Professional Documents

Culture Documents

Concepts in Financial Management

Uploaded by

feiloh0 ratings0% found this document useful (0 votes)

209 views3 pagesThis document discusses concepts in financial management. It outlines key topics that will be covered, including the concept of finance under different approaches, the significance and nature of financial management, and the relationship between finance and other organizational functions. It also describes the role of a finance manager and new challenges they may face. Finally, it provides an overview of the duties of various financial managers such as controllers, treasurers, cash managers, and risk and insurance managers.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses concepts in financial management. It outlines key topics that will be covered, including the concept of finance under different approaches, the significance and nature of financial management, and the relationship between finance and other organizational functions. It also describes the role of a finance manager and new challenges they may face. Finally, it provides an overview of the duties of various financial managers such as controllers, treasurers, cash managers, and risk and insurance managers.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

209 views3 pagesConcepts in Financial Management

Uploaded by

feilohThis document discusses concepts in financial management. It outlines key topics that will be covered, including the concept of finance under different approaches, the significance and nature of financial management, and the relationship between finance and other organizational functions. It also describes the role of a finance manager and new challenges they may face. Finally, it provides an overview of the duties of various financial managers such as controllers, treasurers, cash managers, and risk and insurance managers.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

concepts in financial management

After reading this lesson you will be able to understand the

following: -

>Concept of ‘Finance’ under different approaches.

>Significance of ‘Finance’.

>Nature of financial management.

>Relationship between finance and other important functions of

the organization.

>Role of a Finance Manager in an organization.

>New challenges faced by the finance manager.

A very warm welcome to all my students in Third Trimester of

PGPACM course at NICMAR, Hyderabad Campus. I will be

teaching you FINANCIAL MANAGEMENT; I must tell you

that I find this subject as the most interesting subject and all my

efforts will be to make it very interesting for you as well. Let’s

discuss

Almost every firm, government agency, and organization has

one or more financial managers who oversee the preparation of

financial reports, direct investment activities, and implement

cash management strategies. As computers are increasingly used

to record and organize data, many financial managers are

spending more time developing strategies and implementing the

long- term goals of their organization.

The duties of financial managers vary with their specific titles,

which include controller,

treasurer or finance officer, credit manager, cash manager, and

risk and insurance manager.

Controllers direct the preparation of financial reports that

summarize and forecast the

organization’s financial position, such as income statements,

balance sheets, and analyses of future earnings or expenses.

Regulatory authorities also in charge of preparing special reports

require controllers. Often, controllers oversee the accounting,

audit, and budget departments.

Treasurersand finance officers direct the organization’s financial

goals, objectives, and budgets.

They oversee the investment of funds and manage associated

risks, supervise cash management activities, execute capital-

raising strategies to support a firm’s expansion, and deal with

mergers and acquisitions. Credit managers oversee the firm’s

issuance of credit. They establish credit- rating criteria,

determine credit ceilings, and monitor the collections of past-

due accounts. Managers specializing in international finance

develop financial and accounting systems for the banking

transactions of multinational organizations.

Cash managers monitor and control the flow of cash receipts and

disbursements to meet the

business and investment needs of the firm. For example, cash

flow projections are needed to determine whether loans must be

obtained to meet cash requirements or whether surplus cash

should be invested in interest-bearing instruments. Risk and

insurance managers oversee programs to minimize risks and

losses that might arise from financial transactions and business

operations undertaken by the institution. They also manage the

organization’s insurance budget.

3

Core Concepts of Financial Management

DownloadPrintMobileCollectionsReport Document

This is a private document.

You might also like

- 3rd Term-Finance ManagementDocument65 pages3rd Term-Finance ManagementShreedhar100% (1)

- Core Concepts of Financial ManagementDocument10 pagesCore Concepts of Financial ManagementDr Sarbesh Mishra100% (15)

- Ratio Analysis Project ReportDocument80 pagesRatio Analysis Project Reportpriya,eNo ratings yet

- Financial Managing and How To BeDocument6 pagesFinancial Managing and How To BeMzia GamerNo ratings yet

- Finance (QUES)Document14 pagesFinance (QUES)Yeasin TusherNo ratings yet

- Funds Flow Statement ProjectDocument99 pagesFunds Flow Statement Projecttulasinad12333% (3)

- Unit OneDocument19 pagesUnit OnePree ThiNo ratings yet

- 2132531t483700 Ratio Analysis Project ReportDocument139 pages2132531t483700 Ratio Analysis Project ReportAmanNo ratings yet

- Ratio Analysis Project Report2bDocument139 pagesRatio Analysis Project Report2bAmanNo ratings yet

- Financial Managers: Top ExecutivesDocument5 pagesFinancial Managers: Top ExecutivesSarah PandaNo ratings yet

- Introduction To Financial ManagementDocument34 pagesIntroduction To Financial ManagementKevin OnaroNo ratings yet

- Financial Mangers JobDocument7 pagesFinancial Mangers JobQudratullahRahmaniNo ratings yet

- University of Banja Luka Faculty of Economics: Seminar Paper Financial ManagersDocument20 pagesUniversity of Banja Luka Faculty of Economics: Seminar Paper Financial ManagersAleksandar CrnovcicNo ratings yet

- Ratio Analysis Project ReportDocument82 pagesRatio Analysis Project ReportkartikNo ratings yet

- Ratio Analysis Project ReportDocument82 pagesRatio Analysis Project ReportShirke KishorNo ratings yet

- Upload Log in Sign Up: Share To Your Social NetworksDocument36 pagesUpload Log in Sign Up: Share To Your Social Networksjinalshah21097946No ratings yet

- Financial ManagerDocument9 pagesFinancial Managerapi-285066062No ratings yet

- Ratio Analysis Project ReportDocument86 pagesRatio Analysis Project Reportnehajijo100% (2)

- Mba856 2022-1Document57 pagesMba856 2022-1Vivian ArigbedeNo ratings yet

- Ratio Analysis Project ReportDocument140 pagesRatio Analysis Project Reportkamdica73% (22)

- Role of Financial ManagersDocument3 pagesRole of Financial ManagersSauhard AlungNo ratings yet

- Ratio AnalysisDocument13 pagesRatio Analysiscknowledge10No ratings yet

- Project Report: Financial Management and AnalysisDocument13 pagesProject Report: Financial Management and AnalysisAli SiddiquiNo ratings yet

- FIN 2-What Does A Financial Manager DoDocument4 pagesFIN 2-What Does A Financial Manager DoJeffrey Jazz BugashNo ratings yet

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessFrom EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNo ratings yet

- Inventory Management in HBLDocument72 pagesInventory Management in HBLNareshkumar KoppalaNo ratings yet

- Business Finance ABM StrandDocument107 pagesBusiness Finance ABM StrandMiss Anonymous23No ratings yet

- CF Assignment 2Document7 pagesCF Assignment 2jannatNo ratings yet

- Reading Article1Document6 pagesReading Article1KOHILAVANI A/P BALAN PREREG STUDENTNo ratings yet

- Introduction To Financial Management - Docx SufDocument16 pagesIntroduction To Financial Management - Docx SufAnonymous 3dM58DTfNo ratings yet

- Lesson 02Document10 pagesLesson 02Zeleine Raine Del RosarioNo ratings yet

- What Is The Relationship of Financial ManagementDocument3 pagesWhat Is The Relationship of Financial ManagementNovelyn DuyoganNo ratings yet

- Role of A Financial ManagerDocument4 pagesRole of A Financial Managerkavitachordiya86No ratings yet

- Finman 1Document4 pagesFinman 1Jahaziel Asis PerezNo ratings yet

- Role & Functions of Financial ManagerDocument19 pagesRole & Functions of Financial Managersumi0% (1)

- Types of Financial ManagementDocument6 pagesTypes of Financial ManagementRohit BajpaiNo ratings yet

- Module 3 FINP1 Financial ManagementDocument8 pagesModule 3 FINP1 Financial ManagementChristine Jane LumocsoNo ratings yet

- Sr. No: Chapter NameDocument85 pagesSr. No: Chapter Nameprashantwagh183No ratings yet

- Role of Financial MangerDocument1 pageRole of Financial MangerPrecious Nicole SantosNo ratings yet

- The Challenging Role of A Finance Manager in A Dynamic Business EnvironmentDocument6 pagesThe Challenging Role of A Finance Manager in A Dynamic Business EnvironmentMuhammad ArifNo ratings yet

- Chapter 1 Financial ManagementDocument13 pagesChapter 1 Financial ManagementsoleilNo ratings yet

- To Financial ManagementDocument19 pagesTo Financial ManagementDenied StellNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementAfifaNo ratings yet

- Day 2 Finman p2Document6 pagesDay 2 Finman p2Ericka DeguzmanNo ratings yet

- MBA Finance CareersDocument3 pagesMBA Finance Careersbhanushyam2No ratings yet

- Module 3 FINP1 Financial ManagementDocument6 pagesModule 3 FINP1 Financial ManagementkimmheanNo ratings yet

- Finance and Accounting CareersDocument3 pagesFinance and Accounting Careersgiri_chayanNo ratings yet

- Course Title: Strategic Finance: Submitted By: Qasim Farooq 1252108Document3 pagesCourse Title: Strategic Finance: Submitted By: Qasim Farooq 1252108Kasem Farook ChaudhryNo ratings yet

- Introduction of FMDocument11 pagesIntroduction of FMsonika7No ratings yet

- The Road to Financial Success: Practical Strategies for Building Wealth and Achieving Financial IndependenceFrom EverandThe Road to Financial Success: Practical Strategies for Building Wealth and Achieving Financial IndependenceNo ratings yet

- Financial Intelligence: Navigating the Numbers in BusinessFrom EverandFinancial Intelligence: Navigating the Numbers in BusinessNo ratings yet

- Financial Intelligence: Mastering the Numbers for Business SuccessFrom EverandFinancial Intelligence: Mastering the Numbers for Business SuccessNo ratings yet

- Financial Control Blueprint: Building a Path to Growth and SuccessFrom EverandFinancial Control Blueprint: Building a Path to Growth and SuccessNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Agricultural Leasehold Agricultural Tenancy Definition and Nature of Agricultural TenancyDocument17 pagesAgricultural Leasehold Agricultural Tenancy Definition and Nature of Agricultural TenancyCarla VirtucioNo ratings yet

- Perverse Consequences of Well-Intentioned Regulation: Evidence From India's Child Labor BanDocument2 pagesPerverse Consequences of Well-Intentioned Regulation: Evidence From India's Child Labor BanCato InstituteNo ratings yet

- Theoretical Framework of E-Business Competitiveness: SciencedirectDocument6 pagesTheoretical Framework of E-Business Competitiveness: SciencedirectAnonymous JmeZ95P0No ratings yet

- Example of A Representation LetterDocument8 pagesExample of A Representation LetterPradhikta RumbagaNo ratings yet

- Tutorial 10 PDFDocument9 pagesTutorial 10 PDFtan keng qi100% (4)

- Honda Case StudyDocument11 pagesHonda Case StudySarjodh SinghNo ratings yet

- Worksheet 1 - IXDocument2 pagesWorksheet 1 - IXJa HahaNo ratings yet

- Contributions of Physician Recruitment To Regional Economic Development: Case of Windsor/Essex, OntarioDocument3 pagesContributions of Physician Recruitment To Regional Economic Development: Case of Windsor/Essex, OntarioAaronMavrinacNo ratings yet

- Reflecting The Nation's History, 'Sōgō Shōsha' Are Unique To Japan - The Japan TimesDocument7 pagesReflecting The Nation's History, 'Sōgō Shōsha' Are Unique To Japan - The Japan TimesbillpaparounisNo ratings yet

- SSUSH 17: The Student Will Analyze The Causes and Consequences of The Great DepressionDocument18 pagesSSUSH 17: The Student Will Analyze The Causes and Consequences of The Great DepressionDewanshu GuptaNo ratings yet

- Establishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesDocument7 pagesEstablishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesJean Placide BarekeNo ratings yet

- Market BasketDocument13 pagesMarket Basketmajmuni1No ratings yet

- Ethiopia Public Debt Portfolio Analysis No 21 - 2019-20Document82 pagesEthiopia Public Debt Portfolio Analysis No 21 - 2019-20Mk FisihaNo ratings yet

- BB Russian Luxury Goods MarketDocument42 pagesBB Russian Luxury Goods MarketShadman KhanNo ratings yet

- PEZA Reportorial RequirementsDocument4 pagesPEZA Reportorial RequirementsMV FadsNo ratings yet

- Annual Report 2017Document158 pagesAnnual Report 2017speedenquiryNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyjustineNo ratings yet

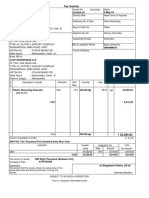

- Tax Invoice: Bhagyalaxmi Plastics (23-24) 30/2023-24 3-May-23Document1 pageTax Invoice: Bhagyalaxmi Plastics (23-24) 30/2023-24 3-May-23Avinash TiwariNo ratings yet

- Industry Projections 2020: Australian Cattle - April UpdateDocument7 pagesIndustry Projections 2020: Australian Cattle - April UpdateMark RippetoeNo ratings yet

- SLA Lead Goal CalculatorDocument20 pagesSLA Lead Goal CalculatorRejoy RadhakrishnanNo ratings yet

- Magazine Nov 2022Document62 pagesMagazine Nov 2022fatrag amloNo ratings yet

- Developing Market Entry Strategy English KPMGDocument24 pagesDeveloping Market Entry Strategy English KPMGMeoki YoNo ratings yet

- Wealth Management in Asia 2016 PDFDocument240 pagesWealth Management in Asia 2016 PDFChristamam Herry WijayaNo ratings yet

- CBSE Class 3 GK Practice WorksheetDocument2 pagesCBSE Class 3 GK Practice Worksheetpinky basak100% (4)

- Midterm 1 Winter 10 Answers Geography 213Document11 pagesMidterm 1 Winter 10 Answers Geography 213Michael HosaneeNo ratings yet

- Firstmasterclass TB Progress Test 3 A4Document4 pagesFirstmasterclass TB Progress Test 3 A4Adri ChNo ratings yet

- Presentation On ABB - PBS Joint VentureDocument13 pagesPresentation On ABB - PBS Joint VenturemousinnnNo ratings yet

- Certificate of AuthorityDocument1 pageCertificate of Authoritybob100% (16)

- Sewale Bitew PDFDocument84 pagesSewale Bitew PDFTILAHUNNo ratings yet