Professional Documents

Culture Documents

Annex D RR 11-2018 PDF

Uploaded by

Neil Borja0 ratings0% found this document useful (0 votes)

43 views1 pageOriginal Title

Annex D RR 11-2018.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views1 pageAnnex D RR 11-2018 PDF

Uploaded by

Neil BorjaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

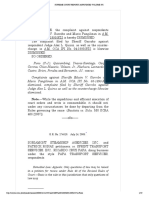

ANNEX “D”

REVISED WITHHOLDING TAX TABLE

Effective January 1, 2018 to December 31, 2022

DAILY 1 2 3 4 5 6

P 685 and

Compensation Range P685 – P1,095 P1,096 – P2,191 P2,192 – P5,478 P5,479 – P21,917 P21,918 and above

below

Prescribed 0.00 P 82.19 P 356.16 P 1,342.47 P 6,602.74

0.00

Withholding Tax + 20% over P 685 + 25% over P 1,096 + 30% over P2,192 + 32% over P 5,479 + 35% over P21,918

WEEKLY 1 2 3 4 5 6

P 4,808 and

Compensation Range below P 4,808 – P 7,691 P 7,692 – P15,384 P 15,385 – P 38,461 P 38,462 – P153,845 P 153,846 and above

Prescribed 0.00 P 576.92 P 2,500.00 P 9,423.08 P 46,346.15

0.00

Withholding Tax + 20% over P 4,808 + 25% over P 7,692 + 30% over P 15,385 + 32% over P 38,462 + 35% over P 153,846

SEMI-MONTHLY 1 2 3 4 5 6

P 10,417 and

Compensation Range P 10,417 – P16,666 P 16,667 – P 33,332 P 33,333 – P 83,332 P 83,333 – P333,332 P 333,333 and above

below

Prescribed 0.00 P 1,250.00 P 5,416.67 P 20,416.67 P 100,416.67

0.00

Withholding Tax + 20% over P 10,417 + 25% over P 16,667 + 30% over P 33,333 + 32% over P 83,333 + 35% over P 333,333

MONTHLY 1 2 3 4 5 6

P 20,833

Compensation Range P 20,833 – P 33,332 P 33,333 – P 66,666 P 66,667 – P 166,666 P 166,667 – P666,666 P 666,667 and above

and below

Prescribed

0.00 0.0 P 2,500.00 P 10,833.33 P 40,833.33 P 200,833.33

Withholding Tax

+ 20% over P 20,833 + 25% over P 33,333 + 30% over P 66,667 + 32% over P 166,667 +35% over P 666,667

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Nicaragua v. Us Case DigestDocument4 pagesNicaragua v. Us Case DigestAn Jo100% (3)

- The Irish Chocolate CompanyDocument7 pagesThe Irish Chocolate CompanyMaeveOSullivanNo ratings yet

- Harden Vs Benguet - G.R. No. L-37331 - March 18, 1933 - Street, JDocument3 pagesHarden Vs Benguet - G.R. No. L-37331 - March 18, 1933 - Street, JNeil BorjaNo ratings yet

- Marcelino Aguas For Plaintiff-Appellant. Attorney-General Jaranilla For Defendant-AppellantDocument4 pagesMarcelino Aguas For Plaintiff-Appellant. Attorney-General Jaranilla For Defendant-AppellantNeil BorjaNo ratings yet

- 112 Tuason - y - Angeles - v. - CIR 155309-1930Document4 pages112 Tuason - y - Angeles - v. - CIR 155309-1930Neil BorjaNo ratings yet

- Risos-Vidal v. COMELECDocument2 pagesRisos-Vidal v. COMELECNeil BorjaNo ratings yet

- 41 - Park Hotel Vs Soriano (2012) - Tan, RDocument3 pages41 - Park Hotel Vs Soriano (2012) - Tan, RNeil BorjaNo ratings yet

- Almendras V AlmendrasDocument14 pagesAlmendras V AlmendrasNeil BorjaNo ratings yet

- Agency Digests 012218Document57 pagesAgency Digests 012218Cristelle Elaine Collera100% (1)

- B2013 Admin BATCH 2 - Dagan v. Phil Racing CommissionDocument1 pageB2013 Admin BATCH 2 - Dagan v. Phil Racing CommissionNeil BorjaNo ratings yet

- Note 1 Code of CommerceDocument17 pagesNote 1 Code of CommerceJudith AlisuagNo ratings yet

- Metrobank V SLGT HoldingsDocument19 pagesMetrobank V SLGT HoldingsNeil BorjaNo ratings yet

- Tan V GVT Engg ServicesDocument21 pagesTan V GVT Engg ServicesNeil BorjaNo ratings yet

- b2013 Admin Batch 4Document81 pagesb2013 Admin Batch 4Neil BorjaNo ratings yet

- 12 Powers of The COMELEC (Poe) - COC (Villarosa) (Joan Therese Medalla's Conflicted Copy 2016-11-17)Document24 pages12 Powers of The COMELEC (Poe) - COC (Villarosa) (Joan Therese Medalla's Conflicted Copy 2016-11-17)Neil BorjaNo ratings yet

- 110 Oña - v. - CIR 141139-1972 PDFDocument11 pages110 Oña - v. - CIR 141139-1972 PDFNeil BorjaNo ratings yet

- 2 CIR V Robertson PDFDocument7 pages2 CIR V Robertson PDFNeil BorjaNo ratings yet

- People V SumiliDocument13 pagesPeople V SumiliNeil BorjaNo ratings yet

- Valeroso V SkyCableDocument6 pagesValeroso V SkyCableNeil BorjaNo ratings yet

- People v. Cardenas (2002)Document14 pagesPeople v. Cardenas (2002)Neil BorjaNo ratings yet

- Herbert Hart Elucidated: Nicola Lacey. Oxford and New York: Oxford University Press. 2004. PPDocument24 pagesHerbert Hart Elucidated: Nicola Lacey. Oxford and New York: Oxford University Press. 2004. PPNeil BorjaNo ratings yet

- Arroyo v. House of Representatives ElectoralDocument35 pagesArroyo v. House of Representatives ElectoralNeil BorjaNo ratings yet

- 45 Ancheta V Guerset-DalaygonDocument22 pages45 Ancheta V Guerset-DalaygonNeil BorjaNo ratings yet

- 102 Testate Estate de Guzman v. de Guzman 138868-1978Document6 pages102 Testate Estate de Guzman v. de Guzman 138868-1978Neil BorjaNo ratings yet

- 6 CIR V CA:ADMUDocument19 pages6 CIR V CA:ADMUNeil BorjaNo ratings yet

- Eurotech Ind. Tech. V CuizonDocument14 pagesEurotech Ind. Tech. V CuizonNeil BorjaNo ratings yet

- XI 4 Filipinas Life v. PedrosoDocument8 pagesXI 4 Filipinas Life v. PedrosoMlaNo ratings yet

- J. Phil. Marine V NLRCDocument8 pagesJ. Phil. Marine V NLRCNeil BorjaNo ratings yet

- Westmont Investment Corp V FranciaDocument15 pagesWestmont Investment Corp V FranciaNeil BorjaNo ratings yet

- Soriamont V Sprint TransportDocument19 pagesSoriamont V Sprint TransportNeil BorjaNo ratings yet

- Cir Vs PagcorDocument3 pagesCir Vs PagcorNivra Lyn Empiales100% (2)

- Standalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Document2 pagesStandalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Carl Rogers Written ReportsDocument3 pagesCarl Rogers Written Reportskyla elpedangNo ratings yet

- SIP Annex 5 - Planning WorksheetDocument2 pagesSIP Annex 5 - Planning WorksheetGem Lam SenNo ratings yet

- Wendy in Kubricks The ShiningDocument5 pagesWendy in Kubricks The Shiningapi-270111486No ratings yet

- Viking Solid Cone Spray NozzleDocument13 pagesViking Solid Cone Spray NozzlebalaNo ratings yet

- JAR66Document100 pagesJAR66Nae GabrielNo ratings yet

- 2020 HGDG Pimme Checklist 16Document2 pages2020 HGDG Pimme Checklist 16Kate MoncadaNo ratings yet

- Problem Set 9Document2 pagesProblem Set 9Siham BuuleNo ratings yet

- Educ 203 CHAPTER 6 Lesson 1Document13 pagesEduc 203 CHAPTER 6 Lesson 1charmen rogando100% (4)

- RPA Solutions - Step Into The FutureDocument13 pagesRPA Solutions - Step Into The FutureThe Poet Inside youNo ratings yet

- Chapter 1 Basic-Concepts-Of-EconomicsDocument30 pagesChapter 1 Basic-Concepts-Of-EconomicsNAZMULNo ratings yet

- Superstitions, Rituals and Postmodernism: A Discourse in Indian Context.Document7 pagesSuperstitions, Rituals and Postmodernism: A Discourse in Indian Context.Dr.Indranil Sarkar M.A D.Litt.(Hon.)No ratings yet

- Periodical Test - English 5 - Q1Document7 pagesPeriodical Test - English 5 - Q1Raymond O. BergadoNo ratings yet

- The Aesthetic Revolution and Its Outcomes, Jacques RanciereDocument19 pagesThe Aesthetic Revolution and Its Outcomes, Jacques RanciereTheoria100% (1)

- Ronaldo FilmDocument2 pagesRonaldo Filmapi-317647938No ratings yet

- Lecture 7 - Conditions of Employment Pt. 2Document55 pagesLecture 7 - Conditions of Employment Pt. 2Steps RolsNo ratings yet

- StarbucksDocument19 pagesStarbucksPraveen KumarNo ratings yet

- Smart Notes Acca f6 2015 (35 Pages)Document38 pagesSmart Notes Acca f6 2015 (35 Pages)SrabonBarua100% (2)

- Philippine Phoenix Surety vs. WoodworksDocument1 pagePhilippine Phoenix Surety vs. WoodworksSimon James SemillaNo ratings yet

- Homicide Act 1957 Section 1 - Abolition of "Constructive Malice"Document5 pagesHomicide Act 1957 Section 1 - Abolition of "Constructive Malice"Fowzia KaraniNo ratings yet

- Roads of Enlightenment GuideDocument5 pagesRoads of Enlightenment GuideMicNo ratings yet

- Mavel Francis TurbinesDocument2 pagesMavel Francis TurbineszecaroloNo ratings yet

- Keys For Change - Myles Munroe PDFDocument46 pagesKeys For Change - Myles Munroe PDFAndressi Label100% (2)

- Bond by A Person Obtaining Letters of Administration With Two SuretiesDocument2 pagesBond by A Person Obtaining Letters of Administration With Two Suretiessamanta pandeyNo ratings yet

- Eve Berlin PDFDocument2 pagesEve Berlin PDFJeffNo ratings yet

- LSG Statement of Support For Pride Week 2013Document2 pagesLSG Statement of Support For Pride Week 2013Jelorie GallegoNo ratings yet

- Alpha Beta Gamma Delta Epsilon Zeta Eta Theta Iota Kappa Lambda MuDocument3 pagesAlpha Beta Gamma Delta Epsilon Zeta Eta Theta Iota Kappa Lambda MulanNo ratings yet

- A Collection of Poems by AKDocument16 pagesA Collection of Poems by AKAnanda KrishnanNo ratings yet