. Therefore, the firm should use both the sources intelligently to finance its current

assets. Financing current assets through a right source assumes a greater significance in

the management of working capital.

Data Collection:

Personal interview were held with key personnel of finance department.

Secondary data from published annual reports for 5 years (2003 to 2006)

and few other relevant data were availed from NFCL. Kakinada.

RESEARCH TOOL:

1. Operating Cycle Method

a. Raw Material Conversion period

b. Work-in-Process Conversion Period

c. Finished goods Conversion Period

d. Receivables Conversion Period

e. Payment deferral Conversion Period

2. Statement of Changes in working capital

3. Trend Analysis

a. Capital Trend

b. Sales Trend

c. PBT Trend

4. Ratio Analysis

a. Liquidity Ratios

b. Activity Ratios

c. Assets Turnover Ratios.

1. OPERATING CYCLE METHOD:

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 30

The operating cycle of a firm begins with the acquisition of raw materials and ends with

the collection of receivable. It may be divided into 4 stages.

Purchase of Raw materials Stage.

Work-in-Process Stage

Finished goods inventory stage

Debtors collection Stage

The firm beings with the purchase of raw materials which are paid after a delay which

represents the accounts payable period. The firm converts the raw materials into finished

goods and then sells the same. The time lay between the purchase of raw materials and the

sale of finished goods is the inventory period. Customers pay their bills some time after the

sales. The period that elapses between the data of the sales and the data of collection of

receivable is the accounts payable.

The duration of the operating cycle is equal to the sum of the duration of each of these

stages less the credit period allowed by the suppliers of the firm. In symbols.

O=R+W+F+D+C

Where,

O = Duration of operating cycle

R = Raw material storage period

W = Work in process period

F = Finished goods storage period

D = Debtors collection period

L = Creditors collection period

The time that elapses between the purchase of raw materials and the collection of cash

for sales in referred to as the operating cycle. It can be represented as follows.

2. Statement of changes in working capital:

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 31

This technique helps to analyze changes in working capital components between two

dates. The comparison of current assets and current liabilities are shown in the table at the

beginning and end of the specific period. By this statement we can know the difference of

individual components in Current Assets + Current Liabilities for the two years respectively.

RATIO ANALYSIS

Several ratios, calculated from the accounting date, can be grouped into various classes

according to financial activity or function to be evaluated. As stated earlier, the parties

interested in financial analysis are short and long-term creditors, owners and management.

“Short-term creditors” main interest is in the liquidity position or the short-term

solvency of the firm. Long-term creditors, on the other hand, and more interested in the long-

term solvency and profitability of the firm. Similarly, owners concentrate on the firms

profitability and financial condition. Management is interested on in evaluating every aspect

of the firms performance. They have to protect the interests of all parties and see that the

firm grows profitably. In view of the requirements of the various users of ratios, we may

classify them into the following four important categories.

Types of Ratio:

Liquidity Ratios

Leverage Ratios

Activity Ratios

Profitability Ratios

I) Liquidity Ratio:

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 32

The liquidity refers to the maintenance of cash, bank balance and those assets, which

are easily convertible into cash in order to meet the liabilities as and when arising. So, the

liquidity ratios study the firm’s short-term solvency and its ability to pay off the liabilities.

Current Ratio:

Current ratio is the ratio of current assets and current liabilities. Current

Assets are assets which can be covered into cash within one year and include

cash in hand and at bank, bills receivable, net sundry debtors, stock of raw

materials, finished goods and work in progress, prepaid expenses,

outstanding and occurred incomes, and short term or temporary investments.

Current liabilities are liabilities, which are to be repaid within a period of 1 year and include

Bills payable, Sundry Creditors, Bank Overdraft, Outstanding

Expenses, Incomes received in advanced, proposed dividend, provision for taxation,

unclaimed dividends and short term loans and advances repayable within 1 year.

Current Assets

Current Ratio= -------------------

Current Liabilities

A Current ratio of 2:1 is considered as ideal: if a business has an undertaking with its bankers

to meet its working capital requirements short notices, a current ratio of is adequate.

2. Quick Ratio :

Quick Assets

Quick Ratio = ------------------------

Quick Liabilities

A quick ratio of 1 is considered as ideal. A quick ratio of less than 1 is indicative of

inadequate liquidity of the business. A very high quick ratio is also not available, as funds can

be more profitably employed.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 33

3. Absolute Liquid Ratio

It is the ratio of Absolute Liquid Assets to Quick Liabilities. However, for calculation

purposes, it is taken as ratio of Absolute Liquid Assets of Current Liabilities. Trade

investment or Marketable securities are equivalent of cash therefore, they may be included in

the computation of absolute liquid ratio.

Absolute Liquid Assets

Absolute Quick Ratio = -------------------------------------

Current Liabilities

II) Leverage Ratios:

Leverage ratios indicate the relative interest of owners and creditors in a business. It

shows the proportions of debt and equity in financing the firm’s assets the long-term solvency

of a firm can be examined by using leverage ratios. The long-term creditors like debenture

holders, financial institutions etc., are more concerned with the firms long-term financial

strength.

There are two aspects of the long-term solvency of a firm

1) Ability to repay the principal when due, and

2) Regular payment of the interest they leverage ratio are calculated to measure the

financial rest and firms abilities of using debt.

1) TOTAL DEBT RATIO:

Total debt will include short and long-term borrowings from financial institutions

debentures bonds. Capital employed will include total debt and net worth.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 34

The firm may be interested in knowing the proportion of the interest bearing debt in

the capital structure by calculating total debt ratio. A highly debt burdened firm will find

difficulty in raising funds from creditors and owners in future. Creditors treat the owner’s

equities as a margin of safety.

Total Debt

Total Ratio = --------------------

Capital Employed

2) DEBT-EQUITY RATIO:

It reflects the relative claims of creditors and shareholders against the assets of the

business. Debt, usually, refers to long-term liabilities. Equity includes preference share

capital and reserves.

The relationship describing the lenders contribution for each refers of the owner’s

contribution is called debt equity ratio. A high ratio shows a large share of financing by the

creditors relatively to the owners and therefore, larger claim against the assets of the firm. A

low ratio implies a smaller claim of creditors. The debt equity indicates the margin of satisfy

to the creditors so, there is no doubt the Beth High and Low debt equity ratios are not

desirable. What is needed is a ratio, which strikes a proper balance between debt and equity.

Total Debt

Debt-Equity Ratio = ----------------------

Net worth

Some financial experts opine that ‘debt’ should include current liabilities also.

However, this is not a popular practice. In case of preference share capital, it is treated as a

part of shareholders funds, but if the preference shares are redeemable, they are taken as a

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 35

part of long-term debt shareholder funds are also known as proprietor funds and it includes

items equity share capital, reserves, and surplus. A debt equity ratio of 3:1 is considered

ideal.

2. PROPRIETORY RATIOS:

It expresses the relationship between net worth and total assets.

Net worth

Property ratio = ----------------------------

Total Assets

Net worth = Equity share capital + Preference share capital + reserves – Fictitious assets.

Total Assets = Fixed assets + current assets (excluding fictitious assets)

Reserves earmarked specifically for a particular purpose should not be included in calculation

of net worth.

A high proprietor’s ratio is indicative of strong financial position of the business. The higher

the ratio, the better it is.

4. FIXED ASSETS RATIO:

Fixed Assets

Fixed Assets = -------------------------

Capital employed

Capital employed – Equity share capital + preference share capital + Reserves + long term

liabilities – Fictitious assets.

This ratio indicates the mode of financing the fixed assets. A financially well-

managed company will have its fixed assets financed by long-term funds. Therefore, the

fixed assets ratio should never be more than

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 36

1. A ratio of 0.67 is considered idea

6. INTEREST COVERAGE RATIOS:

This interest coverage ratio is computed by dividing earnings before interests and

taxed by interest charges.

Debt

Interest Coverage Ratio = ------------------

Interest

The interest coverage ratio shows the number of times the interest charges are covered

by funds that are or demurely available for their payment. A high ratio is desirable but too

high ratio indicates that the firm is very conservative in using debt and that is not using credit

to the debt advantage of shareholder. A lower ratio indicates excessive use of debt or

inefficiency operations. The firm should make efforts to improve the operating efficiency or

to retire debt to have a comfortable coverage ratio.

III. ACTIVITY RATIOS:

Activity ratios measure the efficiency or effectiveness with which a firm manages its

resources or assets. They calculate the speed with which various assets, in which funds are

blocked up, get converted into sales.

1) TOTAL ASSETS TURNOVER RATIOS:

The assets turnover ratio, measures the efficiency of a firm in managing and utilizing

its assets. The higher the turnover ratio, the more efficiency the management and utilization

of the assets while low turnover ratio is indicative of under-utilization of available resources

and presence idle capacity. The total assets turnover ratio is computed by dividing sales by

total assets.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 37

Sales

Total assets turn over ratio = ------------------

Total Assets

2) WORKING CAPITAL TURNOVER RATIOS:

Cost of goods sold

Working capital turnover ratio = -----------------------------

Working Capital

Where if cost of goods sold is known. Net sales can be taken in the numerator.

Working capital = Current Assets – Current liabilities.

A high working capital turnover ratio indicates efficiency utilization of the firm’s

funds. However, it should not result in overtrading.

3) DEBTORS TURNOER RATIO:

Debtor’s turnover ratio expresses the relationship between debtors and sales. It is

calculated.

Net credit sales

Debtors Turnover Ratio = -------------------------

Average debtors

Net credit sales inspire credit sales after adjusting for sales returns. In case

information no credit sale is not available. “Sales” can be taken in the numerator. Debtors

include bills receivable. Debtors should be taken at Gross Value, without adjusting

provisions for bad debts. In case, average debtors can’t be found; closing balance of debtors

should be taken in the denominator. A high debtors turnover ratio or a low debt collection

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 38

period is indicative of a sound credit management policy. A debtors turnover collection

period of 30-36 days is considered ideal.

4. DEBT COLLECTION PERIOD:

The debt collection period measures the quality of debtors since it indicates the speed

of the collection. The shorter the average collection period implies the prompt payment by

debtors.

No. of days year

Debt collection period = ---------------------------

Debt collection Period

An excessively long collection period implies a very liberal and inefficient credit and

collection performance. This certainly delays the collection of each and impairs the firm’s

liquidity. The average no. of days for which debtors remain outstanding is called debt

collection period or average collection period.

5. CREDITORS TURNOVER RATIO:

Creditors turnover ratio expresses the relationship between creditors and purchases.

Net Credit Purchase

Creditors turnover Ratio = -------------------------------

Average Creditors

Net credit purchases imply credit purchases after adjusting for purchases returns. In

case information on credit purchases is not available purchase may be taken in the numerator.

Creditors include bills payable. In case avenue creditors can’t be found, closing balance of

creditors should be taken in the denominator.

The creditors turnover ratio is 12 or more. However, very less creditors turnover

ratio, or a high debt payment period, may indicate the firm’s inability in meeting its

obligations in time.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 39

6. PAYMENT PERIOD RATIO:

Credit turnover rate can also be expressed in terms of number of days taken by the

business to pay off its debts. It is termed as debt payment period which is calculated as:

Number of days in a year

Payment Period Ratio= --------------------------------

Creditors turnover ratio

7. FIXED ASSETS TURNOVER RATIO : It is defined as

Net Sales

Fixed Assets Turnover Ratio= -----------------

Fixed Assets

Fixed assets imply net fixed assets i.e. after depreciation. A high fixed assets turnover

ratio indicates better utilization of the firm’s fixed assets. A ratio around 5 is considered

ideal.

8. INVENTORY TURNOVER RATIO :

Stock turnover ratio indicates the number of times the stock has turned over into sale

sin the year. It is calculated as

Cost of good sold

Inventory Turnover Ratio= --------------------------------

Average Inventory

Cost of goods sold = Sales Gross Profit

Average Stock = (Opening stock and closing stock ½)

In case, information regarding cost of goods sold is not known. Sales may be taken in

the numerator. Similarly, if average stock can’t be calculated, closing stock should be taken

in the denominator.

A stock turnover ratio of ‘8’ is considered ideal. A high stock turnover ratio indicates

that the stocks are fast moving and get converted into sales quickly. However, it may also be

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 40

on account of holding low amount of stocks and replenishing stocks in larger number of

installments.

IV. PROFITABILITY RATIO:

It measures the overall performance and effectiveness of the firm. Poor operational

performance may indicate poor sales and hence poor profits. A lower profitability may arise

due to the lack of control over the expenses. Bankers, financial institutions and other

creditors look at the profitability’s. Ratio as an indicator whether or not the firm earns

substantially more than it pays interest for the use of borrowed funds and whether the

ultimate repayment of their debt appear reasonably certain owner are interested to know the

profitability as it indicates the return which they can get on this instruments.

Profitability ratios measure the profitability of a concern generally. They are

calculated either in relation to sales or in relation to investment.

1). NET PROFIT RATIO:

It indicates the result of the overall operation of the firm.

The higher the ratio, per profitable is the business. The net profit ratio is reassured by

dividing net profit buy sales. The net profit ratio indicates management efficiency in

manufacturing administrating and selling the products. This ratio is the overall firm’s ability

to turn each rupee of sale into net profit. If the net profit margin is inadequate, the firm fails

to achieve satisfactory return on shareholder’s funds.

Profit After Tax

Net Profit Ratio = --------------------------

Net Sales

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 41

A firm with high net profit margin can make better use of favorable conditions. Such

as rising selling prices, falling cost of products or increasing demand for the product. Such a

firm will be able to accelerate its profits at a faster rate than a firm with a low net profit

margin. This ratio also indicates the firm capacity to withstand adverse economic conditions.

2). RETURN ON NET WORTH RATIO:

It indicates the return, which the shareholders are earning on their resources invested

in the business.

Profit after tax

Return on net worth ratio = ----------------------------

Net Wroth

Net worth = Shareholders funds = Equity share capital + Preference share capital + Reserves

– Factious Assets.

The higher the ratio, the better it is for the shareholders. However, inter firm

comparisons should be made to ascertain if the returns from the company are adequate. A

trend analysis of the ratio over the past few years much is done to find out the growth or

deterioration in the profitability of the business.

3). RETURN ON ASSETS RATIO: It is calculated as:

Profit after tax

Return on assets ratio = --------------------------

Total Assets

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 42

Total assets do not include fictitious assets. The higher the ratio, the better it is.

4). EARNINGS PER SHARE RATIO:

Earnings per share are the net profit after tax and preferences dividend, which is

earned on the capital representative of one equity share. It calculated as:

Profit after tax available to equity holders

Earning per share ratio = --------------------------------------------------------------

Number of ordinary share

The higher the EPS, the better is the performance of the company. The EPS is one of

the diving factors in investment analysis and perhaps the most widely calculated ratio

amongst all ratios used for financial analysis.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 43

DATA ANALAYSIS & INTERPRETATION

CHANGES IN WORKING CAPITAL STATEMENT

For the year ended 31st March 2001

Rs. LAKHS

PARTICULARS 2000 2001 Increase Decrease

Current Assets

Inventories 18054.29 17765.50 - 188.79

Sundry Debtors 53232.07 39797.99 6565.92 -

Cash & Bank 4246.65 4880.31 633.66 -

Loans &

41147.20 45547.83 4400.63 -

Advances

Total (A) 96680.21 107991.63 11600.21 288079

Current

Liabilities

Creditors 11483.81 13863.48 - 1879.67

Unclaimed

644.18 871.06 - 226.88

dividend

Deposits 4149.11 4498.28 - 349.17

Interest accrued

but not due on 2268.17 4369.79 - 2101.62

loans

Provision per

4202.15 - 4202.15 -

dividend

Provision for tax 3461.80 3854.06 - 392.26

Total (B) 26209.22 26956.67 4202.15 4949.60

A – B working

70470.99 81034.96 15802.36 5238.39

capital

Increase in

- 10563.97

Working capital

TOTAL 81034.96 81034.96 15802.36 15802.36

CHANGES IN WORKING CAPITAL STATEMENT

For the year ended 31st March 2002

Rs. LAKHS

PARTICULARS 2001 2002 INCREASE DECREASE

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 44

Current Assets:

Inventories 17765.50 18198.78 433.28 -

Sundry Debtors 39797.99 51608.54 11810.55 -

Cash & Bank 4880.31 5851.53 971.22 -

Loans &

45547.83 46522.47 974.64 -

Advance

Total (A) 107991.63 122181.32 14189.69 -

Current

Liabilities:

Creditors 13363.48 9784.48 3579.00 -

Unclaimed

871.06 699.14 191.92 -

dividend

Deposits 4498.28 4394.61 103.67 -

Interest

occurred but not 4369.79 1278.33 3091.46 -

due on loans

Provision per

3854.06 179.28 3674.78 -

income tax

Total (B) 26956.67 16335.84 10620.83 -

A – B (Working

81034.96 105845.48 24810.52 -

Capital)

Increase in

24810.52 24810.52

Working Capital

TOTAL 105845.48 105845 24810.52 24810.52

CHANGES IN WORKING CAPITAL STATEMENT

For the year ended 31st March, 2003

Rs. LAKHS

PARTICULARS 2002 2003 INCREASE DECREAES

Current Assets:

Inventories 18198.78 18342.69 143.91 -

Sundry Debtors 51608.54 36945.10 - 14663.38

Cash & Bank 5351.53 1932.37 - 2129.75

Loan & 46522.47 44392.72 3919.16 2129.75

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 45

advances

Total (A) 122181.32 101612.94 143.91 20712.29

Current

Liabilities:

Creditors 9784.48 6995.84 2788.64 -

Unclaimed

699.14 692.26 6.88 -

dividend

Deposits 4394.61 1196.25 3198.36 -

Interest

occurred but not 1278.33 3503.19 - 2224.86

due on loans

Provision for tax 179.28 - 179.28 -

Total 16335.84 12387.54 6173.16 2234.86

A.B. (WC) 105845.48 89225.40 6317.07 22937.15

Increase in

- 16620.08 16620.08 -

Working capital

Total 105845.88 105845.88 22937.15 22937.15

CHANGES IN THE WORKING CAPITAL STATEMENT

FOR THE YEAR ENDED 31st MARCH 2004

Rs. Lakhs

PARTICULARS 2003 2004 INCREASE DECREASE

Current assets

Inventories 18342.69 6157.47 - 12185.22

Debtors 36945.16 35383.91 - 1561.25

Cash & Bank 1932.37 1463.99 - 468.38

Loans & Advances 44392.72 44816.83 424.11 -

Total Current Assets

(A) 101612.94 87822.20 424.11 14214.85

Current Liabilities

Sundry Creditors 3.12 2.91 0.21 -

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 46

Small scale

industries 5929.73 4867.78 1062.95 -

undertakings

Others 692.26 575.33 116.93 -

Unclaimed dividend 241.79 139.05 102.74 -

Unclaimed fixed

deposits 378.36 365.20 13.16 -

Debentures 72.96 54.80 18.16 -

Interest occurred on

above deposits 1196.25 807.21 389.04 -

Interest occurred but

not due on loans 3503.19 234.84 3268.35 -

Other liabilities 402.52 511.18 - 108.66

Provisions 238.74 224.21 14.53 -

Total Current

Liabilities (B) 12658.92 7782.51 4986.07 108.66

Working capital (A-

88954.02 80039.69 5410.29 14323.51

B)

Decrease in working

capital - 8914.33 8913.22 -

Total

88954.02 88954.02 14323.51 14323.51

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 47

CHANGES IN WORKING CAPITAL STATEMENT

For the year ended 31st March 2005

Rs. Lakhs

PARTICULARS 2004 2005 INCREAE DECREASE

Current Assets

Inventories 6157.47 7620.13 1462.66 -

Sundry Debtors 3538.91 22170.64 - 13213.27

Cash & Bank 1463.99 1922.16 458.17 -

Loans &

62111.27 18163.62 - 43947.65

Advances

Total (A) 105116.64 49876.55 1920.83 57160.92

Current

Liabilities

Sundry

2.91 40.41 - 37.50

Creditors

Small scale

industrial under 4867.78 7086.42 - 2218.64

takings

others 575.33 441.83 133.5 -

Unclaimed 139.05 59.98 79.07 -

Unclaimed fixed

365.20 359.15 6.05 -

deposits

Unclaimed

54.80 30.86 23.94 -

debentures

Interest

occurred above 807.21 898.39 - 91.18

deposits

Other liabilities 511.18 195.78 315.4 -

Interest occurred

but not due on 234.84 262.87 - 28.03

loans & Deposits

Total (B) 7558.30 9375.30 557.96 2375.35

WC (A-B) 97558.34 40501.25 2478.79 59536.27

Decreased in

57087.09 57087.09 -

Working capital

TOTAL 97558.34 97558.34 59536.27 59536.27

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 48

CHANGES IN WORKING CAPITAL STATEMENT

For the year ended 31st March 2006 Rs. Lakhs

PARTICULARS 2005 2006 INCREASE DECREASE

Current Assets

Investors 7620.13 5776.20 - 1843.98

Sundry Debtors 22170.64 31124.31 8953.67 -

Cash & Bank 1922.16 6084.00 4161.84 -

Loans & Advance 18163.62 24529.91 6366.29 -

Total (A) 49876.55 67514.42 194818 1843.93

Current Liabilities

Sundry Creditors 40.41 2.99 37.42 -

Small Scale 7086.42 12898.27 - 5811.85

industrial

undertakings

Others 441.83 280.75 161.08 -

Unclaimed 59.98 46.80 13.18 -

dividend

Unclaimed fixed 359.15 - - -

deposits

Unclaimed 30.86 7.19 23.67 -

debentures

Interest occurred 898.39 1133.90 - 235.51

on above deposits

Other liabilities 195.78 180.98 14.8 -

Interest occurred 262.87 251.69 11.18 -

but not due on

loans/deposits

Total (B) 9375.69 14802.57 261.33 6047.36

40500.86 52711.85 19220.47 7891.29

WC (A-B)

Increase in WC 12210.99 - - 12210.99

TOTAL 52711.85 52711.57 19220.47 4220.47

1. LIQUIDITY RATIO:

Liquidity ratio measures the firm-ability to meant current obligations.

1. Current Ratio

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 49

The current ratio is the measure of the firm short term solvency – it indicates the

availability of current assets in rupees every one rupees of current liability

Rs. Lakhs

Years Current assets (Rs) Current Liabilities (Rs) Current Ratio

2001-2002 122189.32 16174.32 7.55

2002-2003 101612.94 12387.54 8.20

2003-2004 87822.00 7782.51 11.28

2004-2005 49876.00 10070.92 4.95

2005-2006 6751.42 20151.82 3.35

INTERPRETATION:

The ideal current ratio of current assets and current liabilities is 2:1

It is tremendous increase in current ratio from the year 2001-2002 to 2003-2004.

There is a decrease in the last two financial years 2004-2005, 2005-2006, which is good for

the organization.

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 50

K.K.C.INSTITUTE OFPG STUDIES, PUTTUR 51

QUICK RATIO:

2. Quick Ratio Establishes a relationship between quick or liquid or assets and current

liabilities.

Rs. Lakhs