Professional Documents

Culture Documents

Fintech Financing - The London Stock Markets

Uploaded by

AlexanderCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fintech Financing - The London Stock Markets

Uploaded by

AlexanderCopyright:

Available Formats

The Funding Position

In 2017, approximately $31 billion was invested into FinTech businesses globally, of which the US

accounted for almost half, at $15.2 billion. This is more than double the $7.4 billion invested in

European FinTechs, and over six times the $1.2 billion invested in German FinTechs.

The large gap between the US and Europe is partly driven by the size of the respective markets, and

the deeper funding ecosystem that exists in Silicon Valley and New York. At the early stages, when

venture capitalists start investing in FinTechs, US FinTechs are already about five times larger than in

Europe ($86 billion and $14.5 billion respectively). By the time the VCs exit, the gap hasn’t closed by

that much. By then US FinTechs are still three times bigger than their European peers ($200 million

vs $70 million respectively).

A similar discrepancy exists within Europe, partly on account of London’s status as the leading

FinTech hub in Europe. According to KPMG, in Q4 2017, European investments in FinTech exceeded

$2 billion, over 80% of which was accounted for by UK businesses. German FinTech investment, by

contrast, only accounted for 7%.

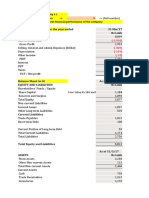

In addition to the various funding discrepancies in the different jurisdictions, there is also significant

difference between available funding at different stages of the funding lifecycle. Historically, there has

been a shortage of funding at the Series C level, which has the lowest cumulative average growth

rate compared to the other series, as seen below:

Global VC Investments by Series ($B)

40

35 CAGR

30 18.6%

25 19.7%

16.5%

20

15.7%

15

10 18.7%

Angel/seed Series A Series B Series C Series D+

© Fox Williams LLP and Herax Partners 2018

The graph shows a marked decrease in later stage VC financing, demonstrated by a drop in Series

D+ investment from $35 billion in 2015, to $25 billion in 2016. This significant drop is a sign of

cautious investors who in the past felt that late stage investment rounds were heavily over-funded,

especially for companies who should have already gone public.

FinTechs and AIM

Alongside the VCs, PEs have become increasingly interested in the FinTech space, with 2017 being

by far the busiest in history for private equity investments in European FinTech businesses. 55 deals

took place during this year, with a total disclosed value of $4.7 billion. However, PE investments are

sporadic and the recent hike in fundraising may only prove temporary, disappearing once central

banks tighten their monetary policy. Generally, the investment criteria for PE funds are often

incompatible with early stage growth companies.

As the sector matures, an increasing number of FinTech businesses are taking the decision to seek

permanent funding from London’s public markets, instead of the more temporary funding typically

provided by PEs and VCs. This includes recent new entrants such as Trufin, Augmentum FinTech

and Integrafin.

London’s AIM market, in particular, is an obvious choice for fast growing FinTech companies, being

the most successful growth market in the world. It was established by the London Stock Exchange

(LSE) to satisfy the needs of smaller, growing companies that may not meet the criteria for a Main

Market listing, or that might benefit from a more flexible regulatory market.

Of particular appeal to fast growing FinTech businesses is the fact that, unlike companies seeking

admission to the premium segment of the LSE, on AIM there is no minimum entry criteria. No specific

company size or lengthy track record of revenue generation is necessary, enabling companies to IPO

at an earlier stage of their lifecycle.

Other attractions of AIM to FinTech businesses include the ‘light touch’ approach to regulation, which

makes it more appropriate for mid-cap and small-cap companies looking to access additional capital

more cheaply, quickly and easily than is possible on the Main Market. AIM also benefits companies

looking to undertake regular transactions without the need for shareholder approval. For international

companies considering where to list, this approach can be contrasted with the regulatory burden on

SEC reporting companies, including those listed on NASDAQ, which is often disproportionate to their

size and can be very costly.

Companies from all over the world are traded on AIM, where they benefit from a large, internationally

focused community of advisers and a broad and deep institutional investor base. Today, almost 1,000

companies are quoted on AIM, of which around 150 are international, with an average market

capitalisation in excess of £80m.

By contrast, NASDAQ First North (OMX), NASDAQ's European growth market focused on the Nordic

and Baltic regions, currently only has around 300 companies. Scale, Deutsche Börse’s equivalent

segment for SMEs, only has 48. These markets are growing and may provide a more viable

alternative for German FinTech’s. For the time being, however, London remains the market of choice

for those companies with an international business model.

Compared to the US’ NASDAQ, which holds considerable appeal for tech sector businesses, AIM’s

advantages are most pronounced for those smaller tech businesses that may otherwise struggle to

attract investor interest and research coverage on the US markets. UK institutional investors active on

© Fox Williams LLP and Herax Partners 2018

AIM tend to be comfortable with companies that have smaller annual revenue and market

capitalisations - most AIM IPOs have market caps in the £30 - £200m range.

In summary, it is fair to say that while the US funding market for FinTechs is by far the largest and

most developed globally, for smaller European FinTechs who are seeking funding opportunities, a

listing in the US may not be a suitable option. Similarly, whilst the European markets, such as Scale

and OMX, may seem like viable listing options for European Fintechs due to their small size, they

might not garner the same attention from investors, in particular, international investors who are used

to focusing on the larger exchanges. By contrast, AIM is located in the FinTech hub of Europe and

has an international reputation that continuously attracts international and domestic investors. AIM

also has an excellent track record of providing early stage funding for growth companies, all of which

are appealing attributes for European FinTech businesses.

The authors

Wolfgang Menig

Herax Partners LLP

Partner

wolfgang.menig@heraxpartners.com

+44 (0)20 7399 1680

www.heraxpartners.com

Alexander Khourdaji

Herax Partners LLP

Analyst

alex.khourdaji@heraxpartners.com

+44 (0)20 7399 1683

www.heraxpartners.com

Guy Morgan

Fox Williams

Partner

gmorgan@foxwilliams.com

+44 (0)20 7614 2527

www.foxwilliams.com

This overview is general guidance. It should not be relied upon without first taking separate legal advice. Neither

the authors nor Fox Williams LLP or Herax Partners LLP accept any responsibility for any consequences resulting

from reliance on the contents of this document.

© Fox Williams LLP and Herax Partners 2018

You might also like

- Activist Investing in Europe October 2016Document12 pagesActivist Investing in Europe October 2016Arnaud DumourierNo ratings yet

- Unit 3: New Venture Planning: Startup Long-Term GrowthDocument14 pagesUnit 3: New Venture Planning: Startup Long-Term GrowthSam SharmaNo ratings yet

- Top Stocks 2017: A Sharebuyer's Guide to Leading Australian CompaniesFrom EverandTop Stocks 2017: A Sharebuyer's Guide to Leading Australian CompaniesNo ratings yet

- Capital for Champions: SPACs as a Driver of Innovation and GrowthFrom EverandCapital for Champions: SPACs as a Driver of Innovation and GrowthNo ratings yet

- Bain Report Asia Pacific Private Equity Report 2020Document48 pagesBain Report Asia Pacific Private Equity Report 2020Xuehao Allen ZhangNo ratings yet

- Fintech and The Evolving Landscape:: Landing Points For The IndustryDocument12 pagesFintech and The Evolving Landscape:: Landing Points For The IndustryYasushi KanematsuNo ratings yet

- The REGTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and Visionaries in RegulationFrom EverandThe REGTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and Visionaries in RegulationNo ratings yet

- Comments On The 15 Growth IllusionDocument4 pagesComments On The 15 Growth IllusionekidenNo ratings yet

- KMPG CB The Pulse of Fintech q2 2016 ReportDocument92 pagesKMPG CB The Pulse of Fintech q2 2016 ReportCrowdfundInsiderNo ratings yet

- Fundsmith Equity Fund +18.3 +449.3 +18.2 1.11 1.06 Equities +12.3 +214.8 +11.9 0.56 0.52 UK Bonds +4.6 +47.5 +3.9 N/a N/a Cash +0.3 +6.3 +0.6 N/a N/aDocument13 pagesFundsmith Equity Fund +18.3 +449.3 +18.2 1.11 1.06 Equities +12.3 +214.8 +11.9 0.56 0.52 UK Bonds +4.6 +47.5 +3.9 N/a N/a Cash +0.3 +6.3 +0.6 N/a N/aGiovanno HermawanNo ratings yet

- Joining AimDocument85 pagesJoining AimmmergenovaNo ratings yet

- Small Companies, Big Profits: How to make money investing in small companiesFrom EverandSmall Companies, Big Profits: How to make money investing in small companiesNo ratings yet

- Understanding Company News: How to interpret stock market announcementsFrom EverandUnderstanding Company News: How to interpret stock market announcementsNo ratings yet

- Third Point Q4 Investor Letter FinalDocument12 pagesThird Point Q4 Investor Letter FinalZerohedge100% (3)

- CB Insights Disruption Investment BankingDocument45 pagesCB Insights Disruption Investment BankingbandarumanasaNo ratings yet

- The Signs Were There: The clues for investors that a company is heading for a fallFrom EverandThe Signs Were There: The clues for investors that a company is heading for a fallRating: 4.5 out of 5 stars4.5/5 (2)

- Fairholme Funds 2017 SemiannualDocument49 pagesFairholme Funds 2017 SemiannualsuperinvestorbulletiNo ratings yet

- Arisaig Quarterly: The Great Disconnect I: Stocks and Economic ActivityDocument13 pagesArisaig Quarterly: The Great Disconnect I: Stocks and Economic Activitygiorgiogarrido6No ratings yet

- Innovate Finance 2018 FinTech VCDocument30 pagesInnovate Finance 2018 FinTech VCspikysanchitNo ratings yet

- AIMA Journal: Alternative Investment Management AssociationDocument32 pagesAIMA Journal: Alternative Investment Management Associationhttp://besthedgefund.blogspot.comNo ratings yet

- SBC PWC FinTech Trends Report 16 Final Online v2Document35 pagesSBC PWC FinTech Trends Report 16 Final Online v2CrowdfundInsiderNo ratings yet

- Venture Pulse Q1 16Document101 pagesVenture Pulse Q1 16BusolaNo ratings yet

- Exitround Tech M&a Report From 0-100 Million, The Exit CurveDocument15 pagesExitround Tech M&a Report From 0-100 Million, The Exit Curvebragster2201No ratings yet

- WWW Toptal Com Finance Venture Capital Consultants Venture CDocument37 pagesWWW Toptal Com Finance Venture Capital Consultants Venture CAbdulazizNo ratings yet

- CGAP Compartamos Case StudyDocument24 pagesCGAP Compartamos Case Studypoket 3337No ratings yet

- 2020 Africa Tech Venture Capital ReportDocument28 pages2020 Africa Tech Venture Capital ReportLoNo ratings yet

- Fairholme Fund 2017 Q2 Letter PDFDocument49 pagesFairholme Fund 2017 Q2 Letter PDFSmitty WNo ratings yet

- The Capital Behind Venture Report - 2020Document27 pagesThe Capital Behind Venture Report - 20207n6jgvvsnqNo ratings yet

- Chapter 4 The Interntional Flow of Funds and Exchange RatesDocument55 pagesChapter 4 The Interntional Flow of Funds and Exchange RatesAndrea ValdezNo ratings yet

- Fina4050 - Jai Paul VasudevaDocument9 pagesFina4050 - Jai Paul VasudevaJai PaulNo ratings yet

- Accountancy Sector Final ReportDocument12 pagesAccountancy Sector Final ReportNtsane LesenyehoNo ratings yet

- Survivor & Thriver: Capital IQ, JDP EstimatesDocument4 pagesSurvivor & Thriver: Capital IQ, JDP EstimatesAndy HuffNo ratings yet

- MerlinPostCrisis - FinalDocument4 pagesMerlinPostCrisis - Finaljennifer7742No ratings yet

- Detour: An Altered Path To Profit For European FintechsDocument10 pagesDetour: An Altered Path To Profit For European FintechsDaltonist OggyNo ratings yet

- The Dividend Imperative: How Dividends Can Narrow the Gap between Main Street and Wall StreetFrom EverandThe Dividend Imperative: How Dividends Can Narrow the Gap between Main Street and Wall StreetNo ratings yet

- SME Equity Financing Atlas PwC's AcceleratorDocument56 pagesSME Equity Financing Atlas PwC's AcceleratorCrowdfundInsiderNo ratings yet

- "Current Scenario of Venture Capital": Contemporary Issue On Seminar A Study OnDocument38 pages"Current Scenario of Venture Capital": Contemporary Issue On Seminar A Study OnneetuNo ratings yet

- 3 Steps to Investment Success: How to Obtain the Returns, While Controlling RiskFrom Everand3 Steps to Investment Success: How to Obtain the Returns, While Controlling RiskNo ratings yet

- When Entry Multiples Don't Matter - Andreessen Horowitz PDFDocument12 pagesWhen Entry Multiples Don't Matter - Andreessen Horowitz PDFbrineshrimpNo ratings yet

- Bargain Stocks Radar March 2023Document18 pagesBargain Stocks Radar March 2023gchandnaNo ratings yet

- Toward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyFrom EverandToward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyNo ratings yet

- Fra LVMH InditexDocument7 pagesFra LVMH InditexValentina EcheverriNo ratings yet

- Democratization of Investing OurCrowd Xconomy Report 2015Document22 pagesDemocratization of Investing OurCrowd Xconomy Report 2015CrowdfundInsiderNo ratings yet

- CB Insights - Fintech Report Q4 2020Document80 pagesCB Insights - Fintech Report Q4 2020bombar diersNo ratings yet

- Forbidden InvestmentsDocument18 pagesForbidden InvestmentsJapa Tamashiro JrNo ratings yet

- The Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsFrom EverandThe Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsNo ratings yet

- The Dividend Investor: A practical guide to building a share portfolio designed to maximise incomeFrom EverandThe Dividend Investor: A practical guide to building a share portfolio designed to maximise incomeNo ratings yet

- 4Q19 Longleaf Shareholder LetterDocument8 pages4Q19 Longleaf Shareholder LetterAndy MaierNo ratings yet

- Dubai: the grand deception?: Yes, without proper preparationFrom EverandDubai: the grand deception?: Yes, without proper preparationNo ratings yet

- Downfall of The Masters of The Universe - A Review of The Hedge Fund Industry During The Global Financial Crisis - Elevator 12Document3 pagesDownfall of The Masters of The Universe - A Review of The Hedge Fund Industry During The Global Financial Crisis - Elevator 12JPFundsGroupNo ratings yet

- Artko Capital 2016 Q4 LetterDocument8 pagesArtko Capital 2016 Q4 LetterSmitty WNo ratings yet

- The 3 Key Differences Between European Vs US StartupDocument5 pagesThe 3 Key Differences Between European Vs US StartupCac SiguerNo ratings yet

- Executive SummaryDocument2 pagesExecutive SummarydrramaraoNo ratings yet

- All Numbers Are in INR and in x10MDocument6 pagesAll Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- " Wise Finserv PVT LTD": A Summer Internship Project (SIP) Done inDocument57 pages" Wise Finserv PVT LTD": A Summer Internship Project (SIP) Done inKajal sainiNo ratings yet

- JFCDocument2 pagesJFCAlyssa MabalotNo ratings yet

- 8 DRTCDocument1 page8 DRTCkaye choiNo ratings yet

- The Nigerian Tourism Sector and The Impact of Fiscal PolicyDocument73 pagesThe Nigerian Tourism Sector and The Impact of Fiscal PolicyAttah Andung PeterNo ratings yet

- APM Assignment 2 - by SameeraDocument18 pagesAPM Assignment 2 - by SameeraRahull GurnaniNo ratings yet

- UNEP GEF Project Document: Energy For Sustainable Development in Caribbean Buildings, 7-2012Document235 pagesUNEP GEF Project Document: Energy For Sustainable Development in Caribbean Buildings, 7-2012Detlef LoyNo ratings yet

- Engineering EconomyDocument87 pagesEngineering EconomyAbhishek KumarNo ratings yet

- Investor Protection To Encourage Investment Climate in IndonesiaDocument5 pagesInvestor Protection To Encourage Investment Climate in IndonesiaDestu ArgiantoNo ratings yet

- Printable ADRA Sponsorship Form 3Document2 pagesPrintable ADRA Sponsorship Form 3Jean CarlosNo ratings yet

- How To See CibilDocument2 pagesHow To See CibilSahil PatelNo ratings yet

- The Home Depot IncDocument12 pagesThe Home Depot IncKhushbooNo ratings yet

- Horizontal Balance Sheet: Total Equity&LiabilitiesDocument7 pagesHorizontal Balance Sheet: Total Equity&LiabilitiesM.TalhaNo ratings yet

- Partnership LiquidationDocument17 pagesPartnership LiquidationIvo N50% (2)

- IFRS 7,9, & 32 Financial Instruments: February 19, 2019Document55 pagesIFRS 7,9, & 32 Financial Instruments: February 19, 2019Andualem ZenebeNo ratings yet

- Reynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodeDocument35 pagesReynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodesaverjaneNo ratings yet

- The Dividend Policies of Private Firms - Insights Into Smoothing, Agency Costs, and Information AsymmetryDocument60 pagesThe Dividend Policies of Private Firms - Insights Into Smoothing, Agency Costs, and Information AsymmetryhhhhhhhNo ratings yet

- Paper NO. BCH 5.4 (B) - Financial Markets, Institutions and ServicesDocument6 pagesPaper NO. BCH 5.4 (B) - Financial Markets, Institutions and Servicessuccess keyNo ratings yet

- The State of Fashion 2020 VFDocument108 pagesThe State of Fashion 2020 VFpapaniko80% (5)

- Inventory Cost Flow Biological AssetsDocument7 pagesInventory Cost Flow Biological Assetsemman neriNo ratings yet

- Module 3 - EntrepreneurshipDocument23 pagesModule 3 - EntrepreneurshipMichael SusmiranNo ratings yet

- PMP Test Ex1Document45 pagesPMP Test Ex1mp272No ratings yet

- Point Figure ChartsDocument11 pagesPoint Figure Chartsja_357No ratings yet

- Annual Report ProjectDocument56 pagesAnnual Report ProjectJoan Frazzetto100% (2)

- 3 Magno Vs CA 1992Document7 pages3 Magno Vs CA 1992Emmanuelle Xriz AtilNo ratings yet

- Standard Chart of AccountsDocument4 pagesStandard Chart of AccountsMihai FildanNo ratings yet

- 2nd CPC - CCS RP Rules 1960 - 02.8.1960Document178 pages2nd CPC - CCS RP Rules 1960 - 02.8.1960No NameNo ratings yet

- MY OGSE Catalogue 18' v4Document138 pagesMY OGSE Catalogue 18' v4Mohamad HafizNo ratings yet

- Formula Sheet - Time Value of MoneyDocument4 pagesFormula Sheet - Time Value of MoneyJainil ShahNo ratings yet

- CFA GuideDocument5 pagesCFA Guideshresth toshniwalNo ratings yet