Professional Documents

Culture Documents

TATA INFRASTRUCTURE FUND INVESTS IN COMPANIES WITH LONG TERM VALUE POTENTIAL

Uploaded by

arun19740 ratings0% found this document useful (0 votes)

11 views1 pageInfrastructure

Original Title

Infrastructure

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInfrastructure

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageTATA INFRASTRUCTURE FUND INVESTS IN COMPANIES WITH LONG TERM VALUE POTENTIAL

Uploaded by

arun1974Infrastructure

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

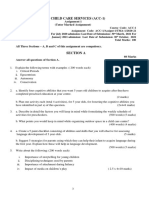

TATA INFRASTRUCTURE FUND

Fund positioning: Invests predominantly in companies with potential of creating long term value from expected investments in infrastructure oriented sectors.

Total Net Assets as on 31/07/06 (Rs Lacs) : 77648.46 Portfolio as on 31/07/06

Scrip Name

Name Mkt. Value % To Net

(Rs. Lacs) Assets

Fund Essentials Banks 364.52 0.47

Date of Allotment December 31, 2004 State Bank Of India 364.52 0.47

Minimum Investment Rs. 5000/- Cement 14,655.22 18.87

Entry Load < Rs. 2 Cr: 2.25%; >= Rs.2 Cr: Nil A.C.C. 3,558.35 4.58

Exit Load Nil Grasim Industries Ltd. 3,074.79 3.96

Gujarat Ambuja Cements Ltd 2,363.19 3.04

For SIP Load Structure please refer Page 30

Madras Cements 1,988.82 2.56

Shree Cement Limited 1,611.98 2.08

Birla Corporation Limited 985.34 1.27

Performance at a Glance (%) - CAGR

Ultratech Cemco Limited 771.55 0.99

Since Inception Last 1 Year Mysore Cements Ltd. 301.20 0.39

Construction Materials 301.89 0.39

42.75 46.75

D.S.Kulkarni Devlopers Limited 301.89 0.39

Past Performance of the Scheme may or may not be sustained in future. Returns are given for growth option. Benchmark Return Construction 11,161.80 14.39

(SENSEX) Last 1 year 40.71%, Since Inception 36.07%. Unitech Ltd 2,994.42 3.86

Nagarjuna Construction Co Ltd 1,512.20 1.95

IVRCL Infrastructures & Project Ltd 1,432.90 1.85

NAV Details Gammon India Limited 1,310.74 1.69

Jai Prakash Associates Limited 1,015.38 1.31

NAV as on NAV as on Hindustan Construction Co.Ltd 1,008.83 1.30

31/07/06 (Rs.) 31/07/05 (Rs.) Simplex Concrete Piles ( India ) Li 940.28 1.21

Dividend Option 16.8912 11.5069 Punj Llyod Limited 471.39 0.61

Mahindra Gesco Developers Ltd 425.68 0.55

Appreciation Option 17.554 11.9617 Valecha Engineering Limited 49.98 0.06

Consumer Durables 2,215.55 2.86

Voltas Limited 2,180.22 2.81

Lloyd Electric & Engineering Ltd 35.34 0.05

Dredging 785.07 1.01

Dividend History (Dividend Option) Dredging Corp Of India Ltd. 785.07 1.01

Dividend (%) Per unit value (on face value of Rs. 10/-) NAV (Rs.) (Date of Declaration of dividend) Ferrous Metals 2,815.15 3.63

4.50 0.45 11.4230 (7/7/2005) Tata Iron & Steel Co. Ltd. 1,097.93 1.41

Monnet Ispat Inds. 487.05 0.63

Sesa Goa Ltd 437.38 0.56

Welspun Gujarat Stahl Rohren Ltd 345.77 0.45

Jindal Saw Limited 339.87 0.44

PSL Limited 107.15 0.14

Industrial Capital Goods 21,687.91 27.94

Sectoral Allocation Bharat Heavy Electricals Ltd. 3,998.87 5.15

Siemens India Ltd 3,900.61 5.02

Larsen & Toubro Ltd. 3,508.45 4.52

Construction Materials 0.39 Crompton Greaves Ltd 2,165.83 2.79

Banks 0.47 ABB Ltd 1,919.36 2.47

Thermax Limited 1,441.60 1.86

Dredging 1.01

Bharat Electronics Ltd. 1,433.90 1.85

Transportation 1.19 Bharati Shipyard Limited 1,194.94 1.54

Oil 1.42 Bharat Earth Movers Ltd. 1,019.36 1.31

Consumer Durables 2.86 Jyoti Structures Ltd. 850.96 1.10

Emco Ltd 254.04 0.33

Telecom - Services 3.31

Industrial Products 3,842.56 4.96

Petroleum Products 3.63 KSB Pumps Ltd. 1,075.91 1.39

Ferrous Metals 3.63 Greaves Limited 1,018.22 1.31

Non - Ferrous Metals 3.99 Kirloskar Brothers Ltd 656.41 0.85

Industrial Products 4.96 Finolex Cables Limited 627.96 0.81

Kirloskar Oil Engines Ltd. 464.06 0.60

Power 7.09 Non - Ferrous Metals 3,104.08 3.99

Construction 14.39 Sterlite Industries (I) Ltd 1,682.83 2.17

Cement 18.87 Hindalco Industries Ltd 889.69 1.14

Industrial Capital Goods 27.94 Hindustan Zinc Limited 531.56 0.68

Oil 1,105.21 1.42

0.00 10.00 20.00 30.00 Oil & Natu. Gas Co. 1,105.21 1.42

Petroleum Products 2,813.80 3.63

Reliance Industries Ltd. 2,055.90 2.65

H.P.C.L. 757.90 0.98

Asset Allocation Power 5,512.07 7.09

National Thermal Power Corp 1,832.48 2.36

(Rs. In Lacs) Reliance Energy Limited 1,298.90 1.67

Equity 73,856.73 KEC International Ltd 1,198.46 1.54

CESC Limited 1,182.24 1.52

Cash, Others 3,791.73 Telecom - Services 2,568.38 3.31

Total Net Assets 77,648.46 Reliance Communication Ventures Ltd 1,497.68 1.93

Tata Tele Services(Maharashtra)Ltd 719.95 0.93

Mahanagar Telephone Nigam Ltd. 350.75 0.45

Transportation 923.52 1.19

Great Eastern Shipping Co. Ltd. 923.52 1.19

Total 73,856.73 95.15

11

You might also like

- Small Cap FundDocument1 pageSmall Cap Fundshailendra.goswamiNo ratings yet

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- UlipDocument1 pageUlipsanu091No ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- Fiscf Franklin India Smaller Companies Fund: PortfolioDocument1 pageFiscf Franklin India Smaller Companies Fund: PortfolioRtsu PtNo ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- Top constituents of NIFTY50 Value 20 indexDocument1 pageTop constituents of NIFTY50 Value 20 indexArati DubeyNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Axis Smallcap FundDocument1 pageAxis Smallcap FundManoj JainNo ratings yet

- DBH1STMF - Quarterly Portfolio Statement - Jun, 2022Document2 pagesDBH1STMF - Quarterly Portfolio Statement - Jun, 2022Forhad UddinNo ratings yet

- GRP SumDocument3 pagesGRP SumPrince AnejaNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Franklin India Bluechip Fund portfolio breakdownDocument1 pageFranklin India Bluechip Fund portfolio breakdownAatish TNo ratings yet

- Ind Nifty CPSEDocument1 pageInd Nifty CPSEAnjalidevi TNo ratings yet

- 11-L&T Infrastructure Fund - Jan17Document1 page11-L&T Infrastructure Fund - Jan17YogeshJaiswalNo ratings yet

- India Consumer Fund PortfolioDocument1 pageIndia Consumer Fund PortfolioNitish KumarNo ratings yet

- Top ET 500 companies list reveals India's largest firms by revenueDocument6 pagesTop ET 500 companies list reveals India's largest firms by revenue0000000000000000No ratings yet

- NIFTY Smallcap 50 Jan2022Document2 pagesNIFTY Smallcap 50 Jan2022Arati DubeyNo ratings yet

- Sub Contractor Interim Payment CertificateDocument7 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- NIFTY50 Value 20 Apr2020Document1 pageNIFTY50 Value 20 Apr2020amitNo ratings yet

- Inv 000014Document1 pageInv 000014Jash Infra MINo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- Rank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCADocument6 pagesRank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCA0000000000000000No ratings yet

- Franklin Templeton mutual fund portfolio statementsDocument191 pagesFranklin Templeton mutual fund portfolio statementsNanthakumar MNo ratings yet

- Star Cement Ltd. - Initiating Coverage ReportDocument22 pagesStar Cement Ltd. - Initiating Coverage ReportSumantha SahaNo ratings yet

- CPCL Paint Supply TenderDocument3 pagesCPCL Paint Supply TenderEliyas YesudossNo ratings yet

- Adobe Scan 16-Mar-2023Document1 pageAdobe Scan 16-Mar-2023SHASHI COMUNICATIONNo ratings yet

- ValueResearchFundcard L&TInfrastructureFund DirectPlan 2017nov23Document4 pagesValueResearchFundcard L&TInfrastructureFund DirectPlan 2017nov23ShamaNo ratings yet

- Ind Nifty MetalDocument2 pagesInd Nifty MetalShah HiNo ratings yet

- NIFTY100 Liquid 15 Apr2020Document1 pageNIFTY100 Liquid 15 Apr2020amitNo ratings yet

- Joel Greenblatt 09 Mar 2023 1719Document2 pagesJoel Greenblatt 09 Mar 2023 1719minjutNo ratings yet

- Evaluation Report-5Document6 pagesEvaluation Report-5Captchandan KumarNo ratings yet

- NIFTY Midcap 50 Apr2020Document2 pagesNIFTY Midcap 50 Apr2020amitNo ratings yet

- NIFTY 50 Nov2020Document2 pagesNIFTY 50 Nov2020Games ZoneNo ratings yet

- 3-Cyrus Mistry Vs Ratan Tata, A Valuable Lesson For B-School StudentsDocument3 pages3-Cyrus Mistry Vs Ratan Tata, A Valuable Lesson For B-School StudentsMadhura DamleNo ratings yet

- A Study On Equity Analysis of Cement Sector StocksDocument19 pagesA Study On Equity Analysis of Cement Sector StocksAshrithaNo ratings yet

- NIFTY Next 50 Nov2020Document2 pagesNIFTY Next 50 Nov2020Games ZoneNo ratings yet

- January 30, 2015: Constituents of CNX COMMODITIESDocument2 pagesJanuary 30, 2015: Constituents of CNX COMMODITIESSaurabh ShubhamNo ratings yet

- JM Midcap Oct 30Document1 pageJM Midcap Oct 30yugendhar janjiralaNo ratings yet

- Reliance Tax Saver Fund Rating Performance Risk ReturnDocument6 pagesReliance Tax Saver Fund Rating Performance Risk ReturnKumar DeepanshuNo ratings yet

- Portfolio - Home 15 OctoberDocument3 pagesPortfolio - Home 15 OctobermukeshinsaaNo ratings yet

- Nifty Mid Cap 100Document7 pagesNifty Mid Cap 100anjeeNo ratings yet

- ICICI Pru Balanced Fund - (G) ::::::::: GraphDocument13 pagesICICI Pru Balanced Fund - (G) ::::::::: GraphVivek GusaniNo ratings yet

- NIFTY Dividend Opportunities 50 Apr2020Document2 pagesNIFTY Dividend Opportunities 50 Apr2020amitNo ratings yet

- NIFTY High Beta 50 Index overviewDocument2 pagesNIFTY High Beta 50 Index overviewAlloySebastinNo ratings yet

- Suzlon Energy Share Price Today - Suzlon Energy LDocument1 pageSuzlon Energy Share Price Today - Suzlon Energy LyuggolaniNo ratings yet

- JKL Q4 22-23 (PR)Document5 pagesJKL Q4 22-23 (PR)likoyiNo ratings yet

- In Focus in Focus in Focus in Focus Technically Technically Technically TechnicallyDocument4 pagesIn Focus in Focus in Focus in Focus Technically Technically Technically TechnicallylalkarresearchNo ratings yet

- NIFTY Infrastructure Jan2022Document2 pagesNIFTY Infrastructure Jan2022Arati DubeyNo ratings yet

- Documents Audit 22Document1 pageDocuments Audit 22Abhinav NigamNo ratings yet

- Ultratech Sales VolumeDocument1 pageUltratech Sales VolumePankaj SinhaNo ratings yet

- 100-200 ET 500 Company List 2022Document6 pages100-200 ET 500 Company List 20220000000000000000No ratings yet

- Walter Schloss value investing approach and analysis of 20 stocksDocument2 pagesWalter Schloss value investing approach and analysis of 20 stocksminjutNo ratings yet

- NIFTY Smallcap 100 Jan2022Document4 pagesNIFTY Smallcap 100 Jan2022Arati DubeyNo ratings yet

- ET 500 Companies ListDocument22 pagesET 500 Companies ListKunal SinghalNo ratings yet

- Top companies in NIFTY by market capitalizationDocument2 pagesTop companies in NIFTY by market capitalizationShakti ShuklaNo ratings yet

- Sbi Life Top 300 Fund PerformanceDocument1 pageSbi Life Top 300 Fund PerformanceVishal Vijay SoniNo ratings yet

- Sub Contractor Interim Payment CertificateDocument10 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- Begc 112 em 2022Document15 pagesBegc 112 em 2022vishal prasadNo ratings yet

- Mco-06 2020-21Document18 pagesMco-06 2020-21arun1974No ratings yet

- Mco-04 2020-21Document14 pagesMco-04 2020-21arun1974No ratings yet

- Ibo-02 2020-21Document17 pagesIbo-02 2020-21arun1974No ratings yet

- Meg 04Document10 pagesMeg 04arun1974No ratings yet

- MCOM Research Methods Data Collection MethodsDocument24 pagesMCOM Research Methods Data Collection Methodsarun1974No ratings yet

- Mco-01 2020-21Document17 pagesMco-01 2020-21arun1974No ratings yet

- Ibo-03 2020-21Document22 pagesIbo-03 2020-21arun1974No ratings yet

- International Business Finance Key ConceptsDocument13 pagesInternational Business Finance Key Conceptsarun1974No ratings yet

- International Marketing Logistics Strategic PlanningDocument19 pagesInternational Marketing Logistics Strategic Planningarun1974No ratings yet

- Ibo-04 2020-21Document16 pagesIbo-04 2020-21arun1974No ratings yet

- Ibo-01 2020-21Document20 pagesIbo-01 2020-21arun1974No ratings yet

- Bbyct-131 em 21-22Document1 pageBbyct-131 em 21-22arun1974No ratings yet

- Meg 02Document16 pagesMeg 02arun1974No ratings yet

- Meg 05Document13 pagesMeg 05arun1974No ratings yet

- Anc-1 emDocument3 pagesAnc-1 emarun1974No ratings yet

- Meg 03Document10 pagesMeg 03arun1974No ratings yet

- Meg 01Document11 pagesMeg 01arun1974No ratings yet

- Assignment MWG 011-January 2020Document1 pageAssignment MWG 011-January 2020arun1974No ratings yet

- Bbyct-135 em 21-22Document2 pagesBbyct-135 em 21-22arun1974No ratings yet

- Bans 183 HM 21-22Document1 pageBans 183 HM 21-22arun1974No ratings yet

- Bbyct-137 em 21-22Document2 pagesBbyct-137 em 21-22arun1974No ratings yet

- Bans 183 em 21-22Document1 pageBans 183 em 21-22arun1974No ratings yet

- Assignment BEGA - 001, 2021-22Document1 pageAssignment BEGA - 001, 2021-22arun1974No ratings yet

- BANC 132 Assignment 2021-22 EnglishDocument1 pageBANC 132 Assignment 2021-22 Englisharun1974No ratings yet

- Solutions Guide for New Literatures in EnglishDocument22 pagesSolutions Guide for New Literatures in Englisharun1974No ratings yet

- BANC 131 Assignment 21-22 EnglishDocument1 pageBANC 131 Assignment 21-22 Englisharun1974No ratings yet

- Meg 9Document10 pagesMeg 9arun1974No ratings yet

- Organising Child Care Services TMADocument3 pagesOrganising Child Care Services TMAarun1974No ratings yet

- Meg 10Document7 pagesMeg 10arun1974No ratings yet

- Acct 2121 Fall 2008 Quiz 1 Ver ADocument8 pagesAcct 2121 Fall 2008 Quiz 1 Ver AKeith JohnsonNo ratings yet

- Top Ten Businssmen in The WorldDocument7 pagesTop Ten Businssmen in The WorldShahnawaz KhanNo ratings yet

- DaanDocument6 pagesDaanMarc GaoNo ratings yet

- Sustainable TourismDocument30 pagesSustainable Tourismravindrahawk100% (1)

- Business Model ManufacturerDocument92 pagesBusiness Model ManufacturerNida Mumtaz AsherNo ratings yet

- Crs Aditya &tata Groups by AviDocument24 pagesCrs Aditya &tata Groups by AviAvinash KumarNo ratings yet

- PPP & IrpDocument37 pagesPPP & IrpSIDRA ALI MA ECO DEL 2021-23No ratings yet

- Module 10 ExercisesDocument5 pagesModule 10 Exercisesomsfadhl50% (2)

- FGP WPMP BrochureDocument12 pagesFGP WPMP BrochureArbiMuratajNo ratings yet

- Multinational Bank SlogansDocument55 pagesMultinational Bank SlogansSachin SahooNo ratings yet

- RENAISSANCERE HOLDINGS LTD 10-K (Annual Reports) 2009-02-20Document207 pagesRENAISSANCERE HOLDINGS LTD 10-K (Annual Reports) 2009-02-20http://secwatch.comNo ratings yet

- Money Market Foreign Exchange DerivativesDocument510 pagesMoney Market Foreign Exchange DerivativesVasif Abdullayev100% (1)

- Brand Territory MatrixDocument13 pagesBrand Territory MatrixOscar CharvetNo ratings yet

- Chapter 11 - LossesDocument20 pagesChapter 11 - LossesMutong ZhengNo ratings yet

- Daftar Saham LQ45 Agustus 2017Document187 pagesDaftar Saham LQ45 Agustus 2017Friedrick VecchioNo ratings yet

- Financial Analysis: Investment Proposal For Zapatoes IncDocument11 pagesFinancial Analysis: Investment Proposal For Zapatoes IncAsi Cas JavNo ratings yet

- Balance of Payments and Comparative Analysis Between India and BhutanDocument30 pagesBalance of Payments and Comparative Analysis Between India and BhutanKshitij ShahNo ratings yet

- Boğaziçi University EC 344 Financial Markets and Institutions L.YıldıranDocument4 pagesBoğaziçi University EC 344 Financial Markets and Institutions L.YıldıranAlp SanNo ratings yet

- LECTURE WEEK 2 (2) DerivDocument40 pagesLECTURE WEEK 2 (2) DerivIvana Second EmailNo ratings yet

- Florist Shop Business PlanDocument19 pagesFlorist Shop Business PlanBrave King100% (1)

- Moore CapitalDocument1 pageMoore CapitalZerohedgeNo ratings yet

- Super Pack 2021-202012210856352449396Document25 pagesSuper Pack 2021-202012210856352449396QUALITY12No ratings yet

- Estimating Cash Flows with Aswath DamodaranDocument15 pagesEstimating Cash Flows with Aswath Damodaranthomas94josephNo ratings yet

- MQF Syllabus 22 390 681Document4 pagesMQF Syllabus 22 390 681Economiks PanviewsNo ratings yet

- 462 Chapter 5 Notes 2019Document23 pages462 Chapter 5 Notes 2019Shajid Ul HaqueNo ratings yet

- PWC Financial Instruments Under Ifrs Guide Through MazeDocument48 pagesPWC Financial Instruments Under Ifrs Guide Through MazeSaeful AzisNo ratings yet

- Objective 4.01 HandoutsDocument10 pagesObjective 4.01 HandoutsHeather CovingtonNo ratings yet

- The Profitless PCDocument12 pagesThe Profitless PCSuchita SuryanarayananNo ratings yet

- Financial Markets Notes for ExamsDocument10 pagesFinancial Markets Notes for ExamsAadeesh JainNo ratings yet

- Global Strategic AlliancesDocument40 pagesGlobal Strategic AlliancesDhruv AroraNo ratings yet