Professional Documents

Culture Documents

CIA vs UIA for $5M investment

Uploaded by

dummy yummyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIA vs UIA for $5M investment

Uploaded by

dummy yummyCopyright:

Available Formats

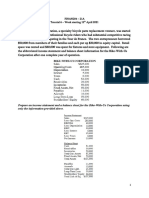

7. Takeshi Kamada—CIA Japan (A).

Takeshi Kamada, a foreign exchange trader at Credit

Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest

$5,000,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and

Japanese yen. He faced the following exchange rate and interest rate quotes. Is CIA profit

possible? If so, how?

Arbitrage funds available $5,000,000

Spot rate (¥/$) 118.60

180-day forward rate (¥/$) 117.80

180-day U.S. dollar interest rate 4.800%

180-day Japanese yen interest rate 3.400%

Start U.S dollar interest rate= 2,4% End

$5.000.000 $5.120.000

$

$5.119.533

$

Spot: ¥118,6 = $1

$Forward: ¥117,8 = $1

¥593.000.000 ¥603.081.000

Japanese yen interest rate= 1,7%

$ $

Terlihat bahwa Covered Interest Arbitrage (CIA) tidaklah lebih menguntungkan

ketimbang apabila Takeshi Kamada melakukan investasi langsung menggunakan dollar.

Karena apabila Takeshi melakukan konversi dari $5.000.000 menjadi ¥593.000.000

kemudian melakukan investasi dengan Japanese yen interest rate sebesar 3,4%, maka ia akan

mengalami kerugian sebesar $5.120.000 - $5.119.533 = $467. Sehingga akan lebih

menguntungkan apabila Kamada melakukan investasi menggunakan dollar dimana U.S dollar

interest rate adalah sebesar 4,8%.

8. Takeshi Kamada—UIA Japan (B). Takeshi Kamada,Credit Suisse (Tokyo), observes

that the ¥/$ spot rate has been holding steady, and that both dollar and yen interest rates have

remained relatively fixed over the past week. Takeshi wonders if he should try an uncovered

interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi’s

research associates—and their computer models—are predicting the spot rate to remain close

to ¥118.00/$ for the coming 180 days. Using the same data as in Problem 7, analyze the UIA

potential.

Start U.S dollar interest rate= 2,4% End

$5.000.000 $5.120.000

$

$5.110.856

$

Spot: ¥118,6 = $1

$Expected: ¥118 = $1

¥593.000.000 ¥603.081.000

Japanese yen interest rate= 1,7%

$ $

Pilihan untuk berinvestasi menggunakan Uncovered Interest Arbitrage (UIA) sangat

tidak dianjurkan untuk dilakukan oleh Takeshi Kamada, karena kerugian yang akan dialami

akan lebih besar ketimbang berinvestasi menggunakan CIA. Apabila Takeshi Kamada

memilih untuk melakukan UIA, dengan Japanese yen interest rate sebesar 1,7%, ketimbang

menginvestasikan langsung menggunakan U.S dollar interest sebesar 2,4%, maka ia akan

mengalami kerugian sebesar $5.120.000 - $5.110.856 = $9.144. Dengan demikian opsi

terbaik Takeshi Kamada untuk melakukan investasi adalah dengan tetap melakukan investasi

langsung menggunakan U.S dollar interest rate.

You might also like

- Naked Forex: High-Probability Techniques For Trading Without IndicatorsDocument290 pagesNaked Forex: High-Probability Techniques For Trading Without Indicatorsmariana95% (44)

- Chapter 20 - IPO, Investment Bank, Financial RestructionDocument20 pagesChapter 20 - IPO, Investment Bank, Financial RestructionFariza SiswantiNo ratings yet

- FX IV PracticeDocument10 pagesFX IV PracticeFinanceman4100% (4)

- Ifm AssignmentDocument4 pagesIfm AssignmentKanupriya Kohli100% (2)

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX Marketskk50% (2)

- Fabozzi CH 03 Measuring Yield HW AnswersDocument5 pagesFabozzi CH 03 Measuring Yield HW AnswershardiNo ratings yet

- MBF14e Chap04 Governance PbmsDocument16 pagesMBF14e Chap04 Governance PbmsKarl60% (5)

- Custom Indicator Builder User GuideDocument24 pagesCustom Indicator Builder User GuideEduardo TogoroNo ratings yet

- Forex WalkthroughDocument342 pagesForex WalkthroughPhuthuma Beauty SalonNo ratings yet

- A Project On Equity AnalysisDocument93 pagesA Project On Equity AnalysisAjith CherloNo ratings yet

- Assignment 2Document3 pagesAssignment 2Lili GuloNo ratings yet

- Financial Markets ModuleDocument248 pagesFinancial Markets ModuleTrường Nguyễn100% (2)

- FINAN204-21A - Tutorial 6 Week 7Document10 pagesFINAN204-21A - Tutorial 6 Week 7Danae YangNo ratings yet

- MBF14e Chap06 Parity Condition PbmsDocument23 pagesMBF14e Chap06 Parity Condition PbmsKarl100% (18)

- Chapter Fourteen Foreign Exchange RiskDocument14 pagesChapter Fourteen Foreign Exchange Risknmurar01No ratings yet

- CH 11 - International Finance - NurhaiyyuDocument62 pagesCH 11 - International Finance - NurhaiyyukkNo ratings yet

- IB Agreement BreakdownDocument7 pagesIB Agreement BreakdownMuh TaufandyanNo ratings yet

- BUS322Tutorial5 SolutionDocument20 pagesBUS322Tutorial5 Solutionjacklee191825% (4)

- GBP USD PersonalityDocument13 pagesGBP USD PersonalityRieyz ZalNo ratings yet

- Tri Thai - GSA-2FAdditional - Use of Data Analytics For Effective Program Oversight - CLPDocument29 pagesTri Thai - GSA-2FAdditional - Use of Data Analytics For Effective Program Oversight - CLPdummy yummyNo ratings yet

- The Equity Millepede StoryDocument798 pagesThe Equity Millepede StoryNihal SinghNo ratings yet

- CH 7Document7 pagesCH 7Asad Ehsan Warraich100% (3)

- Problem 6.7Document4 pagesProblem 6.7SamerNo ratings yet

- Chap08 Pbms SolutionsDocument25 pagesChap08 Pbms SolutionsDouglas Estrada100% (1)

- Tutorial 5 Exercises TemplateDocument17 pagesTutorial 5 Exercises TemplateHà VânNo ratings yet

- Sallie Schnudel speculates on Singapore dollar appreciationDocument25 pagesSallie Schnudel speculates on Singapore dollar appreciationveronika100% (1)

- Bus 322 Tutorial 5-SolutionDocument20 pagesBus 322 Tutorial 5-Solutionbvni50% (2)

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Tugas Manajemen InvestasiDocument6 pagesTugas Manajemen InvestasiYosep Erjuandi SilabanNo ratings yet

- FX II PracticeDocument10 pagesFX II PracticeFinanceman4No ratings yet

- Gilliam FIN 435 HomeworkDocument3 pagesGilliam FIN 435 Homeworkchocolatedoggy12100% (1)

- Hansen AISE IM Ch08Document54 pagesHansen AISE IM Ch08AimanNo ratings yet

- Exercise Stock ValuationDocument2 pagesExercise Stock ValuationUmair ShekhaniNo ratings yet

- SolutionsToPracticeProblems Working Capital ManagementDocument2 pagesSolutionsToPracticeProblems Working Capital ManagementPrima Facie100% (1)

- Chap03 Pbms MBF12eDocument15 pagesChap03 Pbms MBF12eRoopak Rewari100% (2)

- P&G India hedges Japanese yen payableDocument17 pagesP&G India hedges Japanese yen payableNguyễn Gia Phương Anh100% (1)

- Solution Manual CH 12 Multinational Financial ManagementDocument1 pageSolution Manual CH 12 Multinational Financial Managementariftanur0% (1)

- International Financial Management Assignment 2Document2 pagesInternational Financial Management Assignment 2Stefven PutraNo ratings yet

- Comparing cash flow plans for investing excess funds from Thailand operationsDocument3 pagesComparing cash flow plans for investing excess funds from Thailand operationsmasskillz33% (3)

- C09 +chap+16 +Capital+Structure+-+Basic+ConceptsDocument24 pagesC09 +chap+16 +Capital+Structure+-+Basic+Conceptsstanley tsangNo ratings yet

- Measuring Exposure to Exchange Rate FluctuationsDocument6 pagesMeasuring Exposure to Exchange Rate Fluctuationsgeorgeterekhov100% (1)

- Blades Inc. CaseDocument2 pagesBlades Inc. Caseplanet_sami0% (1)

- Tutorial 2 CorrectionDocument8 pagesTutorial 2 Correctionkacem_hz100% (1)

- Ventura, Mary Mickaella R - Chapter8p.256-258Document3 pagesVentura, Mary Mickaella R - Chapter8p.256-258Mary VenturaNo ratings yet

- Ex - TransExposure SOLDocument5 pagesEx - TransExposure SOLAlexisNo ratings yet

- In 2008 Keenan Company Paid Dividends Totaling 3 600 000 On NeDocument1 pageIn 2008 Keenan Company Paid Dividends Totaling 3 600 000 On NeAmit PandeyNo ratings yet

- Chapter 19 - Dividend & Other PayoutDocument23 pagesChapter 19 - Dividend & Other PayoutHameed WesabiNo ratings yet

- Bullock Gold Mining: Corporate Finance Case StudyDocument28 pagesBullock Gold Mining: Corporate Finance Case StudyVivek TripathyNo ratings yet

- Chapter 7 Corporate FinanceDocument25 pagesChapter 7 Corporate FinanceCalistoAmemebeNo ratings yet

- Spot Exchange Markets. Quiz QuestionsDocument14 pagesSpot Exchange Markets. Quiz Questionsym5c2324100% (1)

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingNo ratings yet

- Assignment No 2 BPDocument2 pagesAssignment No 2 BPBernadette AnicetoNo ratings yet

- Bookoff Case AnalysisDocument7 pagesBookoff Case AnalysisLeo SanjayaNo ratings yet

- Mini CaseDocument9 pagesMini CaseJOBIN VARGHESENo ratings yet

- Chapter 9-STOCK VALUATION-FIXDocument33 pagesChapter 9-STOCK VALUATION-FIXRacing FirmanNo ratings yet

- MBF13e Chap20 Pbms - FinalDocument11 pagesMBF13e Chap20 Pbms - FinalAnonymous 8ooQmMoNs1100% (3)

- Rangkuman Chapter 9 Cost of CapitalDocument4 pagesRangkuman Chapter 9 Cost of CapitalDwi Slamet RiyadiNo ratings yet

- Assigment - 3: Nama: Listi Maulida Saapitri NPM: 1111197034Document1 pageAssigment - 3: Nama: Listi Maulida Saapitri NPM: 1111197034Wanabakti SatriaNo ratings yet

- Finance - Module 7Document3 pagesFinance - Module 7luckybella100% (1)

- TUGASDocument13 pagesTUGASAnas SutrinoNo ratings yet

- BioTron Medical Foreign Exchange Risk AnalysisDocument19 pagesBioTron Medical Foreign Exchange Risk AnalysisQurratul Asmawi100% (2)

- Assignment 1 (BP)Document3 pagesAssignment 1 (BP)Bernadette AnicetoNo ratings yet

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument22 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global Editionpatrecia 18960% (1)

- Chapter 4-FinanceDocument14 pagesChapter 4-Financesjenkins66No ratings yet

- Actividad 8 en ClaseDocument2 pagesActividad 8 en Claseluz_ma_6No ratings yet

- Chapter-10 Market Risk Math Problems and SolutionsDocument6 pagesChapter-10 Market Risk Math Problems and SolutionsruponNo ratings yet

- Tiger Brands' Strategic Approach and BCG Matrix for Hyundai ChinaDocument2 pagesTiger Brands' Strategic Approach and BCG Matrix for Hyundai ChinaAomame Fuka-Eri67% (3)

- ZumoDocument6 pagesZumoStefanStojsavljevicNo ratings yet

- International ParityDocument5 pagesInternational ParitySumit GuptaNo ratings yet

- International Parity Relationships & Forecasting Exchange Rates - ShortDocument12 pagesInternational Parity Relationships & Forecasting Exchange Rates - ShortYoussef BrahmiNo ratings yet

- LPKR Ki Pmthmetd - IdDocument5 pagesLPKR Ki Pmthmetd - Iddummy yummyNo ratings yet

- 6.18 East Asiatic CompanyDocument2 pages6.18 East Asiatic Companydummy yummyNo ratings yet

- CIA vs UIA for $5M investmentDocument2 pagesCIA vs UIA for $5M investmentdummy yummyNo ratings yet

- Tax Management on Outbound InvestmentDocument15 pagesTax Management on Outbound Investmentdummy yummyNo ratings yet

- SIPI Pertemuan 8 Kelompok IDocument7 pagesSIPI Pertemuan 8 Kelompok Idummy yummyNo ratings yet

- Revenue and Expenditure Cycle: Erni Br. Simanjuntak Kelompok I: Joko Kisworo Widya NingsihDocument6 pagesRevenue and Expenditure Cycle: Erni Br. Simanjuntak Kelompok I: Joko Kisworo Widya Ningsihdummy yummyNo ratings yet

- SIPI - Pertemuan 9 (Autosaved)Document12 pagesSIPI - Pertemuan 9 (Autosaved)dummy yummyNo ratings yet

- FX4Cash Currency Guide 2021Document133 pagesFX4Cash Currency Guide 2021Jairo BastidasNo ratings yet

- ForwardRates - October 16 2017Document2 pagesForwardRates - October 16 2017Tiso Blackstar GroupNo ratings yet

- SWIFT Standards 2019 Annual MaintenanceDocument49 pagesSWIFT Standards 2019 Annual MaintenanceFerjani RiahiNo ratings yet

- BFM-C Treasury Management NotesDocument10 pagesBFM-C Treasury Management NotesMuralidhar Goli100% (1)

- M&BDocument41 pagesM&Bshahgroups0% (1)

- AFAR 3 AnswersDocument5 pagesAFAR 3 AnswersTyrelle Dela CruzNo ratings yet

- TYBMS Problems of IfDocument13 pagesTYBMS Problems of IfKunal MasurkarNo ratings yet

- IBPS PO Model Paper - Allahabad Bank Probationary Officer Exam Previous Year Question PaperDocument52 pagesIBPS PO Model Paper - Allahabad Bank Probationary Officer Exam Previous Year Question PaperSona LavaniaNo ratings yet

- Restored Republic Via A GCR 6-27-2023Document13 pagesRestored Republic Via A GCR 6-27-2023timNo ratings yet

- Secure DownloadDocument2 pagesSecure DownloadSK Kg Pertanian SandakanNo ratings yet

- Financial Institutions, Markets, and Money, 8 Edition: Power Point Slides ForDocument39 pagesFinancial Institutions, Markets, and Money, 8 Edition: Power Point Slides ForMahmoud AbdullahNo ratings yet

- Cityam 2011-01-10Document32 pagesCityam 2011-01-10City A.M.No ratings yet

- Sheam. Bank Management.-1Document121 pagesSheam. Bank Management.-1SM SheamNo ratings yet

- Foreign Exchange Management ActDocument13 pagesForeign Exchange Management ActRashi PanditNo ratings yet

- Yes Bank - ReportDocument51 pagesYes Bank - ReportRajatNo ratings yet

- Newsletter September 2022: Next Meeting Mon Sept 26 @Document6 pagesNewsletter September 2022: Next Meeting Mon Sept 26 @api-328329592No ratings yet

- Philippine Money and Currency - PESO Bills and CoinsDocument6 pagesPhilippine Money and Currency - PESO Bills and CoinsMa'am Katrina Marie MirandaNo ratings yet

- NRI AccountDocument26 pagesNRI AccountabhishekNo ratings yet

- Finance ProjectDocument78 pagesFinance ProjectChandramauli MishraNo ratings yet

- QUIZ CHAPTER 10 & 13 FX, STRATEGY & COMPETITIVE ADVANTAGEDocument4 pagesQUIZ CHAPTER 10 & 13 FX, STRATEGY & COMPETITIVE ADVANTAGEBea DatingNo ratings yet

- Tianjin Plastics (China) : Maple EnergyDocument11 pagesTianjin Plastics (China) : Maple EnergySoraya ReneNo ratings yet