Professional Documents

Culture Documents

Worked - : Payments (Vat Input) Summary

Uploaded by

bongoloid0 ratings0% found this document useful (0 votes)

8 views1 pageVAT-P4-2015

Original Title

VAT-P4-2015

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVAT-P4-2015

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageWorked - : Payments (Vat Input) Summary

Uploaded by

bongoloidVAT-P4-2015

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

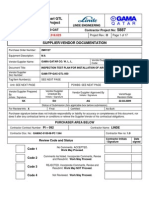

Month March

.............................. PAYMENTS (VAT INPUT) SUMMARY (For cheques, cards or direct banking) © P. Hingston

TOTAL VAT Drawings, NI Stock or Employee Premises Costs

Date Paid To Ref (incl VAT) (or Salary) Raw Material Costs Rent/Rates WORKED -

Utilities

2 Auto Repair Co 364 70 10 11 68 “Employee Costs” is for & Guide 1

2 Self (to personal a/c) D/B 1500 00 1500 00 wages, NI (National Insurance) and 2

PAYE, also Directors’ salaries, though

3 Webdesigns S/O 50 00 you may find it convenient to put your own 3

363 salary under “Drawings (or Salary)”. For “Premises Costs”

3 ABCD Company 17 50 2 92 sole traders and partners, record your also includes Cleaning and

4

4 Stationery Supplies D/B 128 26 21 38 wages under “Drawings”. Property Insurance. Use the 5

next blank column

9 The Big Phone Co D/D 289 87 48 31 if necessary.

6

12 Local Council D/D 750 00 750 00 7

14 Auto Repair Co 367 139 99 23 33 This “Utilities”

8

14 Parcels Service 365 158 27 26 38 column is for Premises 9

Costs that relate to any

18 APR Co 366 400 00 66 67 Electric, Gas, Heating 10

Computer Supply Co D/B or Water bills. 11

29 625 00 104 17

31 Self (Card reimbursement) D/B 562 58 93 76 125 00 12

4691 57 398 60 1500 00 125 00 750 00 13

14

The entries above are VAT

listed in the same order (and dates) If there is VAT included in a payment, 15

as they appear in your Bank Statement, record it in the VAT column, then put the net

16

and in the same order as the invoices amount (ie the total less the VAT) in the appropriate

are filed. This makes this page expenses column. Note: The VAT rate used in this 17

easier to complete & check. Worked Example is 20% but the rate may be

changed at any time by the 18

Government.

“Ref” (Reference) 19

This column could show the last 3 figures 1st Column 20

of the cheque number, or “D/B” for a Direct The first column heading

Banking, “D/D” for a Direct Debit, or is blank. You could use it for 21

“S/O” for a Standing Order. a category of expenses that you

have to pay often. Alternatively, 22

you could use it as a second 23

VAT column.

24

25

26

27

28

29

PROCEDURE FOR PERSONAL CARDS PROCEDURE FOR CHEQUES PROCEDURE FOR DIRECT BANKING 30

If you use a personal card for some business For each cheque: record the date (as it appears in This includes online and telephone banking, and

purchases, then reimburse yourself from your business the Bank Statement), the payee, the last 3 figures of the where you are paying your suppliers by Direct Debit or 31

account every month or so, and at that time enter cheque number (as a Reference) and the total paid. You then by Standing Order. Record the date (as it appears in the

write the VAT (if any) in the VAT column. Then “analyse” 32

the details in that month’s PAYMENTS (as Bank Statement), the payee, the reference, and the total paid.

shown on the 31st above). the payment by entering the total (less VAT) in the You then write the VAT (if any) in the VAT column. Then 33

correct expenses column (or columns, “analyse” the payment by entering the total (less VAT)

where relevant). in the correct expenses column (or columns, 34

PROCEDURE FOR BUSINESS CARDS where relevant). 35

For a debit card on your business account, for

each transaction: record the date (as it appears in 36

the Bank Statement), the payee, the word “Card” (as a 37

Reference) and the total paid. You then write the VAT

(if any) in the VAT column. Then “analyse” the payment 38

by entering the total (less VAT) in the correct

expenses column (or columns, 39

where relevant).

40

General Note

All the data in this Worked Example 41

is fictitious.

42

43

44

45

46

At the end of the month, total up 47

each column. The overall Total Payments (£4,691.57

Overflow Pages

in this worked example) is then entered in the MONTH’S 48

If in any month you need more lines,

BANK BALANCE on the previous page.

then please note there are overflow pages 49

after Month 12 in this book.

50

Total Payments for Month 4691 57 398 60 1500 00 125 00 750 00

VAT-P4 (2015).p65 4 04/09/2015, 15:29

Black

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Atari sm124 Dead Monitor FixDocument5 pagesAtari sm124 Dead Monitor FixbongoloidNo ratings yet

- Apj 9Document109 pagesApj 9bongoloidNo ratings yet

- Assembly Programming Journal 8Document80 pagesAssembly Programming Journal 8AmineBenali100% (1)

- Dramatists Modern FormatDocument1 pageDramatists Modern FormatbongoloidNo ratings yet

- Captain Beefheart 10 Commandments of Guitar PlayingDocument1 pageCaptain Beefheart 10 Commandments of Guitar PlayingbongoloidNo ratings yet

- Cmx469a DatasheetDocument18 pagesCmx469a DatasheetbongoloidNo ratings yet

- Faro Booklet PDFDocument1 pageFaro Booklet PDFbongoloidNo ratings yet

- Harmonica 030912X PDFDocument36 pagesHarmonica 030912X PDFbongoloid100% (1)

- Miniature Microwave AmplifiersDocument6 pagesMiniature Microwave AmplifiersbongoloidNo ratings yet

- Mod #2Document2 pagesMod #2bongoloidNo ratings yet

- Unix Prog DesignDocument7 pagesUnix Prog Designirs_bNo ratings yet

- Mod #3Document2 pagesMod #3bongoloidNo ratings yet

- Zmap: Fast Internet-Wide Scanning and Its Security ApplicationsDocument15 pagesZmap: Fast Internet-Wide Scanning and Its Security ApplicationsbongoloidNo ratings yet

- A Chronology of Filofax: Kevin Hall April 13, 2010Document11 pagesA Chronology of Filofax: Kevin Hall April 13, 2010bongoloid0% (1)

- Olympia SG1Document13 pagesOlympia SG1bongoloidNo ratings yet

- Mind Machines You Can Build PDFDocument202 pagesMind Machines You Can Build PDFbongoloidNo ratings yet

- Harmonica 030912X PDFDocument36 pagesHarmonica 030912X PDFbongoloid100% (1)

- UsingAndUnderstandingMiniatureNeonLamps PDFDocument132 pagesUsingAndUnderstandingMiniatureNeonLamps PDFbongoloidNo ratings yet

- Understanding Speech Inversion PDFDocument2 pagesUnderstanding Speech Inversion PDFbongoloidNo ratings yet

- A Homebrew Gin PoleDocument2 pagesA Homebrew Gin PolebongoloidNo ratings yet

- Making Printed Circuit Boards - : A Different ViewDocument4 pagesMaking Printed Circuit Boards - : A Different ViewbongoloidNo ratings yet

- Microwave Circuit BoardsDocument10 pagesMicrowave Circuit BoardsbongoloidNo ratings yet

- Gin Pole For Peanuts: Ever Ull o y Straps? Build His G Ea S y ToweDocument2 pagesGin Pole For Peanuts: Ever Ull o y Straps? Build His G Ea S y TowebongoloidNo ratings yet

- Tone Signaling Over Telephone Lines A Technician's PrimerDocument3 pagesTone Signaling Over Telephone Lines A Technician's PrimerbongoloidNo ratings yet

- The Gin PoleDocument4 pagesThe Gin PolebongoloidNo ratings yet

- MagnetronDocument5 pagesMagnetronbongoloidNo ratings yet

- Frequency Locking A Microwave SourceDocument4 pagesFrequency Locking A Microwave SourcebongoloidNo ratings yet

- Practical Microwave Filter DesignDocument5 pagesPractical Microwave Filter Designbongoloid100% (1)

- Lumped Element Rat Race CouplerDocument6 pagesLumped Element Rat Race Couplerbongoloid100% (1)

- The Art and Craft of Coil ConstructionDocument3 pagesThe Art and Craft of Coil ConstructionbongoloidNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Exercises 1 FinalDocument2 pagesExercises 1 FinalRemalyn Quinay CasemNo ratings yet

- Litografia Soft LithographyDocument33 pagesLitografia Soft Lithographyrfm147No ratings yet

- WWW - Manaresults.Co - In: Set No. 1Document1 pageWWW - Manaresults.Co - In: Set No. 1My Technical videosNo ratings yet

- Rahul Soni BiodataDocument2 pagesRahul Soni BiodataRahul SoniNo ratings yet

- ListaDocument1 pageListaRonaldhinoFrankoNo ratings yet

- Urea ProjectDocument17 pagesUrea ProjectAbdo Shaaban100% (2)

- 050-Itp For Installation of Air Intake Filter PDFDocument17 pages050-Itp For Installation of Air Intake Filter PDFKöksal PatanNo ratings yet

- NS0 157Document42 pagesNS0 157Muthu LNo ratings yet

- Design of A. C. MachineDocument11 pagesDesign of A. C. MachineMahesh PatelNo ratings yet

- M312 and M315 Excavators Electrical System: M312: 6TL1-UP M315: 7ML1-UPDocument2 pagesM312 and M315 Excavators Electrical System: M312: 6TL1-UP M315: 7ML1-UPСергей ТаргоньNo ratings yet

- Urethyn HG 0 - Pi - (Gb-En)Document2 pagesUrethyn HG 0 - Pi - (Gb-En)CriVe OffeNo ratings yet

- ESS PASI SEISMIC CivilEngineering Seismograph CE-3SDocument2 pagesESS PASI SEISMIC CivilEngineering Seismograph CE-3SRaydenTeuinkNo ratings yet

- Adjustment of Conditions: Contents: Procedure Adjustment Methods Country-Specific Methods in Austria and SwitzerlandDocument41 pagesAdjustment of Conditions: Contents: Procedure Adjustment Methods Country-Specific Methods in Austria and Switzerlandtushar2001No ratings yet

- Domino's PizzaDocument37 pagesDomino's PizzaAristianto Pradana0% (3)

- ToraycaDocument1 pageToraycaAnonymous NFsIMHyfLtNo ratings yet

- Accenture Global Pharmaceutical and Company Planning Forecasting With Oracle HyperionDocument2 pagesAccenture Global Pharmaceutical and Company Planning Forecasting With Oracle HyperionparmitchoudhuryNo ratings yet

- Air Force Qualification TrainingDocument51 pagesAir Force Qualification TrainingJanJanLuNo ratings yet

- Project Charter Template v071611Document14 pagesProject Charter Template v071611Andreea CristinaNo ratings yet

- Yahclick: Satellite InternetDocument6 pagesYahclick: Satellite InternetVasco JosephNo ratings yet

- Townsend Labs Sphere L22 Microphone System User GuideDocument59 pagesTownsend Labs Sphere L22 Microphone System User GuideGuillermoMazaNo ratings yet

- GemDocument23 pagesGemMukesh KumarNo ratings yet

- Ea295 PDFDocument3 pagesEa295 PDFjhiilNo ratings yet

- BC-5800 Liquid SystemDocument114 pagesBC-5800 Liquid SystemДмитрийNo ratings yet

- Math Lesson Plan-Topic 8.4 - Tens and OnesDocument4 pagesMath Lesson Plan-Topic 8.4 - Tens and Onesapi-352123670No ratings yet

- How To Find MAC Address On A Mobile PhoneDocument11 pagesHow To Find MAC Address On A Mobile PhoneEyiwin WongNo ratings yet

- Ina201 Industrial Network ArchitectureDocument2 pagesIna201 Industrial Network ArchitectureFranNo ratings yet

- Laserfiche Import Agent 9 Quick StartDocument11 pagesLaserfiche Import Agent 9 Quick StartFernando Munive ZacatzontleNo ratings yet

- 2009-07-04 170949 Mazda TimingDocument8 pages2009-07-04 170949 Mazda TimingSuksan SananmuangNo ratings yet

- GNP-GAP Installation InstructionsDocument10 pagesGNP-GAP Installation InstructionsLeonardo ValenciaNo ratings yet

- Gambar SuspensiDocument1 pageGambar SuspensiMashiro HikariNo ratings yet