Professional Documents

Culture Documents

Wintop Industrial Doc.1

Uploaded by

aqeel1970Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wintop Industrial Doc.1

Uploaded by

aqeel1970Copyright:

Available Formats

CERTIFICATE OF FOOD GRADE LUBRICANT

SKF LGFP IS A CLEAN, NON-TOXIC LUBRICANT, WHICH I S BASED ON

MEDICAL WHITE OIL USING AN ALUMINUIM COMPLEX SOAP.

HIGH RESISTANCE TO WATER

EXCELLENT LUBRICANT LIFE

EXCELLENT CORROSION RESISTANCE

AN ESSANTIALLY NEUTRAL PH VALUE

NSF H1 REGISTERED AND HALAL AND KOSHER CERTIFIED

,,�,•

r.1:3a

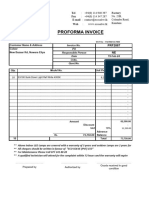

SALES TAX INVOICE

S.T.N: 32-77-8761-158-94 N.T.N: 7141337-8

Messers: UNEXOLABS (PVT) LIMITED

S.T.N: N.T.N: 1355767-0

SALES TAX INVOICE NO: 957 P.O. NO: DATE: 27/3/2018

Sr.No. DESCRIPTION QTY RATE AMOUNT

1 LGFP2/1SKF 1 6,500 6,500

-

·,. .,. -

.....

----- I - ------- - -

) -

-

-

-

-

-

TOTAL 6,500

ADD 17% SALE TAX 1,105

GRAND TOTAL 7,605

SEVEN THOUSAND SIX HUNDRED FIVE RUPEES ONLY

·. .,, /

--·

WINTOP INDUSTRIAL SOLUTIONS (PVT) LTD.

SEAL & SIGNATURE

Tel: +92 42 37654811, 37664811 info@wintop.com.pk

14/1, Rehman Street No. 6, wintopis@gmail.com

Nishter (Brandreth) Road, Fax: +92 42 37651411

Cell: 0300 8403599, 0322 9195555 www.wintop.com.pk

Lahore-Pakistan

DATE: 27-3-2018

SALES TAX INVOICE: 957

AMOUNT: 7,605=/-

UNDERTAKING

INCOME TAX EXEMPTION

This is to inform to that the supplies made to you vide our Invoice No: 957- Date: 27-3-2018

Ware imported by us as commercial importer as mentioned in clause (47A) if part iv of the

second schedule of the Income tax ordinance 2001 and supplied to you in the same sate written

any value addition therein and income tax has already been collected at import stage under section

148- these goods was cleared by us in accordance with the exemption available vide SRO No 97 (I)

/2002 date 12

February 2002 no further tax under section 153 of Income tax ordinance 2001 is deductible from the

payments made to us against these supplies to you.

SALES TAX EXEMPTION

We are commercial importers and withholding of sales tax is not applicable on commercial importers

vide Clause (xi) sale tax special procedure (withholding) Rules 2007 as amended vide SRO 897(i)/2013

Date 04-10-2013.

You are therefore requested not to deduct/ withholding Income tax as well as sales tax from payments

made by you against the supplies made by us.

In case of any objection or demand by tax authorities resulting from your compliance with our above

request, we hereby under take to pay you the withholding tax not deducted by you.

Thanking you, we remain

Yours truly

WINTOP INDUSTRIAL SOLUTIONS (PVT) LTD.

SEAL & SIGNATURE

Custom File No.

! J TRANSSHIPMENT PERM;T

r· ,.....,

.,,.

SKF ASIA PACIFIC ?TE LTD

NO. 1 CHANG! SOUTH LANE SINGAPORE 486070

7

• "'i\ · }

...,I ..:.,

5.PAGE 1 OF

,

6.CUSTOM OFFICE

MCC Appraisement Karactl

7 BANK CODE

ON BEHALF·OF SKF E4ROTRADE 1-B B.IGMJEGM NO a DT KAFW· 167-2017 Dale'. 10-09-2017 IND-:X 175

e.ORY PORT IGM/EGM NO & INDEX

10.IMPORTEf!'SICONSIGNEE'SIPASSENGER NAME & ADDRESS

11.0ECLARANT (OTHER THA IMPORTERF..XPCRTER)

'MNTOP INOUSTR!AI. SOLUTIONS (PVT.) LIMITED

MIS M. ZAFAR & CO. ROOM NO. 405, SHAMS CHAMBER, SliAHRAH-E-UAQAT

14/1, REHMAN STREET#6 NISHTER BRANDRETH ROAD, LAHORE, Lahore 12.TEL 03002190785

�

,av��T�wn!l:.! �----�----...,..,,,,.-,,,,,,,-,..,..,..,,,.,-,,,:-=-===.,.,,,...,...,,,.,.,,,,,... �--� 750 Job No

14.NTN 15.sTR.No/ PASSPORT NO & DATE i1.1:1i1:i..iCi.H�A�LFUo:i,s,e:n

uc.':e,u

l-l!:r------m ::rn: Aili OO IT

17.TRAAANSACTJO

P i---:---1

N TYPEEE

7141337 327787tl115894 False

161lOCUMENTSATIACHED. 1:�0ffl\ No Oat• Value lS.LC/DD NO. & DATE 20.COUNTRl' OF DESTINATION

Q INV { } BiG -�17 22000.6861 Pakistan

Q a/Awe/ [ J IT EXMP 21.CURRENCY NAME & CODE 30.MARKS/CONTAINER NOS.

Cl CO ( J EURO 998 WlNTOP

O Pl. [ J INDUSTRIAL

�22--E-SS-eL-�-OE�-OF-----------T23.,. . ,BLA:��--,CO-,-N-N�O�&-OA,,.- T-E------------+2�4�EX"°"'C�HANG

" " eE�RA�T�E----------;SOLUTIONS

AA7080112001 �1712:00:00AM 125.400000 (PVl) LTD

NEWARK. 1Qllll/201723:59 '. 14/1REHMAN

ORT;-;::OF;;-;:,H�l,;:;:-:;,:ENT:-; ------------+,26.::; -: P;.A�M;.,:N

t::l!a.P= "' T:; .-:;T;;;ER=.;-----------:J ST,6, N!SHTAR

Slng,ipore Wlhout LC ROAD

k27�.�PO�RT--o-F-�-SCH-

A- , . �E�R�T=ER"""'M�S...---------iS4000V.KORC

R GE--------+.,,28.�PlA�CE"""'O��DEU�VER-Y------------�-9-D'"a,,.v

CFR PU�9

1,3_1._Nl M�E""R'"OF-P.�A�CAA=

G es,,__..;..__,_ ,,,3,,.2""TYP"'E'"O.-F"""'A " C"'KA.,. .,G"'E,------.&..--..-,,,33."'G""R""o"'""""WT:----r.3<,:,.v"'o"'u"'m"'""M""--I PAKISTAN

NOS.

28.000 PAOOGES 1 ·54400 MT 11e59977S"1eOO

as.GENERAL OESCRll'TlON OF GOOPS 9802,9804

t-11:TWT 7186C-0077

AS PER H.BIL

1.16700MT

L�QI.JAtolllTY 41.HS Code

-r�� .

37.ITEM NO · :ie(b),NO OF .UNIT&

1 , 1'173,0000 84621000

42.H EM . r- OF <;NUU::, 41llEVY 47.RAlE 48 SUM PAYABLE (?l<Fi)

co 11.00 �� 246703.0000

17.00 � _,_427020.0000

--

1.00 % 22426.0000

3.00 % 7:JSOOOO

L=�

... IT 165764.0000

37.ITEI.! NO .�),NPOF'lJNJTi; , 39.CO C001: ,, 40.SRO NO · - , . 41HSCode

2 . f ' 00 . . �.0000; .. lletmany 1

5.f\% Advence l.nccmo Taxu/s 148 In,�

848Z2000

,CQ.LEvY 47.RATE O.SltA PAYABLE (PKR)

42. "'"' -�"" ,,_, • Ur """""""" '

SK1'.6RANOTAl'ERROU.!!R SeAAlNG •PAATN0.'30309 .ll/Q "2214 J2AJ 32211 J2/Q !2207f2JO co 11.00 % 9123.0000

·3il2ll5 J2IQ O.t:>:111.SO CtfflAI ., .. . .

�2(ar ST 17.00 ,y. 15791.0000

t-,::-:-,:-:-,.,,.,-,,::--�--��--,..,.,�·:::,,,,,-.,.,,.,..,.,,,,..�'----------�-,--��-�-----------�ACO 1.00 % 0290000

43.UN!T VALUE· 44. fOTAL VALUE. 46,CUSTOM VALUE (PKR)

�:�;��-------F�{;�·· .. ··:·- �-�--,.·-··T��···.... �;;:�; ,�:�--

AST 3.00 % 2787.0000

Dedlll9d , As-.ed Oedlnd . As,sessed Oedared Asaessed

IT 5.50 % 61310000

49.SRO I T11it R81J()rt No & Ct 50.FOBVALUE 54.LANOJNG CHARGES@ 1% , 0000%

0.0000 55.0THER OiARGES · 0.0000

52.CFR VALUE .2,"'flS0.8001

56.ASSESSED VALUE PKR 2901352.0000

53.INSURANCE 1.0000 % 57.TOTAL REBATE CLAJMI PROV ASSMNT UIS 81

58.MACHINE NO. 51lt11:Vl:l'IUE RE9')VER E!O.AMOUNT (PKR)

&OATE COOE LEV'(

K,\PW-HC-40921· . co' 31Si:39.00

22-09-2017 ST 1152<115.00 ·

61.A,O'g name, sig & &lamp SIG&DATE

-

us.. 00000 ACO 29013.00

DATE

Appraiser.

AST

IT

97485.00

214<168.llO

xxxxxx 65..CJF/O NO &

--·-

C-KAPW--011501·22C9201 7

xxxxxx

Examiner. Pil)'menl Received by Abdul Mad Farooa"'

62.P .As name, slg & stamp . .,-.--

xxxxxx

63.0ut OI Charge Sig & Stamp

Total: 12125,aoooo es.Bank Stsmp

This is• ll)'Stem ceoented documenr. il ti= not require •igJJ.tturc o, stantp" u defined in sub section (kka) of Section 2 of Customs Acr 1969

You might also like

- Vios Receipt EditedDocument2 pagesVios Receipt EditedsujeeNo ratings yet

- Western Drugs 1070Document1 pageWestern Drugs 1070pyo14No ratings yet

- IFFCO-TOKIO INSURANCEDocument1 pageIFFCO-TOKIO INSURANCEsurendarNo ratings yet

- 234R-2411-2022 Algihaz - Ramesh JiDocument1 page234R-2411-2022 Algihaz - Ramesh Jiمحمد اصدNo ratings yet

- Link Indya Projects: GSTIN - 20ABFPI5344B1ZFDocument1 pageLink Indya Projects: GSTIN - 20ABFPI5344B1ZFMohammad ShamsuddinNo ratings yet

- Panel 2-2Document2 pagesPanel 2-2Anonymous xGPr45NeNo ratings yet

- Colorz Proforma InvoiceDocument1 pageColorz Proforma InvoiceemmafashionspvtltdNo ratings yet

- 10 Aleson Shipping Inc. Anika Gayle 1 PDFDocument1 page10 Aleson Shipping Inc. Anika Gayle 1 PDFAlan Tul-idNo ratings yet

- Faisal Spinning D.ODocument1 pageFaisal Spinning D.ORafayMalikNo ratings yet

- 234-2411-2022 Algihaz - Ramesh JiDocument1 page234-2411-2022 Algihaz - Ramesh Jiمحمد اصدNo ratings yet

- 1. Abid Gulberg GreenDocument1 page1. Abid Gulberg GreenShahid AsifNo ratings yet

- Ing M Ent Co A R: ''''"''','',e, o ''' - ''' ''' '' Eo' ' '" 'H, "",., H'""""Document1 pageIng M Ent Co A R: ''''"''','',e, o ''' - ''' ''' '' Eo' ' '" 'H, "",., H'""""Je RoNo ratings yet

- SS 304 3MMDocument1 pageSS 304 3MMRavi MehtaNo ratings yet

- Arab Company For Restaurants and Fast Food: Purchase OrderDocument1 pageArab Company For Restaurants and Fast Food: Purchase OrderTarek ShalashNo ratings yet

- Sales InvoiceDocument10 pagesSales InvoicetesNo ratings yet

- Haritha Hotel SiddipetDocument1 pageHaritha Hotel SiddipetAditya SharmaNo ratings yet

- May-LCS-22Document2 pagesMay-LCS-22Naseem HameedNo ratings yet

- 3. Col Sibta Gulberg GreenDocument1 page3. Col Sibta Gulberg GreenShahid AsifNo ratings yet

- Rekap Biaya Dan Cost CenterDocument5 pagesRekap Biaya Dan Cost CenterAba GrafisNo ratings yet

- Onnorokom Solutions LTDDocument3 pagesOnnorokom Solutions LTDYeamin KaziNo ratings yet

- Tax Invoice for Drilling and Grouting WorkDocument2 pagesTax Invoice for Drilling and Grouting WorkNarayana rao dubaNo ratings yet

- Invoice AbitamaHydro 06021Document1 pageInvoice AbitamaHydro 06021RomyNo ratings yet

- Navaratna Hypermarket: Work OrderDocument5 pagesNavaratna Hypermarket: Work OrderSudeep MenonNo ratings yet

- ABC (1)Document1 pageABC (1)vaishnavi dhinakaranNo ratings yet

- 00060Document2 pages00060dieselmotorsbogotasasNo ratings yet

- Tax Invoice Godown RentDocument1 pageTax Invoice Godown RentB SubashNo ratings yet

- Equipment Process Data Sheet: 'GYPT "".SCDocument3 pagesEquipment Process Data Sheet: 'GYPT "".SCMo ZeroNo ratings yet

- Tax Invoice: Smart Lifts & ElectricalsDocument1 pageTax Invoice: Smart Lifts & ElectricalsYours PharmacyNo ratings yet

- Proposed Residential Building ElevationDocument1 pageProposed Residential Building ElevationMach VargasNo ratings yet

- Form Cash Advance 2018Document1 pageForm Cash Advance 2018Lina SasmithaNo ratings yet

- History - Customer - Bengkel B 1742 BAC PDFDocument21 pagesHistory - Customer - Bengkel B 1742 BAC PDFtryed suksesNo ratings yet

- Pro Forma Invoice: A. Kodir SaputraDocument1 pagePro Forma Invoice: A. Kodir SaputraMuhammad HaryadiNo ratings yet

- HydraulicDocument2 pagesHydraulicSupaporn KlabklaydeeNo ratings yet

- 00065Document2 pages00065dieselmotorsbogotasasNo ratings yet

- Fivefold Renewable Energy Pvt. Ltd.Document1 pageFivefold Renewable Energy Pvt. Ltd.Vijander HaldkarNo ratings yet

- Heavy Vehicle Workshop & Facilities Project ScheduleDocument1 pageHeavy Vehicle Workshop & Facilities Project ScheduleadjiNo ratings yet

- Friday, February 5, 2021: Description QTY Unit Price (MMK) Total (MMK) RemarkDocument1 pageFriday, February 5, 2021: Description QTY Unit Price (MMK) Total (MMK) RemarkCukar GcNo ratings yet

- 02 - Quotation Farmat EnglishDocument3 pages02 - Quotation Farmat EnglishOznulb ANo ratings yet

- Invoice For Excavation Hire - 4 Days Eviction WorksDocument1 pageInvoice For Excavation Hire - 4 Days Eviction WorksJustin KubulNo ratings yet

- Dec - Reimbursement Claim FormDocument1 pageDec - Reimbursement Claim FormAshish Kumar Mishra100% (1)

- Scientific Testing InvoiceDocument260 pagesScientific Testing Invoicesartlab accountsNo ratings yet

- 7M-2 Plate Heat ExchangerDocument18 pages7M-2 Plate Heat ExchangerZhengwei YinNo ratings yet

- Nasuba Sei Glugur Ke Mabar-A PDFDocument1 pageNasuba Sei Glugur Ke Mabar-A PDFAdi Semprol KenyutNo ratings yet

- Mohamed Khair Bashir ArabistanDocument2 pagesMohamed Khair Bashir Arabistanmohdkhair bashirNo ratings yet

- Lentilles de Prescription: Fashion Frames - Contact Lenses Prescription Lenses Montures - Verres de ContactDocument1 pageLentilles de Prescription: Fashion Frames - Contact Lenses Prescription Lenses Montures - Verres de ContactAbu Sayed Md. RashedNo ratings yet

- Techincal Data Sheet For Compressor Scr20epm-8 and 100epm2-8Document16 pagesTechincal Data Sheet For Compressor Scr20epm-8 and 100epm2-8saul ospinoNo ratings yet

- Pats f100 PDFDocument1 pagePats f100 PDFnicamarcosNo ratings yet

- Proforma-Invoice VIPRADocument1 pageProforma-Invoice VIPRAsknagarNo ratings yet

- Yodock 2001m Dimensions PDFDocument1 pageYodock 2001m Dimensions PDFSteve LavnerNo ratings yet

- 4 8automatic Oil Expeller With Vacuum System Filter Machine 4 80 1613635298256 PDFDocument1 page4 8automatic Oil Expeller With Vacuum System Filter Machine 4 80 1613635298256 PDFGopal ViswakarmaNo ratings yet

- THE National Siviall Industries Corporatiol'L Timited: Wwilr (FRDocument3 pagesTHE National Siviall Industries Corporatiol'L Timited: Wwilr (FRmktg rewNo ratings yet

- February, 2023 Gas Production and Utilization DataDocument1 pageFebruary, 2023 Gas Production and Utilization DataMohdNo ratings yet

- Apriavronijs: Date: November 9, 2020Document2 pagesApriavronijs: Date: November 9, 2020Martine Amos AntonioNo ratings yet

- Barrel Quote - 20211110 - 0001Document1 pageBarrel Quote - 20211110 - 0001RAVEENDRA OFFICENo ratings yet

- Aloft Hotels - 1Document1 pageAloft Hotels - 1Chaitanya HandaNo ratings yet

- 2. AVM SobhanDocument1 page2. AVM SobhanShahid AsifNo ratings yet

- Allsafe (FZ) : Certificate of Conformi YDocument2 pagesAllsafe (FZ) : Certificate of Conformi YDusyanth KumarNo ratings yet

- Shop Drawing SectionsDocument1 pageShop Drawing SectionshungNo ratings yet

- Septic Tank & Related Service Revenues World Summary: Market Values & Financials by CountryFrom EverandSeptic Tank & Related Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- NHS PDFDocument7 pagesNHS PDFaqeel1970No ratings yet

- Environmental Management System ISO 14001 - 9519499903Document110 pagesEnvironmental Management System ISO 14001 - 9519499903Nelson Alejandro Fierro100% (2)

- Vendor Audit TemplateDocument9 pagesVendor Audit Templateaqeel1970No ratings yet

- Blog-MASTER IQ FOR HVAC SYSTEMDocument30 pagesBlog-MASTER IQ FOR HVAC SYSTEMaqeel1970No ratings yet

- I So 90012008 Certificate of Conformance 2013Document1 pageI So 90012008 Certificate of Conformance 2013aqeel1970100% (1)

- Document 112Document1 pageDocument 112aqeel1970No ratings yet

- STRUKTUR ORGANISASI PROPINSI DKI JAKARTADocument1 pageSTRUKTUR ORGANISASI PROPINSI DKI JAKARTAaqeel1970No ratings yet

- NF Monographs - Methacrylic Acid CopolymerDocument1 pageNF Monographs - Methacrylic Acid Copolymeraqeel1970No ratings yet

- Setra SI-410S Sierra 407128 Precision Balance 410 X 0.001 G - Coupons and Discounts May Be AvailableDocument2 pagesSetra SI-410S Sierra 407128 Precision Balance 410 X 0.001 G - Coupons and Discounts May Be Availableaqeel1970No ratings yet

- SOP For Conduct Temperature Mapping in Stores - Pharmaceutical GuidelinesDocument1 pageSOP For Conduct Temperature Mapping in Stores - Pharmaceutical Guidelinesaqeel1970100% (1)

- Precisa 18 en PDFDocument4 pagesPrecisa 18 en PDFaqeel1970No ratings yet

- Esco Pharmacon Downflow Booth, Model DFB-1.5S1-1-CDocument4 pagesEsco Pharmacon Downflow Booth, Model DFB-1.5S1-1-Caqeel1970No ratings yet

- Factories Act 1934Document25 pagesFactories Act 1934Syed Mujtaba HassanNo ratings yet

- Precisa 18 Weight Checking MachineDocument4 pagesPrecisa 18 Weight Checking Machineaqeel1970No ratings yet

- Quality Assurance in The Analytical Chemistry Laboratory PDFDocument321 pagesQuality Assurance in The Analytical Chemistry Laboratory PDFaqeel1970No ratings yet

- Quality Assurance in The Analytical Chemistry Laboratory PDFDocument321 pagesQuality Assurance in The Analytical Chemistry Laboratory PDFaqeel1970No ratings yet

- Drap ActDocument35 pagesDrap Actaqeel1970No ratings yet

- Eries: User's ManualDocument56 pagesEries: User's Manualaqeel1970No ratings yet

- Series 200 UV/VIS Detector User's ManualDocument177 pagesSeries 200 UV/VIS Detector User's Manualaqeel1970No ratings yet

- Drug Pricing Policy Notification in Pakistan GazetteDocument21 pagesDrug Pricing Policy Notification in Pakistan GazetteSajidur Rehman SyedNo ratings yet

- Pharmaceutical Microbiology LabsDocument27 pagesPharmaceutical Microbiology LabsThuy LeNo ratings yet

- SRO 251 21FEB2018 Reductions1Document11 pagesSRO 251 21FEB2018 Reductions1aqeel1970No ratings yet

- Registration Form for Imported DrugDocument4 pagesRegistration Form for Imported DrugAbdullahAbroNo ratings yet

- Installation Qualification and Operation Qualification (IQ/OQ)Document4 pagesInstallation Qualification and Operation Qualification (IQ/OQ)Kerollus KhairyNo ratings yet

- 46-74569MAN Series200DiodeArrayDetectorII PDFDocument60 pages46-74569MAN Series200DiodeArrayDetectorII PDFaqeel1970100% (1)

- 46-74568MAN Series200AutosamplerDocument256 pages46-74568MAN Series200Autosampleraqeel1970No ratings yet

- Hvac Qas15-639 31082015 PDFDocument76 pagesHvac Qas15-639 31082015 PDFPutrianty AnnisaNo ratings yet

- Mesh To Micron ConverterDocument1 pageMesh To Micron ConverterAniket royNo ratings yet

- 44-136839TCH Validating UV VisibleDocument12 pages44-136839TCH Validating UV VisibleMSKNo ratings yet

- Partnership Operation - ProblemDocument1 pagePartnership Operation - ProblemIñego Begdorf100% (2)

- Electricity BillDocument1 pageElectricity BillPaul LivesNo ratings yet

- IDFC FIRST BANK PAYSLIPDocument1 pageIDFC FIRST BANK PAYSLIP90s stockNo ratings yet

- Subcontracting ProcessDocument5 pagesSubcontracting ProcessRenu BhasinNo ratings yet

- Chapter 4 5 TaxDocument6 pagesChapter 4 5 TaxOwncoebdiefNo ratings yet

- Fringe Benefits Tax GuideDocument16 pagesFringe Benefits Tax GuideTresbelle VueNo ratings yet

- Annex ADocument1 pageAnnex AZen Catolico Erum100% (2)

- Maintenance of Books - FCRADocument15 pagesMaintenance of Books - FCRAJatinKalraNo ratings yet

- CLASSIFICATION of TAXES FUNDAMENTAL PRINCIPLES OF TAXATION-wordDocument5 pagesCLASSIFICATION of TAXES FUNDAMENTAL PRINCIPLES OF TAXATION-wordCatibog ClarisseNo ratings yet

- Txndetails 101878000509244982Document1 pageTxndetails 101878000509244982s5t5wffcnfNo ratings yet

- Dream Seller Presentation1300Document55 pagesDream Seller Presentation1300Subhadeep SahaNo ratings yet

- Nps One PagerDocument2 pagesNps One PagerldorayaNo ratings yet

- Encouraging Women EntrepreneurshipDocument3 pagesEncouraging Women Entrepreneurshipjasson babaNo ratings yet

- 556salary Slip Template V12Document5 pages556salary Slip Template V12Kathleen PascualNo ratings yet

- How fiscal policy options affect demand-pull inflation and the economyDocument3 pagesHow fiscal policy options affect demand-pull inflation and the economypikachu_latias_latiosNo ratings yet

- Upay - 03 07 2021Document1 pageUpay - 03 07 2021Darsh SinghNo ratings yet

- Target recovery arrears CGST Central Excise Division JabalpurDocument3 pagesTarget recovery arrears CGST Central Excise Division JabalpurAshish KhandelwalNo ratings yet

- Penalty Notice - Dhanush - AY 2016-17Document2 pagesPenalty Notice - Dhanush - AY 2016-17client itNo ratings yet

- CGST & Central Excise - Range OfficeDocument2 pagesCGST & Central Excise - Range OfficeAYUSH PRADHANNo ratings yet

- Instructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument6 pagesInstructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNo ratings yet

- Calculate VAT payable for 3 business problemsDocument3 pagesCalculate VAT payable for 3 business problemsAngela Ricaplaza ReveralNo ratings yet

- A Practical Guide To GST - Adv. Sanjay Dwivedi (2017 Edition)Document435 pagesA Practical Guide To GST - Adv. Sanjay Dwivedi (2017 Edition)Sanjay DwivediNo ratings yet

- Succession PlanningDocument2 pagesSuccession PlanningRomit DasguptaNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceMansi JaiswalNo ratings yet

- Overman Handbook Book in HindiDocument12 pagesOverman Handbook Book in Hindivikram02091989No ratings yet

- GST Charts by Vishal SirDocument3 pagesGST Charts by Vishal SirVikram KatariaNo ratings yet

- LEI-Advance Reciept 39739 040720191718Document1 pageLEI-Advance Reciept 39739 040720191718Rubesh KumarNo ratings yet

- Document 1944 2629Document63 pagesDocument 1944 2629caninerawboned.2rfl40No ratings yet

- S C Test Bank Income TaxationDocument135 pagesS C Test Bank Income Taxationthenikkitr50% (6)

- Tax Invoice BreakdownDocument1 pageTax Invoice Breakdownrahul swainNo ratings yet