Professional Documents

Culture Documents

Blue P4 2015

Uploaded by

bongoloidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blue P4 2015

Uploaded by

bongoloidCopyright:

Available Formats

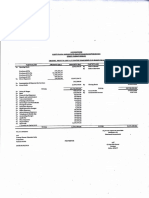

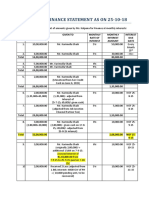

Month March

.............................. PAYMENTS (by cheque, card or direct banking) © P. Hingston

Paid To Ref TOTAL Books Drawings Stock or Employee Premises Costs

Date

Raw Material Costs Rent/Rates Utilities WORKED -

2 Auto Repair Co 359 70 05 The first column 1

& Guide

heading is blank for

2 Self (to personal a/c) D/B 1,500 00 your own heading. You 1,500 00 “Premises Costs”

2

3 XYZ Supplies Co D/B 17 50 might use it for those also includes Cleaning and 3

expenses that occur Property Insurance. Use the

3 ABC Co 356 78 26 regularly. next blank column 4

4 50 00 50 00 if necessary.

The Bookshop 357 “Employee Costs” is

5

9 The Big Phone Co D/D 189 87 where you record employees’ 6

wages & PAYE (also Directors’ The “Utilities”

10 Webdesigns S/O 50 00 salaries). For sole traders and column is for Premises 7

partners, record your wages Costs that relate to any

14 Auto Repair Co 362 139 99 under “Drawings”. Electric, Gas, Heating

8

14 Parcels Office 363 158 27 or Water bills. 9

18 Computer Supply Co 360 725 00 10

29 Landlord & Co 364 500 00 500 00 11

30 A. Brown D/B 62 58 12

31 Self (Card reimbursement) D/B 400 00 125 00 13

31 A-Z Van Salesroom D/B 2,900 00 14

15

16

The entries above are VAT

listed in the same order (and dates) If there is any VAT in an invoice, 17

as they appear in your Bank Statement, don’t separate it out. Record the full invoice

value, including the VAT, in both the TOTAL 18

and in the same order as the invoices

are filed. This makes this page column and the appropriate expenses column 19

easier to complete & check. (as you are not VAT-registered).

20

“Ref” (Reference)

This column could show the last 3 figures 21

of the cheque number, or “D/B” for a Direct

22

Banking, “D/D” for a Direct Debit, or

“S/O” for a Standing Order. 23

24

25

26

27

28

PROCEDURE FOR PERSONAL CARDS PROCEDURE FOR CHEQUES

For each cheque: record the date (as it appears PROCEDURE FOR DIRECT BANKING 29

If you use a personal card for some business This includes online and telephone banking, and

purchases, then reimburse yourself from your business in the Bank Statement), the payee, the last 3 figures 30

of the cheque number (as a Reference) and the total paid. where you are paying your suppliers by Direct Debit or

account every month or so, and at that time enter by Standing Order. Record the date (as it appears in the

the details in that month’s PAYMENTS (as Then “analyse” the payment by entering the figure again 31

in the correct expenses column (or columns, Bank Statement), the payee, the reference and the total paid.

shown on the 31st above). Then “analyse” the payment by entering the figure again

where relevant). 32

in the correct expenses column (or columns,

where relevant). 33

PROCEDURE FOR BUSINESS CARDS 34

For a debit card on your business account, for 35

each transaction: record the date (as it appears in

the Bank Statement), the payee, the word “Card” (as a 36

Reference) and the total paid. Then “analyse” the

payment by entering the figure again in the 37

correct expenses column (or columns, 38

where relevant).

General Note 39

All the data in this Worked Example

is fictitious. 40

41

Only a few entries are 42

shown here to illustrate how to

43

complete this double page.

44

45

At the end of the month, total up 46

Overflow Pages each column. The overall TOTAL (£6,841.52 in this worked

example) is then entered in the MONTH’S BANK BALANCE 47

If in any month you need more lines,

then please note there are overflow pages on the previous page.

48

after Month 12 in this book.

49

Total Payments for Month 6,841 52 50 00 1,500 00 125 00 500 00 50

BLUE - P4 (2015).p65 4 04/09/2015, 15:20

Black

You might also like

- Pranjal Mishra HRC044 Management AccountingDocument3 pagesPranjal Mishra HRC044 Management Accountingmishrapranjal977No ratings yet

- Forecast - WH5 Cost Report JanDocument7 pagesForecast - WH5 Cost Report JanMarkyNo ratings yet

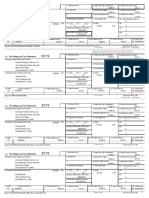

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument1 pageWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atHenry KilmekNo ratings yet

- HpsebDocument25 pagesHpsebVimal SinghNo ratings yet

- Markham TPS 010308Document6 pagesMarkham TPS 010308samuel100No ratings yet

- Dell La-9931p PDFDocument62 pagesDell La-9931p PDFFabregas RonaldNo ratings yet

- Dell Latitude E6440Document62 pagesDell Latitude E6440ivanka petrova0% (1)

- 3CGM8900987 Customer ADocument1 page3CGM8900987 Customer ALeoNo ratings yet

- Item 1 - Ficha Tecnica IBOP Upper Canrig 1250 ACDocument6 pagesItem 1 - Ficha Tecnica IBOP Upper Canrig 1250 ACanghelo marquezNo ratings yet

- PCC M-15Document1 pagePCC M-15Faisal RizwanNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- Ap 3-1234Document4 pagesAp 3-1234api-397556034No ratings yet

- 09T030 FinalDocument14 pages09T030 FinalKriengsak RuangdechNo ratings yet

- Dell / Compal Confidential: Schematic DocumentDocument4 pagesDell / Compal Confidential: Schematic DocumentAMEN HAG MOSANo ratings yet

- COMPAL LA 3301P IBQ00 REV 1.0 (ComunidadeTecnica - Com.br)Document59 pagesCOMPAL LA 3301P IBQ00 REV 1.0 (ComunidadeTecnica - Com.br)Carlos Tome De SousaNo ratings yet

- OSEC-FMS Form No. 3: Tree Planting, Assisting LGU's in Their Community Quaratine Related ActivitiesDocument2 pagesOSEC-FMS Form No. 3: Tree Planting, Assisting LGU's in Their Community Quaratine Related ActivitiesERIC T. VALIENTENo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument9 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerImran SadiqNo ratings yet

- Mcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Solutions ManualDocument19 pagesMcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Solutions Manualairpoiseanalyzernt5t100% (21)

- Jawaban Sesi 3 Ujikom Pt. BoombasstikDocument12 pagesJawaban Sesi 3 Ujikom Pt. BoombasstikNada Nadya100% (1)

- Mark Scheme January 2008: GCE O Level Accounting 7011Document16 pagesMark Scheme January 2008: GCE O Level Accounting 7011ashiakas8273No ratings yet

- Dell Latitude 3550 ZAL50 ZAL60 LA-B072P LA-B071P r0.1 PDFDocument54 pagesDell Latitude 3550 ZAL50 ZAL60 LA-B072P LA-B071P r0.1 PDFyencoNo ratings yet

- Profit Center Split DeterminationDocument9 pagesProfit Center Split DeterminationRajab Ali JiwaniNo ratings yet

- Cost Sheet 21-22Document531 pagesCost Sheet 21-22Gyan PrakashNo ratings yet

- DELL XPS 13-9350 AAZ80 LA-C881P r1.0 A00Document59 pagesDELL XPS 13-9350 AAZ80 LA-C881P r1.0 A00nomi_nomi100% (1)

- Project Cost Tracking WorksheetDocument3 pagesProject Cost Tracking WorksheetSUku Sakat NamfattNo ratings yet

- REVISED APP 2022 - Quarter 4Document3 pagesREVISED APP 2022 - Quarter 4EVELYN PASANANo ratings yet

- Mcgraw Hills Taxation of Individuals and Business Entities 2019 Edition 10th Edition Spilker Solutions ManualDocument19 pagesMcgraw Hills Taxation of Individuals and Business Entities 2019 Edition 10th Edition Spilker Solutions Manualairpoiseanalyzernt5t100% (24)

- Annex 2Document2 pagesAnnex 2Delwar HossainNo ratings yet

- SPCL Offer 9 (New) - 03.12.09Document55 pagesSPCL Offer 9 (New) - 03.12.09ptn999No ratings yet

- To To To To To To To To To To To To To To To To To To: RantanDocument1 pageTo To To To To To To To To To To To To To To To To To: RantanNasim KhanNo ratings yet

- DOPrint PageDocument2 pagesDOPrint PageHim DigitalsNo ratings yet

- DES Template (For 2017 Uniform Allowance) - SignedDocument1 pageDES Template (For 2017 Uniform Allowance) - Signedniko TanNo ratings yet

- Ap 3 Merge 3-1234Document4 pagesAp 3 Merge 3-1234api-295670758No ratings yet

- Divn.5, Work Wise Statement (January 2022) ..Document3 pagesDivn.5, Work Wise Statement (January 2022) ..cekpknr filesNo ratings yet

- Adobe Scan Sep 22, 2023Document4 pagesAdobe Scan Sep 22, 2023romykumar5678No ratings yet

- Annemarie BednarDocument3 pagesAnnemarie BednarSmerling PaulinoNo ratings yet

- HP ELITEBOOK 8840 8840W - COMPAL LA-4902P - REV 1.0sec PDFDocument47 pagesHP ELITEBOOK 8840 8840W - COMPAL LA-4902P - REV 1.0sec PDFابراهيم السعيديNo ratings yet

- Commercial: Guganram TarachandDocument2 pagesCommercial: Guganram Tarachandvijay_anlakNo ratings yet

- Divn.6, Statement of Works ID.6 Sulthanabad BE 2022-23Document2 pagesDivn.6, Statement of Works ID.6 Sulthanabad BE 2022-23cekpknr filesNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument1 pageW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceKyngleaf DamnNo ratings yet

- LA-D993P Rev 1.0 Schematic DiagramDocument70 pagesLA-D993P Rev 1.0 Schematic DiagramLuis EstradaNo ratings yet

- Continuous Beam: N12VB4: SectionsDocument3 pagesContinuous Beam: N12VB4: SectionsHanTeongNo ratings yet

- CARINA New Warehouse CAPEX Sheet (Updated March 12th 2018) : % Committed vs. Total CAPEX BudgetDocument1 pageCARINA New Warehouse CAPEX Sheet (Updated March 12th 2018) : % Committed vs. Total CAPEX BudgetAmr Abdel HamidNo ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- DOPrintPage - 2024-01-17T124056.130Document2 pagesDOPrintPage - 2024-01-17T124056.130sahresh.officialNo ratings yet

- State Mobile Ward Status Preparedate Email-Id: Computation Total IncomeDocument4 pagesState Mobile Ward Status Preparedate Email-Id: Computation Total IncomejayminNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008jacqueline corral0% (1)

- W-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageW-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesus GarciaNo ratings yet

- Vacancy Position 2023-24Document108 pagesVacancy Position 2023-24super cartoonsNo ratings yet

- Lanea E-2 TCP-GR Invoice 2019-01-18Document2 pagesLanea E-2 TCP-GR Invoice 2019-01-18DIEUDONNE MBAIKETENo ratings yet

- Chapter 9. Office TPM ManualDocument25 pagesChapter 9. Office TPM ManualVivek Kumar100% (1)

- 19-20-330-340-PLC DWG-250MW-BIKANER-RAJ-As BuiltDocument41 pages19-20-330-340-PLC DWG-250MW-BIKANER-RAJ-As Builtpradeep.selvarajanNo ratings yet

- d800 COMPAL LA-1901 - REV A02Sec PDFDocument59 pagesd800 COMPAL LA-1901 - REV A02Sec PDFMichael DavenportNo ratings yet

- Forecast - WH5 Cost Report NEW VERSIONDocument6 pagesForecast - WH5 Cost Report NEW VERSIONMarkyNo ratings yet

- CAD Practice Exercise Vol 1 1Document12 pagesCAD Practice Exercise Vol 1 1Erick PiresNo ratings yet

- Book ReferenceLiquidationDocument4 pagesBook ReferenceLiquidationOrlando AlcoberNo ratings yet

- Vsjev La-A031p 1127 FinalDocument22 pagesVsjev La-A031p 1127 FinalRiza VirsadaNo ratings yet

- Unihunt Consulting Private Limited: Salary Slip of FebDocument1 pageUnihunt Consulting Private Limited: Salary Slip of FebSiddesh MorjeNo ratings yet

- Null PDFDocument1 pageNull PDFsureshNo ratings yet

- Apj 9Document109 pagesApj 9bongoloidNo ratings yet

- Atari sm124 Dead Monitor FixDocument5 pagesAtari sm124 Dead Monitor FixbongoloidNo ratings yet

- Cmx469a DatasheetDocument18 pagesCmx469a DatasheetbongoloidNo ratings yet

- Faro Booklet PDFDocument1 pageFaro Booklet PDFbongoloidNo ratings yet

- Captain Beefheart 10 Commandments of Guitar PlayingDocument1 pageCaptain Beefheart 10 Commandments of Guitar PlayingbongoloidNo ratings yet

- Dramatists Modern FormatDocument1 pageDramatists Modern FormatbongoloidNo ratings yet

- Assembly Programming Journal 8Document80 pagesAssembly Programming Journal 8AmineBenali100% (1)

- Zmap: Fast Internet-Wide Scanning and Its Security ApplicationsDocument15 pagesZmap: Fast Internet-Wide Scanning and Its Security ApplicationsbongoloidNo ratings yet

- Unix Prog DesignDocument7 pagesUnix Prog Designirs_bNo ratings yet

- A Chronology of Filofax: Kevin Hall April 13, 2010Document11 pagesA Chronology of Filofax: Kevin Hall April 13, 2010bongoloid0% (1)

- Mod #2Document2 pagesMod #2bongoloidNo ratings yet

- Olympia SG1Document13 pagesOlympia SG1bongoloidNo ratings yet

- Mod #3Document2 pagesMod #3bongoloidNo ratings yet

- Harmonica 030912X PDFDocument36 pagesHarmonica 030912X PDFbongoloid100% (1)

- Miniature Microwave AmplifiersDocument6 pagesMiniature Microwave AmplifiersbongoloidNo ratings yet

- Harmonica 030912X PDFDocument36 pagesHarmonica 030912X PDFbongoloid100% (1)

- Understanding Speech Inversion PDFDocument2 pagesUnderstanding Speech Inversion PDFbongoloidNo ratings yet

- Microwave Circuit BoardsDocument10 pagesMicrowave Circuit BoardsbongoloidNo ratings yet

- Frequency Locking A Microwave SourceDocument4 pagesFrequency Locking A Microwave SourcebongoloidNo ratings yet

- Mind Machines You Can Build PDFDocument202 pagesMind Machines You Can Build PDFbongoloidNo ratings yet

- UsingAndUnderstandingMiniatureNeonLamps PDFDocument132 pagesUsingAndUnderstandingMiniatureNeonLamps PDFbongoloidNo ratings yet

- Gin Pole For Peanuts: Ever Ull o y Straps? Build His G Ea S y ToweDocument2 pagesGin Pole For Peanuts: Ever Ull o y Straps? Build His G Ea S y TowebongoloidNo ratings yet

- Making Printed Circuit Boards - : A Different ViewDocument4 pagesMaking Printed Circuit Boards - : A Different ViewbongoloidNo ratings yet

- A Homebrew Gin PoleDocument2 pagesA Homebrew Gin PolebongoloidNo ratings yet

- Lumped Element Rat Race CouplerDocument6 pagesLumped Element Rat Race Couplerbongoloid100% (1)

- The Gin PoleDocument4 pagesThe Gin PolebongoloidNo ratings yet

- Practical Microwave Filter DesignDocument5 pagesPractical Microwave Filter Designbongoloid100% (1)

- MagnetronDocument5 pagesMagnetronbongoloidNo ratings yet

- Tone Signaling Over Telephone Lines A Technician's PrimerDocument3 pagesTone Signaling Over Telephone Lines A Technician's PrimerbongoloidNo ratings yet

- The Art and Craft of Coil ConstructionDocument3 pagesThe Art and Craft of Coil ConstructionbongoloidNo ratings yet

- Questionnaire For Adoption of Mobile WalletDocument5 pagesQuestionnaire For Adoption of Mobile WalletAditya Shukla75% (12)

- The State of Food Delivery Apps 2021 Condensed FinalDocument19 pagesThe State of Food Delivery Apps 2021 Condensed FinalHarry BinosNo ratings yet

- Cloud Computing NotesDocument2 pagesCloud Computing NotessacbansalNo ratings yet

- Period End Processing - Summary The Following Outlines:: PayablesDocument3 pagesPeriod End Processing - Summary The Following Outlines:: Payablesbritesprite2000No ratings yet

- E Rupee REVIEWSDocument8 pagesE Rupee REVIEWSMohmmedKhayyumNo ratings yet

- Boa StatementDocument3 pagesBoa Statementmrs merle westonNo ratings yet

- BG B NG 00067030000011672Document3 pagesBG B NG 00067030000011672Shiva Kumar MadigaNo ratings yet

- LivingOffYourPaycheck 66WaysToSaveMoney Handout 1Document8 pagesLivingOffYourPaycheck 66WaysToSaveMoney Handout 1Brenda L.No ratings yet

- Gyg32Qlh4Wna Prague: Old Town Hall & Astronomical Clock Entrance TicketDocument5 pagesGyg32Qlh4Wna Prague: Old Town Hall & Astronomical Clock Entrance TicketAds00No ratings yet

- 864 867 TimetableDocument8 pages864 867 TimetableDavid Le0% (1)

- AirCheck Detail Report - PK8AP02Document100 pagesAirCheck Detail Report - PK8AP02Trion Ragil NugrohoNo ratings yet

- Brand Positioning of Bharti Airtel LimitedDocument40 pagesBrand Positioning of Bharti Airtel LimitedAshish SrivastavaNo ratings yet

- Park An InvoiceDocument8 pagesPark An InvoiceShrey KanherkarNo ratings yet

- Reference NumberDocument3 pagesReference NumberShaharul ShahNo ratings yet

- Major Global Distribution SystemDocument2 pagesMajor Global Distribution SystemEnjoan FloresNo ratings yet

- Voucher Payable System Report 2Document10 pagesVoucher Payable System Report 2Krssh Kt DgNo ratings yet

- Cyber Security Global Information InfrastructureDocument7 pagesCyber Security Global Information InfrastructureonesnoneNo ratings yet

- RONADocument4 pagesRONARona De la PeñaNo ratings yet

- Trading AccountDocument14 pagesTrading AccountKrishna100% (8)

- Rosa Spec Fica ION: Page 1 of 2 Effect Ve Fro Ev 1 0Document23 pagesRosa Spec Fica ION: Page 1 of 2 Effect Ve Fro Ev 1 0ManognaNo ratings yet

- EN Ascot RemoteControl CatalogueDocument4 pagesEN Ascot RemoteControl CatalogueYasir ShukryNo ratings yet

- Computer Networks Question Bank With AnswersDocument17 pagesComputer Networks Question Bank With AnswersBolt FFNo ratings yet

- TD Bank Statement - Scott W Springer#2Document2 pagesTD Bank Statement - Scott W Springer#2fehijan689No ratings yet

- Ghilmis User Setup Form - 10032020Document1 pageGhilmis User Setup Form - 10032020IgnatiusNo ratings yet

- Bibliografia BRT 11Document6 pagesBibliografia BRT 11Leidy Ortega QuinteroNo ratings yet

- ReportDocument1 pageReportCaptain AtikNo ratings yet

- Linkhub hh70vhDocument35 pagesLinkhub hh70vhMax LedererNo ratings yet

- Final Envío 673Document5 pagesFinal Envío 673cristianNo ratings yet

- Kalpana Financial Statement - Updated As On 25-10-18Document8 pagesKalpana Financial Statement - Updated As On 25-10-18Nelapudi SureshNo ratings yet

- Advertising PlaybookDocument53 pagesAdvertising PlaybookMariana FerronatoNo ratings yet