Professional Documents

Culture Documents

Budget Car Rentals Question

Uploaded by

Md Jahid Hossain0 ratings0% found this document useful (0 votes)

20 views1 pageBudget rentals qUESTION

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBudget rentals qUESTION

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 pageBudget Car Rentals Question

Uploaded by

Md Jahid HossainBudget rentals qUESTION

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

The unadjusted trial balance for Budget car Rentals for the year ended 30 June 2015 is

shown below:

Unadjusted trial balance

Account Title Debit Credit

.

Cash at bank $ 9,000

Trade debtors 7,500

GST outlays 2,000

Prepaid insurance 6,250

Budget cars 125,000

Accumulated depreciation-Cars 50,000

Office equipment 10,425

Accumulated depreciation-Office equipment 1,250

Accounts payable 7,925

Loan payable 47,500

Unearned rental revenue 2,500

GST Collections 4,250

Jack’s, Capital 52,750

Jack’s, Drawings 12,750

Rental revenue 60,000

Salaries expense 26,500

Rent expense 5,000

Repairs & Maintenance expense 6,250

Supplies expense 12,000

Telephone expense 3,500

Total $226,175 $226,175

Depreciation expense-Office equipment

Depreciation expense-Cars

Telephone expense payable

Repairs & Maintenance expense payable

Interest payable

Interest Expense

Insurance expense

Salaries payable

Total

The following additional information is available at the end of June:

1. Depreciation on the Budget cars fleet for 1 year is $15,000. Depreciation on the office

equipment is $425.

2. Expired insurance amounted to $1,250.

3. The balance in the Unearned Rental revenue account includes $1,500 received for

services rendered on 27th June.

4. Salary earned but not yet paid amounted to $6,500.

5. Accrued interest on the loan payable is $1,750

6. Repairs on one of the Budget’s Car done in June for $750 have not yet paid for or

recorded.

7. The June telephone costs of $500 have not yet been paid for or recorded.

Required:

a) Prepare adjusting journal entries for the additional information provided.

b) Prepare a 10 column worksheet for the year ending 30th June 2015.

c) Provide the Income Statement, Statement of Changes in Owner’s Equity & Balance

Sheet.

You might also like

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Practice Questions For Closing EntriesDocument2 pagesPractice Questions For Closing EntriesZainullah KhanNo ratings yet

- HP Service Company TransactionsDocument18 pagesHP Service Company TransactionsAndrew Sy ScottNo ratings yet

- 2022 Sem 1 ACC10007 Lecture IllustrationsDocument8 pages2022 Sem 1 ACC10007 Lecture IllustrationsJordanNo ratings yet

- Lab Komputer Akuntansi KeuanganDocument8 pagesLab Komputer Akuntansi KeuanganlistianiNo ratings yet

- Simple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Document11 pagesSimple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Masood Ahmad AadamNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- Budget Car Rentals SolutionDocument2 pagesBudget Car Rentals SolutionMd Jahid HossainNo ratings yet

- Book 1Document6 pagesBook 1chrstncstlljNo ratings yet

- Adjusting entries for end of year financial statementsDocument4 pagesAdjusting entries for end of year financial statementsNajia SalmanNo ratings yet

- ACT110.Worksheet Activity - IllustrateDocument1 pageACT110.Worksheet Activity - IllustrateAra JeanNo ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- Adam's Learning Centre, Lahore: Company AccountsDocument6 pagesAdam's Learning Centre, Lahore: Company AccountsMasood Ahmad AadamNo ratings yet

- ACCT 2105 Tutorial Exercises - Topic 4 - Income StatementDocument8 pagesACCT 2105 Tutorial Exercises - Topic 4 - Income StatementHoàng Trọng HiếuNo ratings yet

- Problem Exercises AnswerDocument6 pagesProblem Exercises AnswersaphirejunelNo ratings yet

- Final Exams AccountingDocument6 pagesFinal Exams AccountingCzarina Joy PeñaNo ratings yet

- Groenke Construction Co, Adjustments December 31, 20X7: Adjust # Account Names Debit CreditDocument5 pagesGroenke Construction Co, Adjustments December 31, 20X7: Adjust # Account Names Debit Creditfarhann JattNo ratings yet

- Self-study submission and adjusting entries for Budi and Afique enterprisesDocument2 pagesSelf-study submission and adjusting entries for Budi and Afique enterprisesAdelene NengNo ratings yet

- Test 2 Jan2023 - Tapah Q2 FS SSDocument4 pagesTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNo ratings yet

- Practice QuestionDocument2 pagesPractice QuestionFadzai MutangaNo ratings yet

- #Chapter 4 Asignación (Recovered)Document22 pages#Chapter 4 Asignación (Recovered)adrianasofiagomez14No ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- Principles of Accounting (ACC-1101)Document4 pagesPrinciples of Accounting (ACC-1101)hojegaNo ratings yet

- Answers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintDocument5 pagesAnswers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintT.F. EvansNo ratings yet

- Principles of Accounting (A B E)Document3 pagesPrinciples of Accounting (A B E)r kNo ratings yet

- Incomplete Records MTQDocument5 pagesIncomplete Records MTQqas4476pubNo ratings yet

- Accounting ExamDocument14 pagesAccounting ExamSally SalehNo ratings yet

- Record Financial TransactionsDocument5 pagesRecord Financial TransactionsamirNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Fuck Fuck FuckDocument5 pagesFuck Fuck FuckRakesh KumarNo ratings yet

- Lazlo Service Co. Trial Balance WorksheetDocument2 pagesLazlo Service Co. Trial Balance WorksheetRoby RamdhanNo ratings yet

- CAP-I June2022 FinalDocument37 pagesCAP-I June2022 FinalArjun AdhikariNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Adjusting Entries ConstantinoDocument5 pagesAdjusting Entries ConstantinoKyla Lyn OclaritNo ratings yet

- Suggested Answer CAP I 2009Document81 pagesSuggested Answer CAP I 2009Meghraj AryalNo ratings yet

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Fundamentals of Accounting I Group AssignmentDocument2 pagesFundamentals of Accounting I Group AssignmentYaredNo ratings yet

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- ACT110.Worksheet ActivityDocument1 pageACT110.Worksheet ActivityAra JeanNo ratings yet

- Practice Question 1Document3 pagesPractice Question 1Josh JobsNo ratings yet

- Tutorial Chapter 5Document8 pagesTutorial Chapter 5Aisyah SafiNo ratings yet

- Adjusting Solution 1Document5 pagesAdjusting Solution 1Umer SiddiquiNo ratings yet

- Soalan Tugasan Perakaunan BBAW2103Document9 pagesSoalan Tugasan Perakaunan BBAW2103Ina RawaNo ratings yet

- Practice Problem 7.0Document4 pagesPractice Problem 7.0Paw VerdilloNo ratings yet

- Assignment 3 - Financial Accounting - February 4Document7 pagesAssignment 3 - Financial Accounting - February 4Ednalyn PascualNo ratings yet

- ACCT1101 Week 5 Practical SolutionsDocument8 pagesACCT1101 Week 5 Practical SolutionskyleNo ratings yet

- Assignment Set 12 NOV 2018 1Document20 pagesAssignment Set 12 NOV 2018 1Jessa BeloyNo ratings yet

- Final Exams Fund of Acctg Bus MGT 2023Document1 pageFinal Exams Fund of Acctg Bus MGT 2023JAN RAY CUISON VISPERASNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- Laura Kartika Puspa - C1G021032 - AccountingDocument1 pageLaura Kartika Puspa - C1G021032 - AccountingLaura Kartika PuspaNo ratings yet

- Adjusting EntryDocument13 pagesAdjusting Entrymichaella maglinteNo ratings yet

- Financial Accounting-Assignment-4Document4 pagesFinancial Accounting-Assignment-4Margaux JohannaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Phrase & Idioms: Most Important Phrase & Idioms For S.S. C & H.S.C Examination Are Given BellowDocument11 pagesPhrase & Idioms: Most Important Phrase & Idioms For S.S. C & H.S.C Examination Are Given BellowMd Jahid HossainNo ratings yet

- Rules of Parts of SpaceDocument2 pagesRules of Parts of SpaceMd Jahid HossainNo ratings yet

- Chapter 7 Risk and Return Question and Answer From TitmanDocument2 pagesChapter 7 Risk and Return Question and Answer From TitmanMd Jahid HossainNo ratings yet

- Topic 4B Preparing Financial Statements 2016 v.1Document37 pagesTopic 4B Preparing Financial Statements 2016 v.1Md Jahid HossainNo ratings yet

- Topic 6B Accounting Systems 2015Document7 pagesTopic 6B Accounting Systems 2015Md Jahid HossainNo ratings yet

- Accounting Cash Management & ControlDocument25 pagesAccounting Cash Management & ControlMd Jahid HossainNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceMd Jahid HossainNo ratings yet

- Topic 5 The Accounting CycleDocument29 pagesTopic 5 The Accounting CycleMd Jahid HossainNo ratings yet

- Financial ManagementDocument44 pagesFinancial ManagementDaniel OlteanuNo ratings yet

- Topic 8 HI5001 - Solution VerDocument4 pagesTopic 8 HI5001 - Solution VerMd Jahid Hossain100% (1)

- Taiwan Consultants Ver.1Document1 pageTaiwan Consultants Ver.1Md Jahid HossainNo ratings yet

- Agricultural Workers East End Alternative WorkDocument3 pagesAgricultural Workers East End Alternative WorkMd Jahid HossainNo ratings yet

- HI5001 Extensive Exervises P1 T1 17Document5 pagesHI5001 Extensive Exervises P1 T1 17Md Jahid HossainNo ratings yet

- Topic 2 Financial Statements & Decision MakingDocument31 pagesTopic 2 Financial Statements & Decision MakingajayNo ratings yet

- Topic 3B Accounting Systems & Processes 2016Document37 pagesTopic 3B Accounting Systems & Processes 2016Md Jahid HossainNo ratings yet

- Topic 5 HI5001 - SolutionDocument5 pagesTopic 5 HI5001 - SolutionMd Jahid HossainNo ratings yet

- Topic 1B Accounting For Decision Making 2016Document28 pagesTopic 1B Accounting For Decision Making 2016Md Jahid HossainNo ratings yet

- HI5001 Topic 8 Receivables - Tutorial QuestionsDocument7 pagesHI5001 Topic 8 Receivables - Tutorial QuestionsMd Jahid HossainNo ratings yet

- Budget Car Rentals SolutionDocument2 pagesBudget Car Rentals SolutionMd Jahid HossainNo ratings yet

- Divina Notes On Revised Corporation CodeDocument11 pagesDivina Notes On Revised Corporation CodeGenevieve PenetranteNo ratings yet

- BS 25999-2 Basics: A Leading Business Continuity StandardDocument3 pagesBS 25999-2 Basics: A Leading Business Continuity StandardMemet H BilgitekinNo ratings yet

- Raising Seed Capital: Steve Schlafman (@schlaf) RRE VenturesDocument82 pagesRaising Seed Capital: Steve Schlafman (@schlaf) RRE Venturesrezurekt100% (2)

- Continuing Certification Requirements: (CCR) HandbookDocument19 pagesContinuing Certification Requirements: (CCR) HandbookLip Min KhorNo ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet

- Aditya Birla Capital Risk Management PolicyDocument6 pagesAditya Birla Capital Risk Management Policypratik zankeNo ratings yet

- SKF Group10Document21 pagesSKF Group10Shashikumar UdupaNo ratings yet

- Ocean Carriers Assignment 1: Should Ms Linn purchase the $39M capsizeDocument6 pagesOcean Carriers Assignment 1: Should Ms Linn purchase the $39M capsizeJayzie LiNo ratings yet

- Channel System: Presented byDocument78 pagesChannel System: Presented bygrace22mba22No ratings yet

- The Entrepreneurial Decision Process for Startups ExplainedDocument13 pagesThe Entrepreneurial Decision Process for Startups ExplainedFe P. ImbongNo ratings yet

- Demantra and ASCP Presentation PDFDocument54 pagesDemantra and ASCP Presentation PDFvenvimal1No ratings yet

- Parivarthane - Campus 2 Corporate Modules - IntroDocument5 pagesParivarthane - Campus 2 Corporate Modules - IntrocbooklenNo ratings yet

- HrumDocument3 pagesHrumDenny SiswajaNo ratings yet

- Retail Management: A Strategic Approach: 11th EditionDocument9 pagesRetail Management: A Strategic Approach: 11th EditionMohamed El KadyNo ratings yet

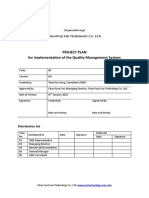

- 01 - Project - Plan - EN For CPS Co - LTDDocument8 pages01 - Project - Plan - EN For CPS Co - LTDThant AungNo ratings yet

- Project of T.Y BbaDocument49 pagesProject of T.Y BbaJeet Mehta0% (1)

- Revision Banking QDocument15 pagesRevision Banking QThảo Hương PhạmNo ratings yet

- Ciencia, Tecnología y Educación Al Servicio Del PaísDocument3 pagesCiencia, Tecnología y Educación Al Servicio Del PaísAdrian JácomeNo ratings yet

- Franchise Questions Part3Document2 pagesFranchise Questions Part3Algen SabaytonNo ratings yet

- Poverty Grant ProposalsDocument2 pagesPoverty Grant ProposalsNewzjunkyNo ratings yet

- Risk Analysis Nina GodboleDocument23 pagesRisk Analysis Nina GodboleRupesh AkulaNo ratings yet

- OpenText Vendor Invoice Management For SAP Solutions 7.5 SP7 - Configuration Guide English (VIM070500-07-CGD-EN-02)Document922 pagesOpenText Vendor Invoice Management For SAP Solutions 7.5 SP7 - Configuration Guide English (VIM070500-07-CGD-EN-02)Varsha Pawaskar100% (4)

- Supply Chain Management Part 1 Lecture OutlineDocument17 pagesSupply Chain Management Part 1 Lecture OutlineEmmanuel Cocou kounouhoNo ratings yet

- Square Inc - 2016 Annual Report (Form 10-K)Document172 pagesSquare Inc - 2016 Annual Report (Form 10-K)trung ducNo ratings yet

- CH 02Document37 pagesCH 02Tosuki HarisNo ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- Olam 09 Annual ReportDocument184 pagesOlam 09 Annual ReportOdenigbo OkekeNo ratings yet

- Exploring Social Origins in The Construction of ESDocument37 pagesExploring Social Origins in The Construction of ESFabioNo ratings yet

- Cvs Caremark Vs WalgreensDocument17 pagesCvs Caremark Vs Walgreensapi-316819120No ratings yet

- Zara Case StudyDocument9 pagesZara Case StudySaatvik SethiNo ratings yet